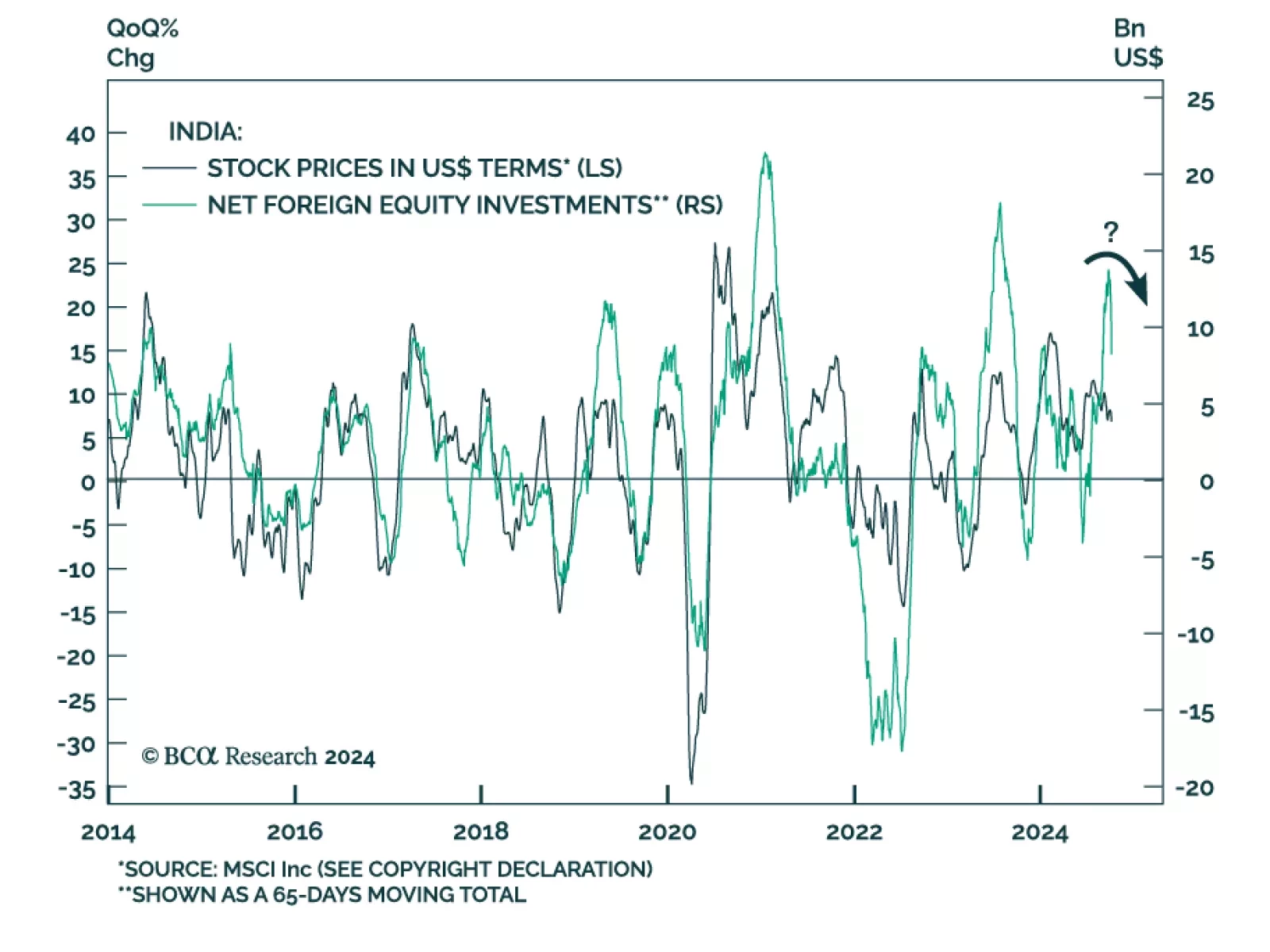

Indian equities reached new highs in late September. Our Emerging Market strategists recommend dedicated EM investors use these gains as an opportunity to reduce Indian equity allocations from neutral to underweight. They expect both…

This report looks at the likely path for the dollar and bond yields over the next 6-to-12 months.

