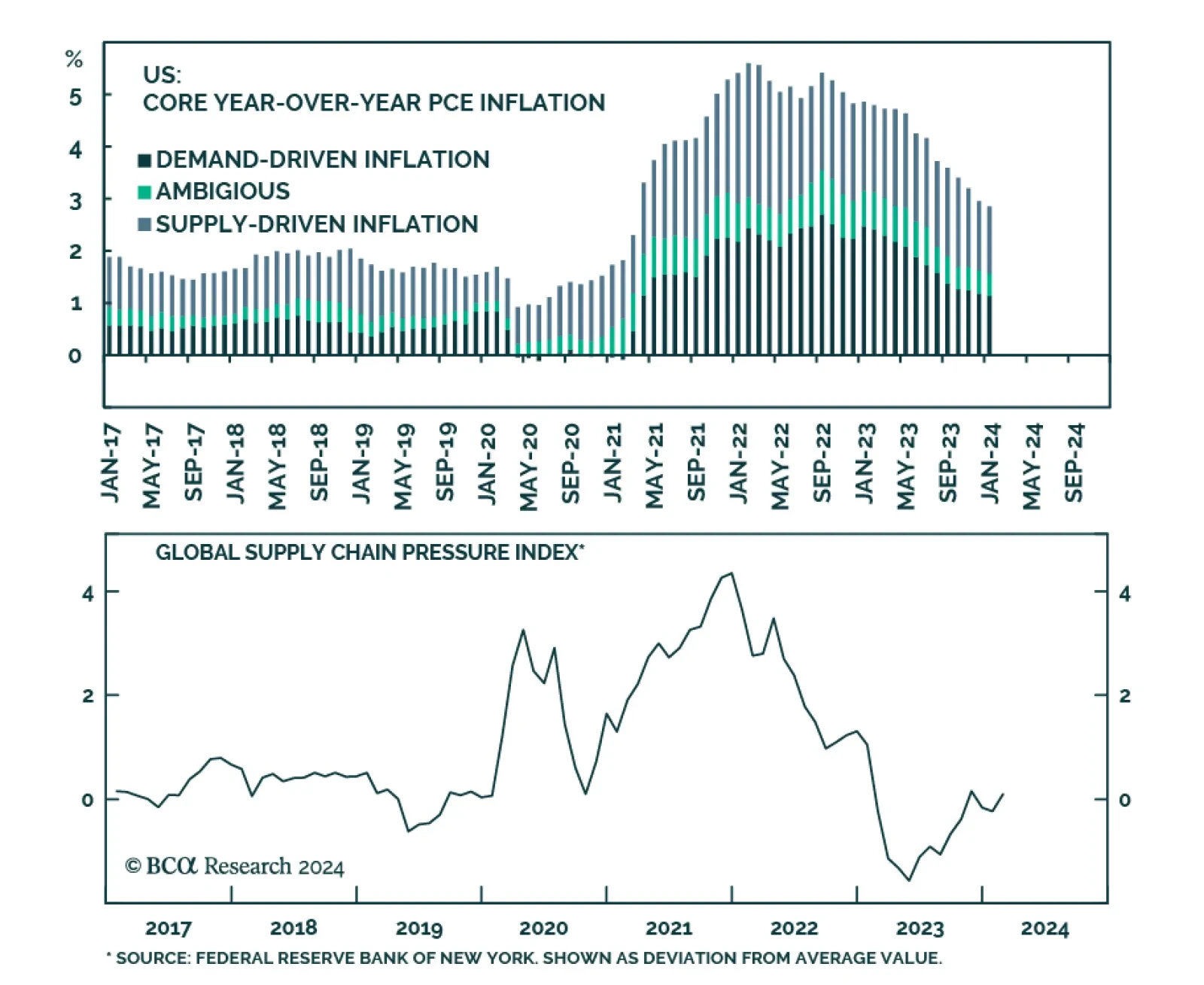

Both supply- and demand-side forces contributed to the inflation surge in 2021/2022. According to the San Francisco Fed’s estimates, the contribution of demand-side forces to annual core PCE inflation jumped from -0.09…

