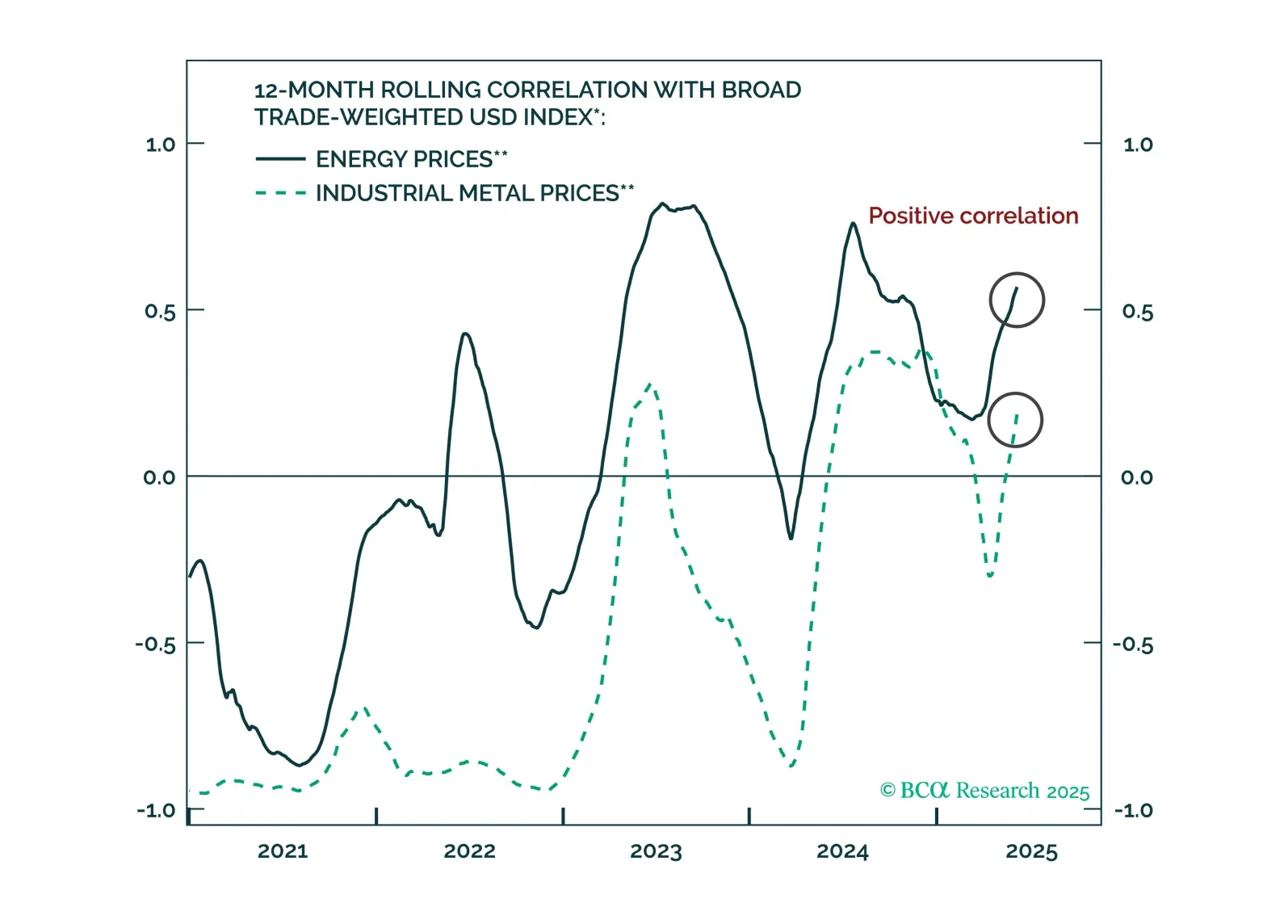

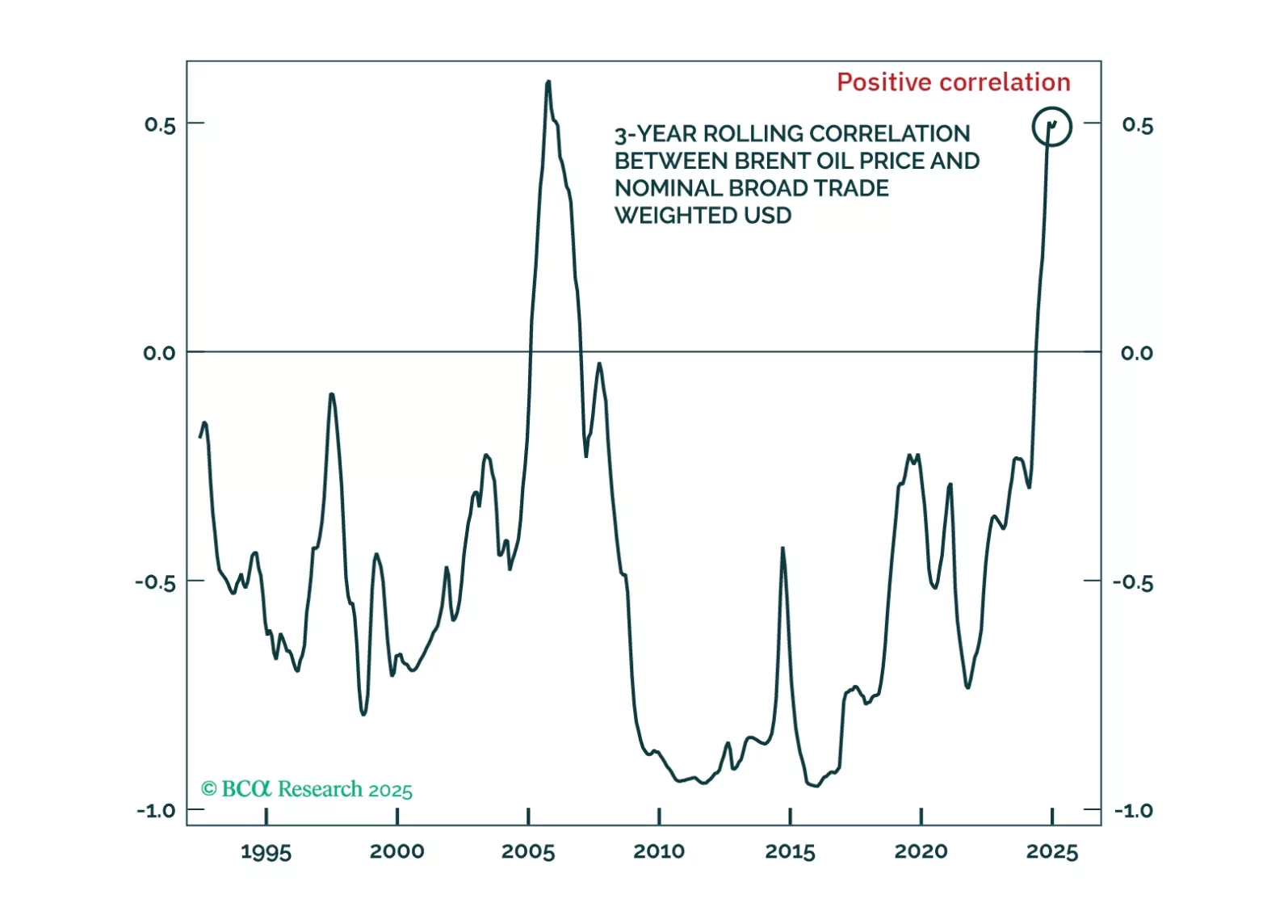

Investors often rely on past relationships to predict future outcomes. This strategy is at risk now that several commodity correlations have broken down. We explore the causes and sustainability of the new commodity relationships.

