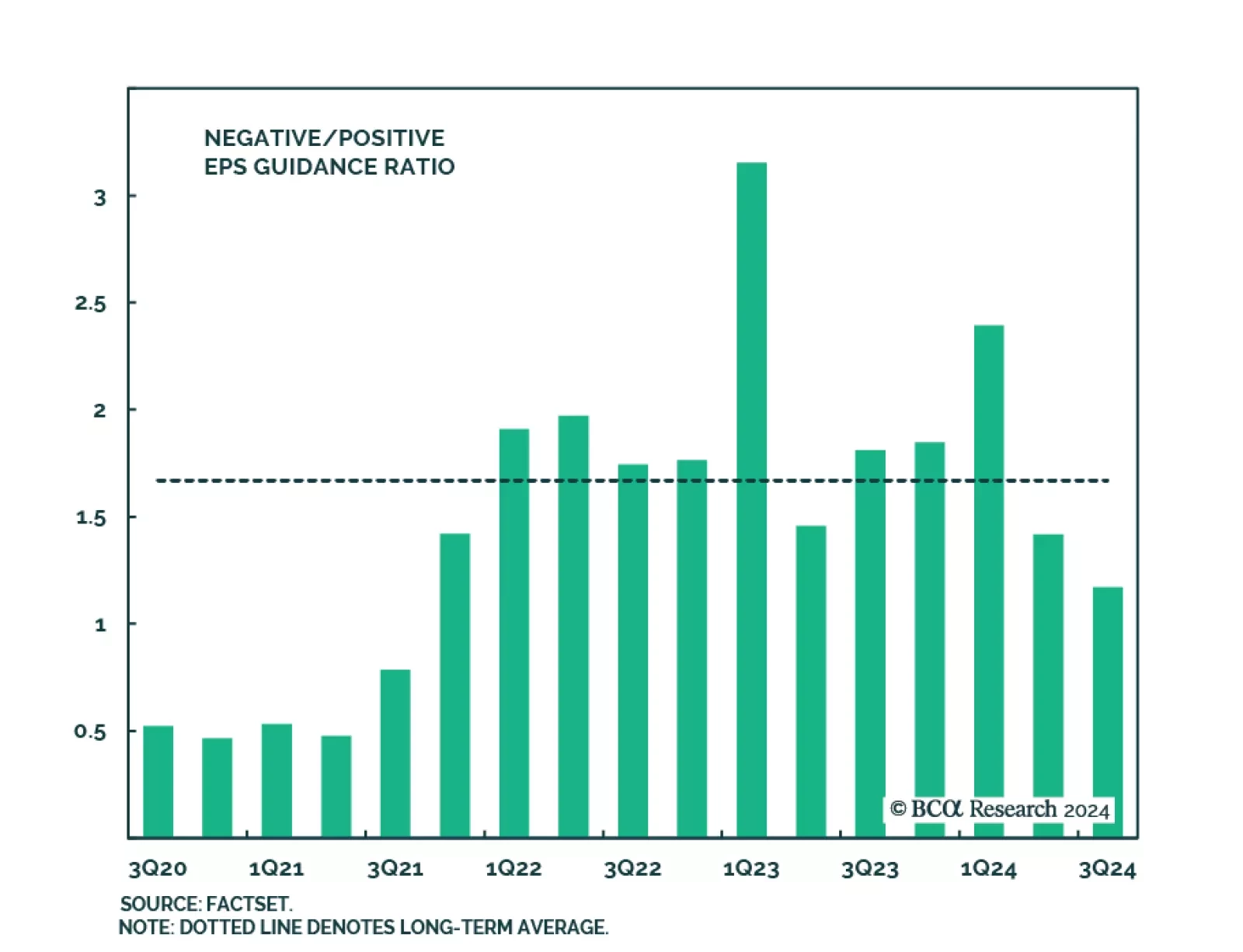

The Q2 2024 earnings season is drawing to a close with 93% of S&P 500 companies having reported results as we go to press. Nearly 80% (60%) of companies have topped earnings (sales) expectations in Q2, according to Factset…