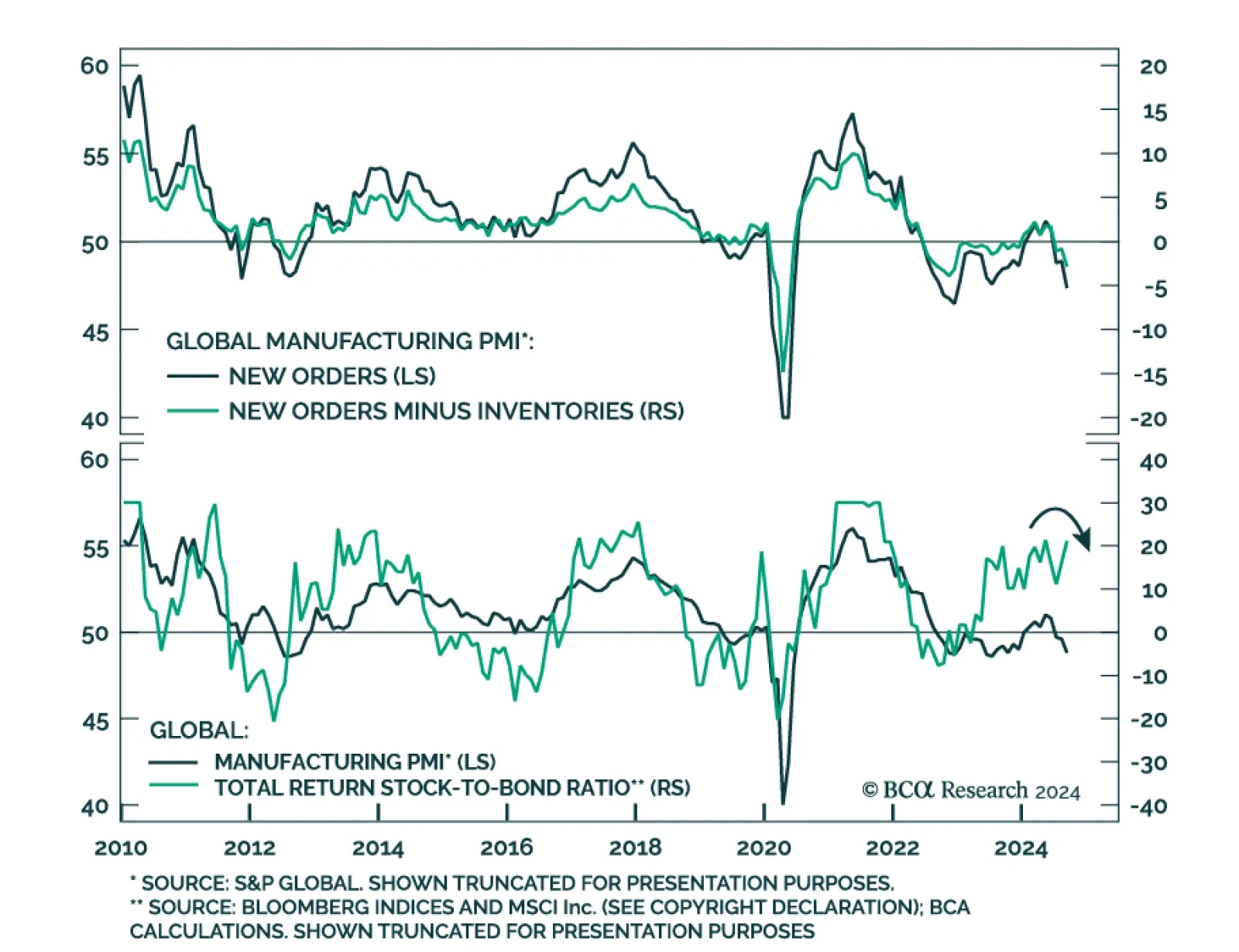

The JPM Global manufacturing PMI declined at an accelerating pace in September (49.6 to 48.8). Moreover, international trade flows deteriorated notably with the new export orders component falling from 48.4 to 47.5. A sector…

