Our US Equity Strategy service looks back at their performance for the first half of the year and assesses what they hit or missed so far and comments on the ongoing rally in the stock market. The team hit on the economic…

Investors are still cautious and have significant cash that needs to be put to work. Trickle-down of it into the US equity market may extend the rally. Overly bearish futures positioning is also a strong contrarian indicator.…

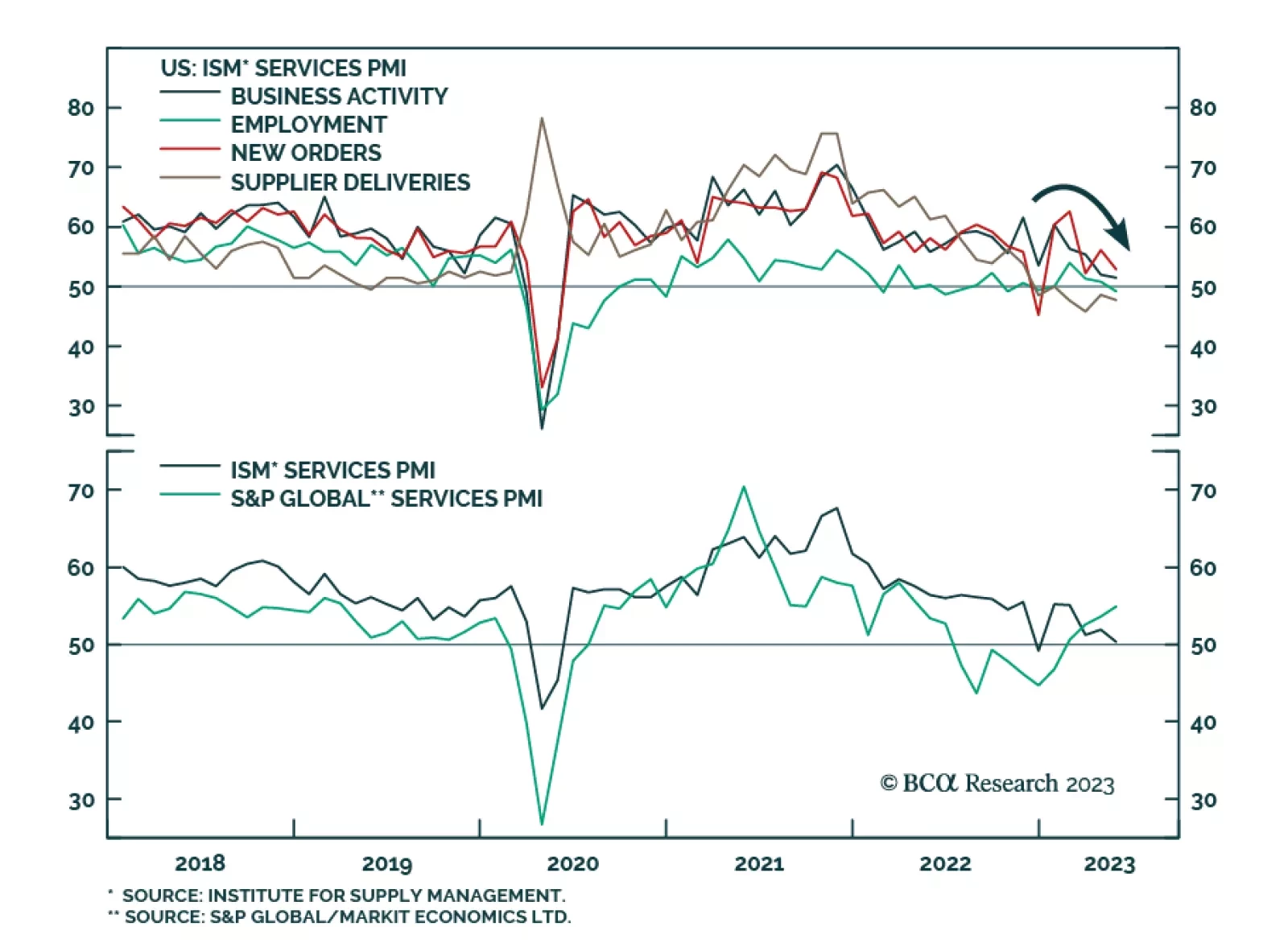

The ISM PMI sent a disappointing signal about US service sector activity in May. The headline index unexpectedly fell from 51.9 to 50.3 – the weakest level since December and surprising expectations of an improvement to 52.…

