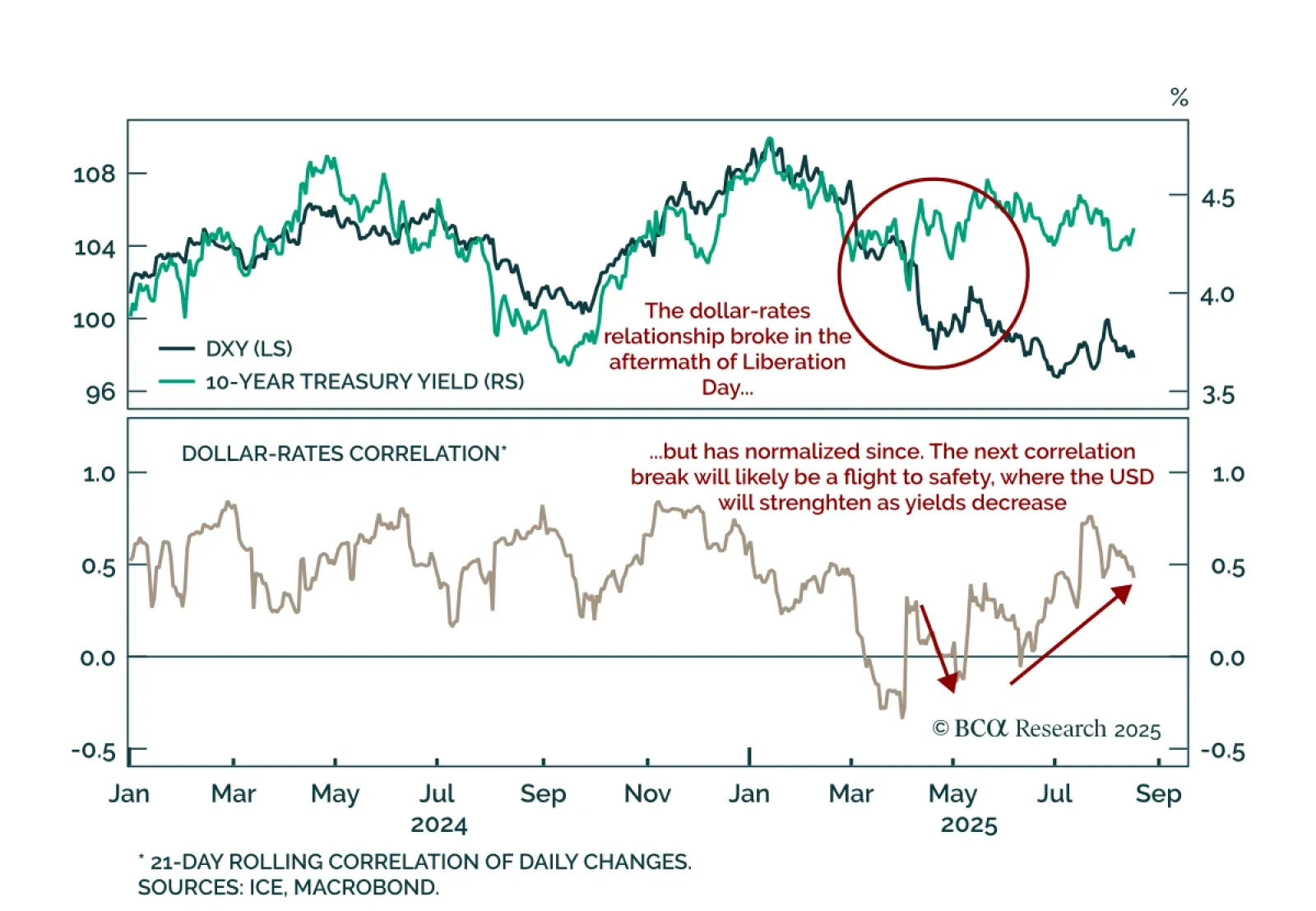

Trade tensions briefly broke the USD-rates link, but the dollar will remain a countercyclical currency for the near future. A key 2025 trend has been USD depreciation, driven by foreign investors reducing exposure to US assets…

