Results from Tuesday’s elections suggest that the Democrats are doing better than what their 2024 polling are showing. While the results are marginally positive for equities, investors should not overrate this off-year election,…

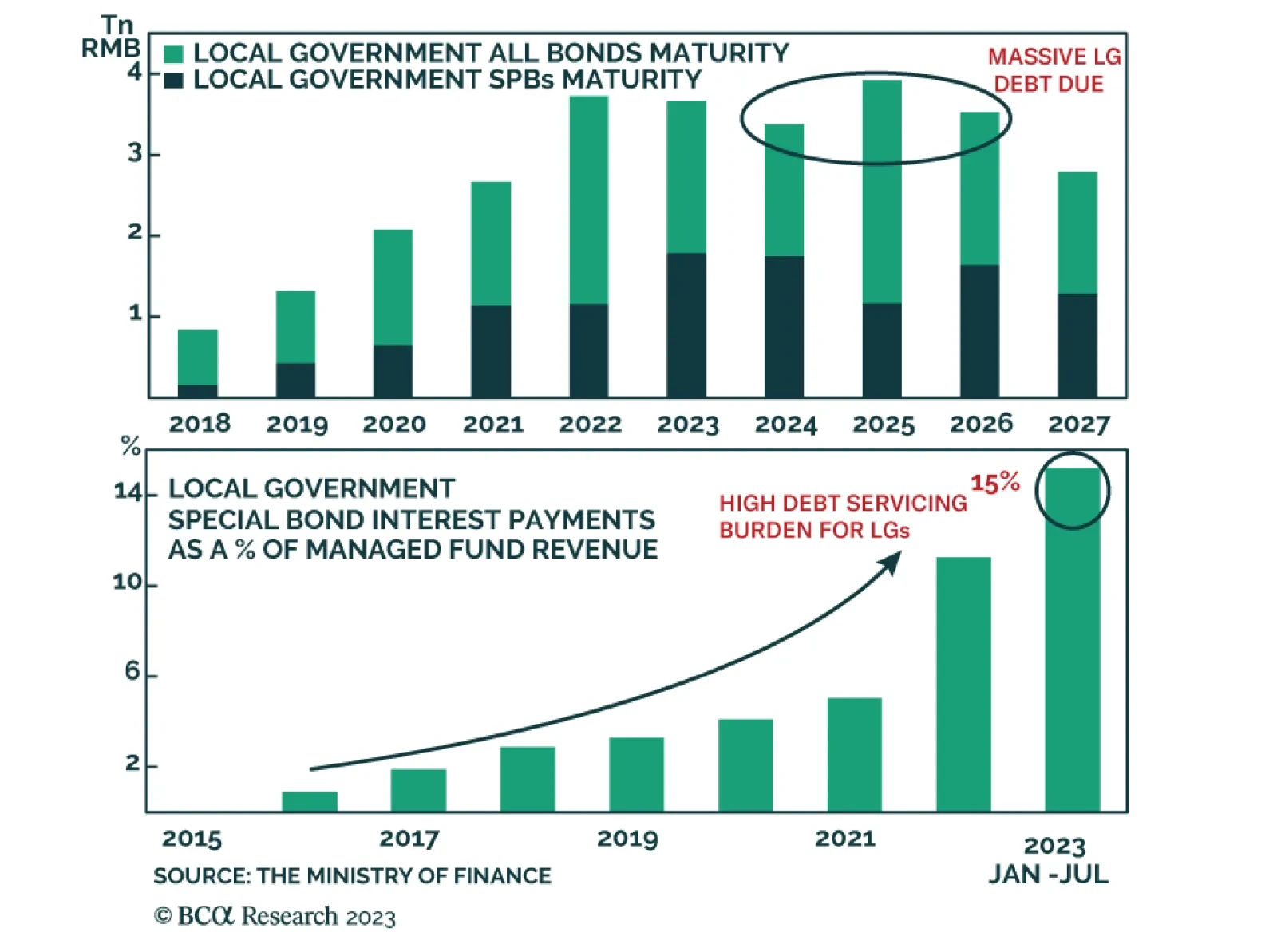

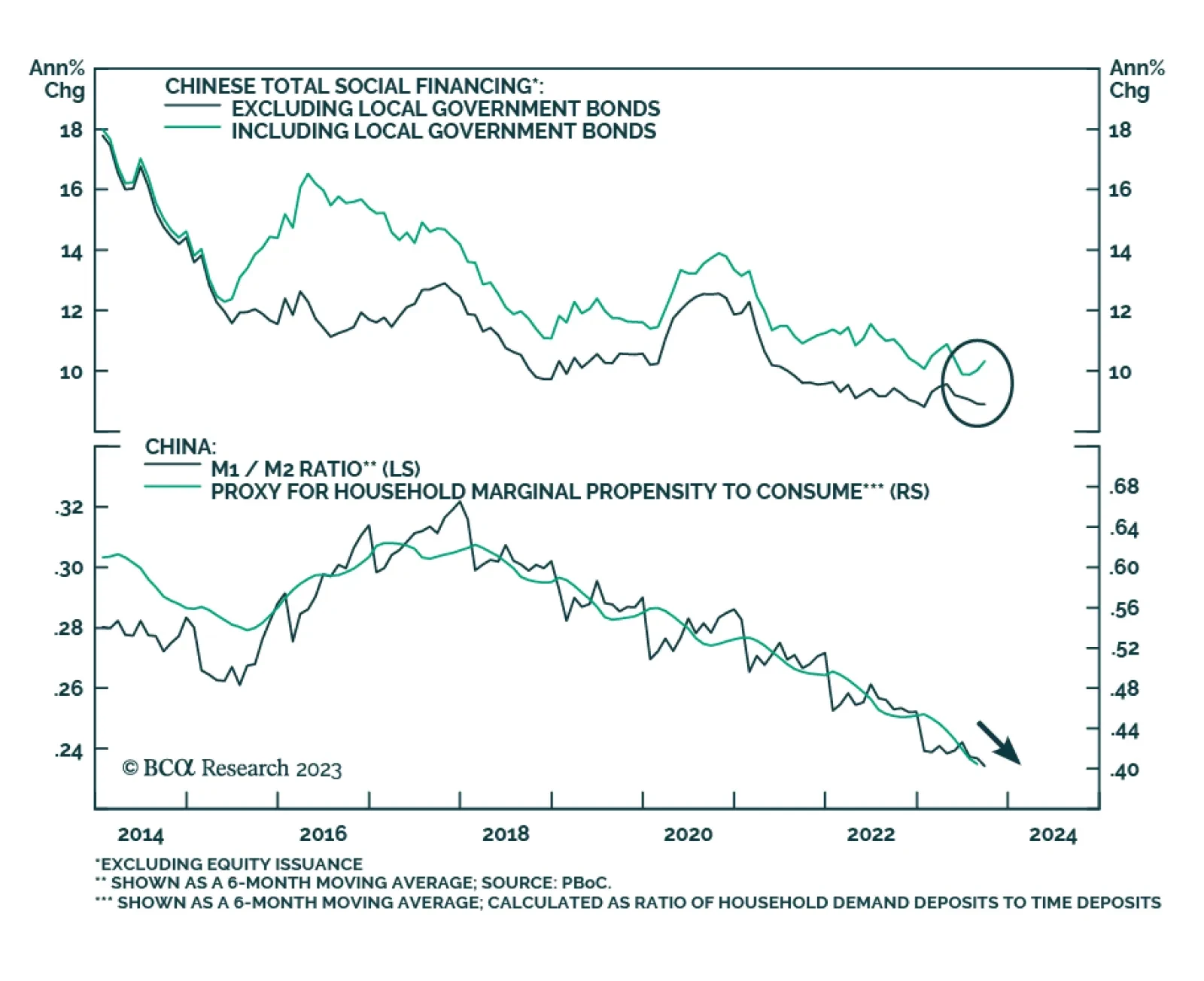

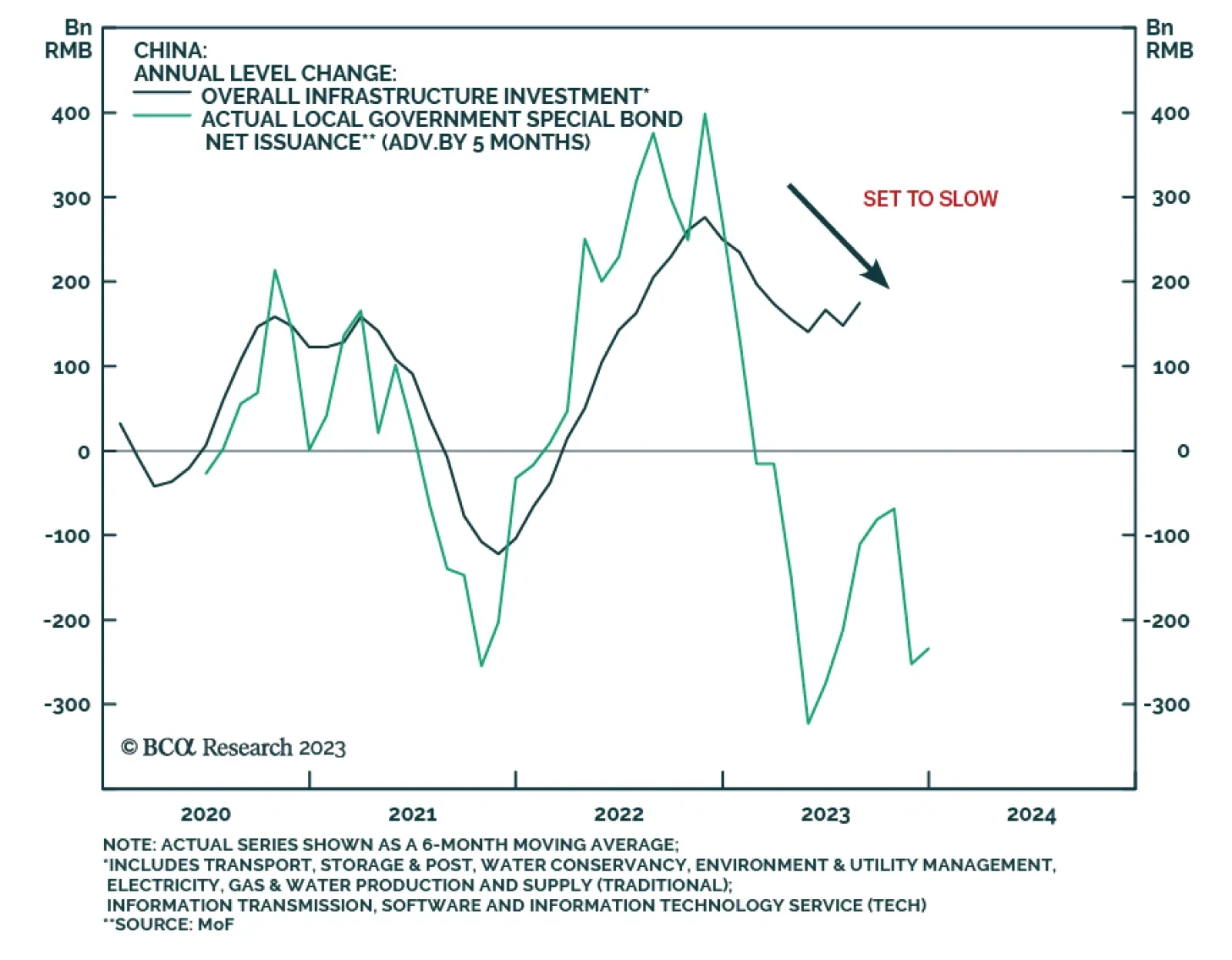

According to BCA Research’s China Investment Strategy service, China's recently introduced debt swap program will help prevent mushrooming defaults, but it will not lead to an acceleration in growth. In August, the…