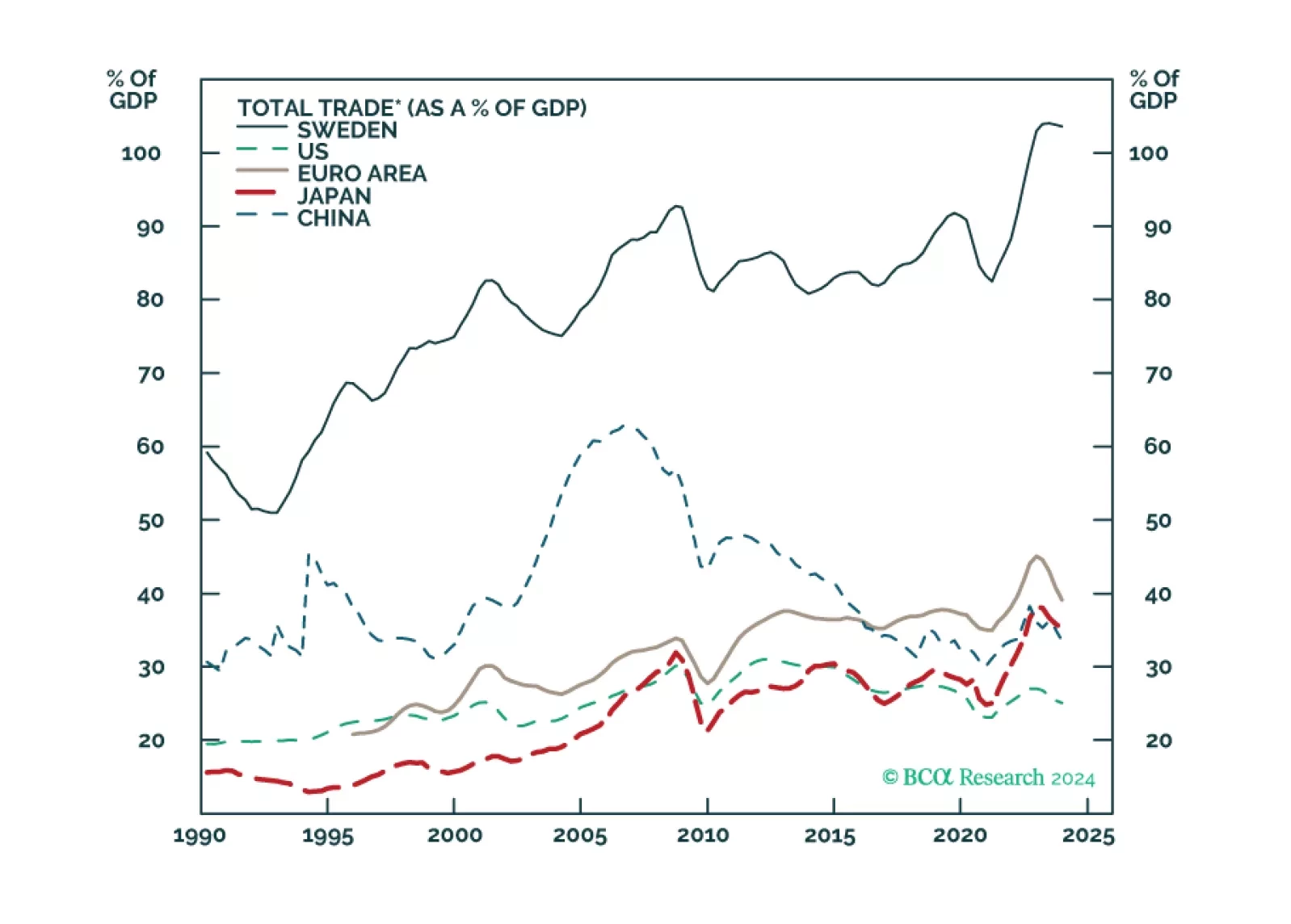

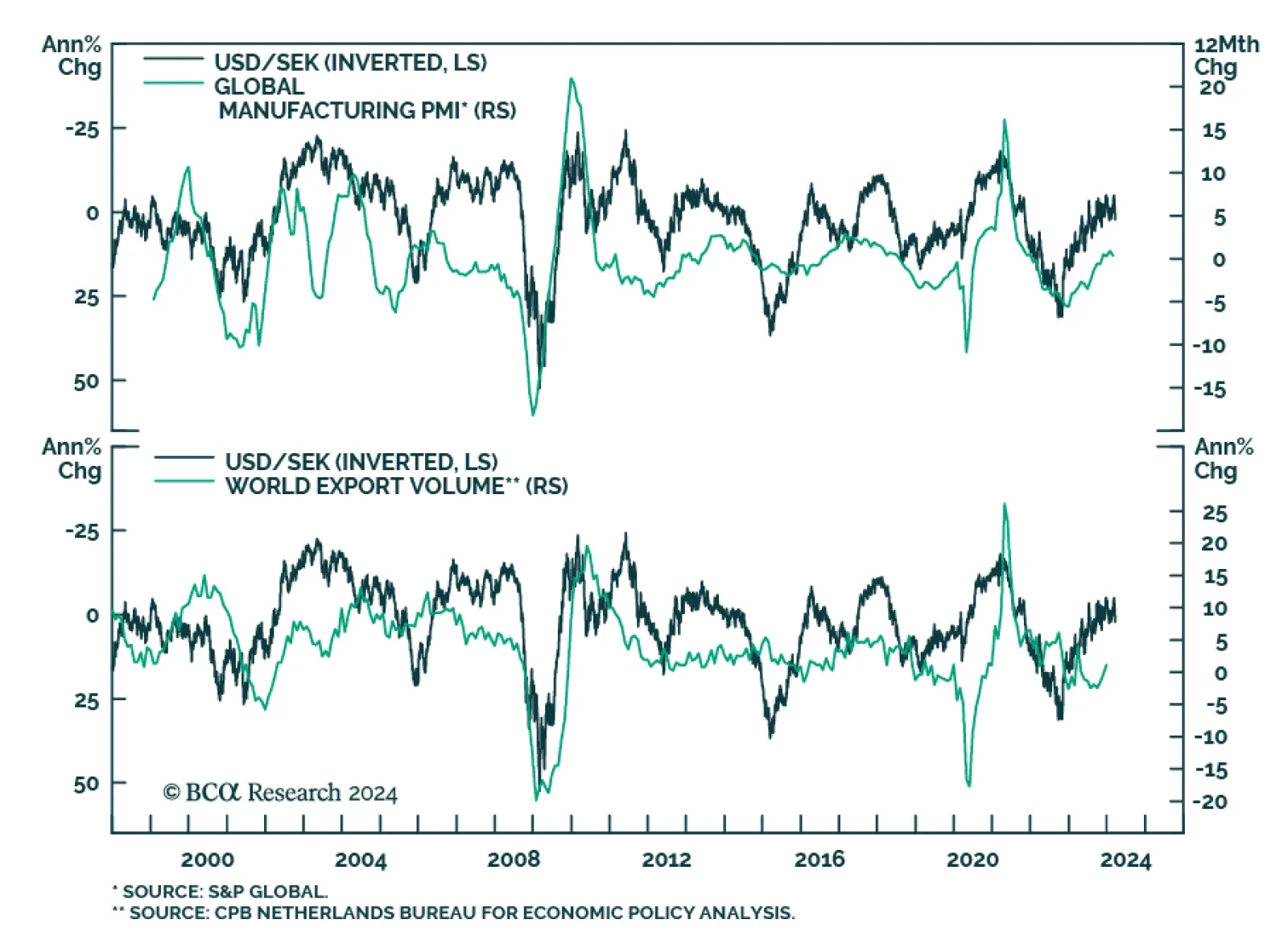

Swedish economic data is usually good at sniffing out the outlook for global growth. Looking at a broad swath of indicators, from