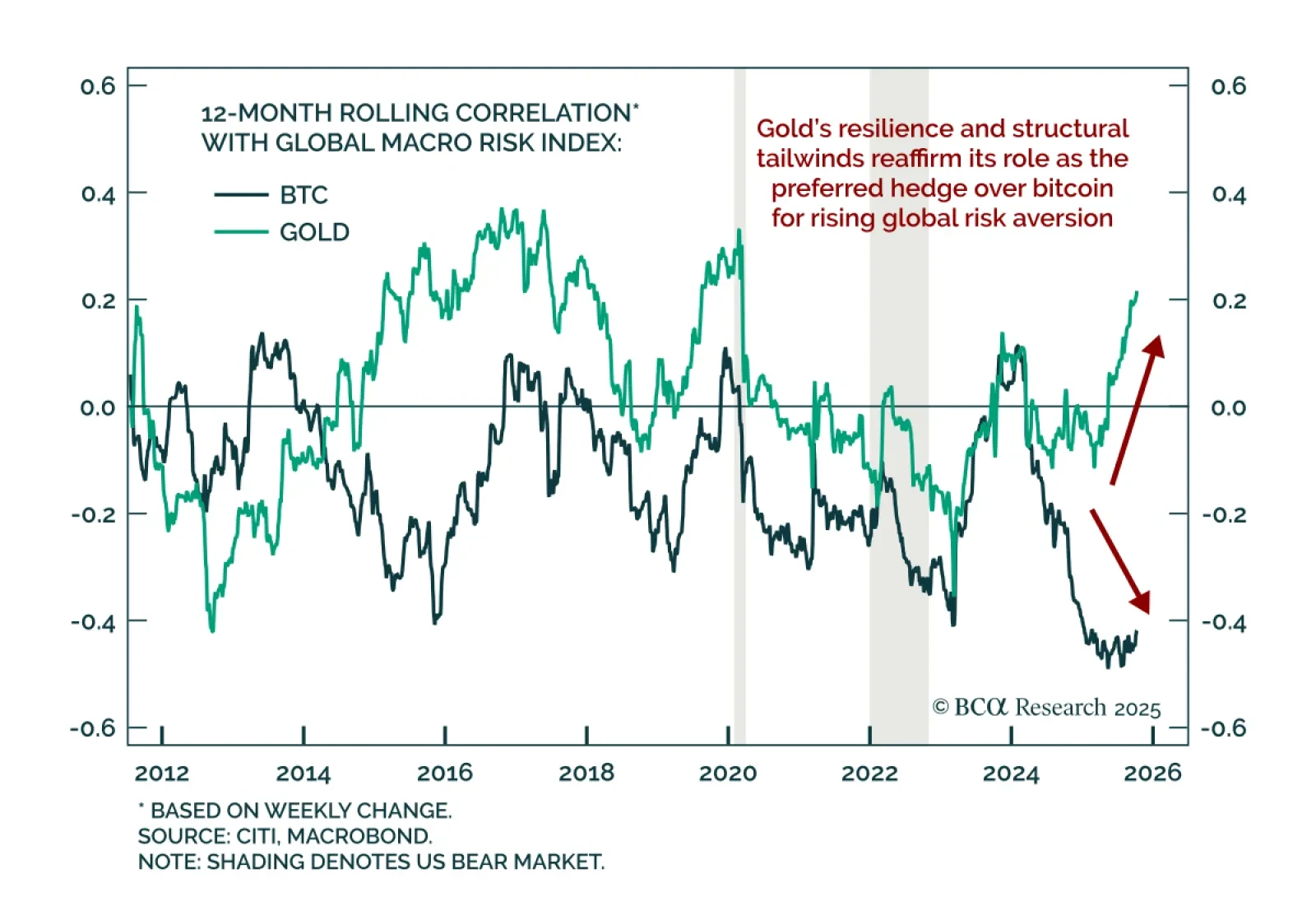

Gold remains a superior hedge asset to bitcoin during global risk-off periods. Both assets have rallied strongly this year, reaching new all-time highs as beneficiaries of the dubbed “debasement trade,” reflecting investor…

In this Q4 Strategy Outlook, we discuss where we stand on our recession call, the outlook for stocks and bonds in various scenarios, why investors are misunderstanding the impact of AI on corporate profits, whether the US dollar has…

