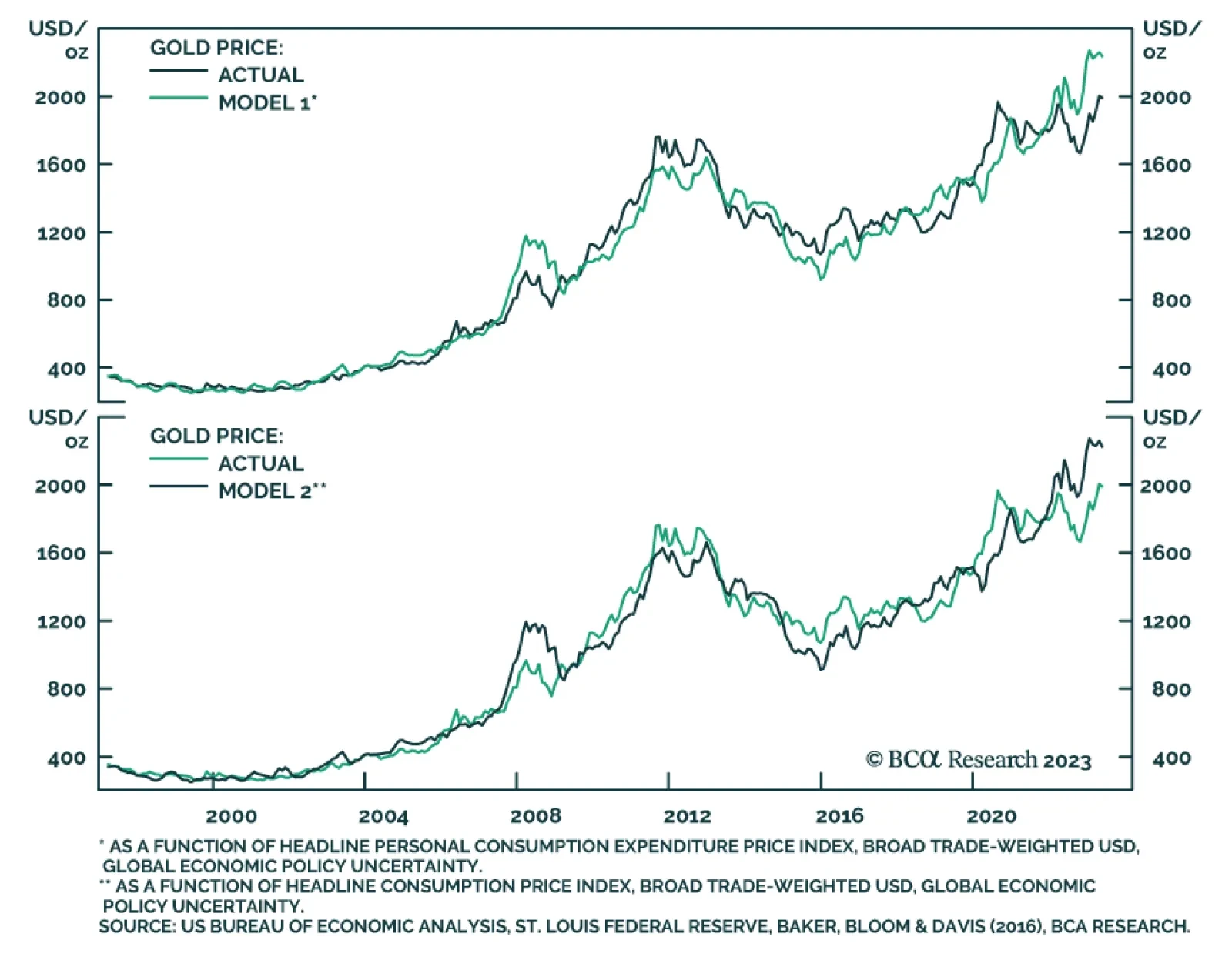

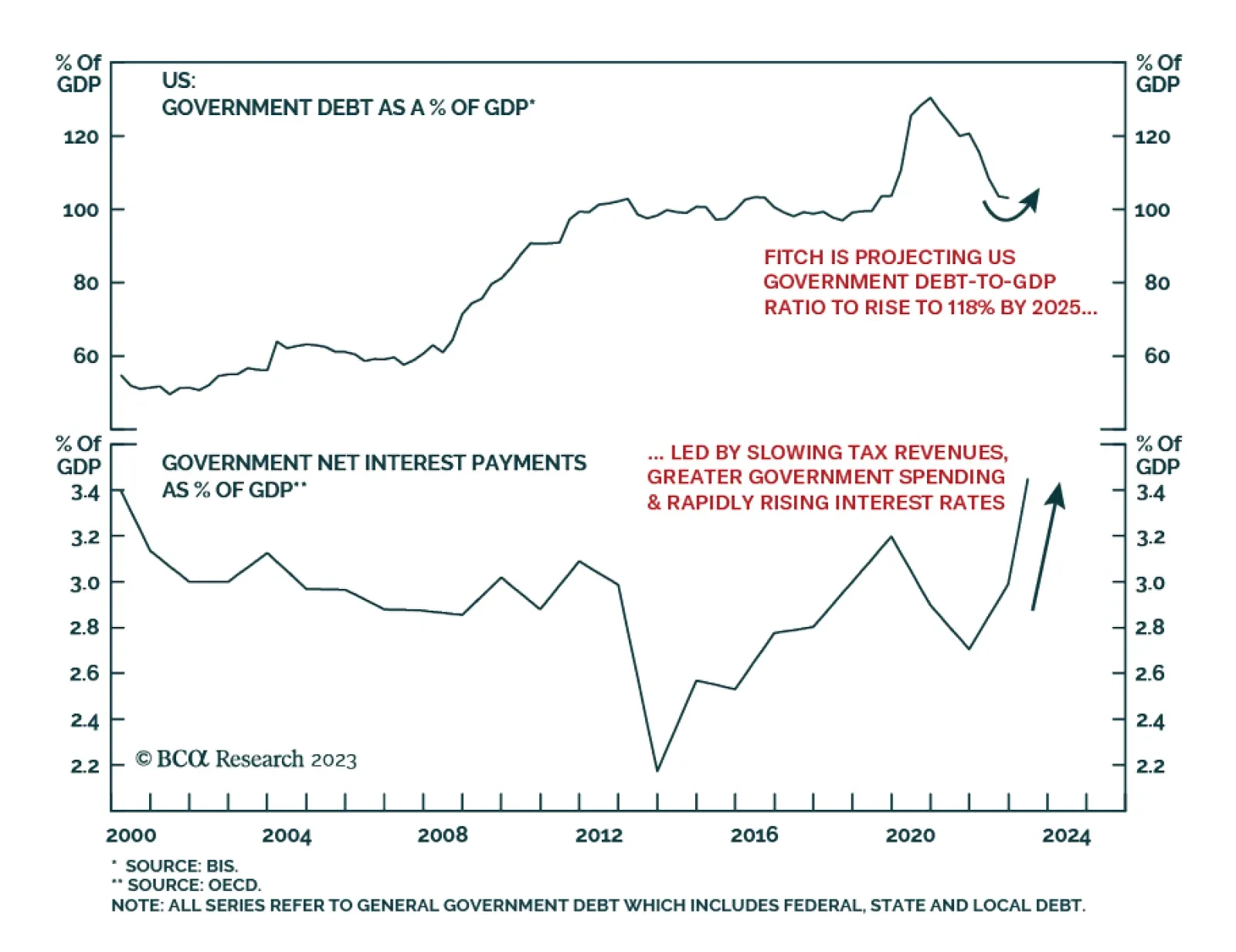

According to BCA Research’s Commodity & Energy Strategy service, gold’s appeal as a safe haven and store of value will increase as fiscal dominance overtakes monetary dominance at the Fed. Fitch’s…

