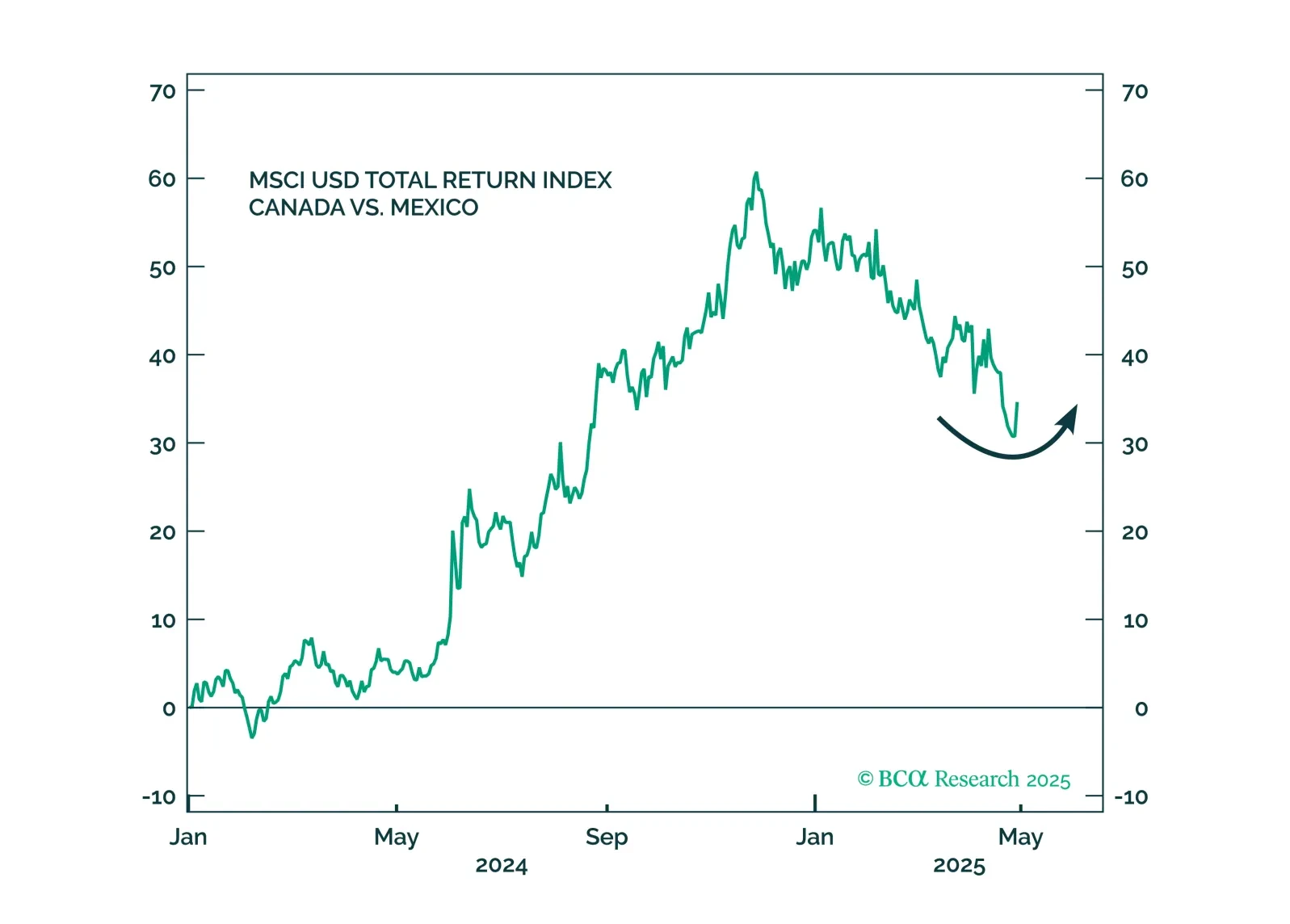

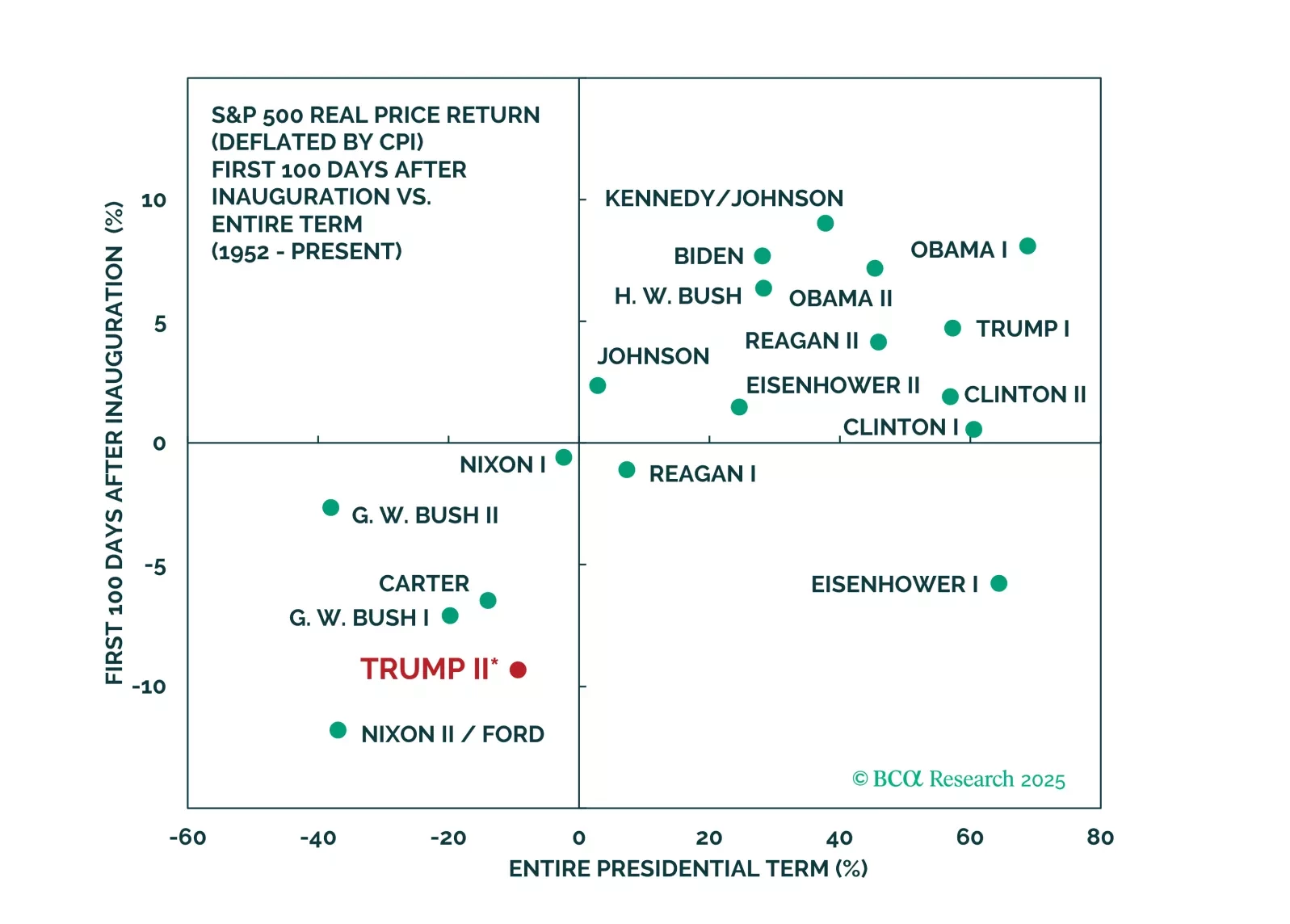

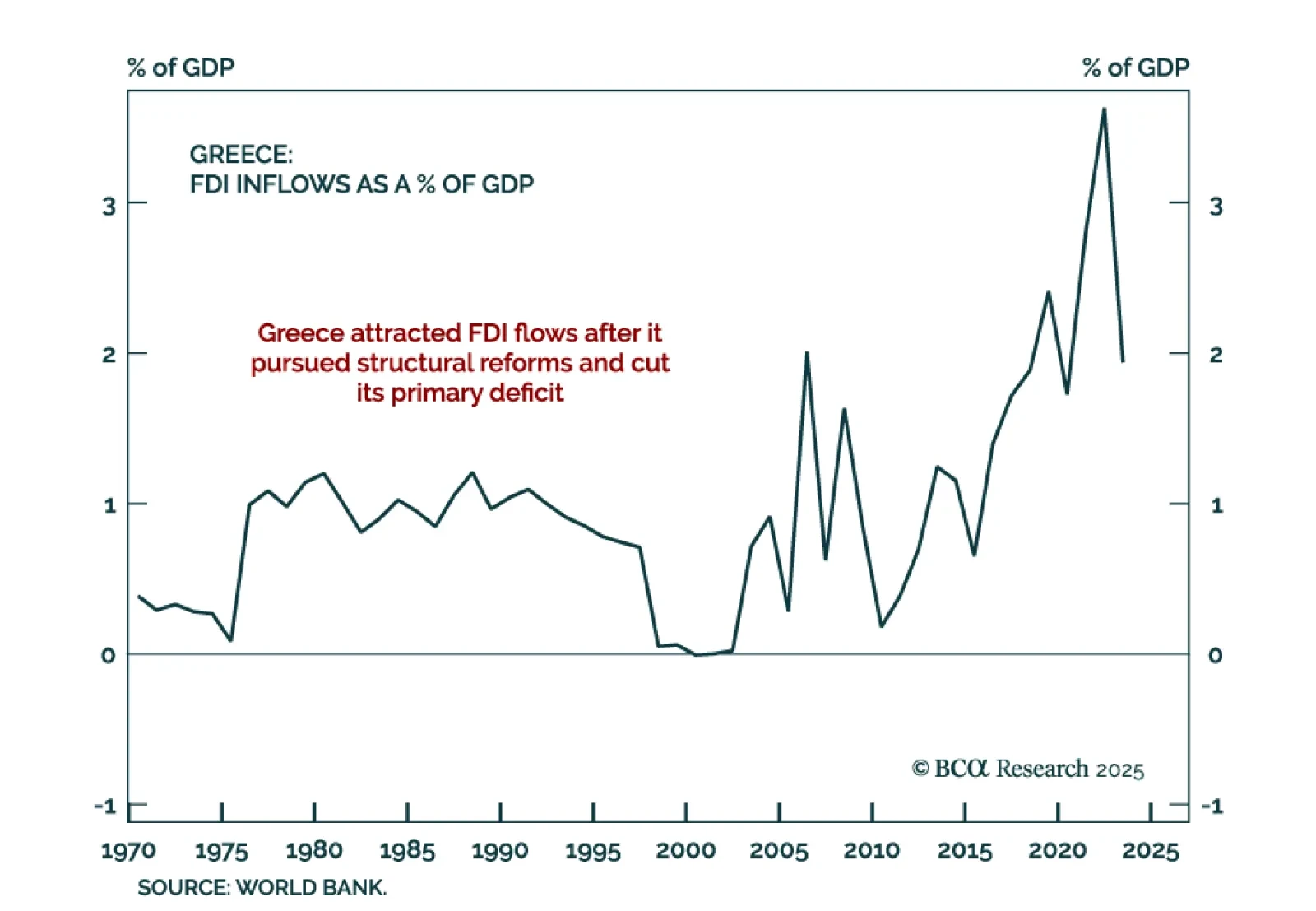

Our GeoMacro strategists remain negative toward US equities as