In the near term, favor oil and oil producers outside the Gulf Arab states. Over a 12-month horizon, favor US and North American equities, defensive sectors over cyclicals, and safe-assets. Within cyclicals, stick to energy and…

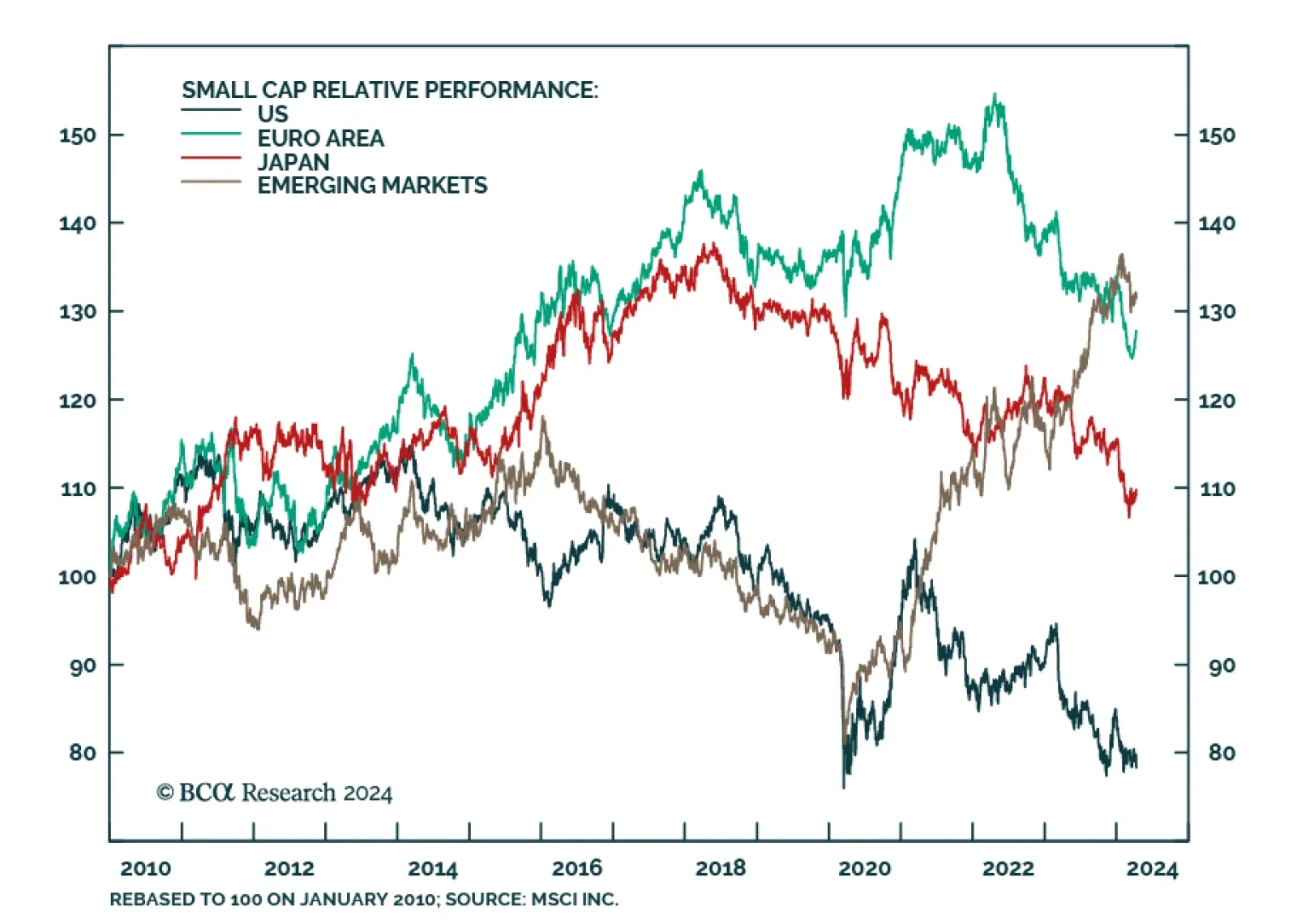

US, European and Japanese small caps have underperformed their large cap counterparts by 22.6%, 15.3% and 10.1% respectively since 2021. They now face conflicting forces. On the one hand, they are extremely beaten down and cheap…

