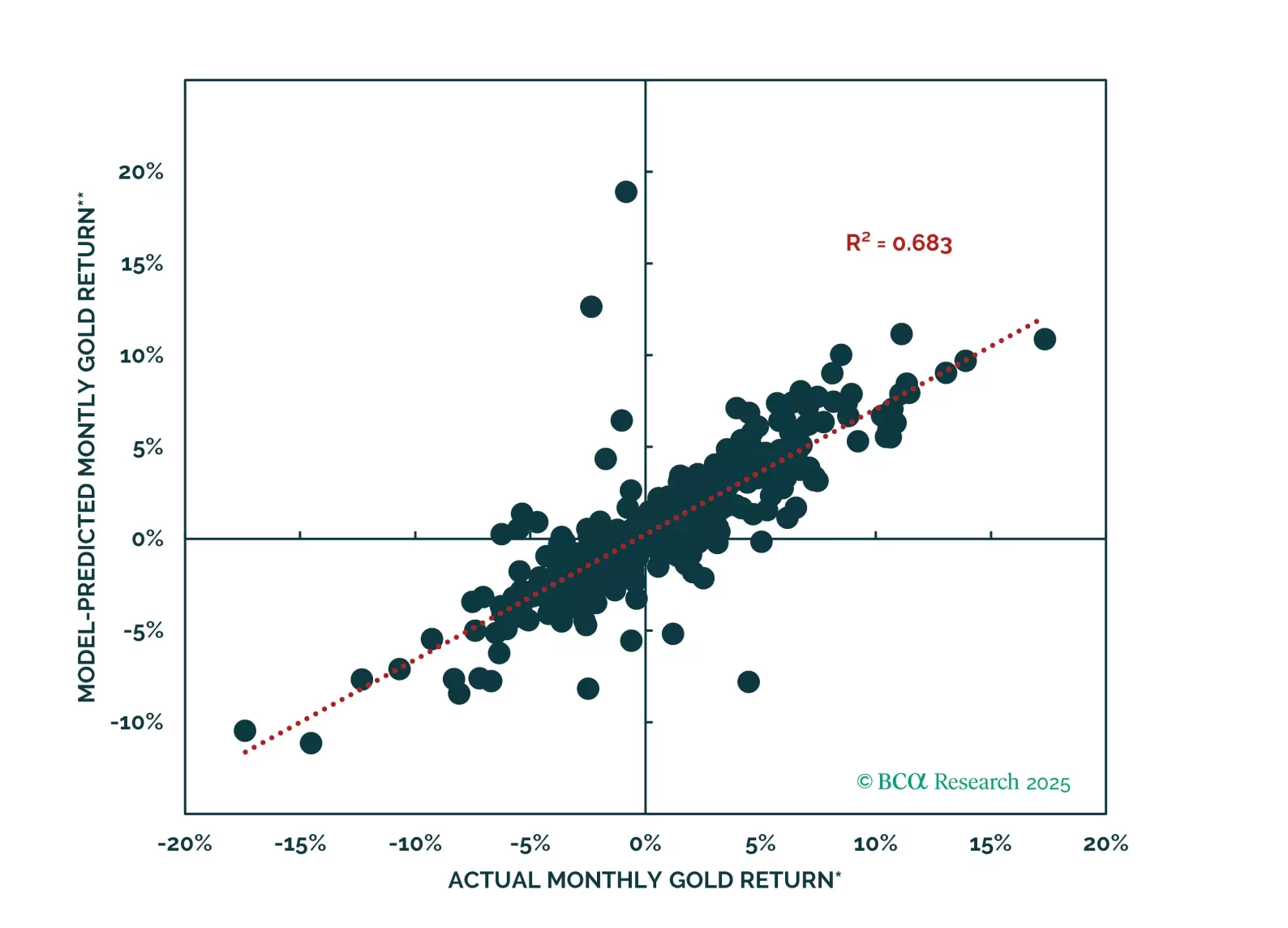

This report is our Part III series on valuation and subsequent returns, where we recalibrate our short-term models to emphasize signals over the next nine-to-twelve months. We will henceforth call these models STTM: Short Term Timing…

