Highlights Exogenous risks will remain more of a threat to grain prices than out-of-whack fundamentals, which are closer to balance than not, as the USDA’s World Agricultural Supply and Demand Estimates (WASDE) indicate. COVID-…

Highlights OPEC 2.0 production discipline and the capital markets’ parsimony in re funding US shale-oil producers will restrain oil supply growth. Monetary and fiscal stimulus will revive EM demand. These fundamentals will push…

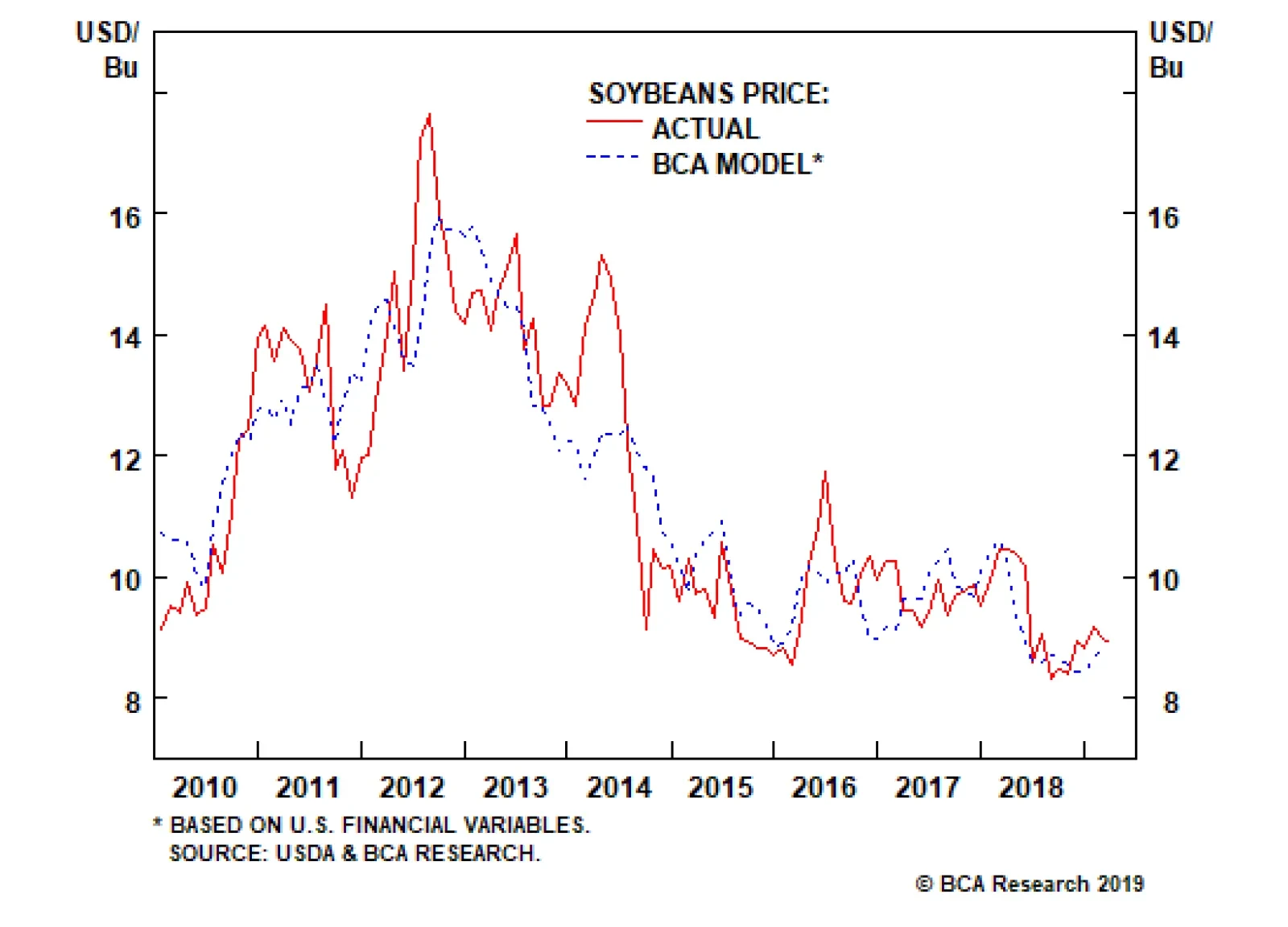

According to China’s official statistics, more than a million pigs have been culled, and Chinese pork production is expected to be slashed by between a 25% and 50% this year. This will depress demand for soybeans, further…

