The annual Prospective Plantings report released by the US Department of Agriculture (USDA) last week was slightly bullish for corn, neutral for soybeans, and slightly bearish for wheat. It forecasts a 5% drop in corn acreage, a…

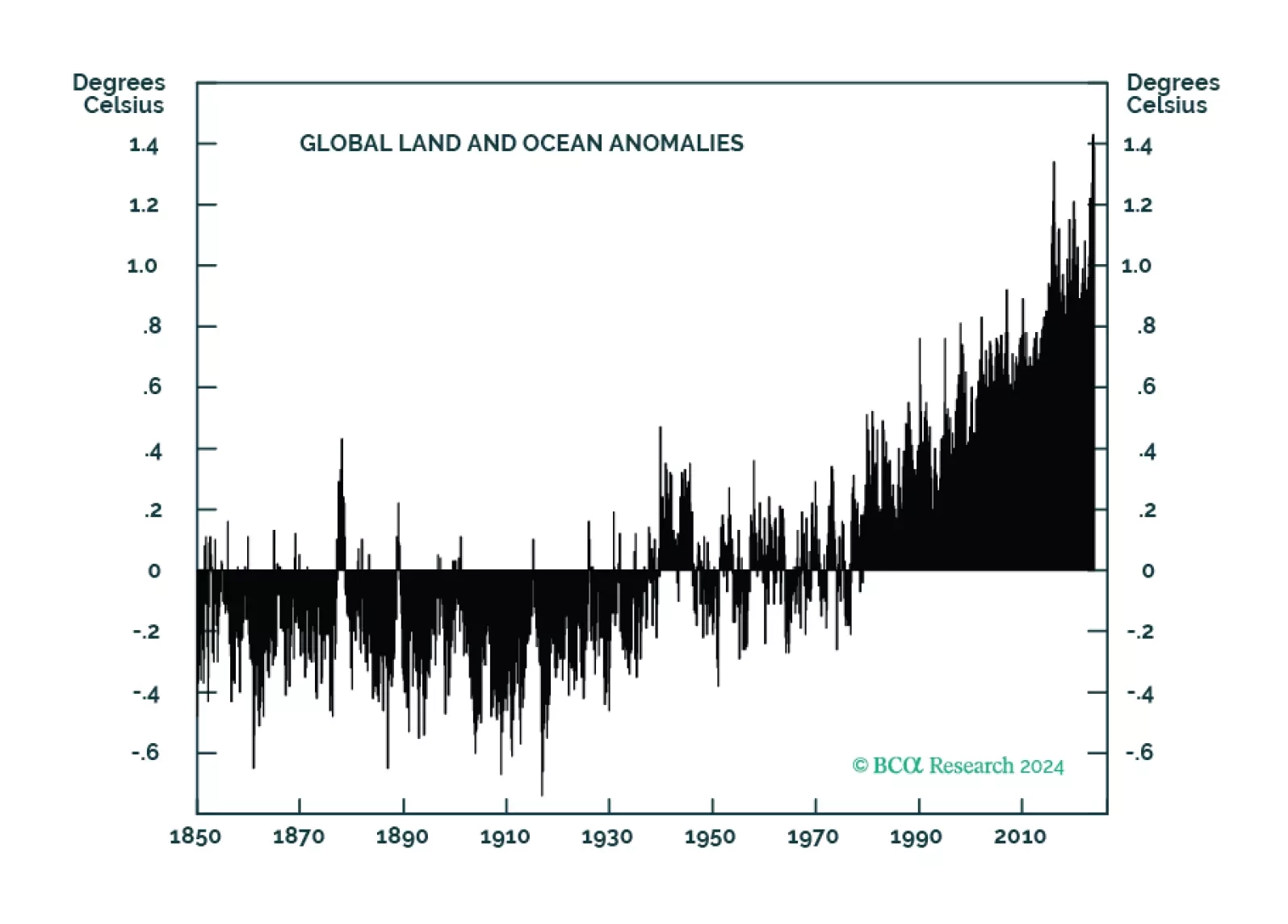

Global ag markets will become more volatile as anthropogenically induced climate change continues to degrade farmland. This will make price signals emanating from these markets less efficient in terms of processing supply-demand…

