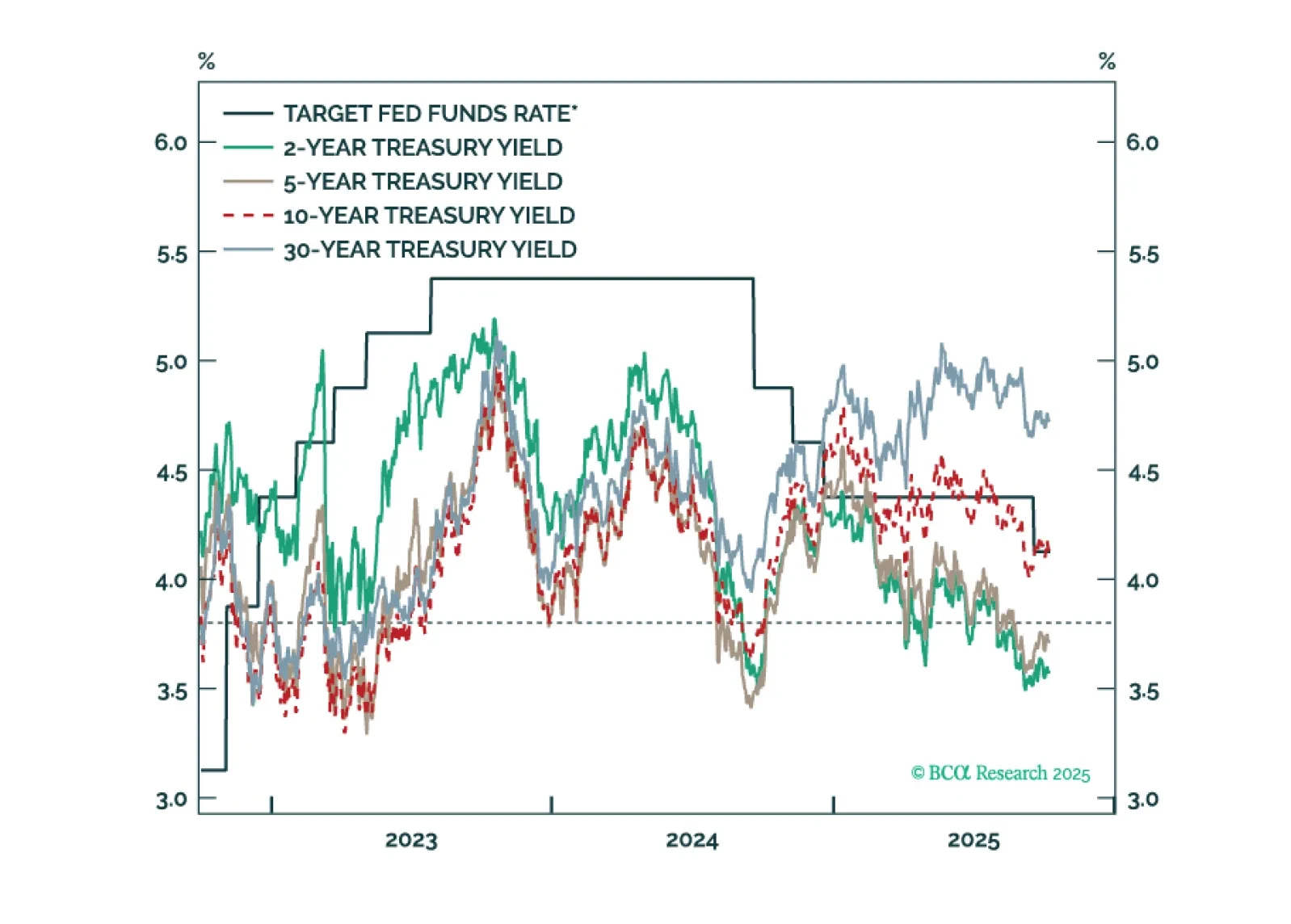

Treasury yields are generally following the pattern of past interest rate cycles, but with a larger term premium keeping the curve steeper than usual.

