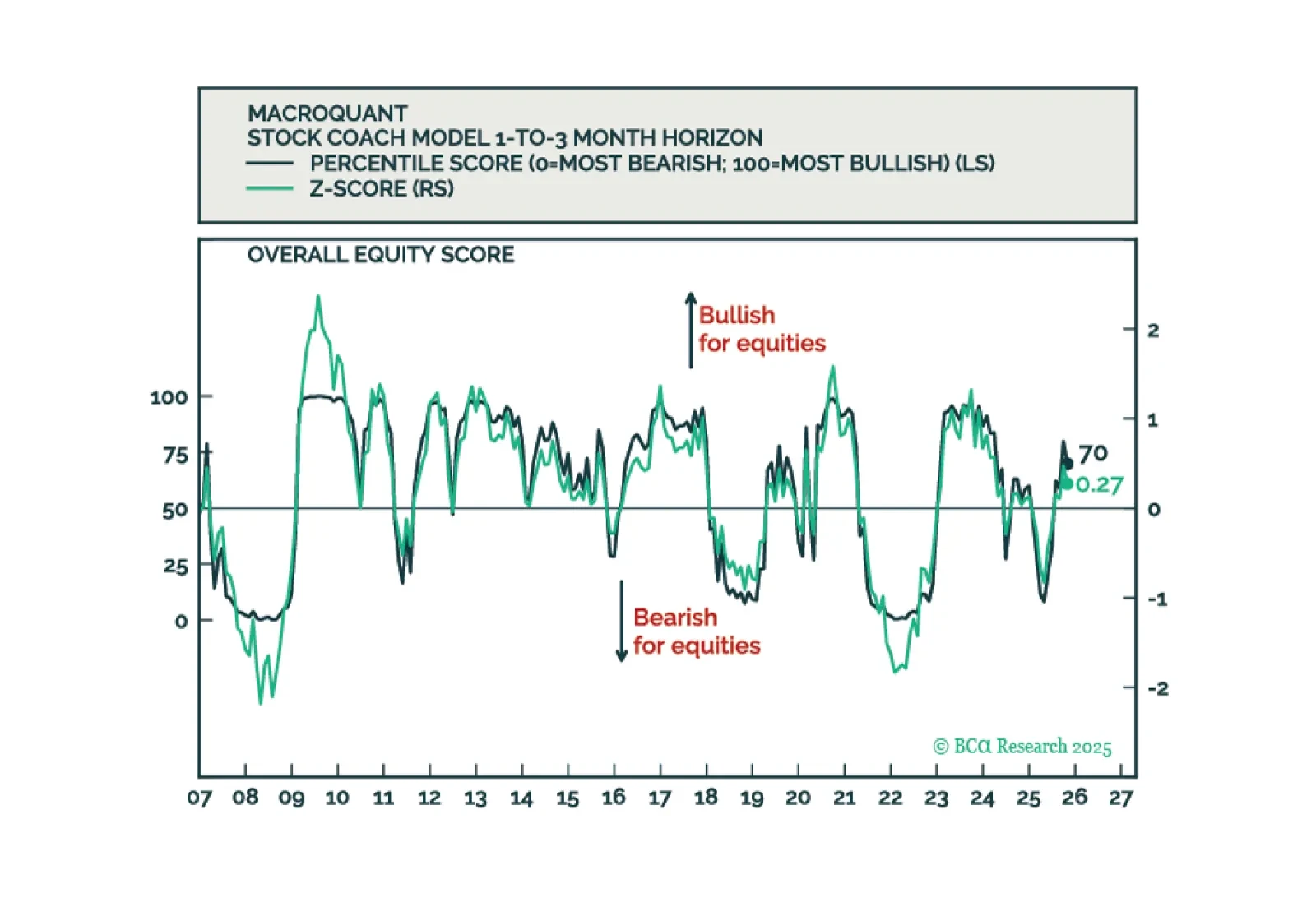

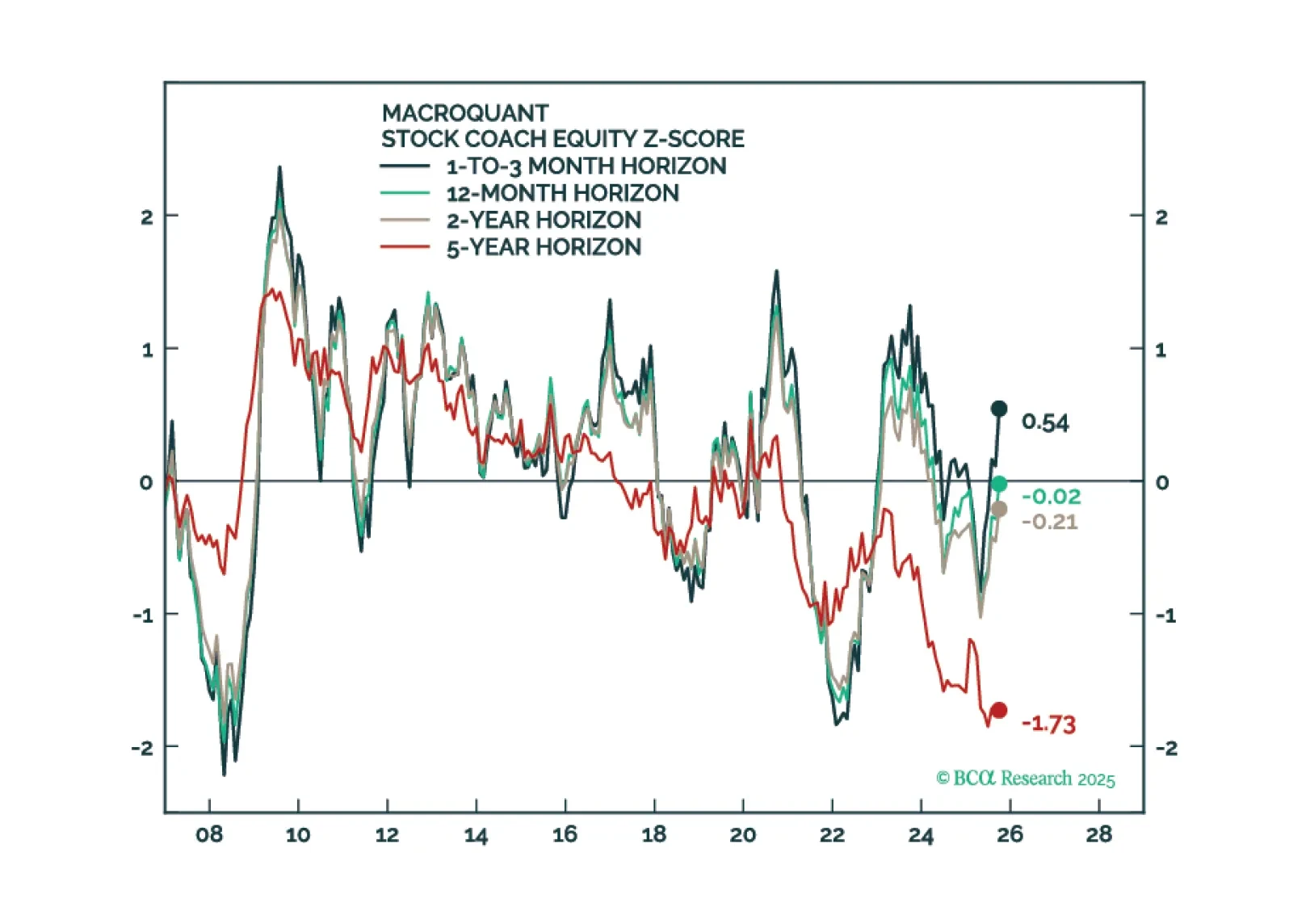

MacroQuant has downgraded equities to underweight, favors a below-benchmark duration stance in fixed-income portfolios, remains bearish on the US dollar, and is still bullish on gold.

This year, we once again present our 2026 outlook as a retrospective from the future – a future in which the AI boom turned to bust.Next week, please join me for a Webcast on Wednesday, December 17 at 10:30 AM EST (3:30 PM GMT, 4:30…

MacroQuant remains tactically overweight equities, favors an above-benchmark duration stance in fixed-income portfolios, remains bearish on the US dollar, and is bullish on gold.