President Trump’s efforts to limit the foreign investments of US firms will undercut their competitiveness. FDI brings clear strategic and financial gains, both…

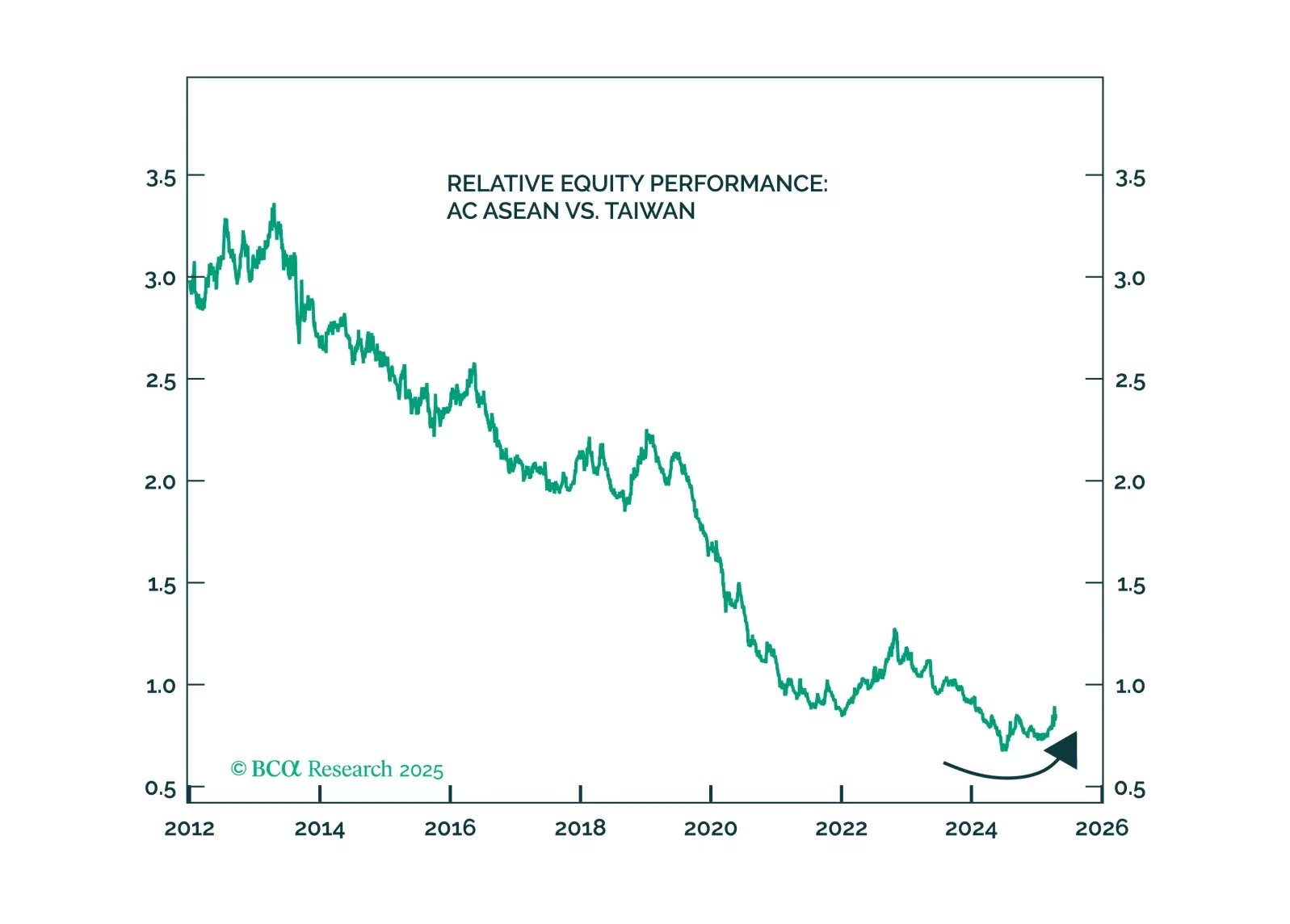

