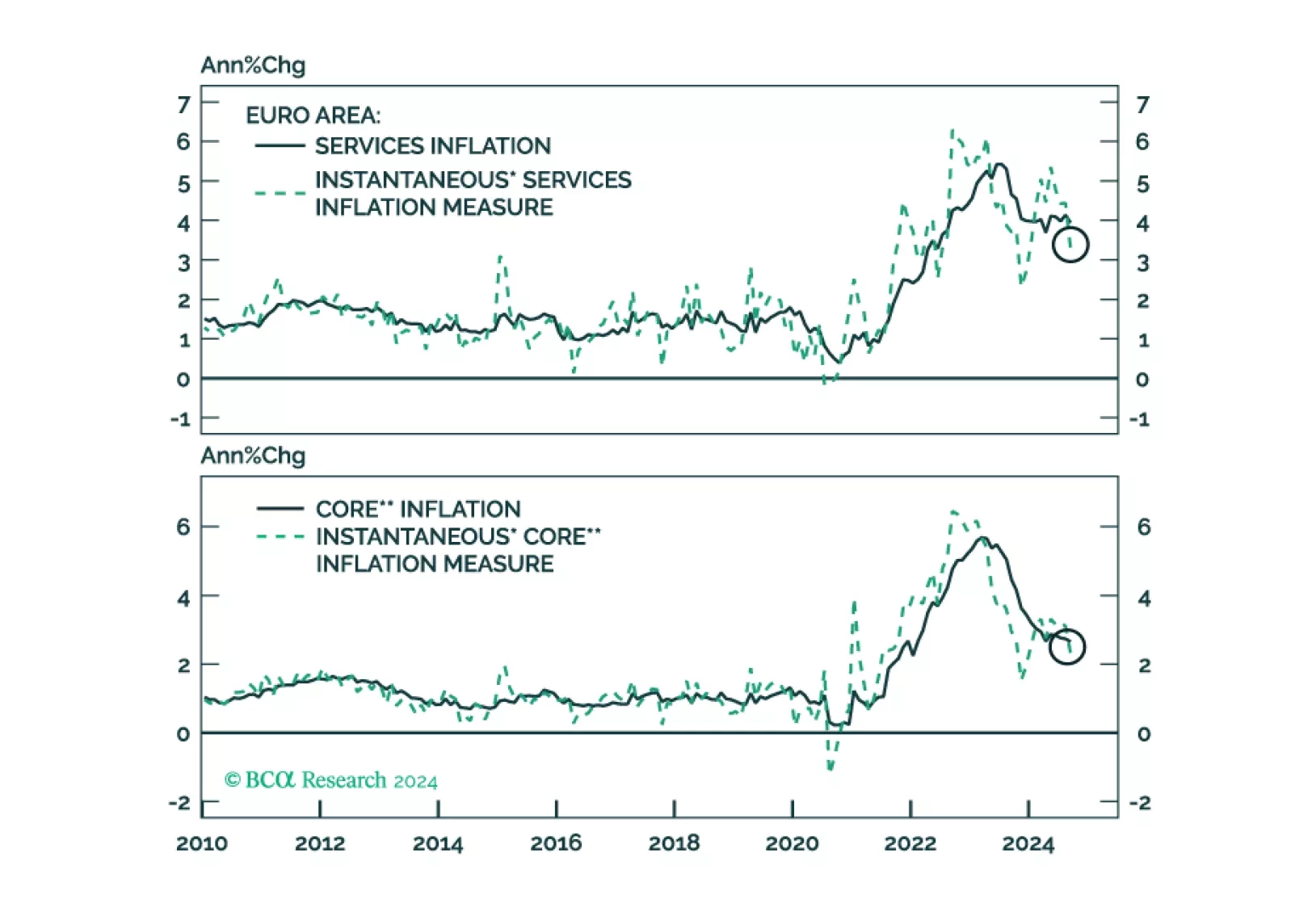

Yesterday, the ECB solidified its recent dovish tilt in response to weaker growth and decreasing inflationary pressures. It is now set to cut rates 25bps each meeting. How low will the ECB deposit rate ultimately go and what does…