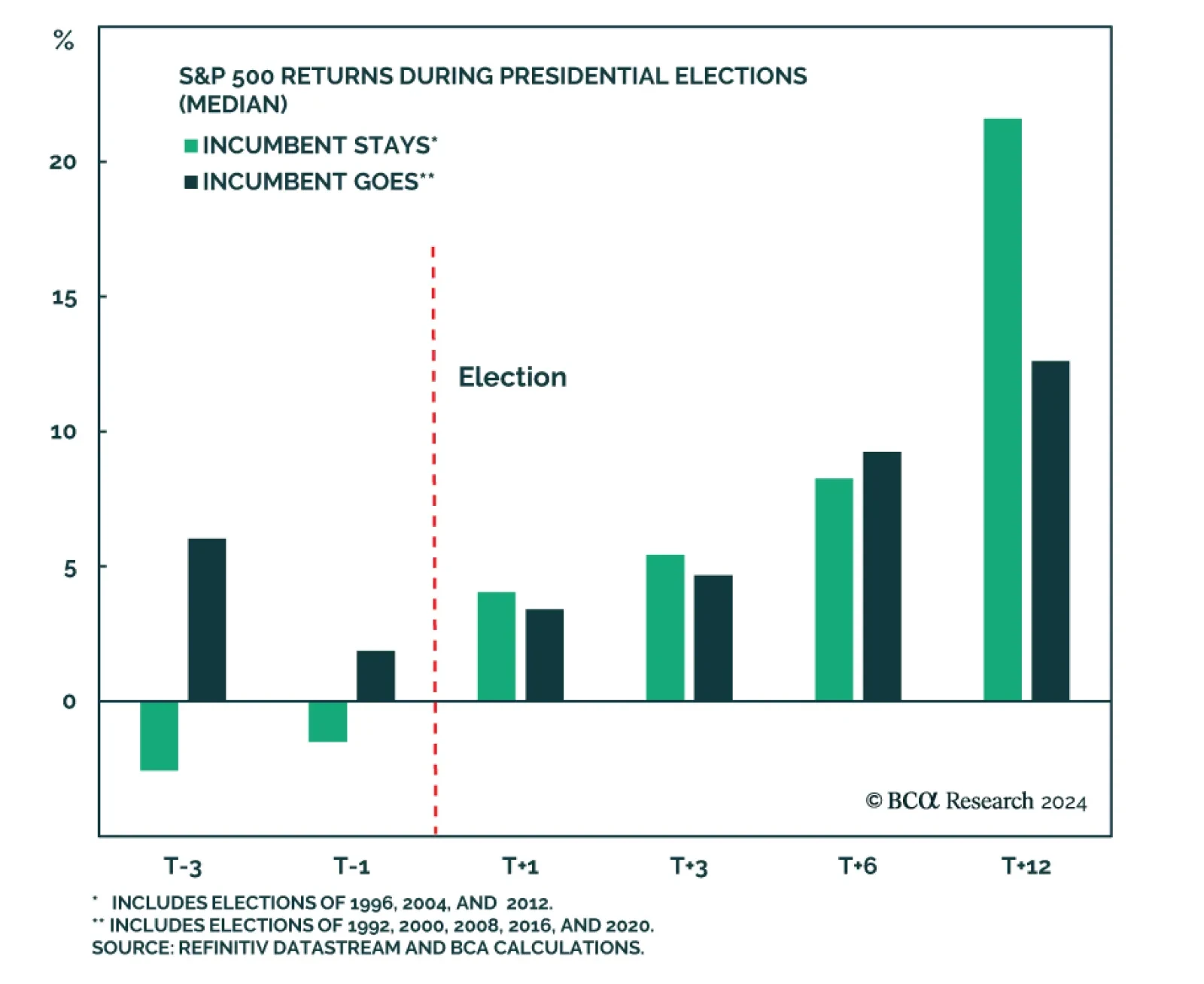

According to BCA Research’s US Political Strategy service, in the final months of an election cycle, equities underperform relative to non-election years. This extends further into Q1 of the following year due to…

We continue to expect a recession by early 2025 but assign non-trivial odds to growth surprising to the upside until then. Our Global Investment Strategy team thus recommends investors adopt a barbell equity strategy as a…