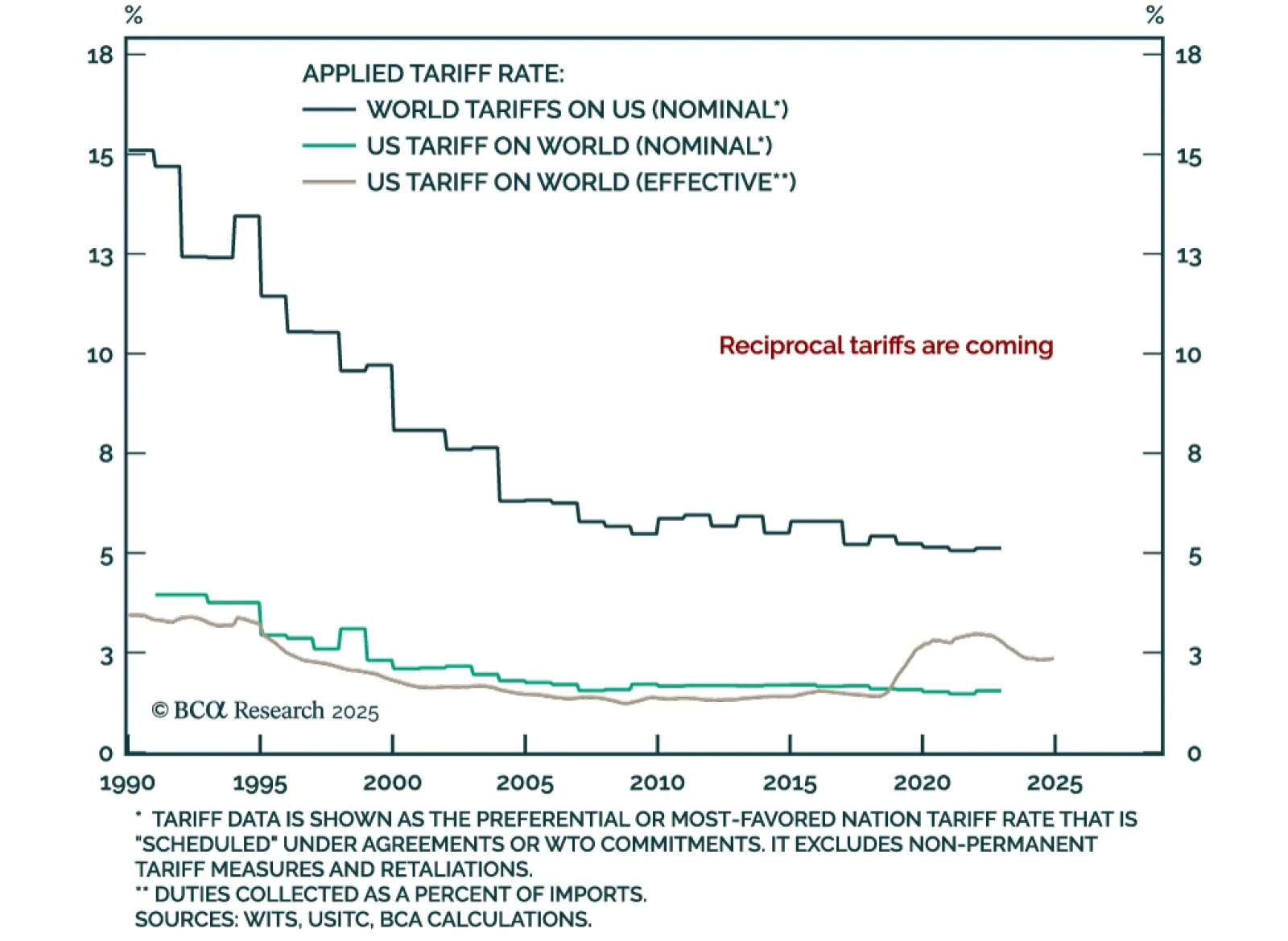

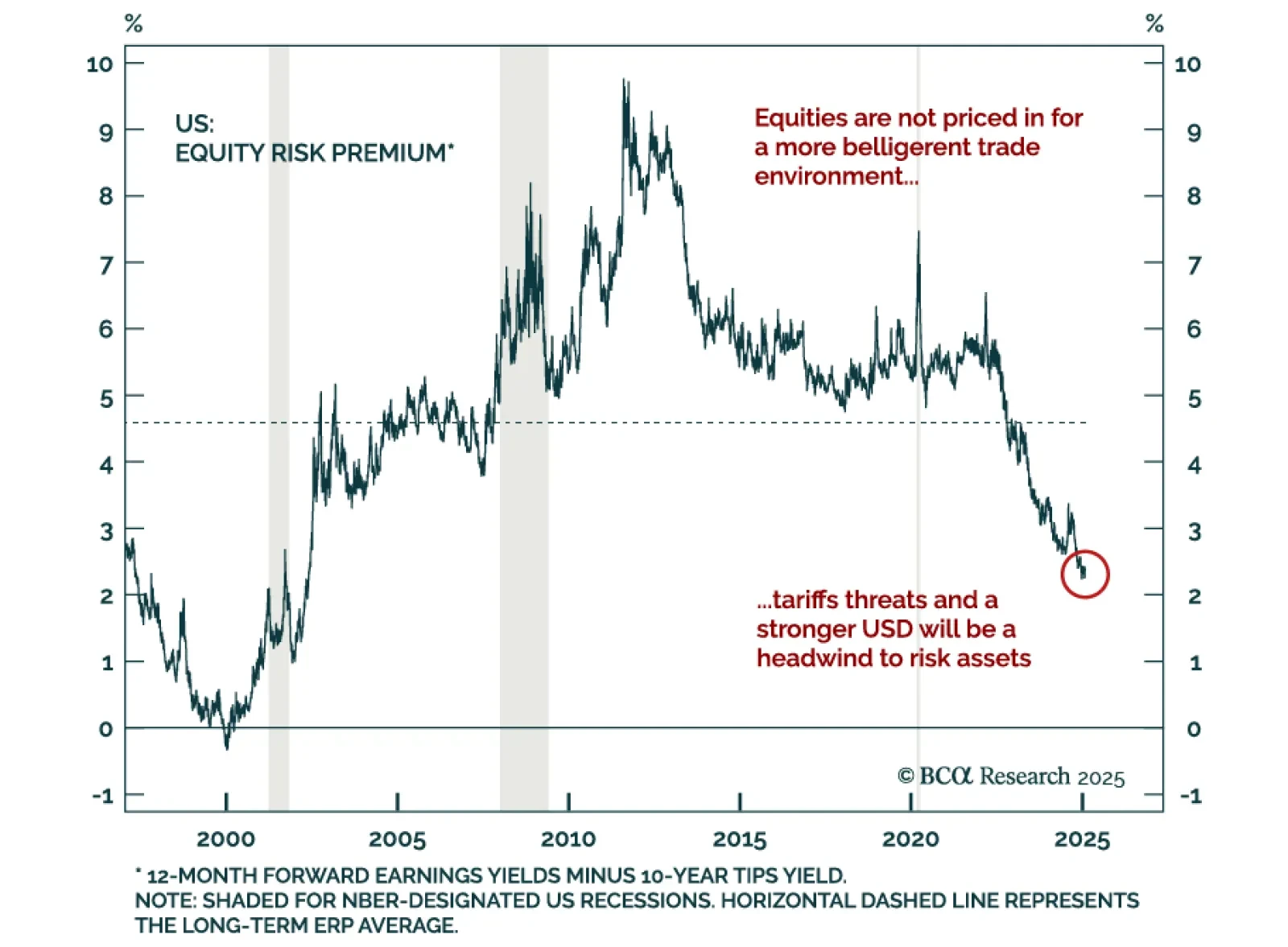

The Trump administration launched its biggest trade action on Tuesday, levying 25% tariffs on Canadian and Mexican goods, and an additional 10% to current tariffs on Chinese imports. Given its crucial role in US supply chains,…