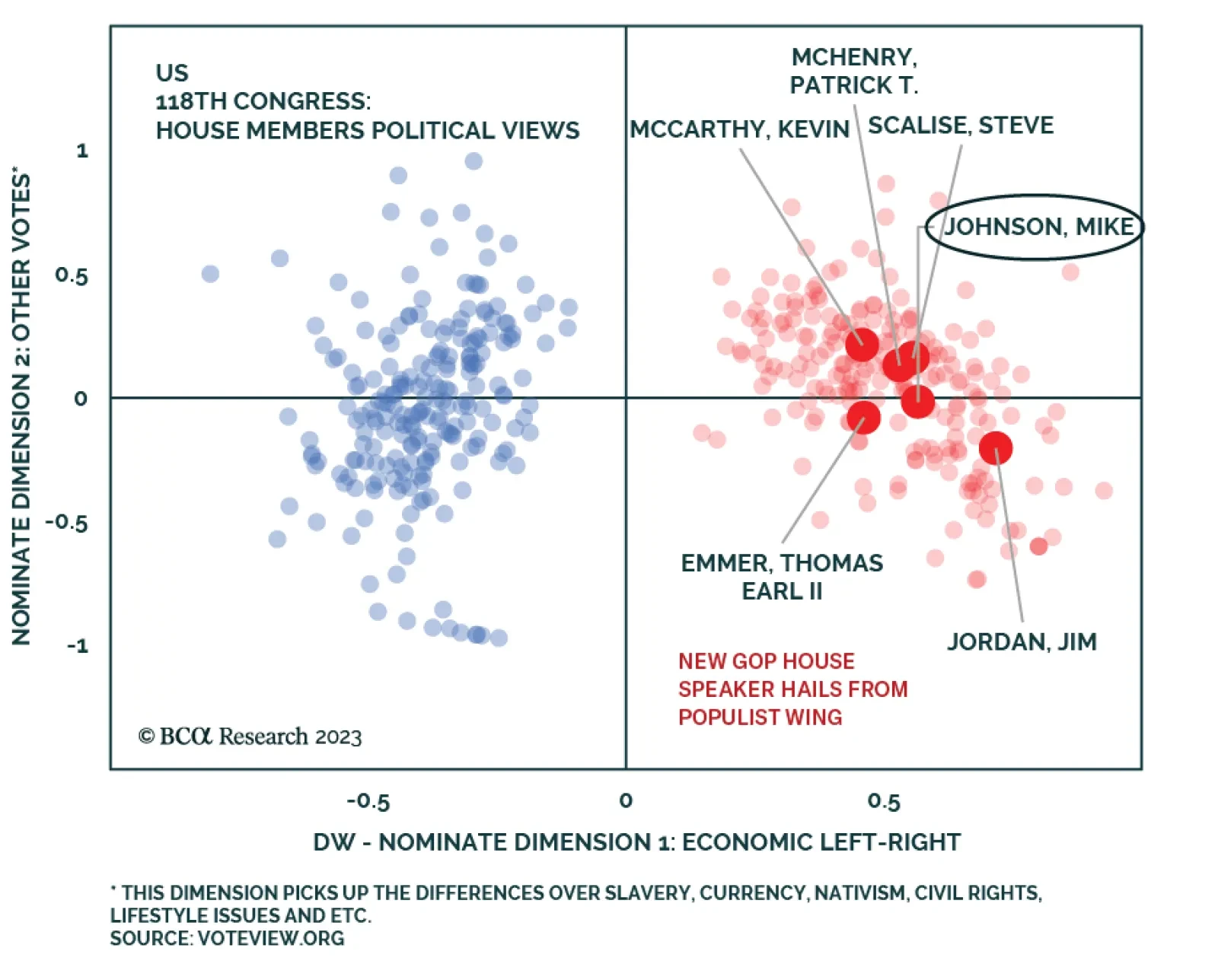

The US House of Representatives finally got a Speaker, but according to BCA Research’s US Political Strategy service, his voting record indicates that he will be a populist hardliner, which increases the chance that there…

