Our Portfolio Allocation Summary for August 2025.

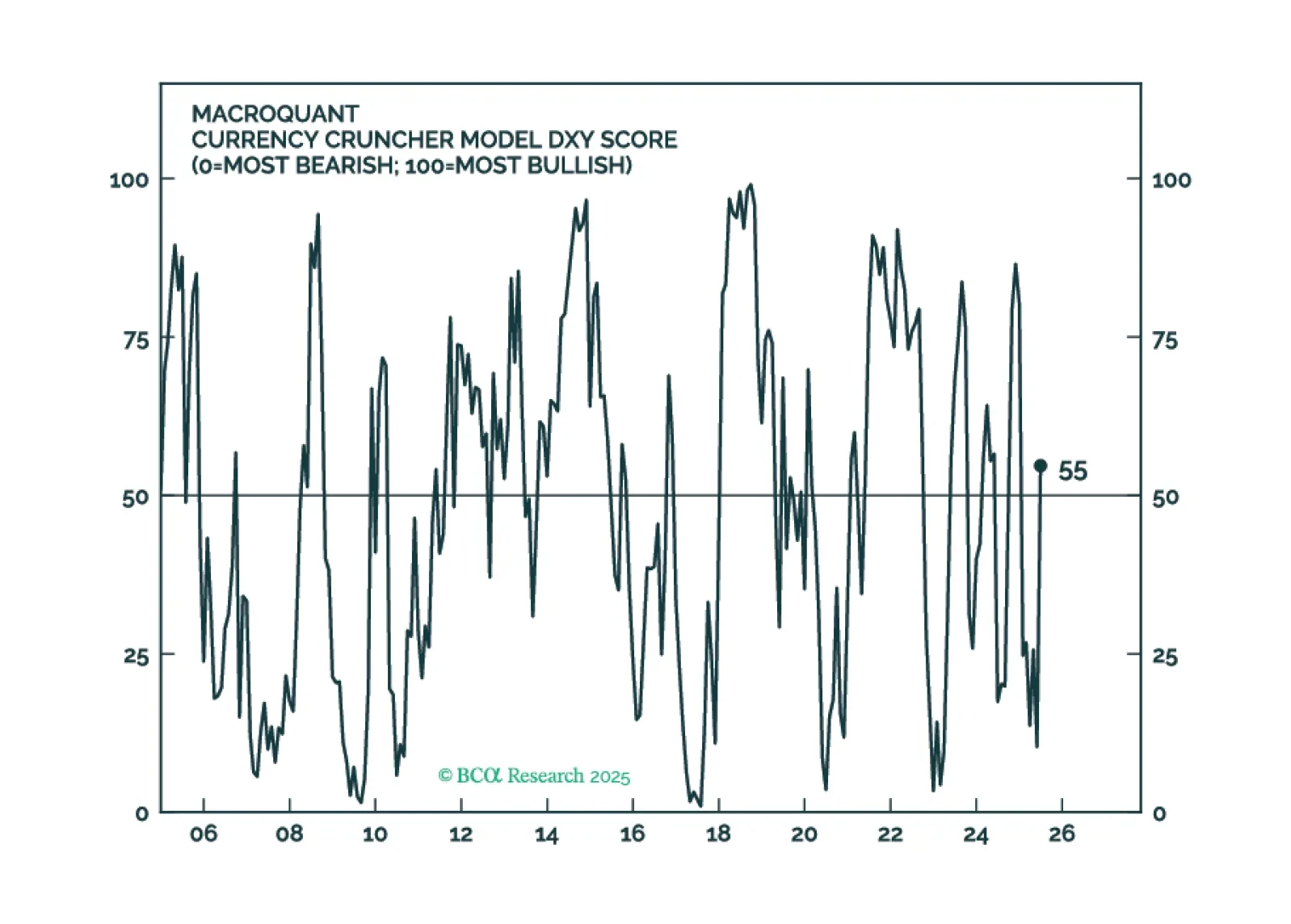

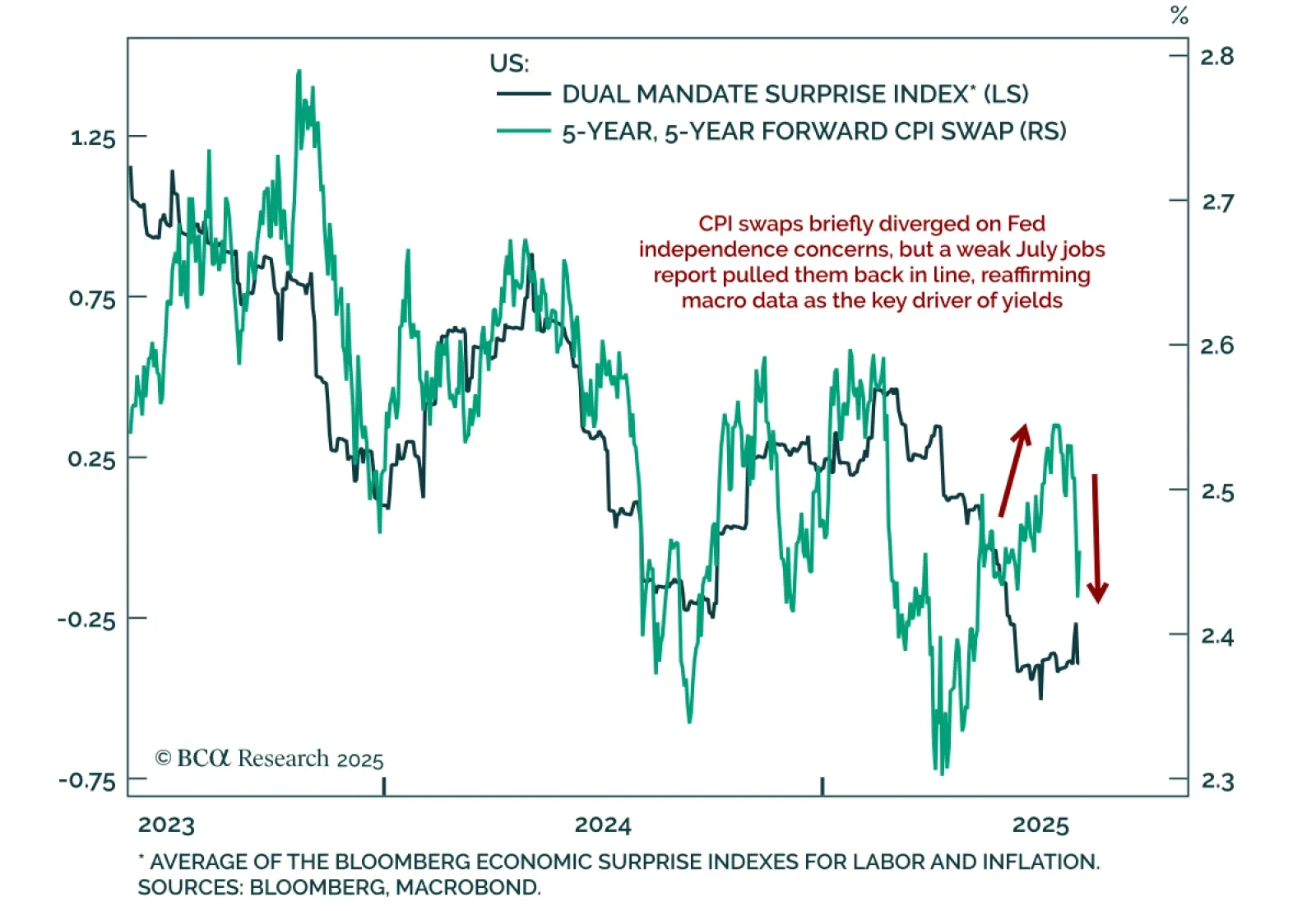

While the early resignation of Fed Gov. Kugler opened the door for a politically aligned nominee, yields will ultimately be determined by the economic outlook. Her departure triggered a further intraday DXY drop, as markets reacted…