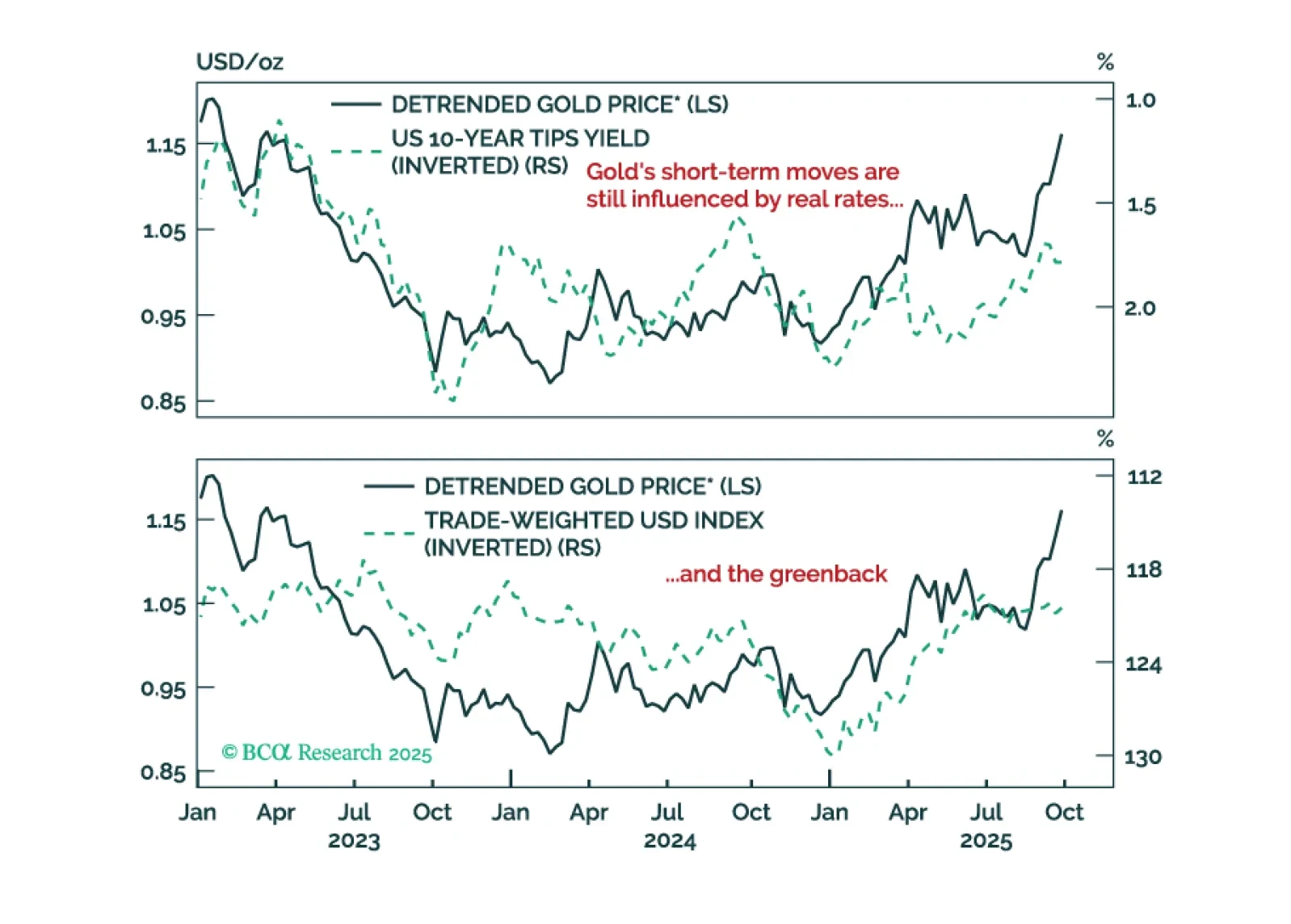

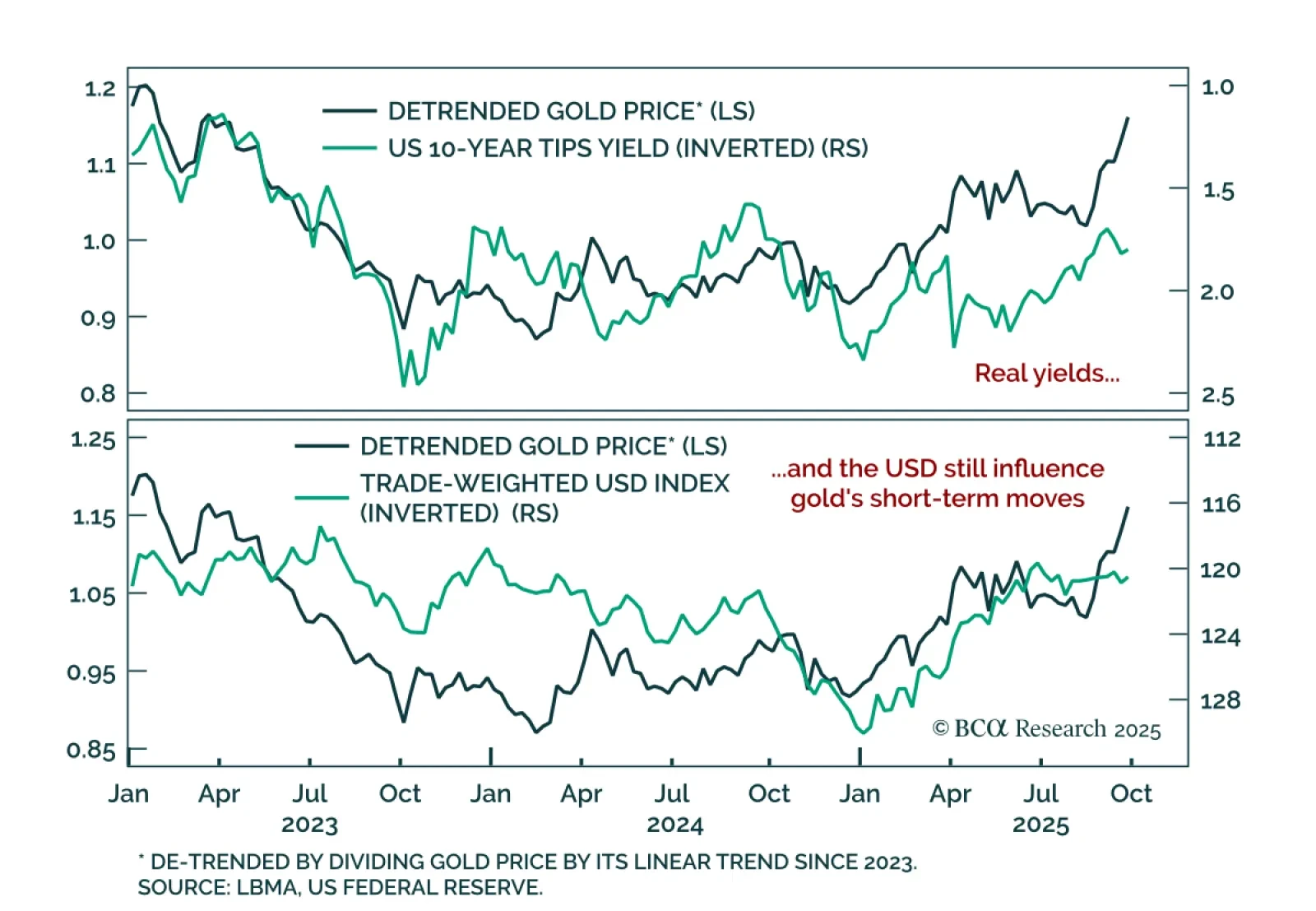

Gold’s decisive break above $4,000/oz, extending gains to over 55% year-to-date, reinforces the structural bull case driven by persistent central bank demand and mounting fiscal concerns globally, supporting an overweight stance in…

Commodity market breadth would need to improve for it to signal bullish conditions for the aggregate commodity complex. We maintain a defensive tilt within commodities, favoring precious metals over the more cyclically sensitive…

A short guide on how best to use and interpret our real-time fractal heatmap for asset allocation.