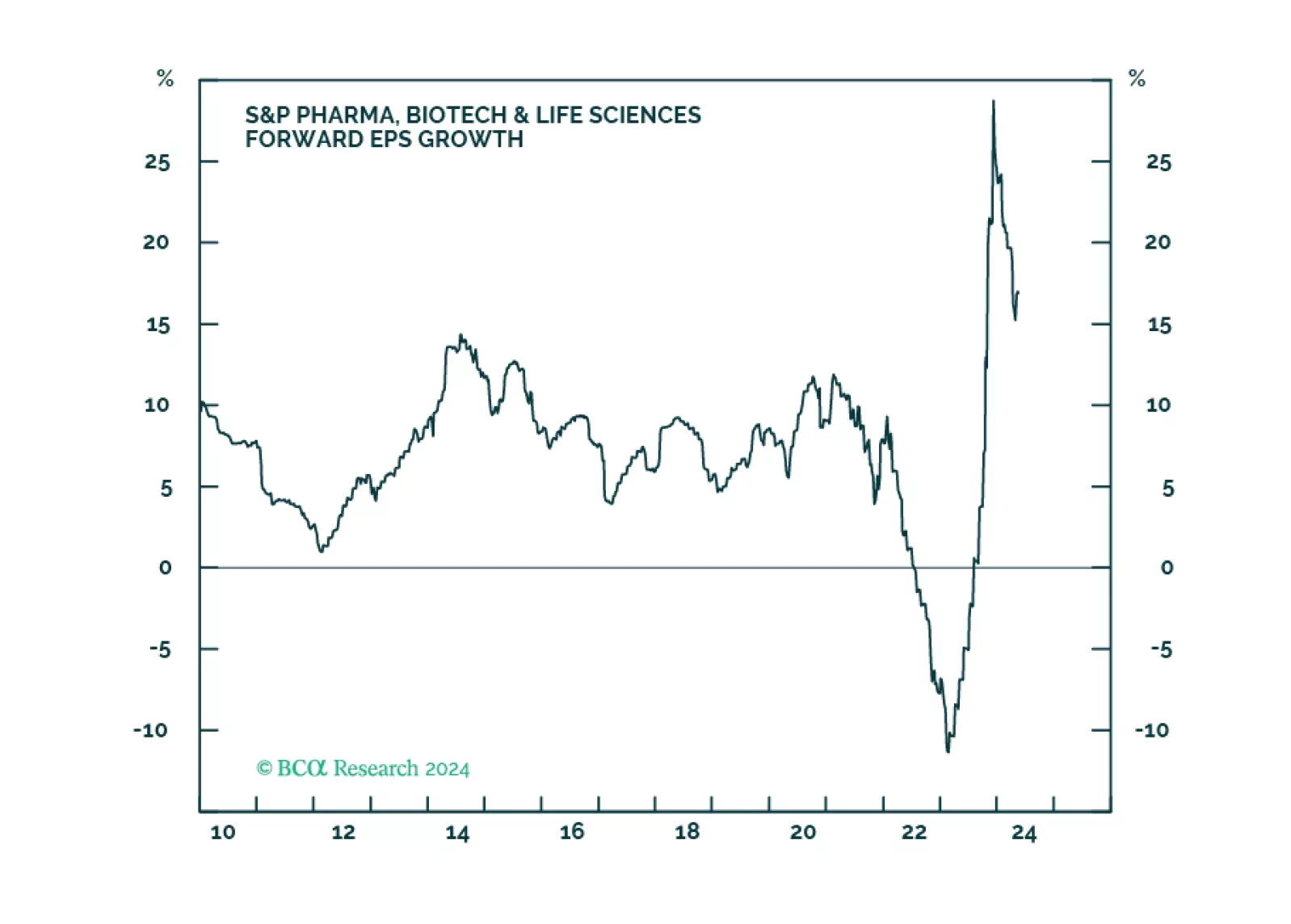

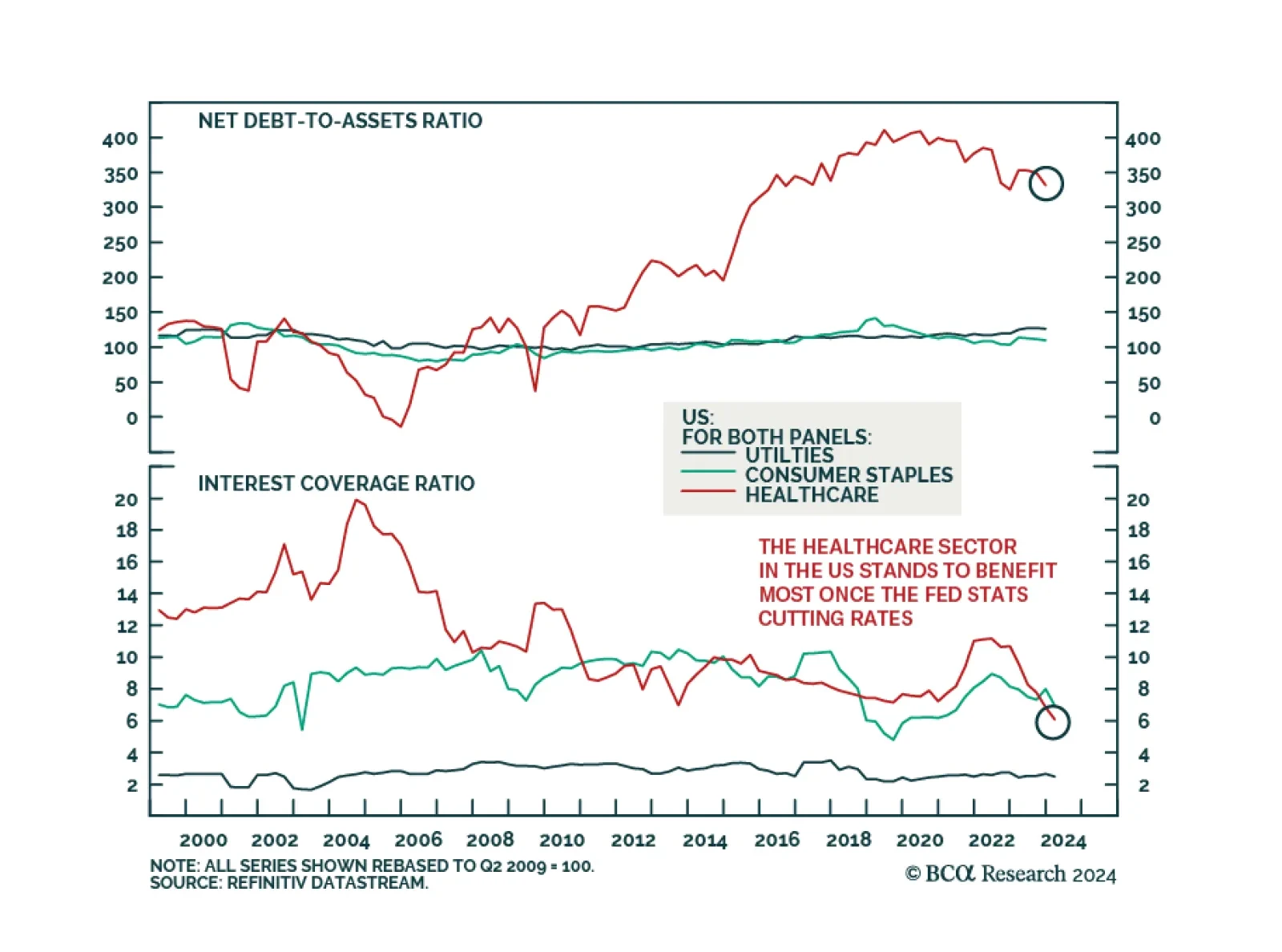

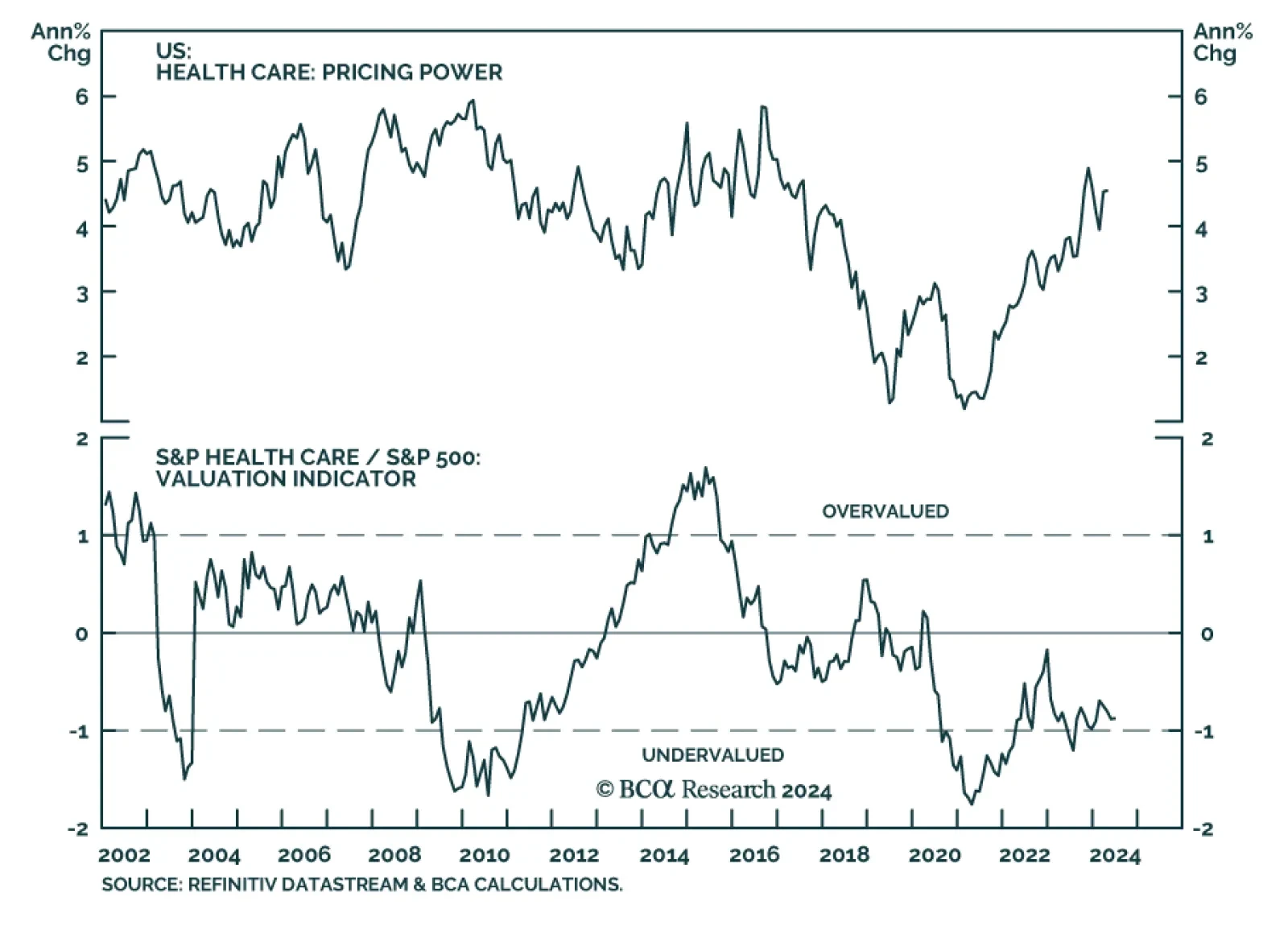