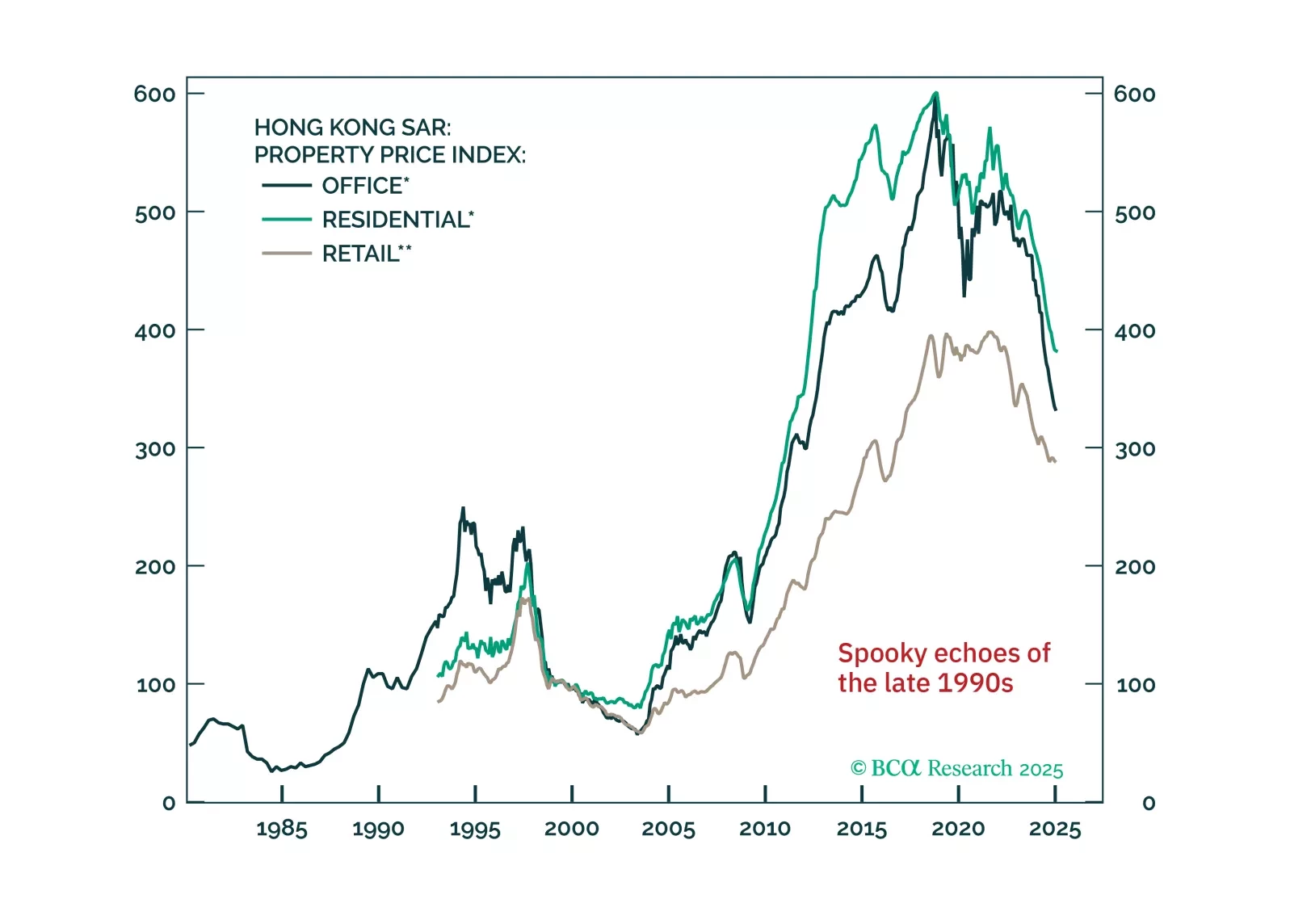

Negotiations on trade, Iran, and Ukraine will prove critical this month. Markets will remain volatile because positive data surprises enable the