The S&P 500 performance was flat in May if not for the strong performance of a small cohort of mega-caps, aided by exposure to AI. Earnings and sales growth are contracting but analysts expect a rebound into a yearend, which is…

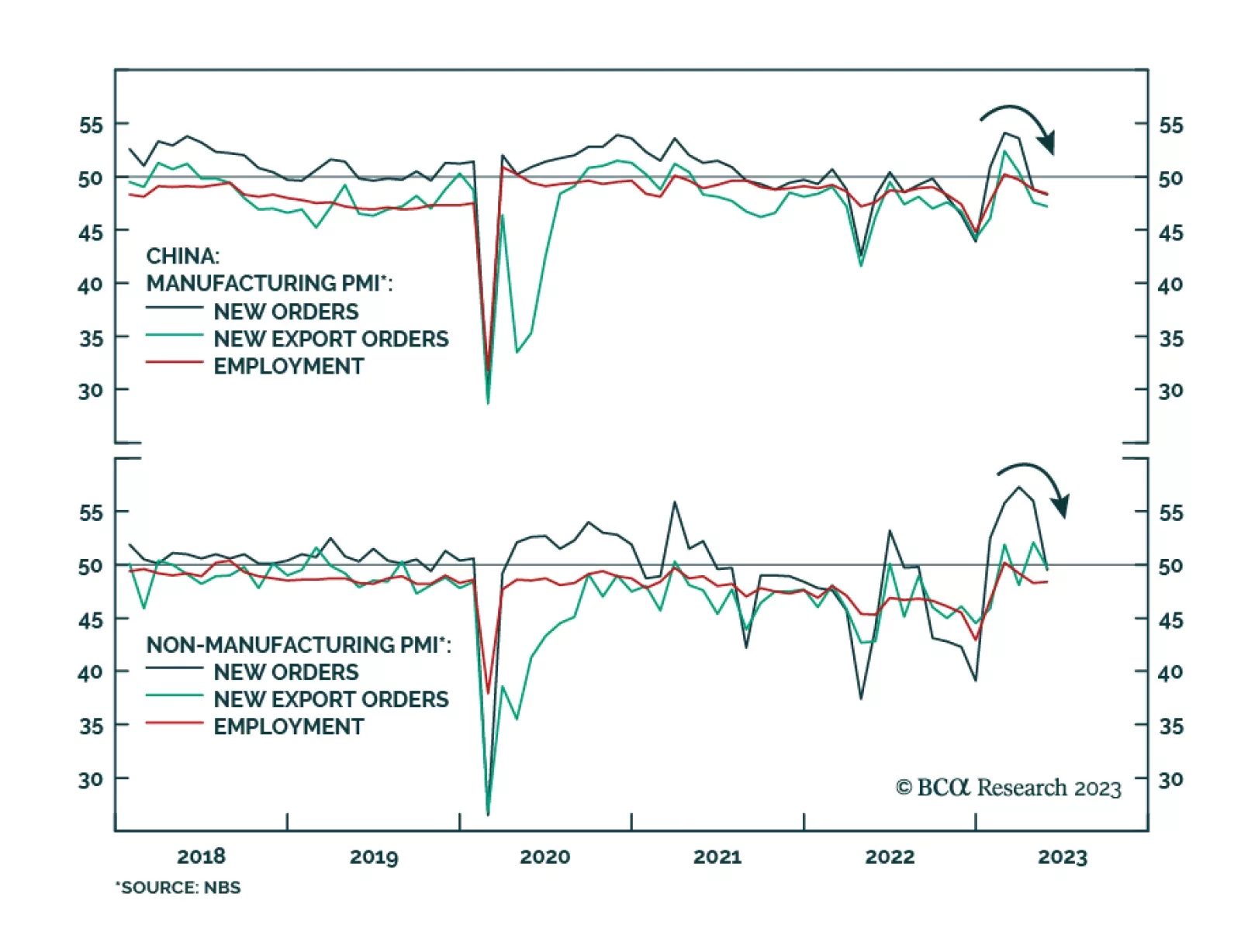

Chinese economic data releases continue to disappoint. Wednesday’s NBS PMI release showed the composite PMI dropped from 54.4 to 52.9 in May – the lowest since January. Importantly, the Manufacturing PMI unexpectedly…