domestic conditions to barometers of external demand, our colleagues from BCA’s Foreign…

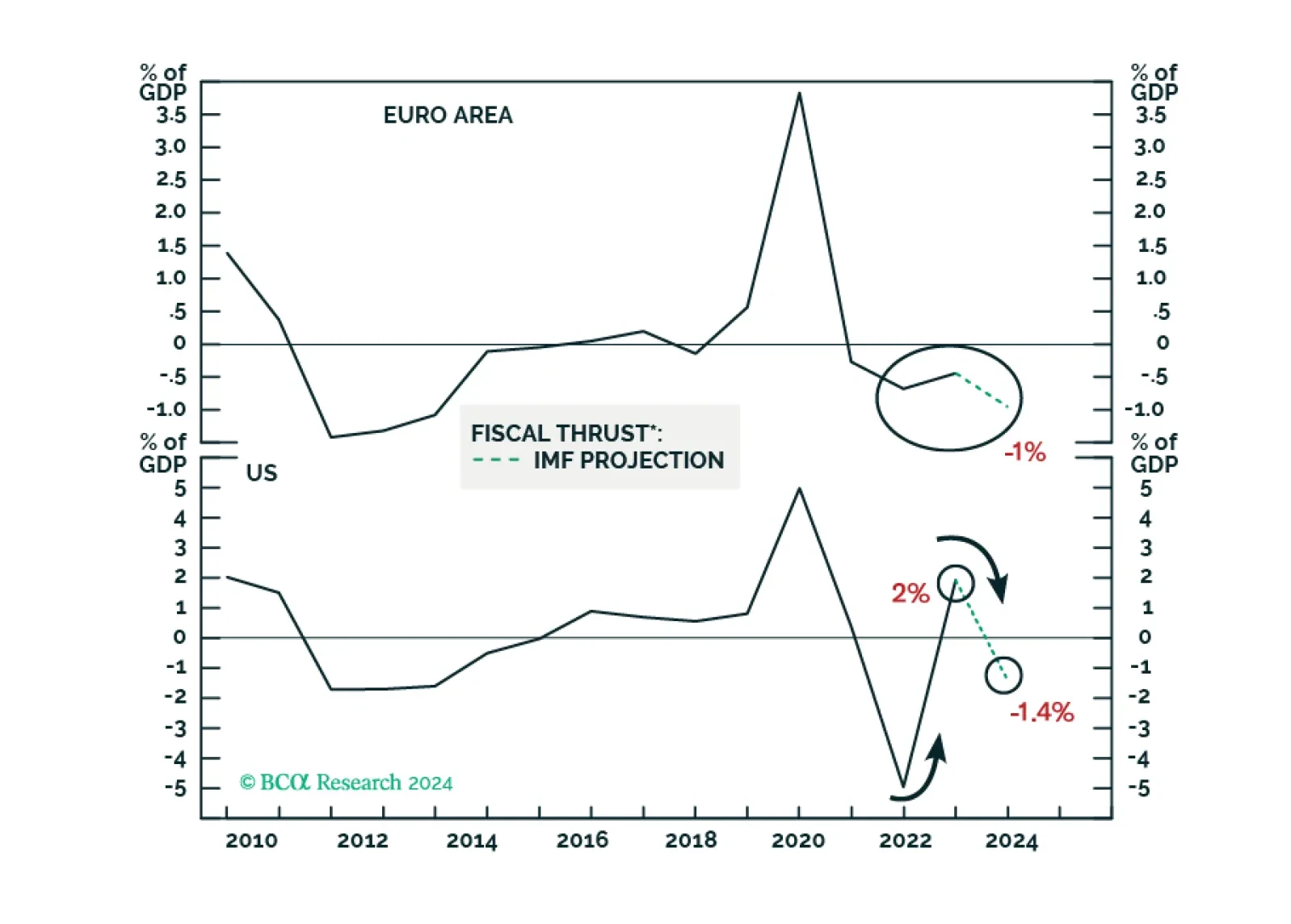

Despite a couple of rate cuts in H2 2024, borrowing costs will remain elevated in real terms amid lower