This is the time of the year when strategists are busy sending out their annual outlooks. Here on the Global Investment Strategy team, we decided to go one step further. Rather than pontificating about what could happen in 2025, we…

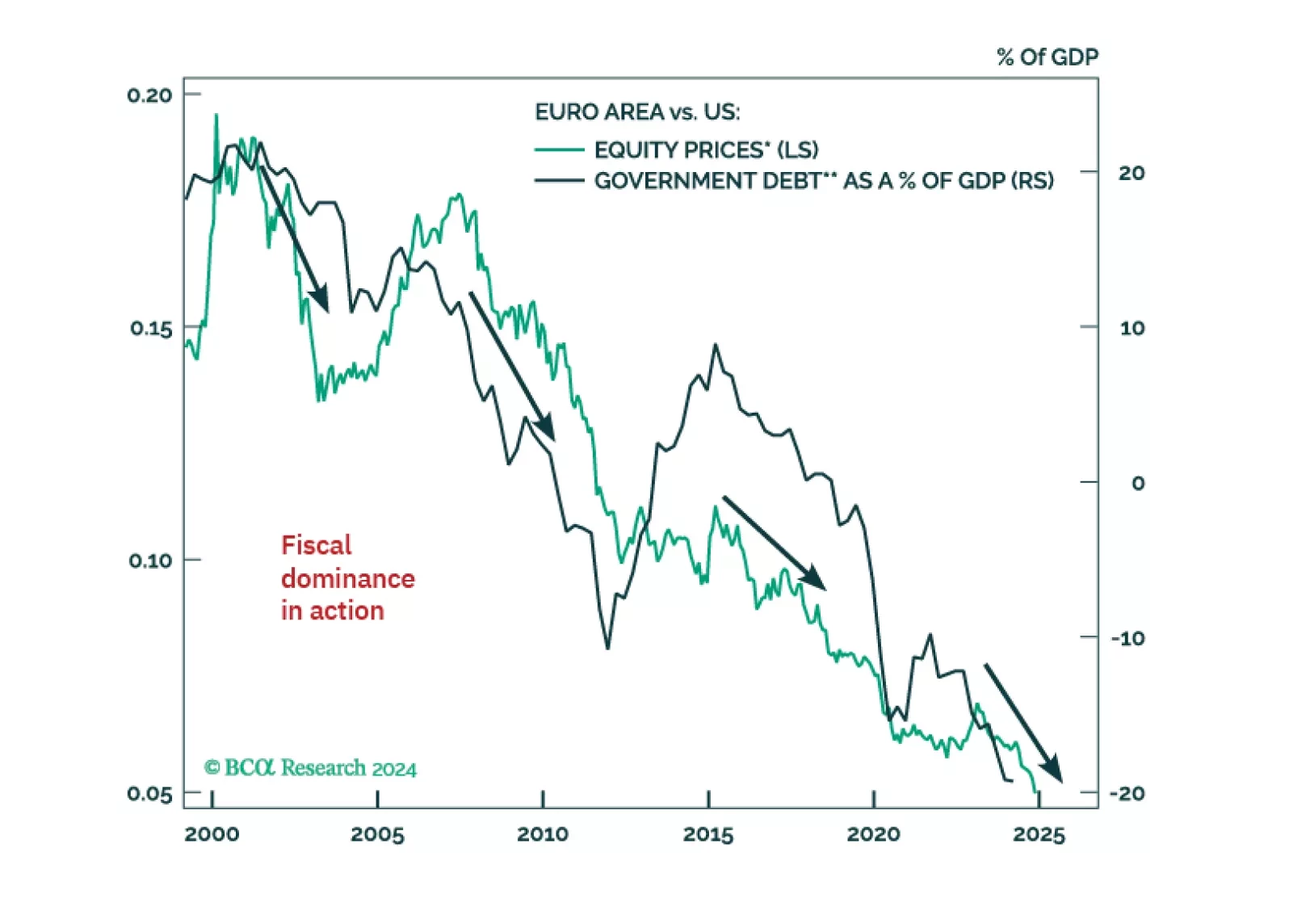

Investors have given up on European assets, which now suffer exceptional discounts to US ones. However, tighter US fiscal policy, the end of Europe’s austerity and deleveraging, the LNG Tsunami about to hit European shores, and the…