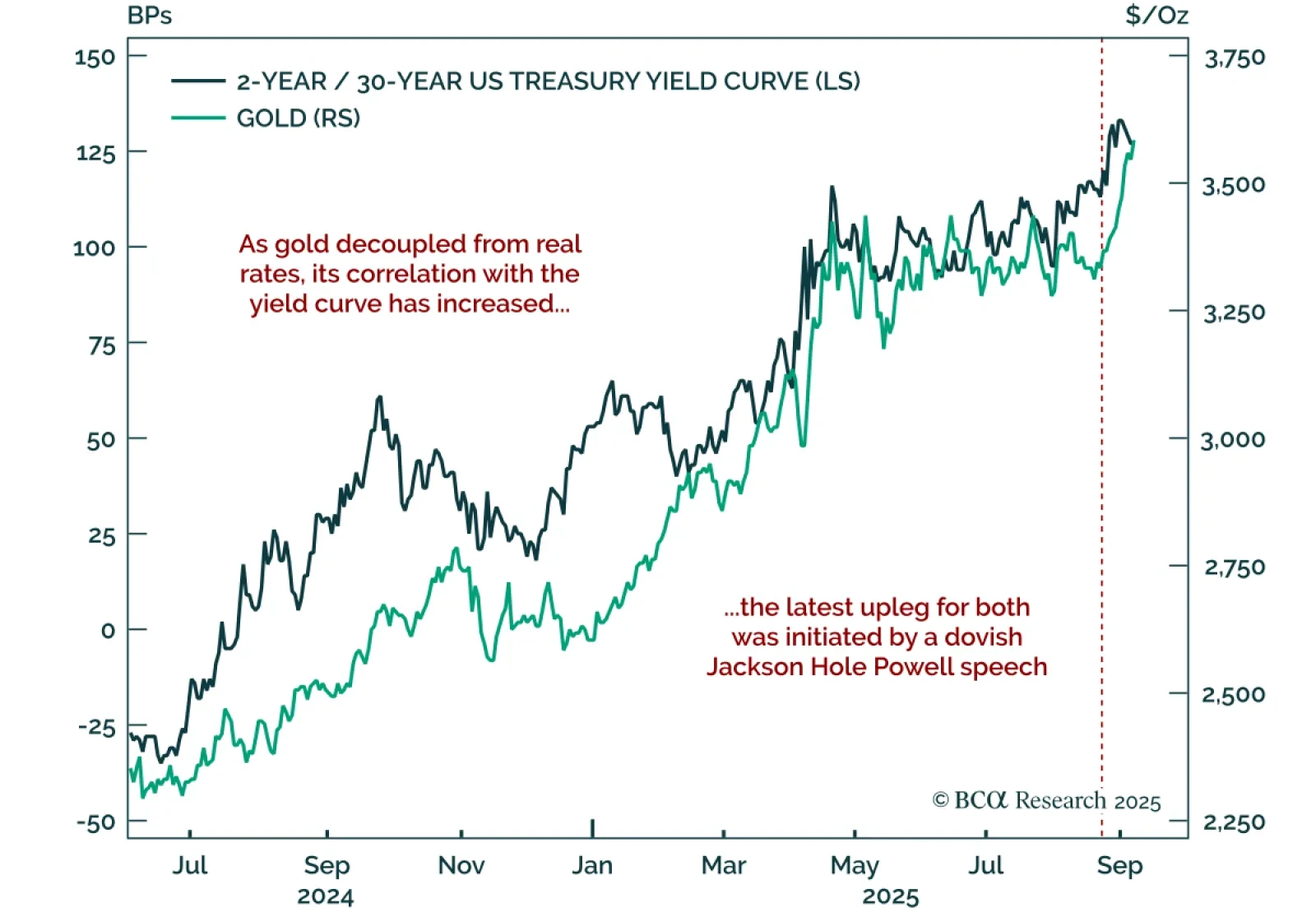

Gold and steepeners remain core trades, supported by structural shifts in markets and policy. Gold broke out of the consolidation range it had been in since April, supported by central-bank buying and heightened policy…