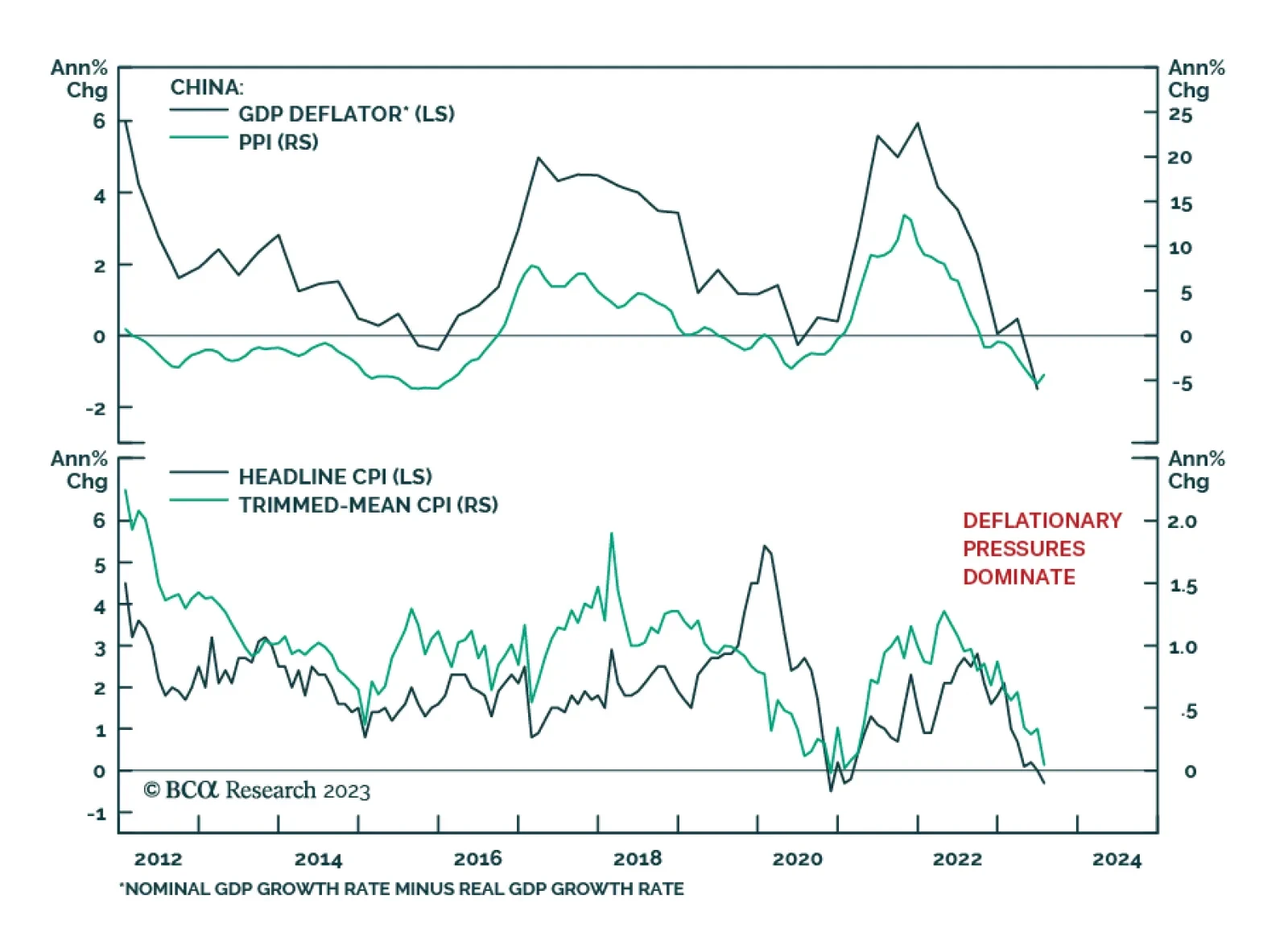

China’s CPI and PPI inflation release for July indicates that deflationary pressures dominate the domestic economy. After remaining unchanged in June, consumer prices fell by 0.3% y/y. Meanwhile, the 4.4% y/y drop in…

The global economy will not enjoy an “immaculate disinflation” but will suffer a very maculate one due to China’s growth slowdown and restrictive monetary policy in the developed world. Investors should stay overweight low-beta…

Some thoughts on this week’s bear-steepening of the Treasury curve and this morning’s employment report.