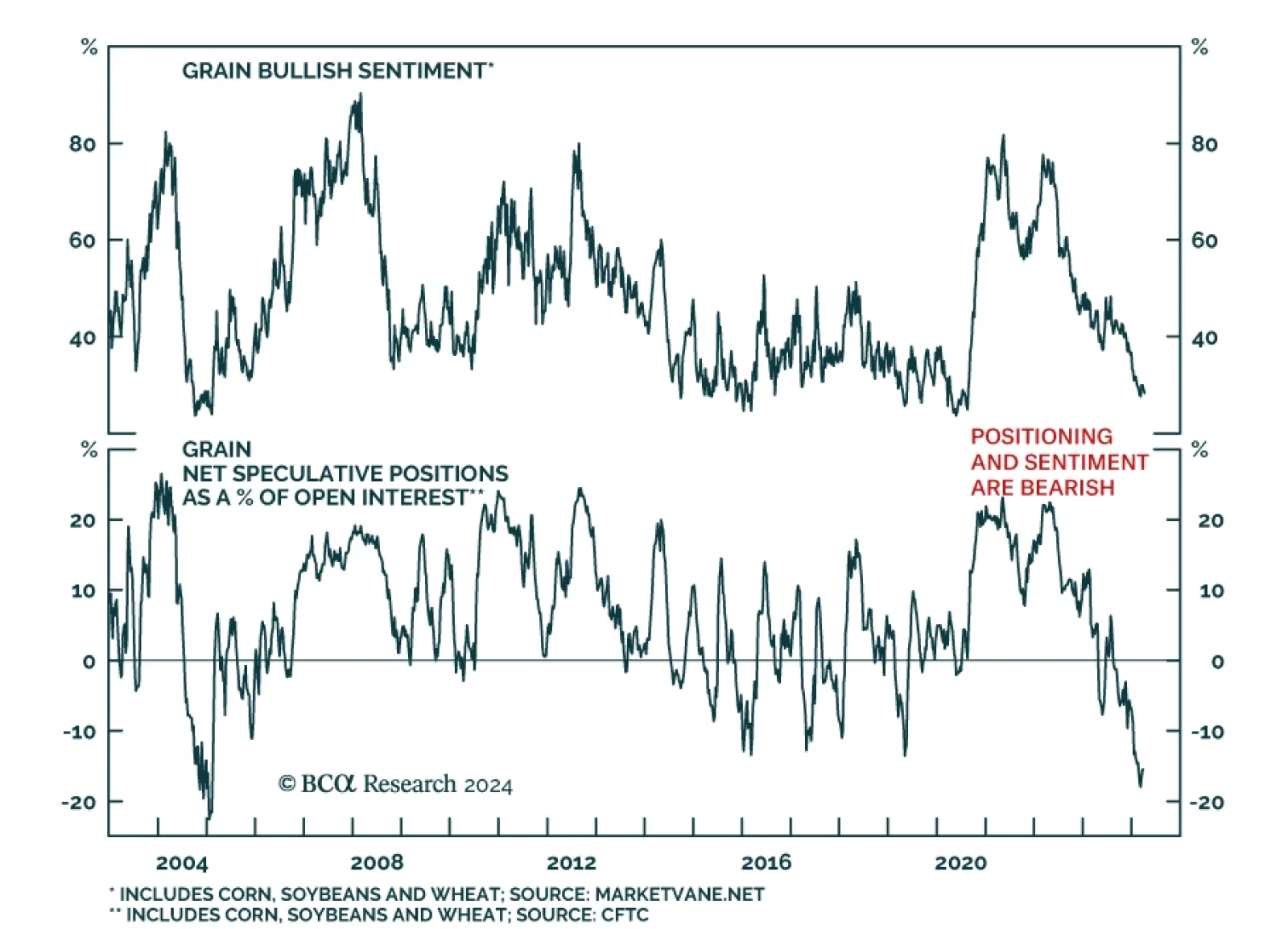

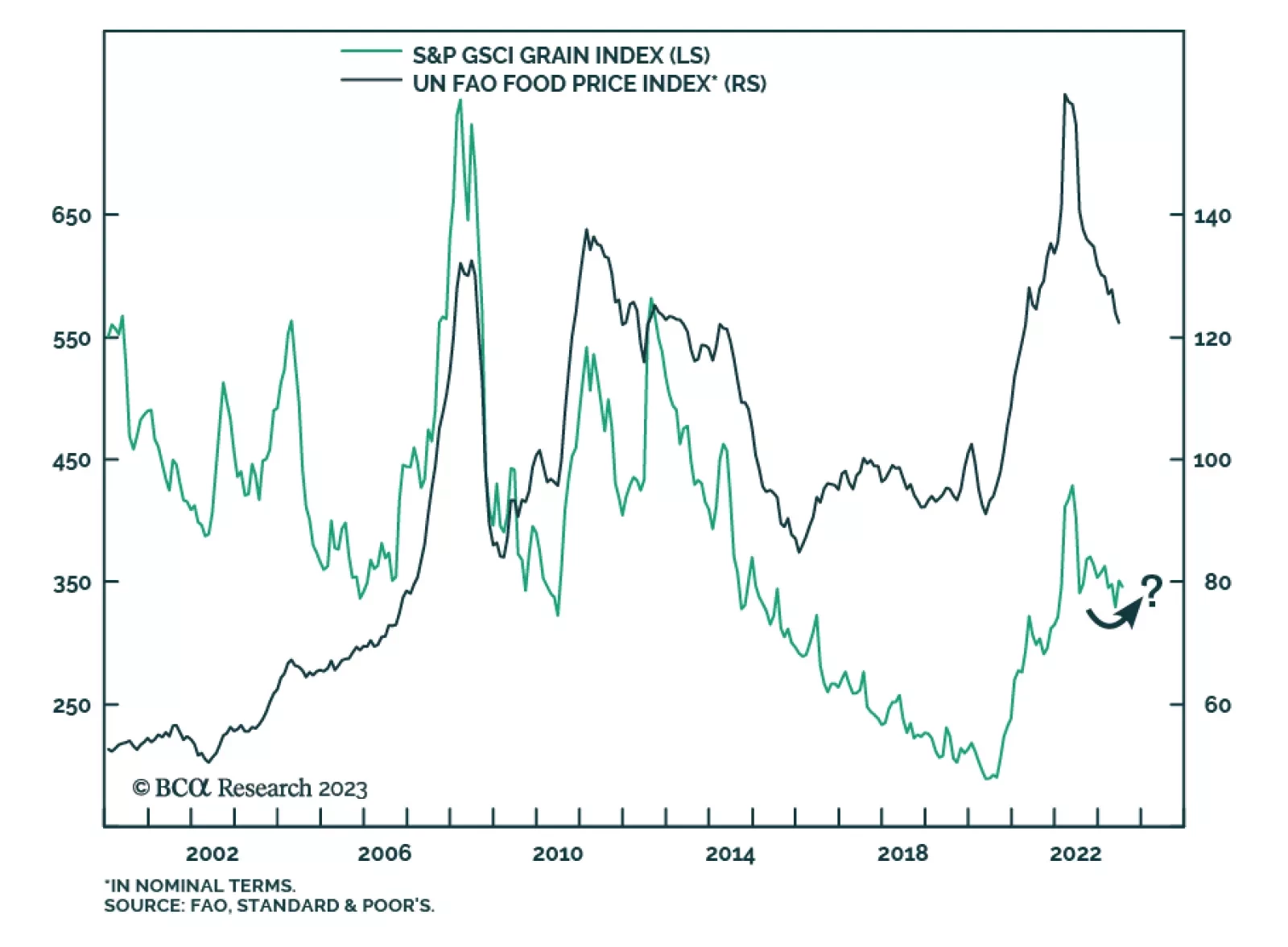

Prices of agricultural commodities have come under intensified downward pressure this year. Corn, soybean, and wheat prices have fallen by 8.6%, 8.3%, and 4.9% respectively so far this year. Multiple factors are behind the…

Wheat and corn prices have surged by 16% and 11%, respectively since Russia refused to renew the Black Sea Grain Initiative after it expired on July 17. The deal, which was negotiated with Turkey and the UN, allowed shipments of…

