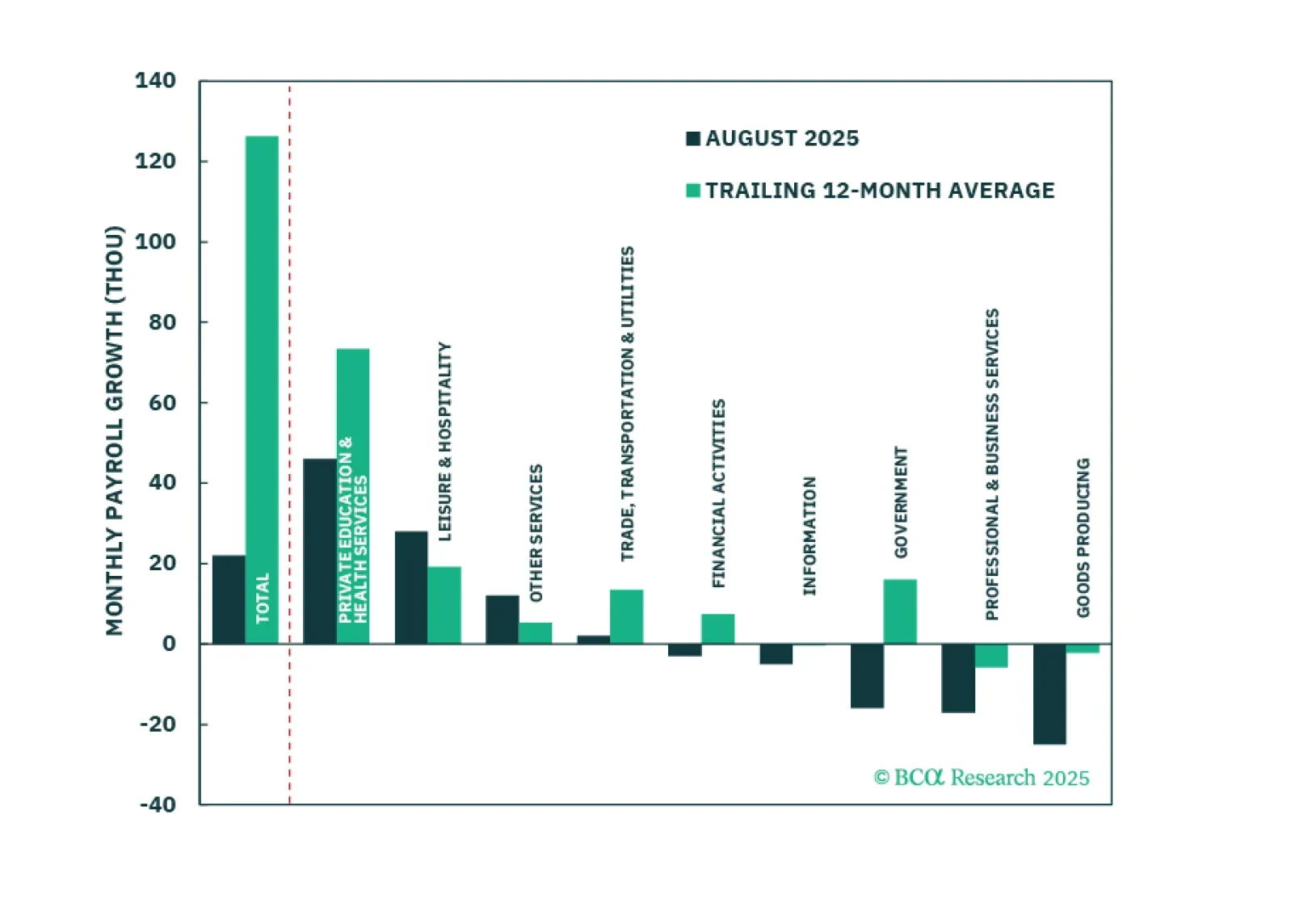

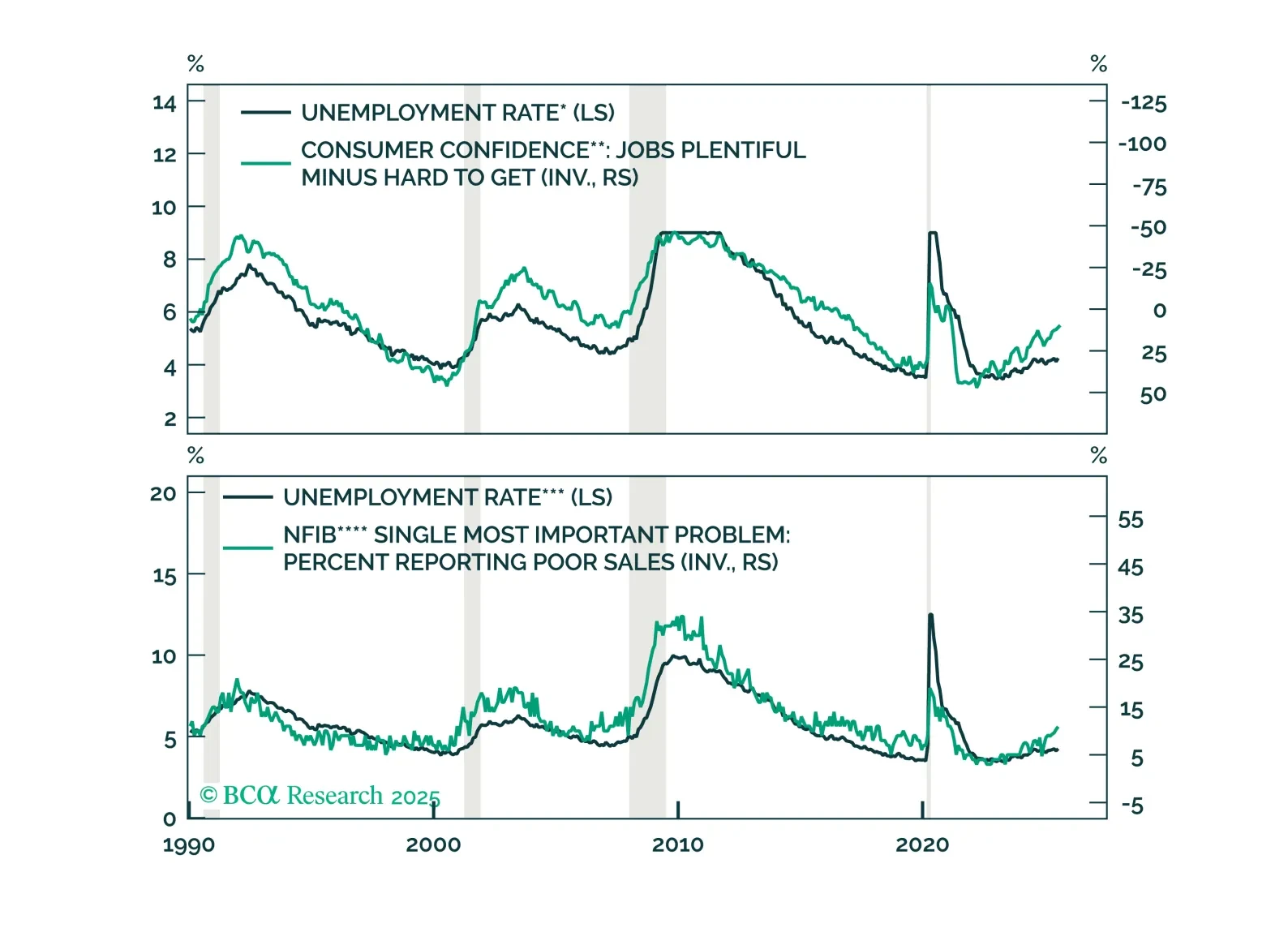

The August employment report showed a modest increase in labor market slack, enough to cement a 25-basis-point rate cut this month.