In this Q4 Strategy Outlook, we discuss where we stand on our recession call, the outlook for stocks and bonds in various scenarios, why investors are misunderstanding the impact of AI on corporate profits, whether the US dollar has…

Despite concerns about fiscal sustainability, a rise in term premia, and attacks on central bank independence, monetary policy remains the primary driver of bond markets. In our Q3 Review & Outlook, we update our views and…

Our Portfolio Allocation Summary for October 2025.

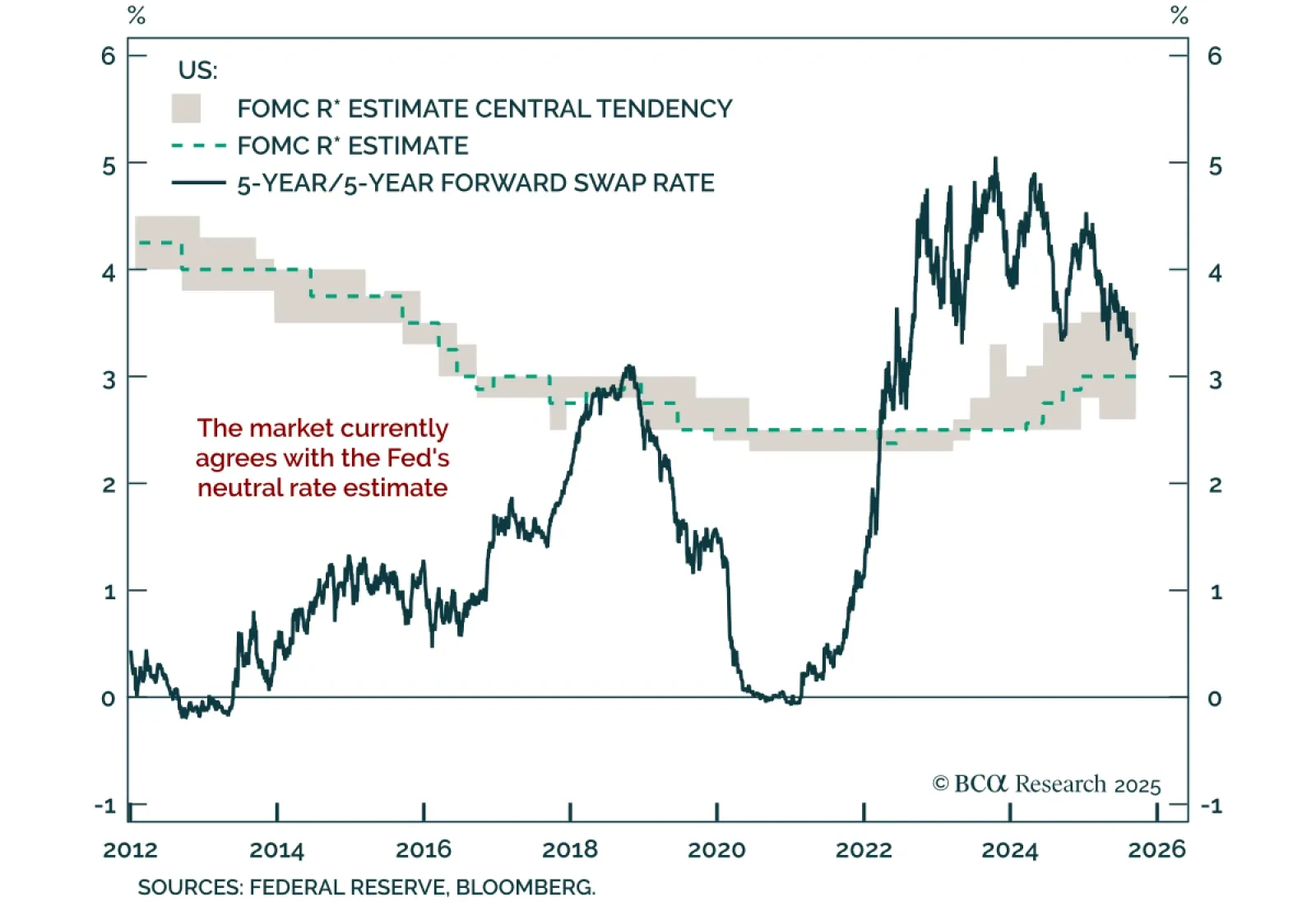

Post-FOMC speeches reveal divisions across the committee, reinforcing long duration as policy remains mildly restrictive. The September dots showed a split, with half of participants expecting at most one 25 bps cut and the rest…

