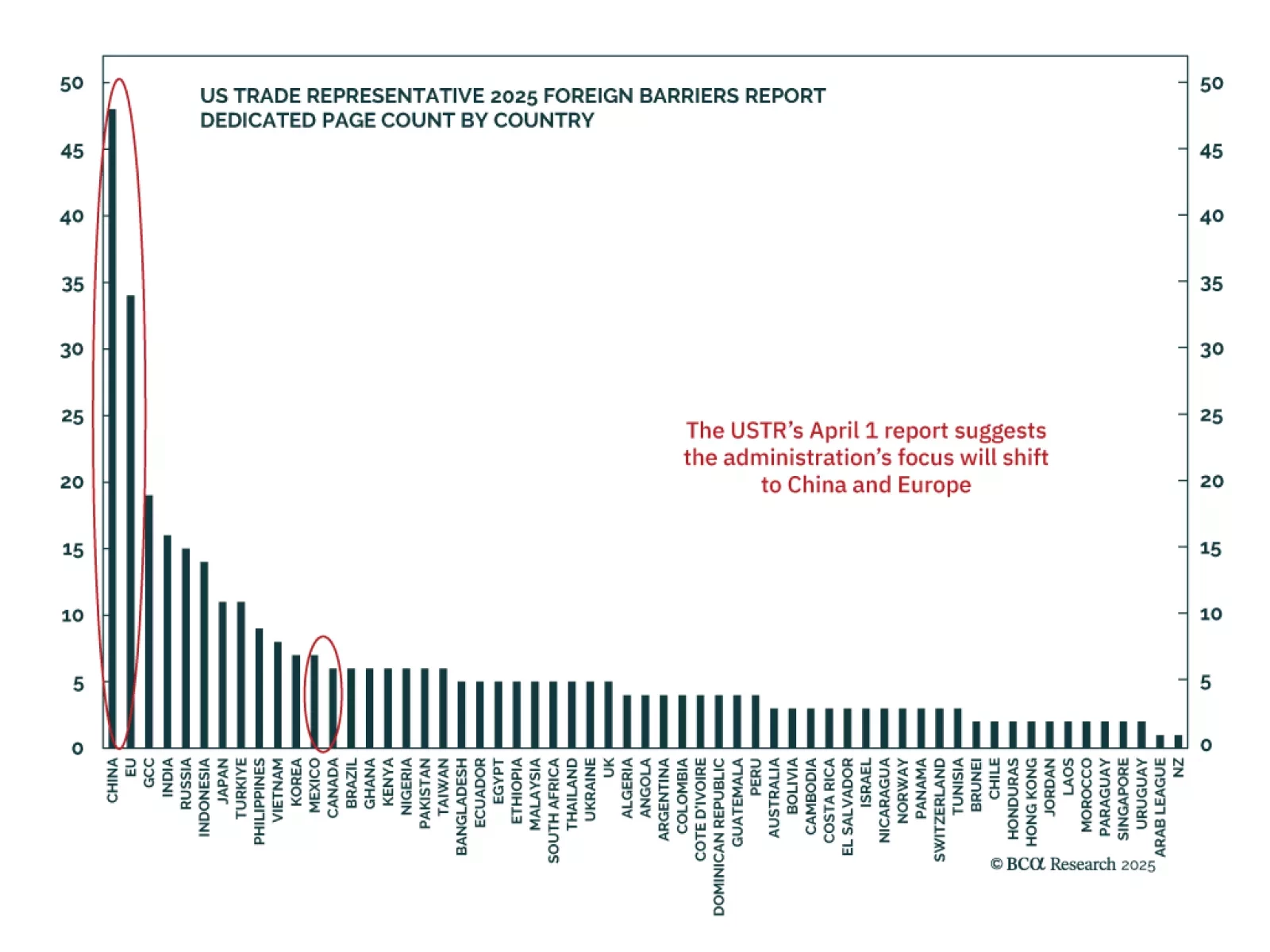

April 2 may mark peak trade tensions, but the path forward remains highly uncertain, supporting our underweight on risk assets and industrial commodities. The USTR’s long-awaited report on trade barriers will guide the next phase of…

