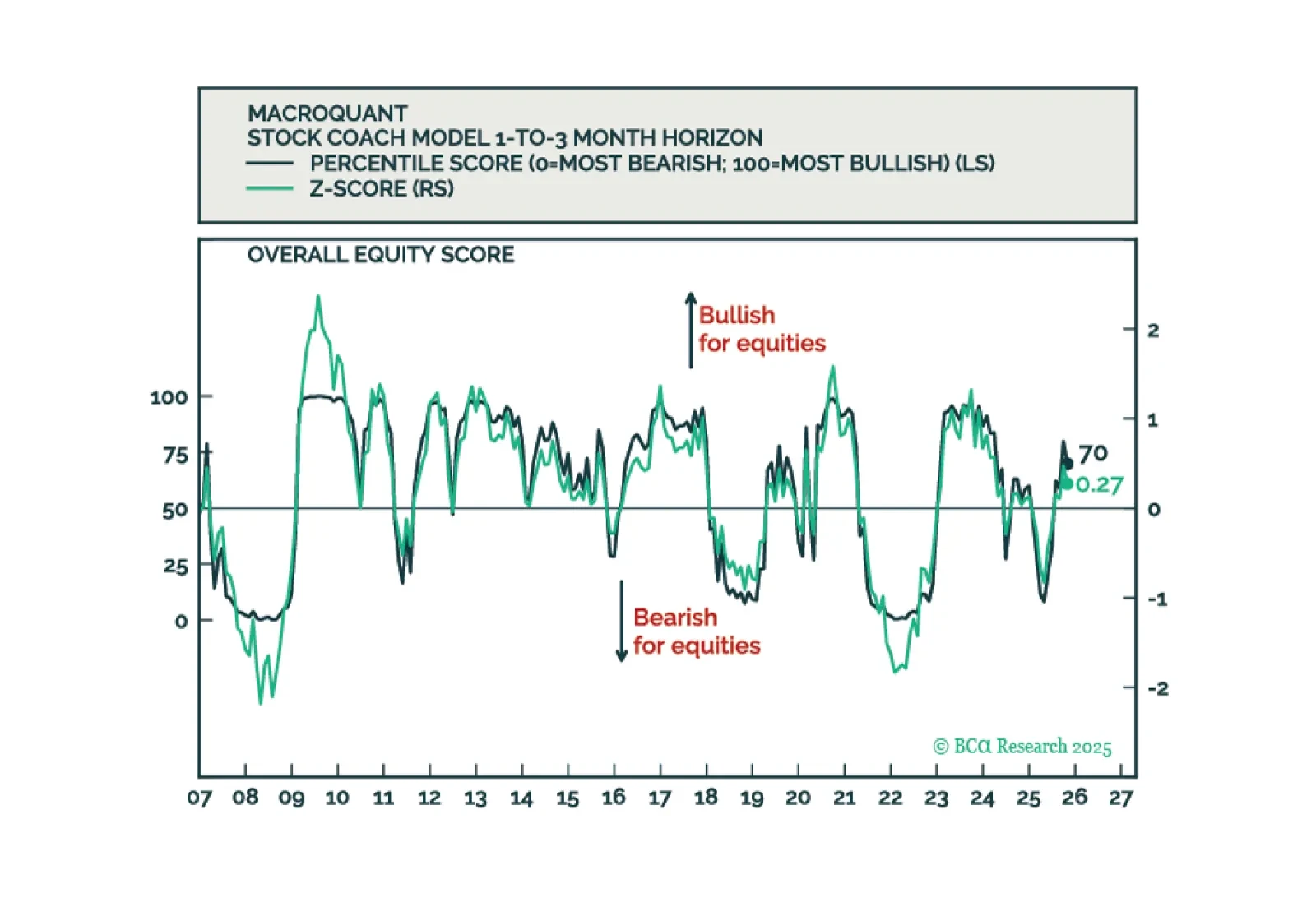

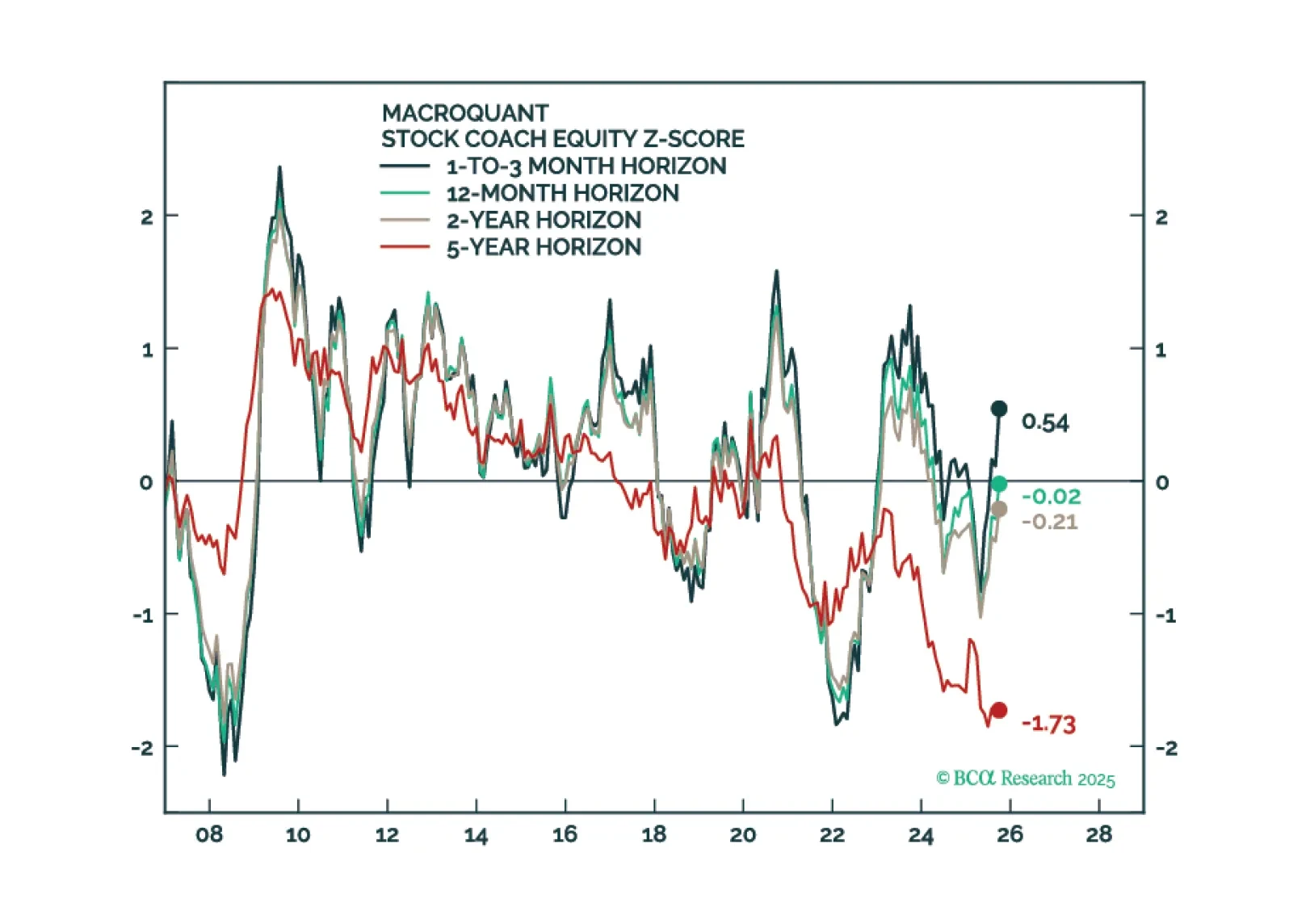

MacroQuant remains tactically overweight equities, favors an above-benchmark duration stance in fixed-income portfolios, remains bearish on the US dollar, and is bullish on gold.

Our Portfolio Allocation Summary for November 2025.

The Bank of England will resume rate cuts in December after the autumn budget is passed. Today’s Strategy Insight discusses what this means for UK gilts and the pound.

MacroQuant is tactically overweight equities, favors an above-benchmark duration stance in fixed-income portfolios, remains bearish on the US dollar, and is bullish on gold and copper.