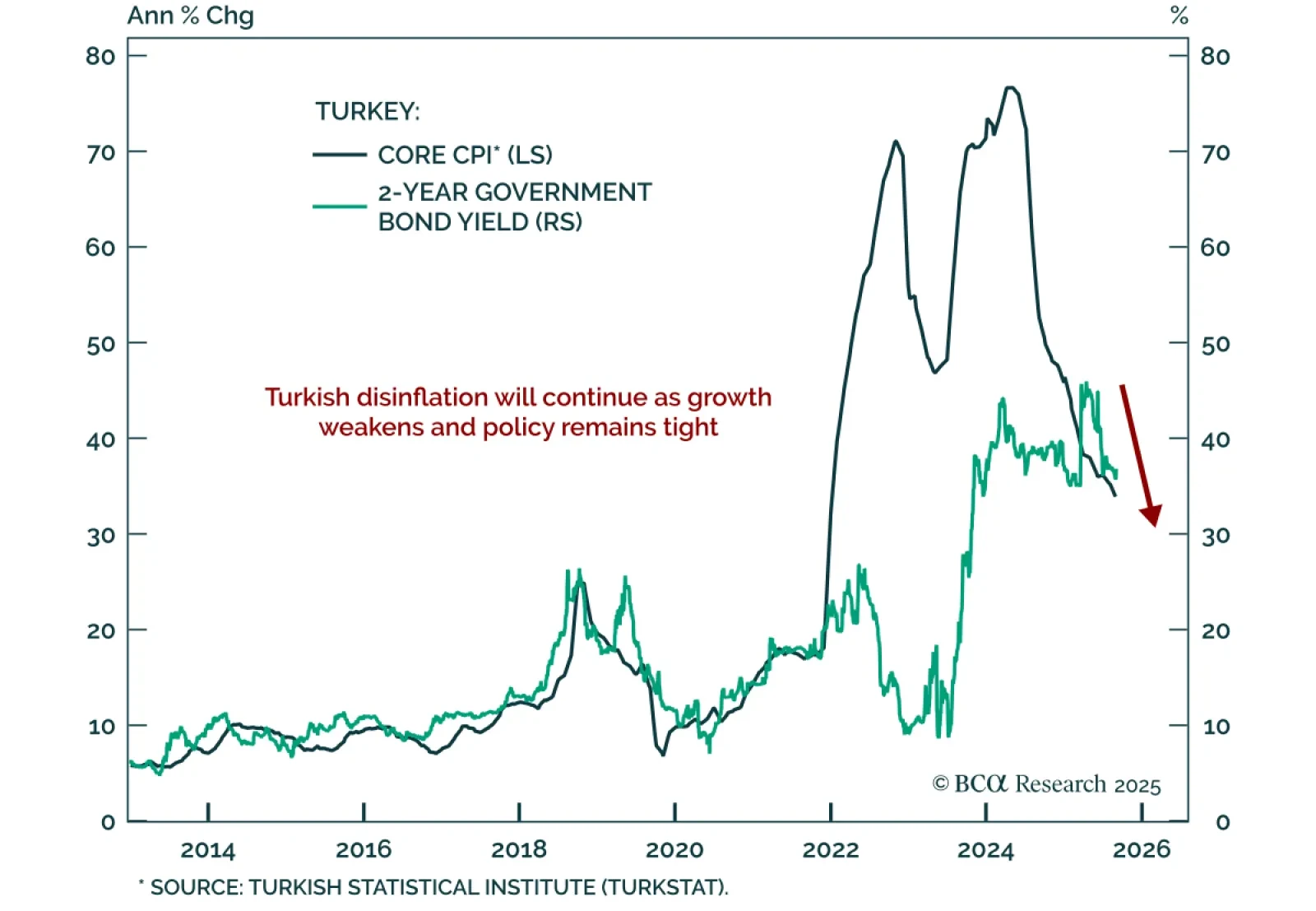

Turkey’s disinflation trend remains intact, supporting a bullish case for short-term bonds. Headline inflation eased to 33% y/y in August from 33.5% in July. Our Emerging Markets strategists expect further slowing as monetary and…

Our Portfolio Allocation Summary for September 2025.