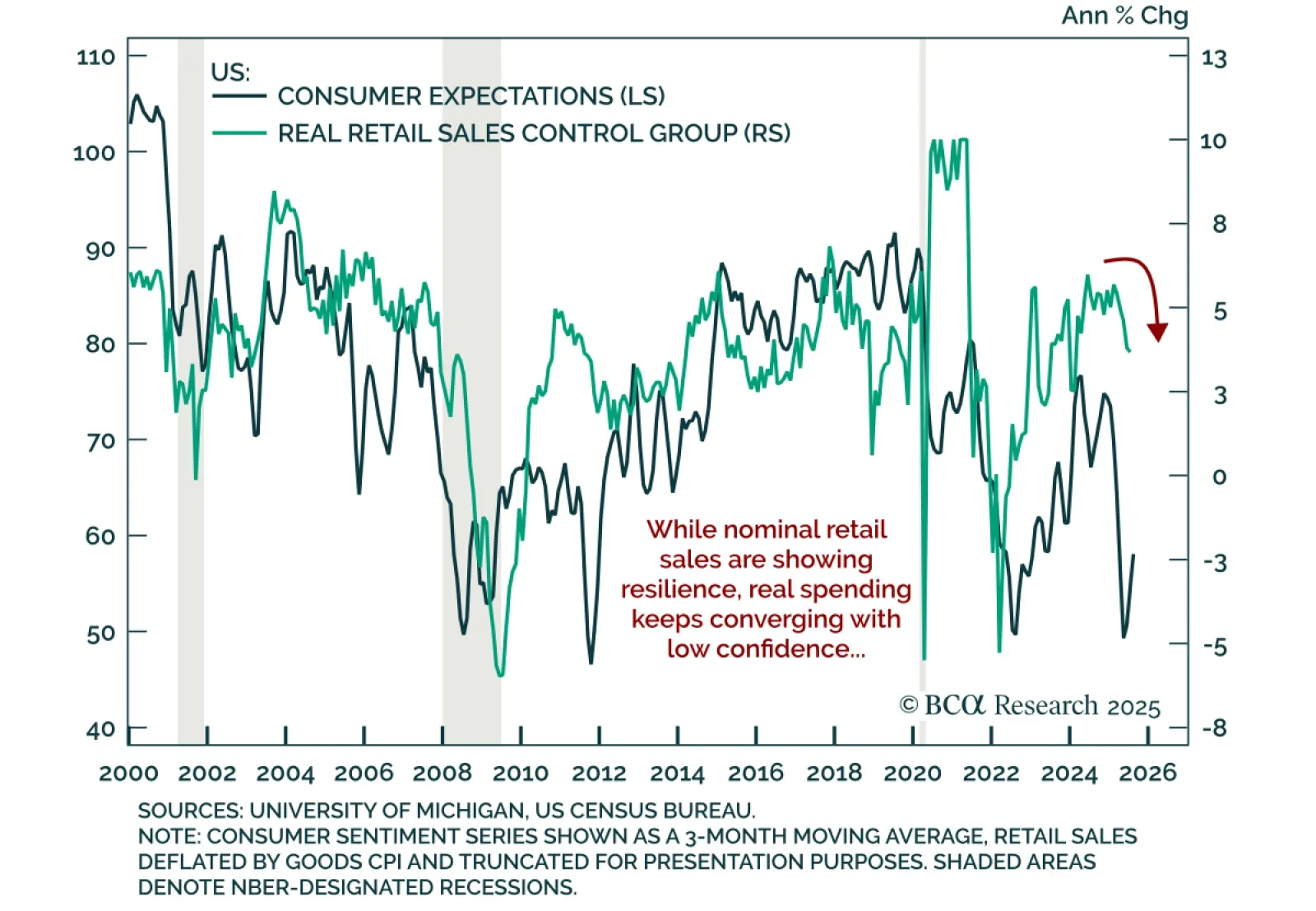

Retail sales and consumer sentiment data point to slowing underlying momentum despite headline resilience. Retail sales rose 0.5% m/m in July, below estimates and decelerating from 0.9% in June. The control group beat estimates…