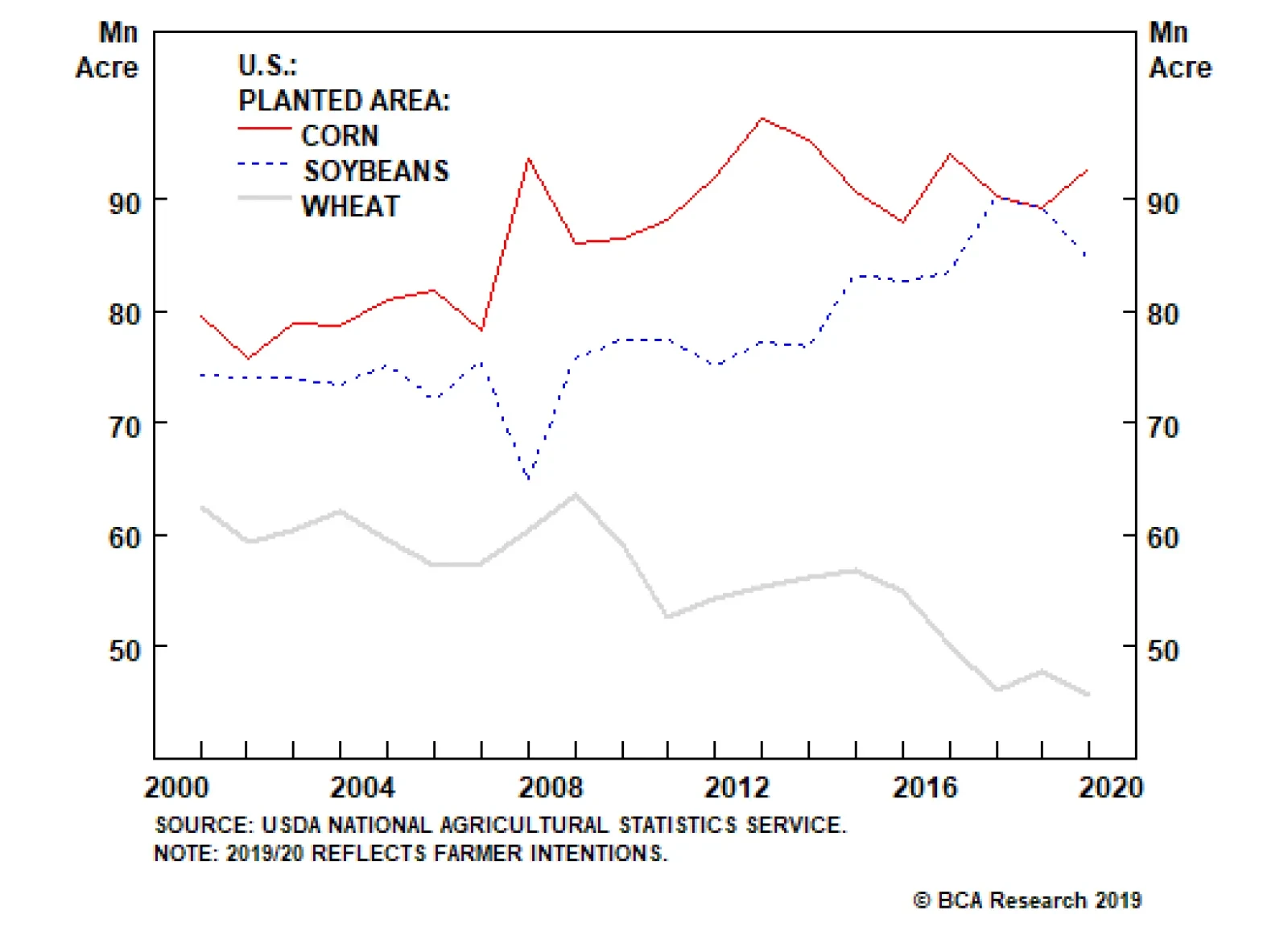

According to the USDA’s annual Prospective Planting Report, released at the end of March, the planted area of corn will likely increase by 4% in 2019, while soybean and wheat acreage will fall 5% y/y and 4% y/y, respectively…

President Trump’s announcement this week of a new deployment of aid to U.S. farmers, to offset China’s retaliation to steeper tariffs, highlights that agriculture has been the sacrificial lamb in the U.S.’s hawkish trade…