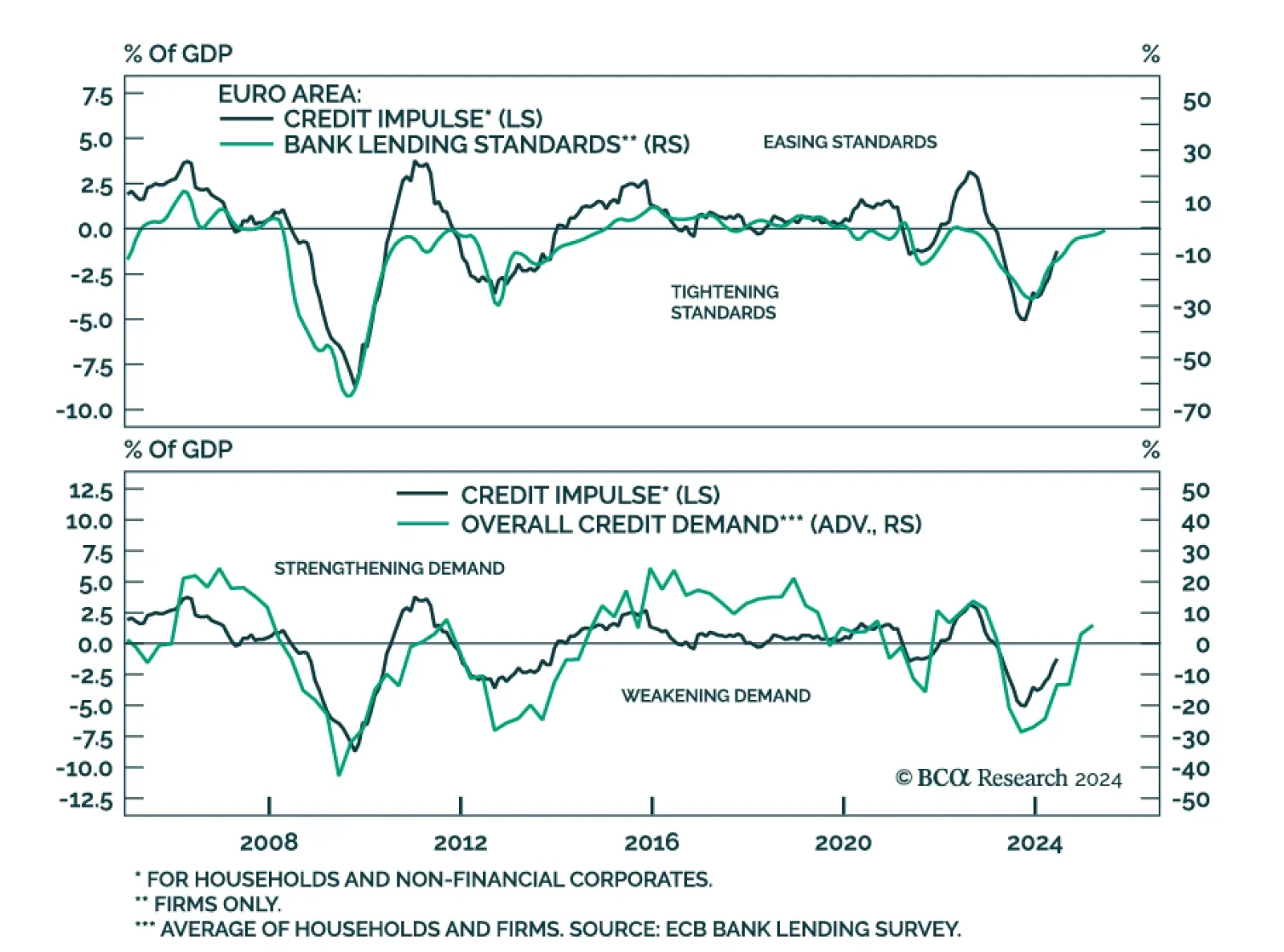

Banks reported an increase in loan demand from both firms and households in the European Central Bank’s Bank Lending Survey, marking the first rise since 2022. This demand increase occurred as lending standards for firms…

While recent cross-asset developments have sent a risk-on signal, with equities and bond yields both higher, the commodity complex has recently been sending a more somber message. “Dr. Copper” is a bellwether for…

