Highlights Gold prices will continue to be challenged by conflicting information flows regarding US monetary policy; higher inflationary impulses from commodity prices and supply-chain bottlenecks; global economic policy uncertainty,…

Highlights The equity risk premium has turned negative for the first time since 2002. It follows that any significant rise in bond yields will cause risk-asset prices to collapse, quickly flipping any incipient inflationary shock into…

Highlights Upgrade The Health Care Sector To An Overweight: Expressed through an overweight position in Health Care Equipment and Services, and an equal weight position in Pharmaceuticals and Biotech The Sector Faces A Few Tailwinds…

Highlights Over the short term – 1-2 years – the pick-up in re-infection rates in Asia and LatAm states with large-scale deployments of Sinopharm and Sinovac COVID-19 vaccines will re-focus attention on demand-side risks to…

Highlights Global oil markets will remain balanced this year with OPEC 2.0's production-management strategy geared toward maintaining the level of supply just below demand. This will keep inventories on a downward trajectory,…

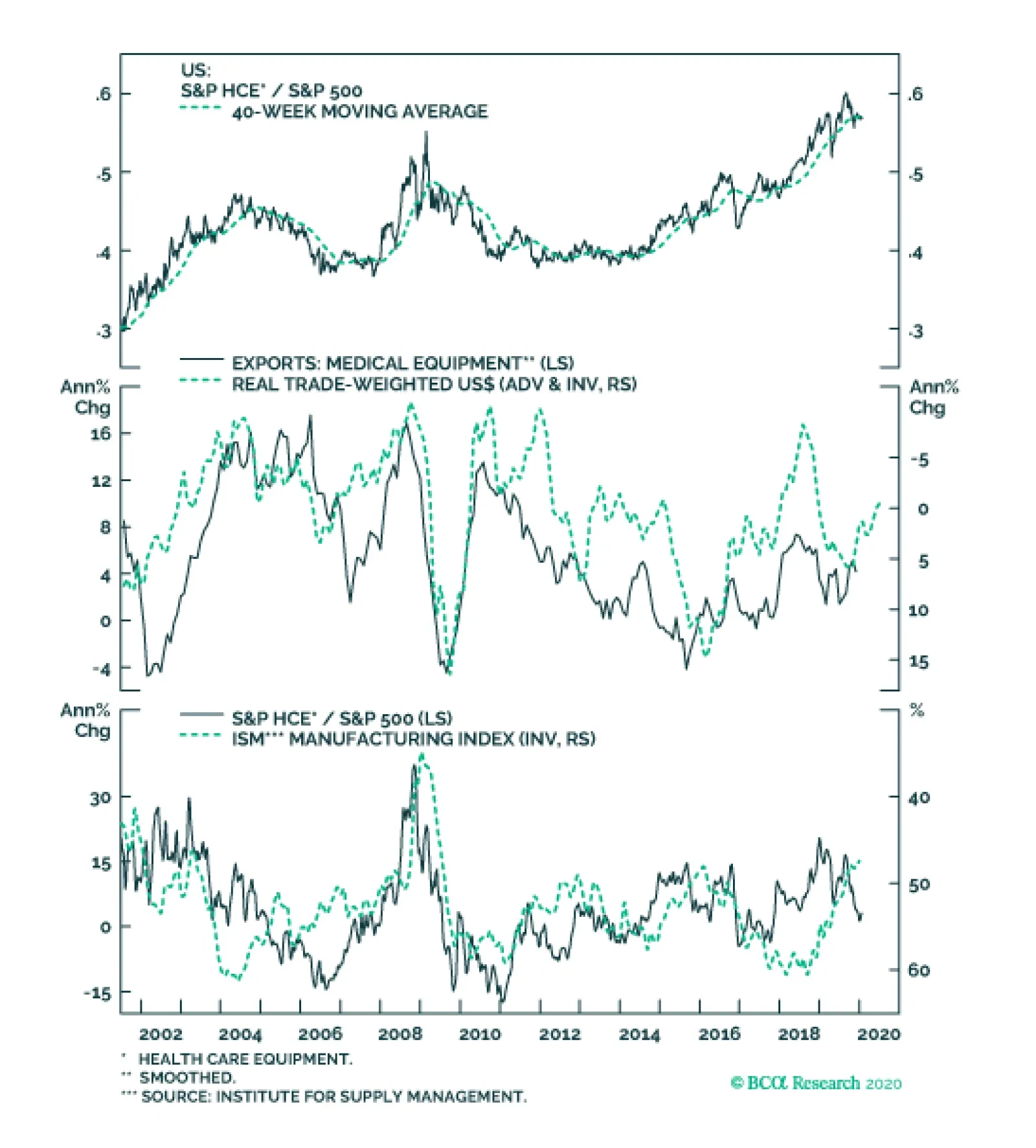

The S&P health care equipment (HCE) index is our only overweight within the health care universe, and over the past several weeks the index has been ripping higher. One of the likely catalysts behind the recent rally in…

US medical equipment manufacturers are world leaders in supplying hospitals with quality equipment. Given that BCA’s house view for 2020 calls for a weaker dollar, HCE exporters have a bright future. Further, the…

Overweight While our overweight S&P health care equipment (HCE) call has given up some of its gains since inception, profit fundamentals have not changed and we continue to recommend an above benchmark allocation in this…