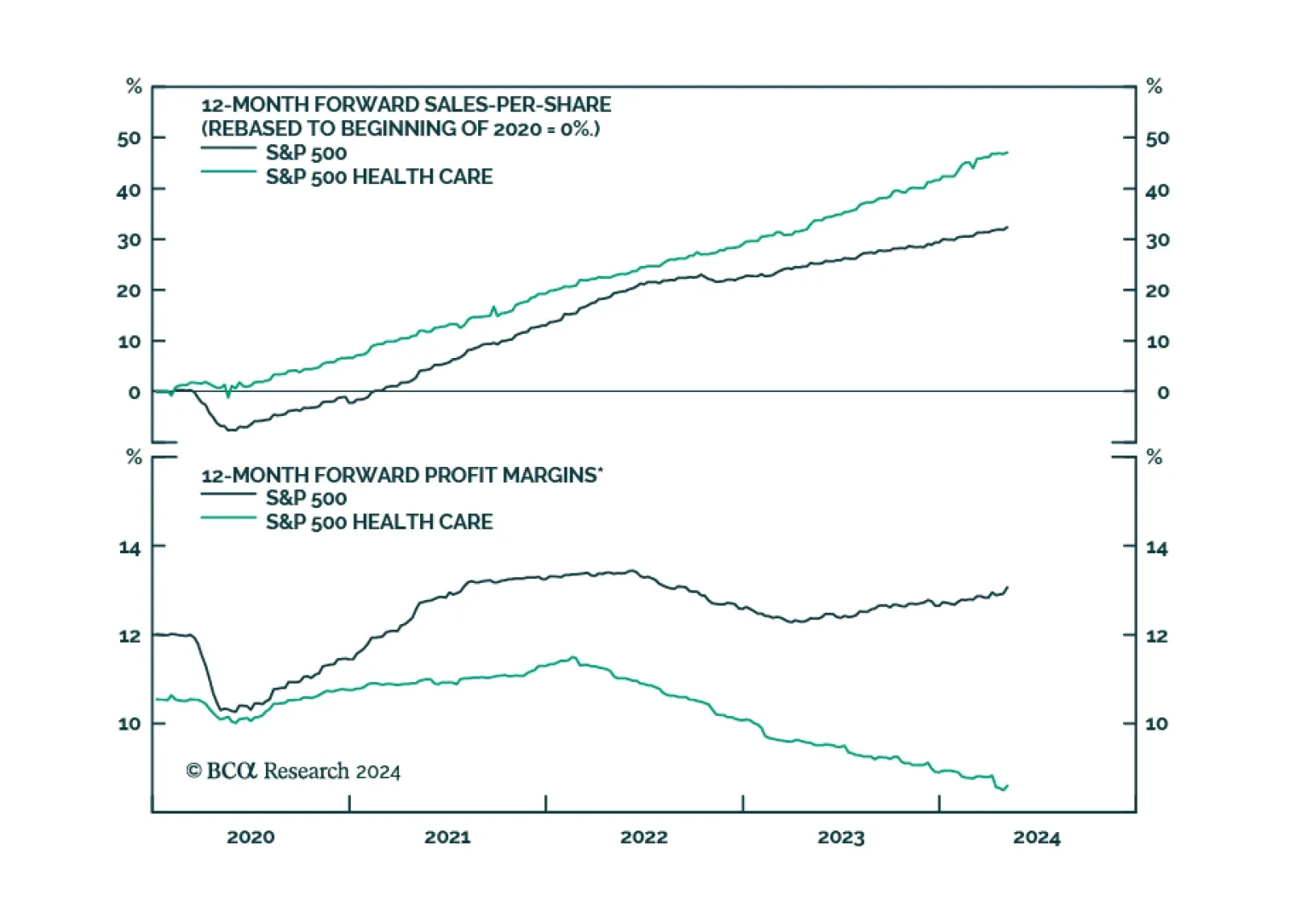

Healthcare has underperformed the S&P 500 by 23% since early 2023. Profit margins have been squeezed since the pandemic revenue windfall dried up and because long-term contracts prevented companies from raising prices in line…