Recent positive US economic surprises drove cross-asset pricing, pushing both equities and Treasury yields higher. What do these yield levels mean for the Treasury market, and what path can we expect looking forward? Our US…

The UK August employment report was in line with recent data showing an economy humming at a decent pace. The unemployment rate decreased 0.1pp to 4% after peaking at 4.4% before the summer. The BoE will look kindly to the…

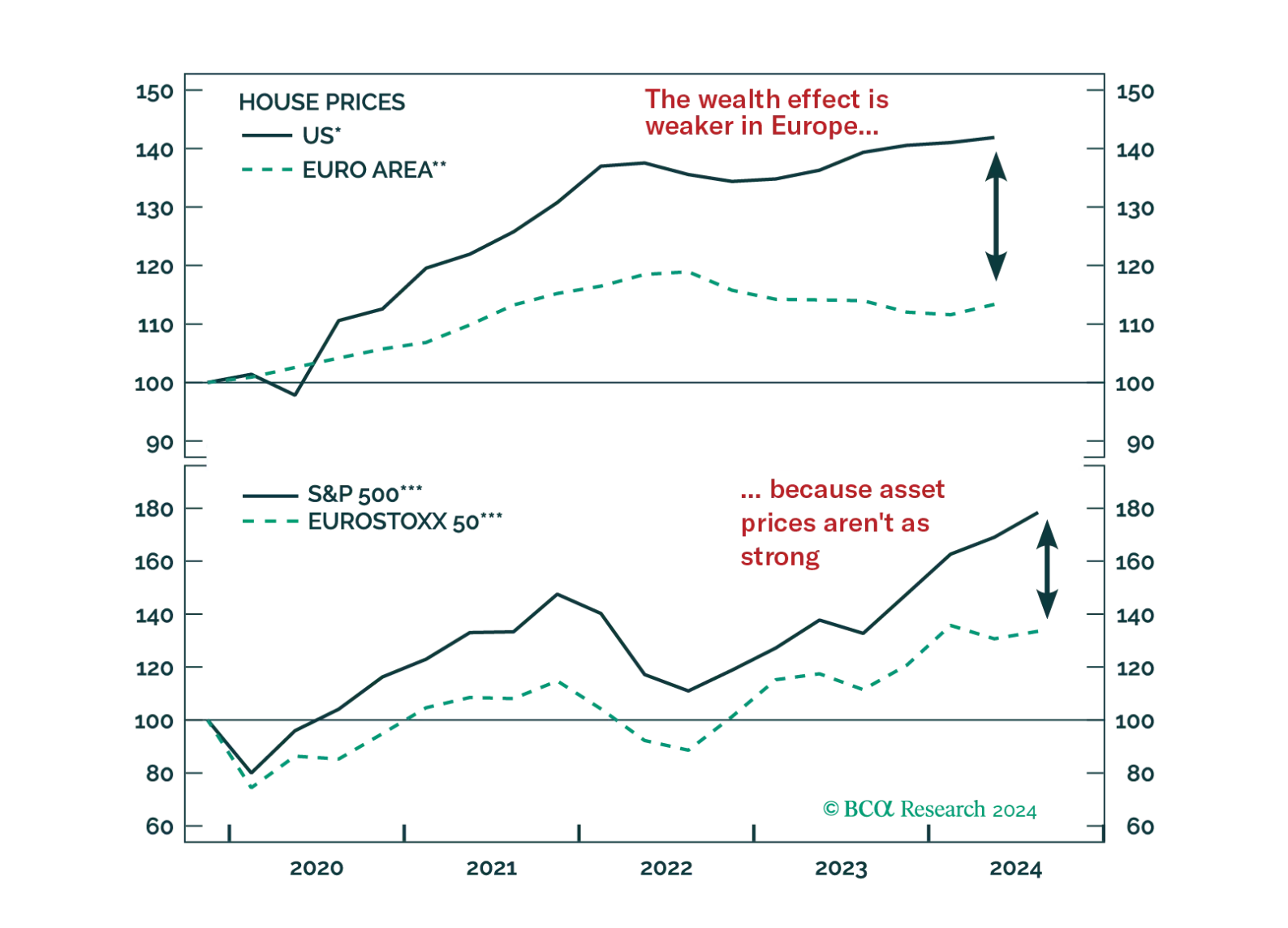

This week, we cover the main questions we fielded during our latest client trip in Europe. Among the many topics broached are Europe’s recession odds, the impact of China’s stimulus, and the outlook for European markets.