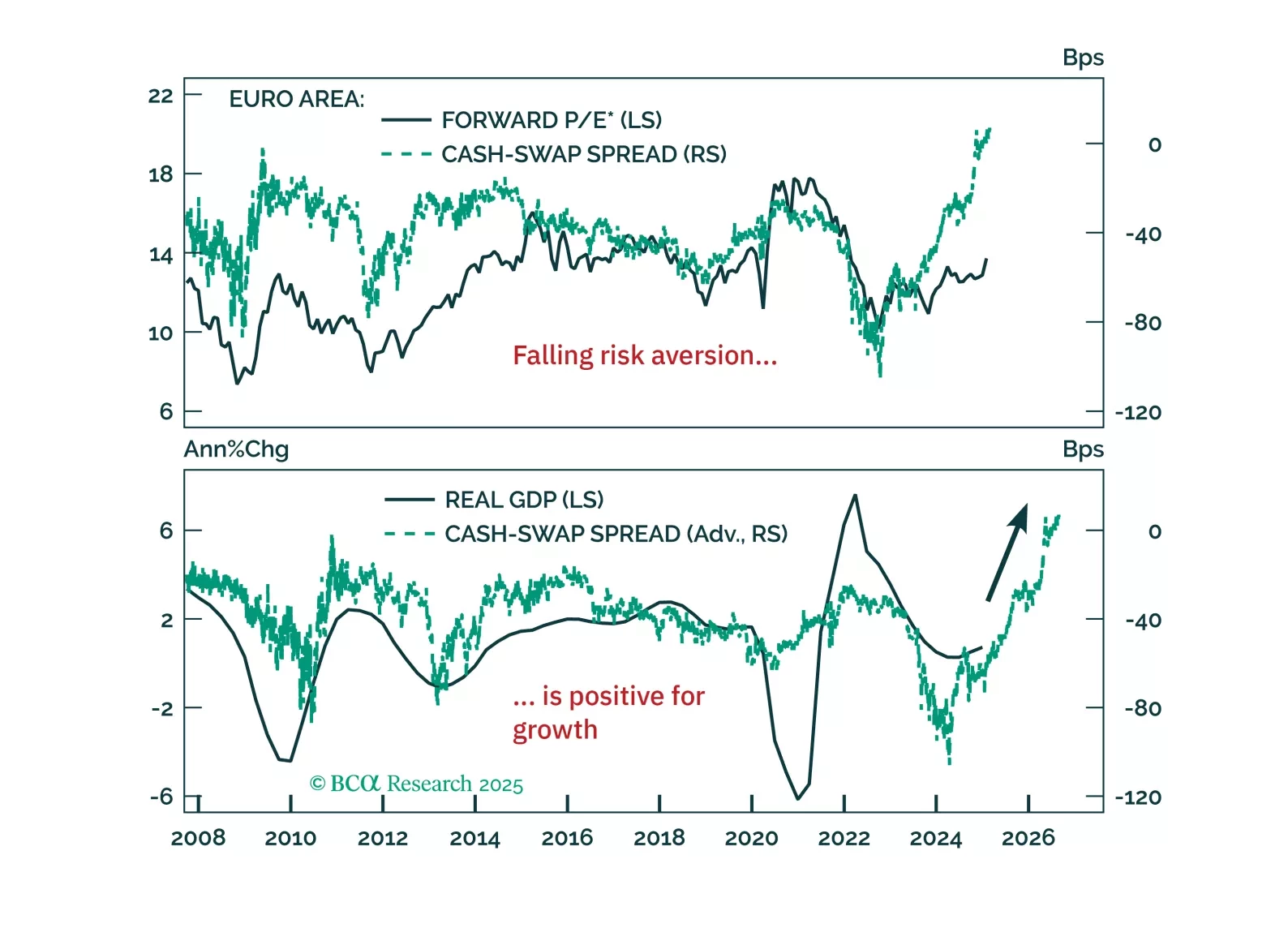

Europe’s resilience to global liquidity deterioration isn’t a fluke—it signals a structural shift. Our latest report explains why the decline in precautionary money demand marks the end of Europe’s liquidity trap and what it means…

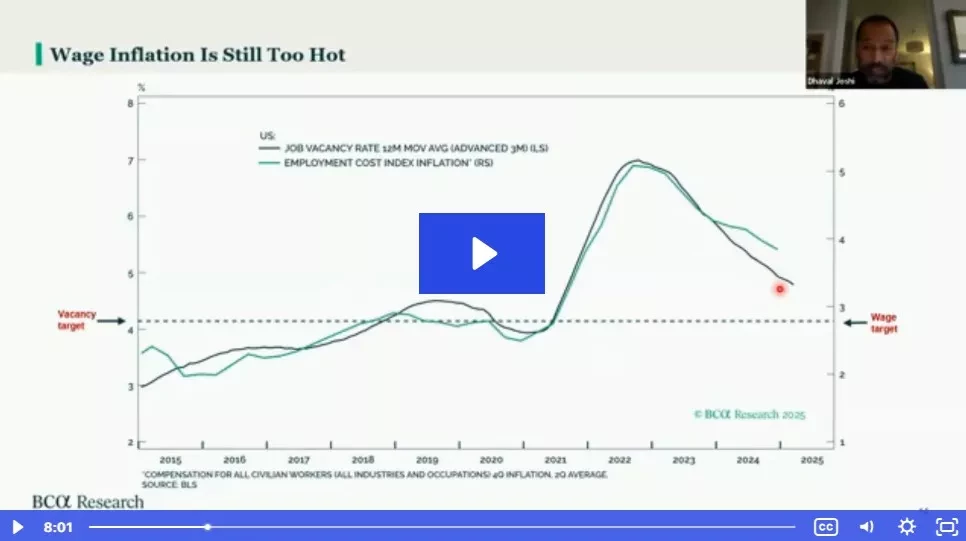

In this webcast, Dhaval will give an update on his key views for 2025. The discussion will include:

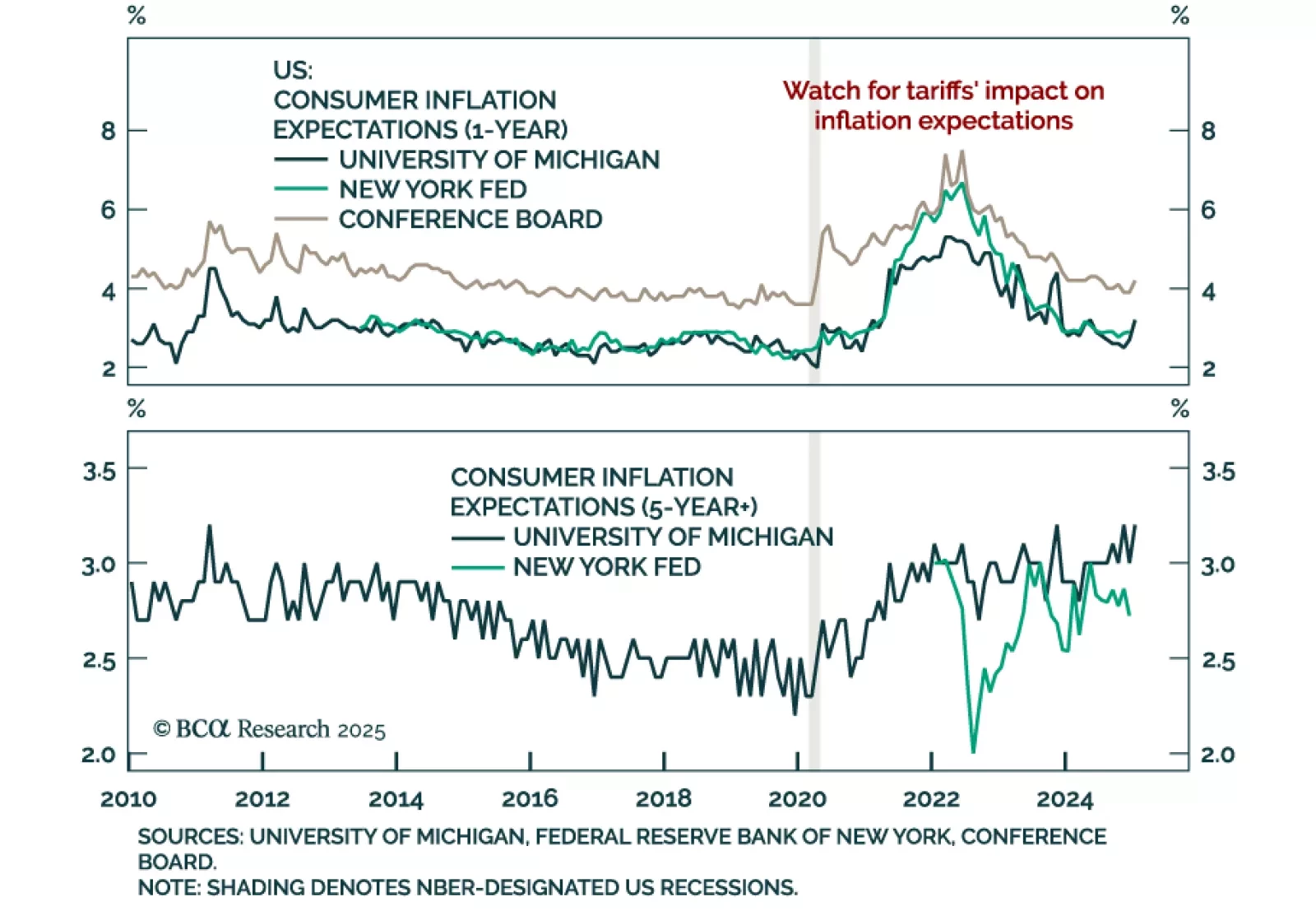

Why the US is heading into ‘mini stagflation’.

Why the BoJ must hike interest rates, and the global consequences.