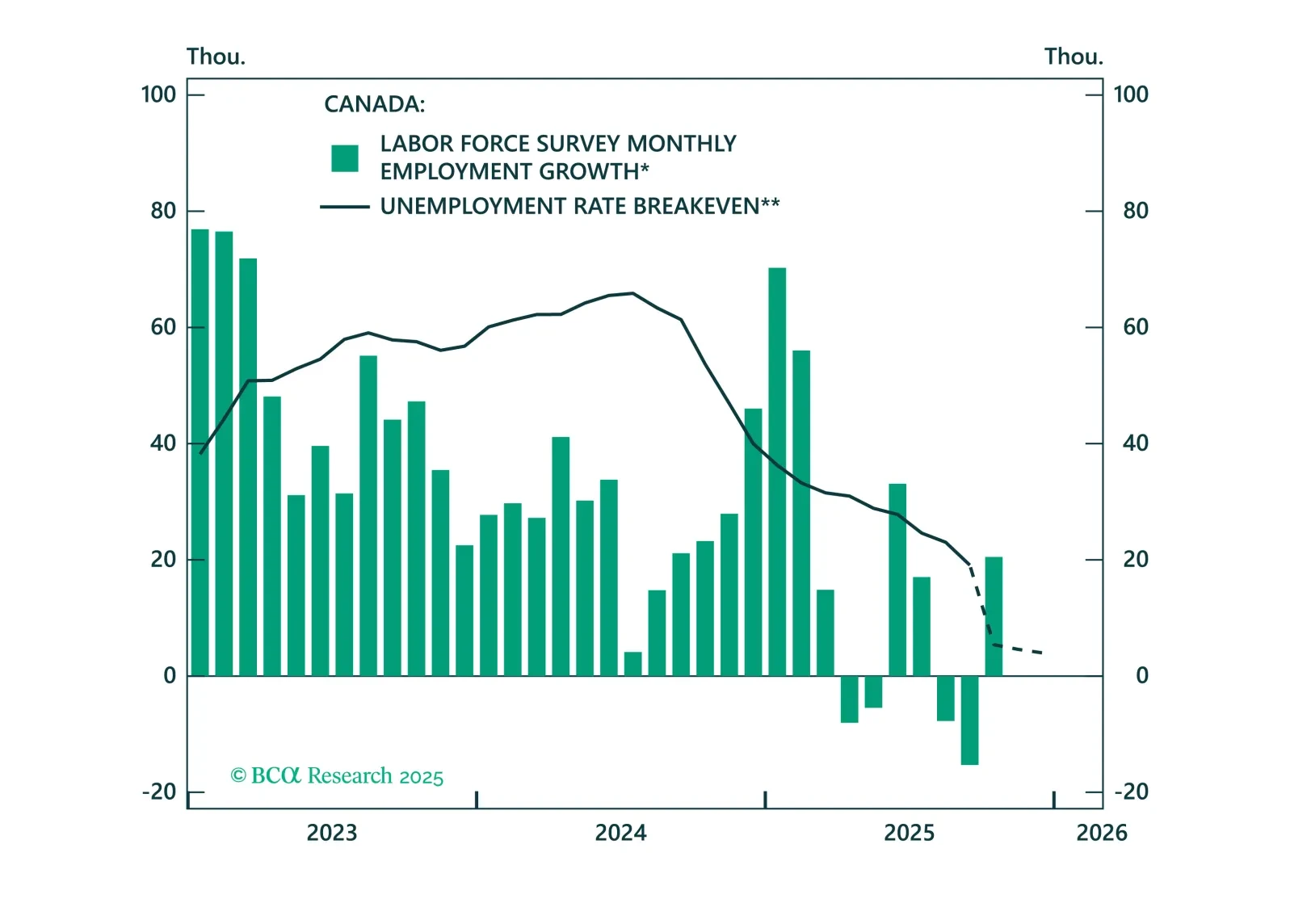

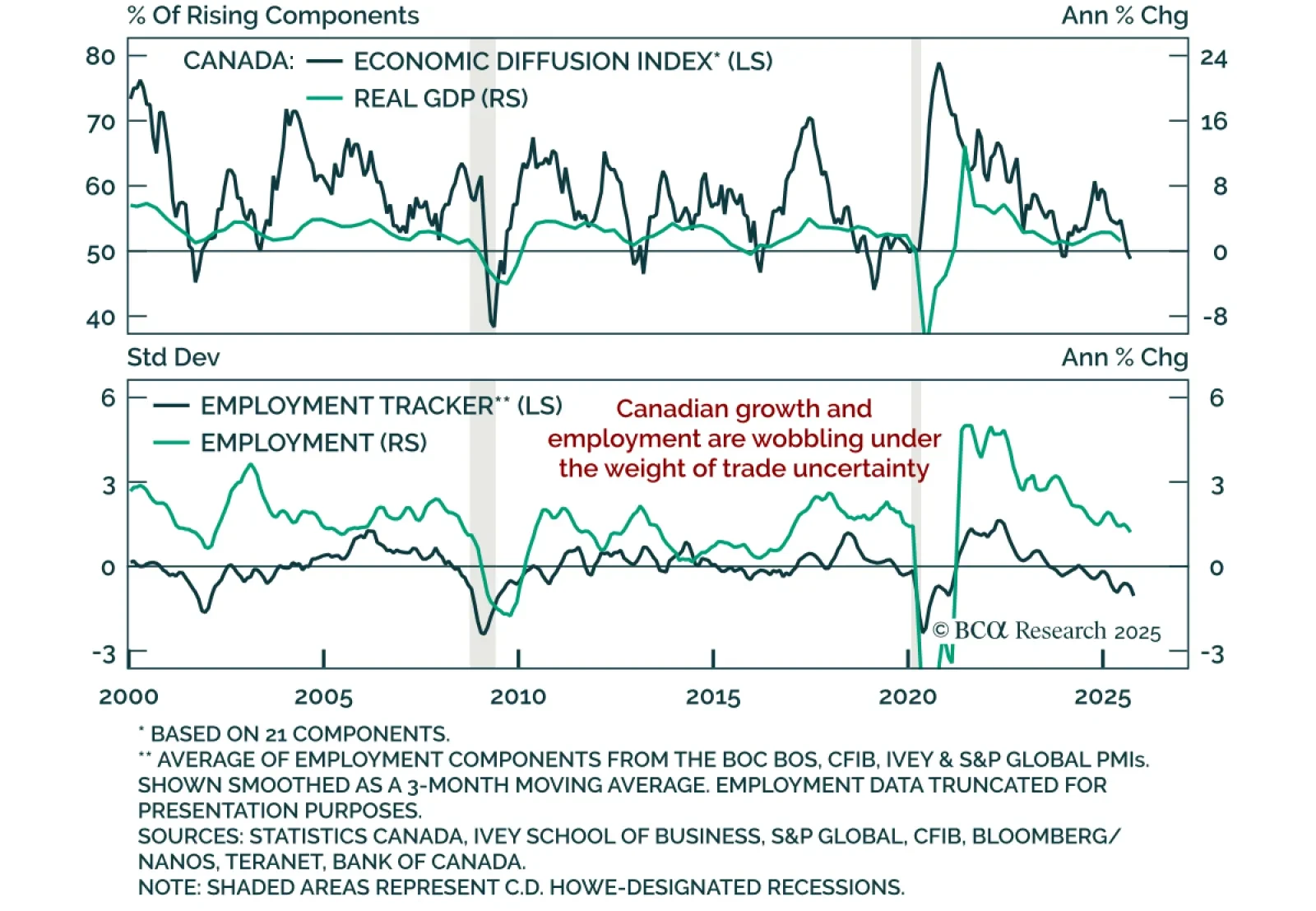

Recent Canadian data confirm slowing growth, reinforcing support for government bonds and steepeners. The October CFIB Business Barometer fell to 46.3 from 50.2, indicating contraction and underscoring the risk posed by small…

