Our thoughts on the bond market’s reaction to the election and this afternoon’s FOMC meeting.

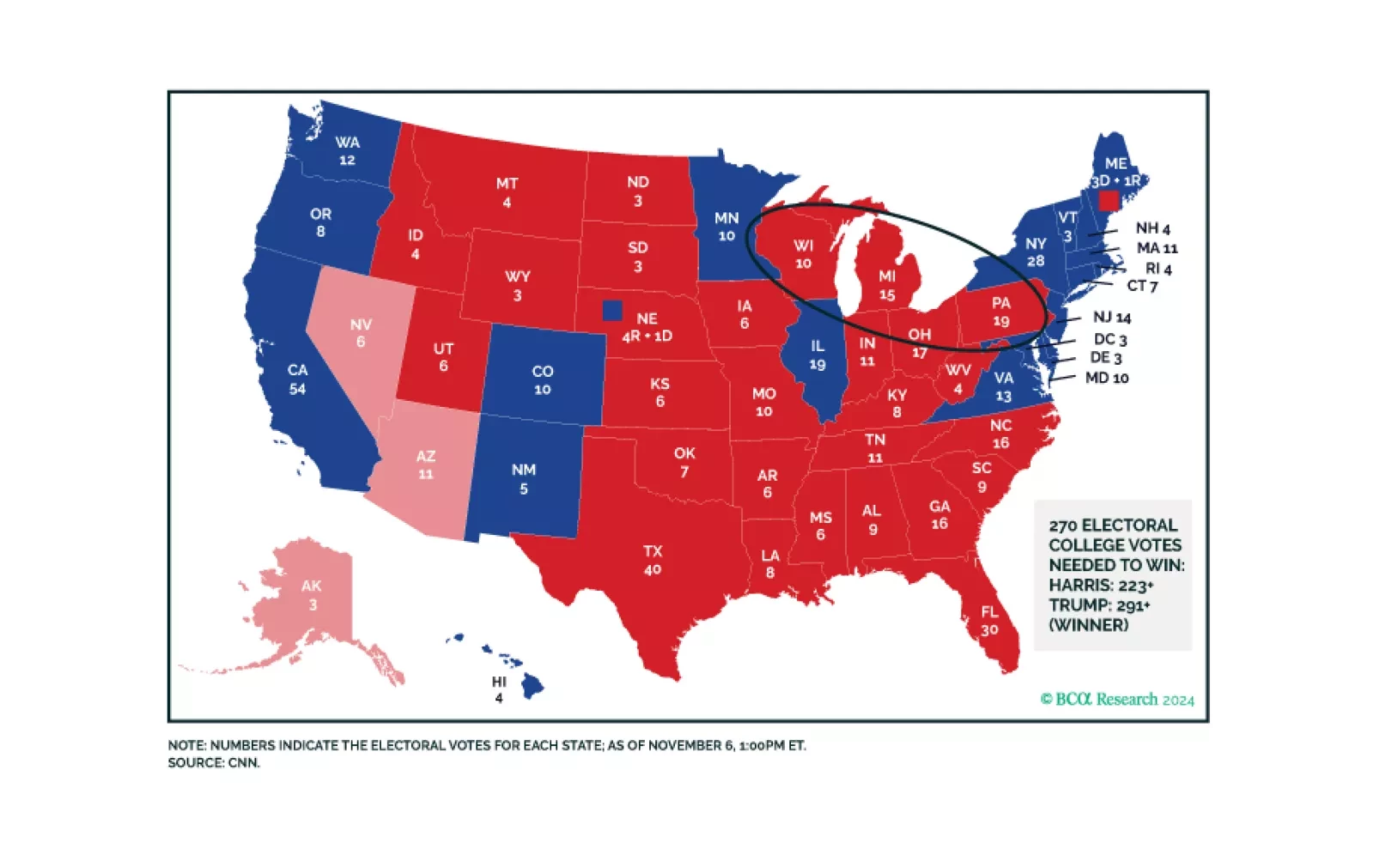

Trump’s resounding victory brings a popular mandate that ensures deregulation and higher trade tariffs. Higher budget deficit and immigration reform are also in the cards as the Republicans look like they may squeak a thin margin in…