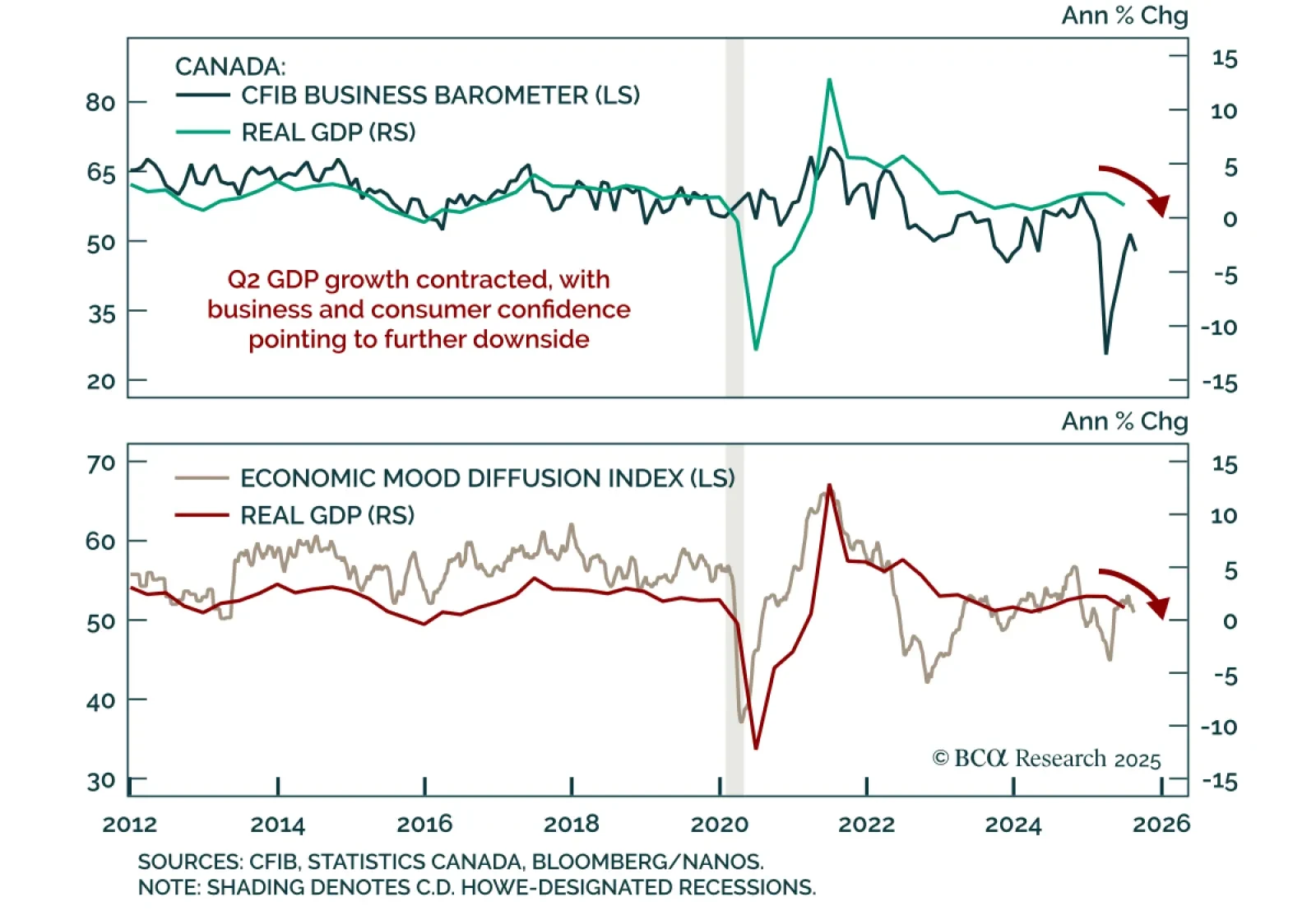

Canada’s Q2 GDP contraction underscores a fragile backdrop where growth risks will outweigh inflation, supporting further BoC easing. Real GDP contracted at an annualized 1.6% after expanding 