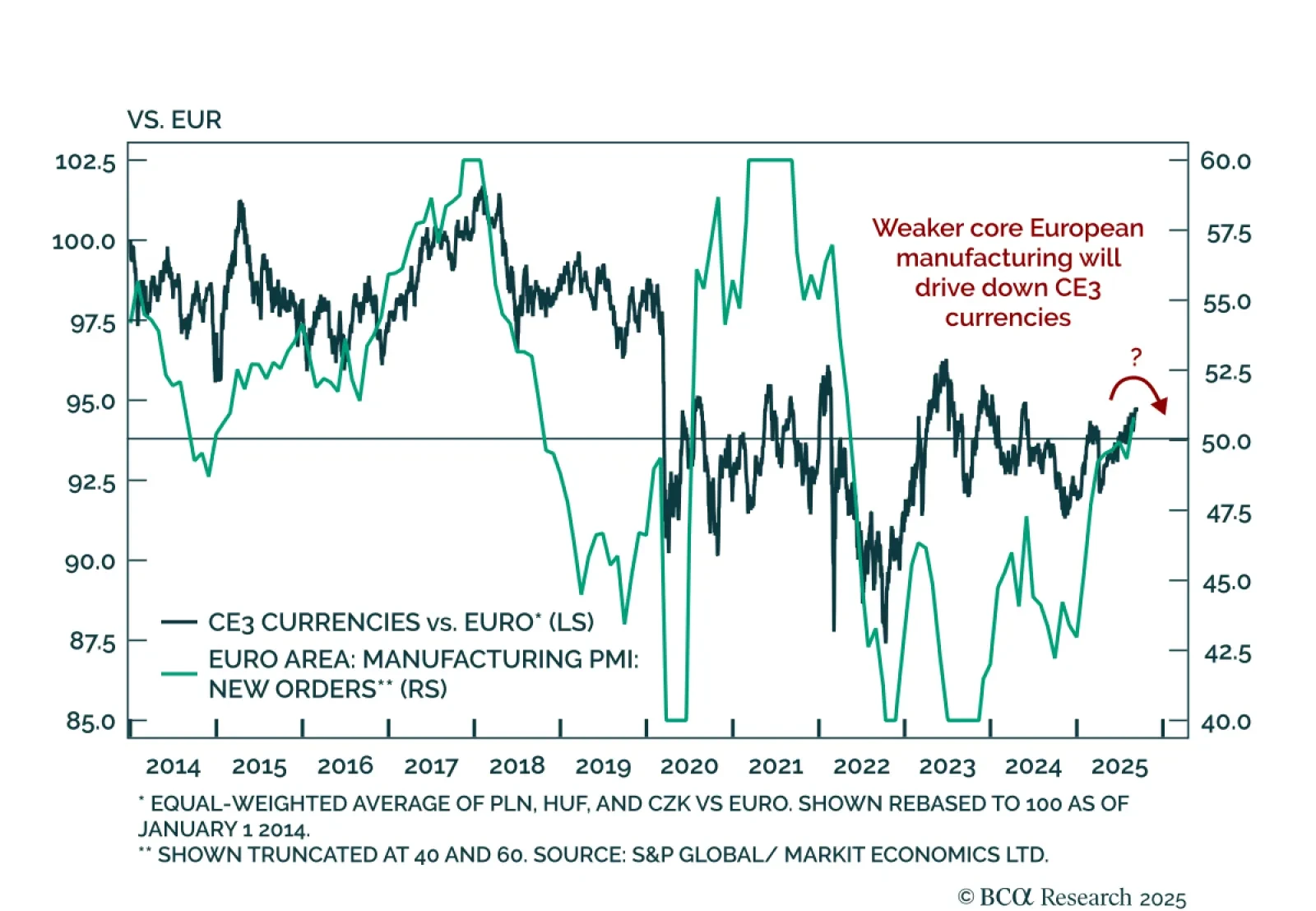

Our Emerging Markets strategists recommend investors go long CE3 domestic bonds, as a deflationary shock in core Europe drives Bund yields and CE3 rates lower. USD-based should go unhedged, while Euro-based investors should hedge…