China’s extremely high savings rate is the real culprit behind its current economic woes. The authorities have been slow to stimulate the economy, and the risks of “Japanification” have increased. For now, the fact that China is…

US financial markets were dealt a summer shock yesterday with Fitch Ratings lowering its sovereign credit rating on the US to AA+ from AAA. This brings the rating down to the same level as that of S&P, which announced its own…

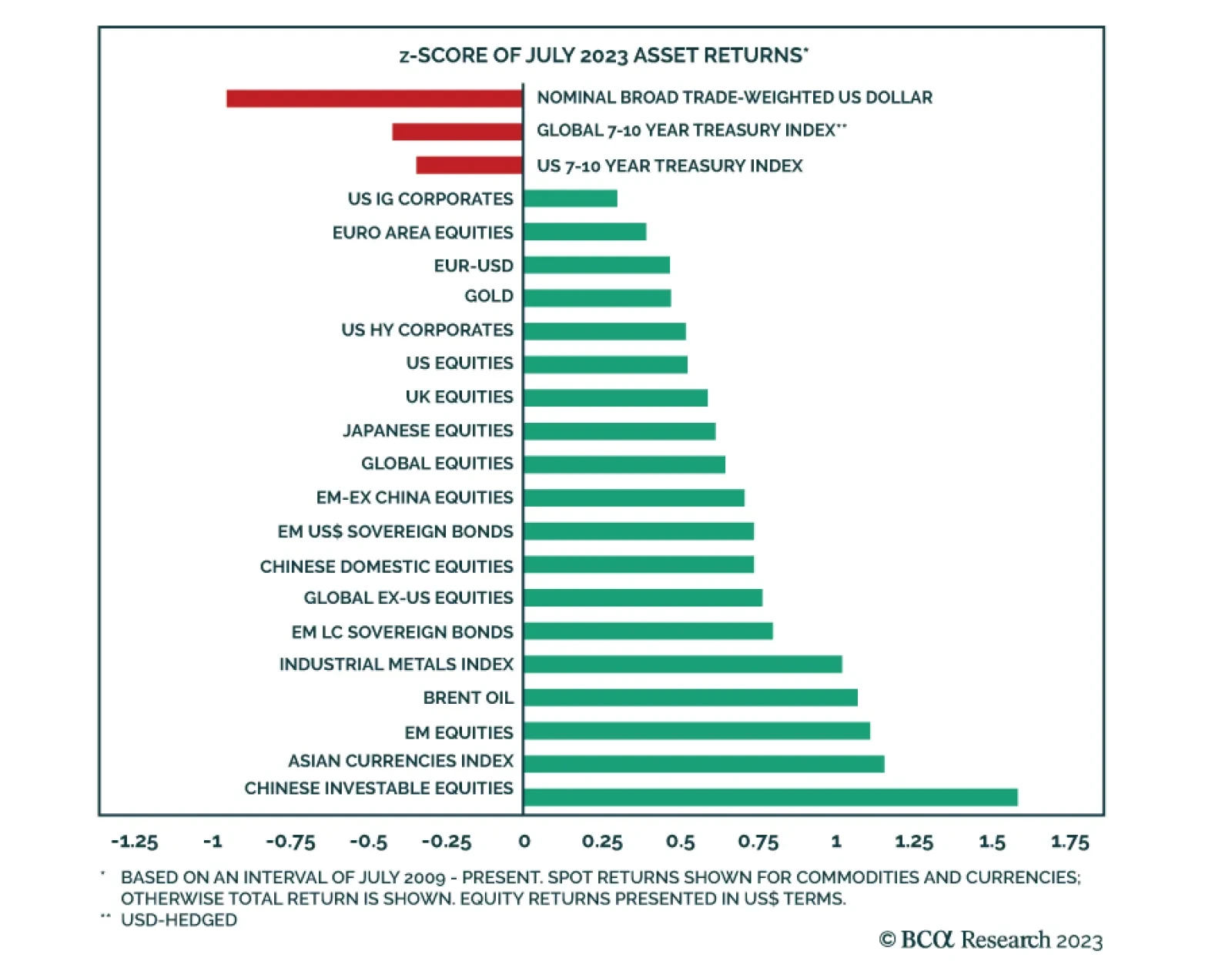

The performance of global financial markets continued to improve in July, with most of the major financial assets we track generating positive abnormal returns for the second consecutive month. Asian markets led this dynamic…