2.2% in Q1, consistent with survey data…

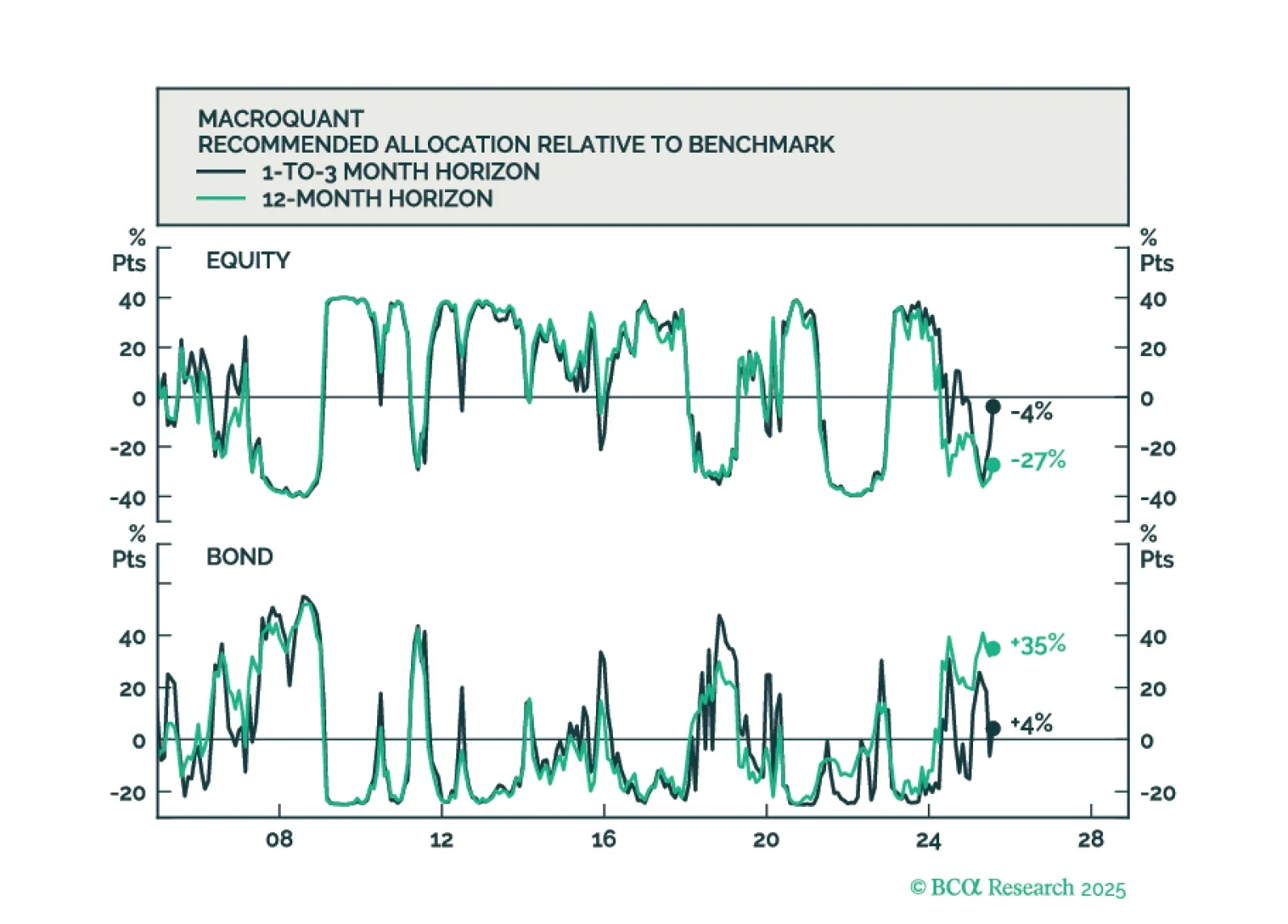

MacroQuant sees downside risks to stocks over a long-term horizon but is not yet saying that we are at imminent risk of an equity bear market.