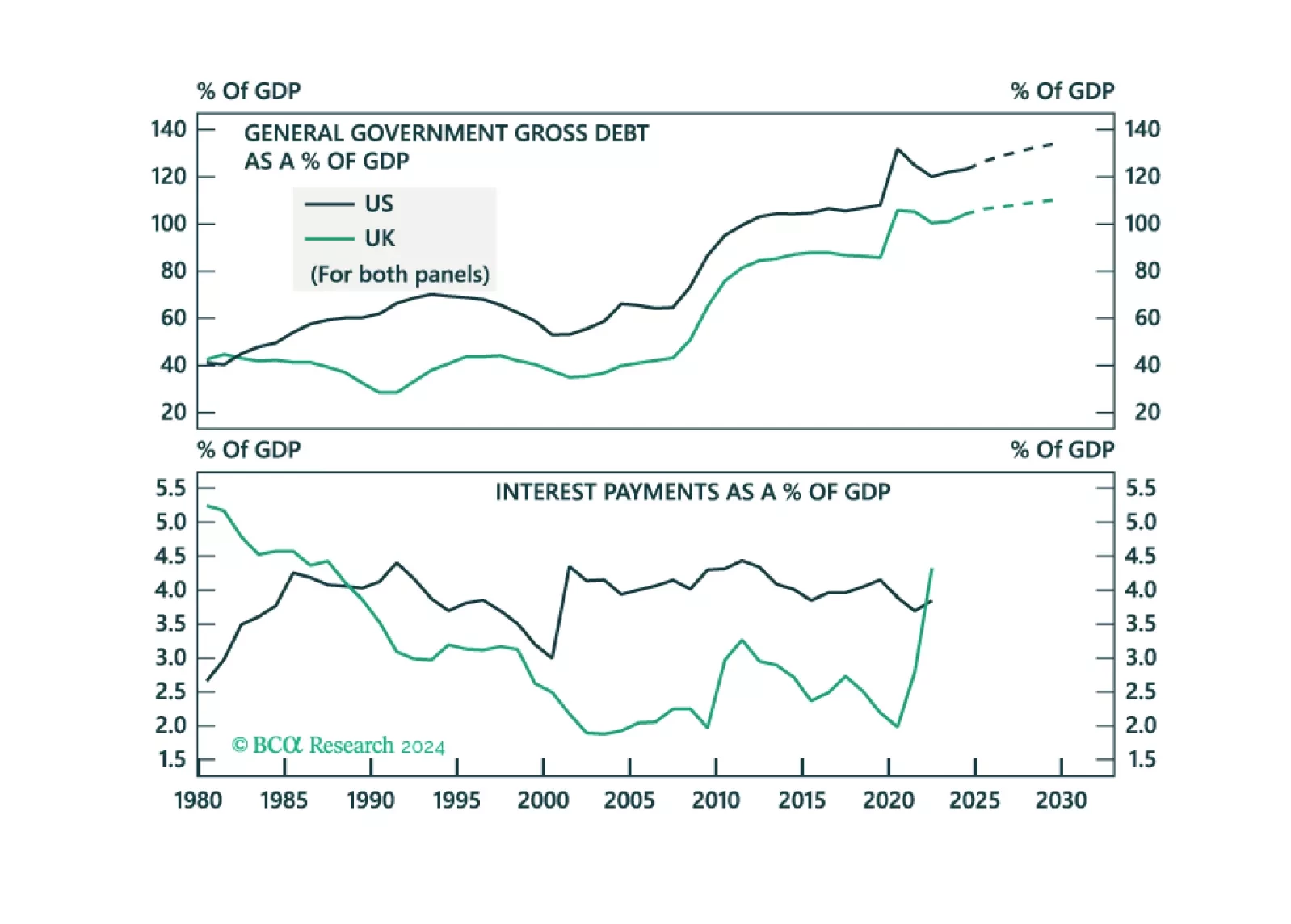

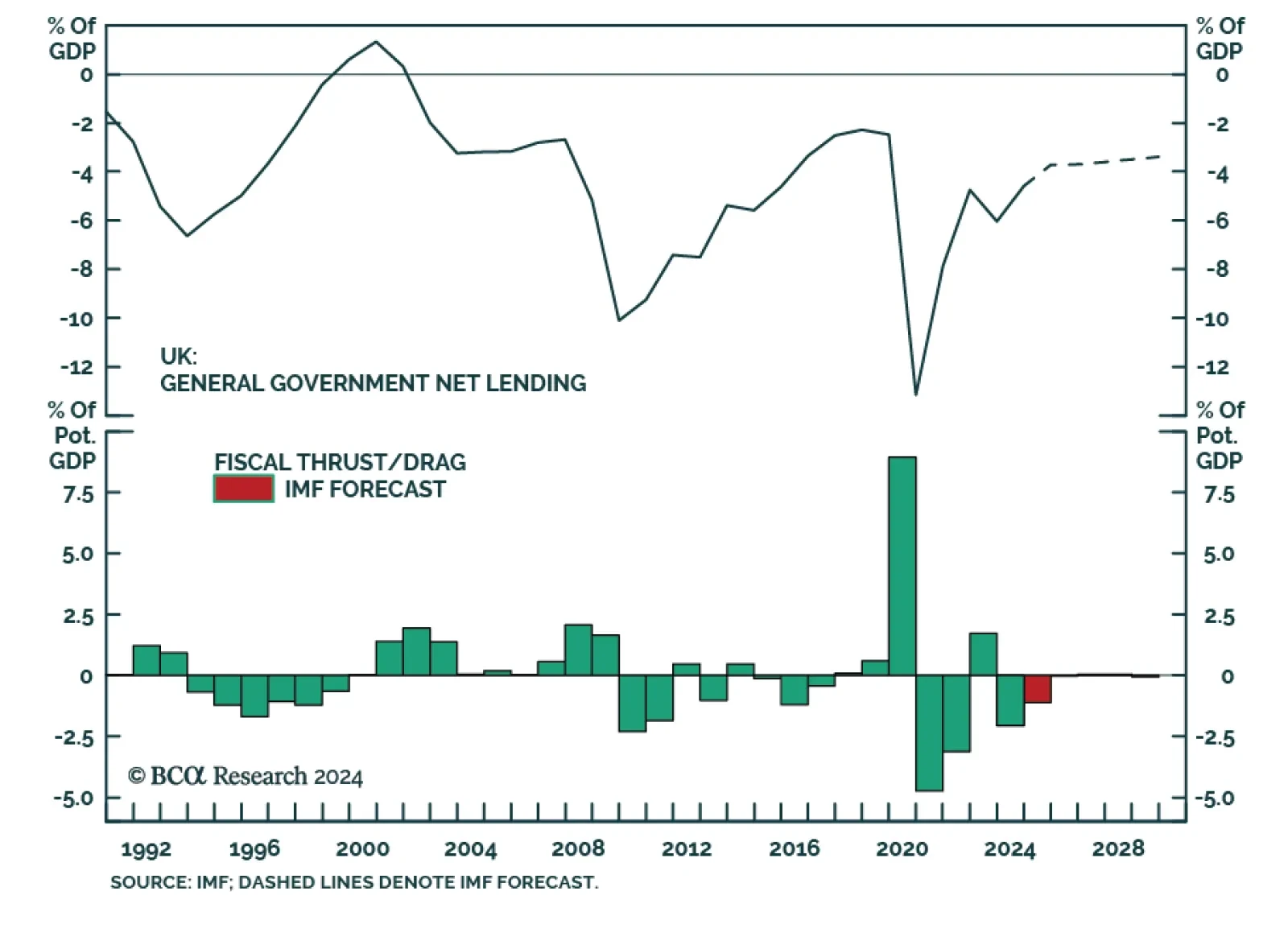

In this Insight, we assess whether investors should expect fiscal turbulence in the UK, that will drive UK yields higher and the pound lower.