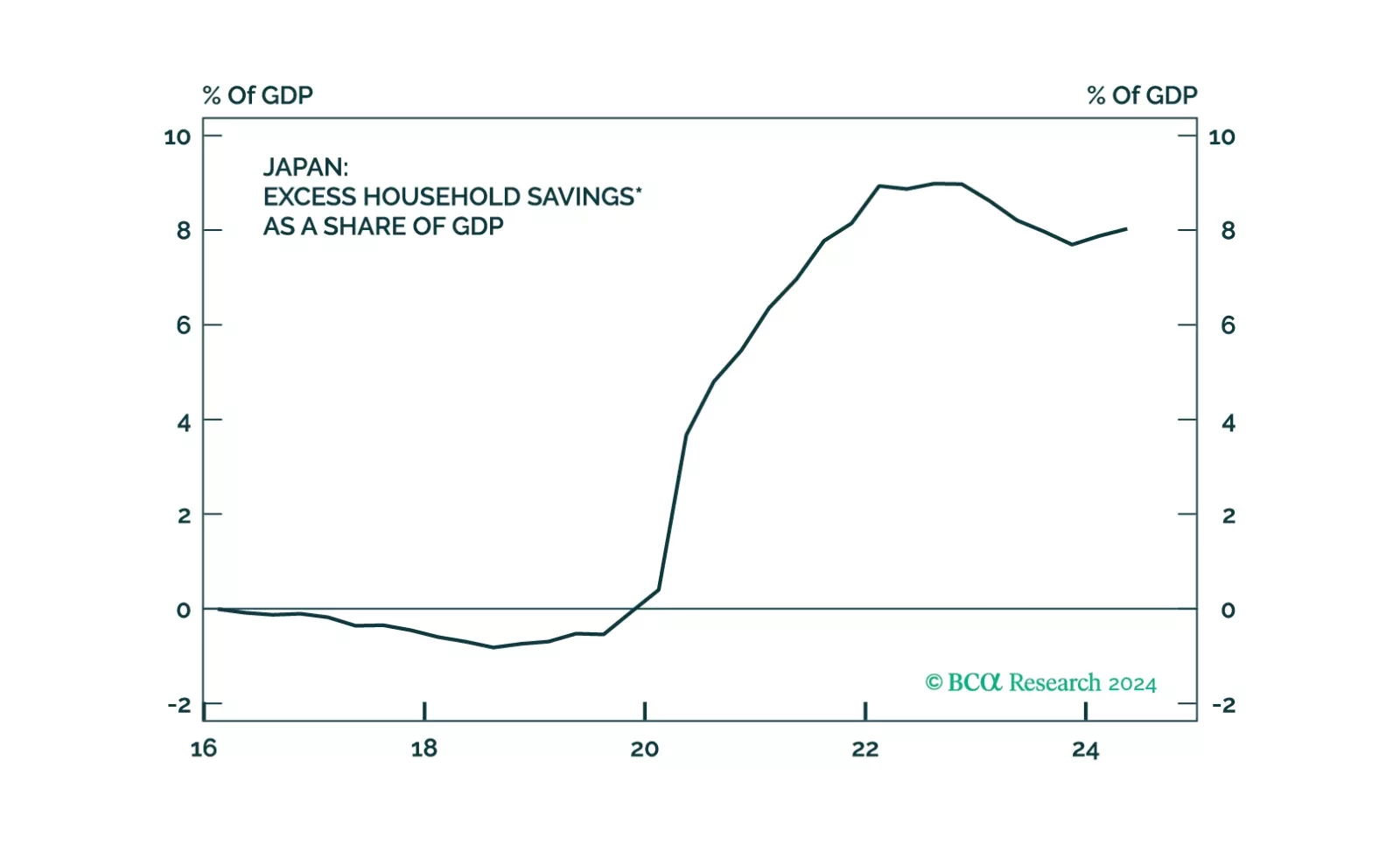

Over the next few months, Japan’s new government will ease fiscal policy, which will improve domestic demand on the margin. Monetary policy may tighten further in the short run but not too much over the long run. The geopolitical…

The latest Bank of Japan meeting did not alter our high-conviction views of being long the yen and underweight JGBs.