Wheat, corn, and soybean all traded lower at the Chicago Board of Trade on Wednesday following the US Department of Agriculture’s latest release of its monthly World Agricultural Supply and Demand Estimates (WASDE) –…

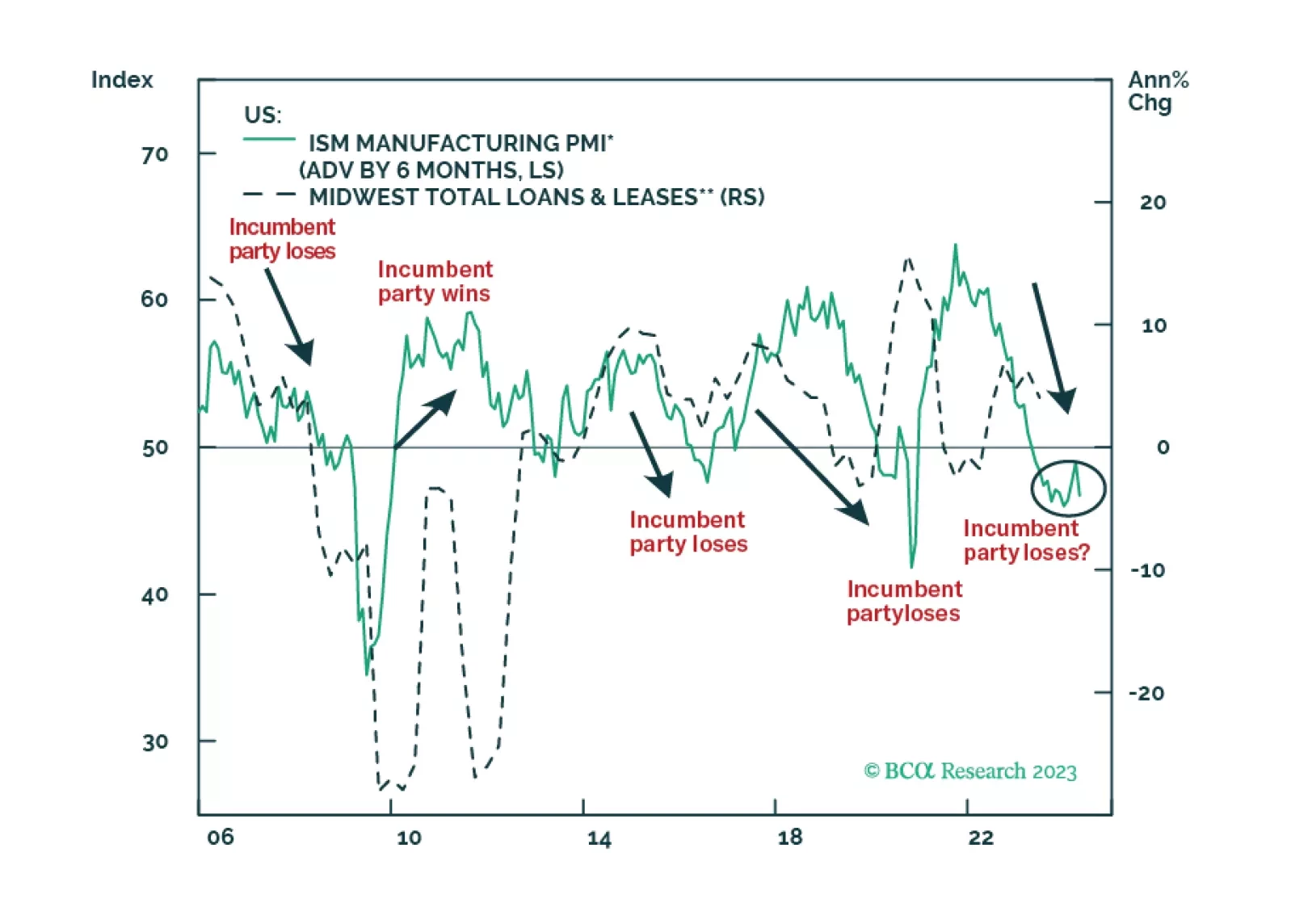

Markets continue to be tossed to and fro by central-bank policy, and risks of higher commodity prices. These are due to fiscal stimulus and exogenous weather and war-related risk, which could send food and energy prices higher this…