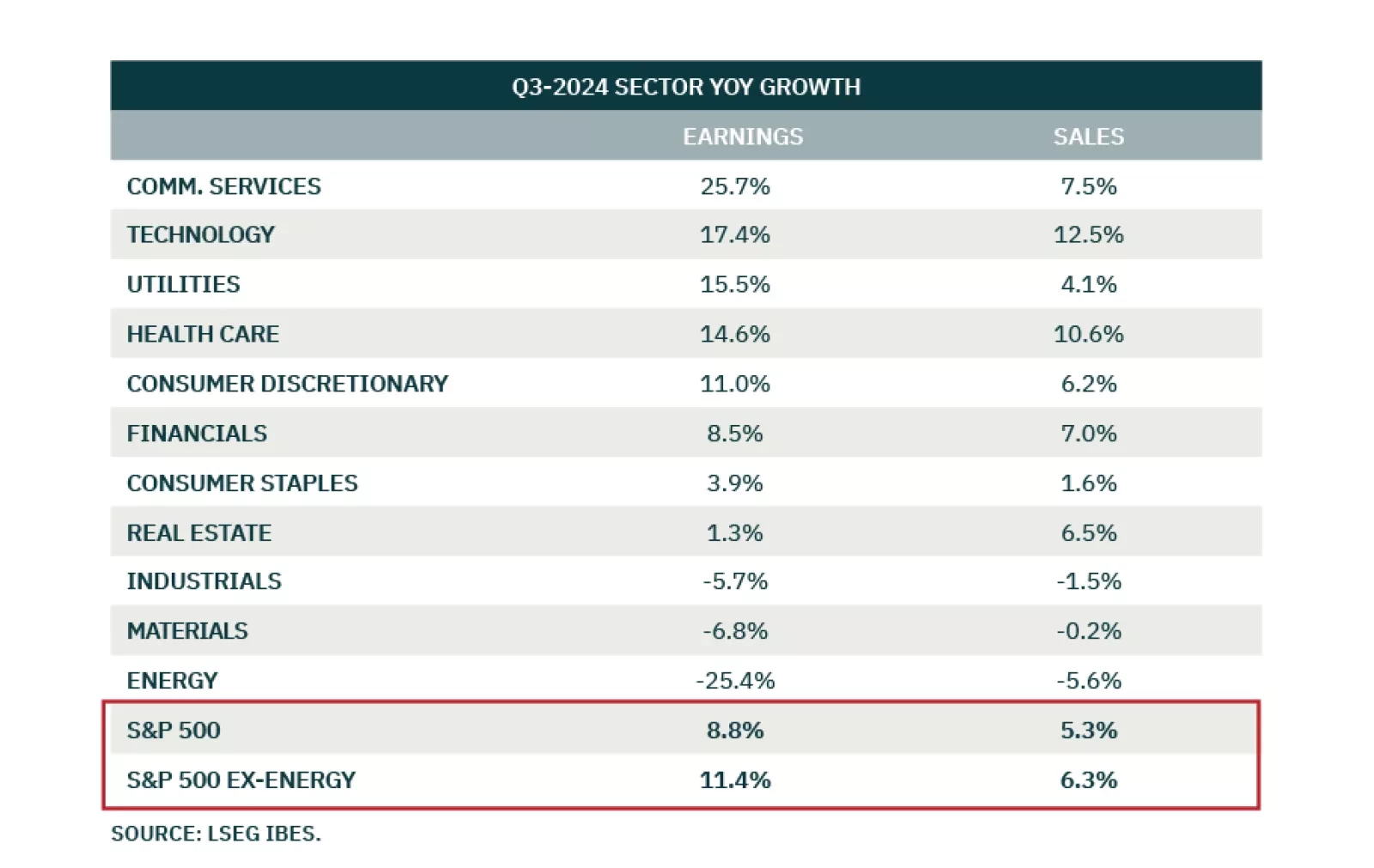

Prior to Nvidia reporting, 76% of S&P 500 companies beat earnings expectations while 61% beat on sales. Nvidia beat earnings expectations, but the magnitude by which guidance beats the most optimistic analyst expectations is…