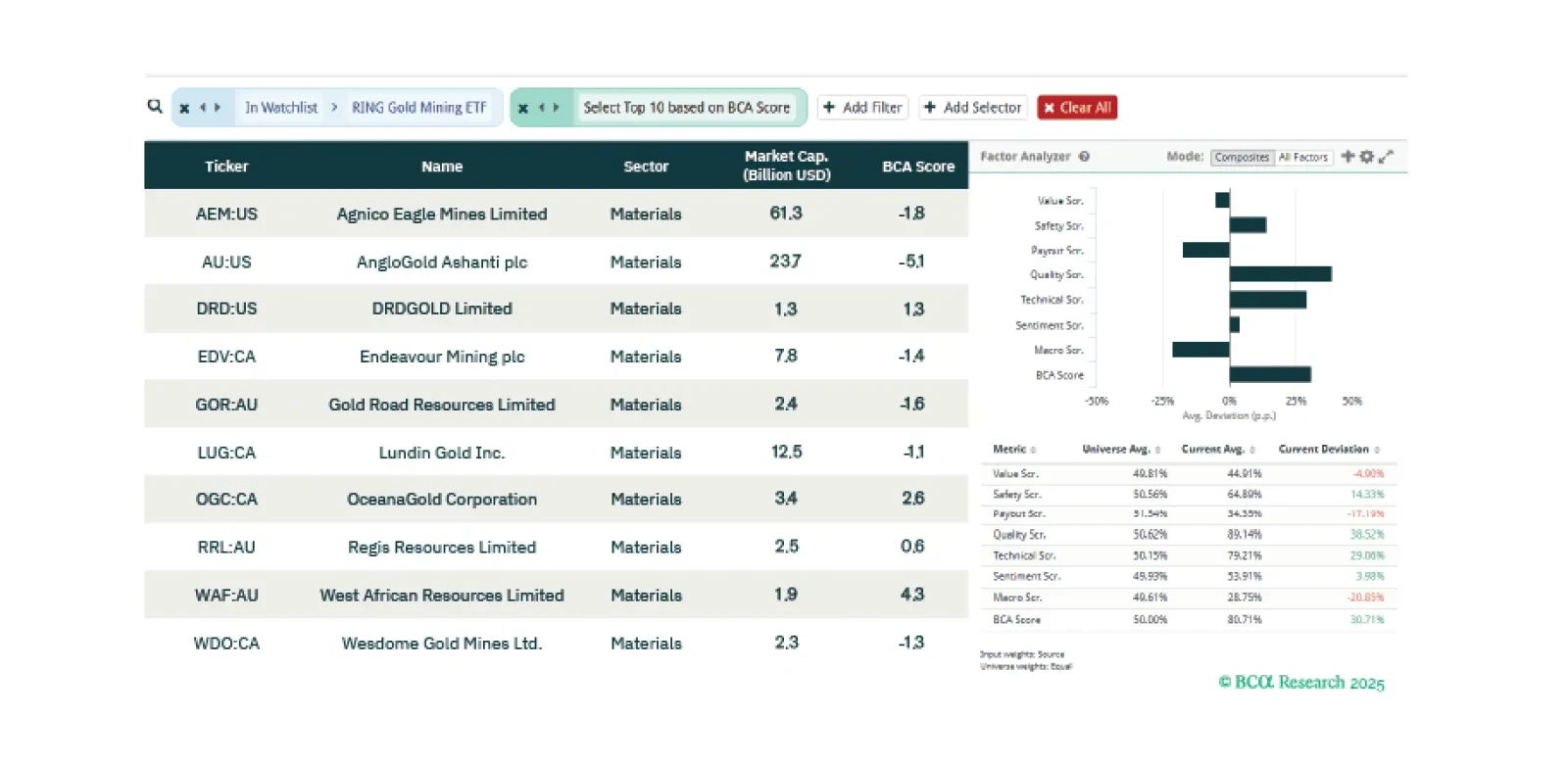

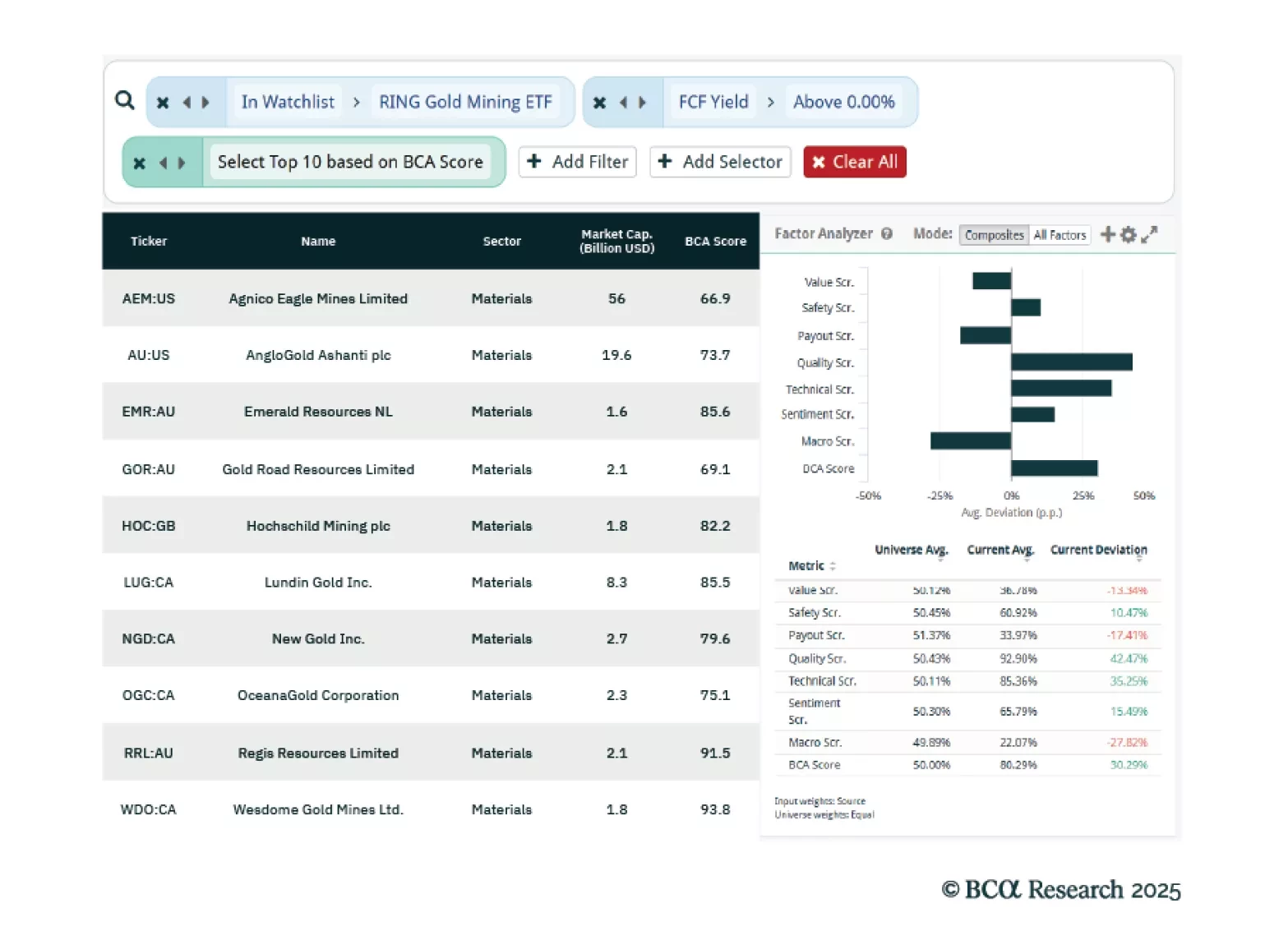

This week our three screeners explore equity trades in gold mining stocks, European banks, and US stocks ex-Tech should a recession not be imminent.

