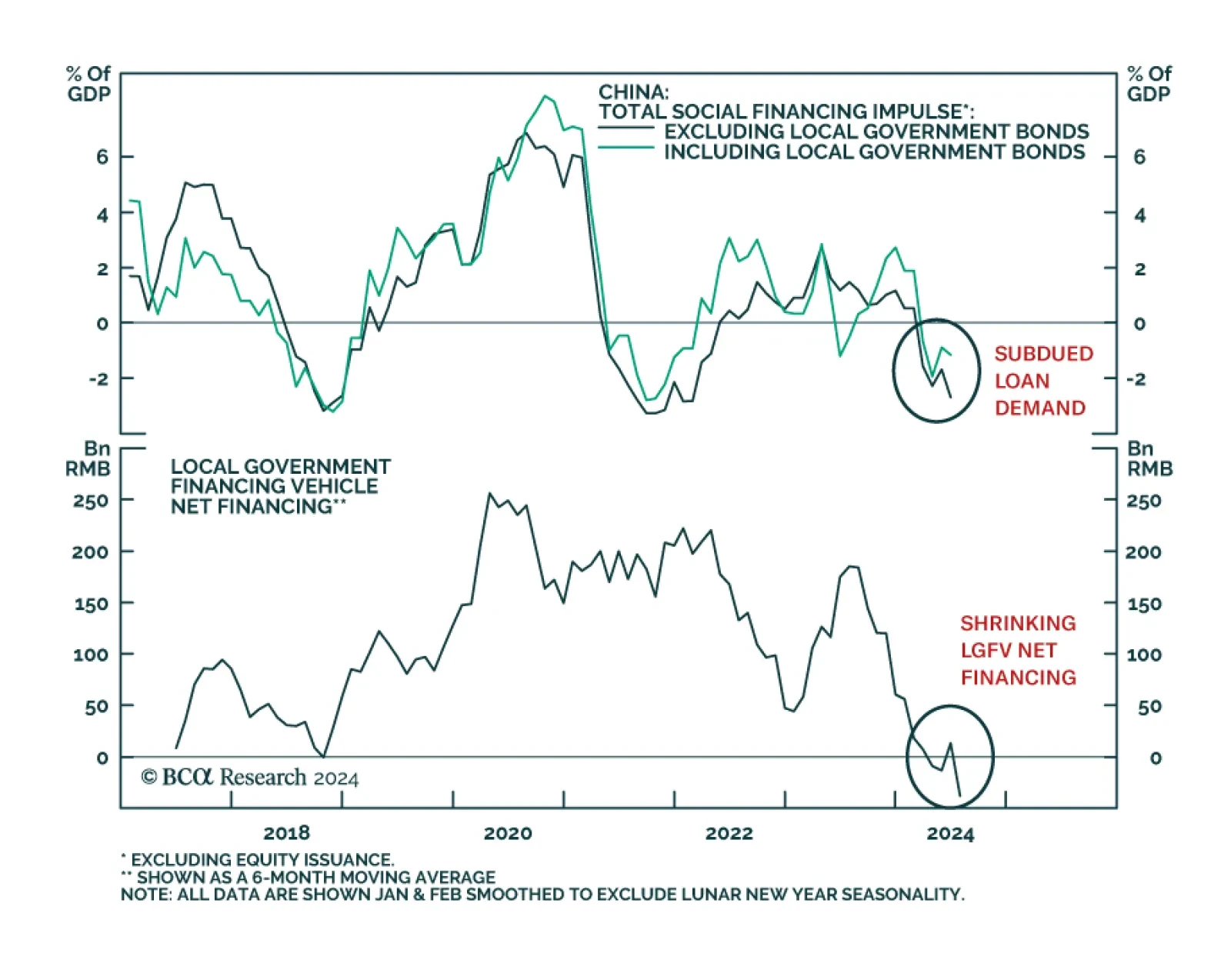

Subdued demand for credit among Chinese private-sector businesses and households persisted through June. The stock of outstanding bank loans grew by 8.3% year-on-year, marking the slowest pace since records began in 2003.…