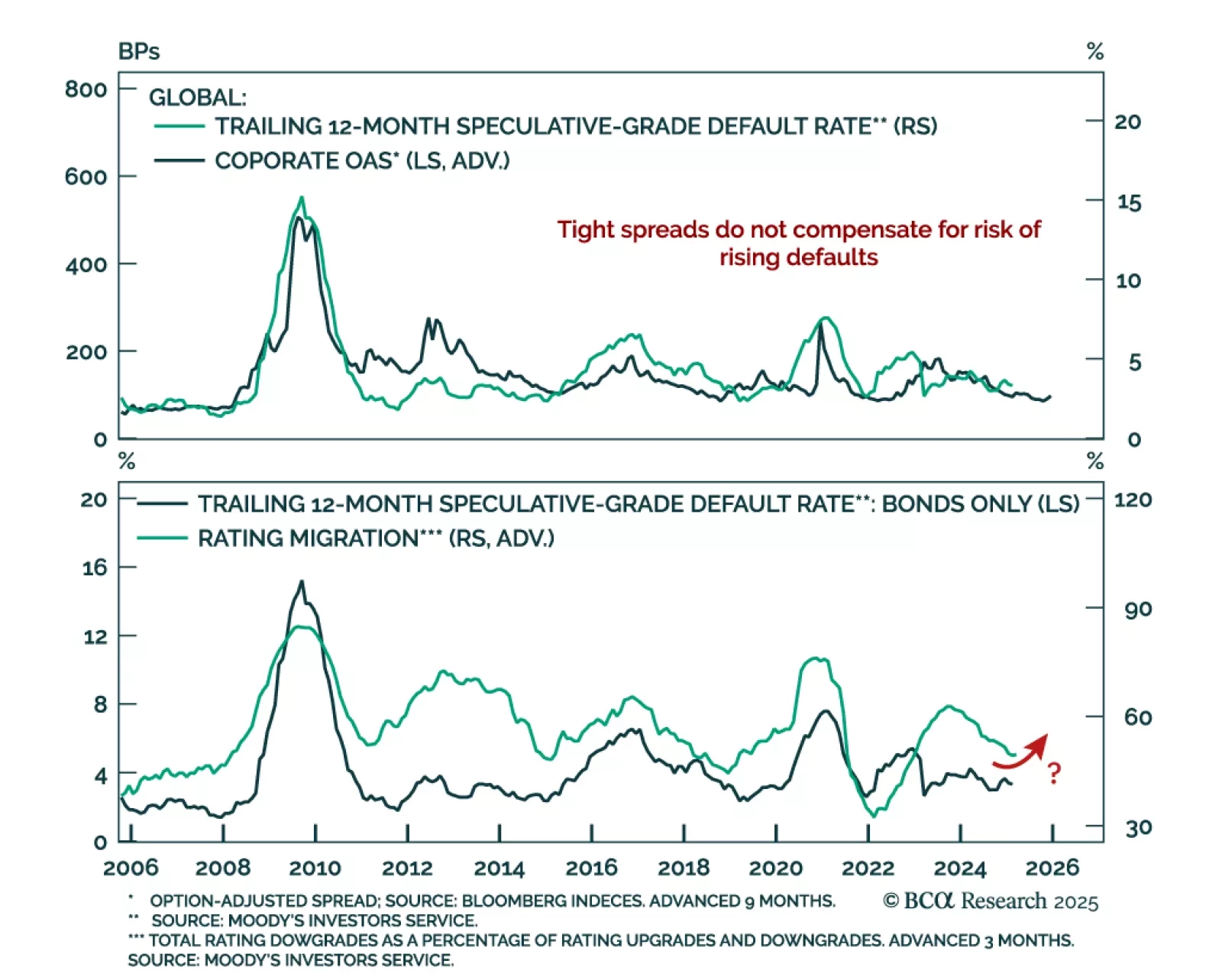

Our Global Fixed Income strategists recommend maintaining an underweight allocation to corporate credit versus government bonds in global fixed income portfolios. Within corporates, they are neutral on the US, UK, Japan, and…