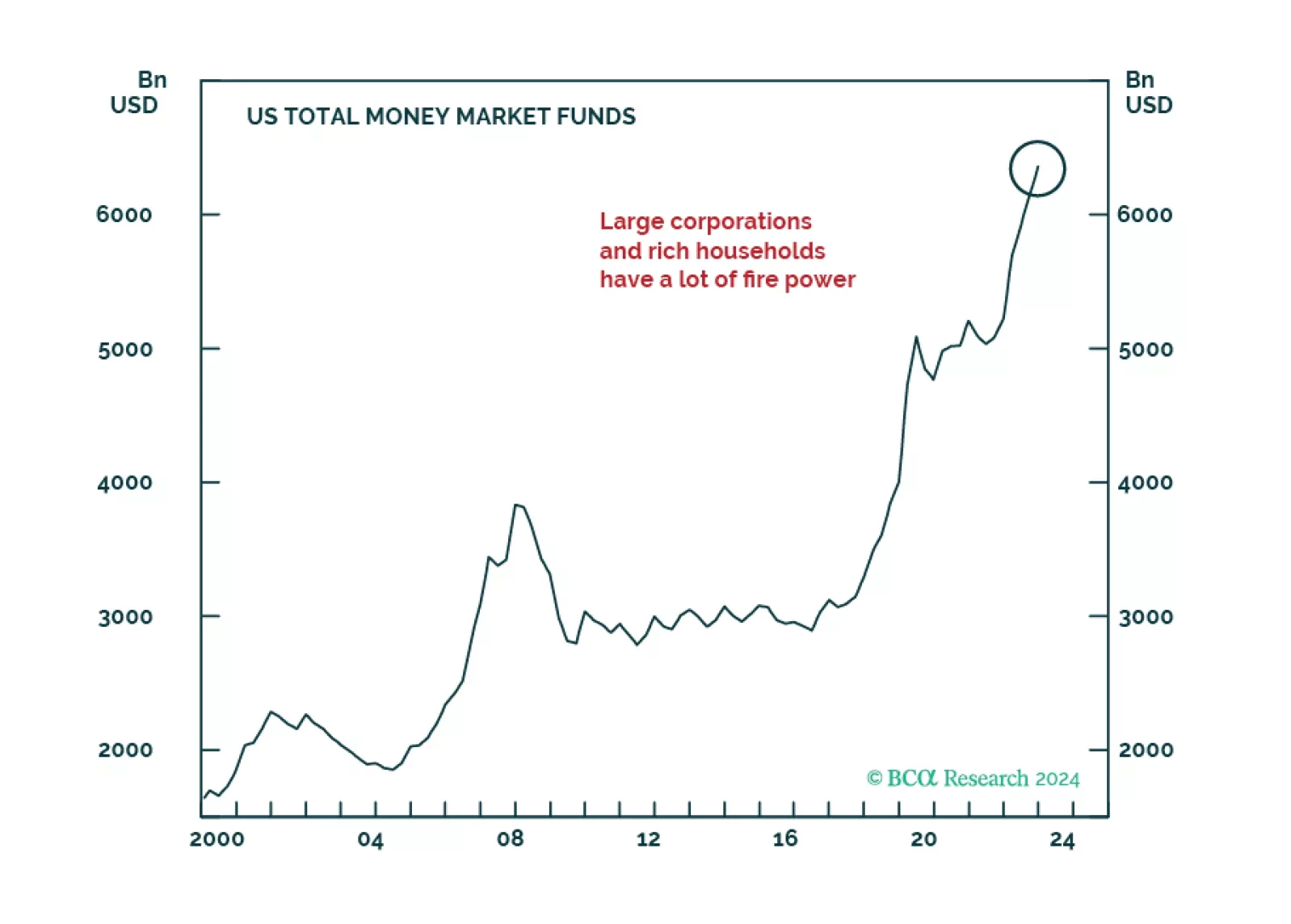

Generative AI-related rally resumed in May. Much of the recent market gains are down to excess liquidity that was begotten by the massive pandemic stimulus, creating a dichotomy between multiple economic challenges and exuberant…