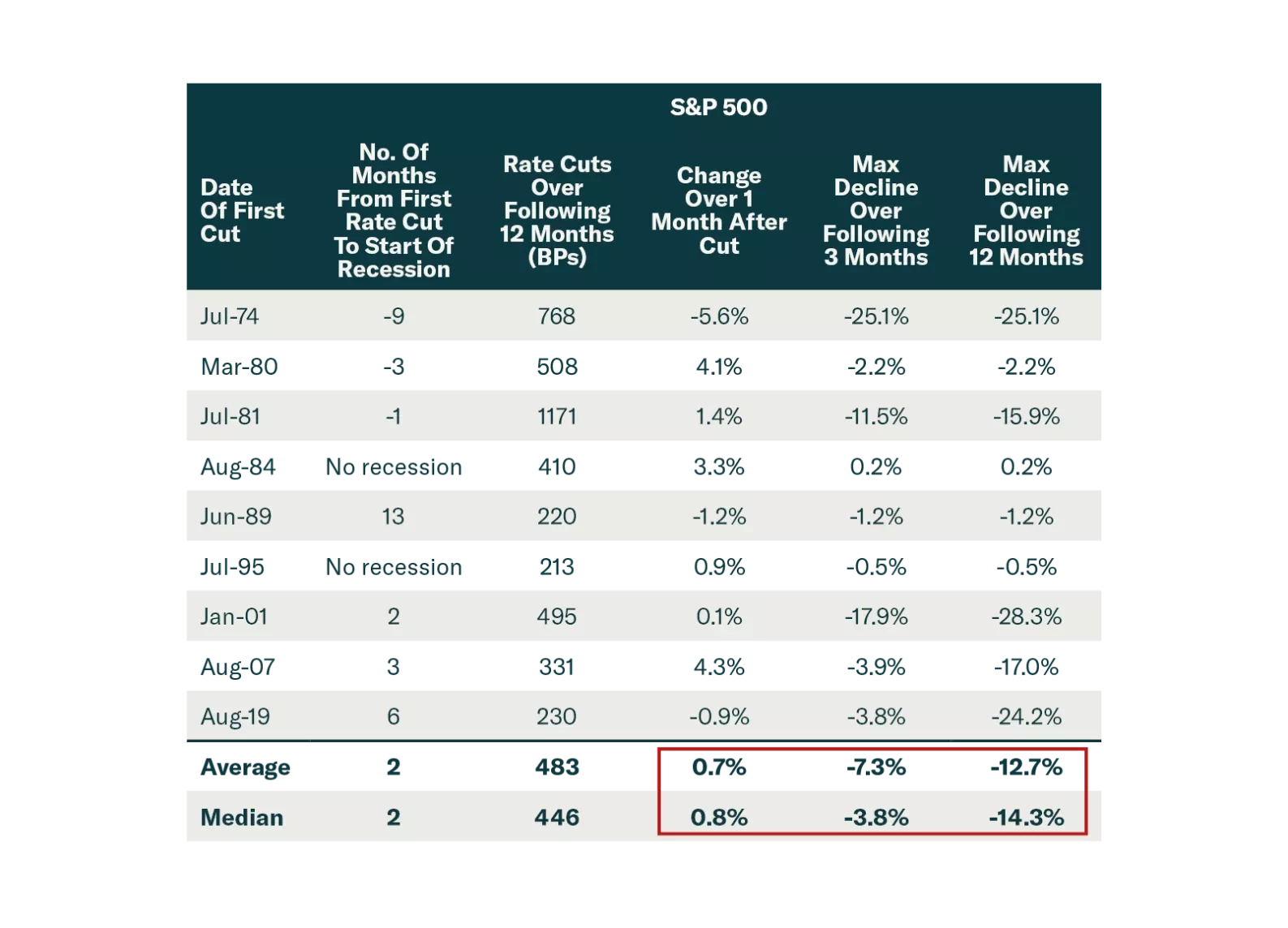

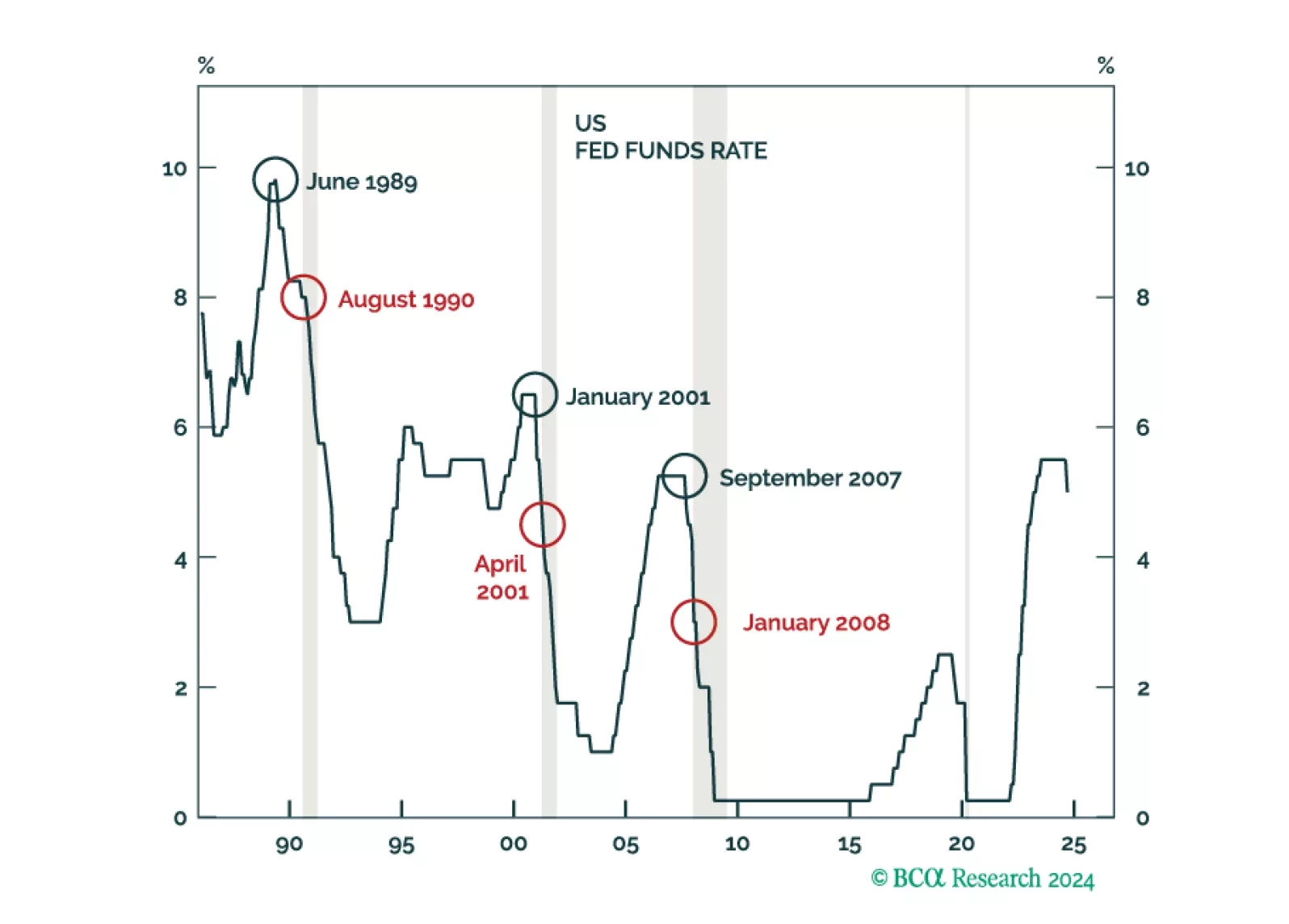

The market got excited by the 50 bps Fed cut and China stimulus. But these are a recognition that economies are slowing significantly. Stocks often rally after the first Fed cut, before falling sharply. Investors should stay…

After resisting the consensus narrative in 2022 that a US recession was imminent, and then predicting an immaculate disinflation for 2023, the Global Investment Strategy team has joined the dark side and is now expecting a recession…