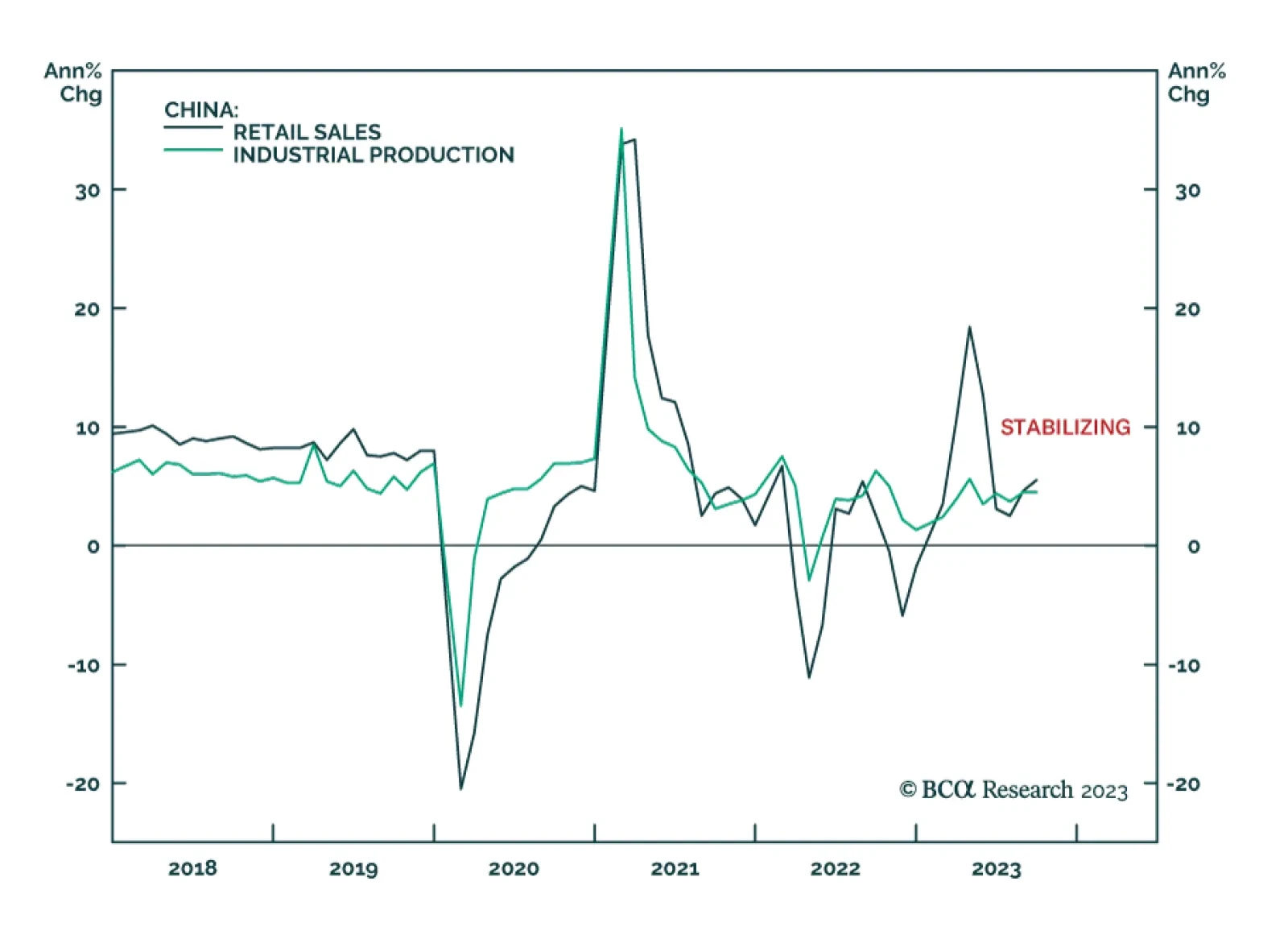

Chinese economic data surprised to the upside on Wednesday. GDP expanded by 4.9% y/y in Q3 – beating expectations of a 4.5% y/y rise. On a quarterly basis, economic activity accelerated from 0.5% q/q to 1.3% q/q –…