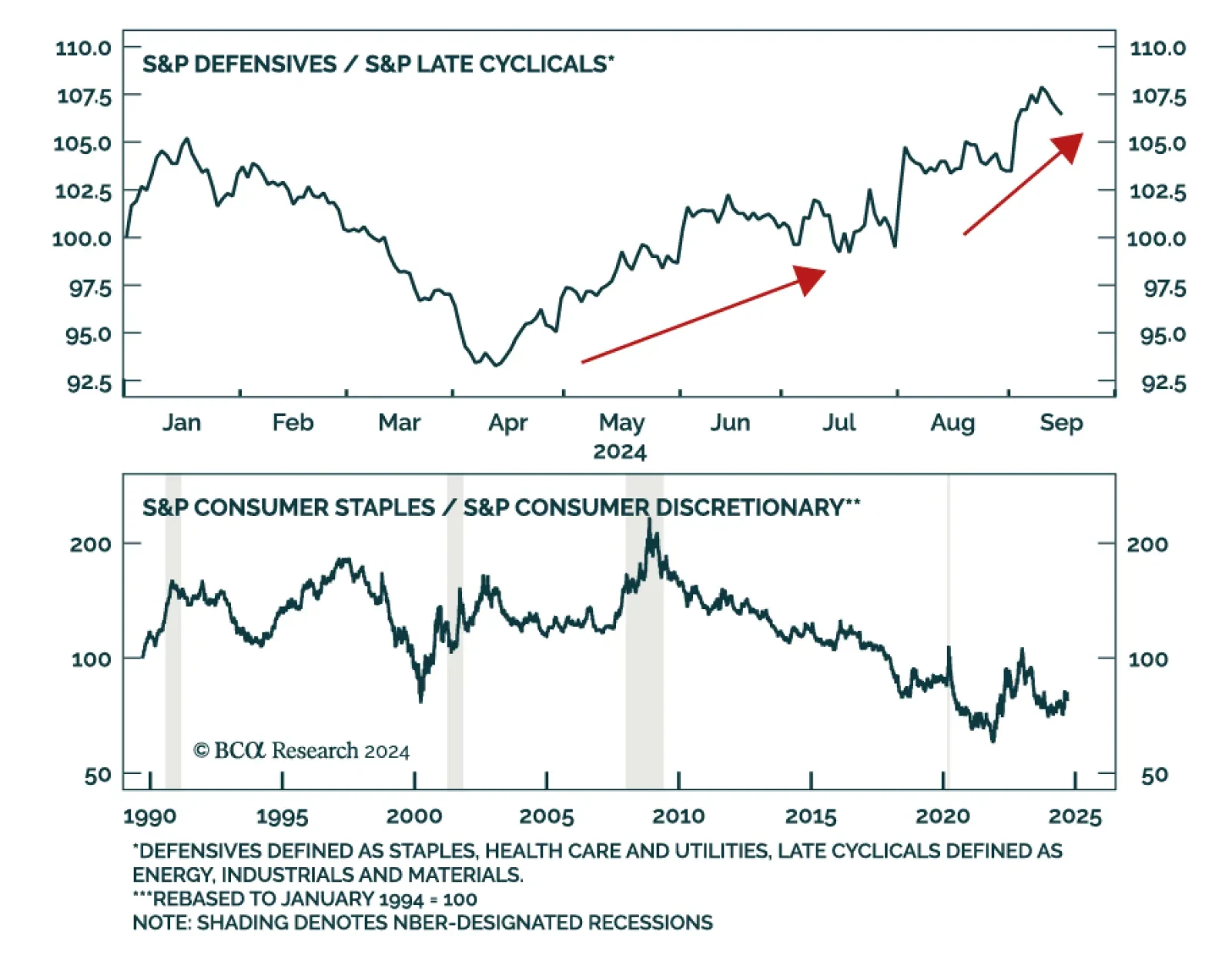

Stocks are a forward discounting mechanism and routinely top before recessions begin, even if they typically do not swoon until the recession has taken hold. According to BCA Research’s US Investment Strategy service, if…