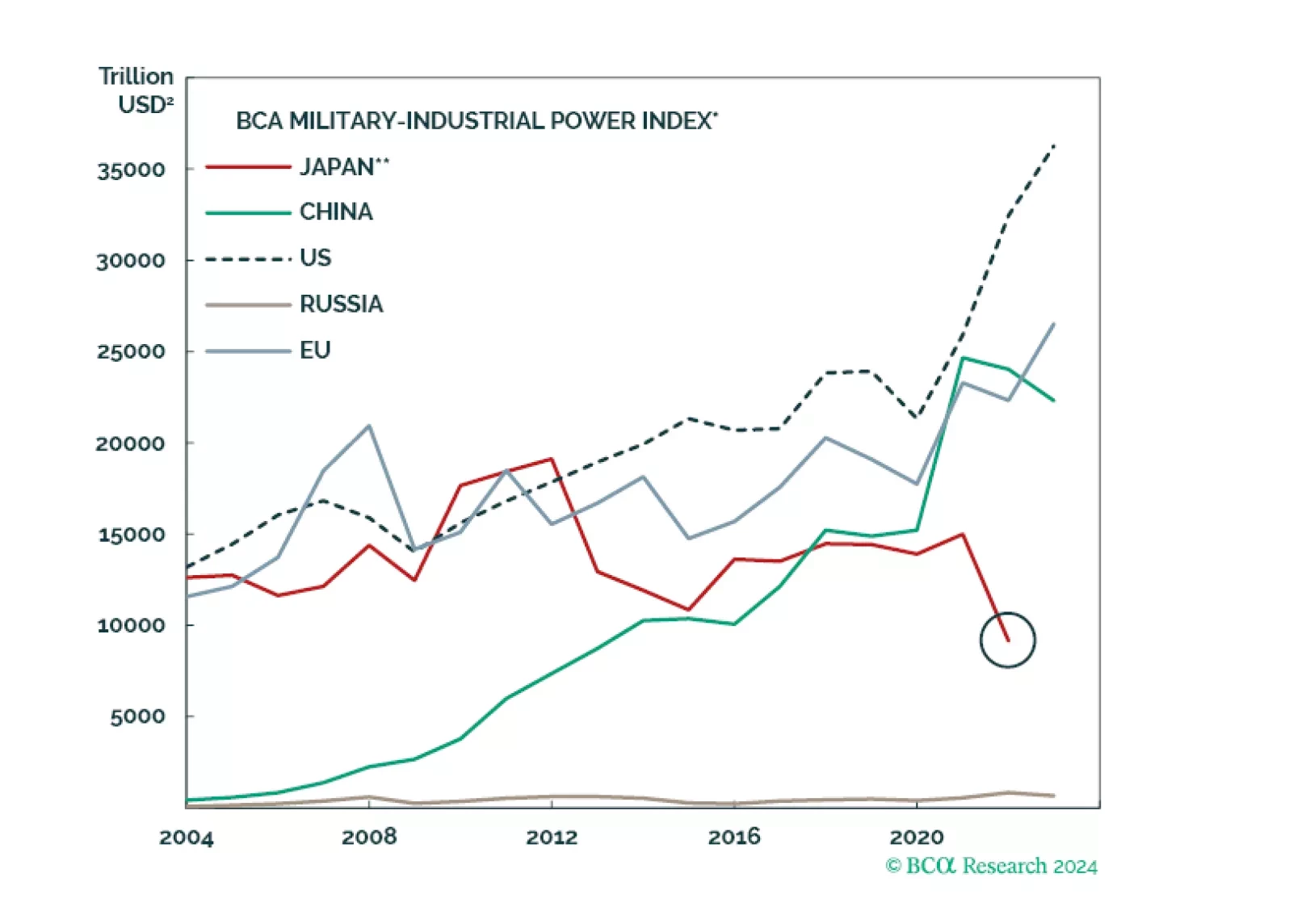

The global political system is destabilizing and the US will turn more hawkish in foreign policy, trade policy, or both, regardless of the election outcome. Tactically go long the dollar.