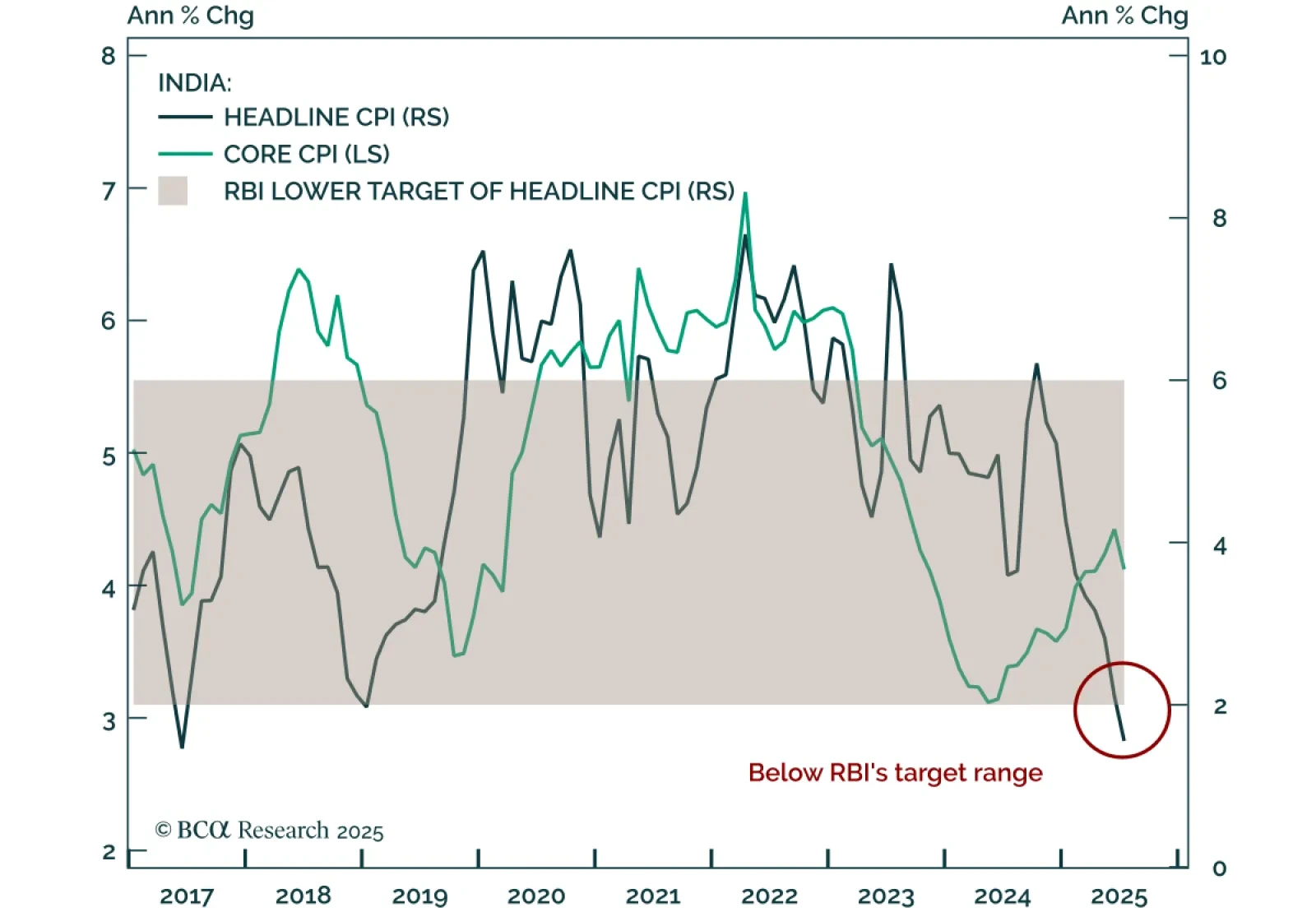

India’s sharp CPI undershoot will bring forward rate cuts, supporting a long on local bonds. Headline CPI fell to 1.55%, well below the RBI’s 2-6% target range, pointing to earlier and deeper easing than markets price. Our…