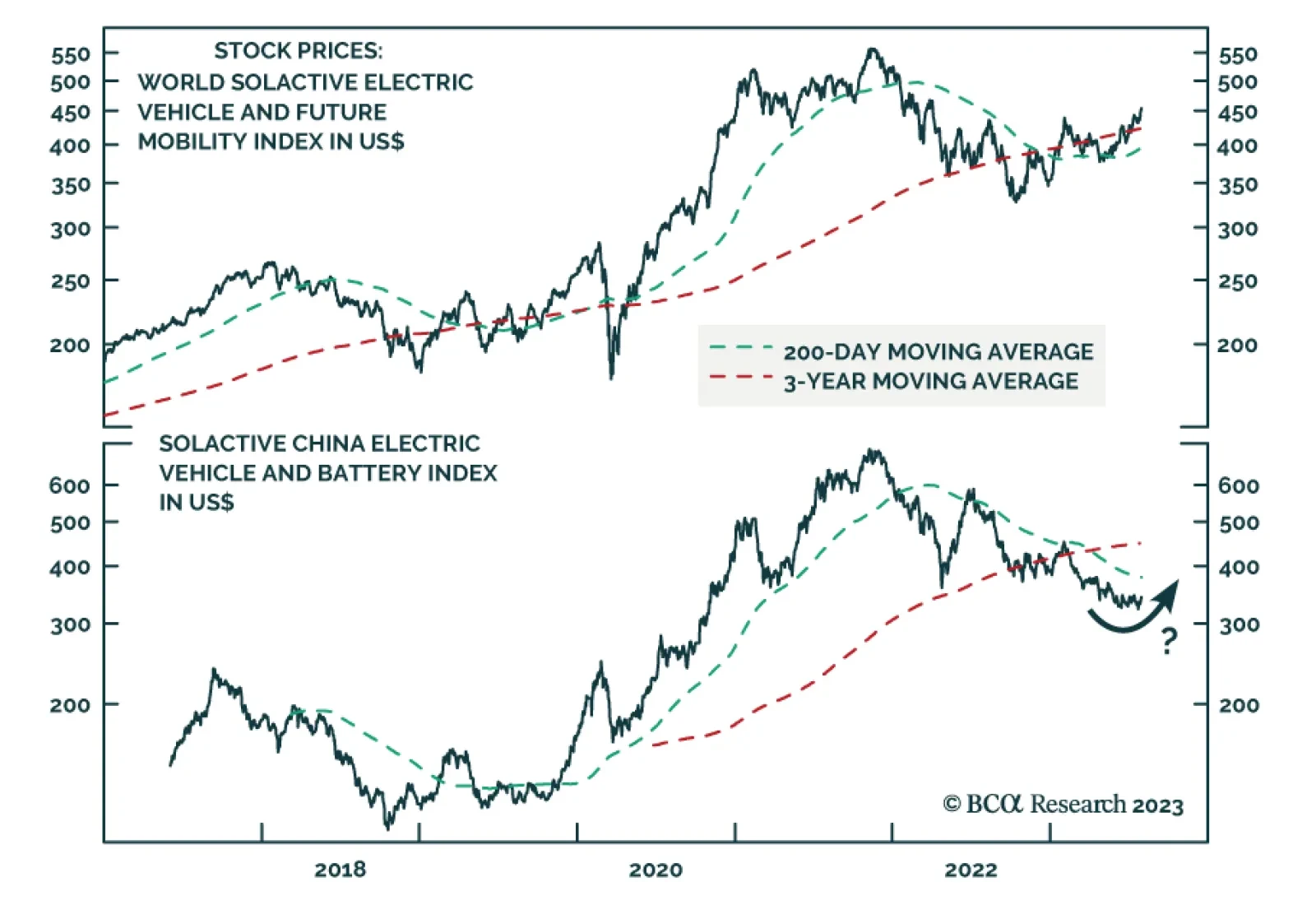

According to BCA Research’s China Investment Strategy service, Beijing’s investment focus is shifting from traditional infrastructure to new economy infrastructure, which includes clean energy and high-tech sectors…