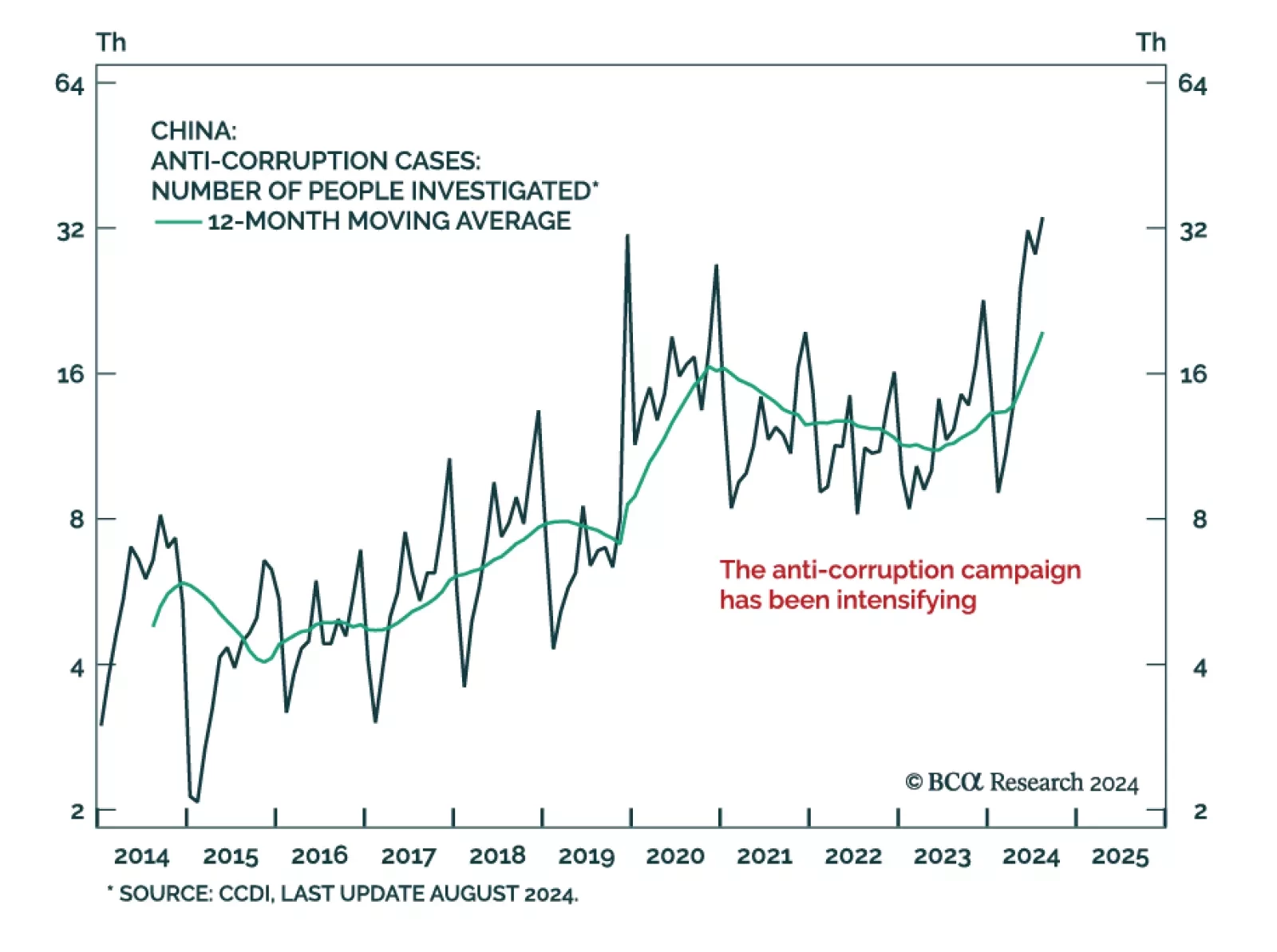

While moving in the right direction, China’s latest stimulus measures are falling short of the mark to reflate the economy. The latest rumors extend this trend. News agencies reported discussions of a CNY 10 trillion…