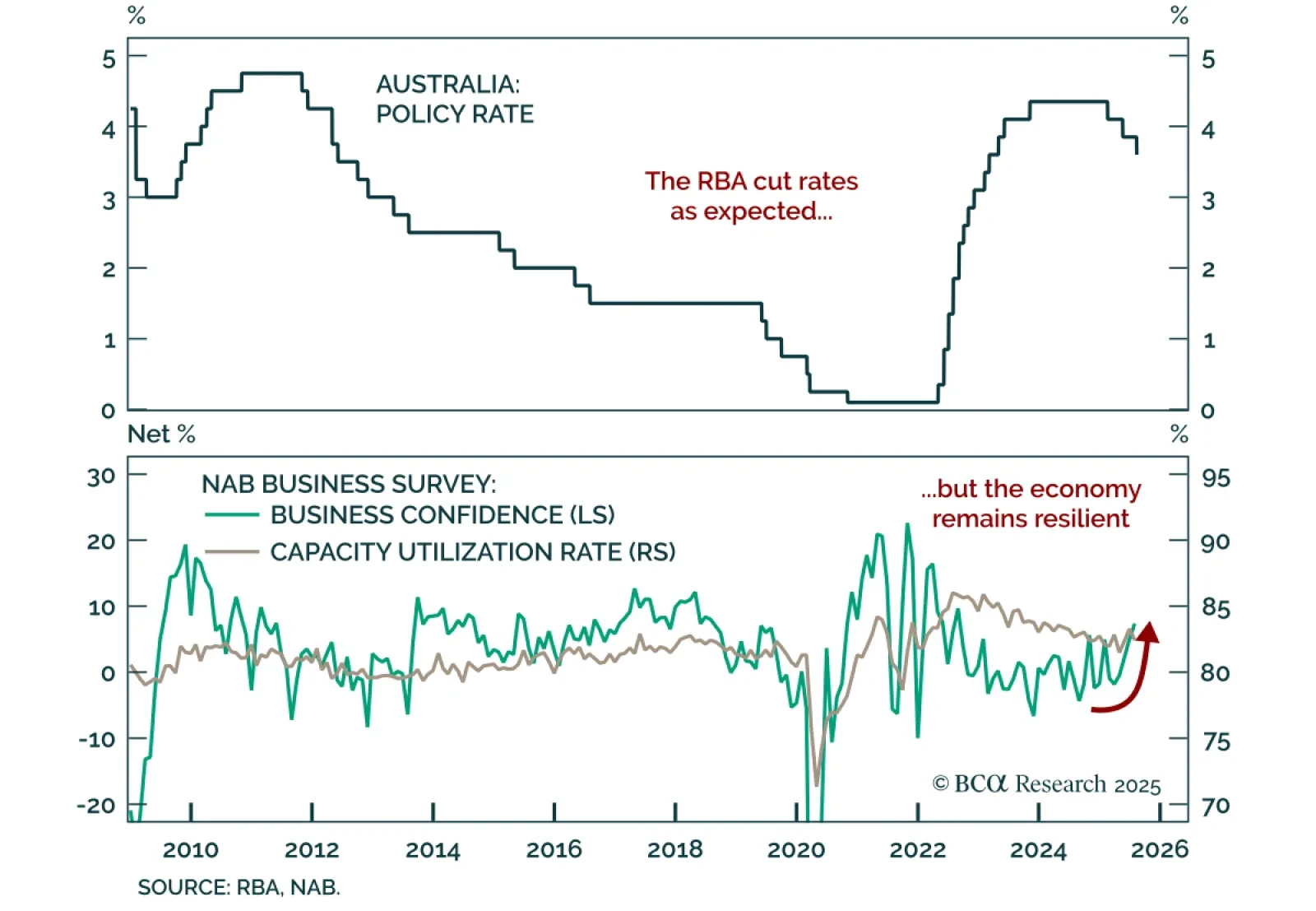

The RBA delivered a widely expected cut to 3.6%, but resilient data warrant an ACGBs underweight. The 25 bps cut was the third this year and Governor Bullock’s guidance was consistent with a cut every other meeting, keeping ACGB…