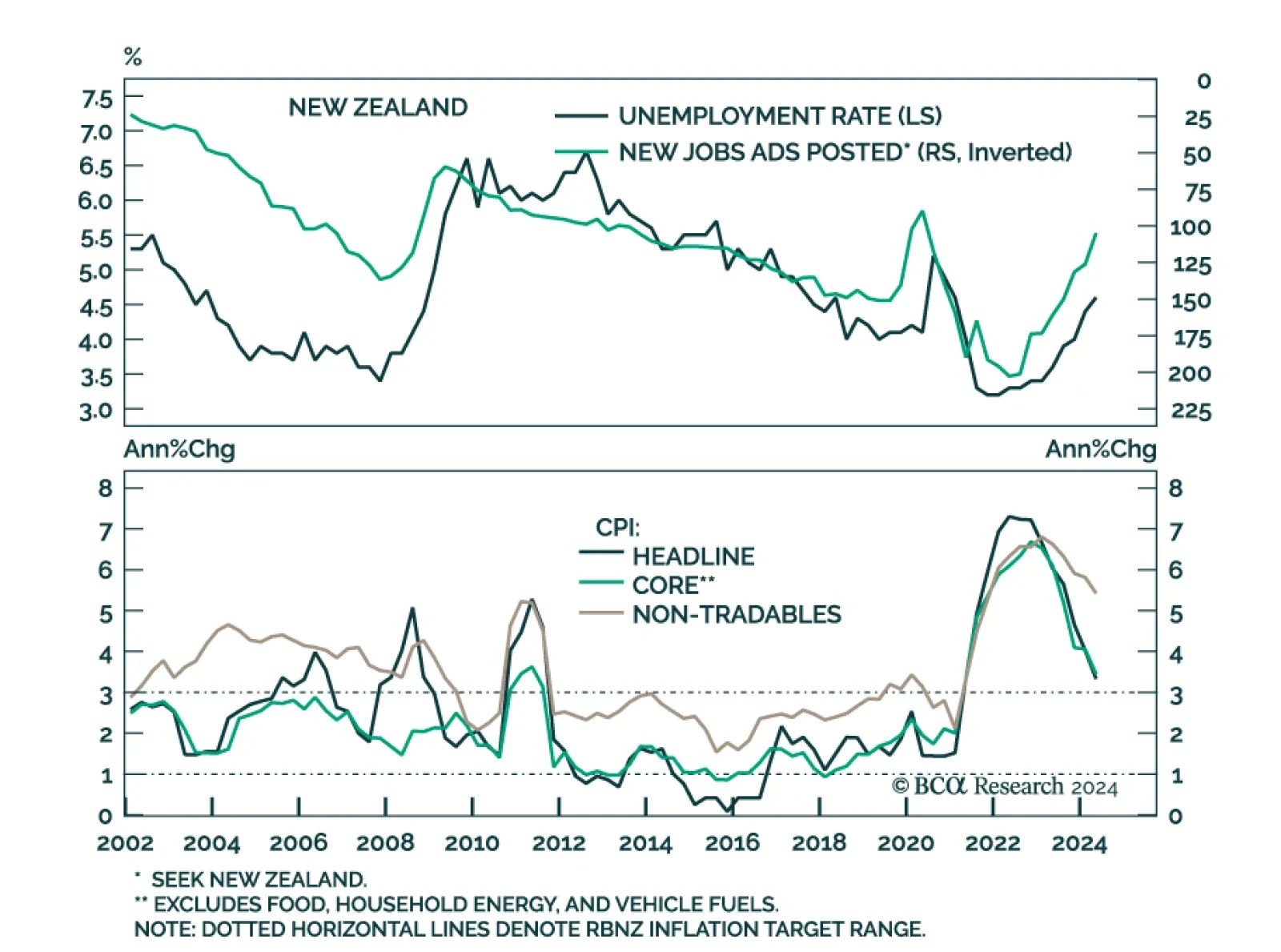

At its October meeting, the Reserve Bank Of New Zealand (RBNZ) cut the Official Cash Rate by 50 bps to 4.75%. The decision was not accompanied by an updated economic forecast or press conference and the latest forecast in August…