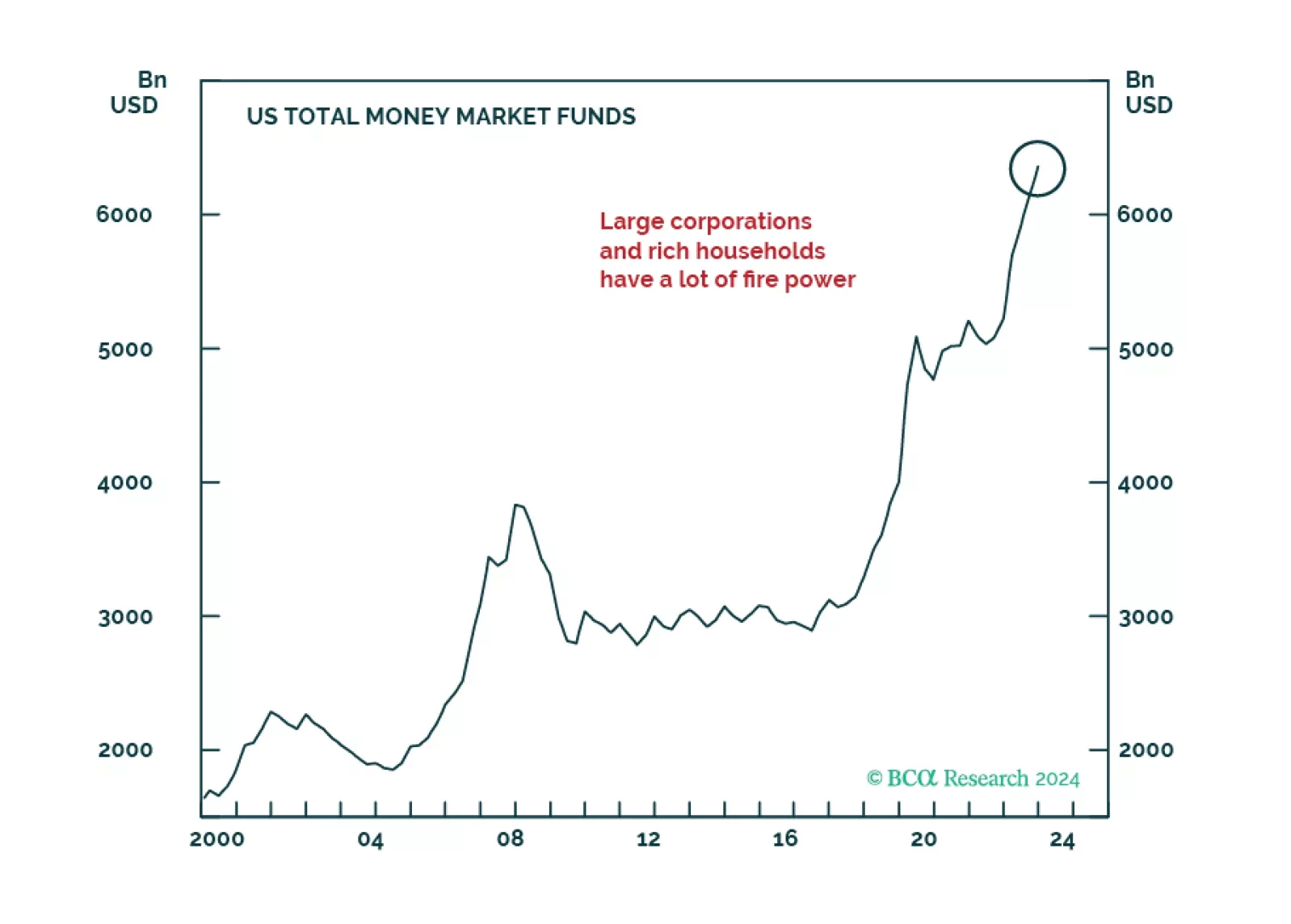

Generative AI-related rally resumed in May. Much of the recent market gains are down to excess liquidity that was begotten by the massive pandemic stimulus, creating a dichotomy between multiple economic challenges and exuberant…