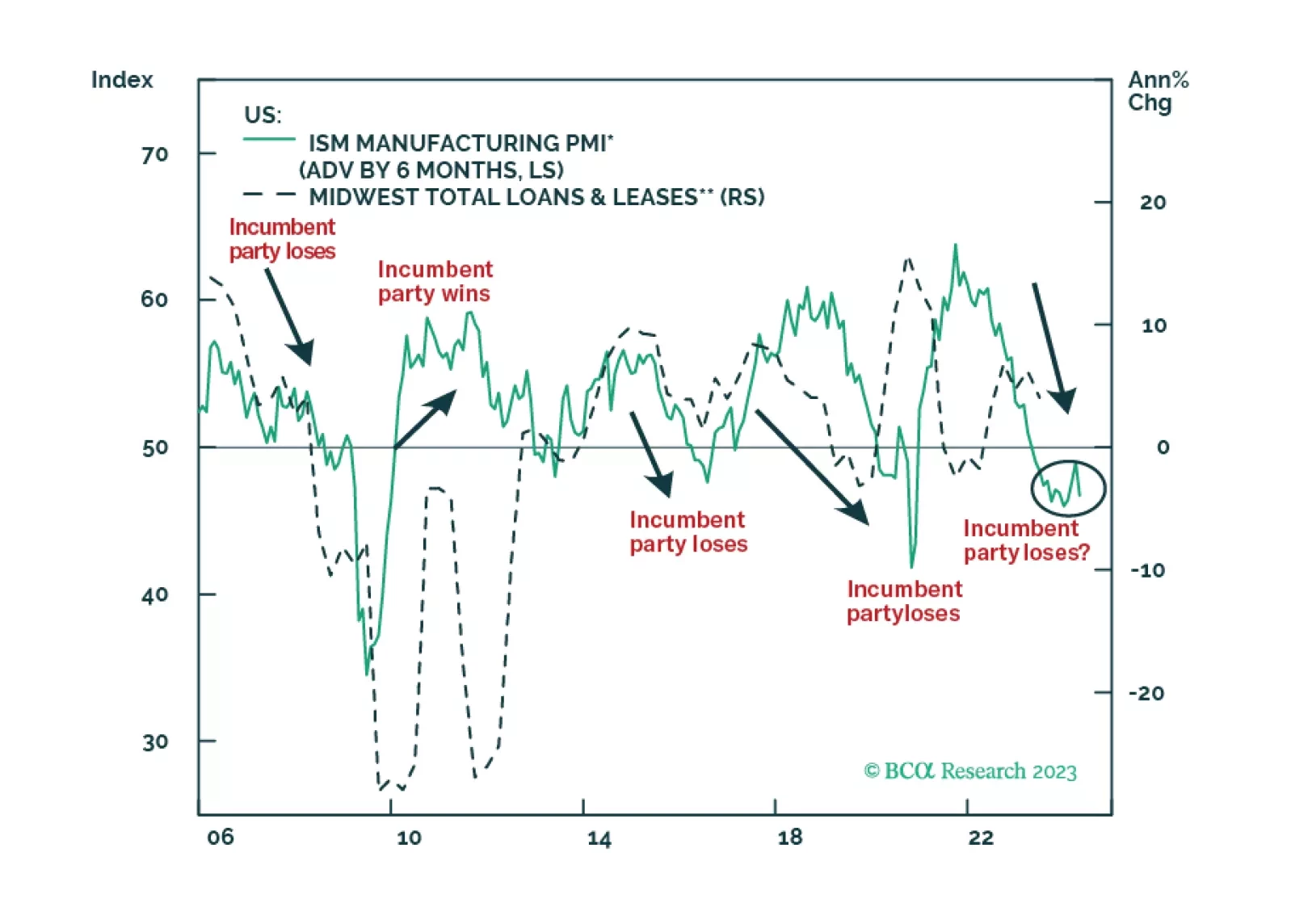

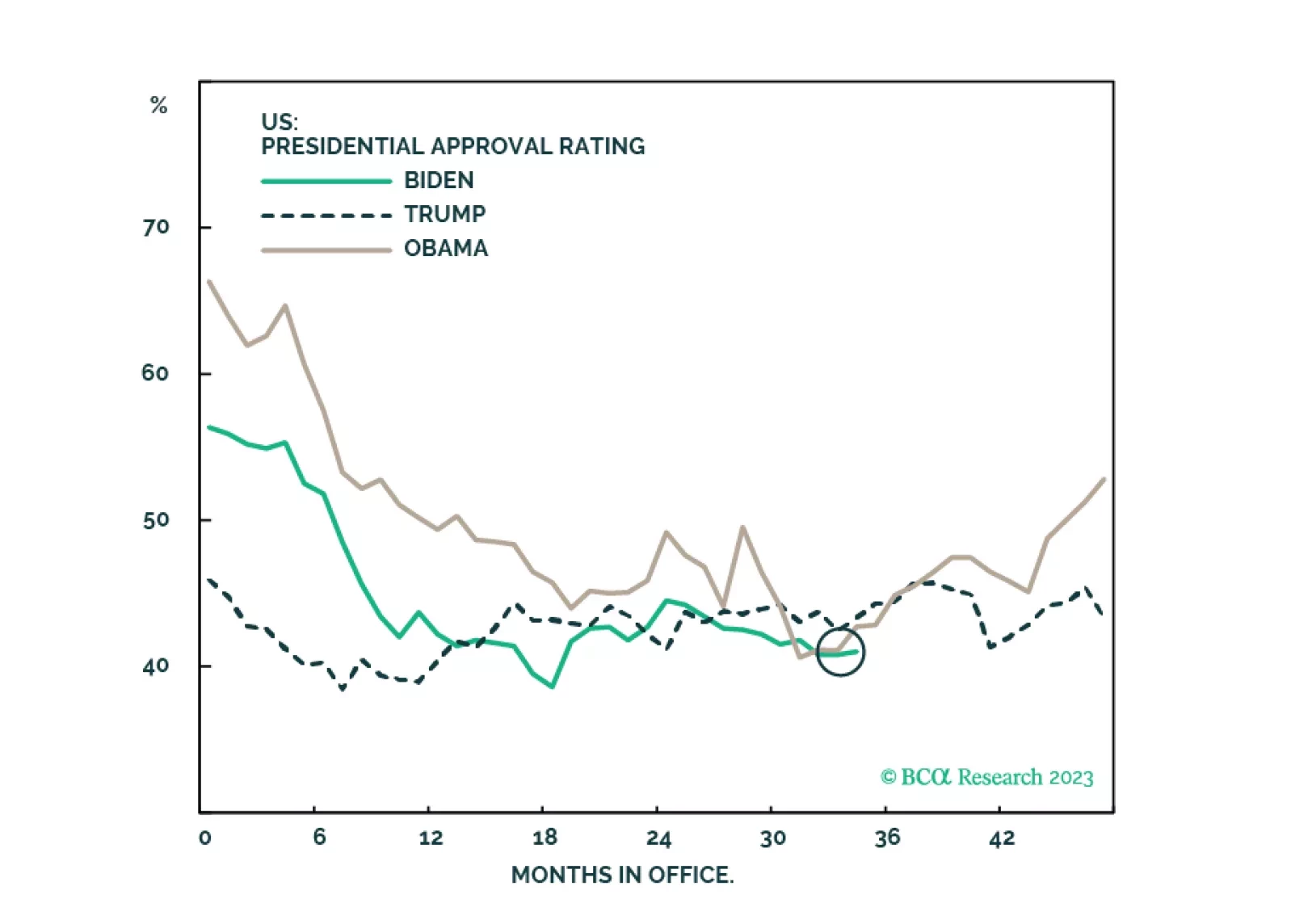

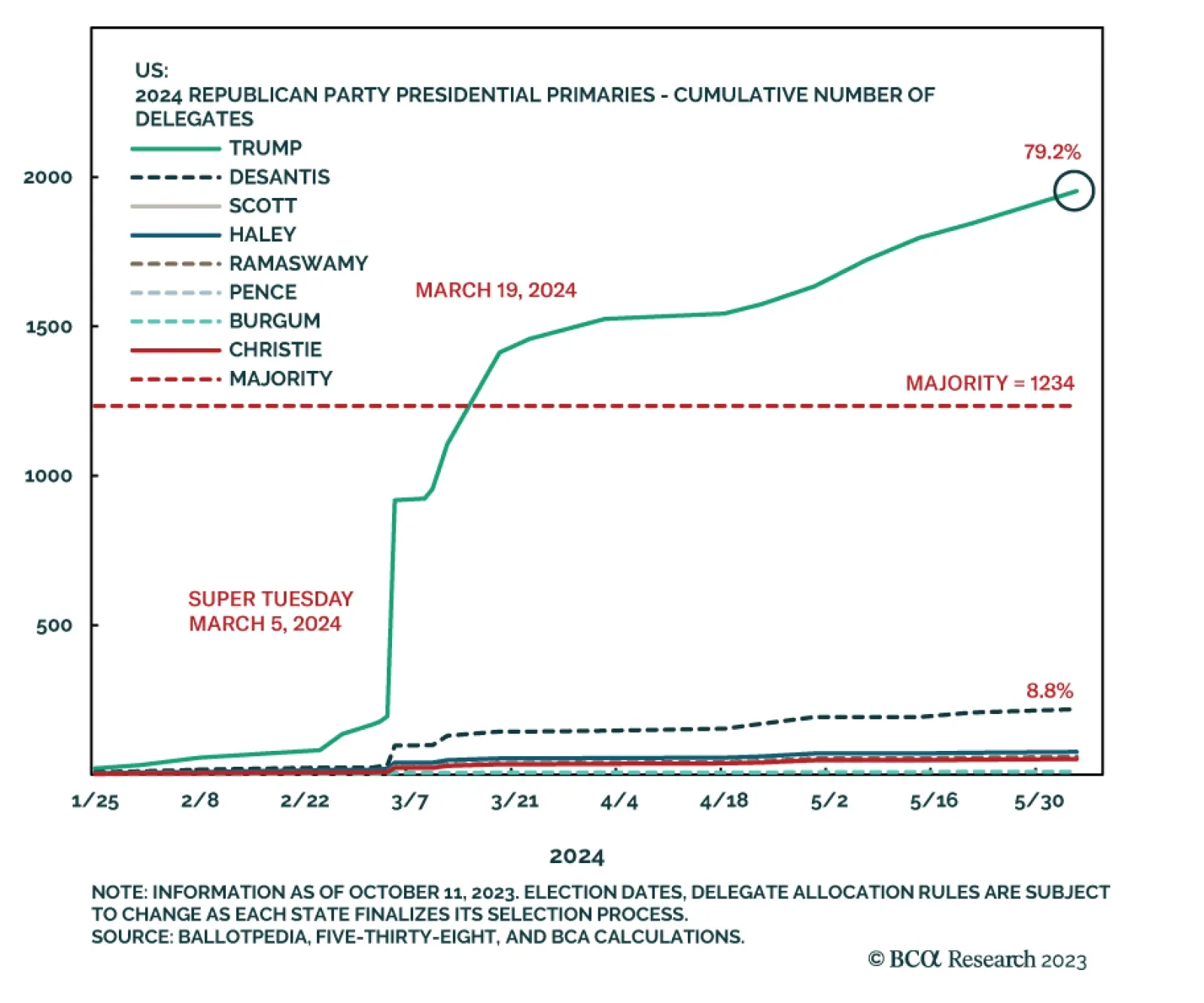

According to BCA Research’s US Political Strategy service, Trump is lined up to win the Republican presidential nomination by March 19, 2024. The takeaway is greater risk of party change, higher US and global policy…

More equity volatility is coming in the short run. Trump’s nomination looks to be smooth, which marginally reduces the incumbent party advantage and increases policy uncertainty.