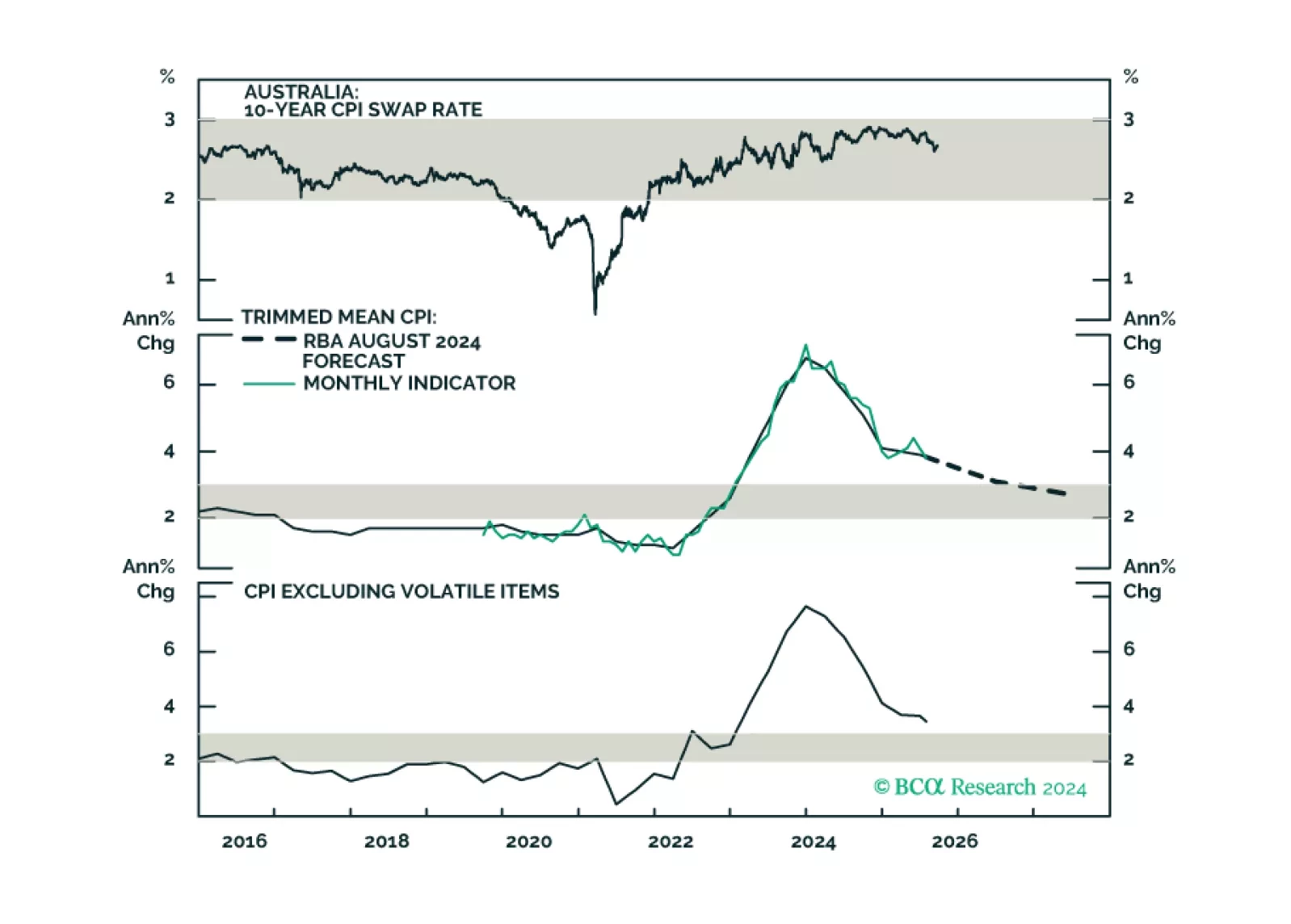

This insight parses through the RBA’s latest policy decision, and makes recommendations on whether to expect any rate cuts in 2024, and beyond.