The equity rally extended into March as hard landing outcome was priced out. It has broadened, as money flowed into less over-loved pockets of the market. Our models signal that margins are about to stabilize, and earnings growth…

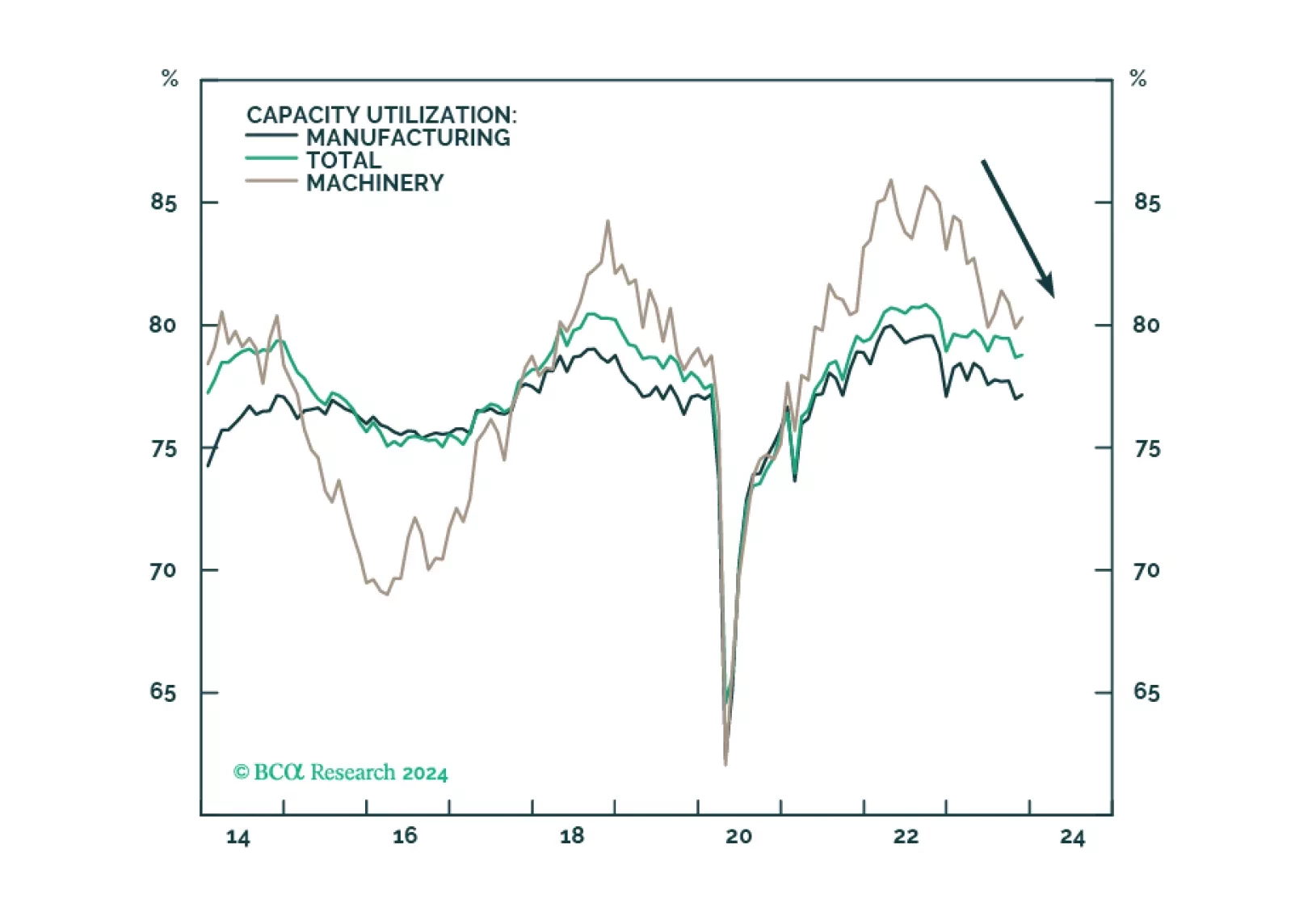

The US manufacturing renaissance, spurred on by reshoring, automation, and government spending, is running its course but progress has slowed on the back of tight monetary conditions and the manufacturing recession. The deceleration…