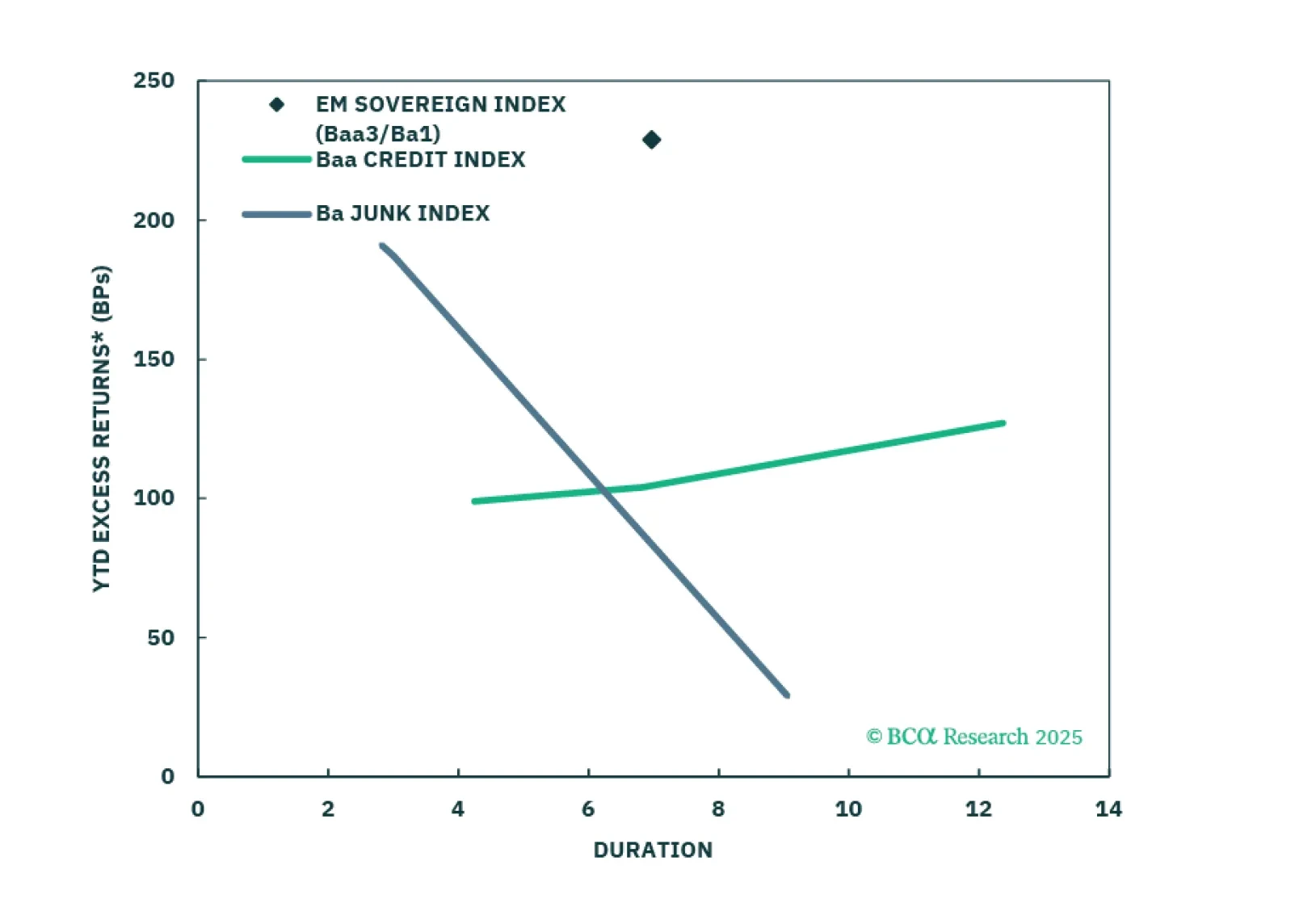

USD-denominated Emerging Market bonds have been outperforming US corporates for the past year. We don’t think the rally is exhausted yet.