inflation in the US and Europe. This and tightening fiscal policy will hinder domestic demand in advanced economies. Domestic…

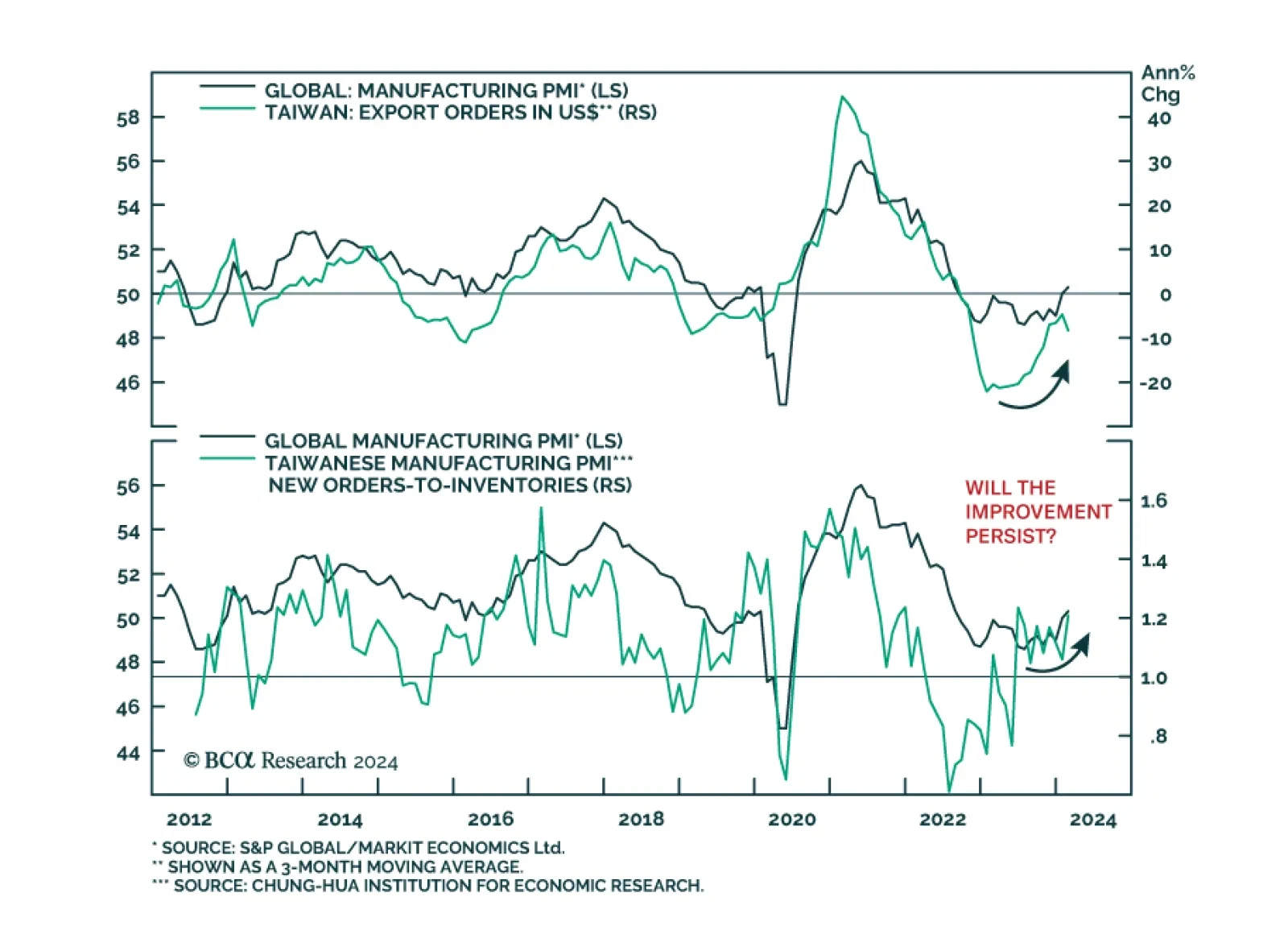

The 10.4% contraction in Taiwanese export orders for February delivered