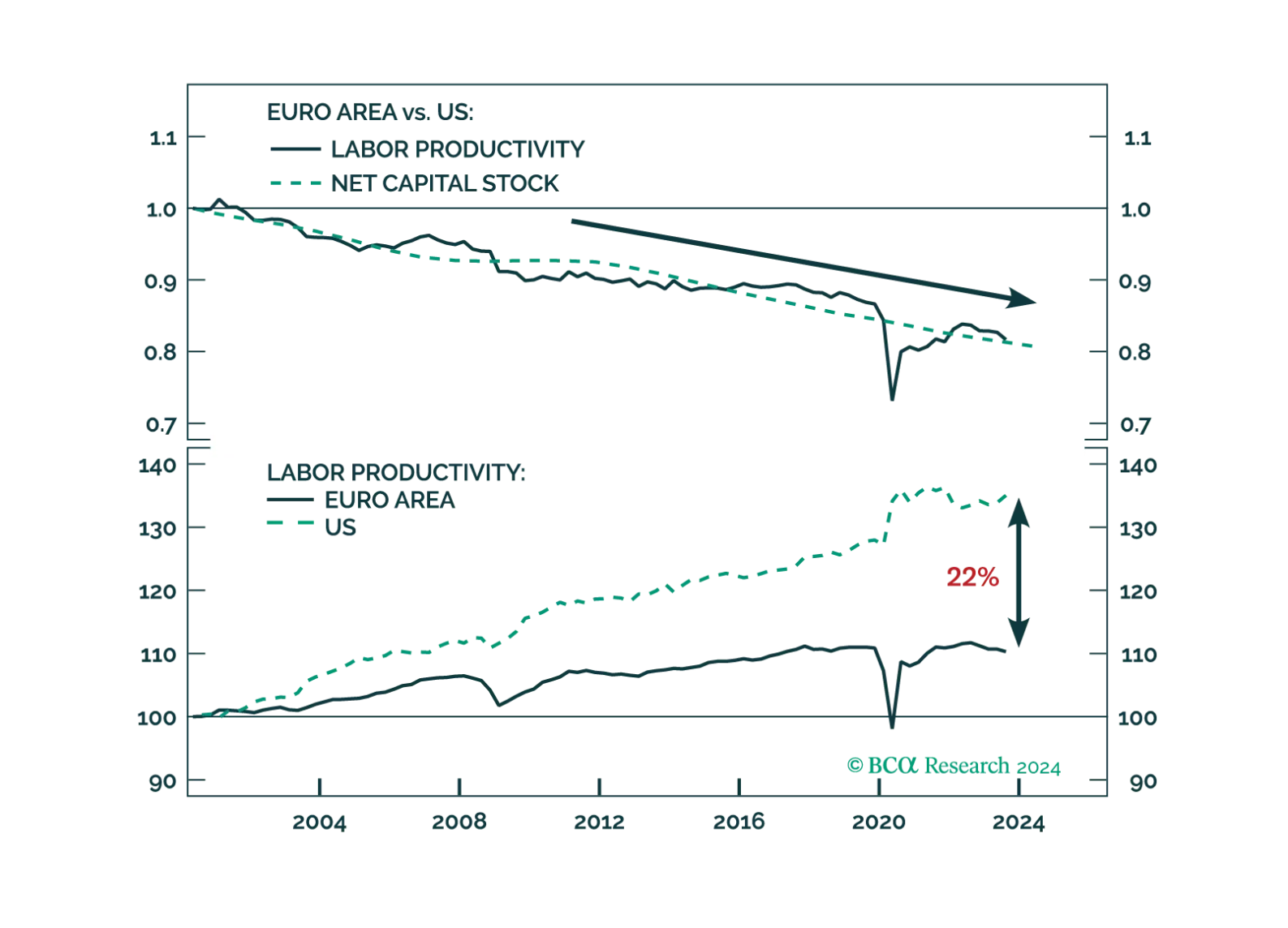

The Draghi report highlights sensible reforms that would address many of Europe’s productivity shortcomings. Whether European capitals heed Mario Draghi’s advices remains to be seen.