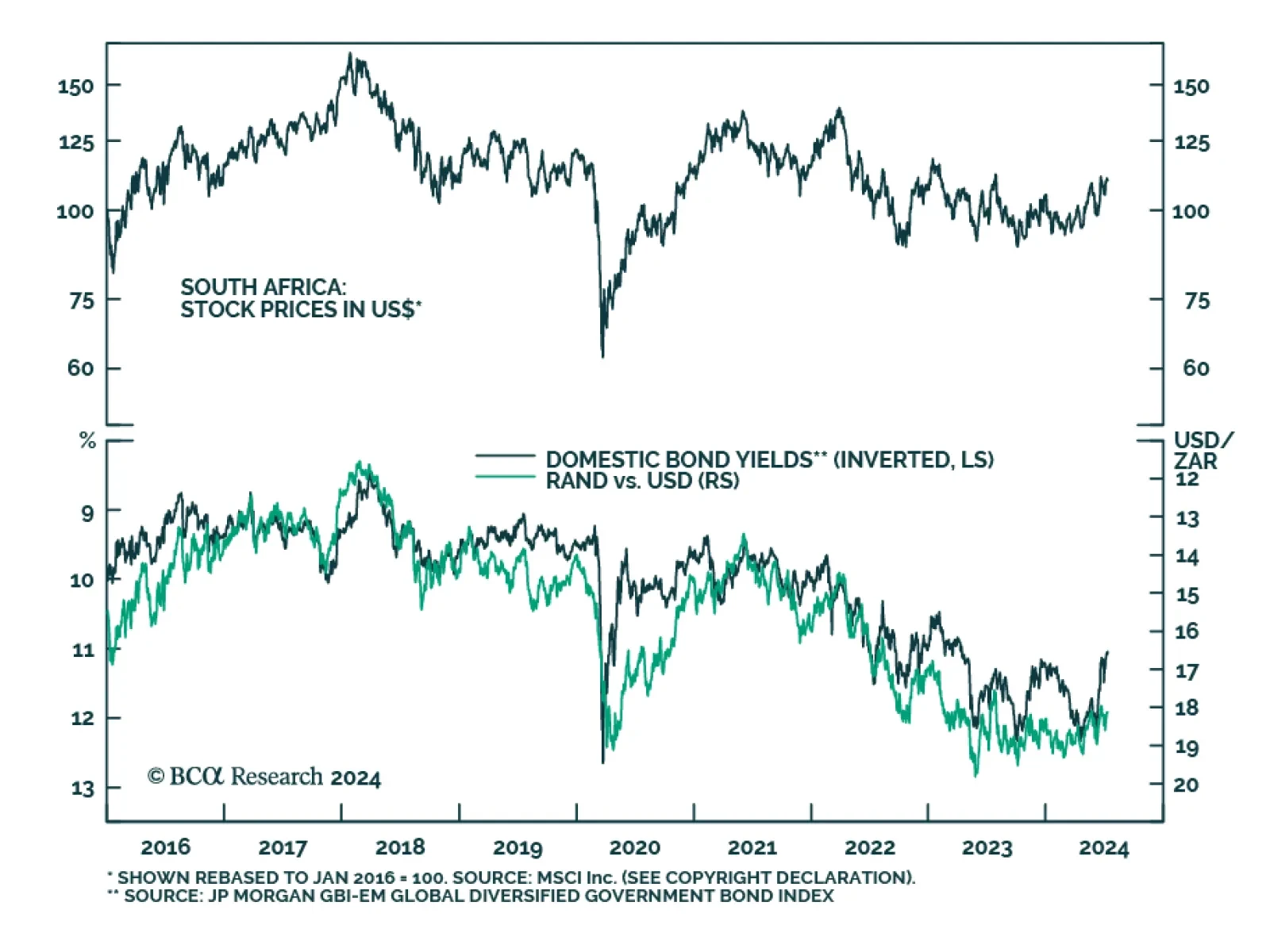

South African stocks, domestic bonds, and currency have all rallied since BCA’s Emerging Markets Strategy team upgraded South African assets last month following the formation of the new national unity government. The rally…