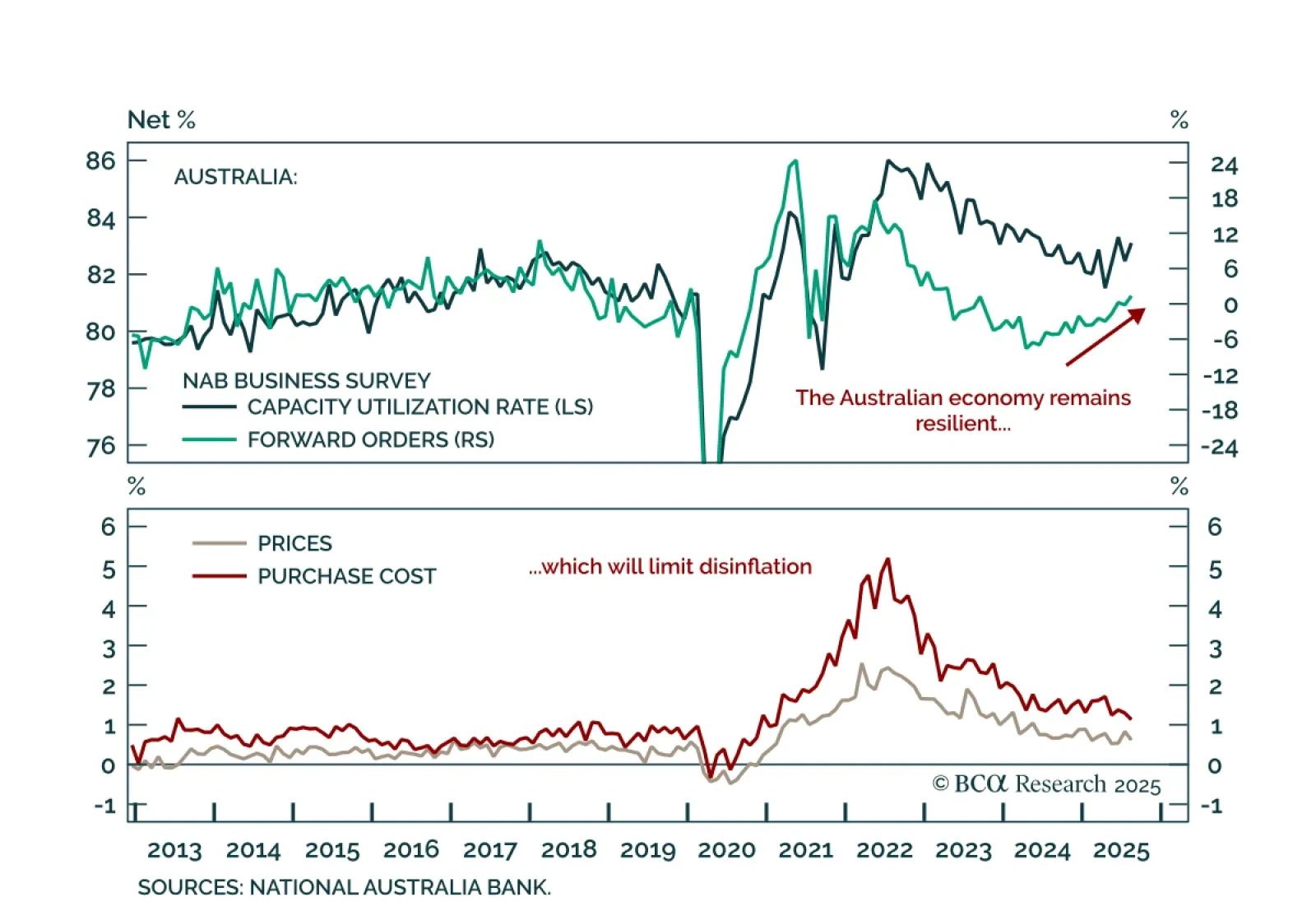

Australia’s NAB survey shows underlying resilience, reinforcing our underweight on ACGBs and the case for AUD flatteners vs. CAD steepeners. The August survey was mixed, with current conditions improving to 7 from 5, while business…