a negative surprise to expectations that the pace of expansion would slow from 1.9% y/y to 1.2% y/y. However, investors should not read too deeply into this…

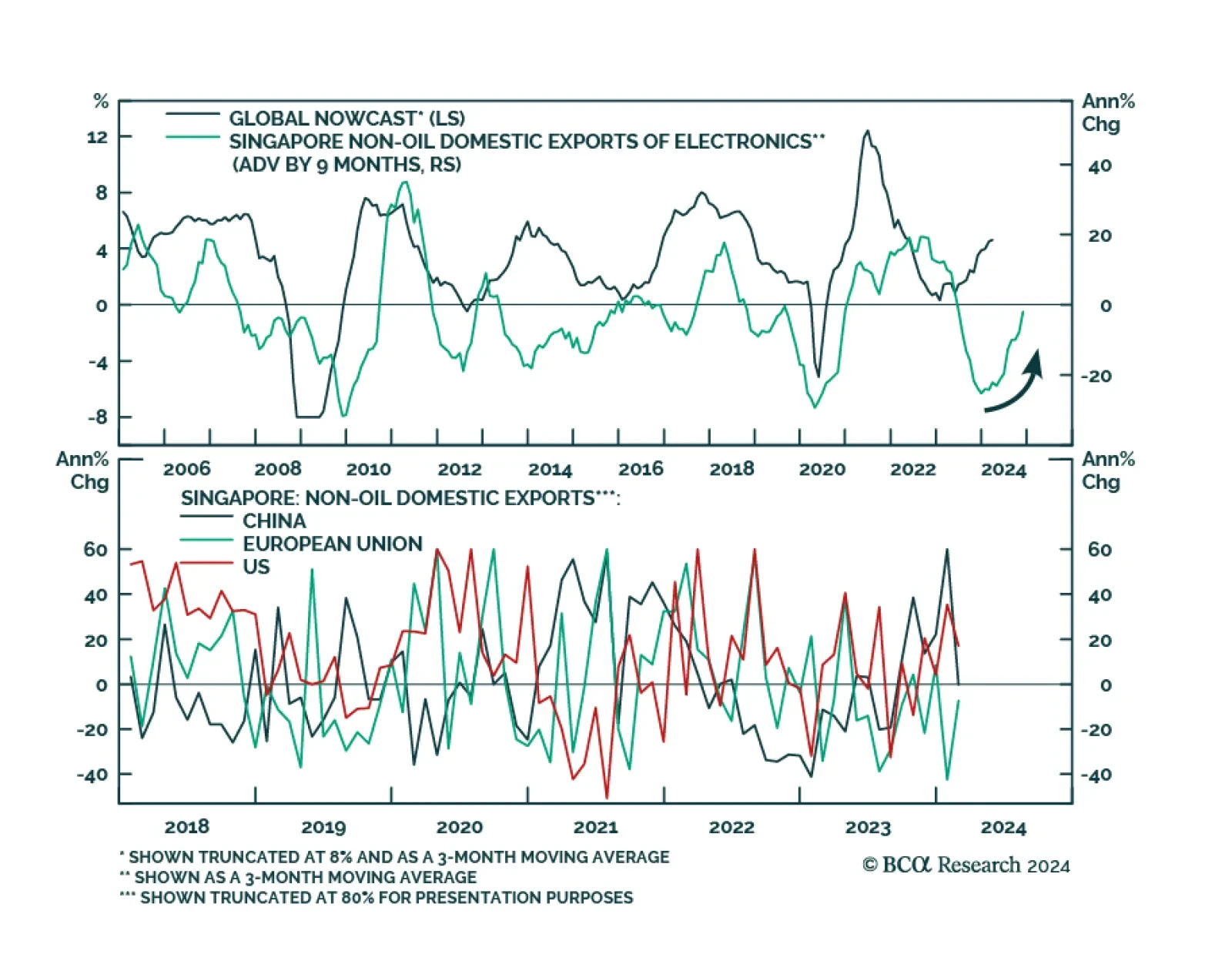