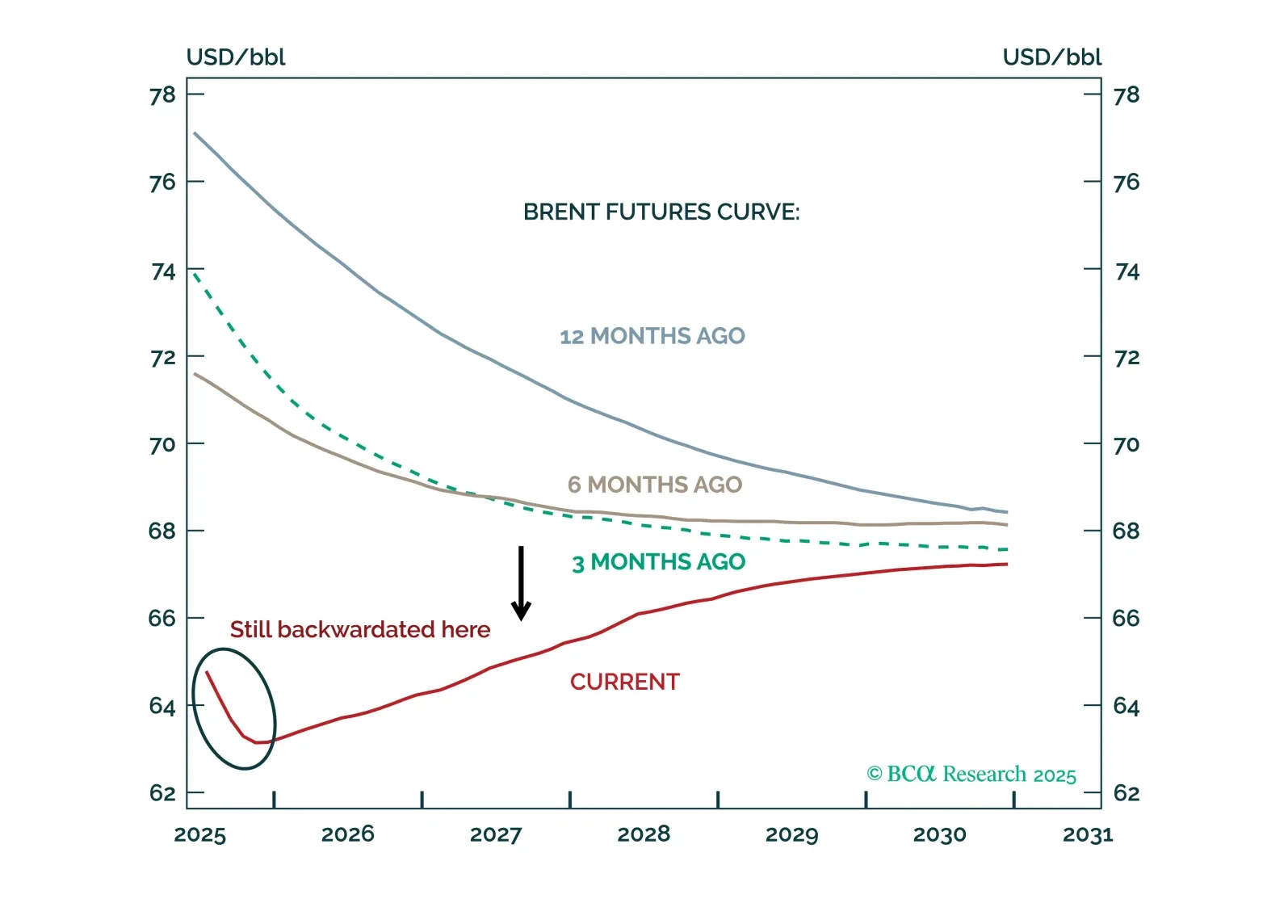

Oil, copper, and gold futures curves have recently experienced abnormal shifts and twists. Brent is no longer fully backwardated, copper curves on the LME and CME have diverged, and gold is in a steep contango. We examine the…