White House to press its hawkish tariff hikes, while negative surprises force the White…

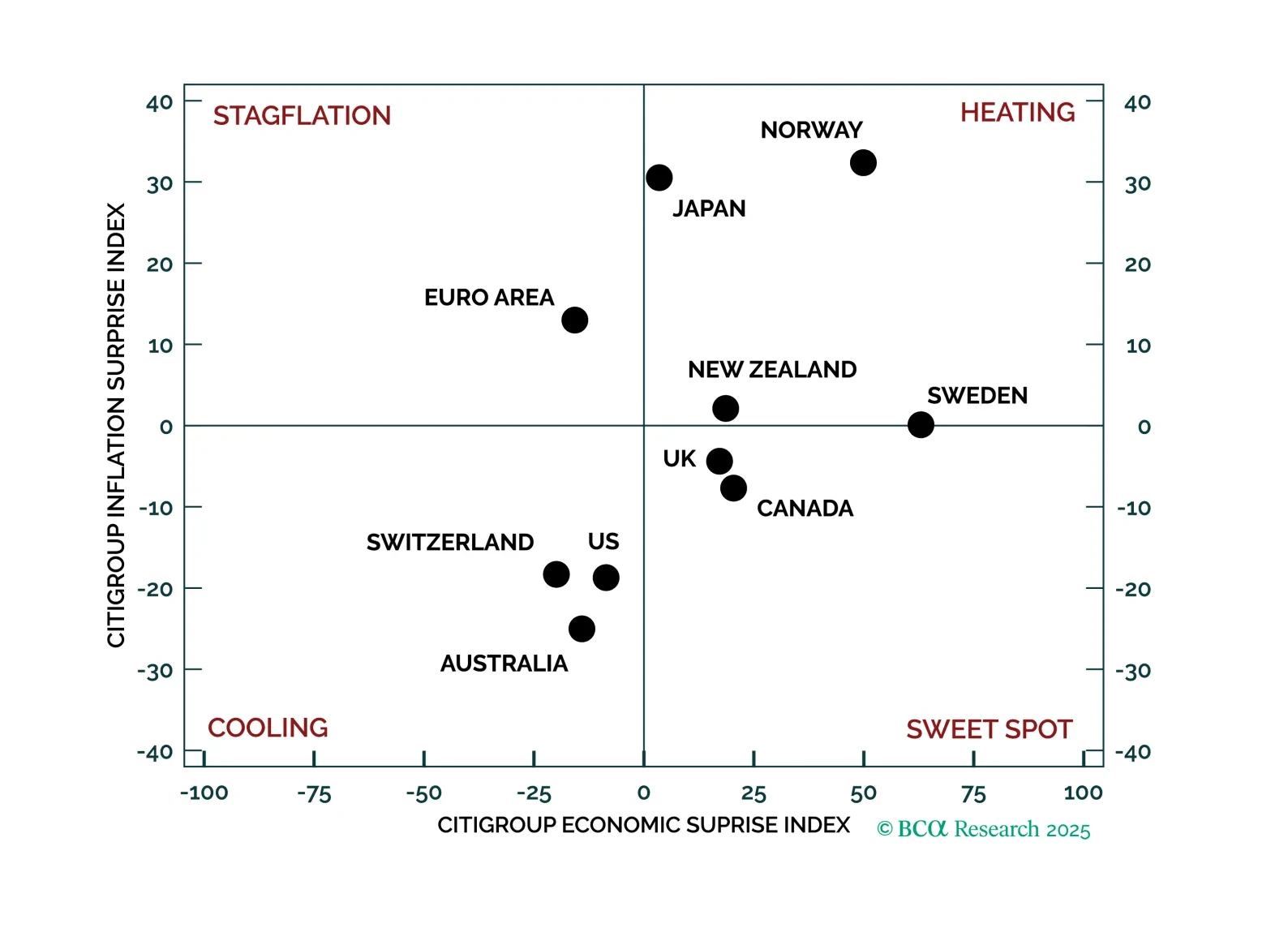

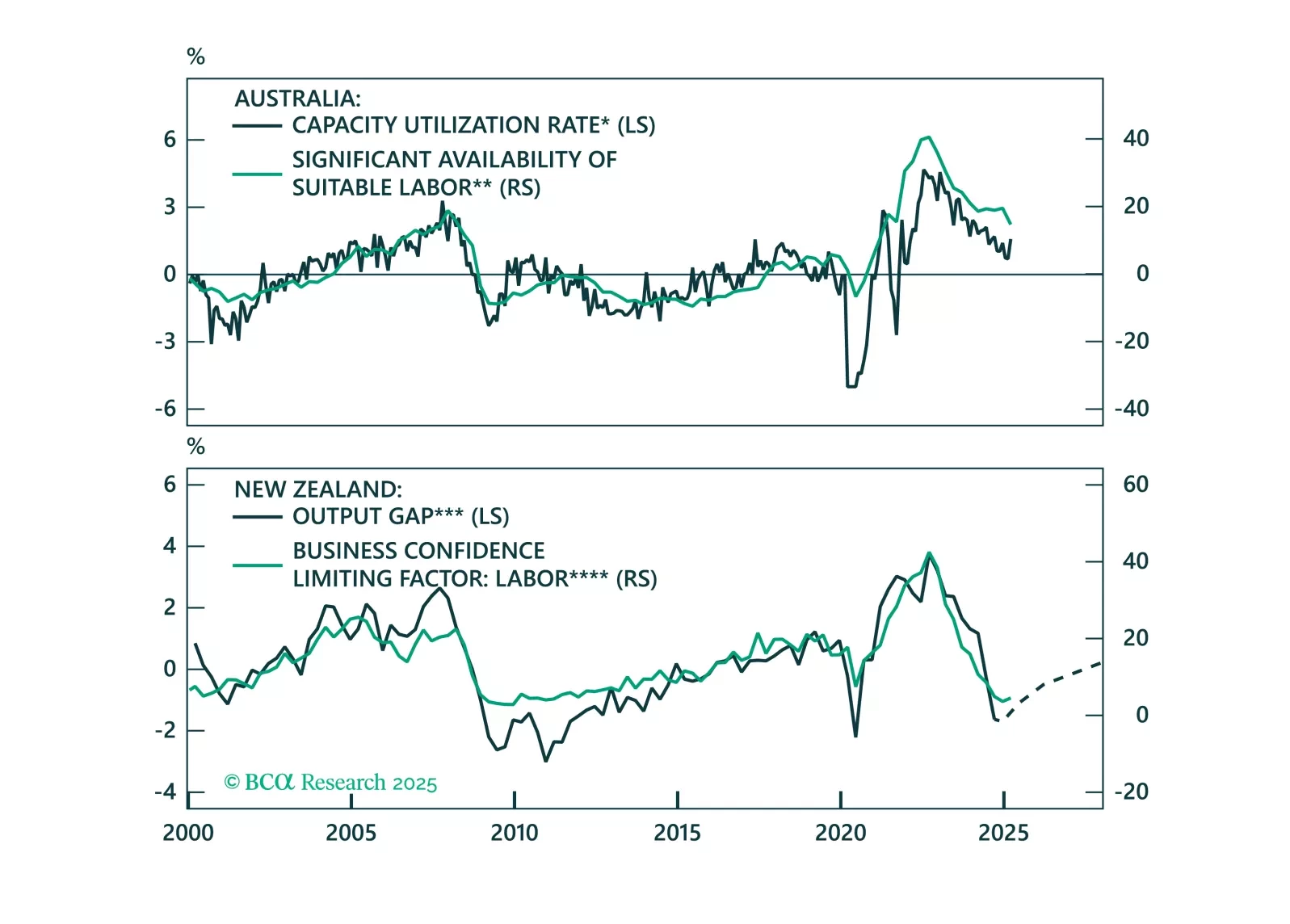