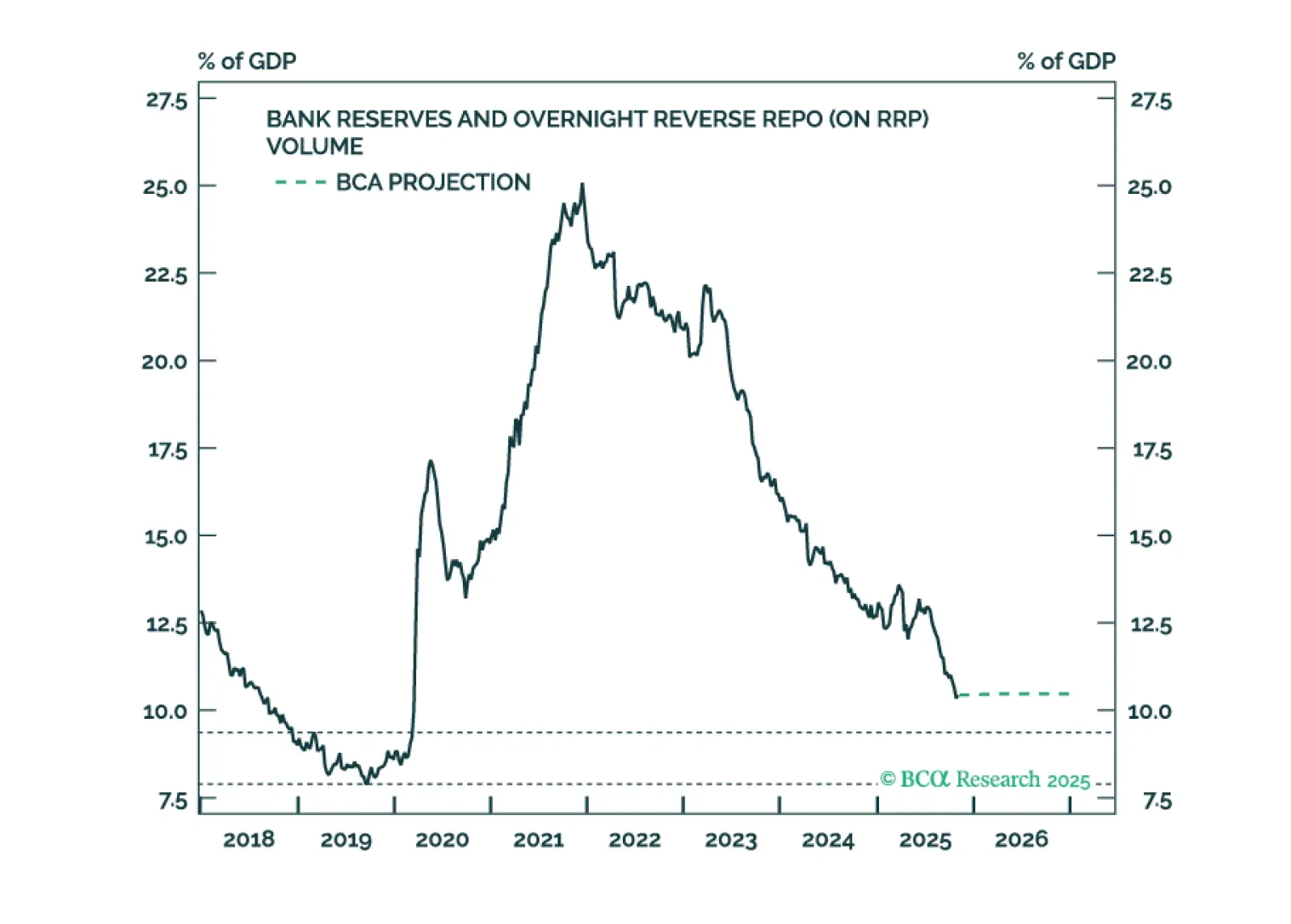

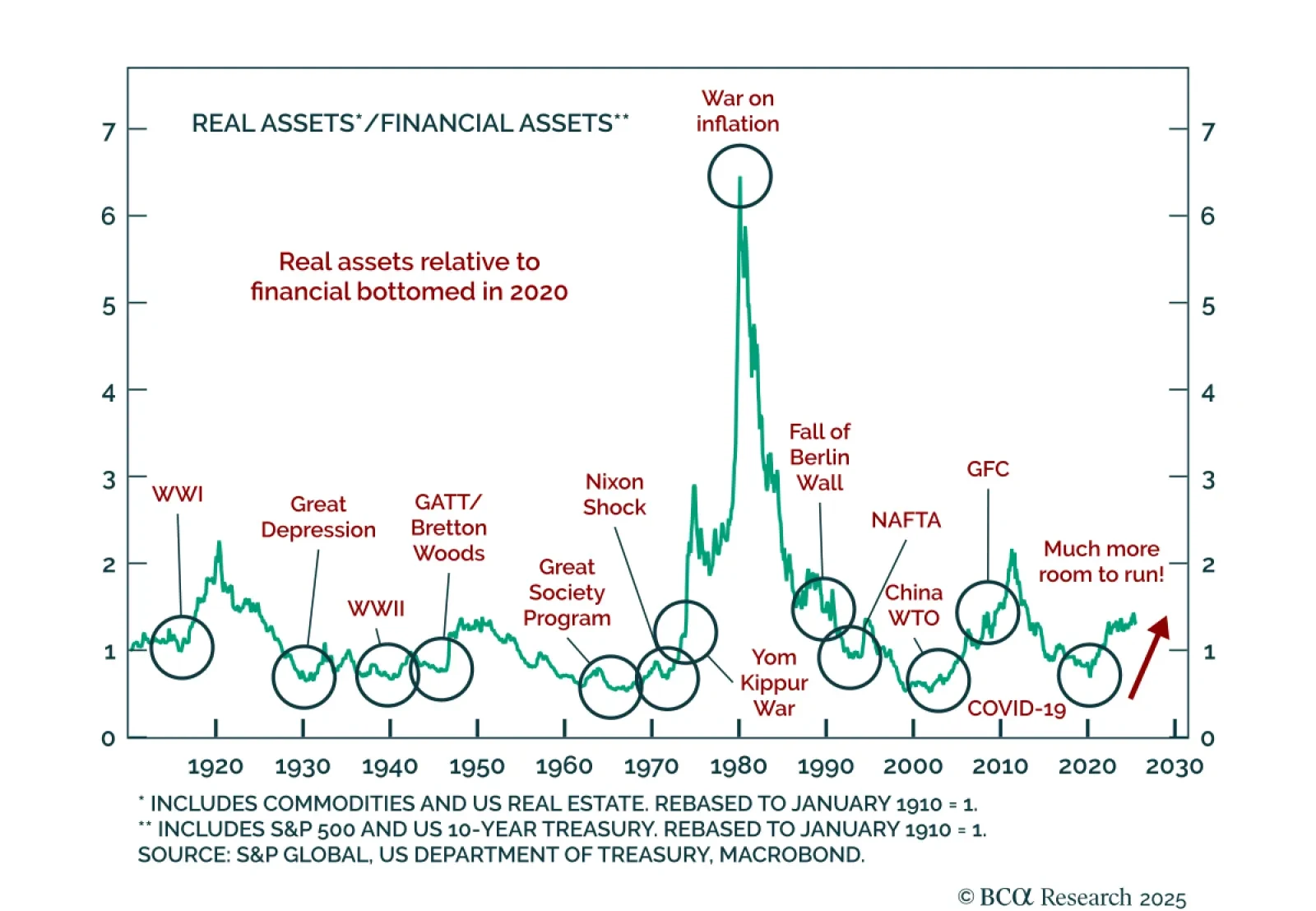

Our GeoMacro strategists remain overweight equities and bonds for now but warn that markets will soon test their “melt-up” thesis, as the cycle transitions from cash- to leverage-driven growth. The dominant theme of 2025 is not AI,…