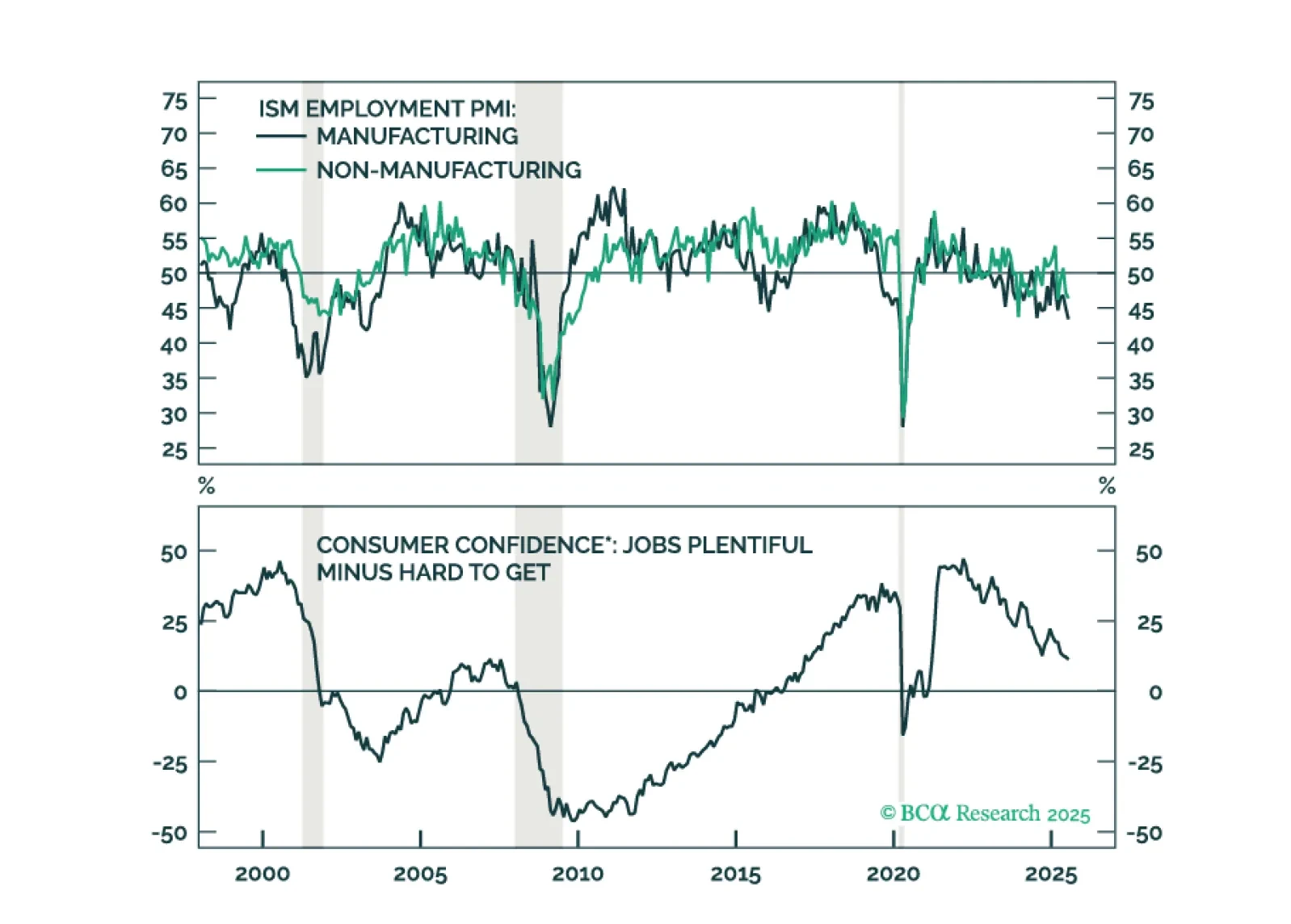

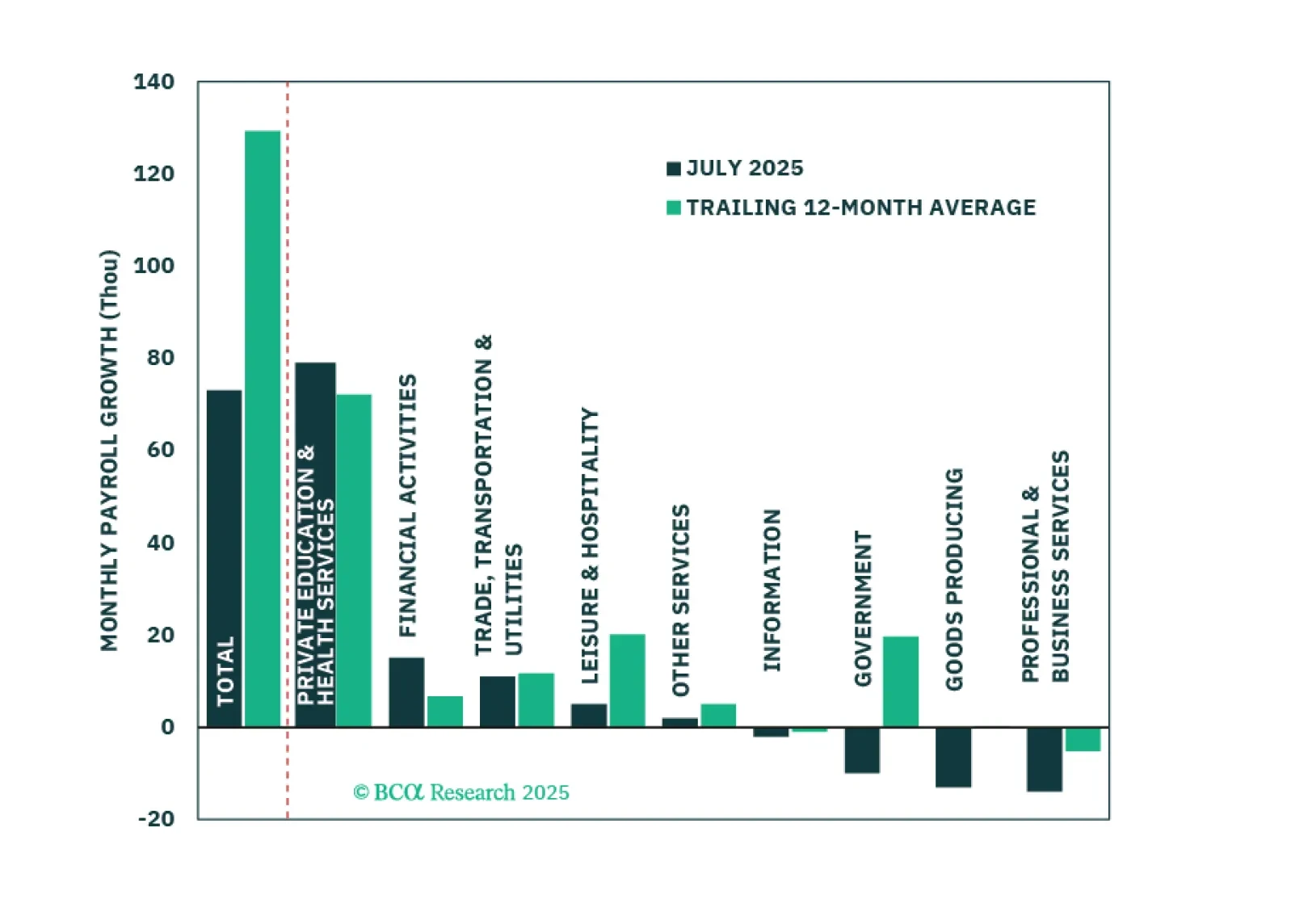

Economic activity and hiring cooled significantly in the first half of the year. The most important question for investors is whether this signals an imminent increase in labor market slack.

MacroQuant is recommending that equity investors keep their finger near the eject button but avoid pressing it for now. The model is warming up to the dollar again and sees scope for oil prices to rise.