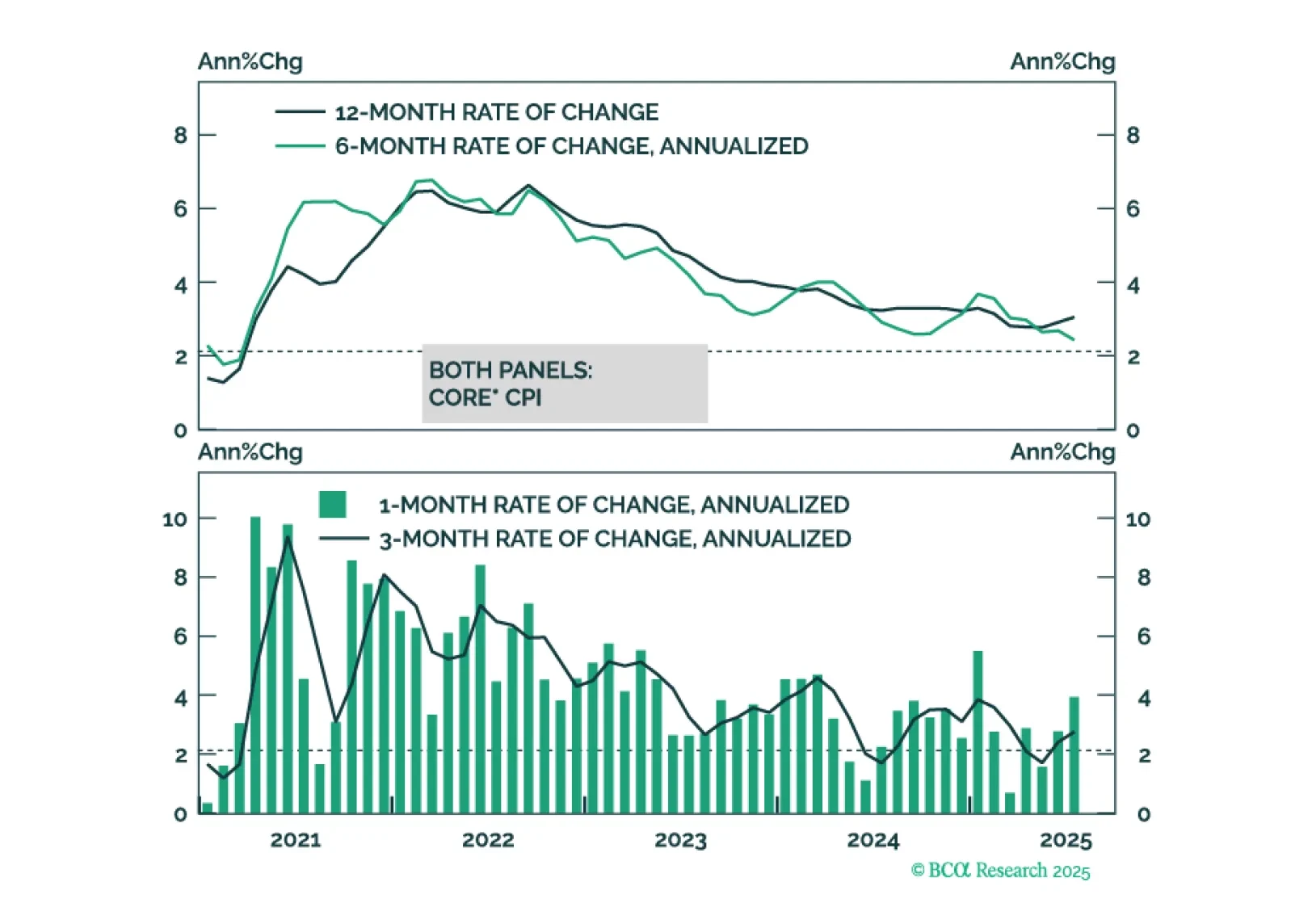

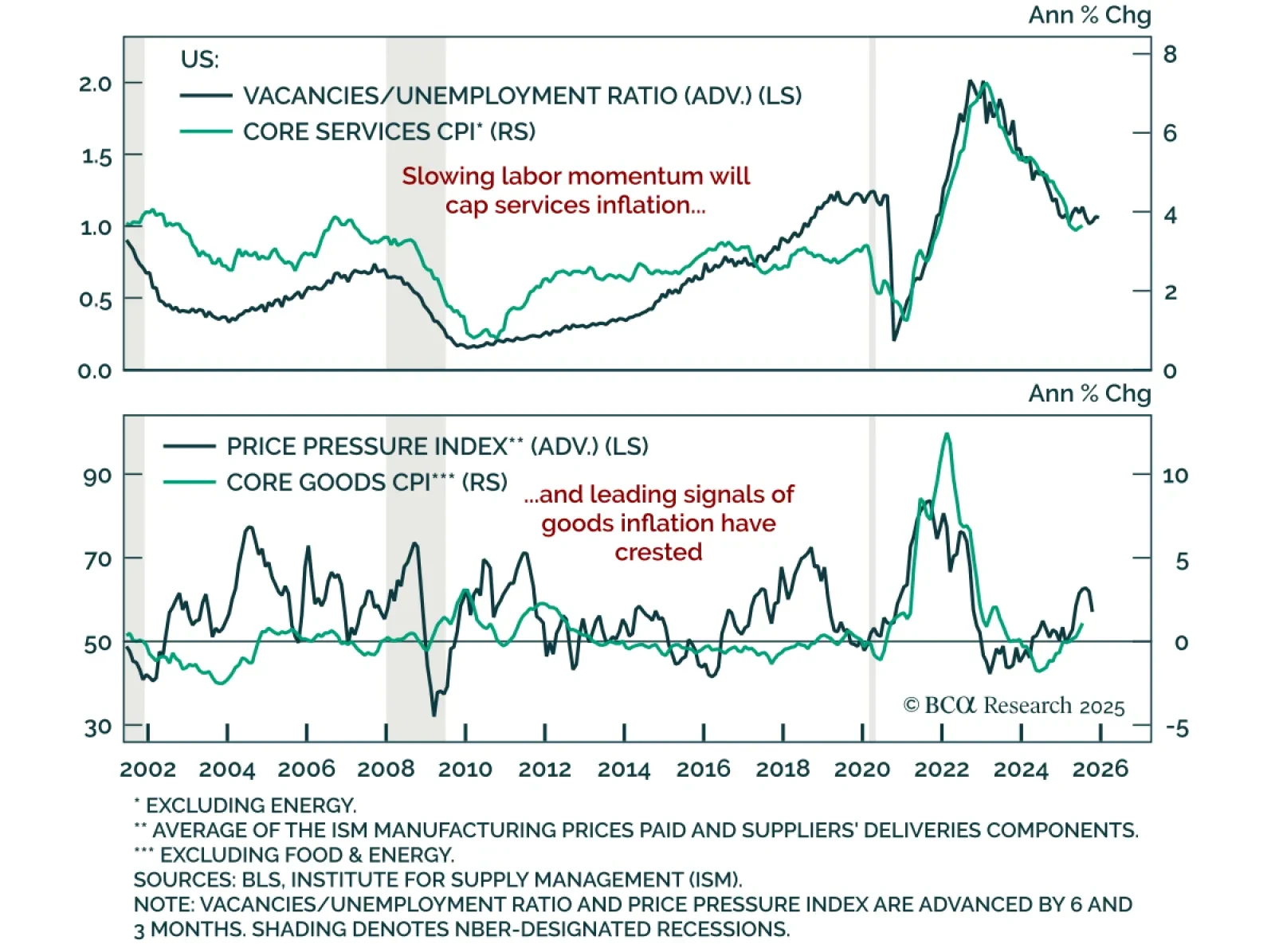

July US CPI met expectations as leading indicators point to disinflation, supporting our long duration stance and preference for 2s5s steepeners. Headline CPI rose 0.2% m/m (2.7% y/y), while core increased 0.3% m/m and…

This morning’s CPI report marginally tips the scales in favor of a September rate cut.