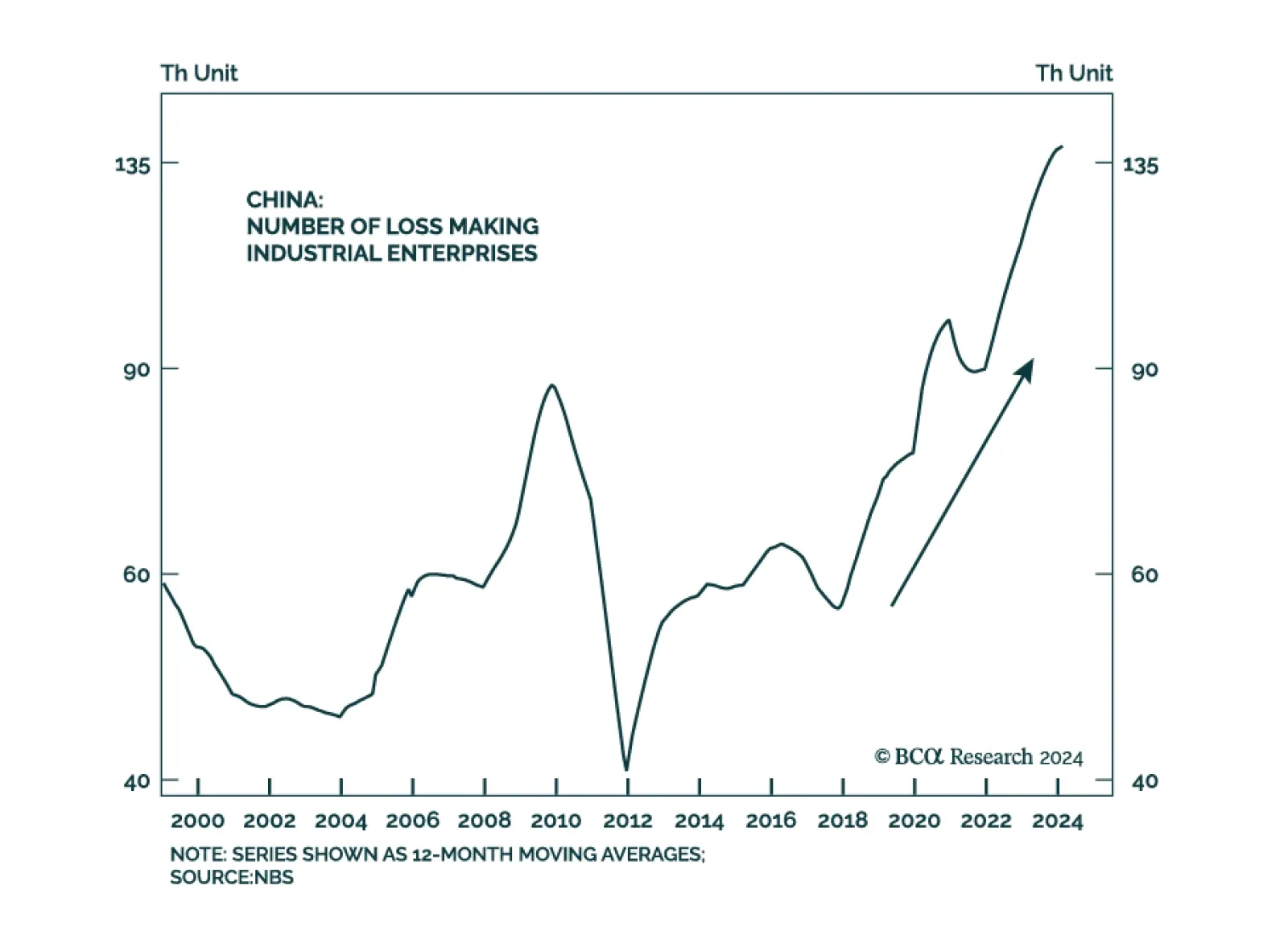

As highlighted in Wednesday’s edition of BCA Live & Unfiltered, the Chinese economy and its financial markets face several daunting challenges. Its demographic outlook is unfavorable, with a low birthrate stifling…