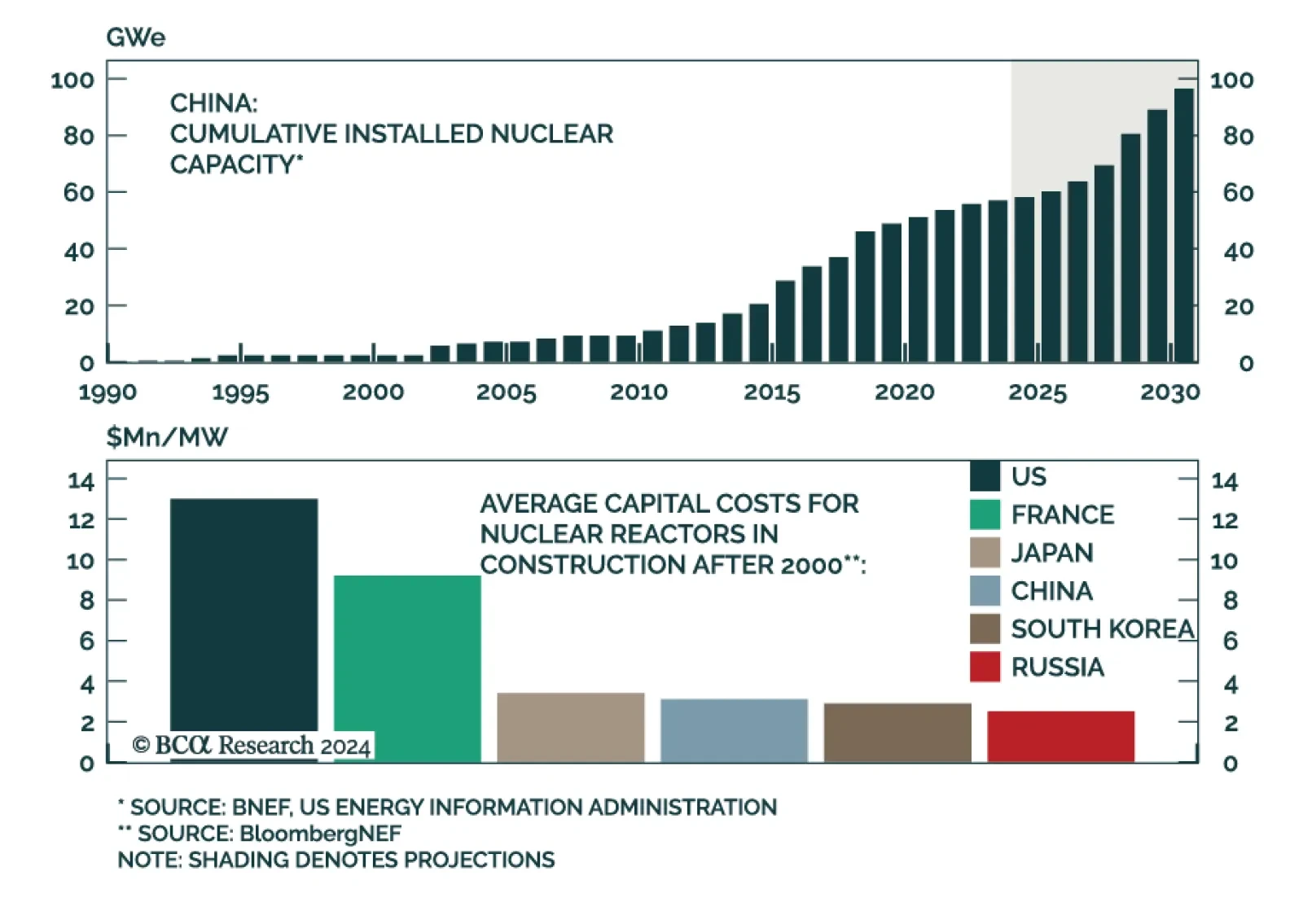

In the fifth installment of a BCA Special Report series on nuclear energy, our colleagues argue that US nuclear energy dominance is decaying. Though still the world’s leader in generation and capacity, the US will not hold…

The US election underscores three long-term trends of Generational Change, Peak Polarization, and Limited Big Government. Investors should expect more volatility around the election and should assess the results before adding more…