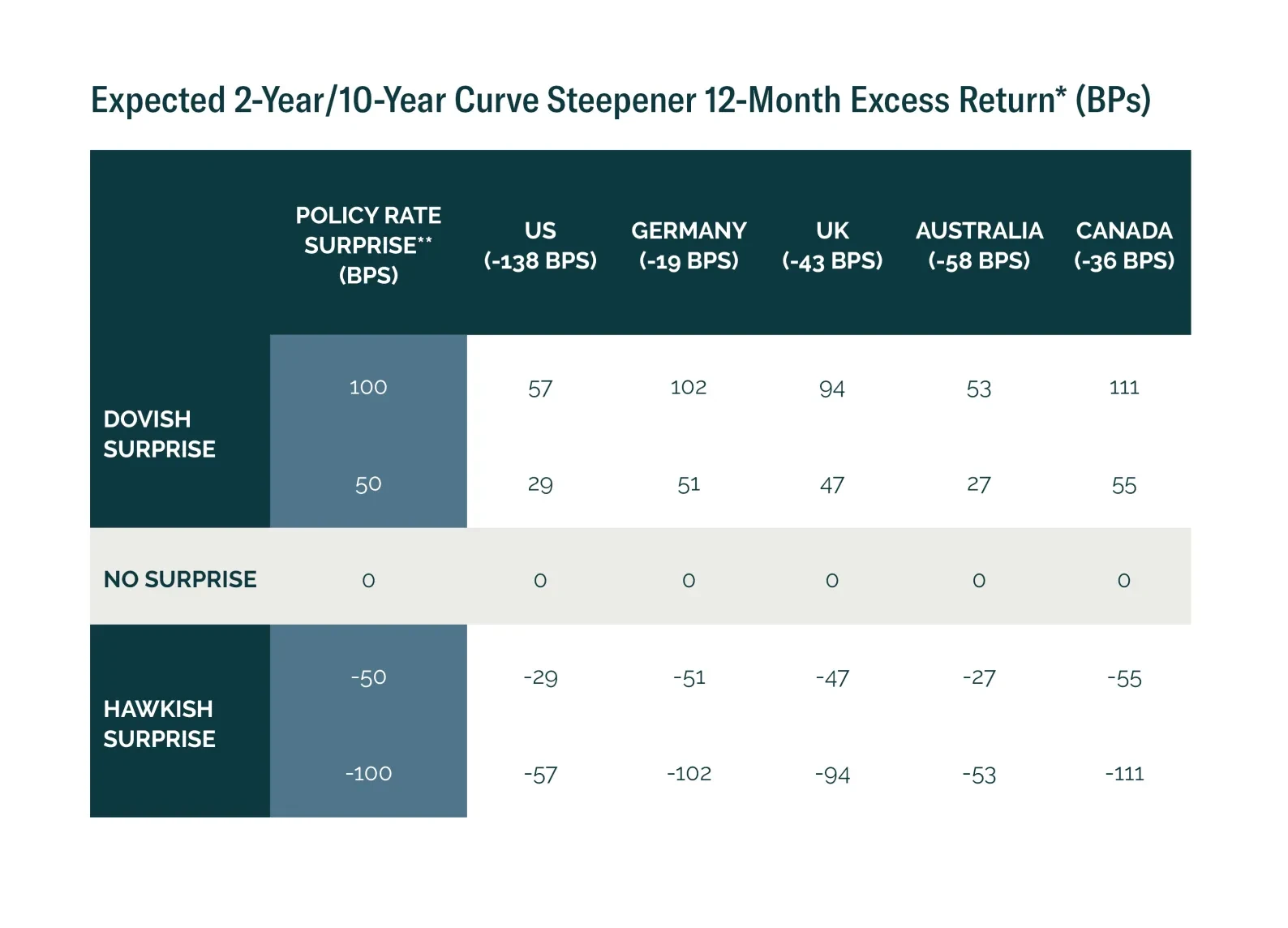

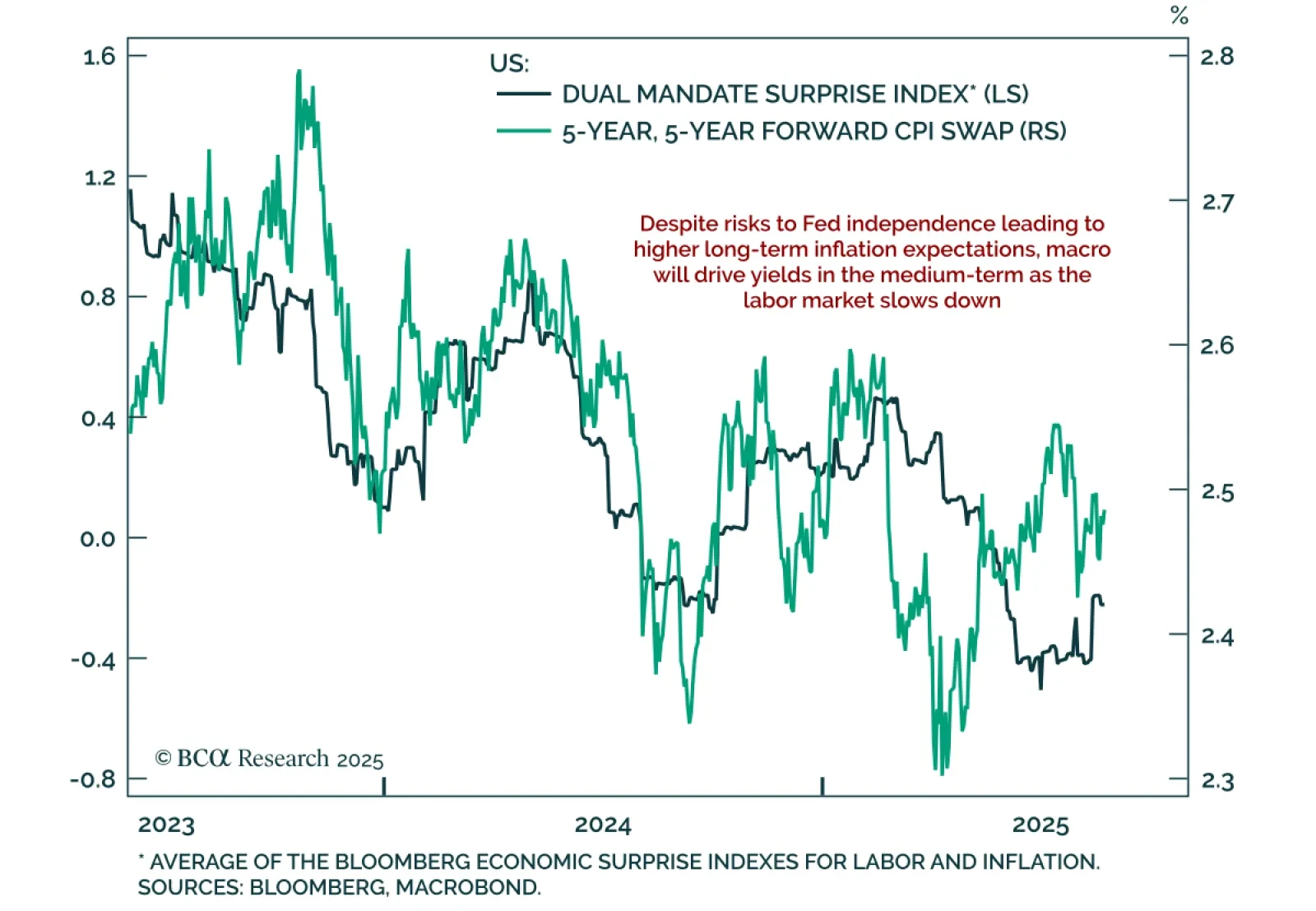

Trump’s firing of Fed Governor Cook raises Fed-independence risks, reinforcing steepener trades. The announcement, aimed at expanding presidential control over the central bank, saw equities fall and bonds initially rally on the…