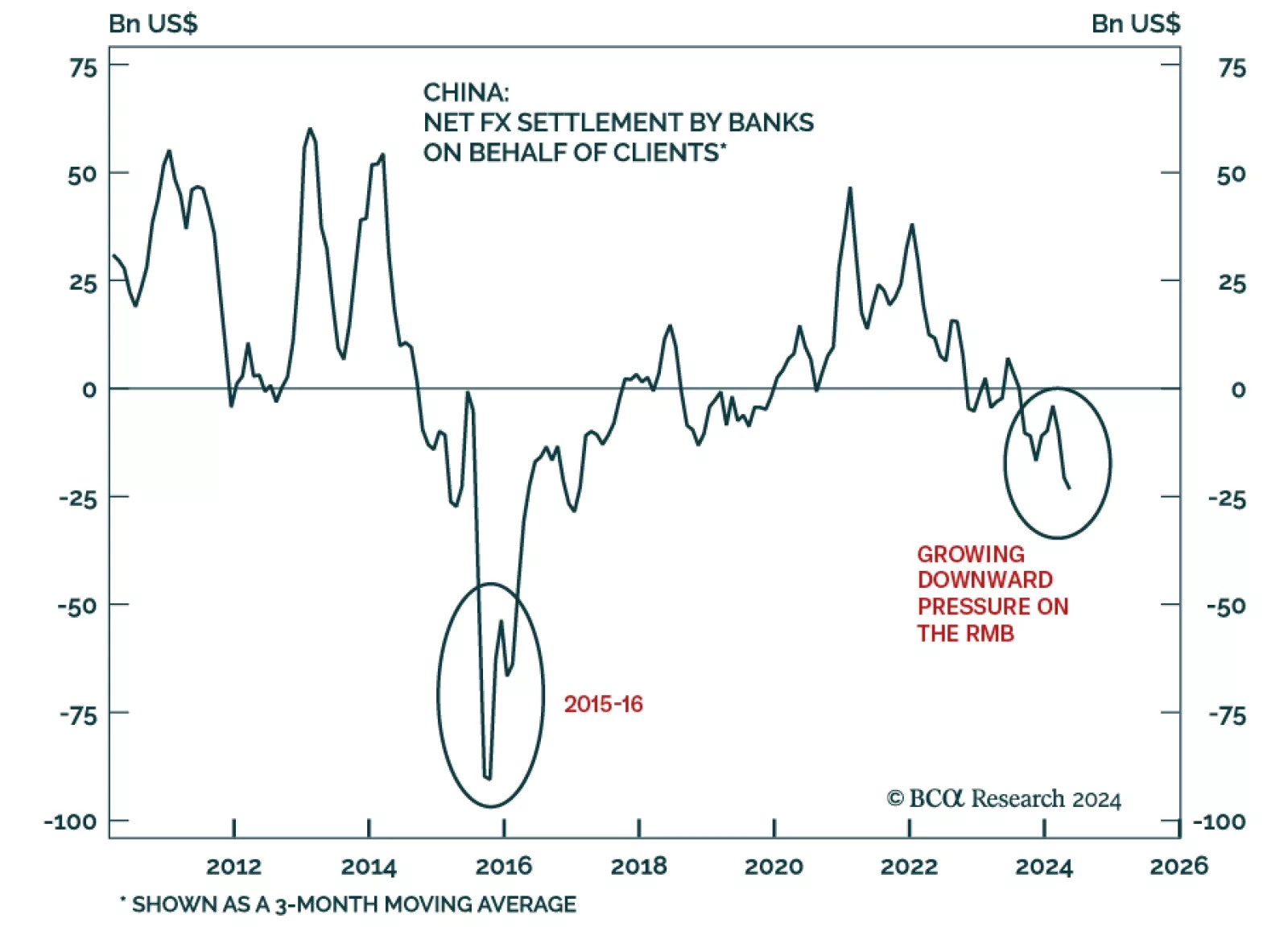

The Chinese currency has been under considerable depreciation pressure due to capital outflows. Additionally, the economy is grappling with debt deflation and a balance sheet recession, conditions that typically call for lower…

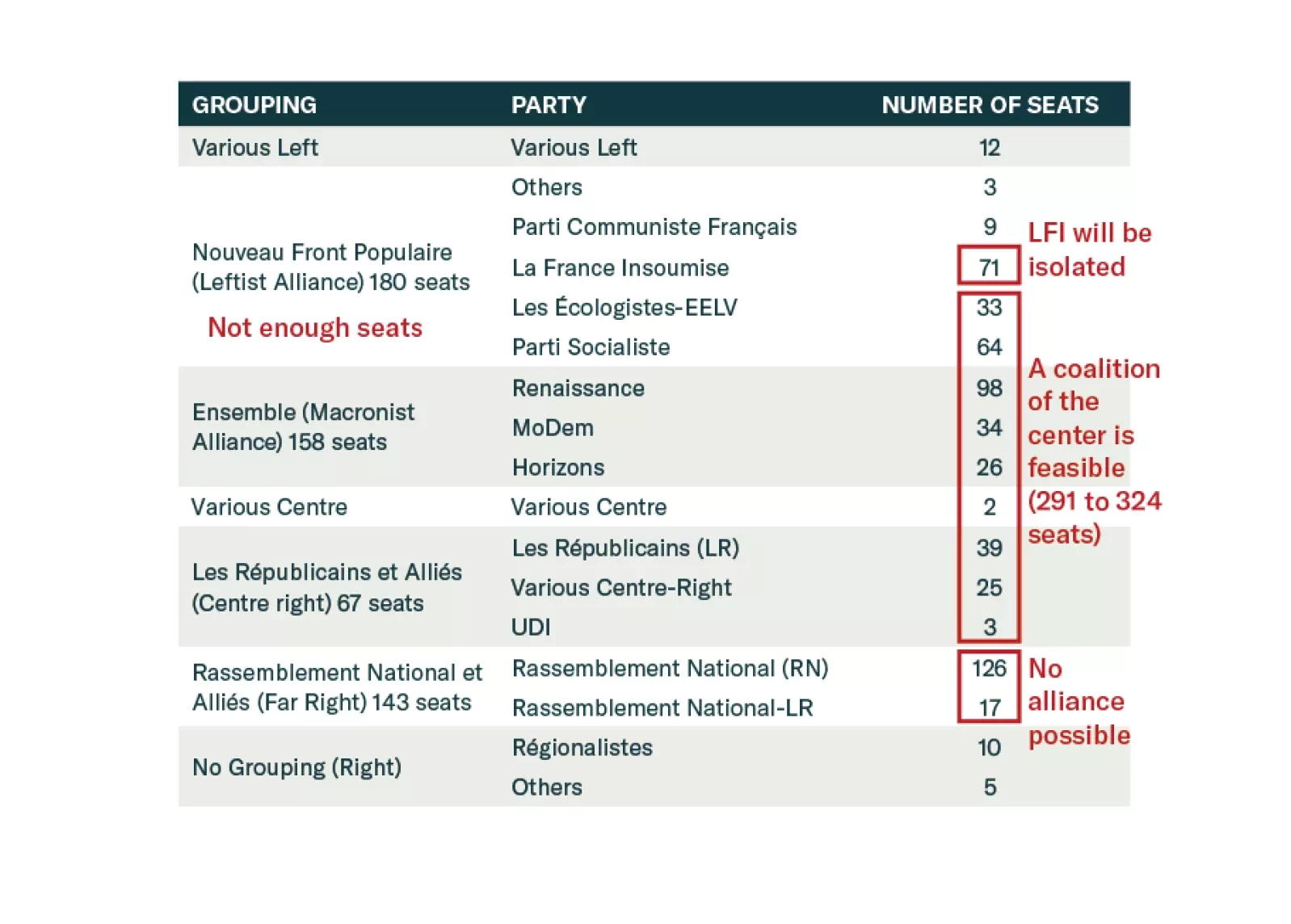

At first glance, France has moved to the far left. However, this coalition is fragile, and Macron’s allies still hold the balance of power. What are the assets that will benefit from this new political setup, and those that will not…