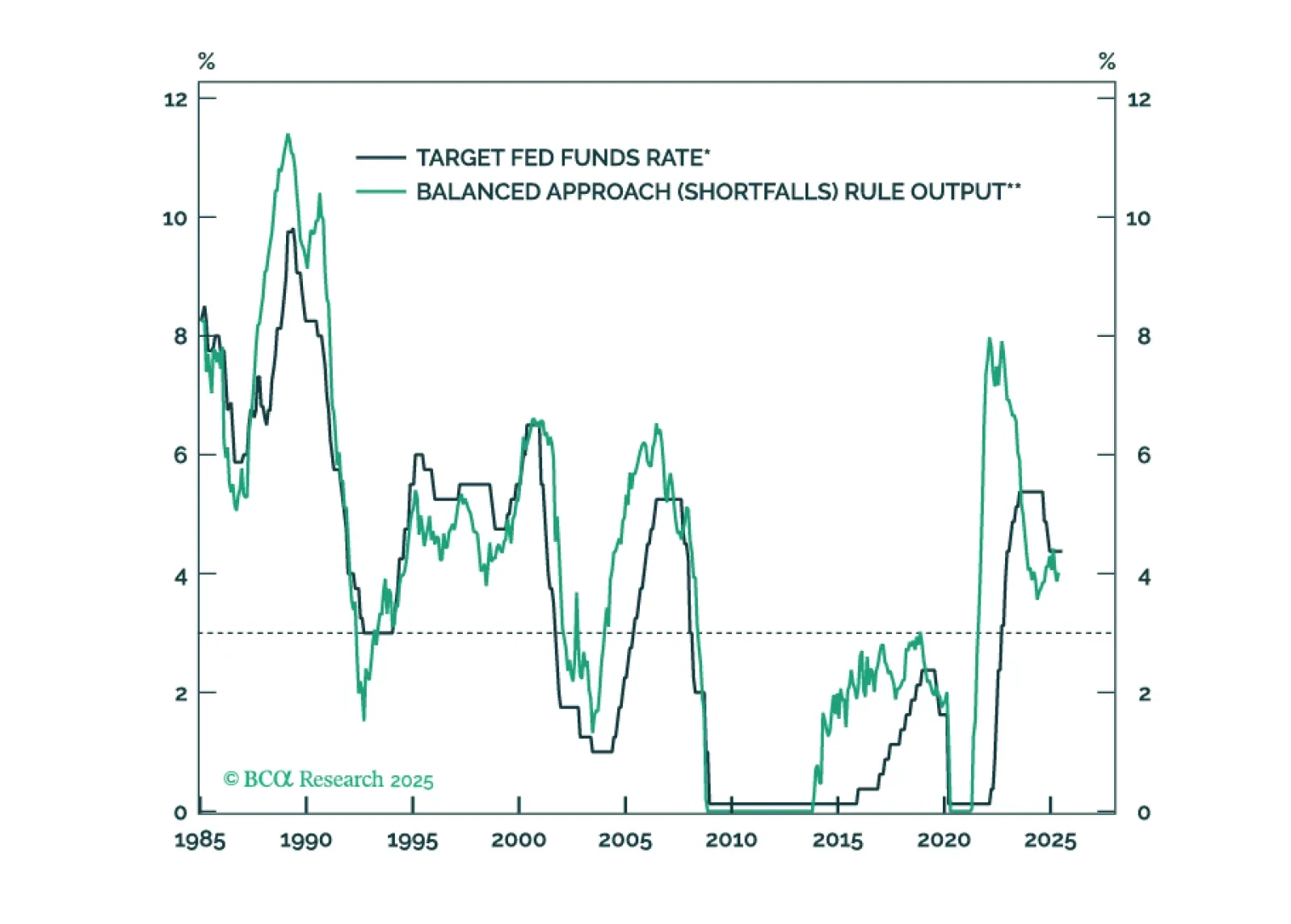

The Fed will keep rates on hold until the unemployment rate forces its hand.