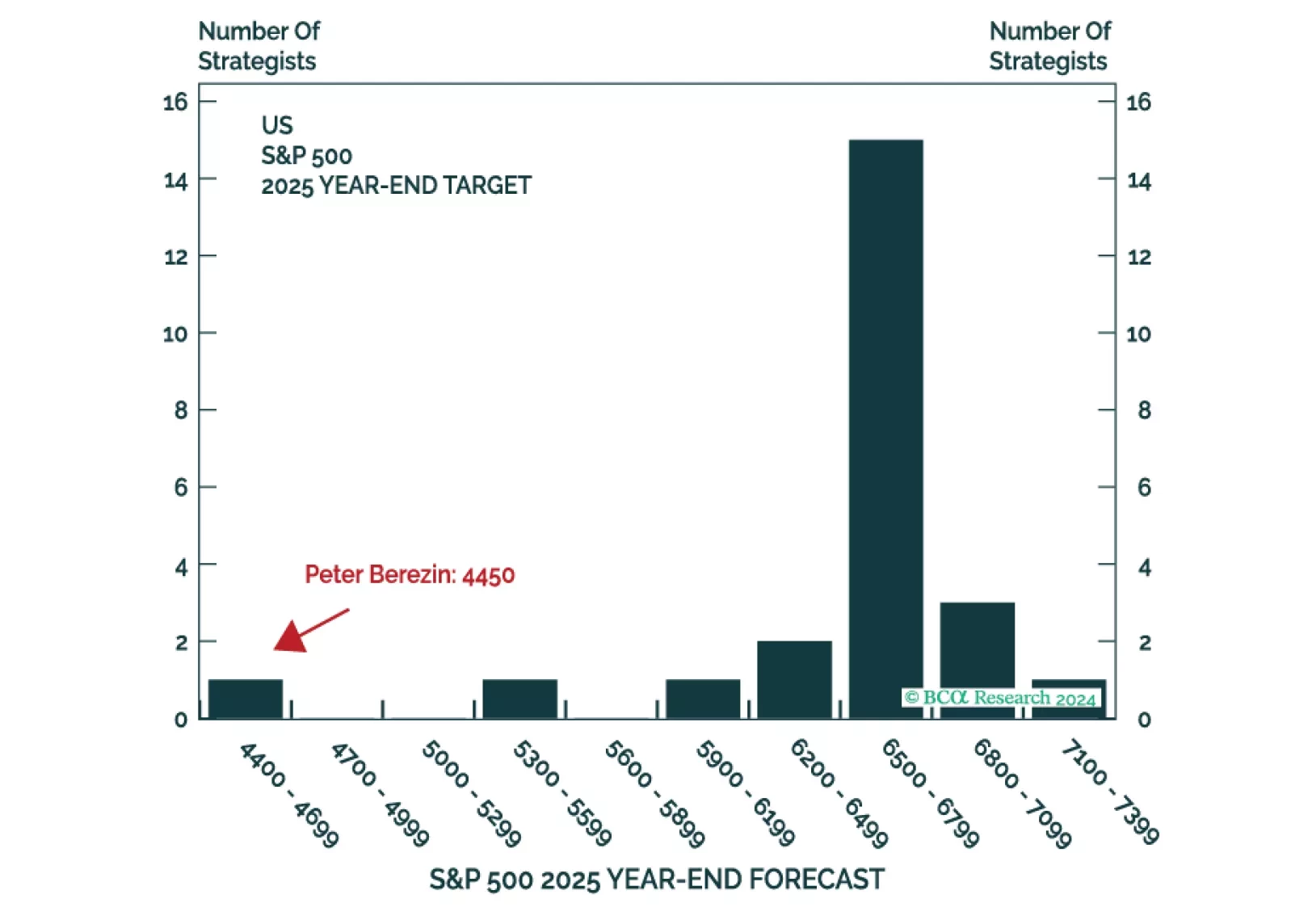

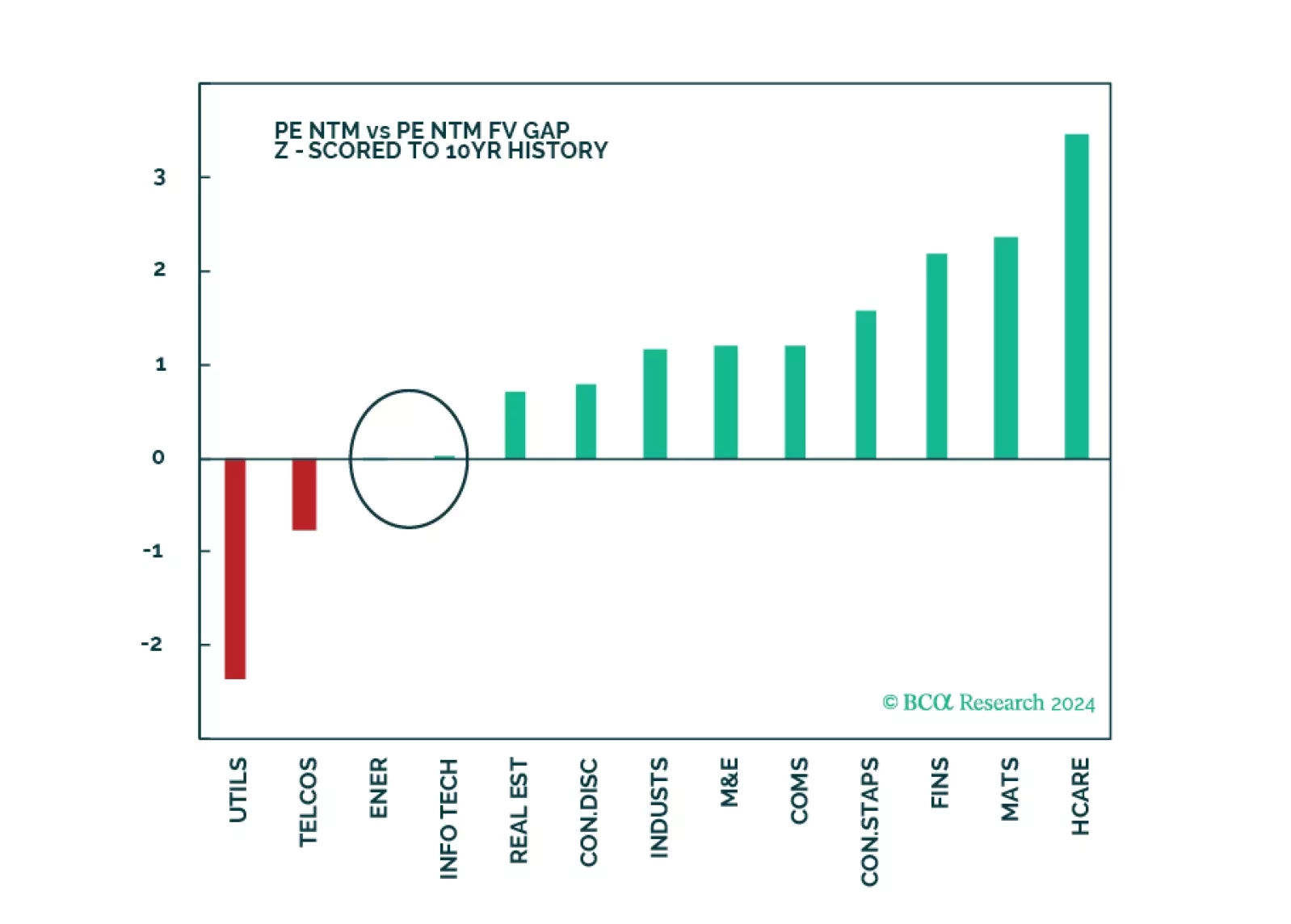

Bulls and bears have capitulated, and the majority of the clients surveyed expect a rangebound market in the near term. Our fair value PE NTM indicates that the S&P 500 is only modestly overvalued. The continued outperformance…