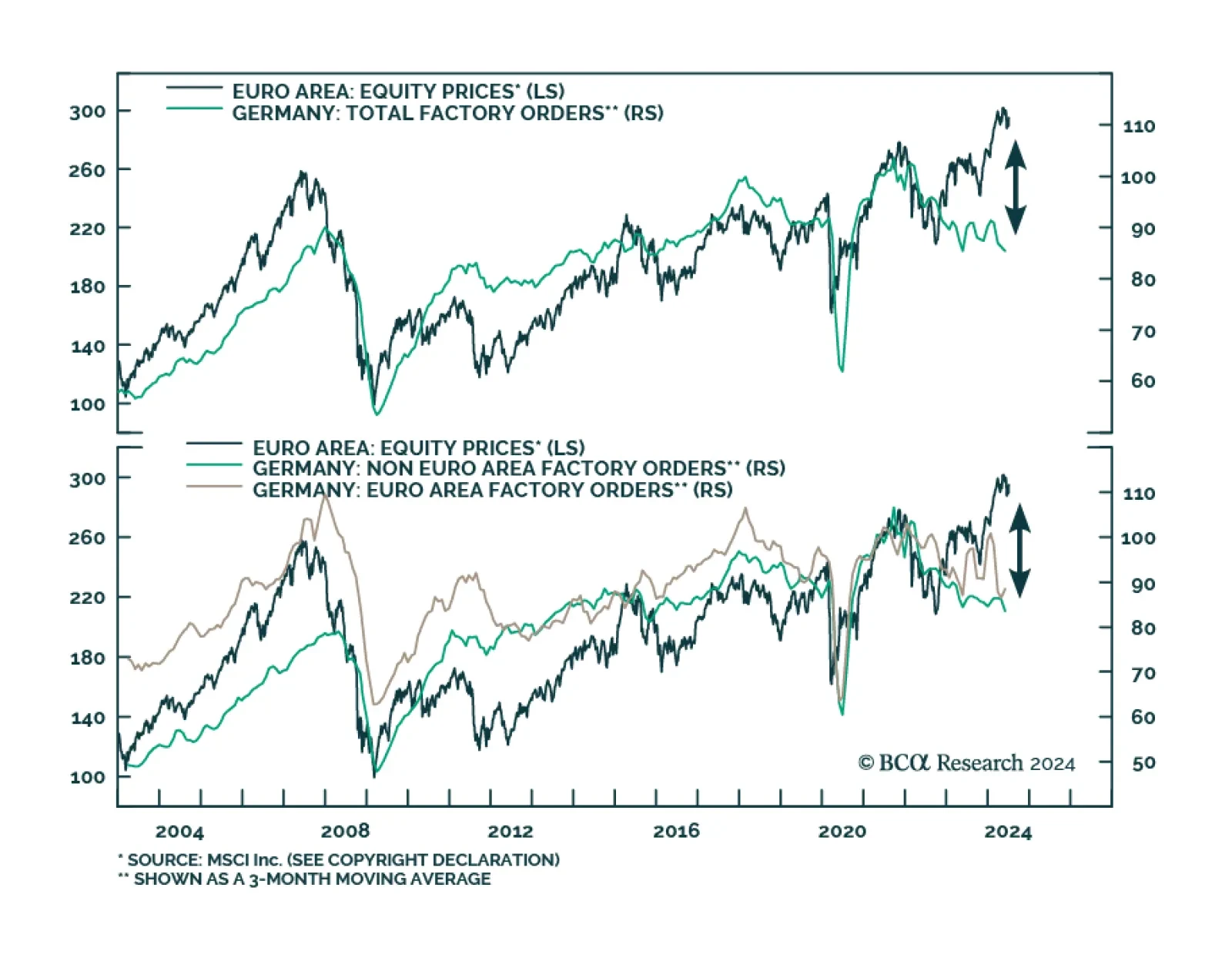

German Factory orders disappointed on Thursday. The month-on-month contraction deepened to 1.6% in June from a contraction of 0.6% in May, revised down from the previously reported 0.2%, well below expectations of a modest 0.5%…