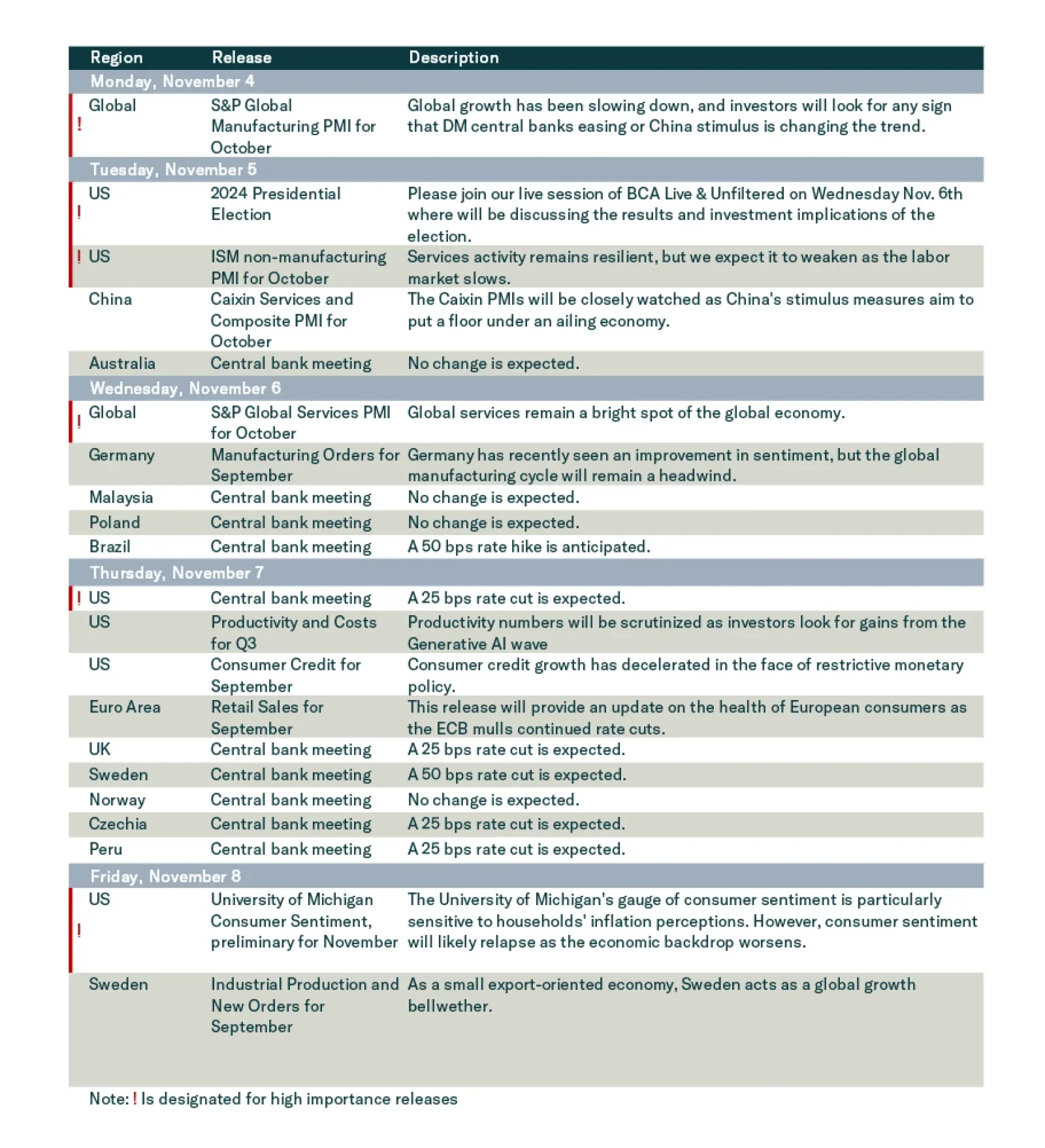

In this Insight, we evaluate if there is more juice in our macro bet of being long June 2025 CORRA versus SOFR futures, and correspondingly, being short the CAD, for investors with a 1-3 month horizon.