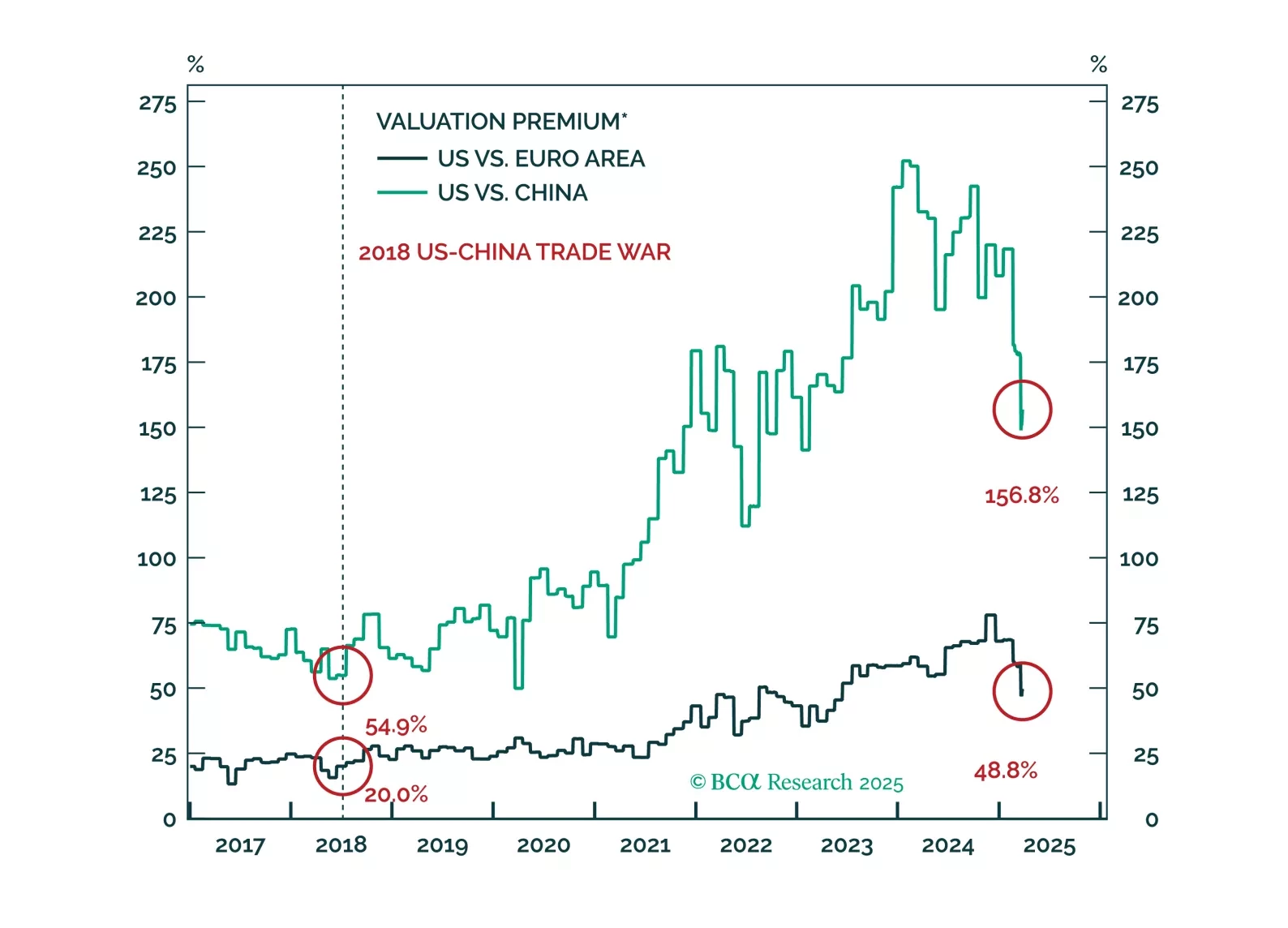

Trump’s foreign policy has been the focus for investors over the past few months. But is it really the underlying cause of the selloff? Market dynamics suggests that tariffs have only been a catalyst. In our view, investors should…