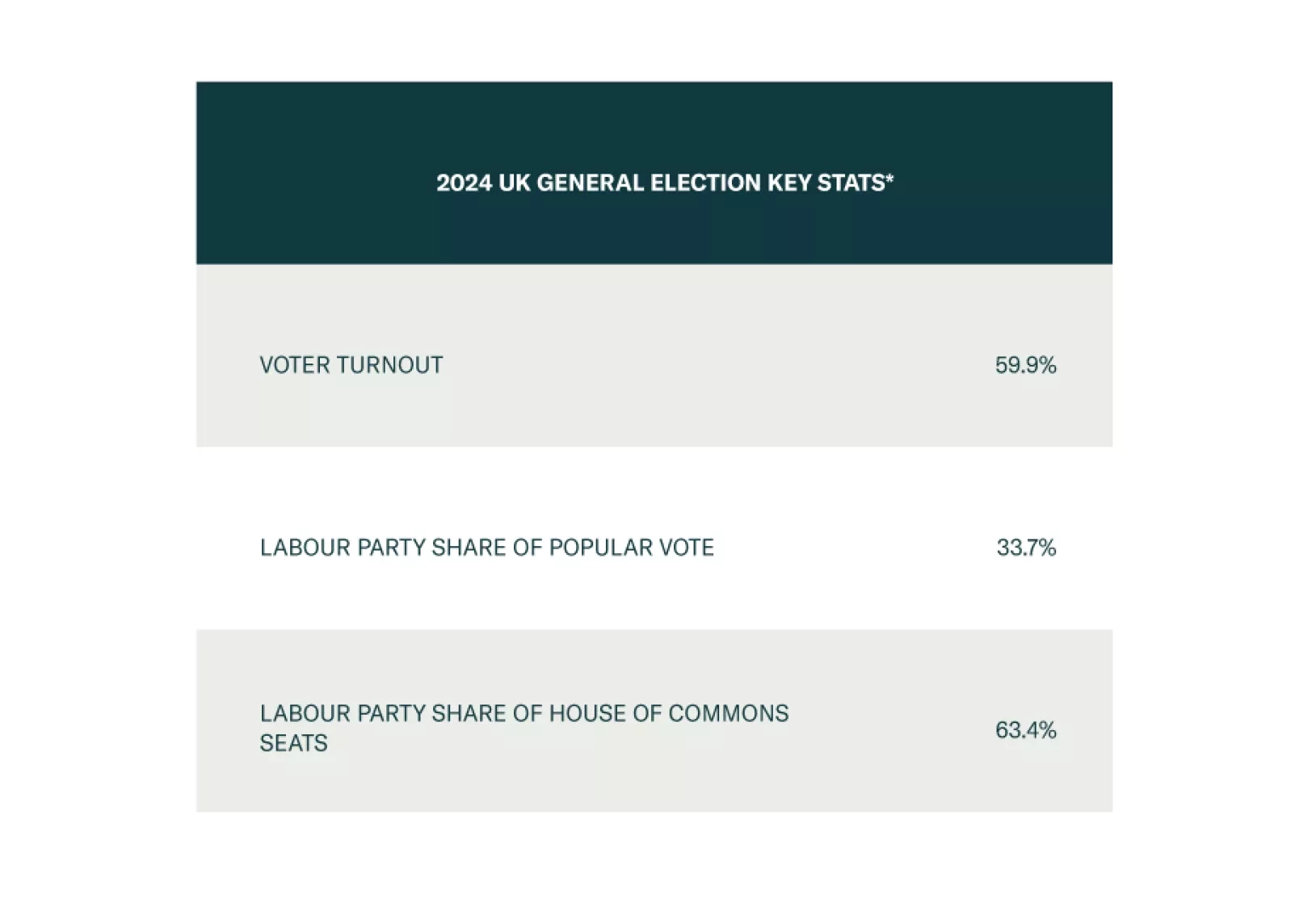

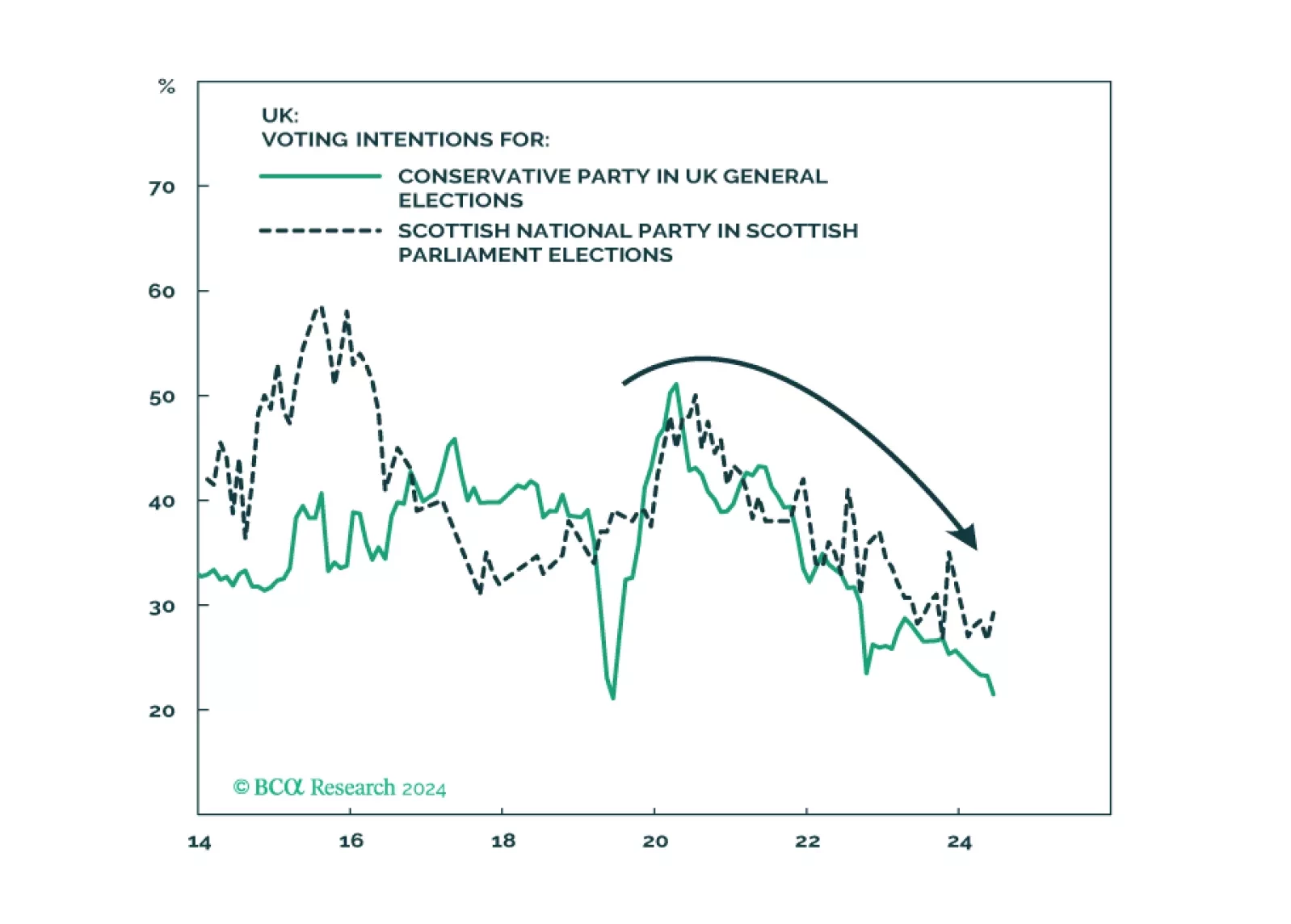

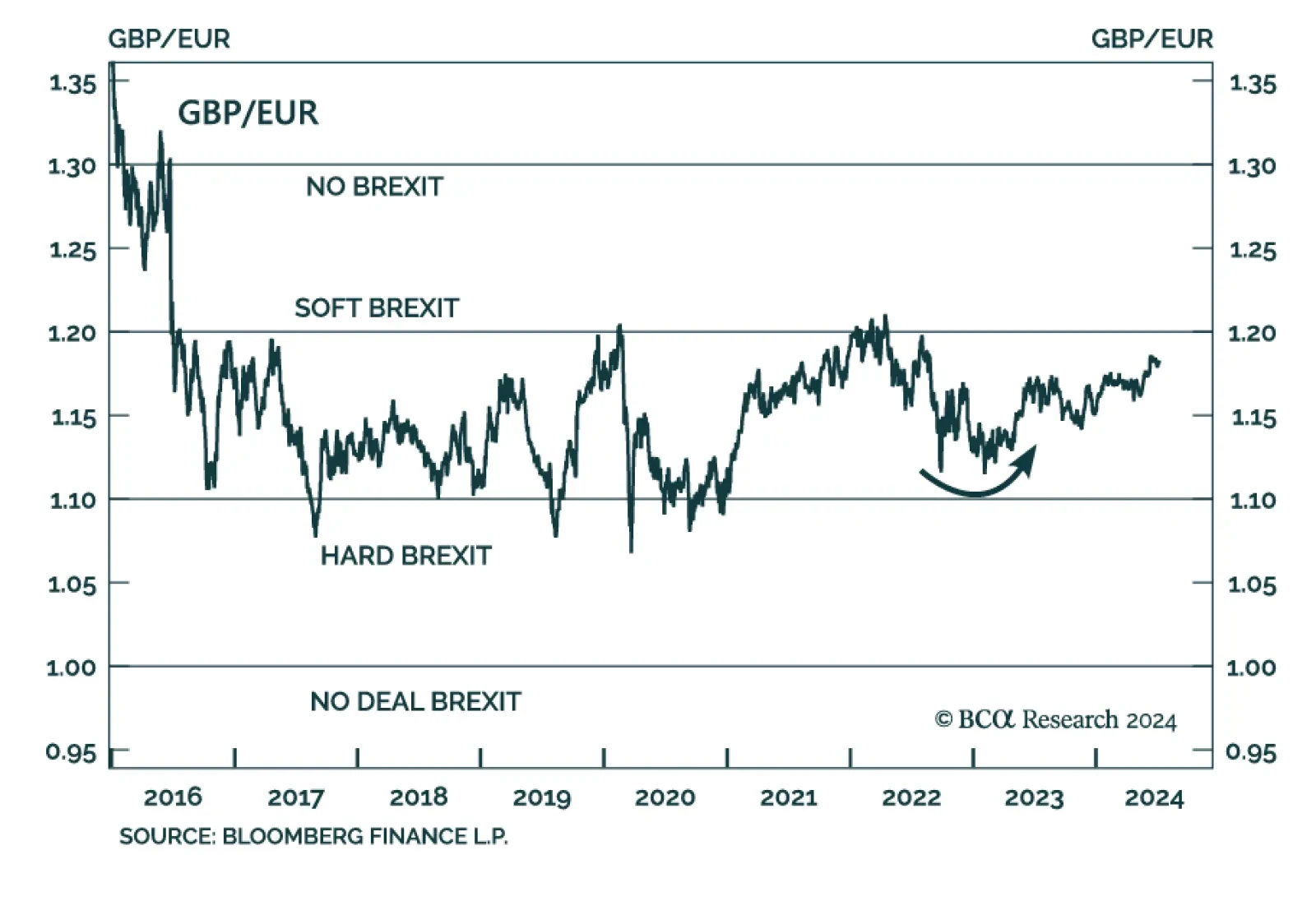

The Labour Party won the UK election, just as BCA Research’s Geopolitical Strategy service predicted back in 2022. However, this win is unlikely to rock