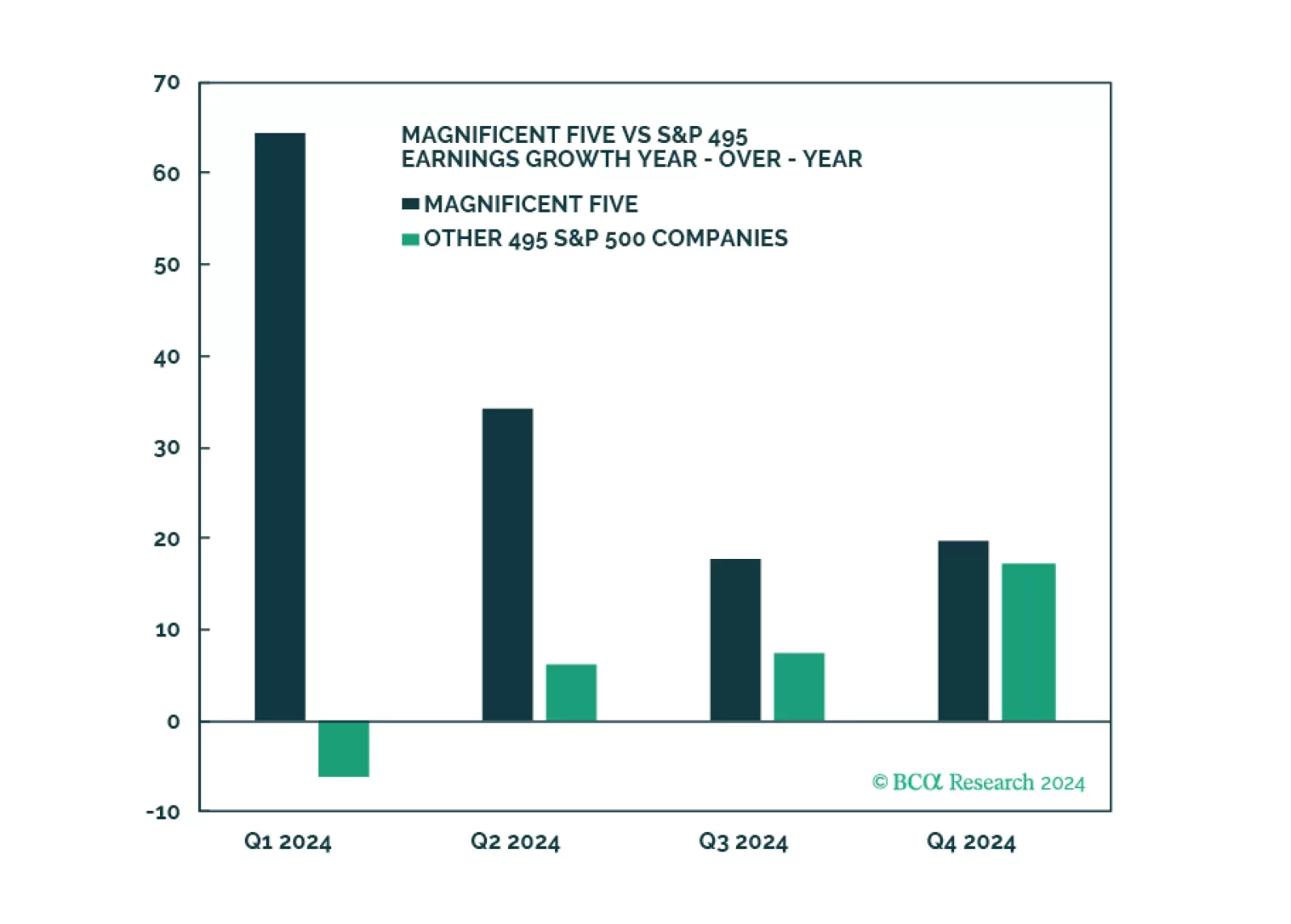

Q1 Earnings and sales growth were strong, but the devil is in the details: Without the Magnificent Five, earnings growth for the index would have been negative. On a positive note, margins have stabilized, and earnings growth is…