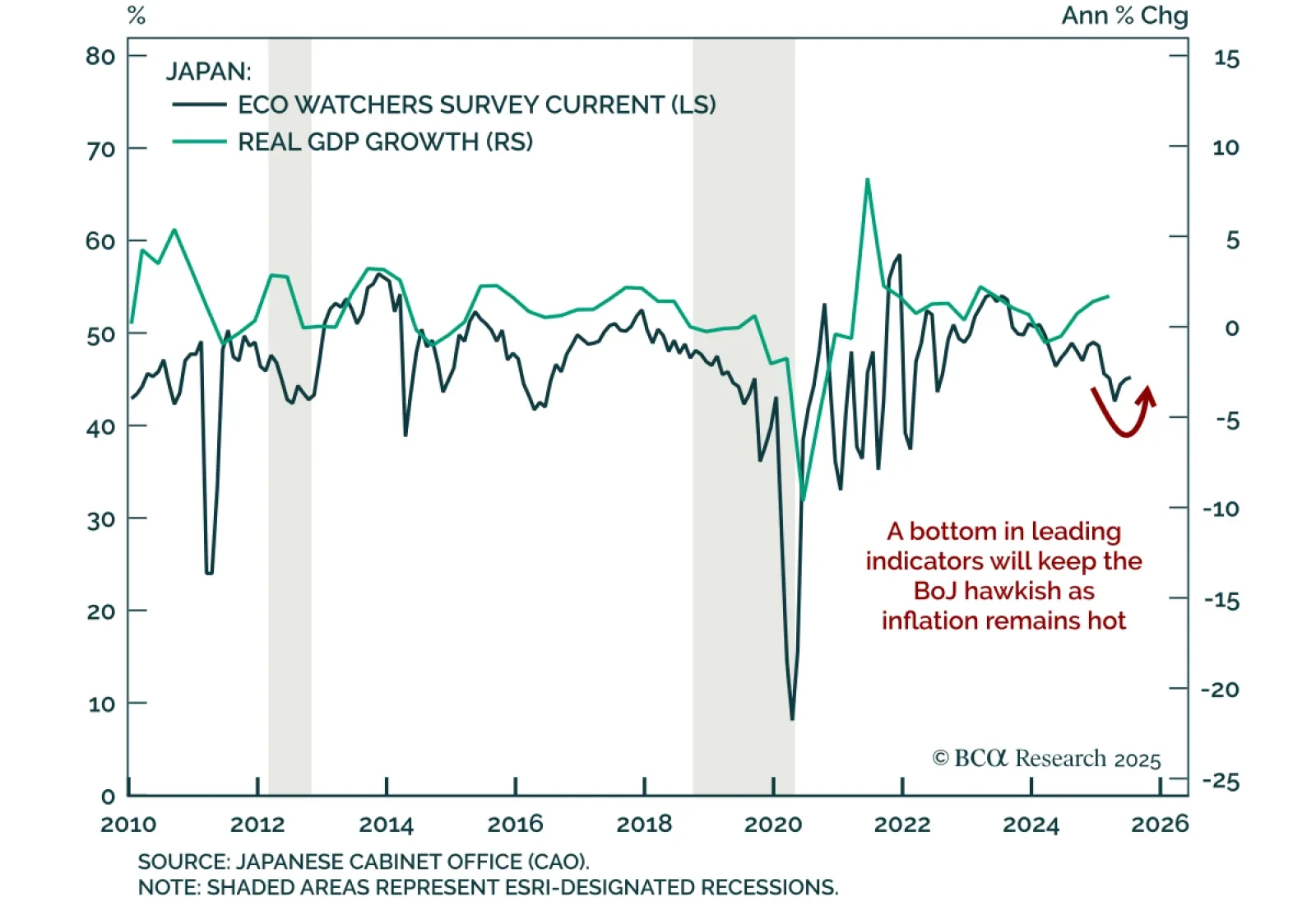

Japan’s Eco Watchers survey suggests growth has troughed, making JGBs vulnerable in both global slowdown and reacceleration scenarios. The July survey showed current conditions ticking up to 45.2 and expectations improving to 47…