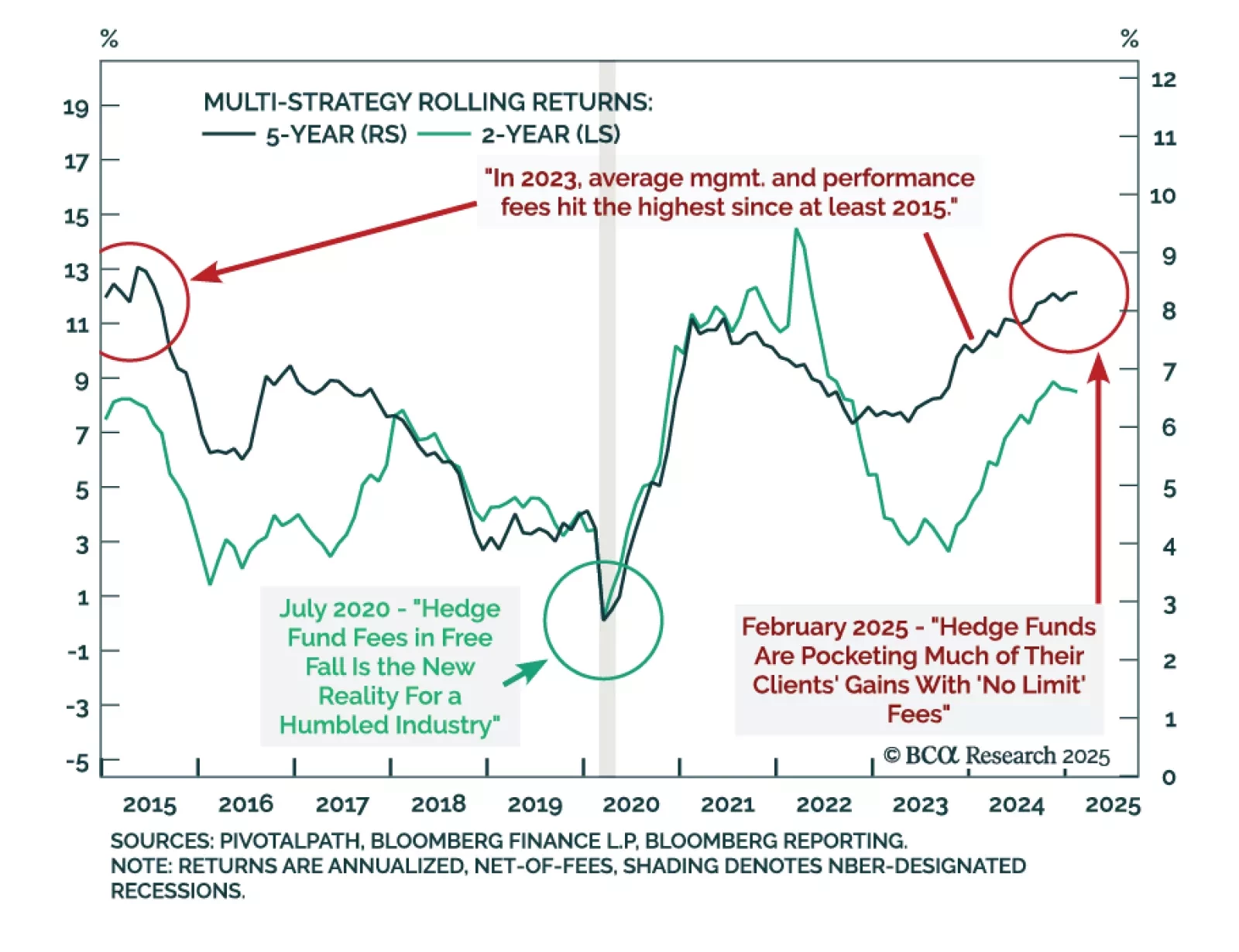

Our Private Markets & Alternatives strategists remain structurally positive but cyclically underweight on Multi-Strategy Hedge Funds. While these funds have delivered consistent alpha and valuable diversification, current market…

Markets may be bracing for April 2, but the real surprise could be how unsurprising it ends up being. Our Chart Of The Week comes from GeoMacro Chief Strategist Marko Papic, who sees the looming tariff salvo as the peak of de-…