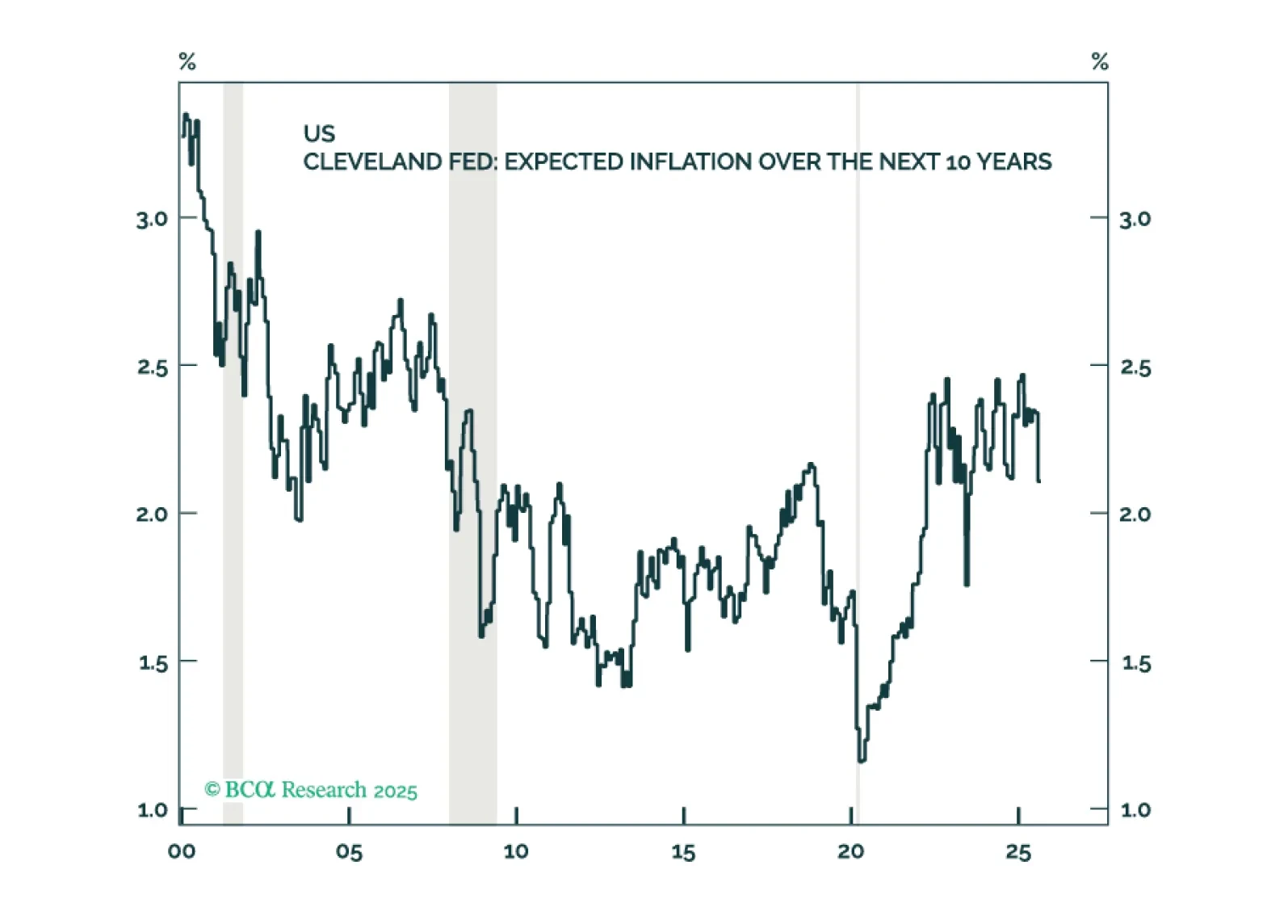

Inflation expectations in the US remain reasonably well anchored and there are few signs of a brewing wage-price spiral. Thus, the near-term risks to growth outweigh the risks of higher inflation. Looking beyond the next year or two…