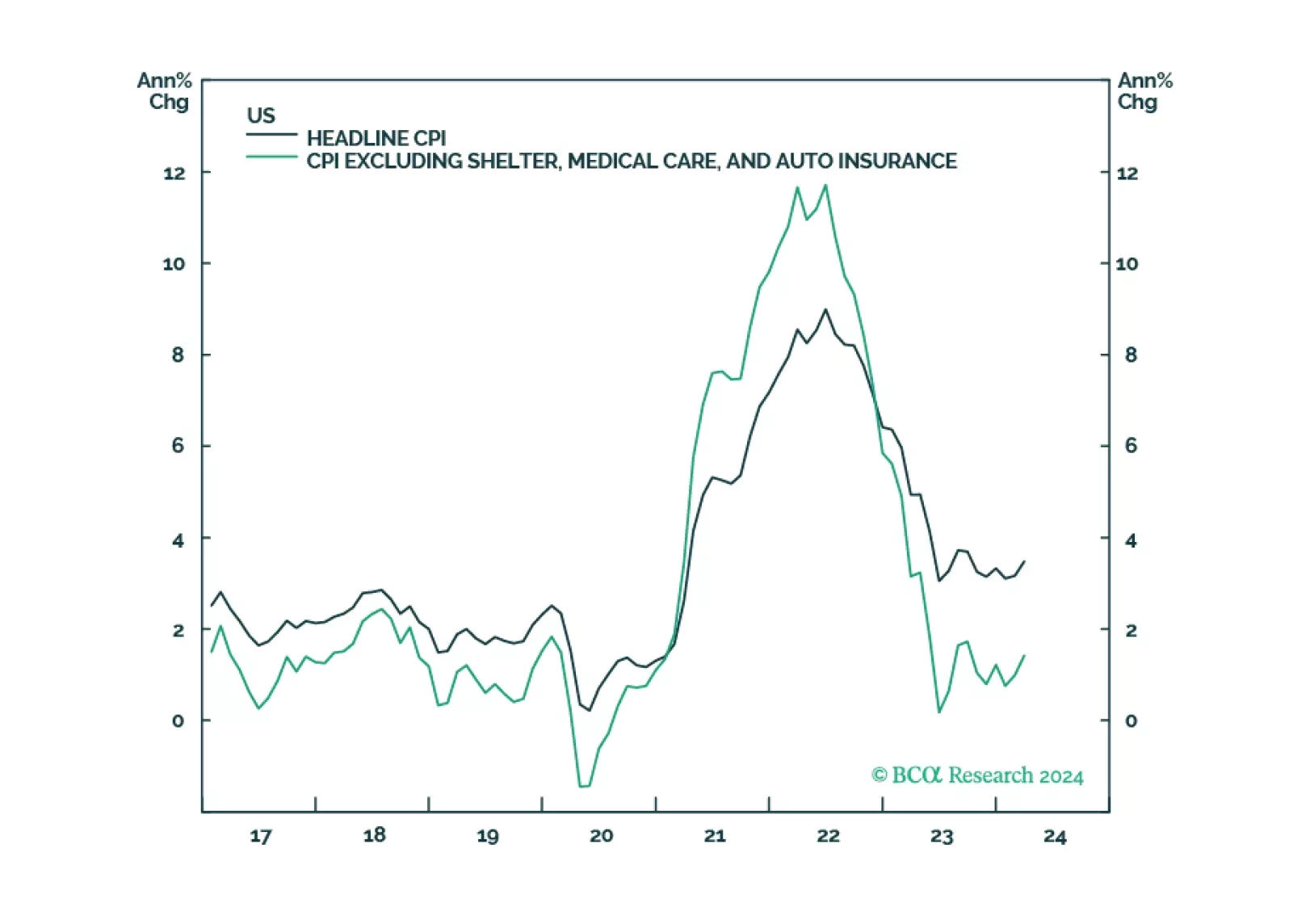

In this week’s report, we defend four out-of-consensus claims. Claim #1: Underlying inflation in the US is not reaccelerating. Claim #2: The US labor market is set to weaken abruptly. Claim #3: The S&P 500 will drop to 3700 in…

Health care stocks have underperformed the US broad market by over 20% since the beginning of 2023. Indeed, vaccination campaigns during the pandemic years had initially boosted health care companies’ earnings. However,…