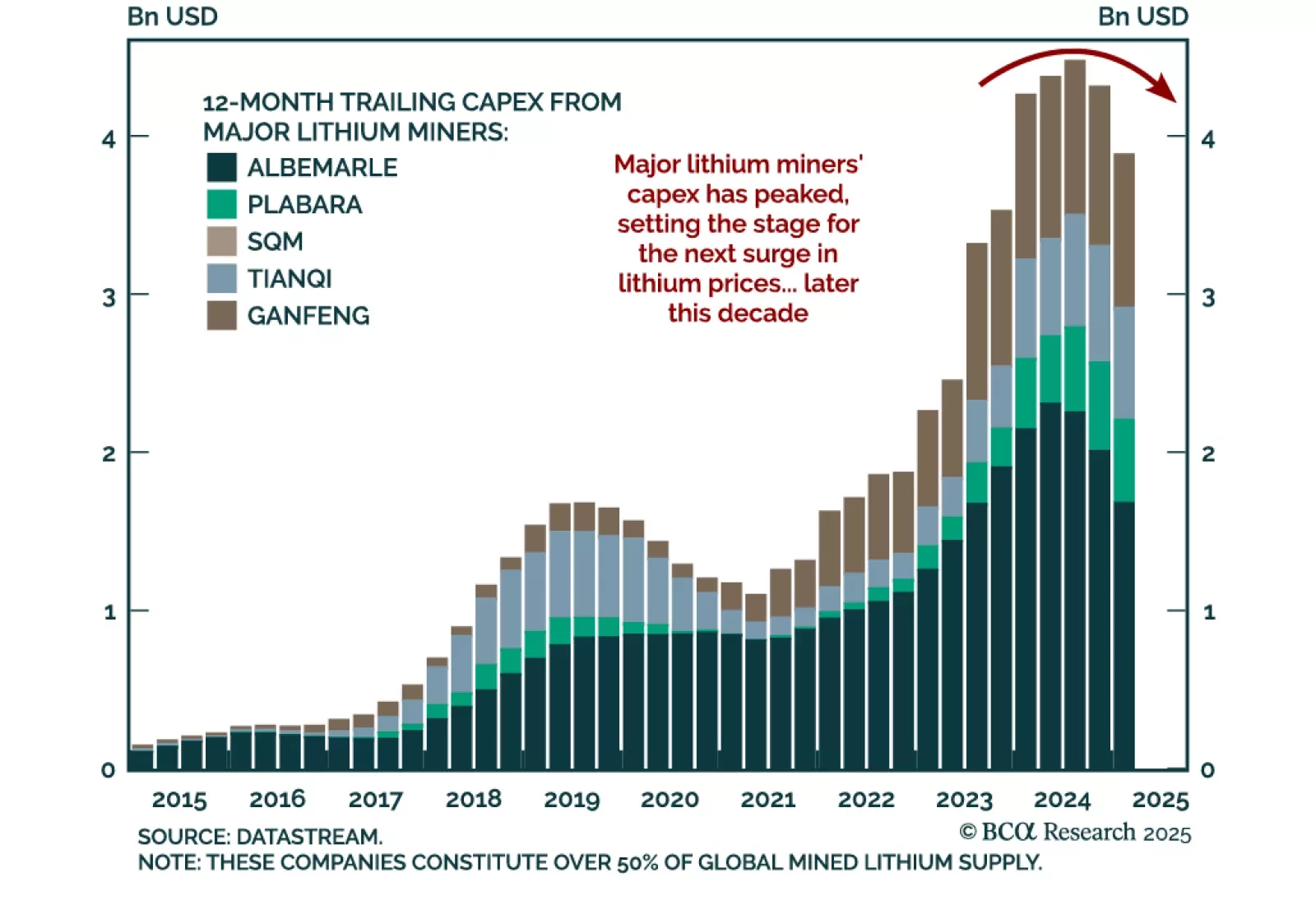

Our Commodities Strategy team advises against positioning for a near-term rebound in lithium prices, given the current headwinds from soft EV sales growth. They recommend patience, with more compelling opportunities likely to emerge…