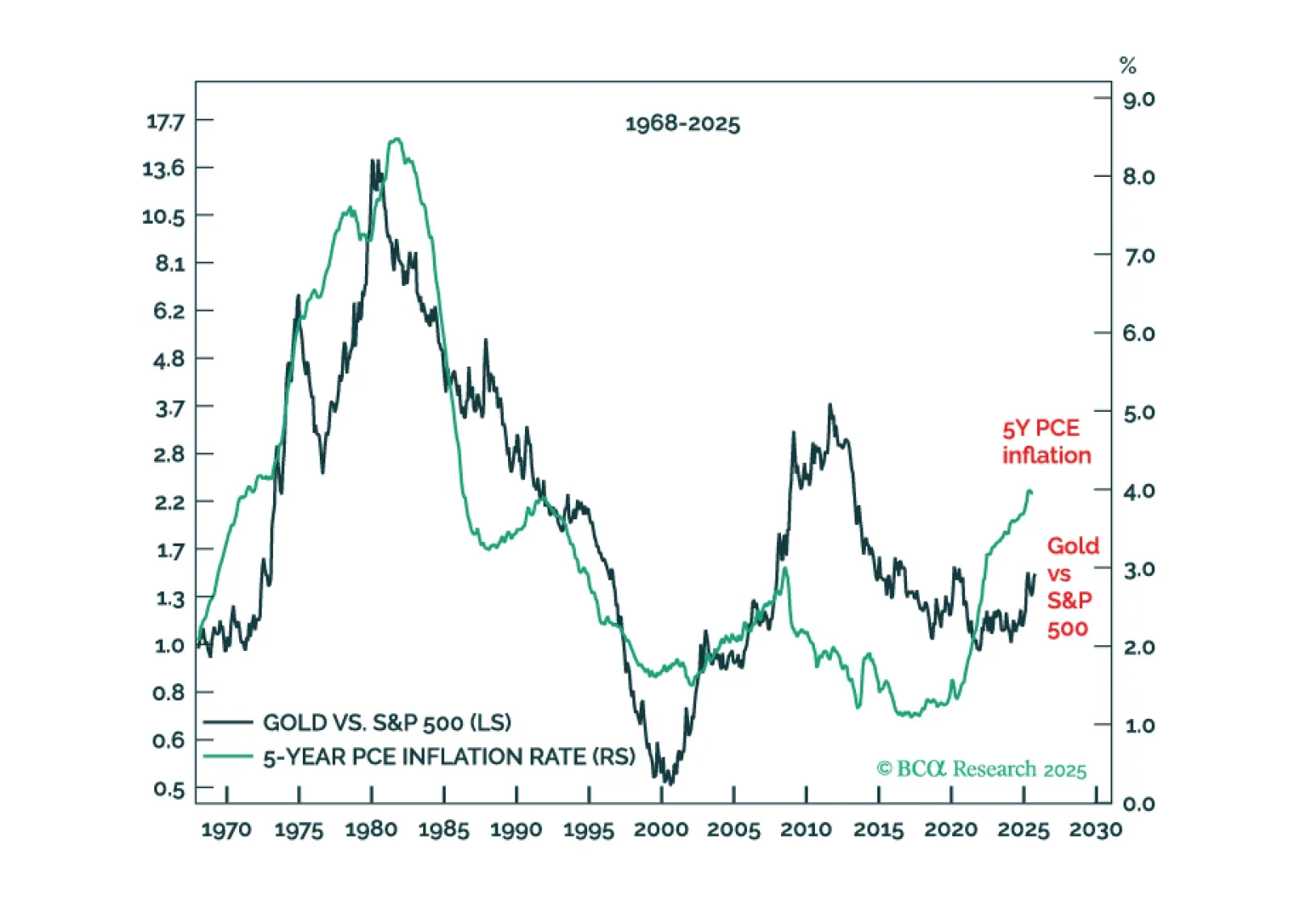

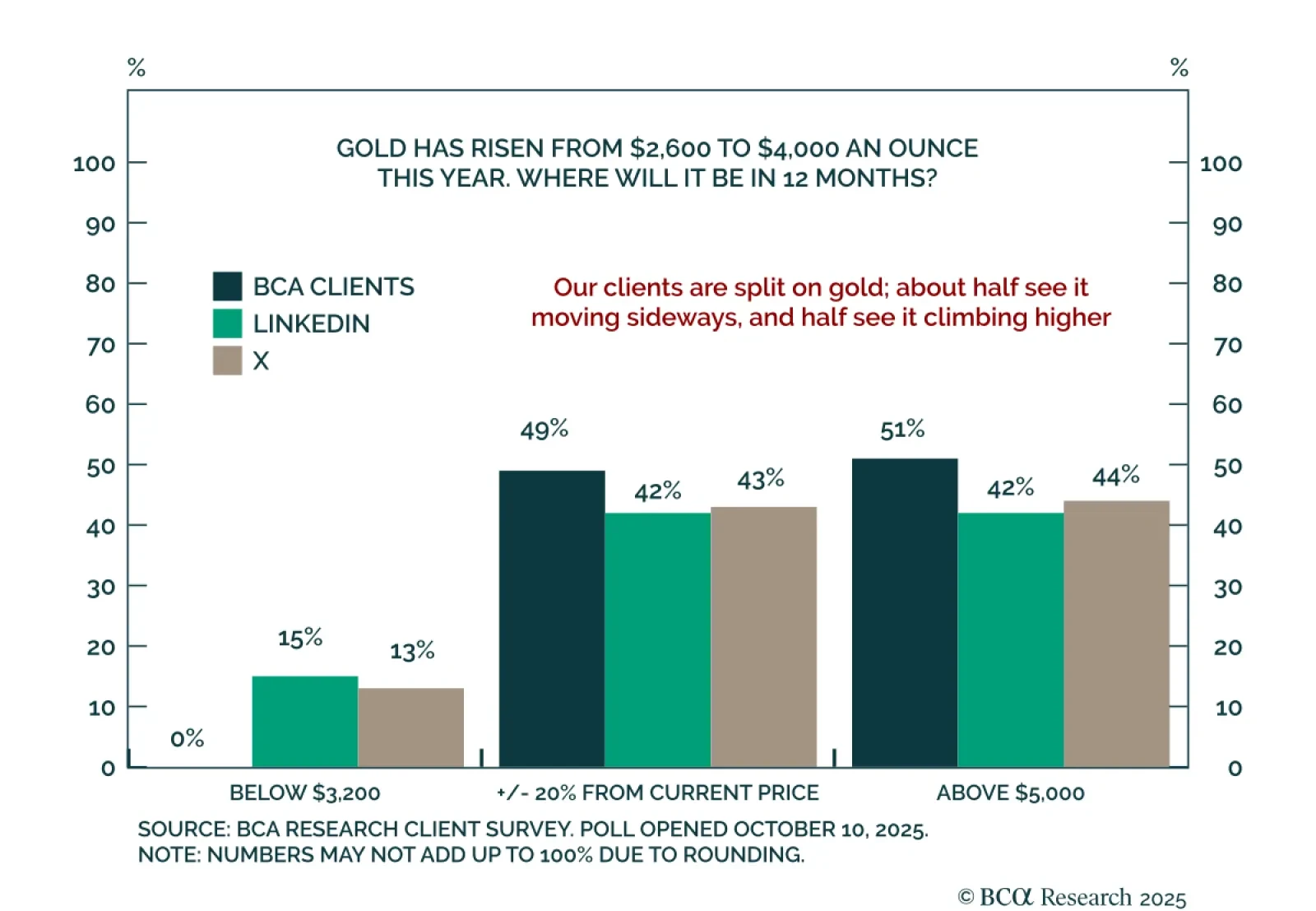

Long-term investors should own gold. The network effect that makes gold the physical ‘insurance asset’ of choice will generate long-term outperformance. But long-term investors should also own bitcoin. The network effect that makes…