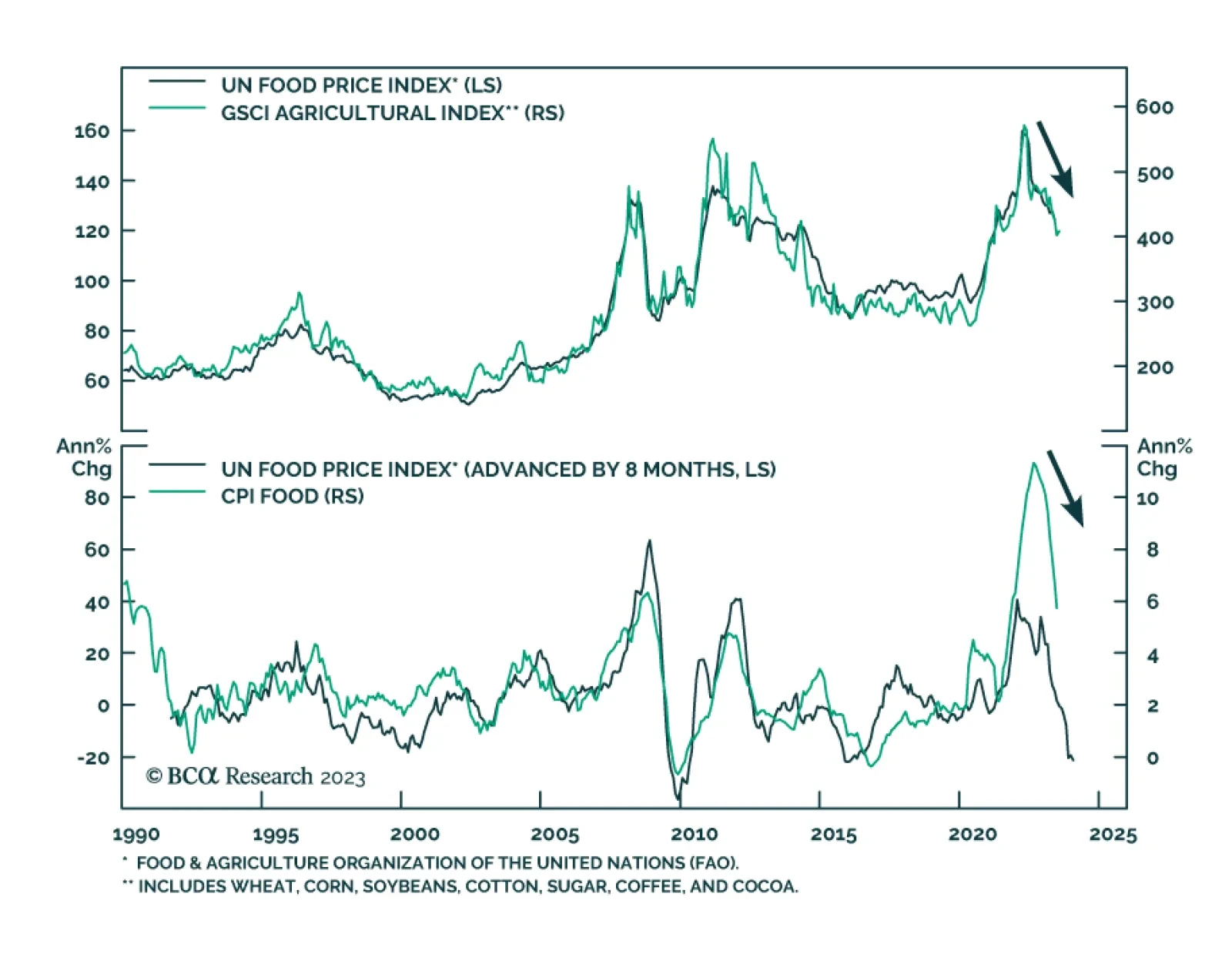

Fertilizer prices will continue to move lower as the natgas price shock touched off by the Russian invasion of Ukraine dissipates. As a result, we expect grain prices to soften another 10% this year. Food-price inflation will move…