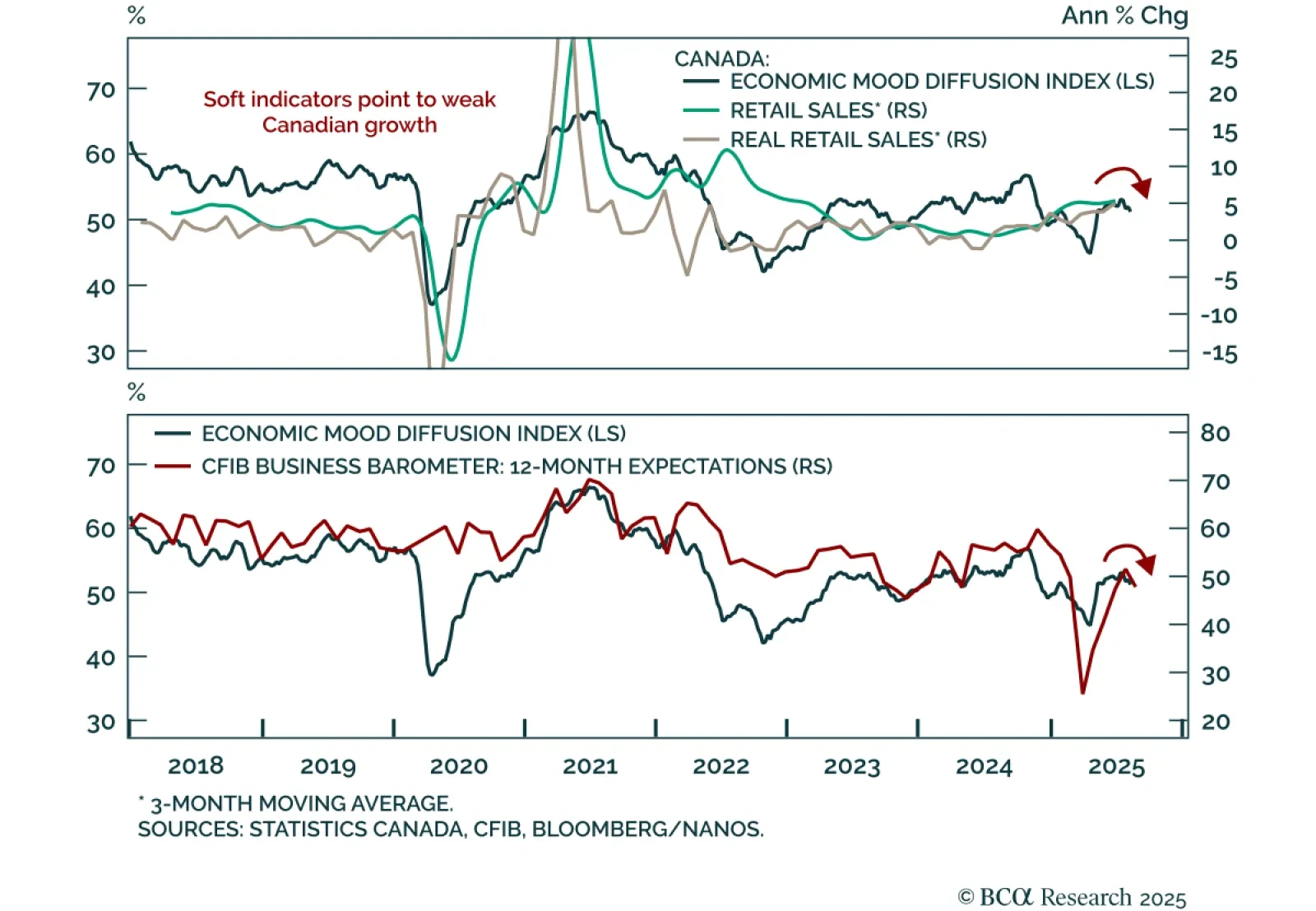

Canada’s fragile growth backdrop reinforces the case for more BoC easing than markets price. June retail sales rose 1.5% m/m, in line with expectations. Excluding autos, sales were stronger at 1.9%. However, the advance estimate…