The outlook…

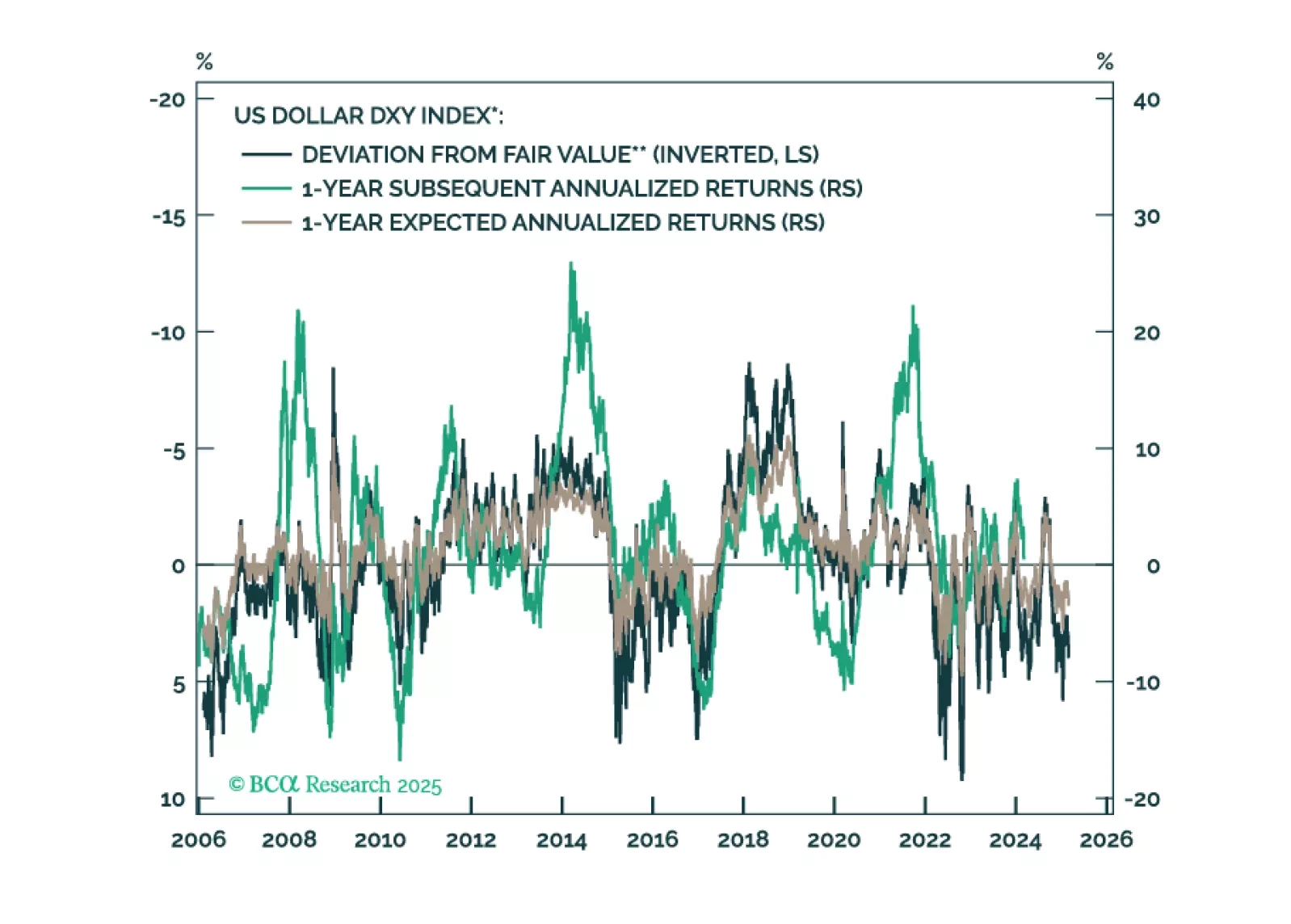

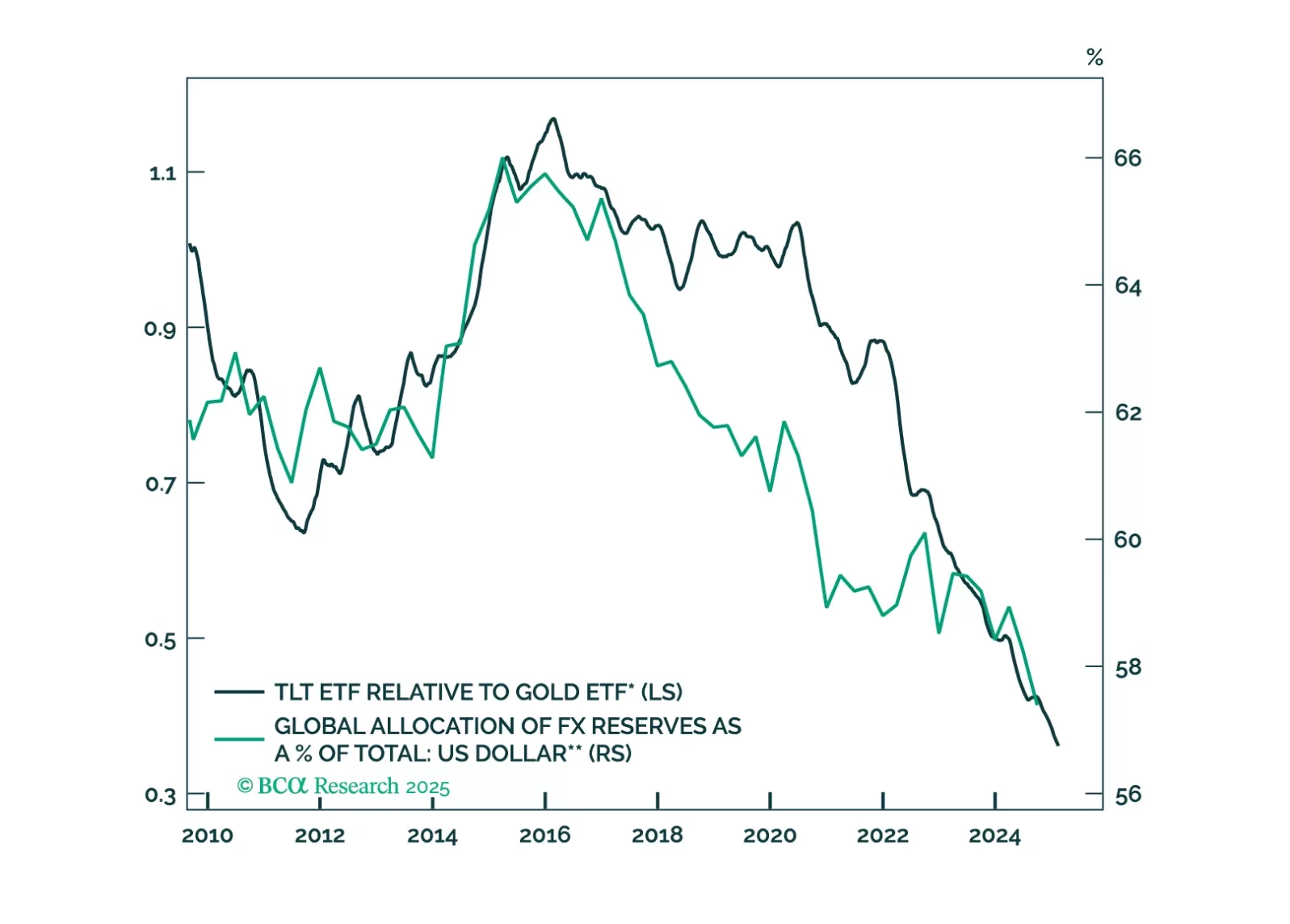

In lieu of all the geopolitical and economic news in media, this report looks at where next the dollar is likely to trend in the next one-to-three months. Our view is down, though on a cyclical horizon (six-to-twelve months), we…