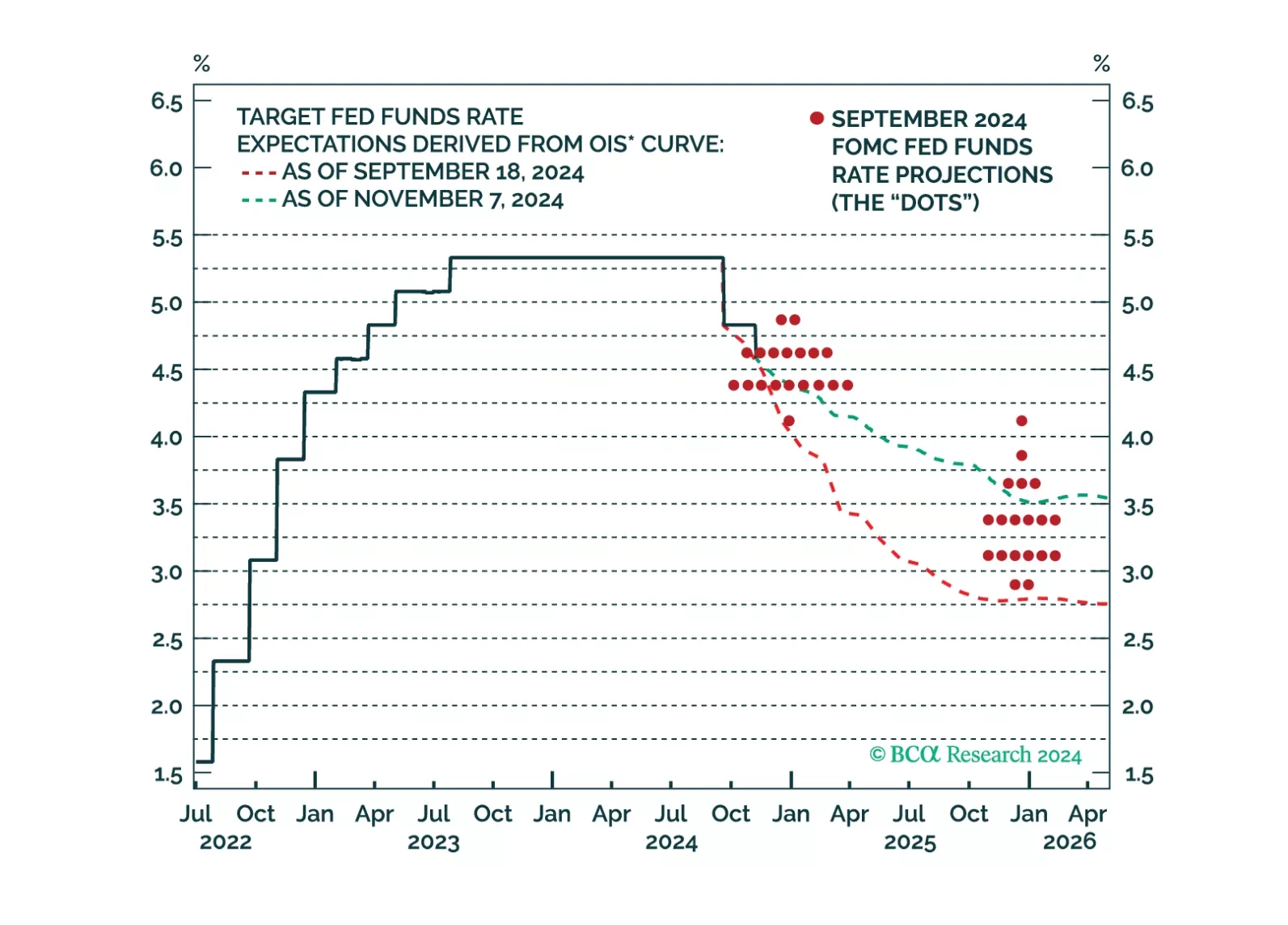

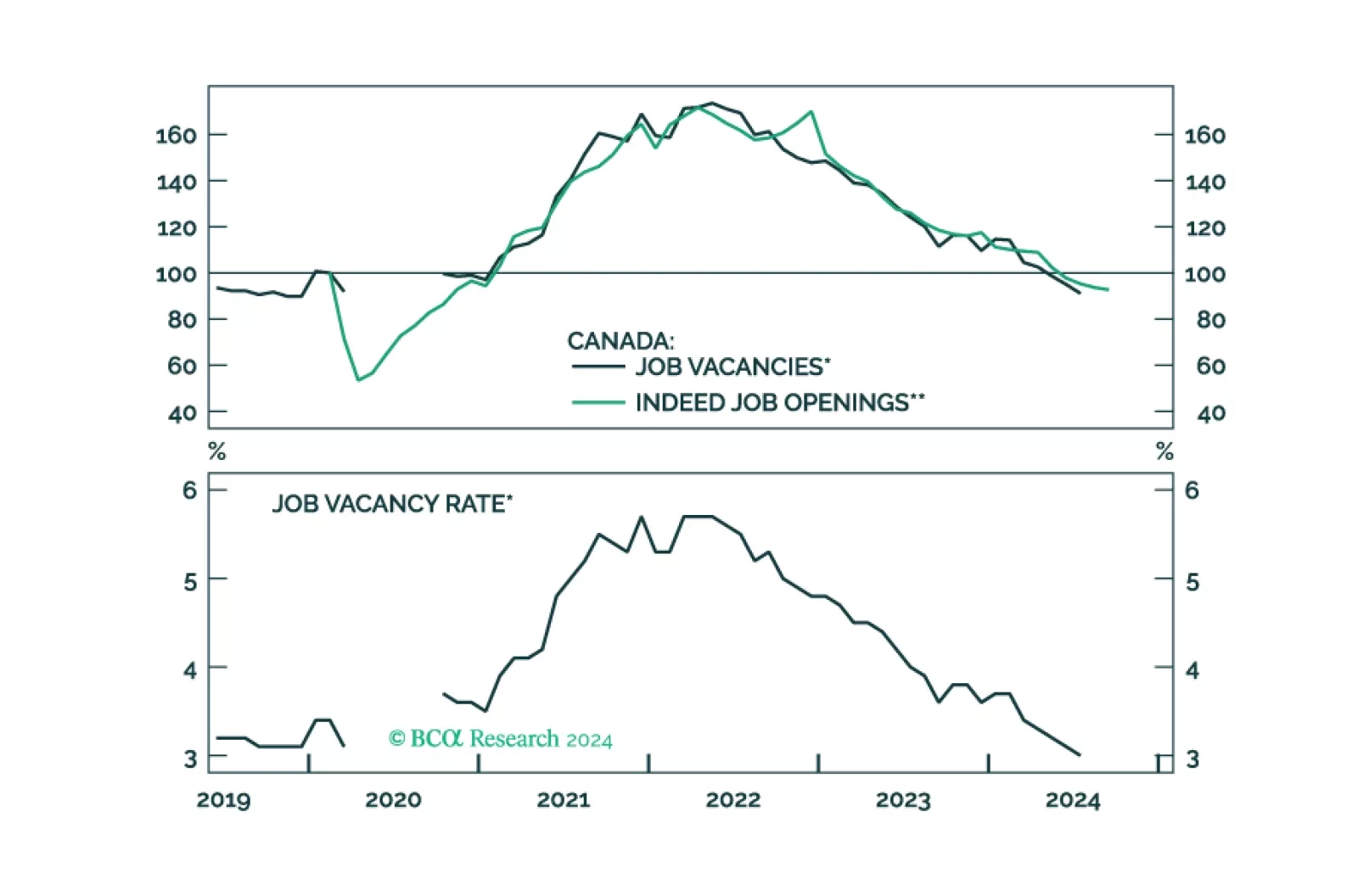

A Donald Trump victory would send bond yields higher during the next few weeks, but yields will fall in 2025 no matter the election outcome.