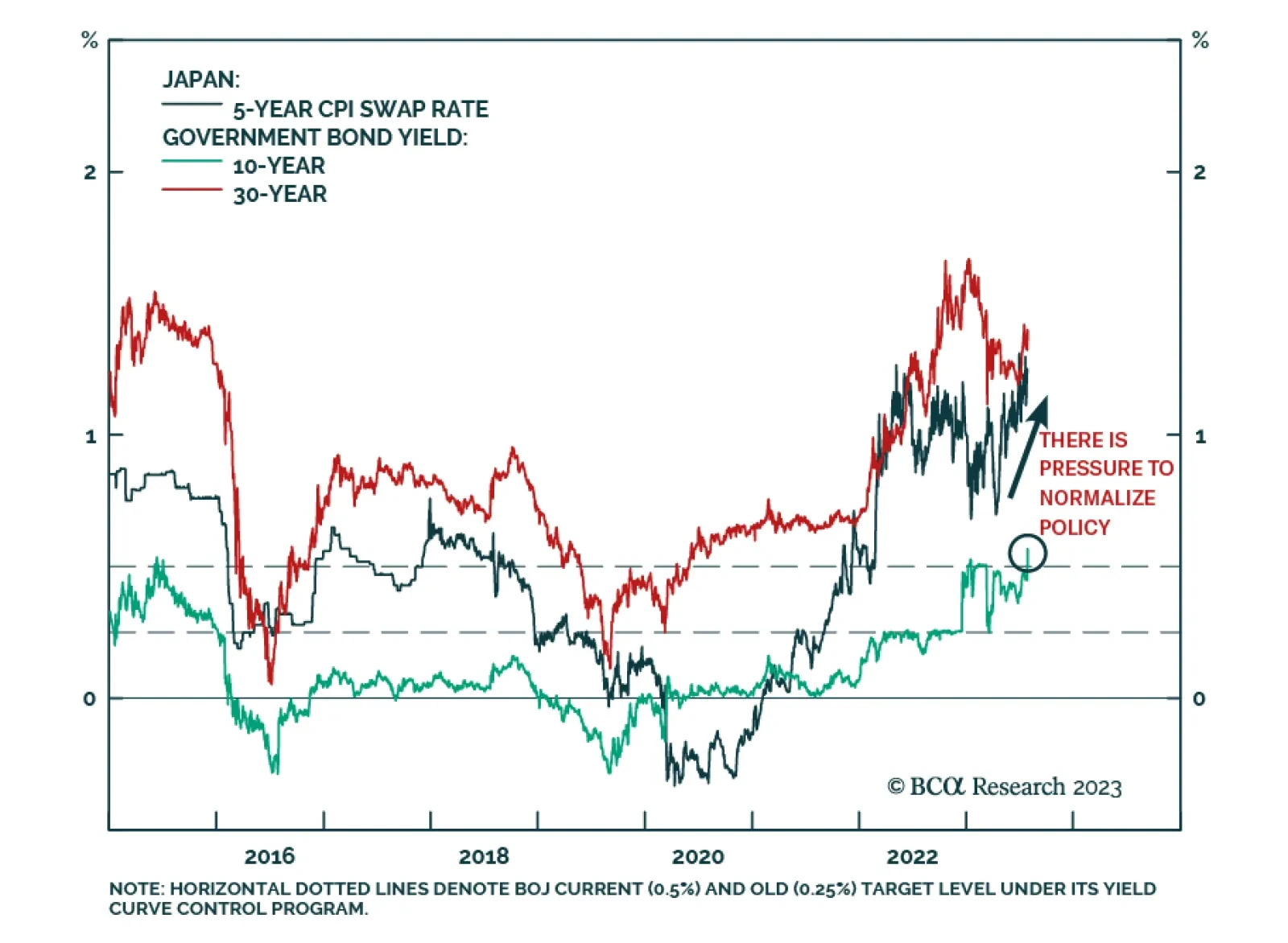

On Friday, the Bank of Japan announced an important tweak to its yield curve control (YCC) program. Although it maintained the 0.5% cap on 10-year bond yields, it indicated that it will manage the program with “greater…