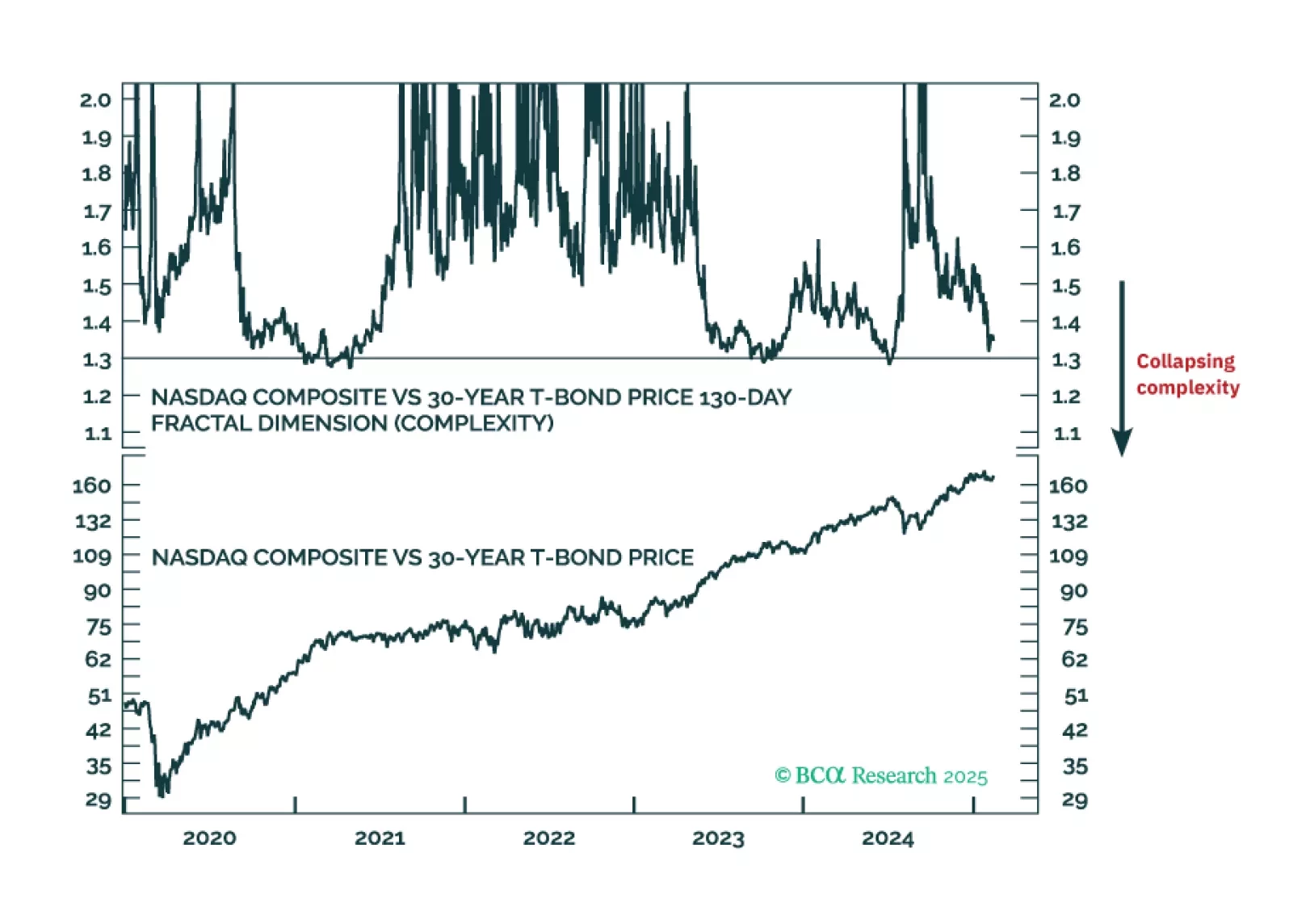

If the 130-day complexity of the Nasdaq versus 30-year T-bond collapsed to 1.30, it would signal the risk of a -20 percent market slump. This indicator, at 1.37, is not yet at critical, but we recommend that you keep a close eye on…