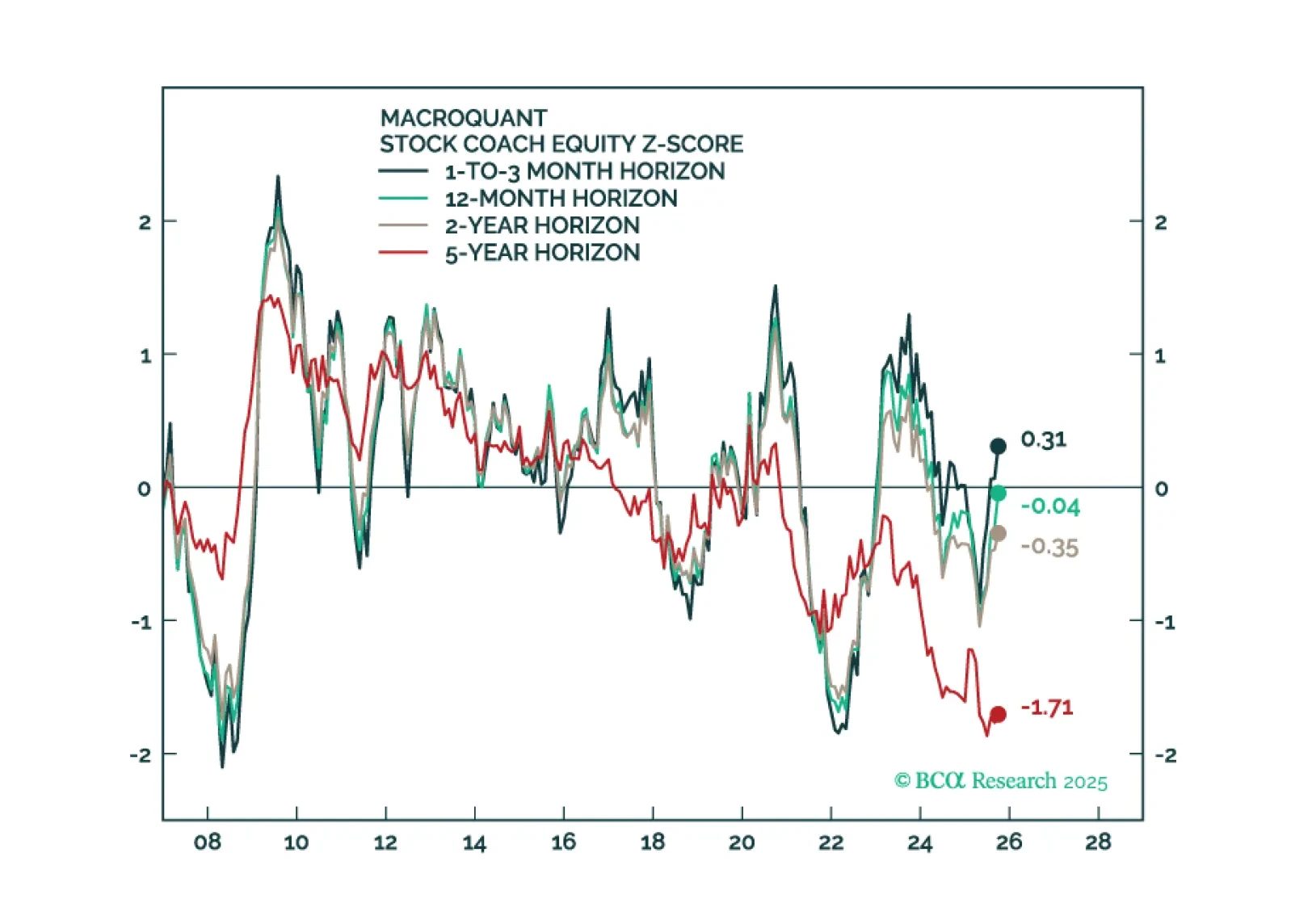

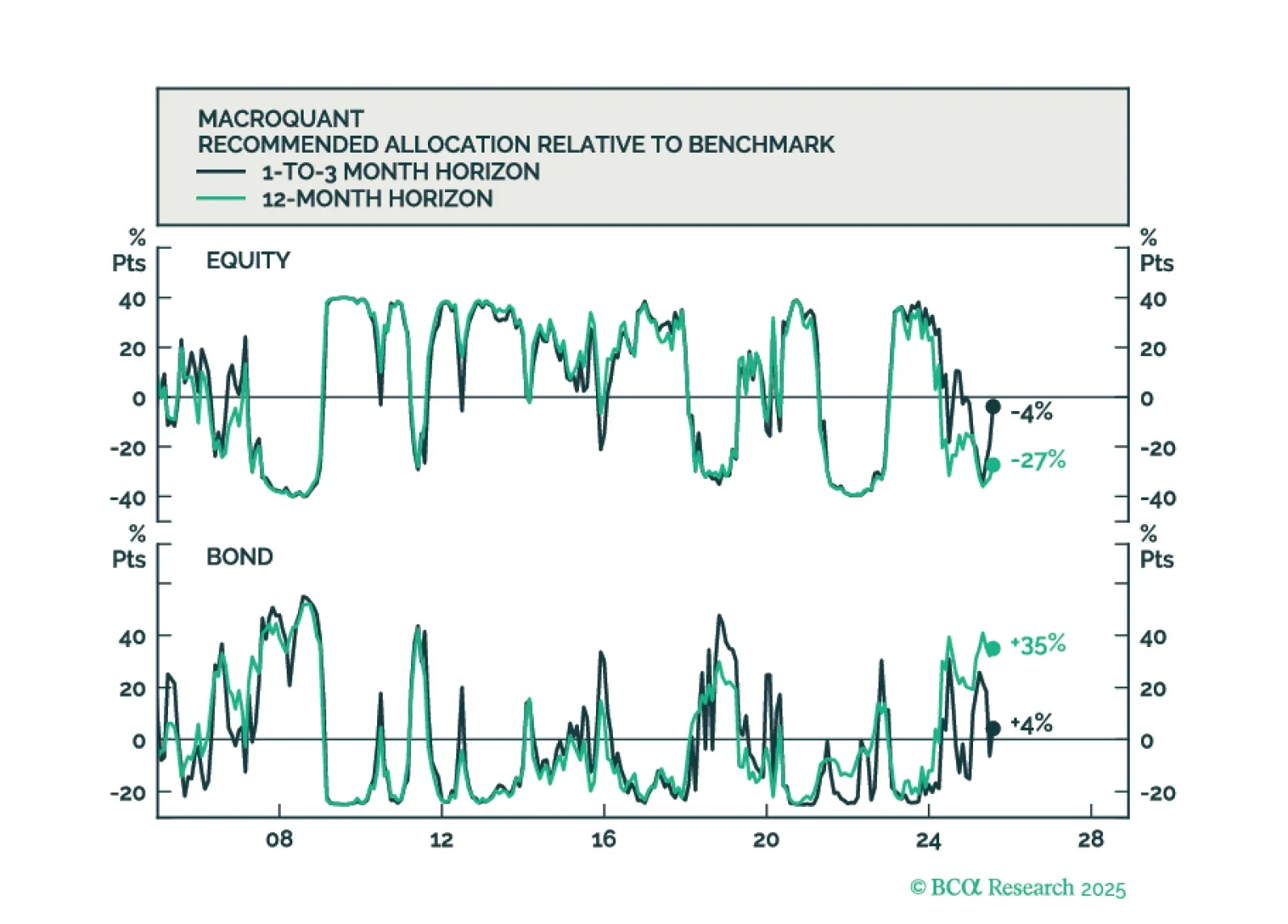

MacroQuant sees downside risks to stocks over a long-term horizon but is not yet saying that we are at imminent risk of an equity bear market.