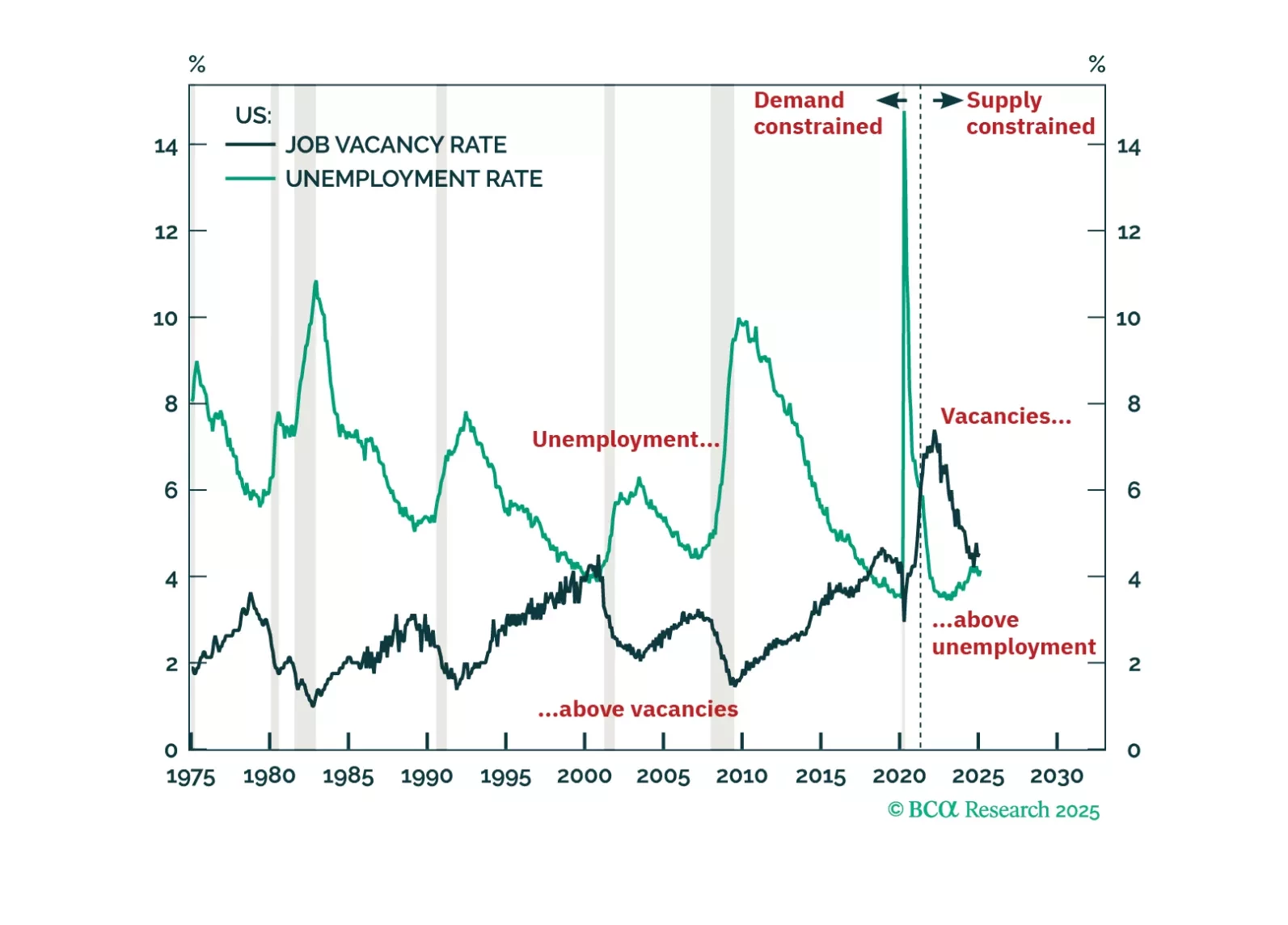

The US economy has never entered a demand-driven recession without labour demand running below labour supply and without the job vacancy rate running below the unemployment rate. Right now though, US labour demand is still running 1.…