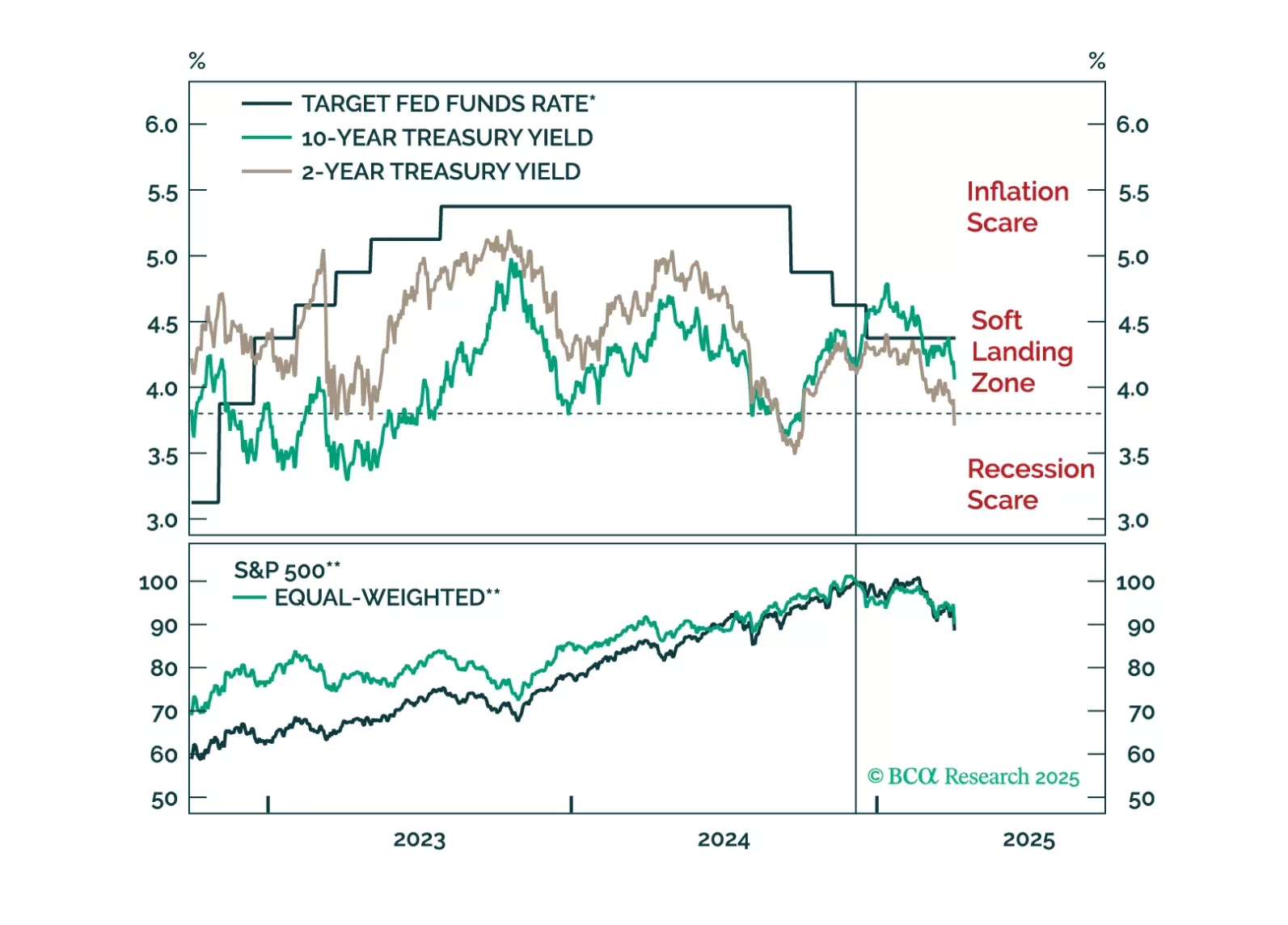

We apply our systematic approach to investing based on economic, inflation, and monetary policy surprises to the major global bond markets. The economic regimes defined by