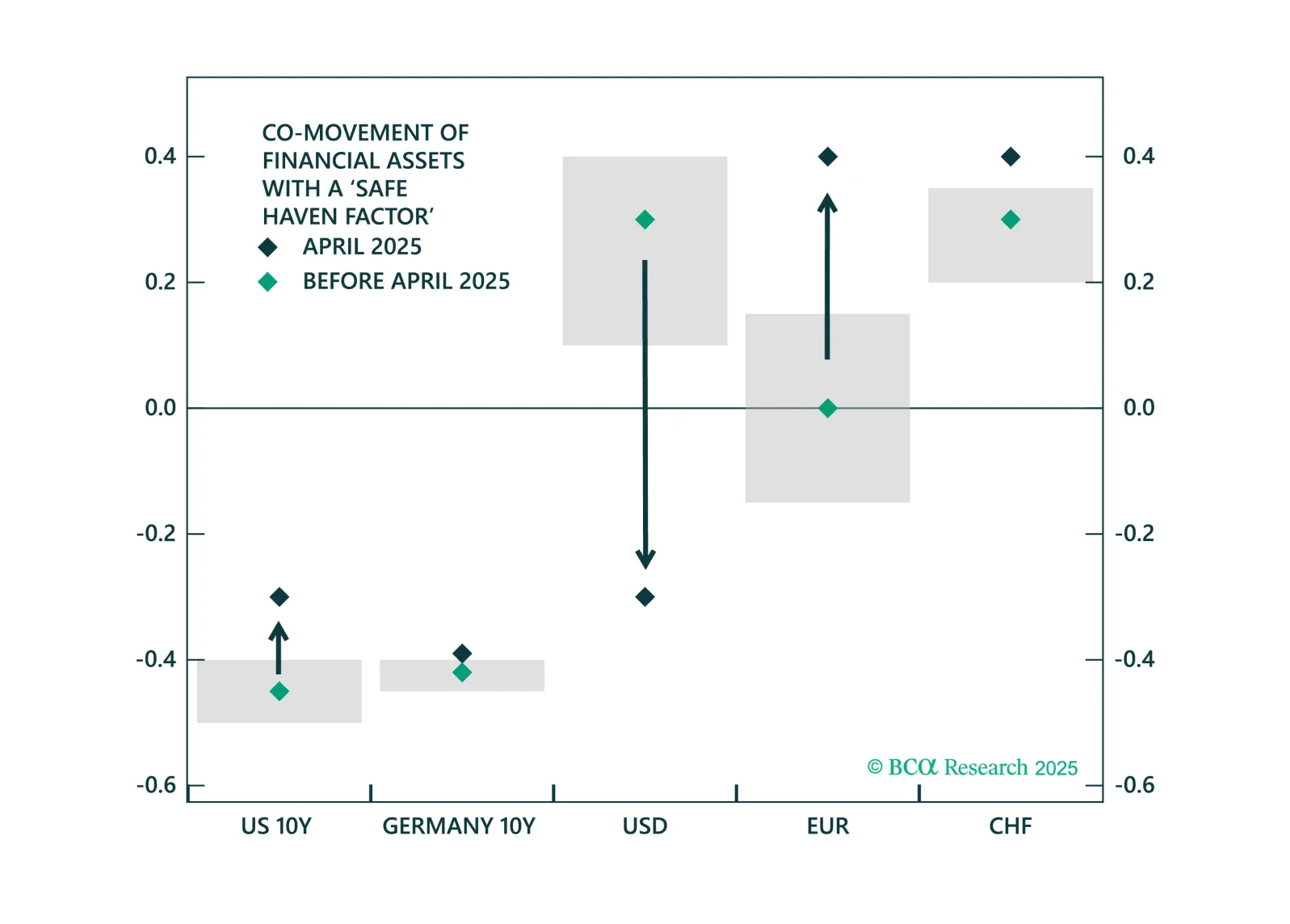

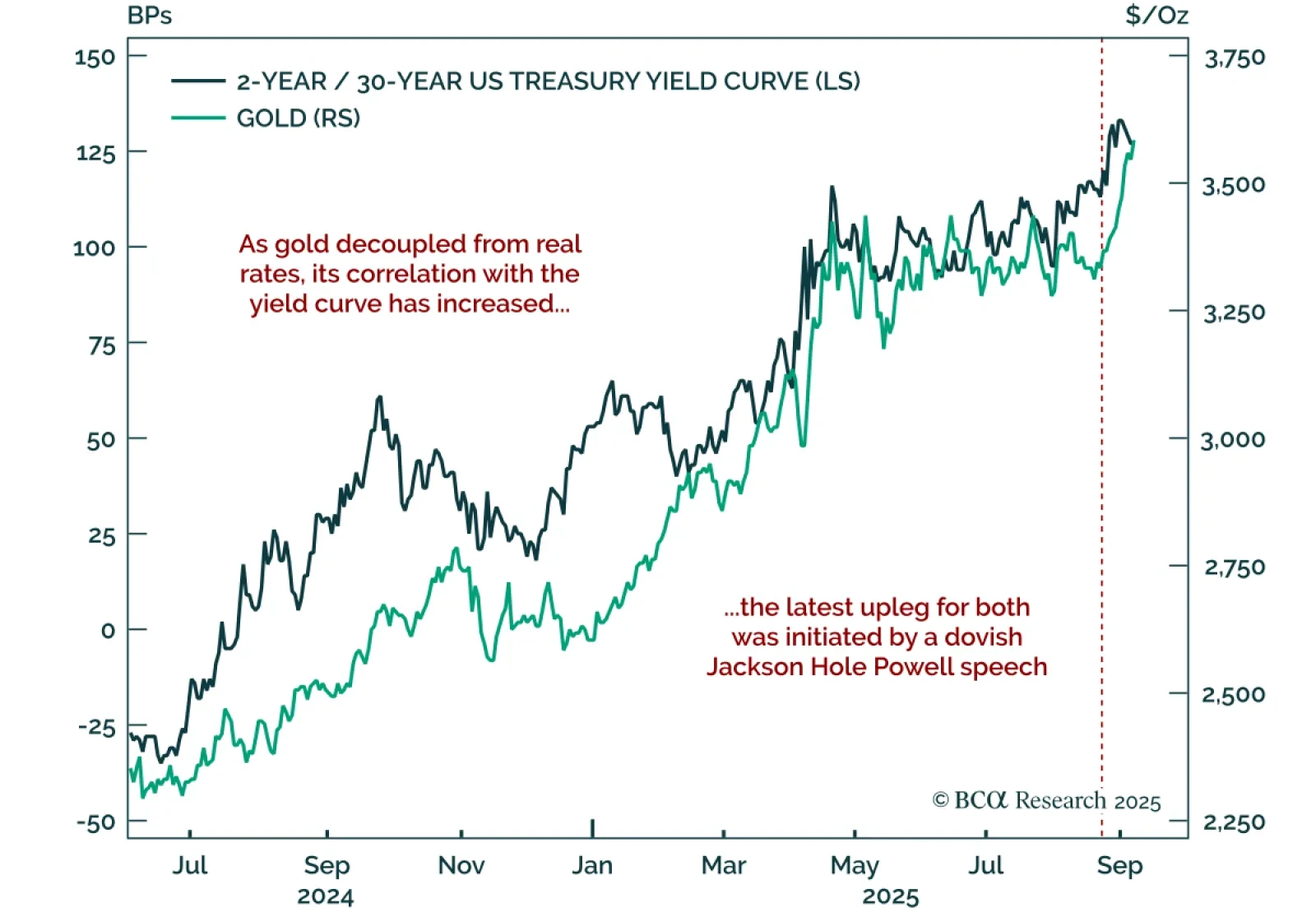

Gold and steepeners remain core trades, supported by structural shifts in markets and policy. Gold broke out of the consolidation range it had been in since April, supported by central-bank buying and heightened policy…