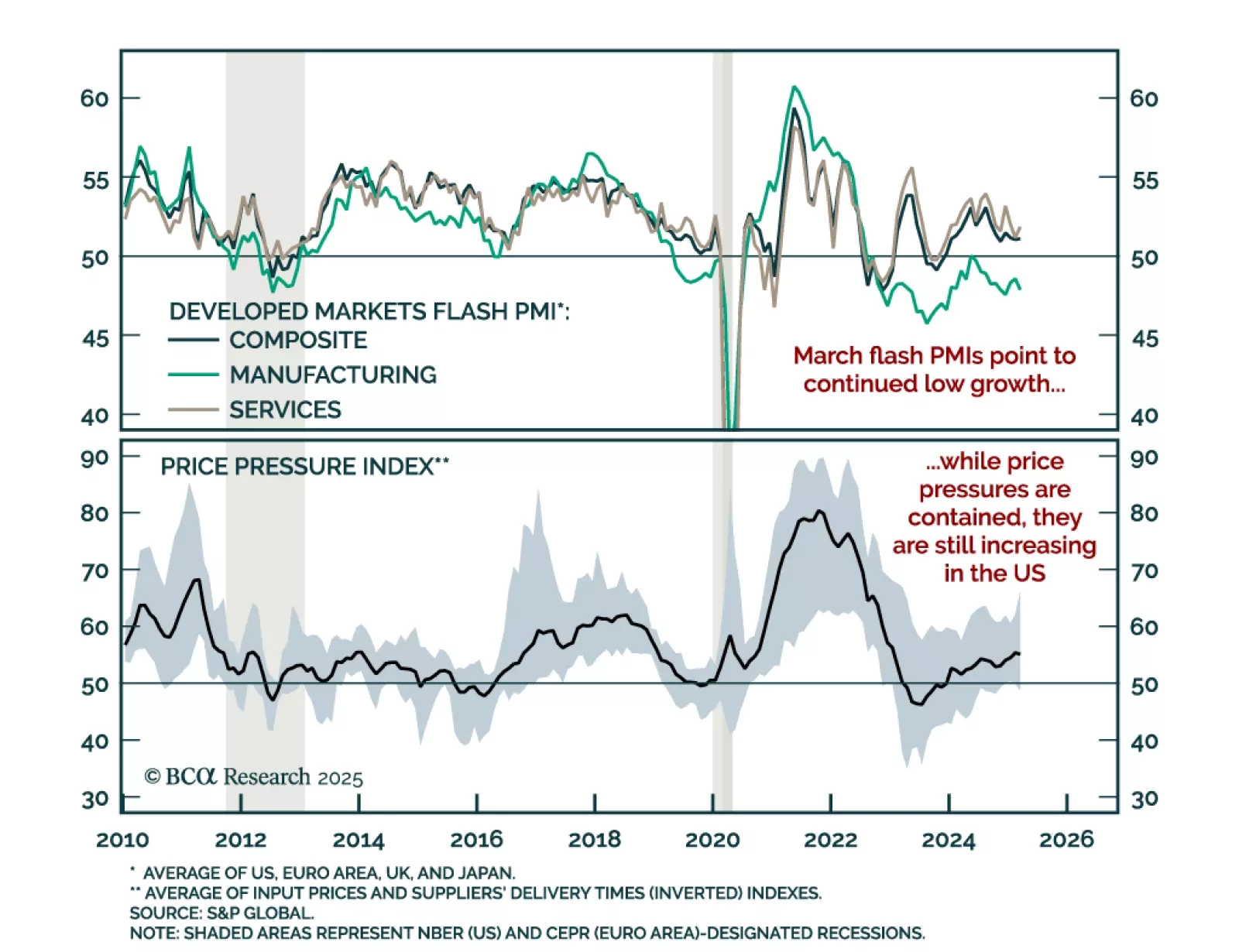

The March PMIs point to a low growth buffer outside the US as uncertainty engulfs the global economy. Aggregate price pressures were contained in March, but input prices still increased in the US. While the market reaction was risk-…