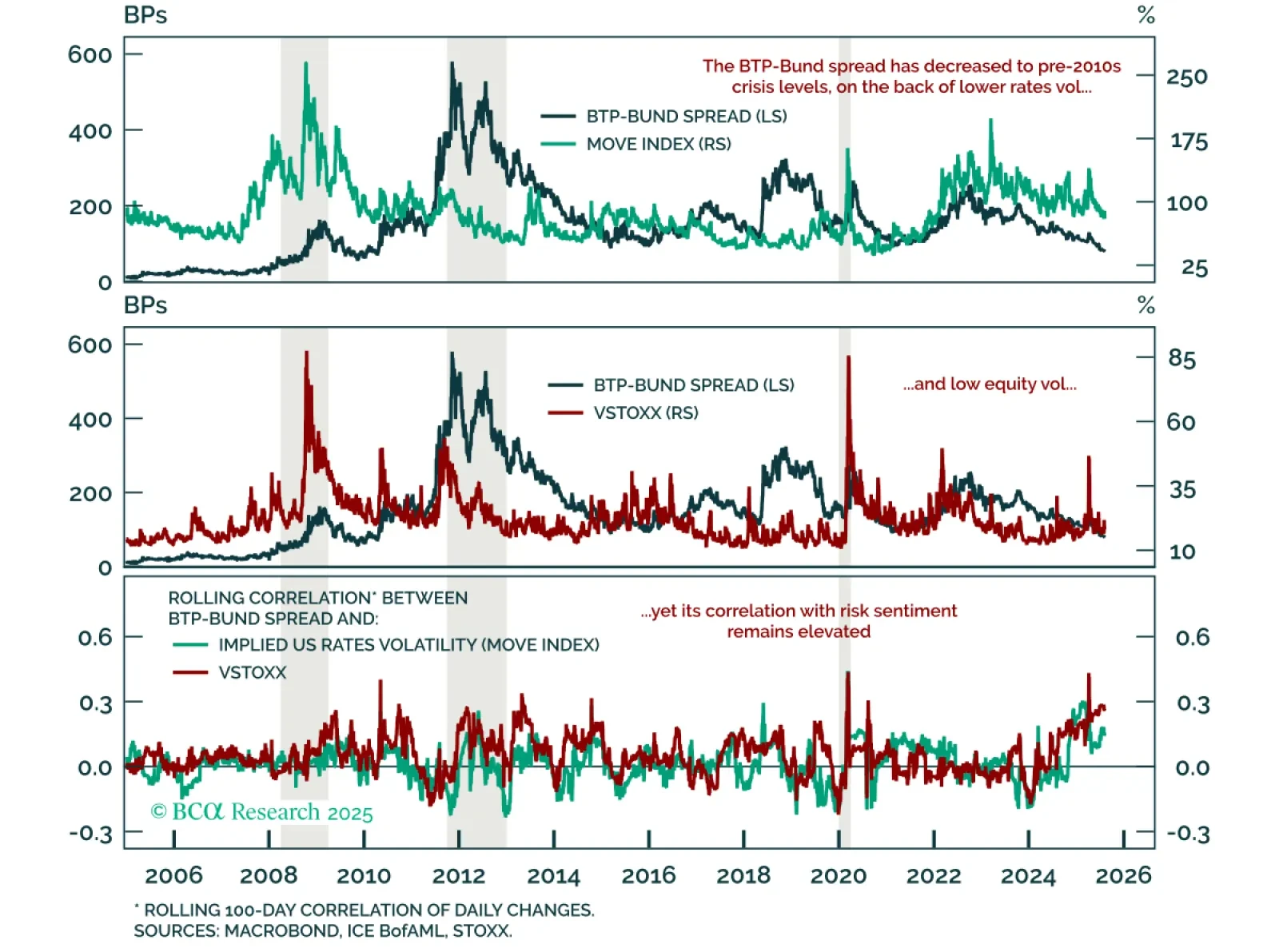

The BTP-Bund spread has tightened to pre-2010s levels, but with global growth risks we favor Gilts over Bunds and prefer BTPs over credit. While the EURO STOXX 50 remains rangebound since the Liberation Day recovery, European…