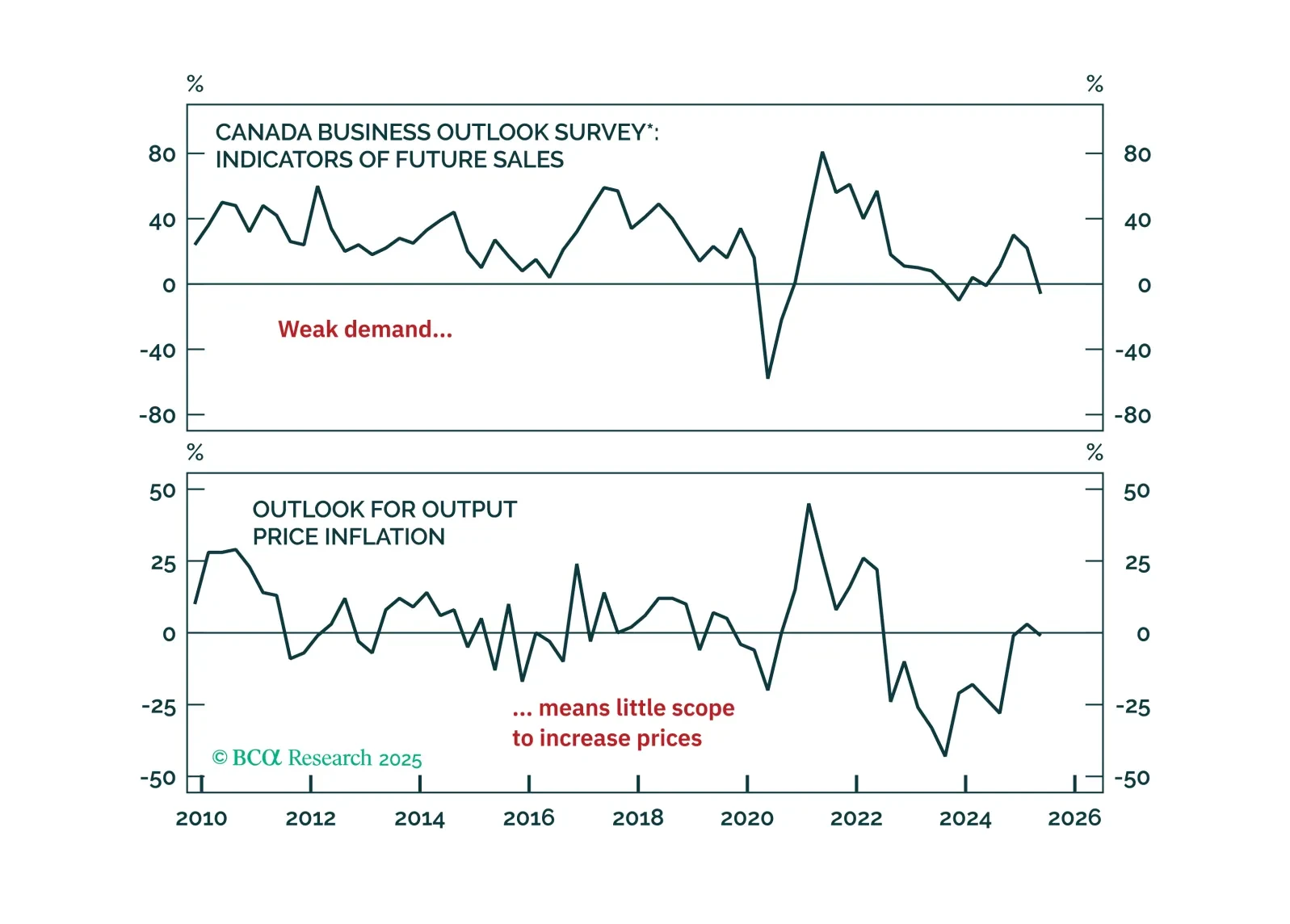

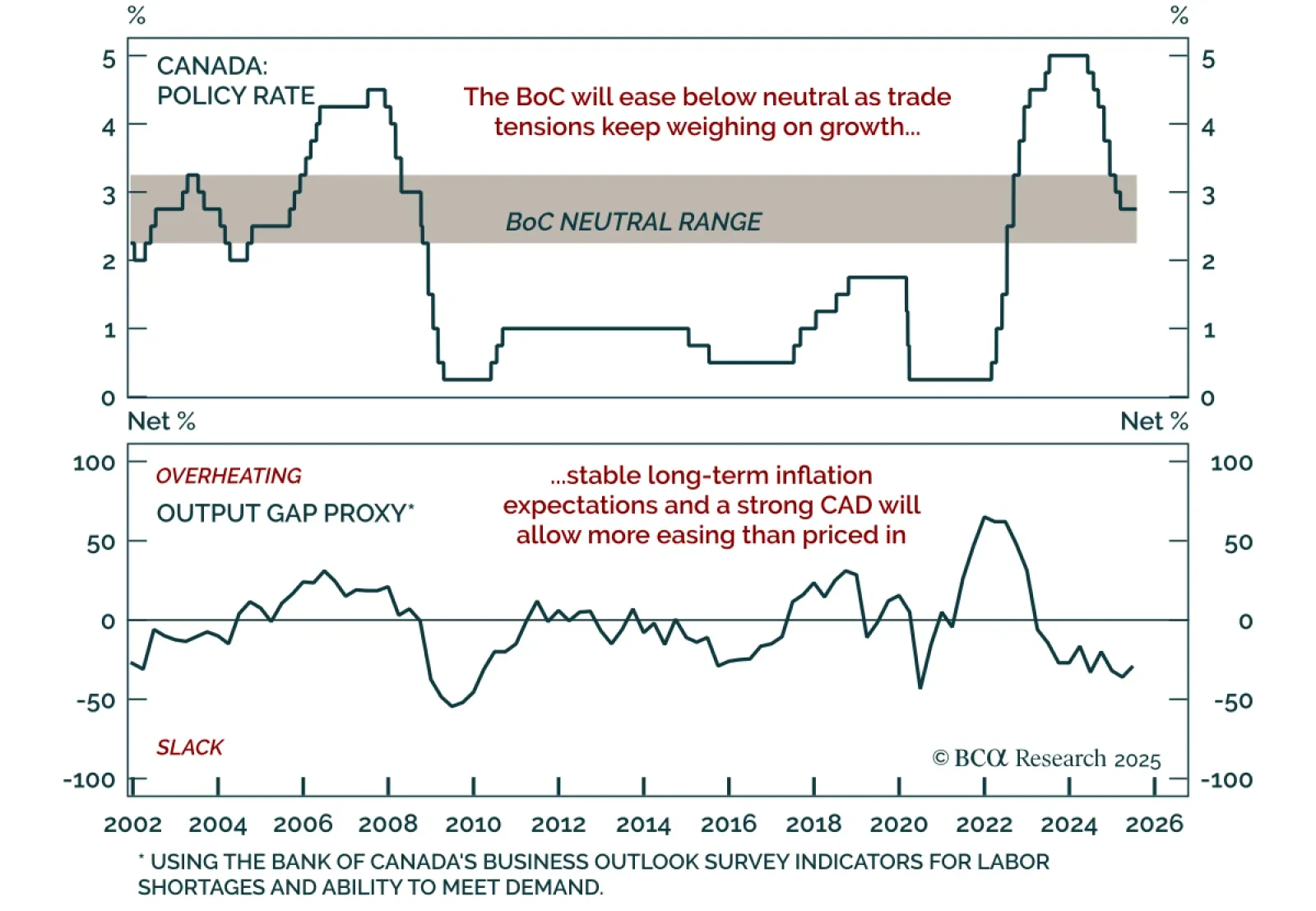

The BoC held rates at 2.75% for a third consecutive meeting, but a weak growth outlook and contained inflation reinforce our overweight in Canadian bonds. With policy within the 2.25%–3.25% neutral range, the BoC remains…

The Bank of Canada continues to hold its policy rate amid trade uncertainty and shows little concern