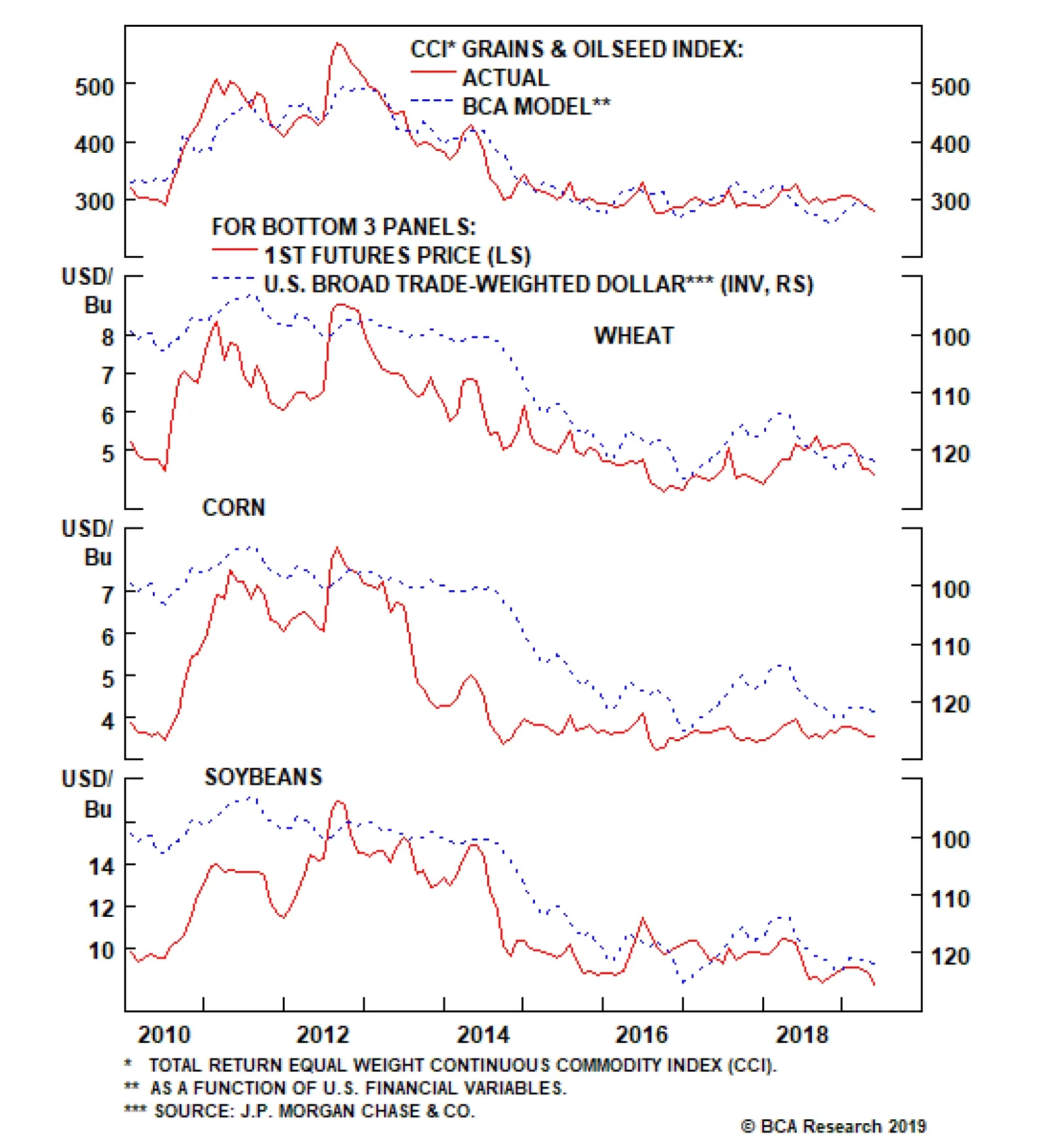

Aside from U.S. financial conditions and supply-demand balances, U.S. trade policy has also been roiling ag markets since China slapped U.S. soybeans with 25% tariffs in mid-2018. In fact, since the escalation of the trade…

Highlights Just when it looked like the agricultural complex was starting to perk up, it was slapped down again. After crawling its way back from a mid-2018 crash – retracing more than half of its decline – the CCI Grains…