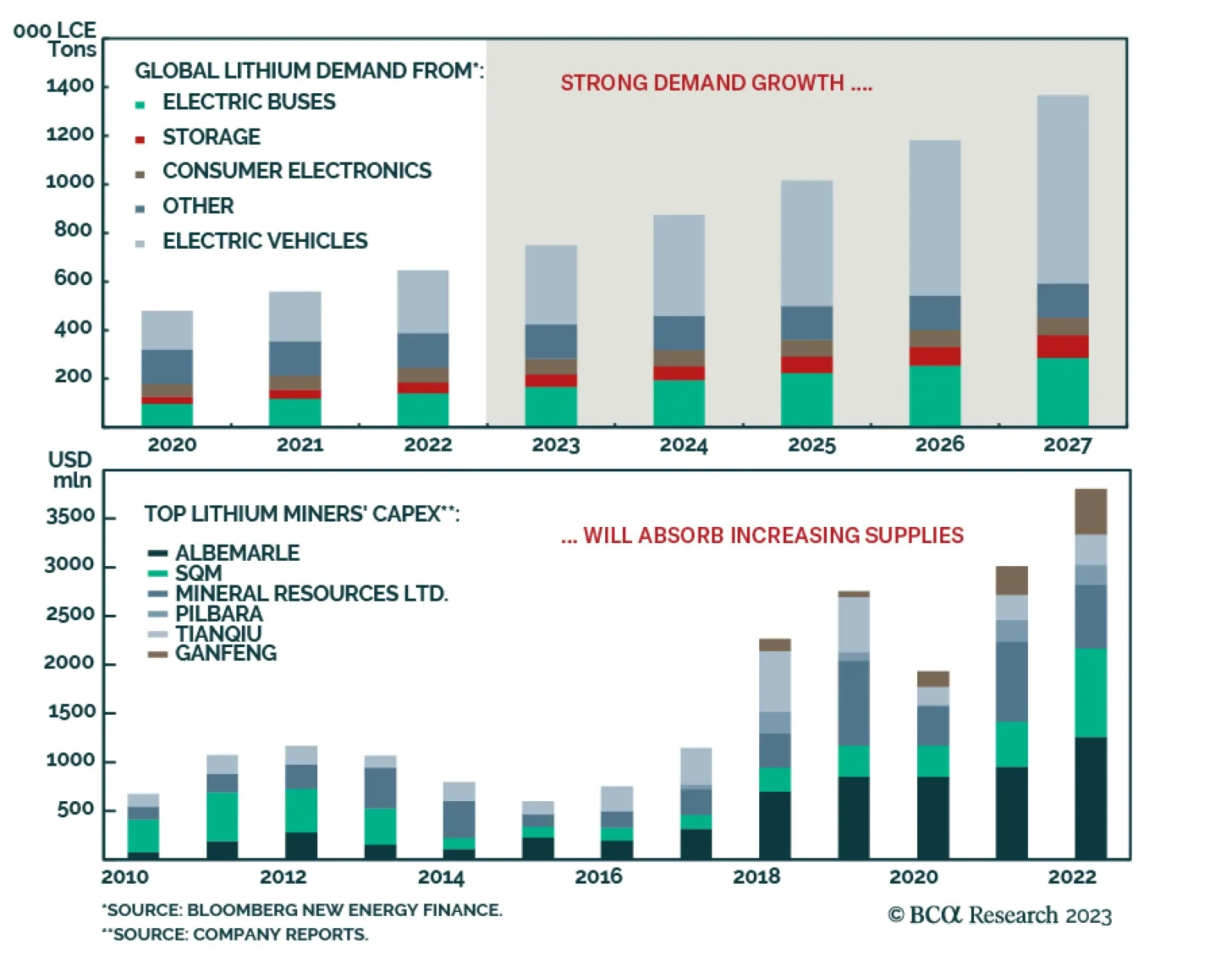

BCA Research’s Commodity & Energy Strategy service expects steady demand for EVs will be able to absorb increasing lithium supplies in the short-to-medium term. The team is getting long the LIT ETF at tonight’s…