about the potential economic damage from tariffs. We judge the risks differently and view a bet on more rate cuts this year as…

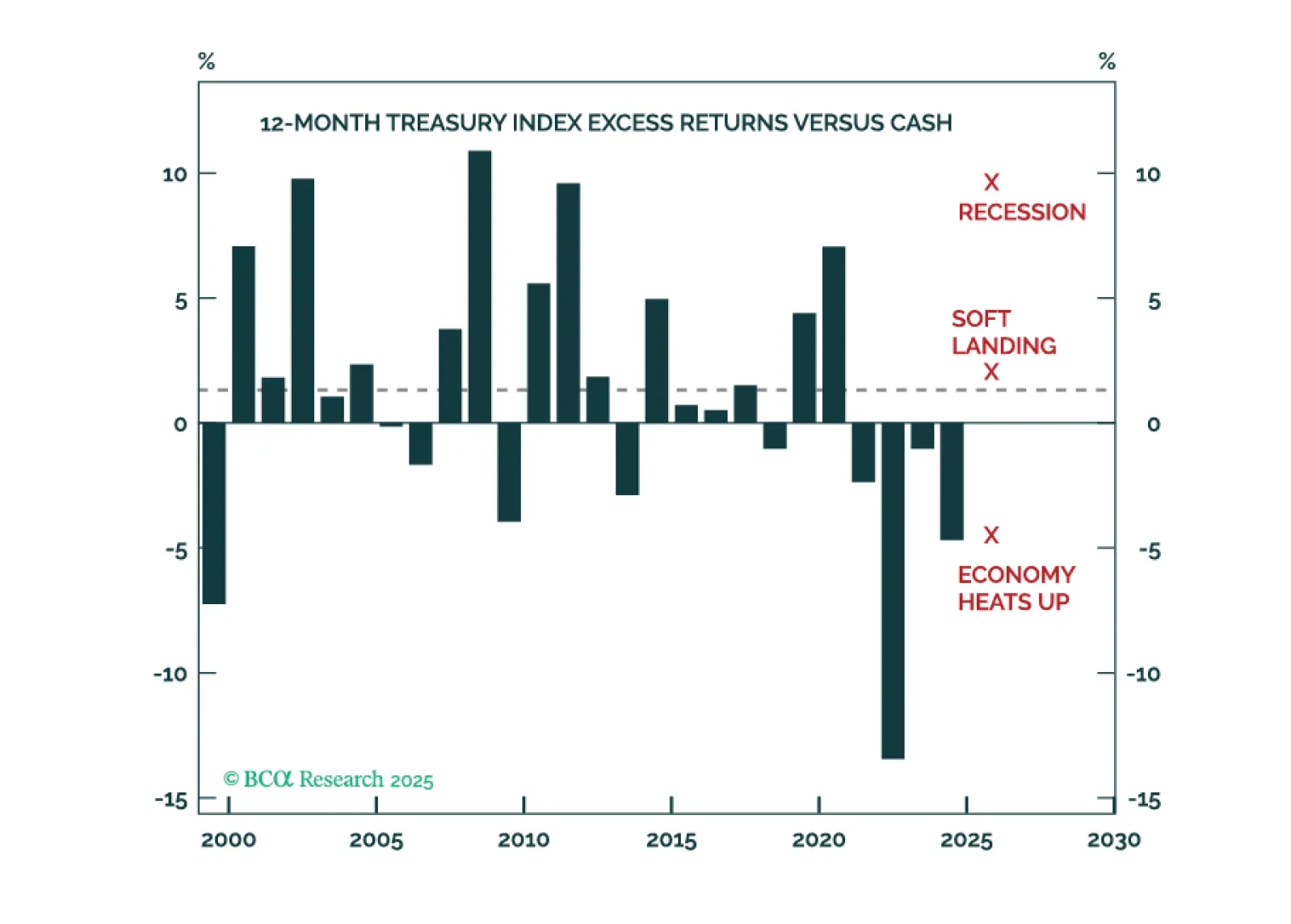

We will only move to a fully defensive stance if the “whites of the recession’s eyes” appear. So far, they have not. We will be increasingly looking to our MacroQuant model for guidance on when the next turning point in markets may…