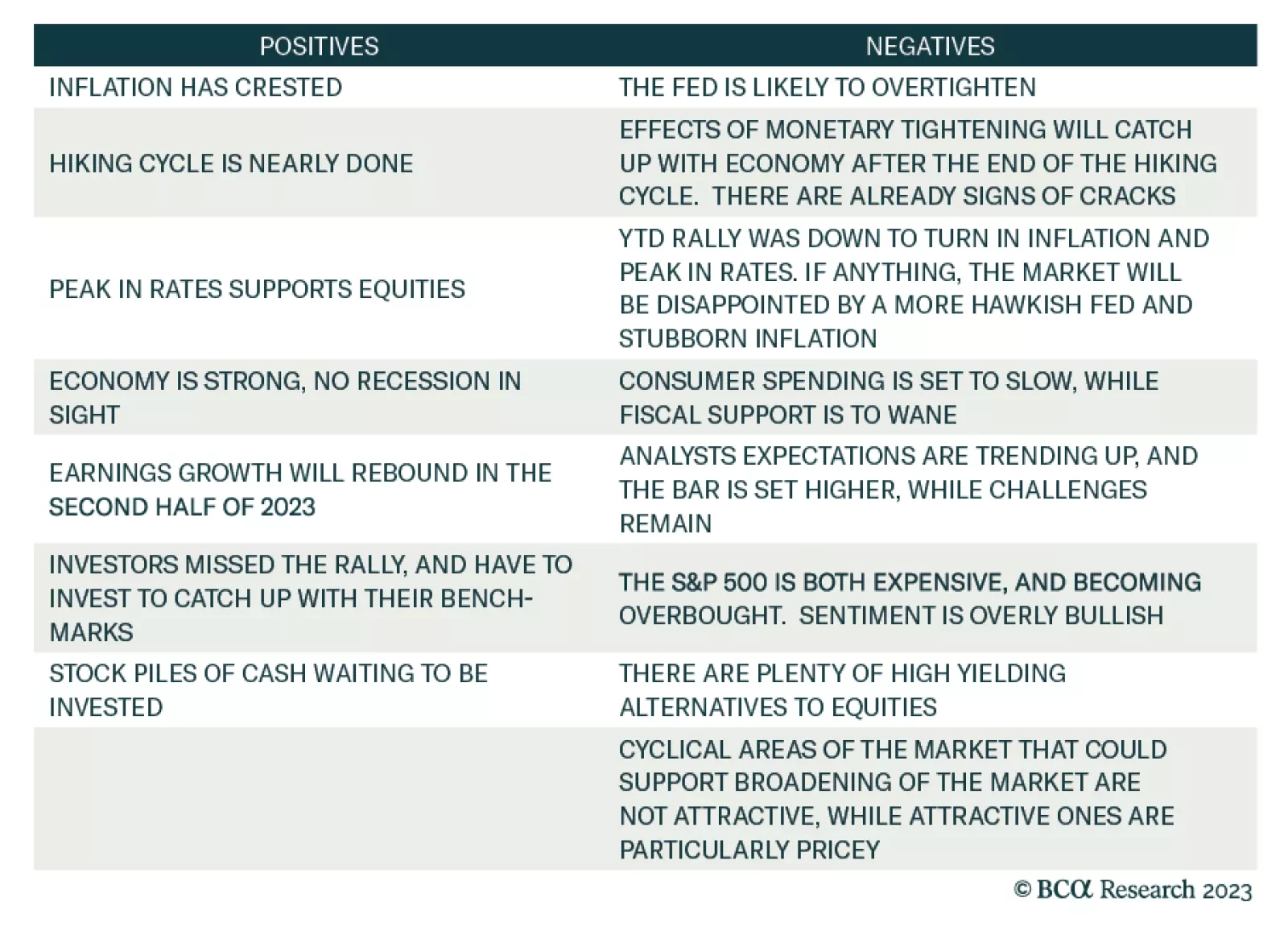

Our US Equity Strategy service looks back at their performance for the first half of the year and assesses what they hit or missed so far and comments on the ongoing rally in the stock market. The team hit on the economic…