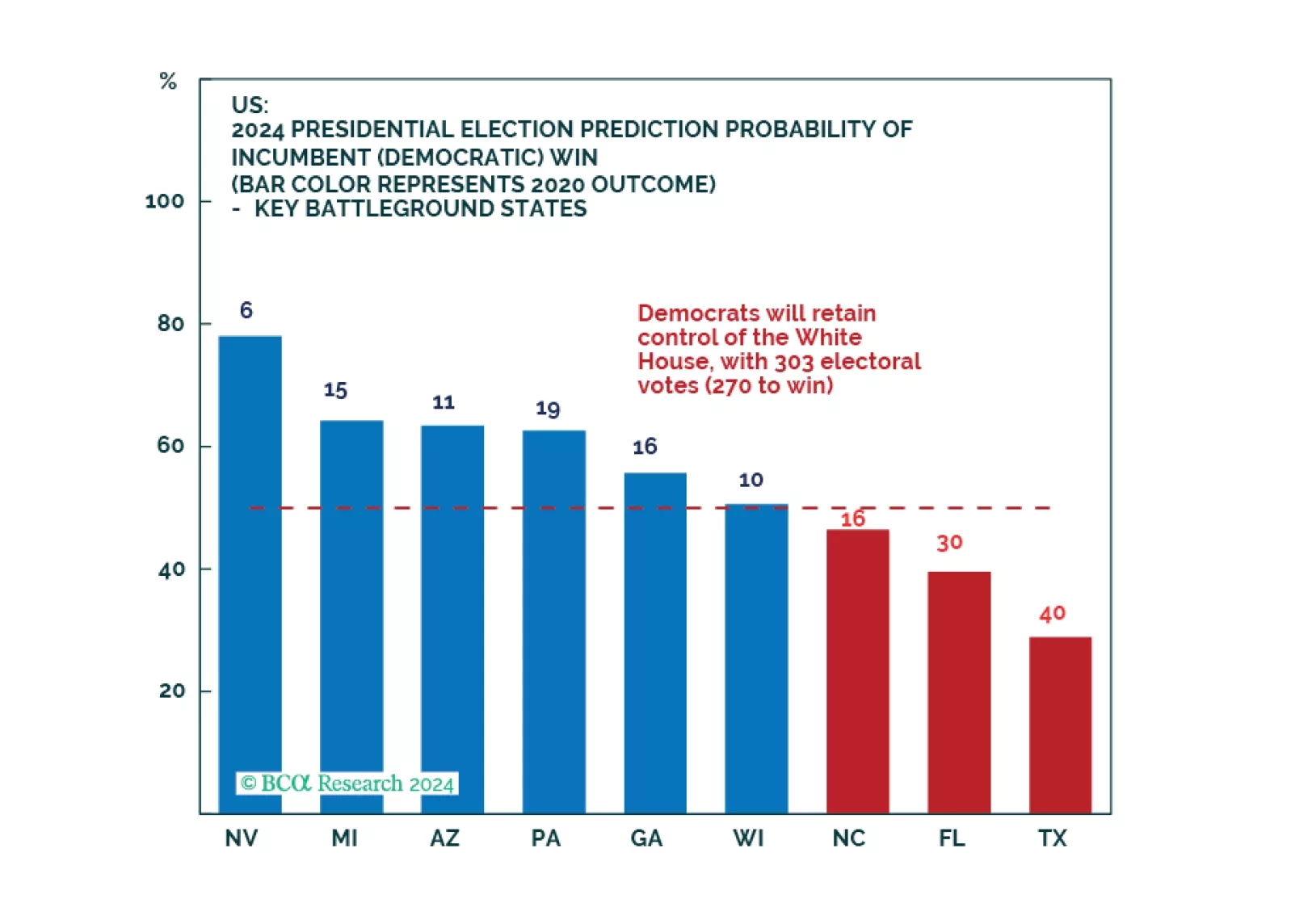

Democrats will not win a full sweep and implement drastic new tax hikes. However, our quant model still favors them to win the White House and just upgraded their odds. While we expect equity volatility around the election, investors…

Even after the Fed cuts rates, policy will remain restrictive for some time. Moreover, in history, stocks have tended to fall around the first rate cut. We remain cautious on the outlook for the economy and risk assets.