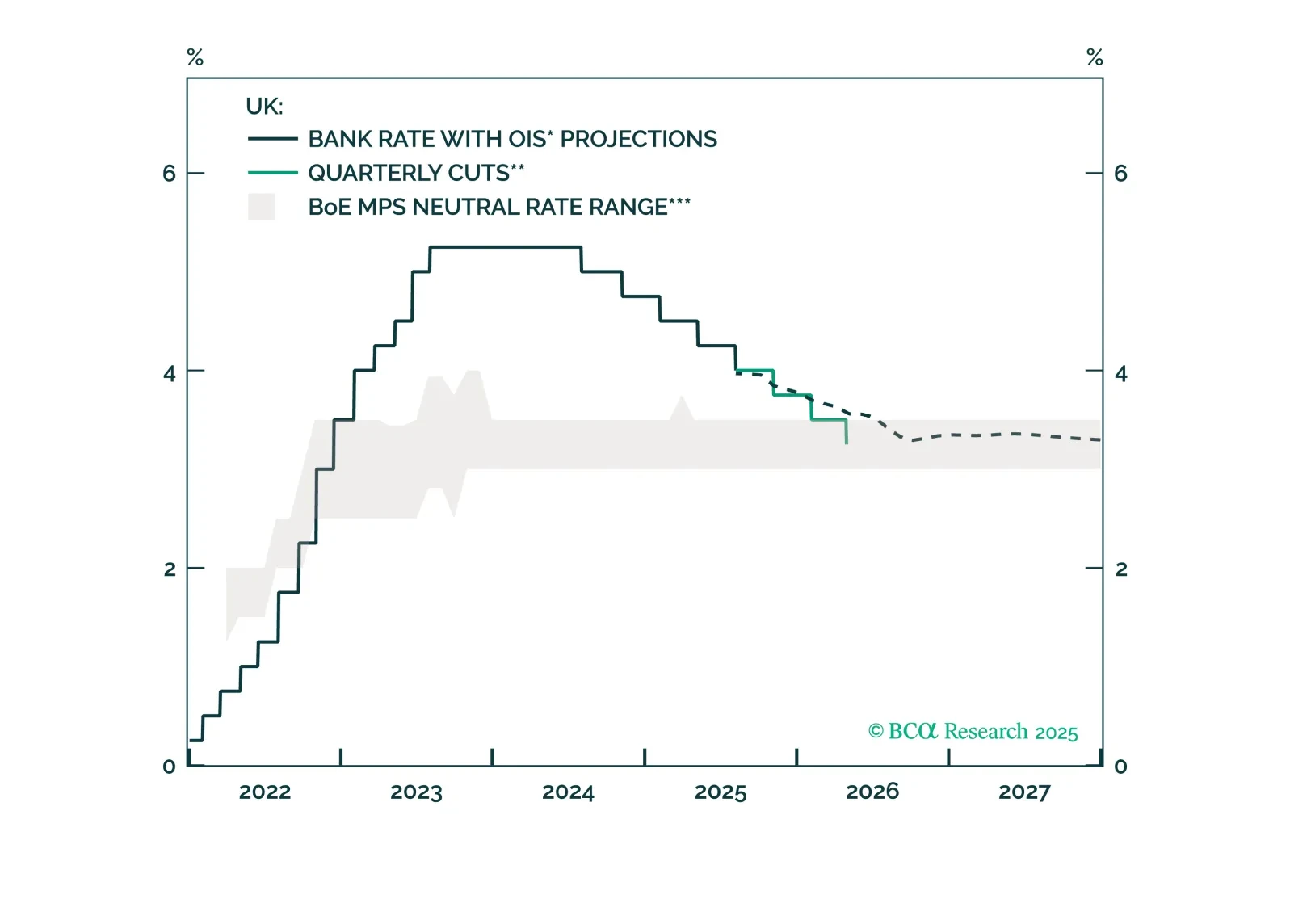

The BoE is easing, but risks falling behind. Labor and growth cracks are starting to emerge, and the Bank may soon be forced to move more decisively. This report outlines why gilts remain a buy and sterling’s path is diverging vs.…

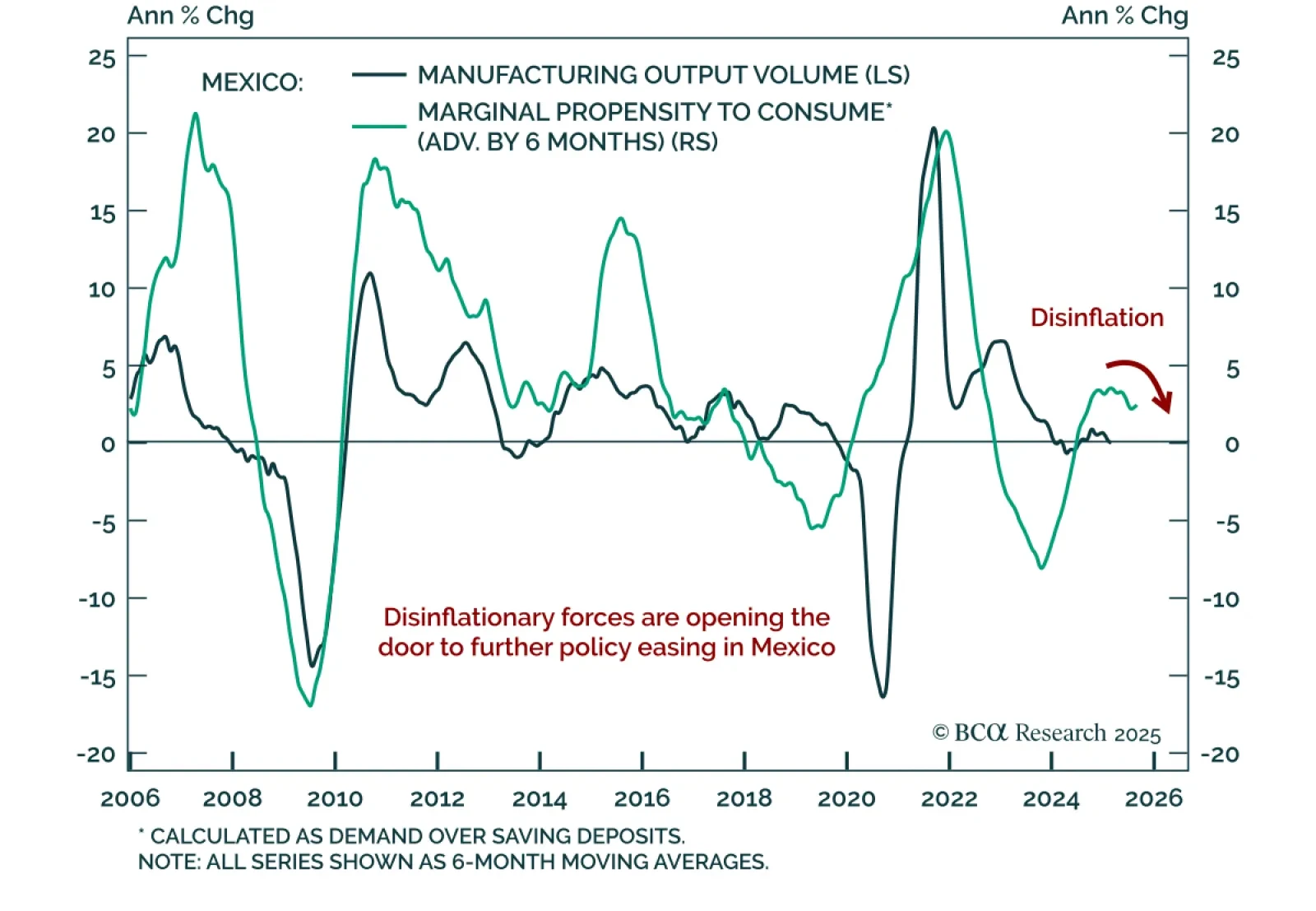

Banxico’s latest rate cut reinforces our bullish view on Mexican domestic bonds. Mexico’s central bank eased policy by another 25 basis points to 7.75%. Investors should bet on further easing. Inflation will continue…