Singapore non-oil exports (NODX) largely disappointed in February, contracting by 4.8% m/m following a 2.3% m/m expansion in January, and falling below expectations of a milder 0.5% m/m decline. In a similar vein, the 0.1% y/y…

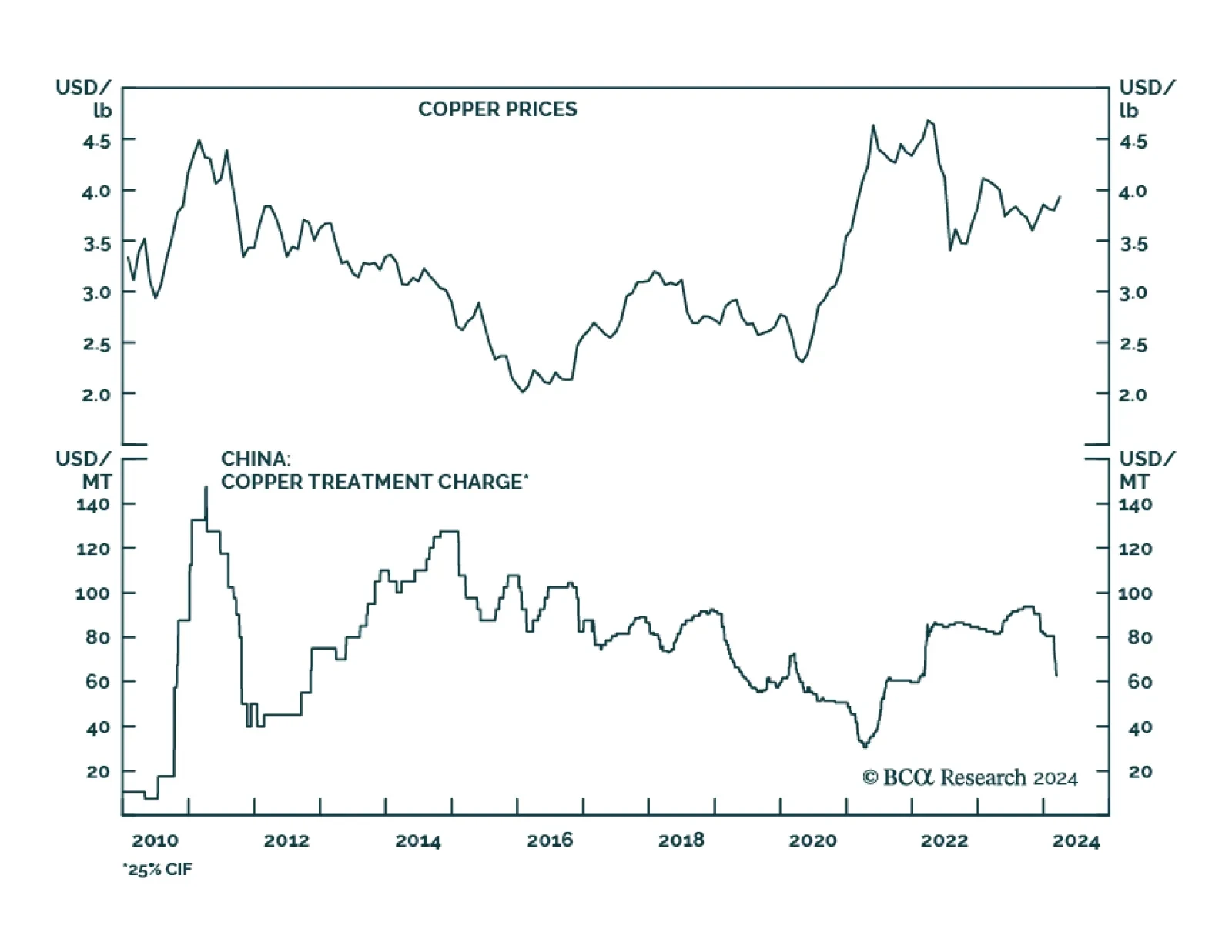