the proverbial geopolitical boat. Popular enthusiasm for Sir Keir…

The new Labour government will have flexibility to respond to macro shocks, which is positive for the UK in general, namely GBP-EUR, and also gilts in absolute terms. But over the long run, tax hikes will likely surprise to the…

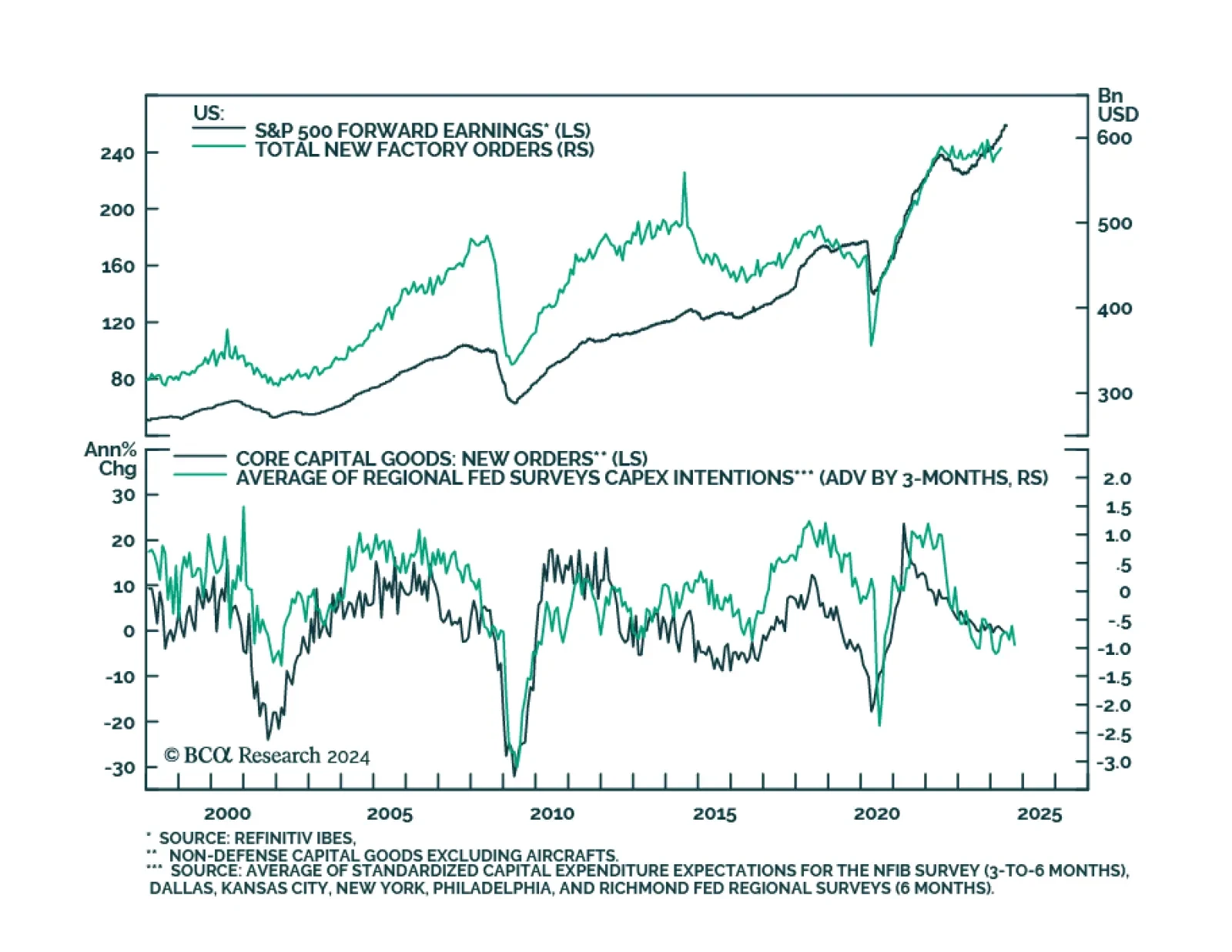

US durable goods orders grew by 0.1% m/m in May, a tick below April’s pace, and upending preliminary expectations they would decline by 0.5%. Moreover, the contraction in core capital goods shipments (an input into the…