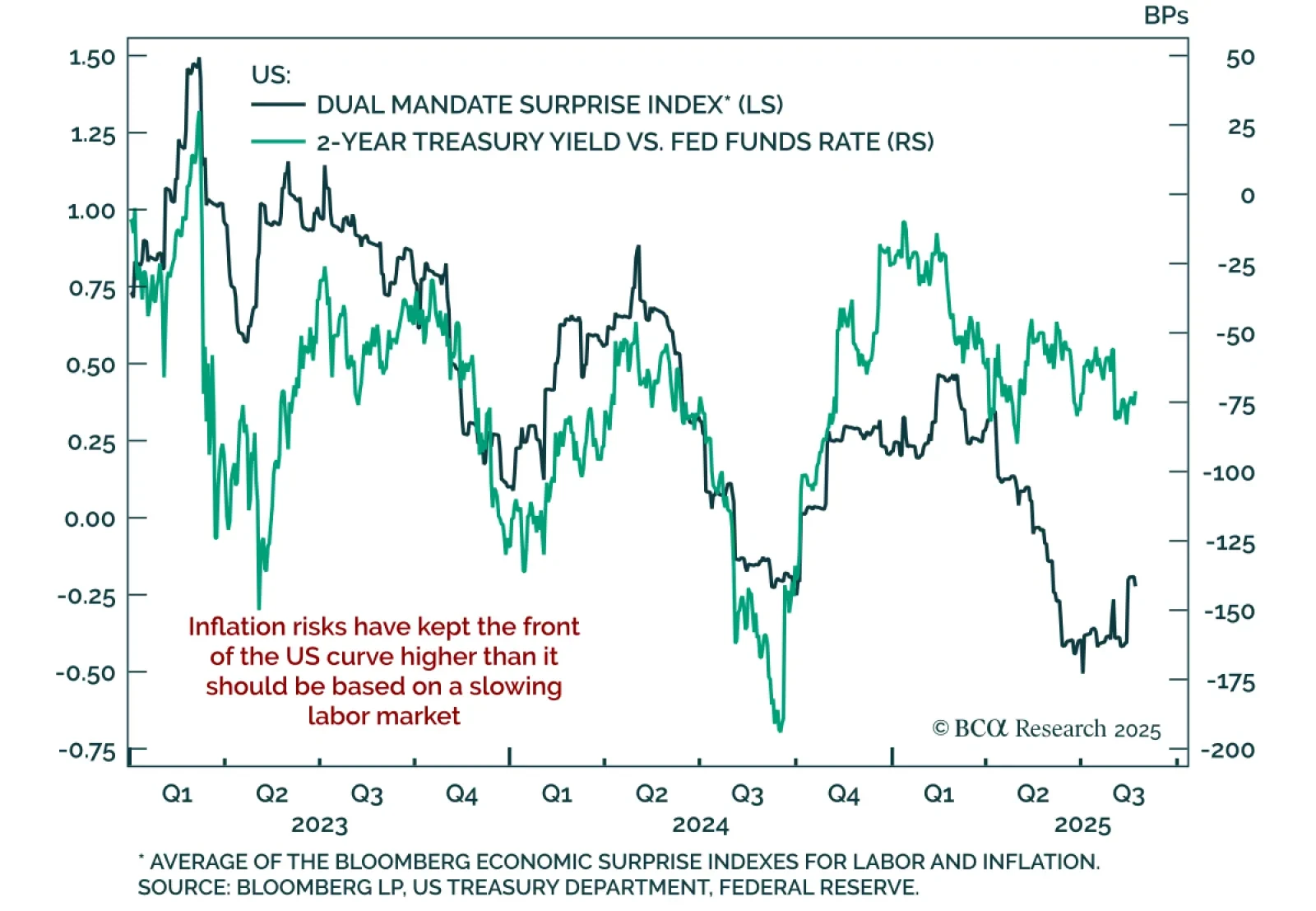

Powell’s final Jackson Hole speech signaled a dovish tilt, opening the door to a September cut. The Fed is under pressure to balance unemployment and inflation risks, with the FOMC split between “proactive” doves and “reactive” hawks…