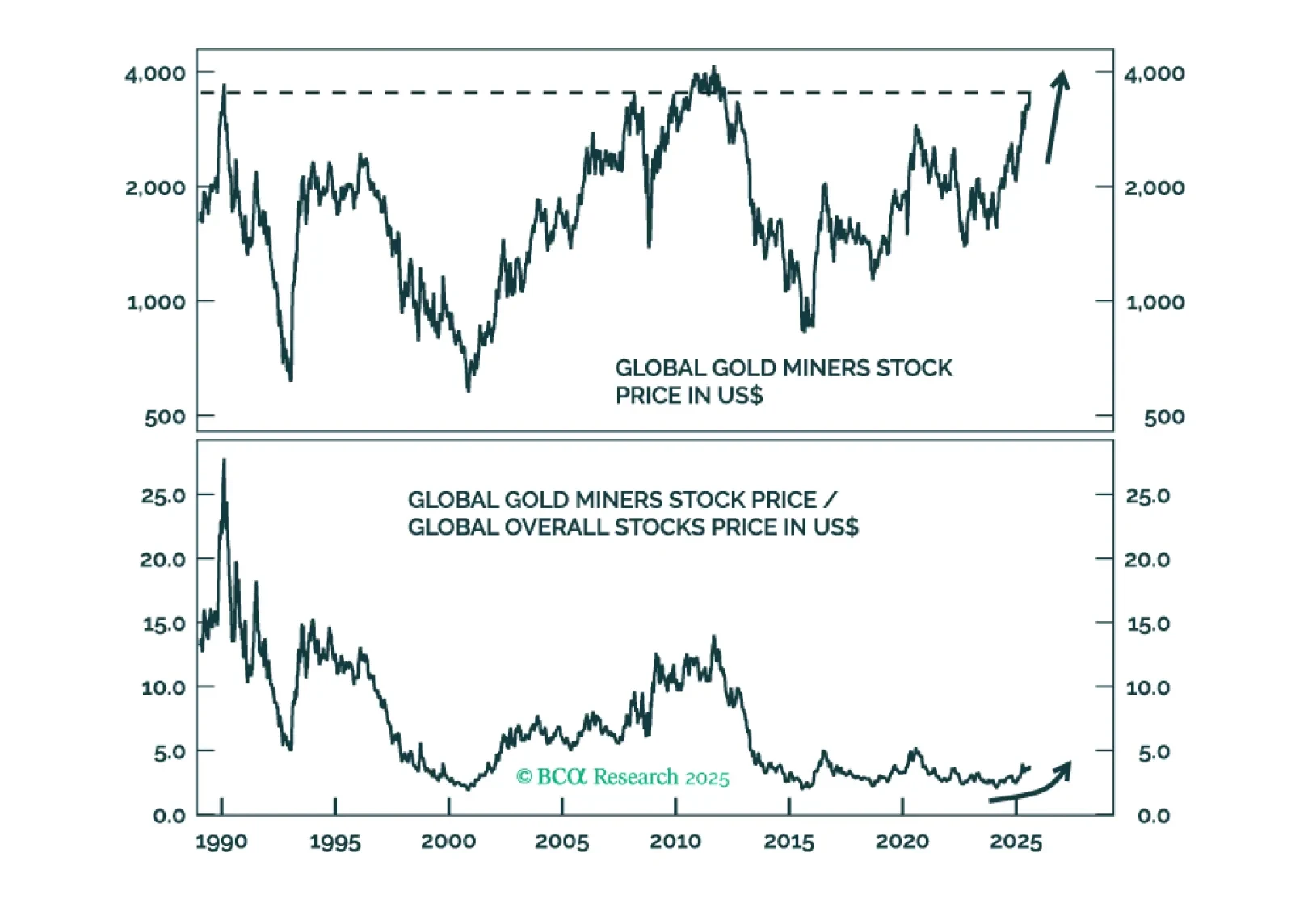

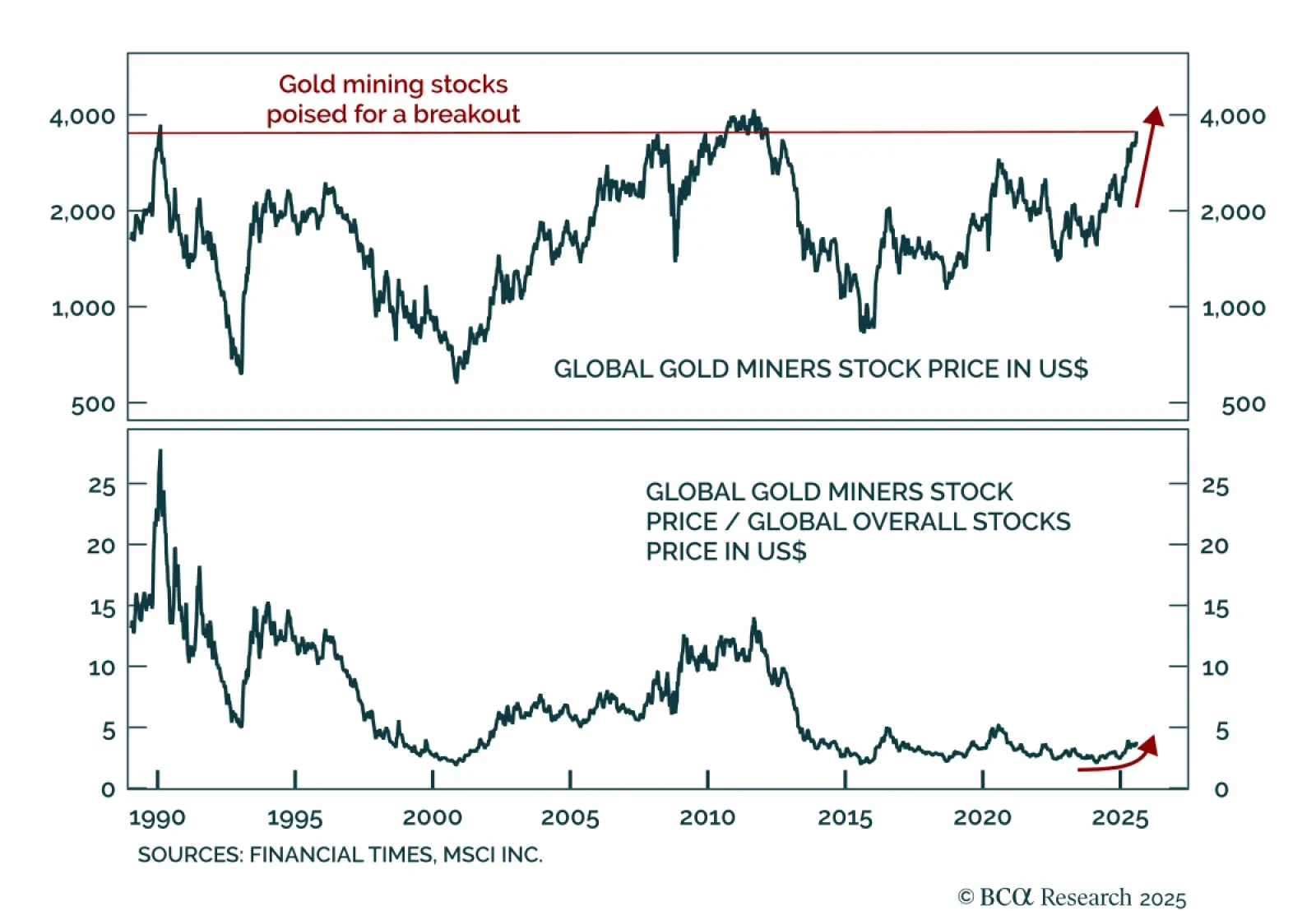

Our Commodity strategists expect gold’s consolidation to resolve in a bullish breakout; buy gold and gold mining stocks in both absolute and relative terms. The metal’s resilience despite unfavorable cyclical drivers points to a…