the current macro-surprises setup confirm our existing fixed-…

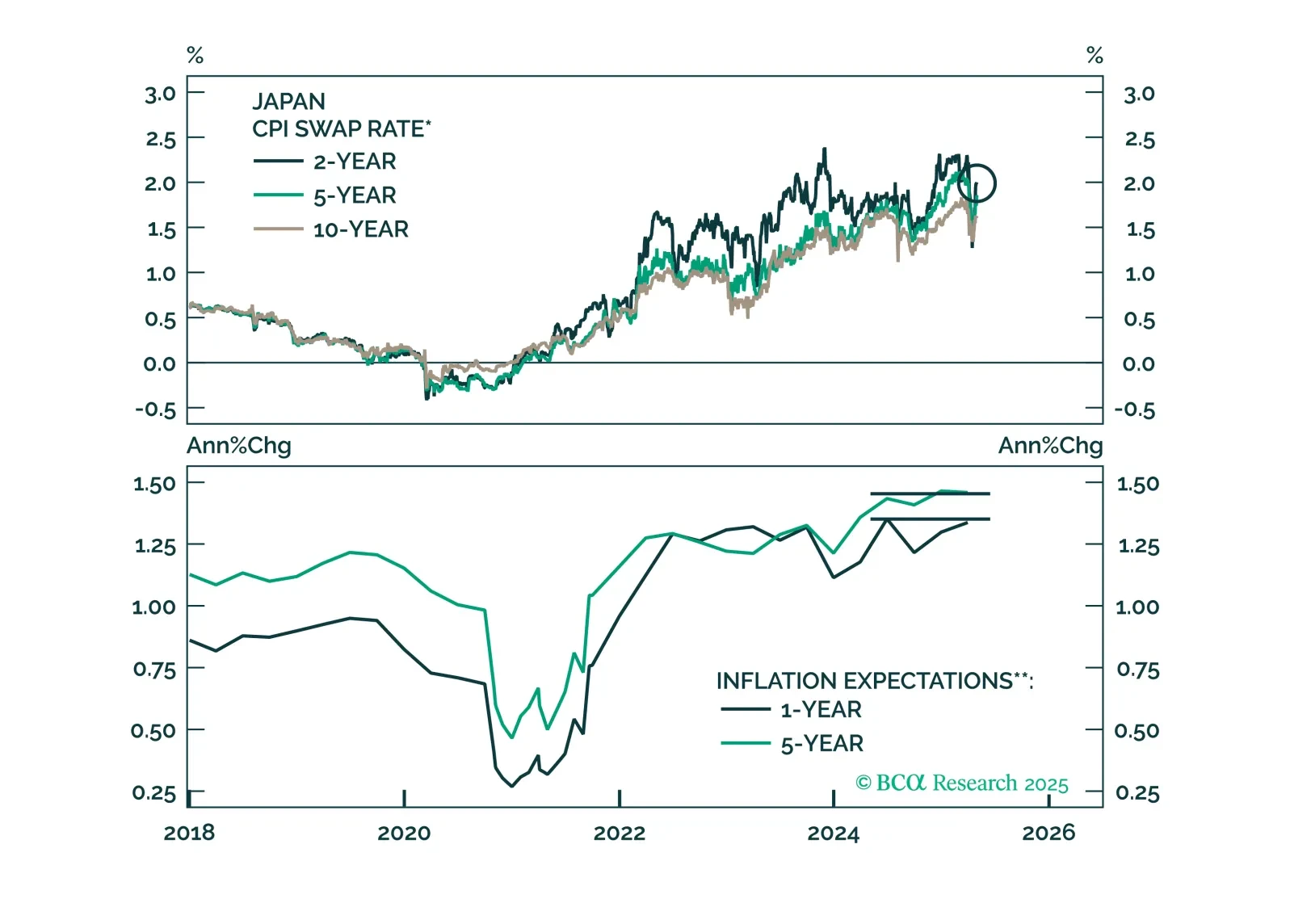

This week’s report looks at Japan, with the recent BoJ meeting. While a trade war has