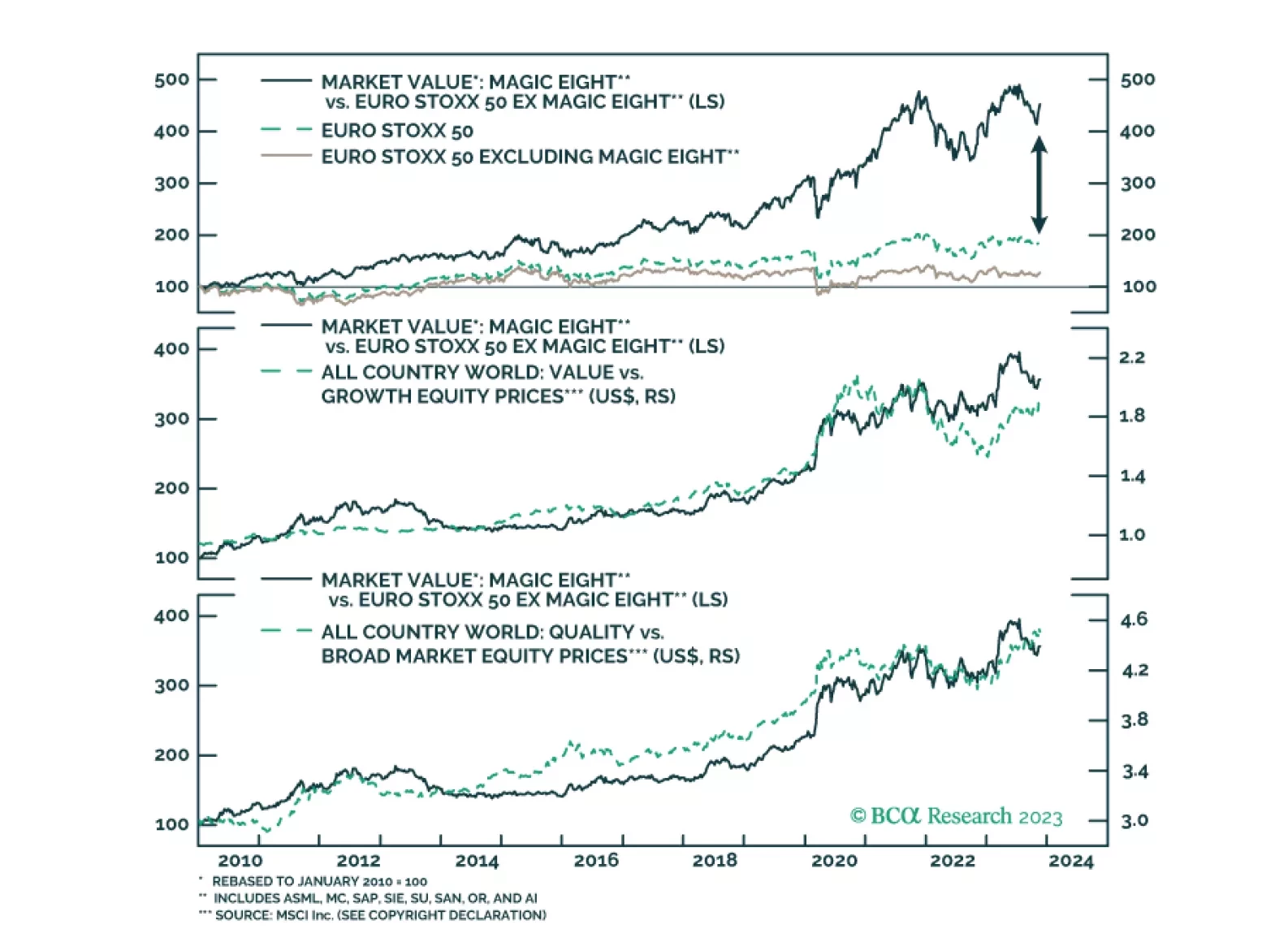

The US has the Magnificent Seven, Europe has the Magic Eight. What drives the performance of those eight stocks crucial to the European market?