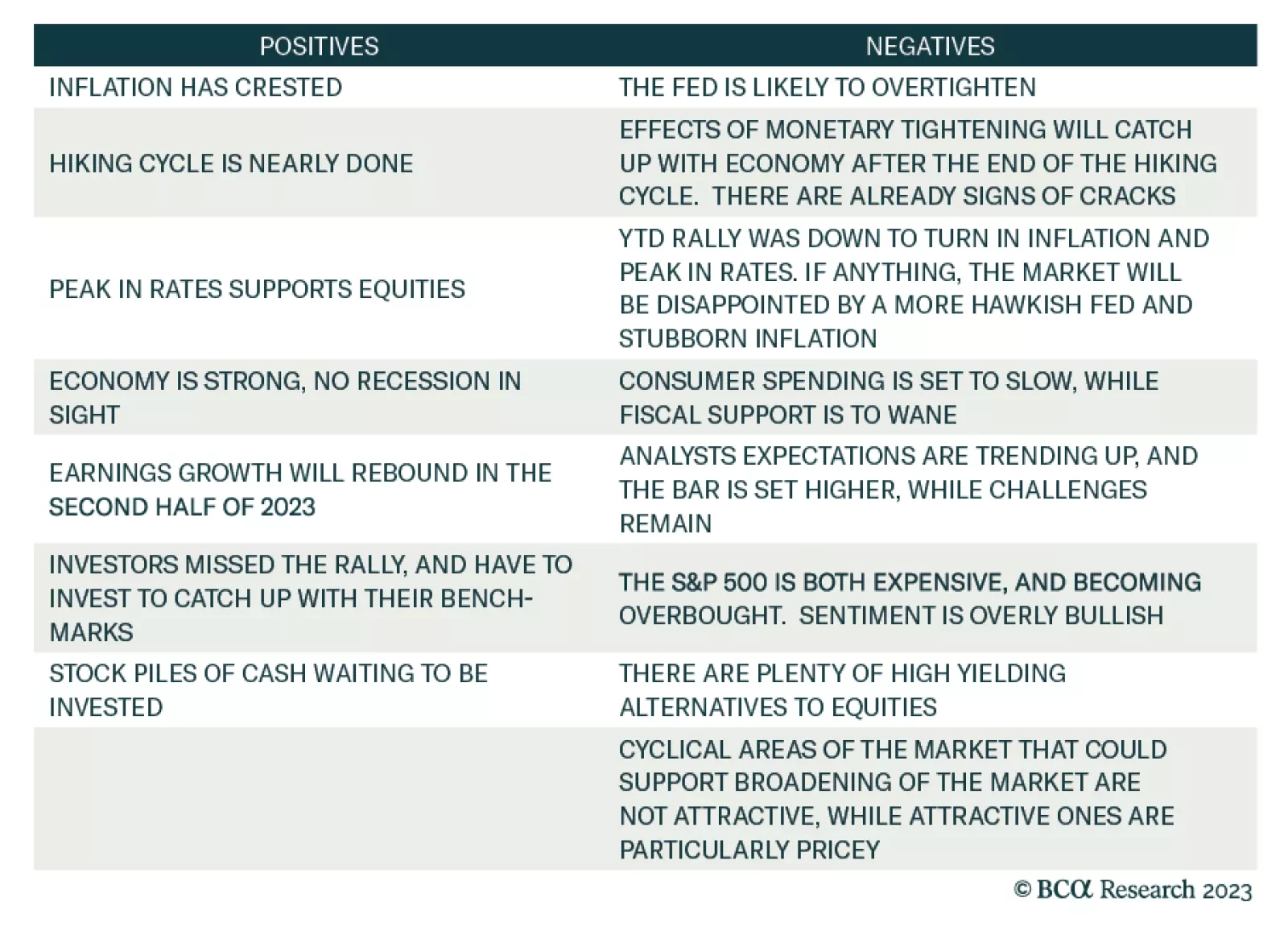

The most important question investors need to answer is whether this is the right time to shift the portfolio to a more aggressive and cyclical stance now that the end of the hiking cycle is in sight. To answer this question, we…