On the surface, Chinese credit data sent a positive signal about the domestic economy. Chinese aggregate social financing totaled CNY 4.1 trillion in September – exceeding both August’s CNY 3.1 trillion and…

Dovish comments by several Fed officials contributed to a Treasury rally and improvement in sentiment towards risk assets on Tuesday. Globally, rumors that Beijing is planning to unleash more stimulus supported Chinese financial…

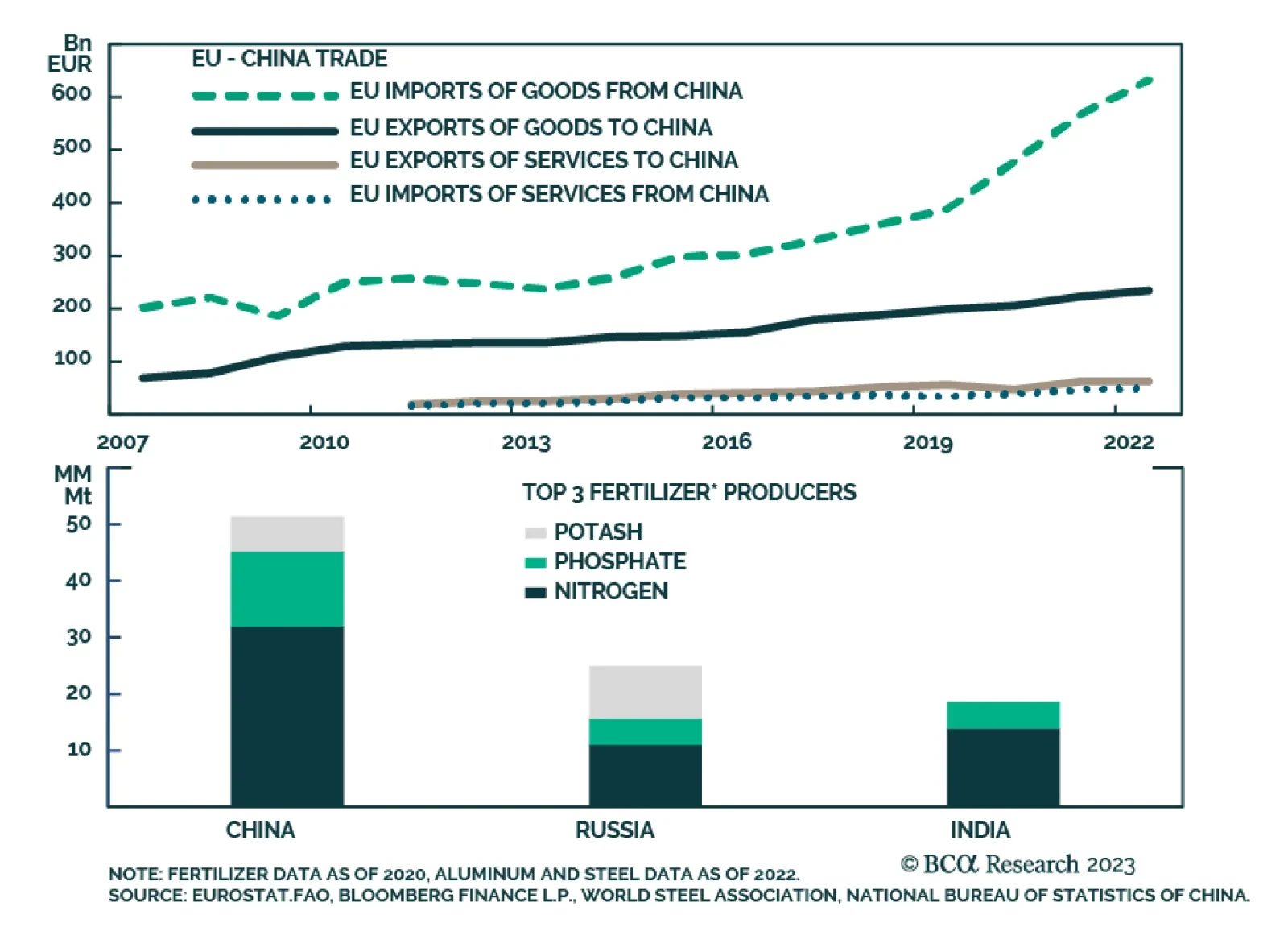

According to BCA Research’s Commodity & Energy Strategy service, the EU carbon tax – aka Carbon Border Adjustment Mechanism (CBAM) – launched Sunday will lead to higher inflation in the medium term (3-5…