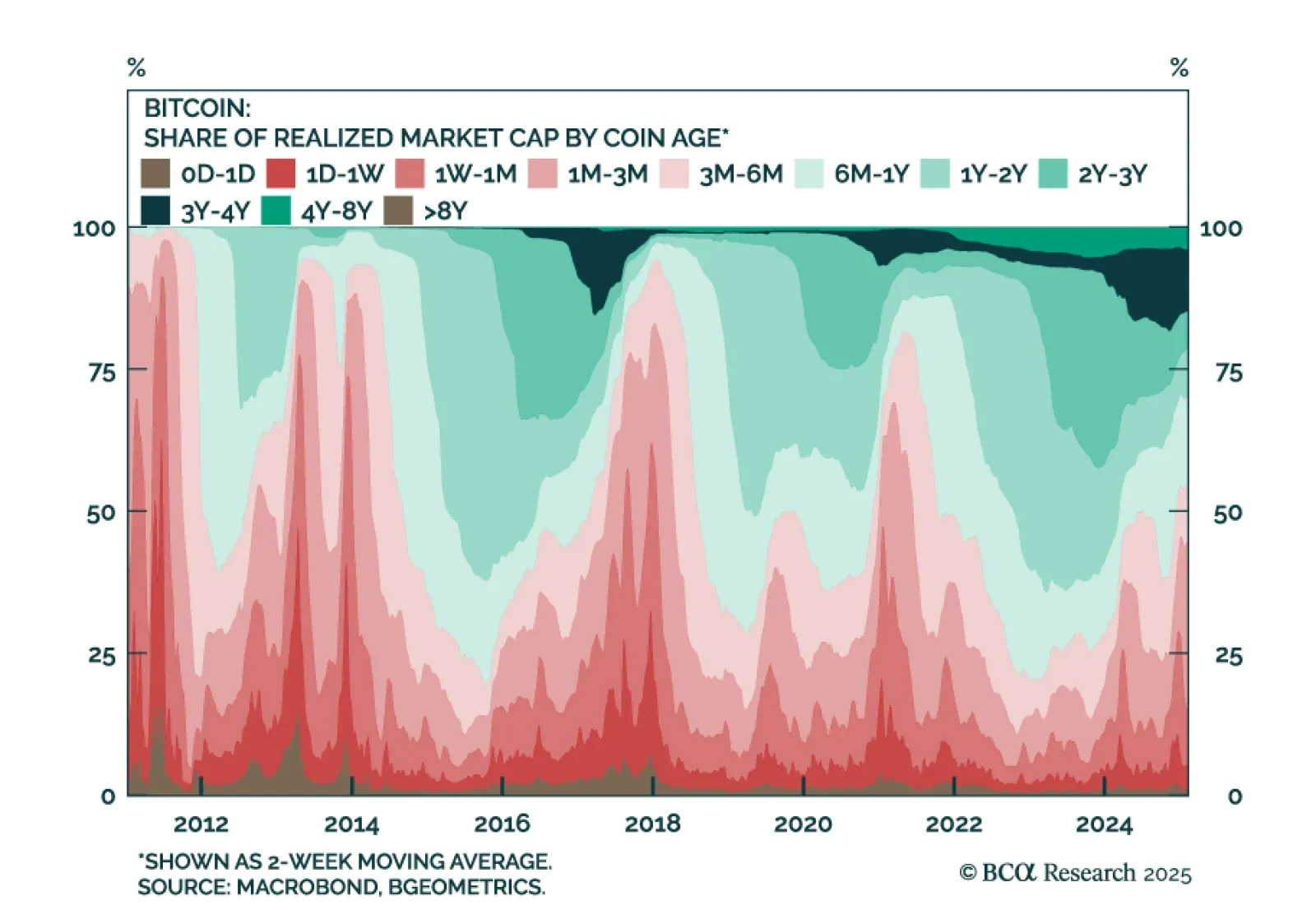

Our Global Asset Allocation strategists assessed the current cryptocurrency environment, and pared back their bullish view on this asset class. In early 2023, our colleagues took a bullish stance on crypto, ahead of the broader…

Trade tensions muddy the outlook for global central banks. The 2010s were an era of low growth and low inflation that called for easy monetary policy. The post-COVID era has been marked by overheating and high inflation calling for…

President Trump shot the opening salvo of his second trade war, announcing 25% tariffs on Canada and Mexico, with a more modest 10% on China and Canadian energy. Both countries retaliated with tariffs and non-tariff measures.…