In a recent Insight we highlighted that the selloff in the price of iron ore – which is down 25.4% year-to-date – is sending a pessimistic signal on China’s economy, suggesting that the current rally in Chinese…

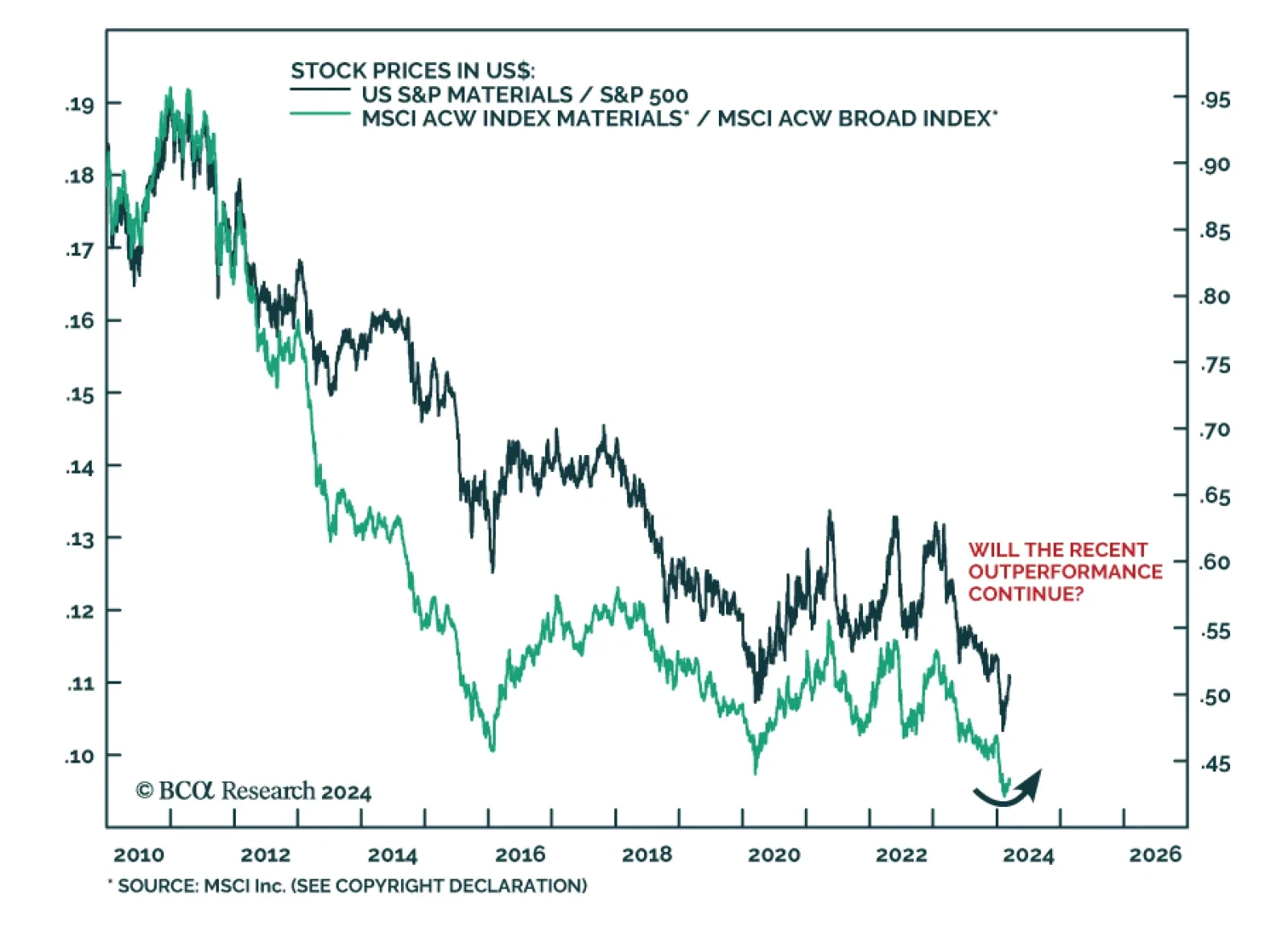

As we highlighted in a recent Insight, dynamics have shifted beneath the surface of the S&P 500. The Materials sector has been rallying sharply since the end of January, gaining 9.9% over this period and taking the top spot…