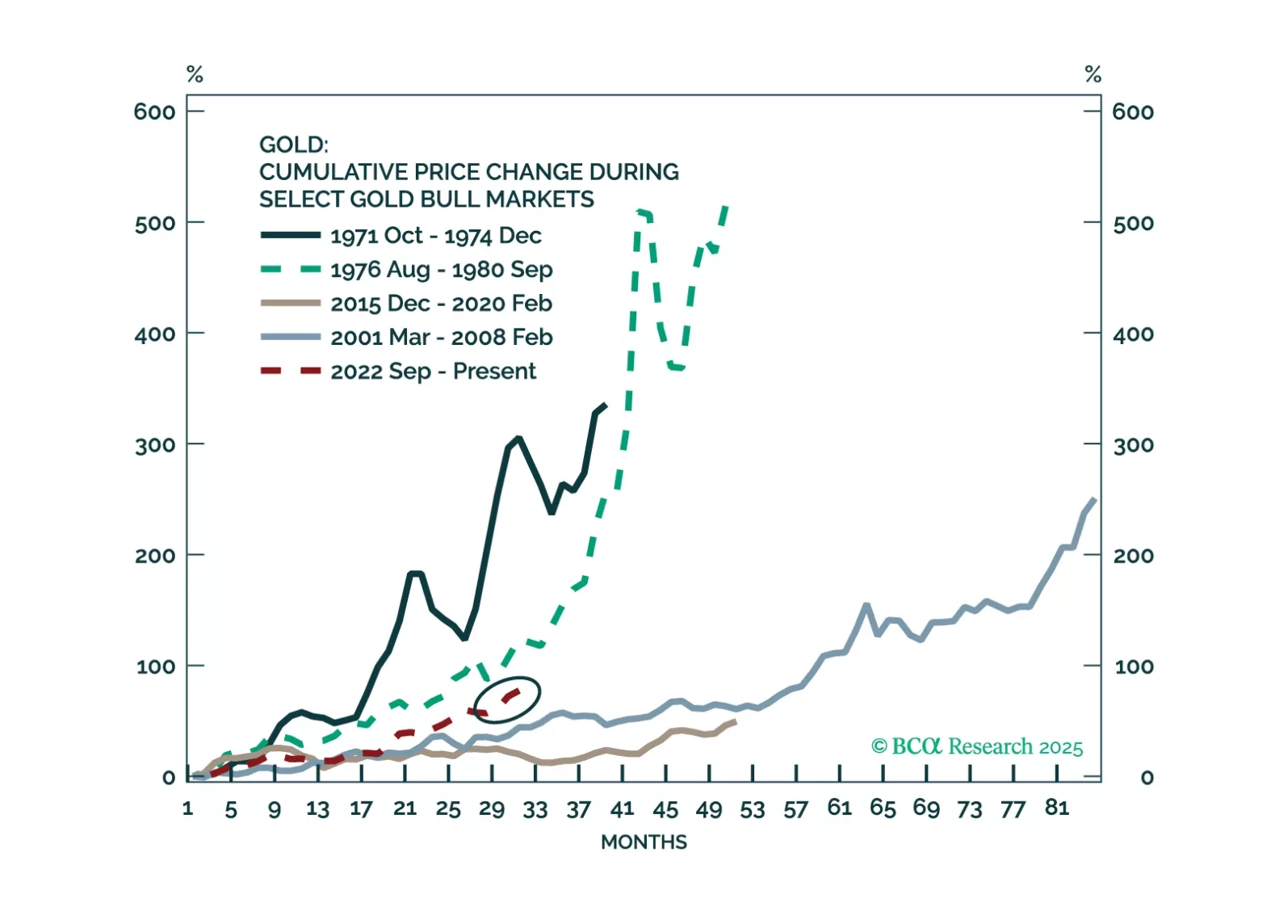

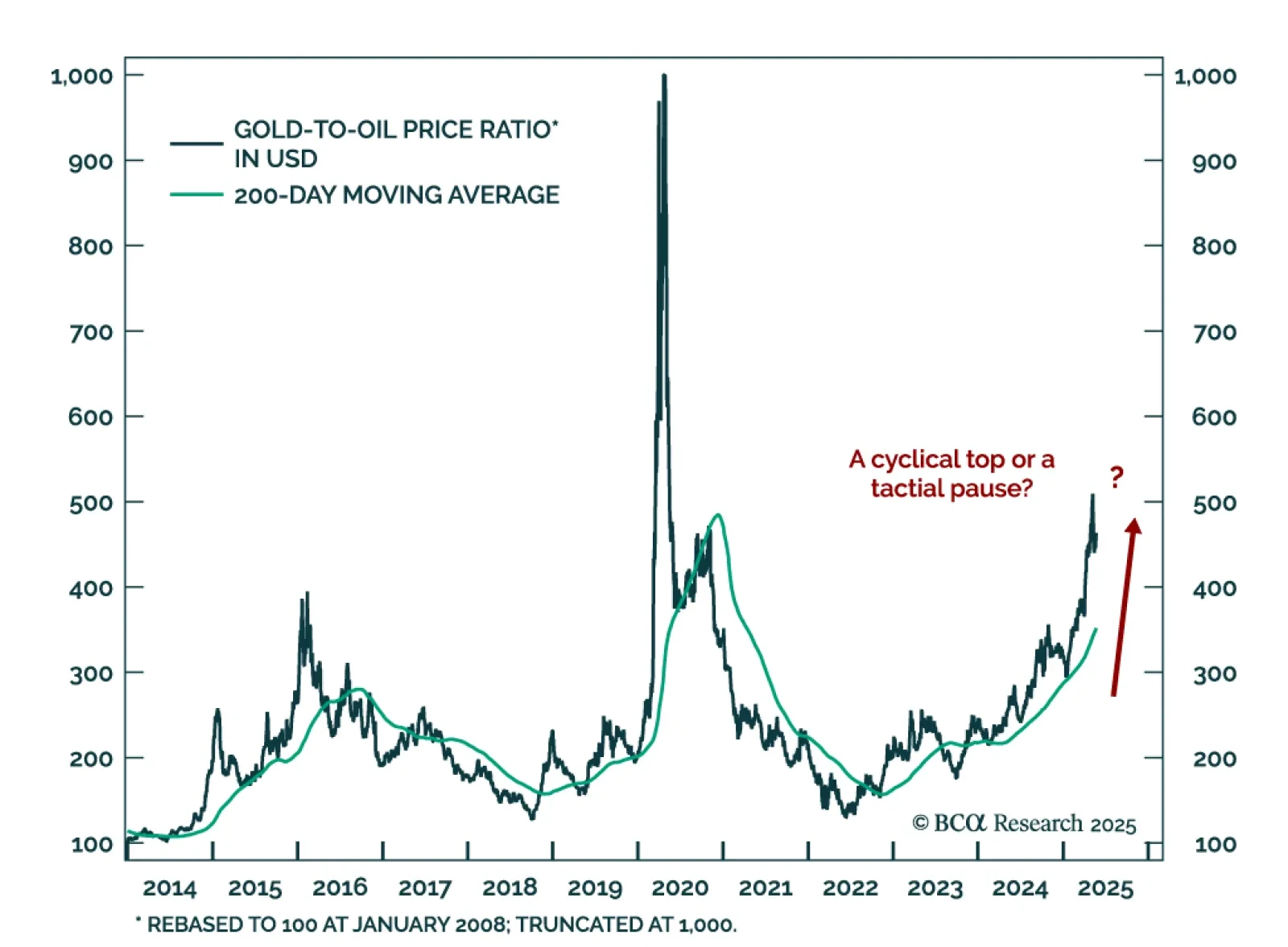

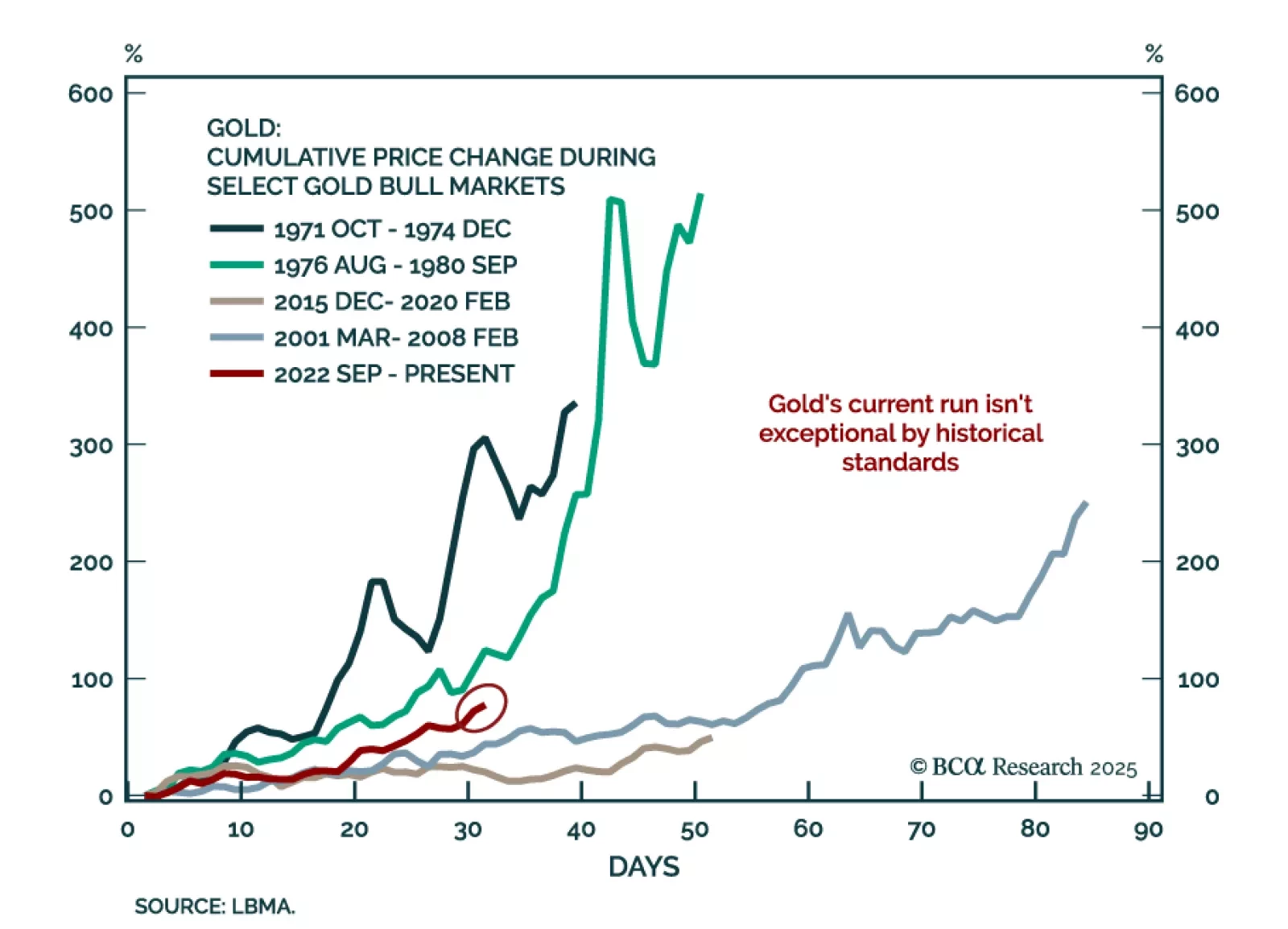

The gold-to-oil price ratio seems tactically overextended, but global macro drivers suggest it will rise further. The gold bull run is still relatively young and not yet stretched compared to rallies from the past 50…