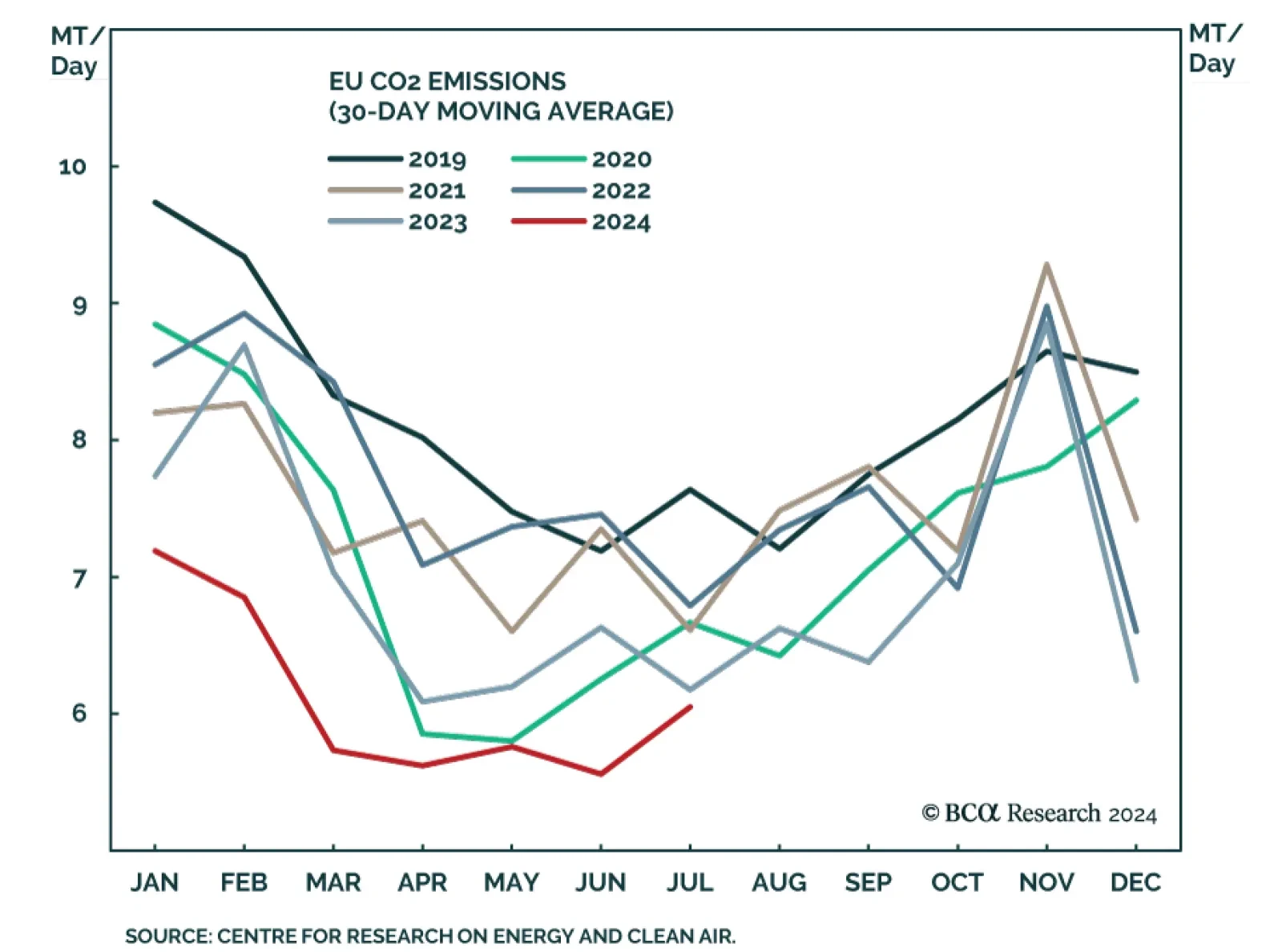

European regulatory carbon credits (EUAs) are becoming increasingly investable as an asset class. In a Special Report published last September, our Global Investment strategists agreed to the strategic bull case for EUAs, but…