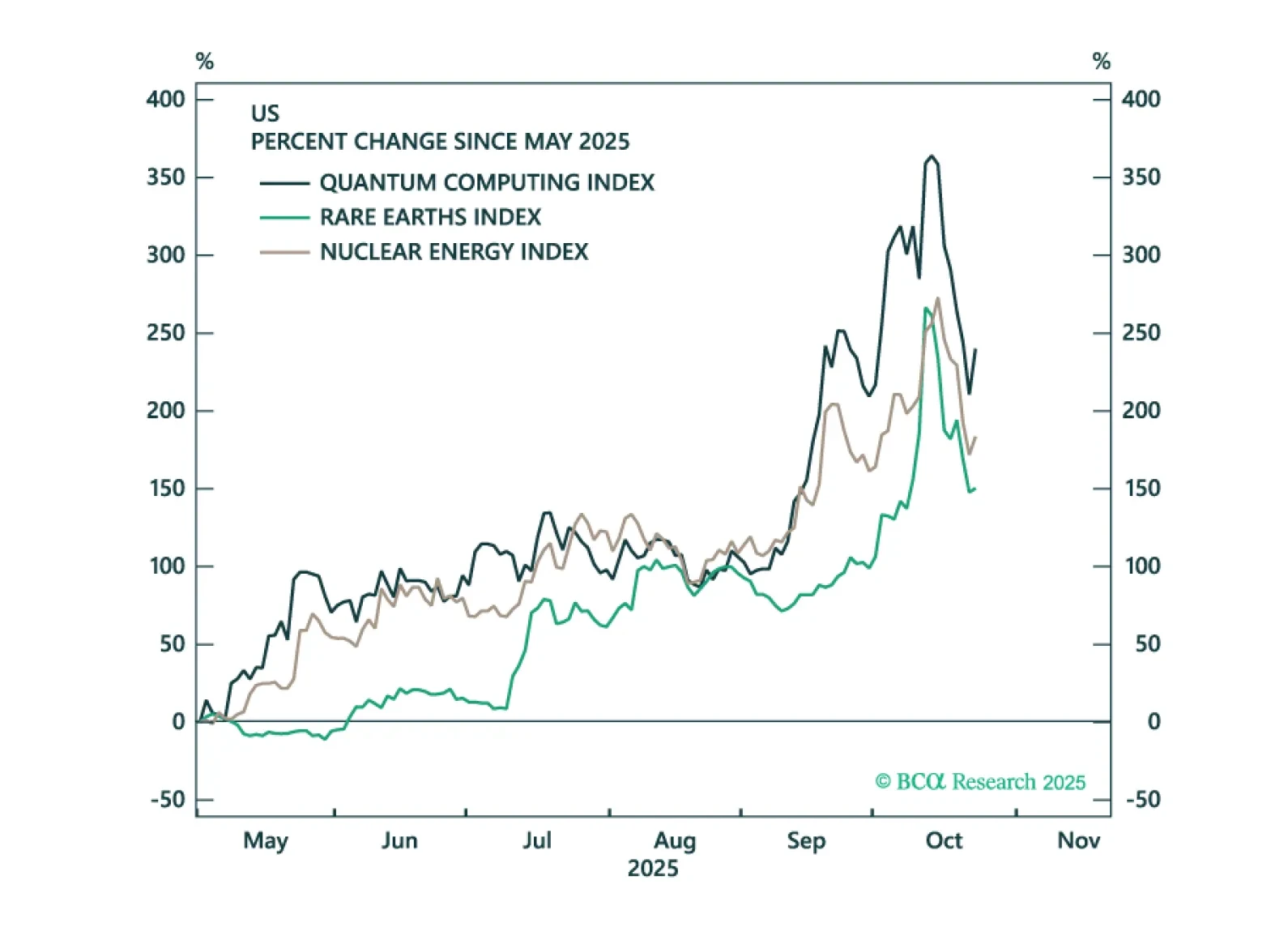

Détente between China and the US is a big deal. Economic data continues to give the Fed reasons to cut. What is there to be worried about? Very little. But we chew on some bearish thoughts as we start thinking about 2026.

MacroQuant is tactically overweight equities, favors an above-benchmark duration stance in fixed-income portfolios, remains bearish on the US dollar, and is bullish on gold and copper.

Precious metals, corporate credit, and tech stocks are all showing signs of late-cycle euphoria. We identify various trigger points that investors should monitor to turn more bearish.

More than half BCA’s Clients expect gold to be above $5,000 in a year’s time. In the latest weekly poll on the Have Your Say section of BCA's website, we asked our clients for their October 2026 gold price forecast. The gold price…