injected uncertainty into the Japanese economy, our conviction remains high that JGBs will underperform other government bond markets, and the yen…

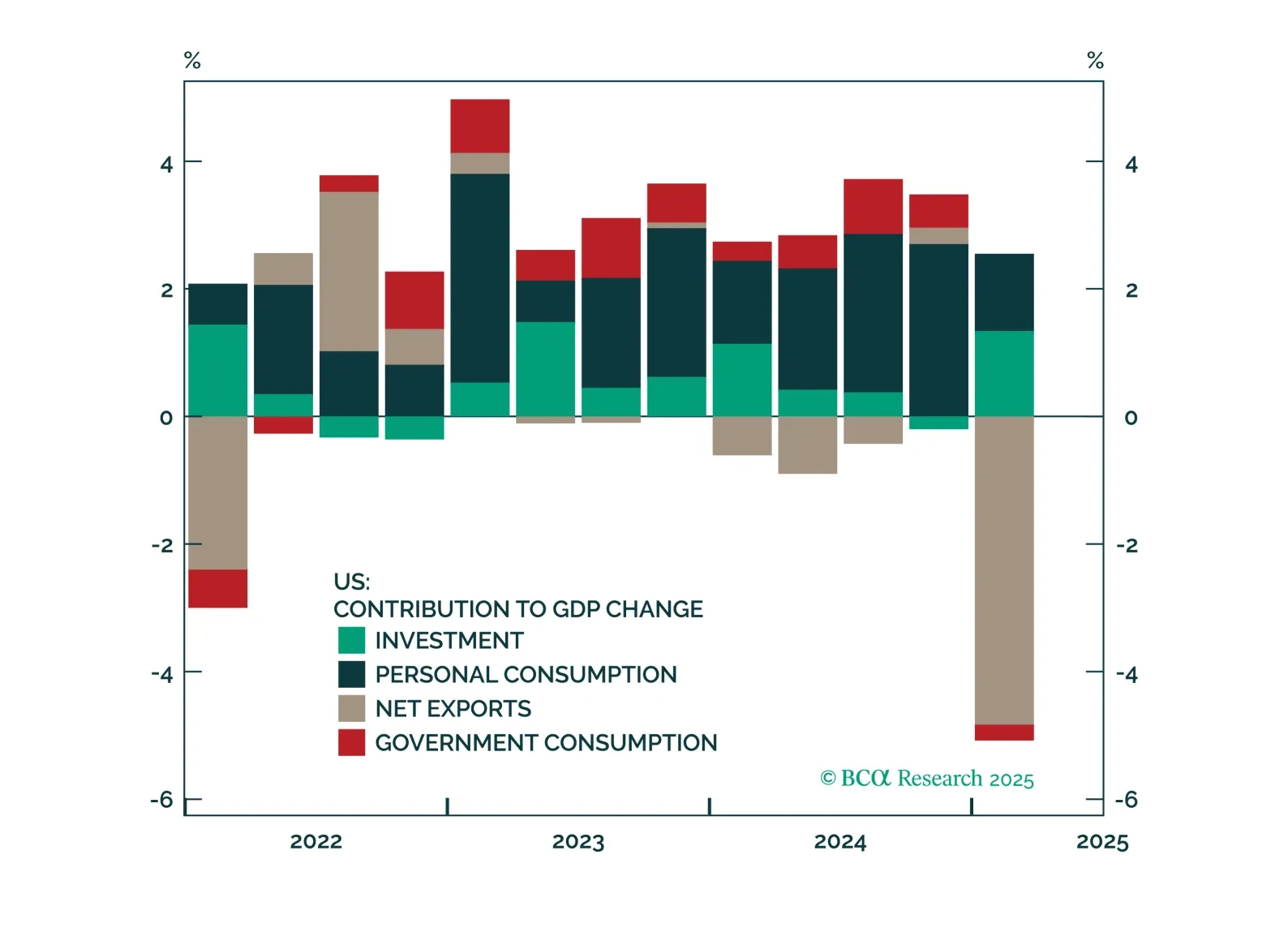

The March employment report showed strong job growth, but the labor market remains in a fragile state and the demand shock from tariffs could be the catalyst that tips it over the edge into recession.