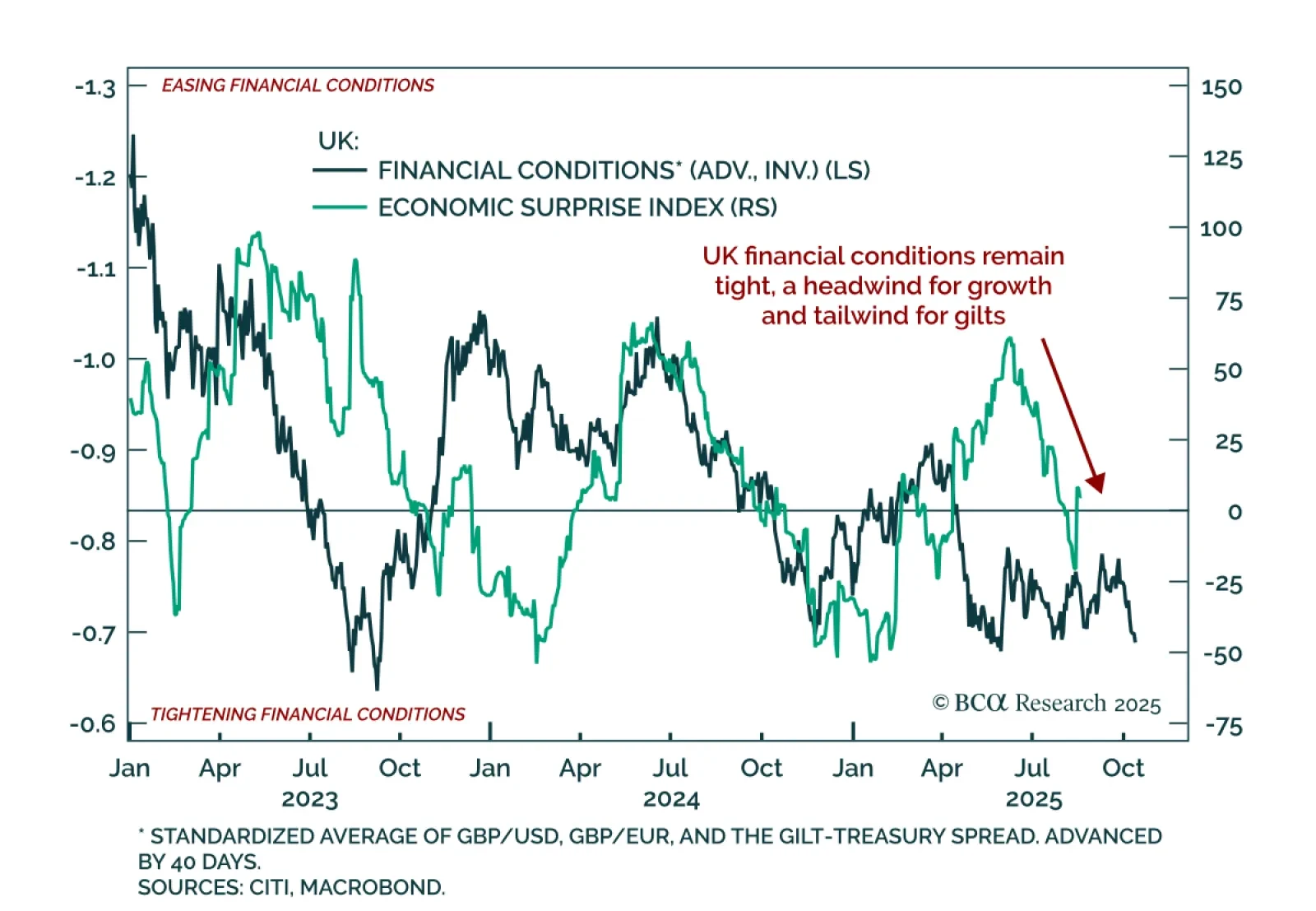

UK data momentum is fading, keeping Gilts attractive and GBP vulnerable. At 5.60%, 30-year Gilts trade at their highest yields since the late 1990s, reflecting persistent pressure on the long end across DMs. The Bank of England…