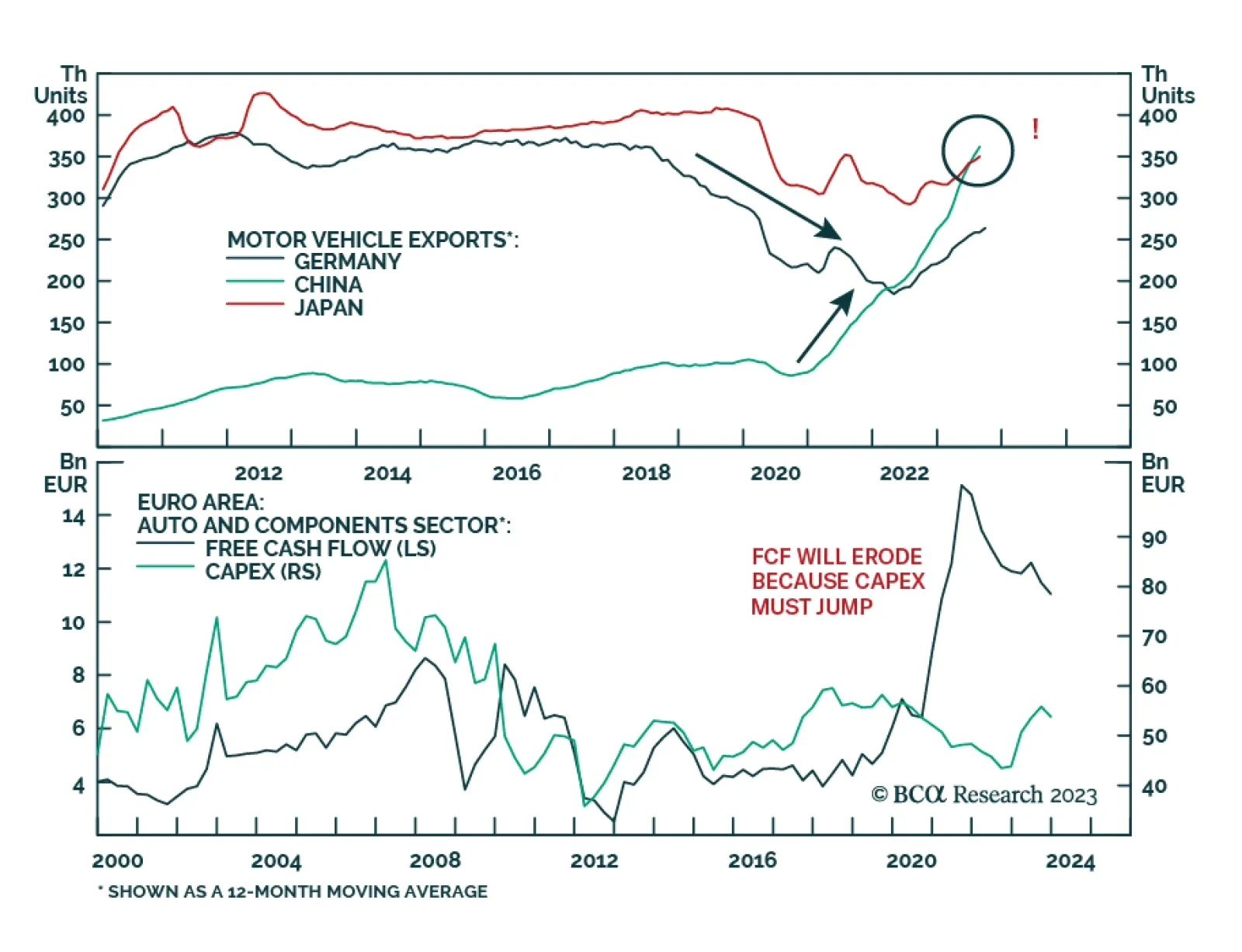

According to BCA Research’s European Investment Strategy service, European automobile and components stocks will suffer over the coming years. The European automobile and components equity sector is cheap, trading at a…

While Chinese stocks have low valuations and are oversold, their attractiveness is dampened by uncertainties in the magnitude of stimulus and the dismal outlook for corporate profits in the next six to nine months.