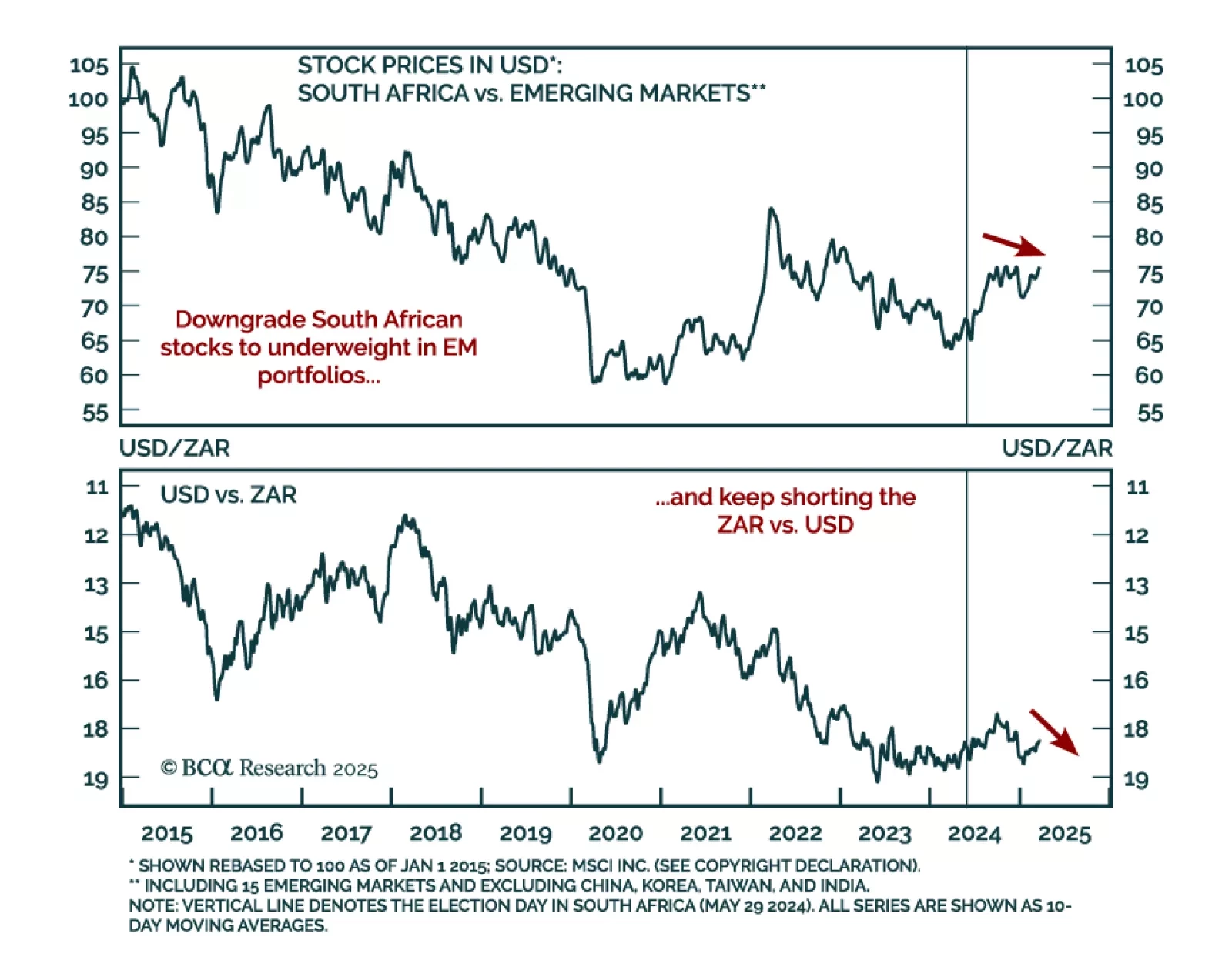

Our Emerging Market strategists reviewed their recommendations on South African assets as economic prospects start fading. South Africa’s fiscal tightening will suppress growth without achieving the necessary 4.2% primary…

Gold is testing the $3,000/oz level. The yellow metal had a great run, outperforming every DM currency for the past few months. Despite rising real yields since the beginning of the year, gold prices are up nearly 15%.The…