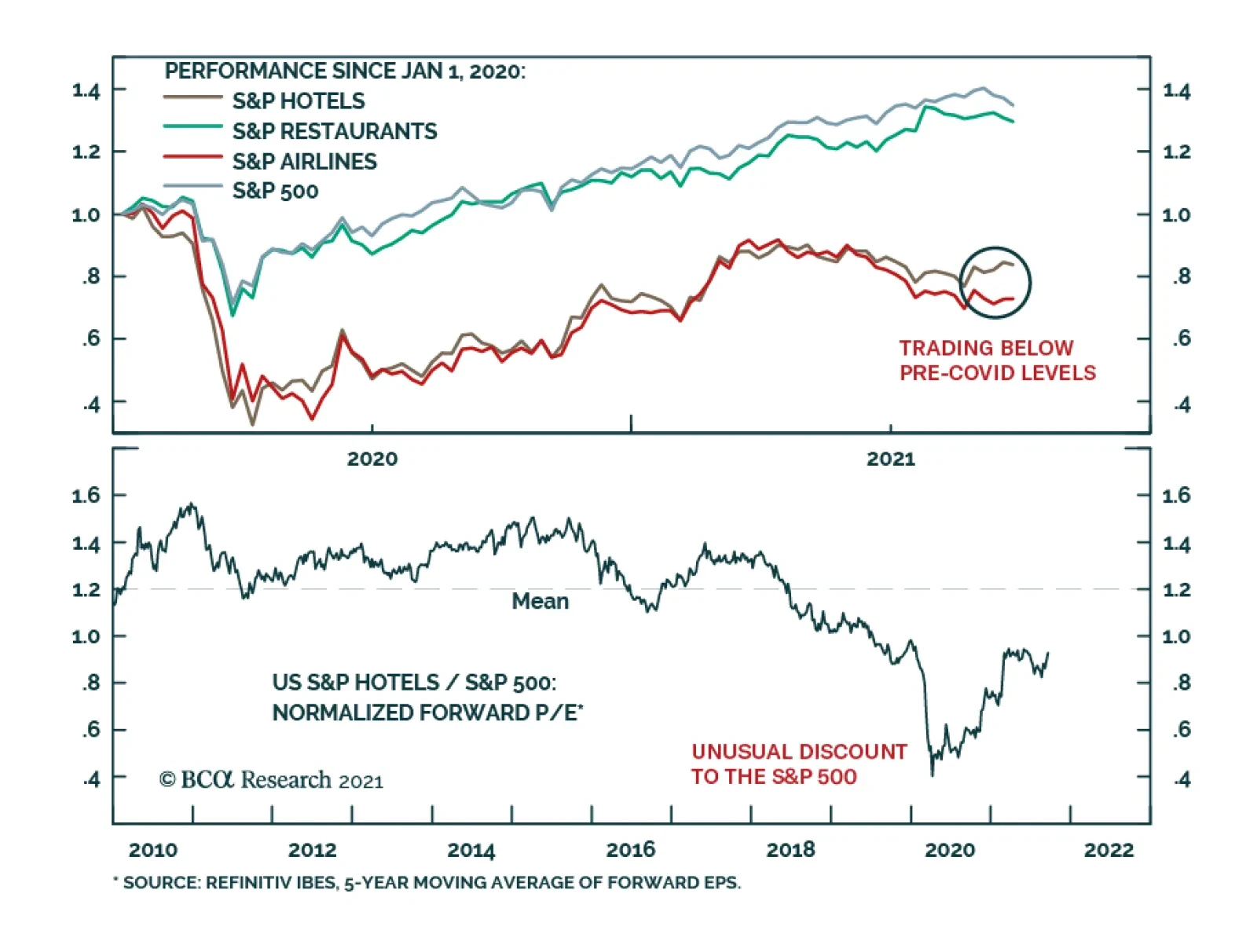

Airlines have staged an impressive recovery this year, exceeding all expectations. While companies are optimistic, we are cautious. Just as pent-up demand for travel will fade, headwinds from slowing growth and high inflation will…

BCA Research’s US Equity Strategy service recommends overweighting the Hotels, Resorts, and Cruise Lines industry. The team summarizes this view as follows: The Delta variant is cresting. Their base case is that herd…

Feature The selloff in Chinese stocks since mid-February reflects a rollover in earnings growth and multiples. Lofty valuations in Chinese equities driven by last year’s massive stimulus means that stock prices are vulnerable to any…

Highlights China’s economic recovery is in a later stage than the US. A rebound in US Treasury yields is unlikely to trigger upward pressure on government bond yields in China. Imported inflation through mounting commodity and…