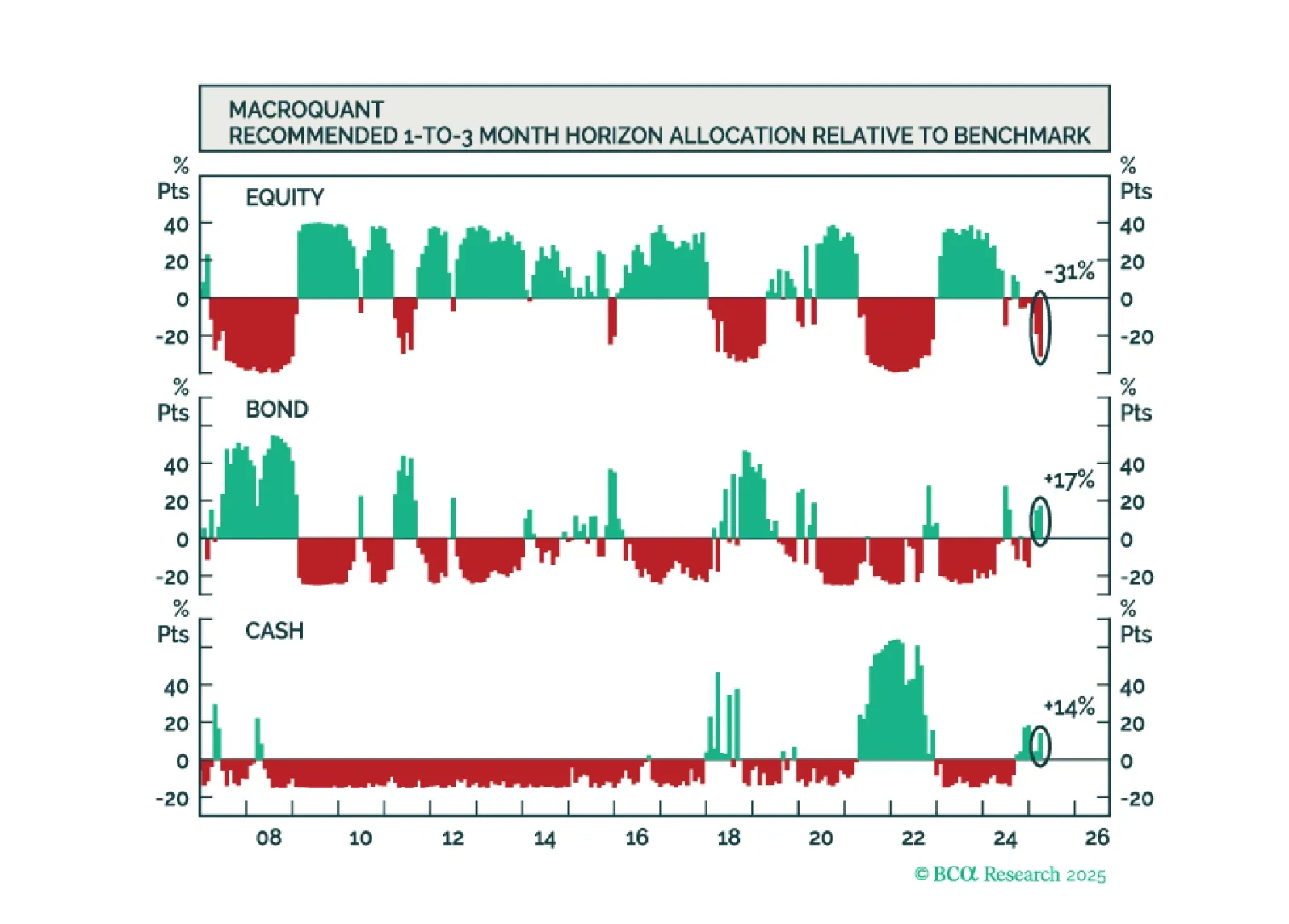

MacroQuant sees the risks to US growth as being to the downside and the risks to inflation as being to the upside. Such a stagflationary brew justifies an underweight on stocks.

MacroQuant sees the risks to US growth as being to the downside and the risks to inflation as being to the upside. Such a stagflationary brew justifies an underweight on stocks.

Our Commodity strategists remain defensive as both demand- and supply risks abound. Stay long gold and underweight oil and copper as increasing OPEC+ supply and tariff-driven demand risks will hurt energy and industrial metals prices…

Commodities have not been spared the wrath of the post-"Liberation Day" selloff. However, in the sea of red, gold continues to shine bright, climbing to a fresh record high. How much further does the recent price action have left to…

This week, our three screeners cover equity plays in: Gold mining stocks, Japanese Staples, and Implicit Dividend Yield.

Commodity prices are succumbing to the risk-off environment triggered by President Trump’s reciprocal tariff announcement. The latest events and market moves raise several important questions about the outlook for commodity markets.…