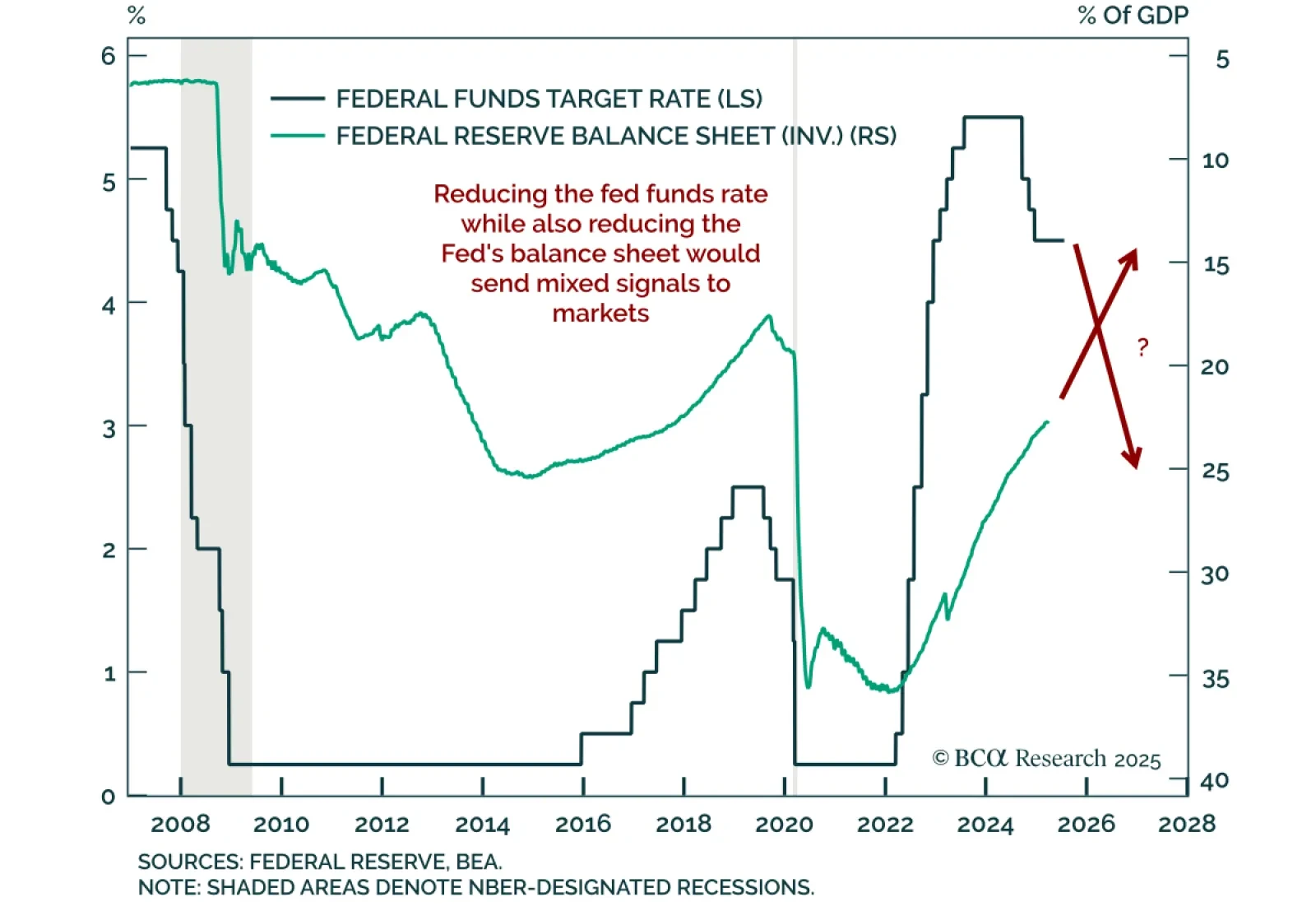

Recent criticism of the Fed centers on post-GFC policy, but proposed solutions would risk policy incoherence and higher long-end yields. Criticism covers the Fed’s reliance on balance sheet policies aimed at easing financial…