Dear Client, In lieu of our regular report next week, I will be holding a webcast with my colleague Dhaval Joshi to discuss the future of cryptocurrencies. Dhaval thinks the price of Bitcoin is going to $125,000. I agree with the last…

Highlights President Biden has called for the US intelligence community to investigate the origins of COVID-19 and one of Biden’s top diplomats has stated the obvious: the era of “engagement” with China is over. This…

Highlights China's high-profile jawboning draws attention to tightness in metals markets, and raises the odds the State Reserve Board (SRB) will release some of its massive copper and aluminum stockpiles in the near future. Over…

Highlights ECB Tapering?: Investor fears that the ECB could follow the Bank of Canada and Bank of England and begin to taper its bond buying sooner than expected – perhaps as soon as next month’s policy meeting – are…

Highlights Global stocks are very vulnerable to a correction. But cyclically the Fed is committed to an inflation overshoot and the global economy is recovering. China’s fiscal-and-credit impulse fell sharply, which leaves global…

Highlights Over the 2021-22 period, renewable capacity will account for 90% of global electricity-generation additions, per the IEA's latest forecast. This will follow the 45% surge (y/y) in renewable generation capacity added last…

Feature Chinese stocks remain in limbo despite robust economic data in April and early May (Chart 1). Onshore equities are pricing in policy tightening risks and a peak in the domestic economic cycle. Meanwhile, a regulatory…

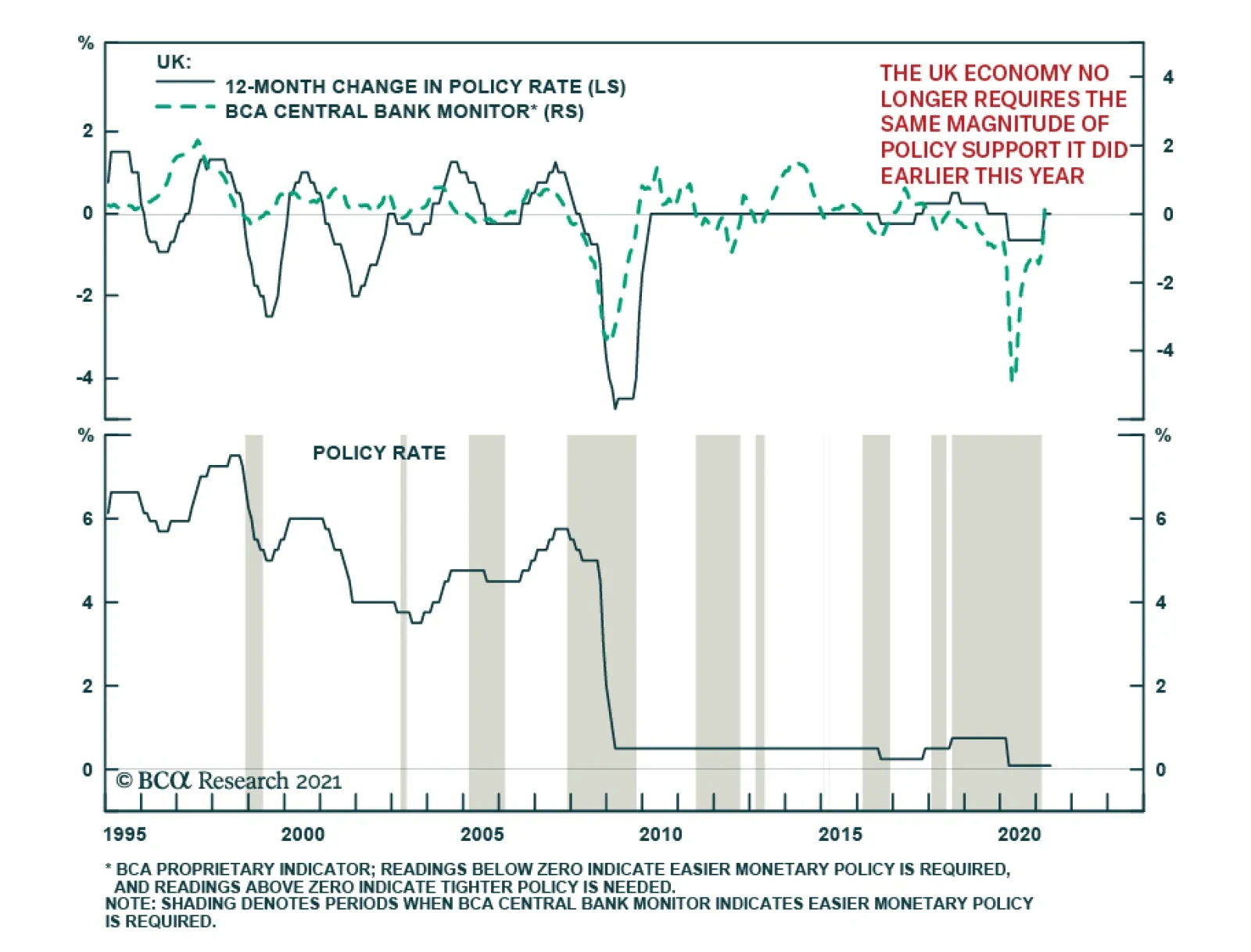

As expected, the Bank of England maintained the bank rate at 0.1% and kept the total target stock of asset purchases unchanged at its Thursday meeting. However, the central bank upgraded its growth outlook and now forecasts GDP…

Highlights A slower money and credit growth in China will eventually generate disinflationary pressures by weighing on demand for commodities. The PBoC has shifted its inflation anchor and policy framework to target core CPI and the…

Highlights Biden’s first 100 days are characterized by a liberal spend-and-tax agenda unseen since the 1960s. It is not a “bait and switch,” however. Voters do not care about deficits and debt. At least not for now.…