Falling inflation enables central banks to pause rate hikes, which is good news. But time goes on. Restrictive monetary policy, Chinese debt-deflation, energy supply shocks, US and global policy uncertainty, and extreme geopolitical…

Positive economic surprises have delayed the onset of recession in the United States. But tighter monetary and fiscal policy, slowing global growth, and a looming rebound in policy uncertainty and geopolitical risk suggest that…

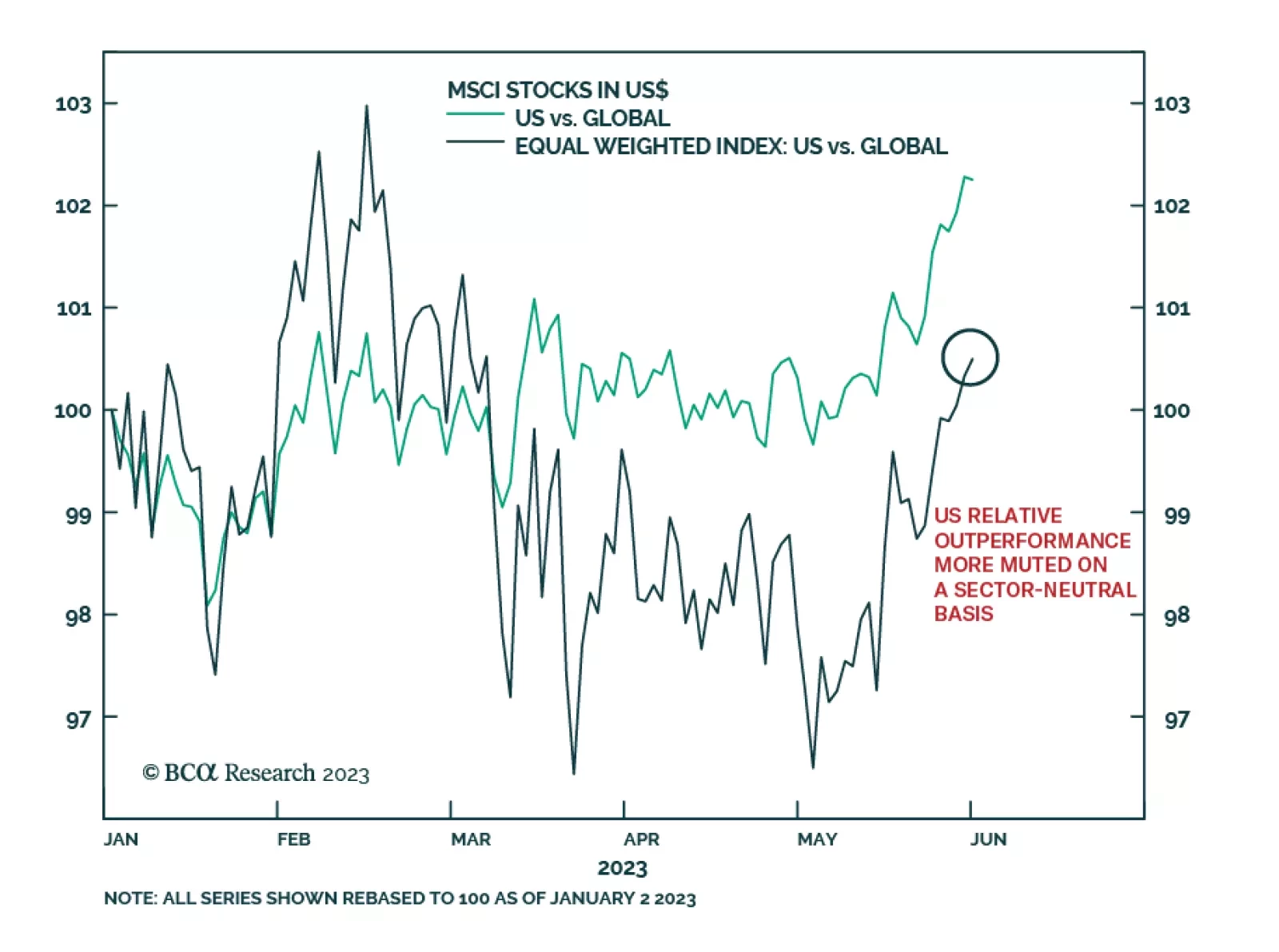

US stocks have outperformed their global peers on a year-to-date basis. The MSCI US index’s 7.5% gain since January 18 eclipses the ACW index’s 3.1% increase. This trend has recently become even more pronounced: while…

Risk assets would perform well over 12 months only if inflation falls to 2% without triggering a recession. That would be unprecedented. We recommend investors stay defensive.