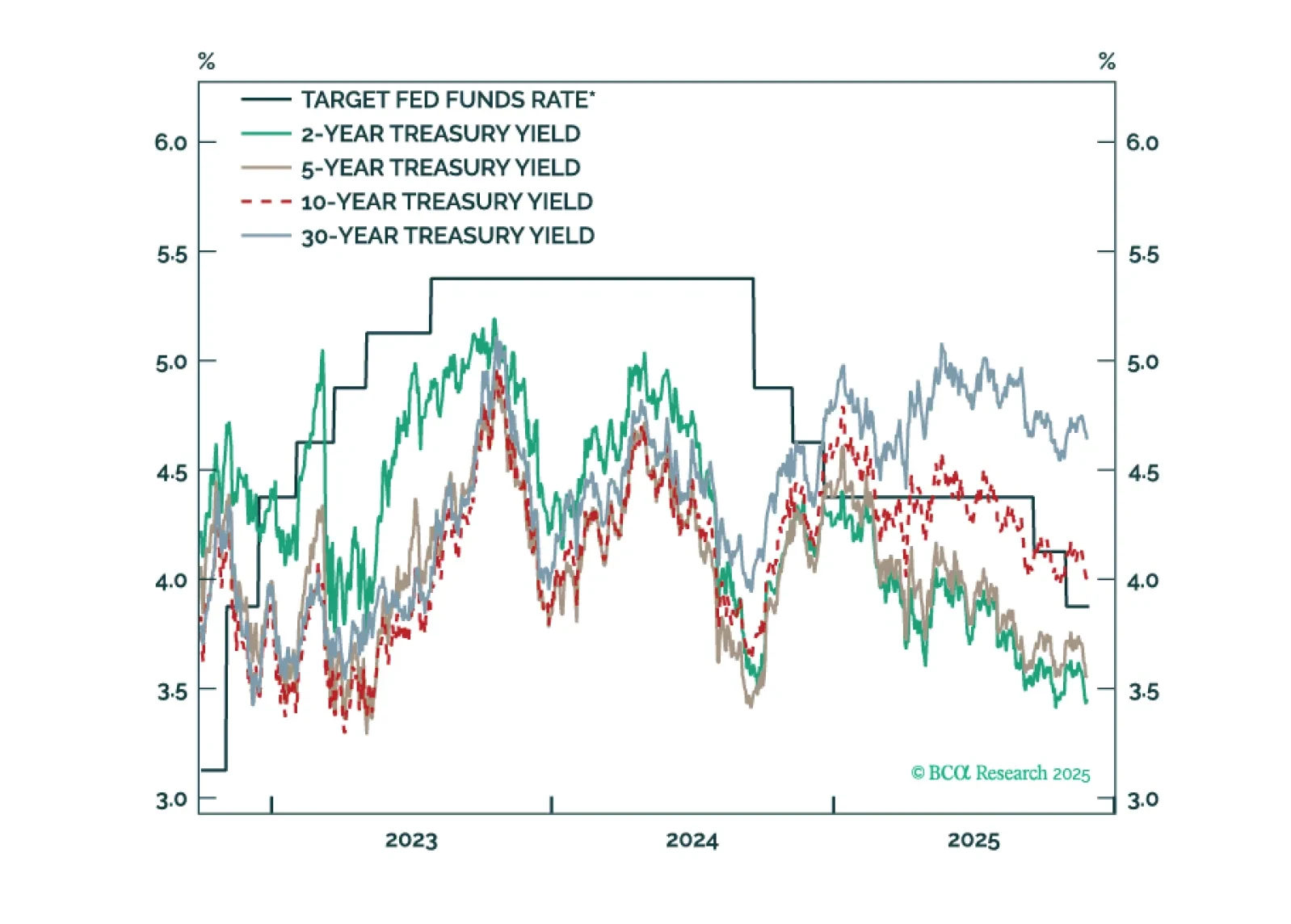

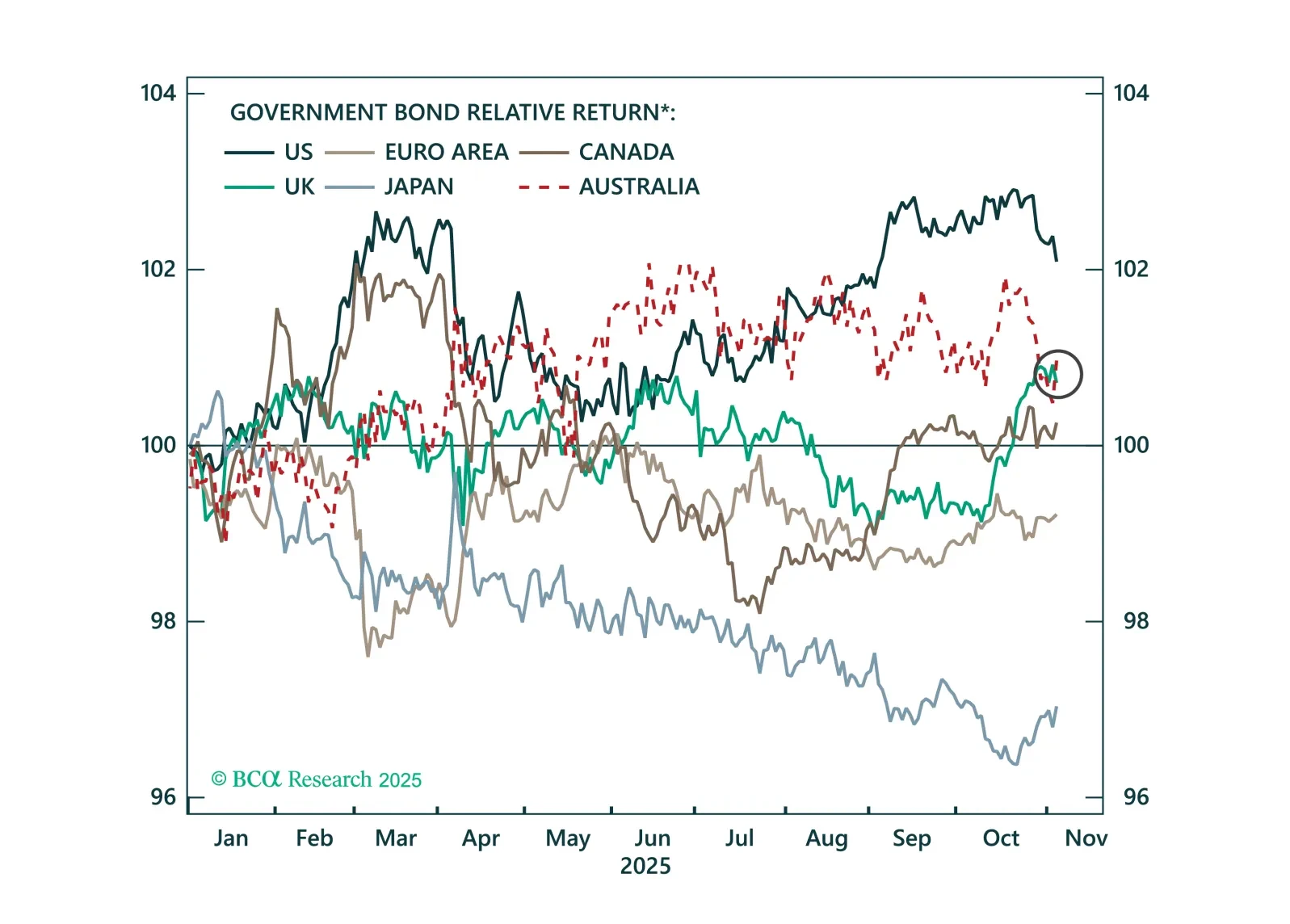

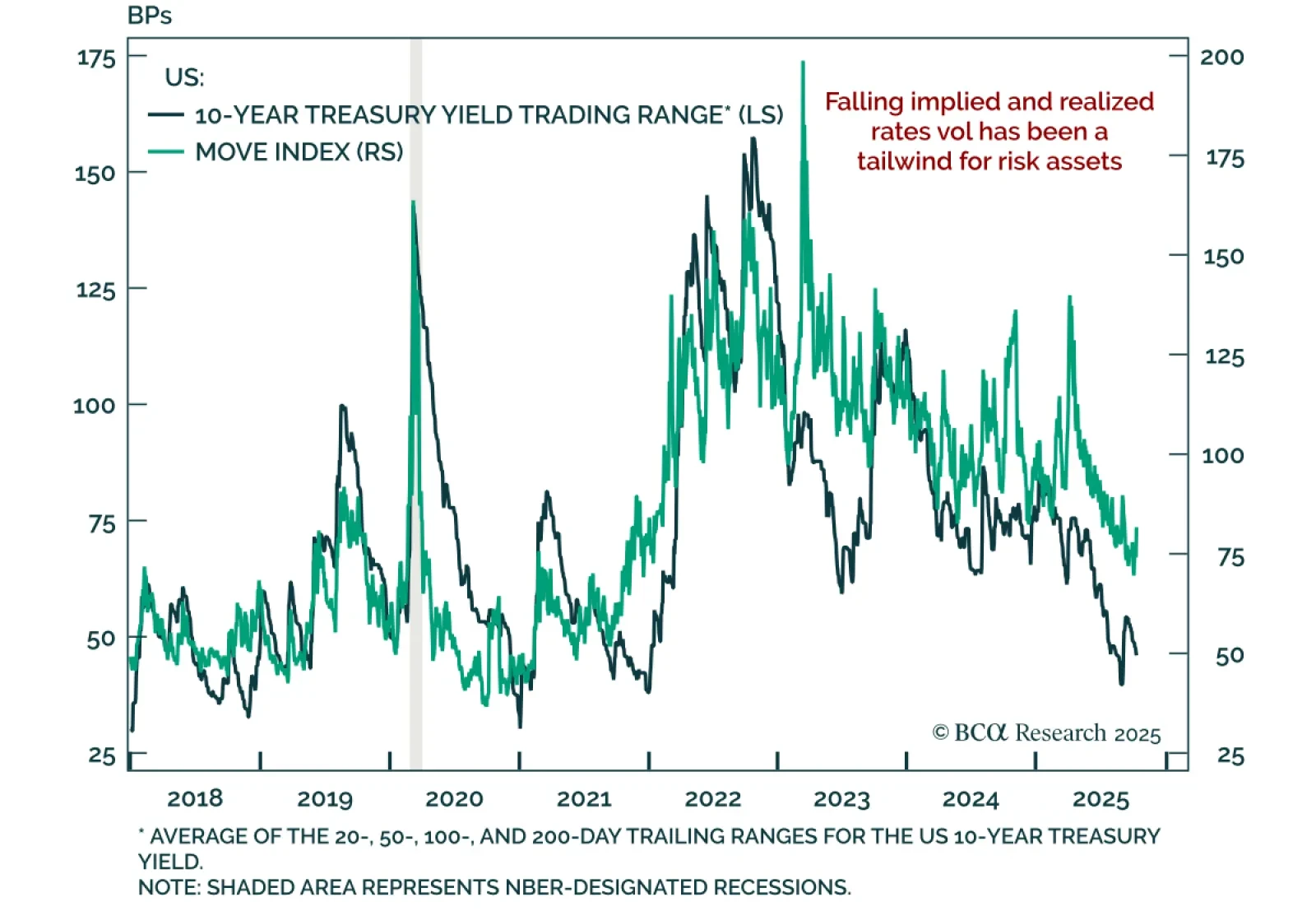

Cross-asset volatility fell in recent weeks, with lower rates volatility supporting risk assets. The MOVE index, which tracks implied USD rates volatility, recently dropped to its 20th percentile before rebounding. This decline…