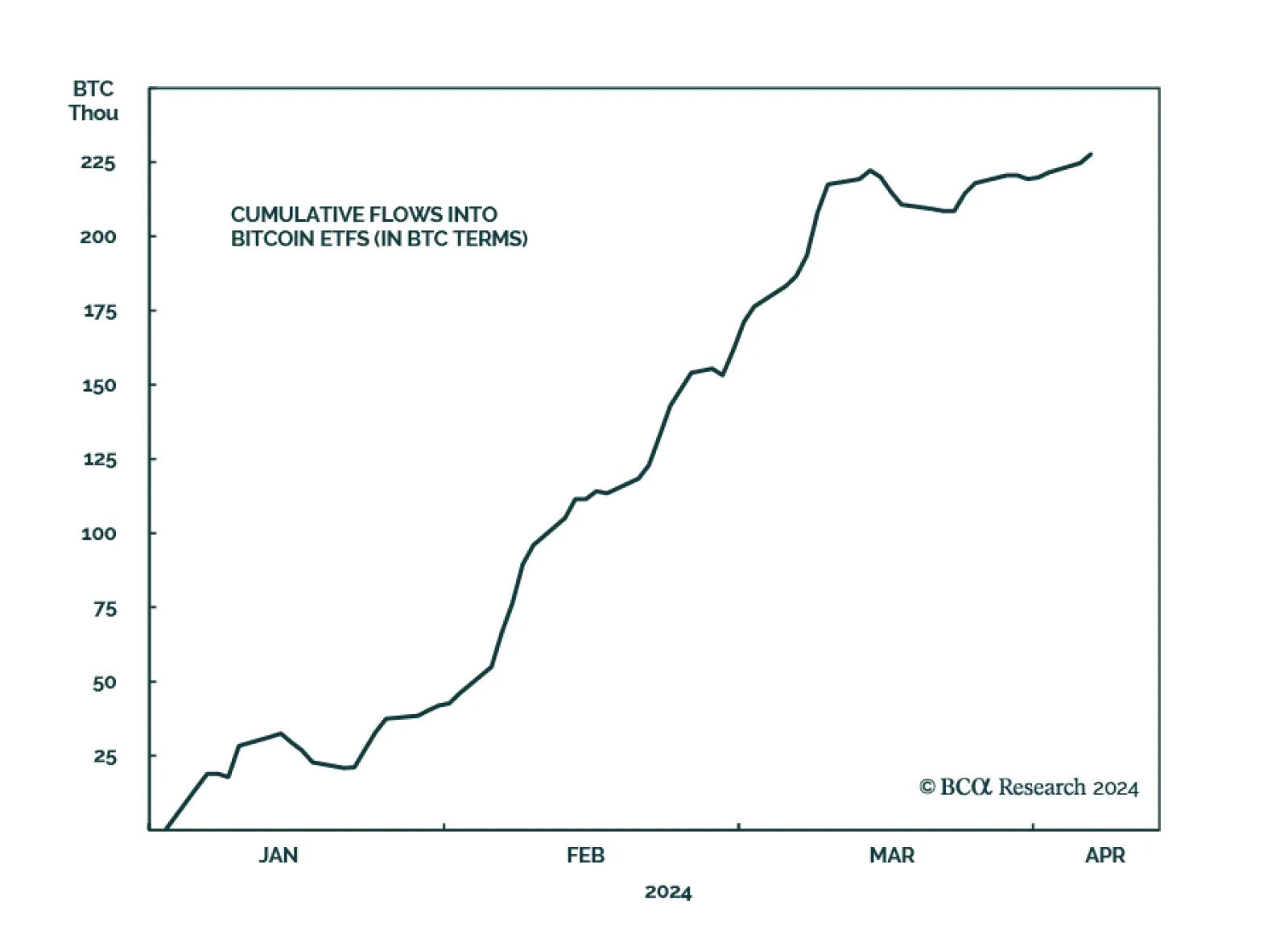

The bitcoin ETFs are breaking several records. The Ishares Bitcoin Trust (IBIT) from Blackrock is closing in on $20 billion in assets, surpassing ETF heavy weights like Ishares MSCI Emerging Markets (EEM), Ishares Japan (EWJ) and…

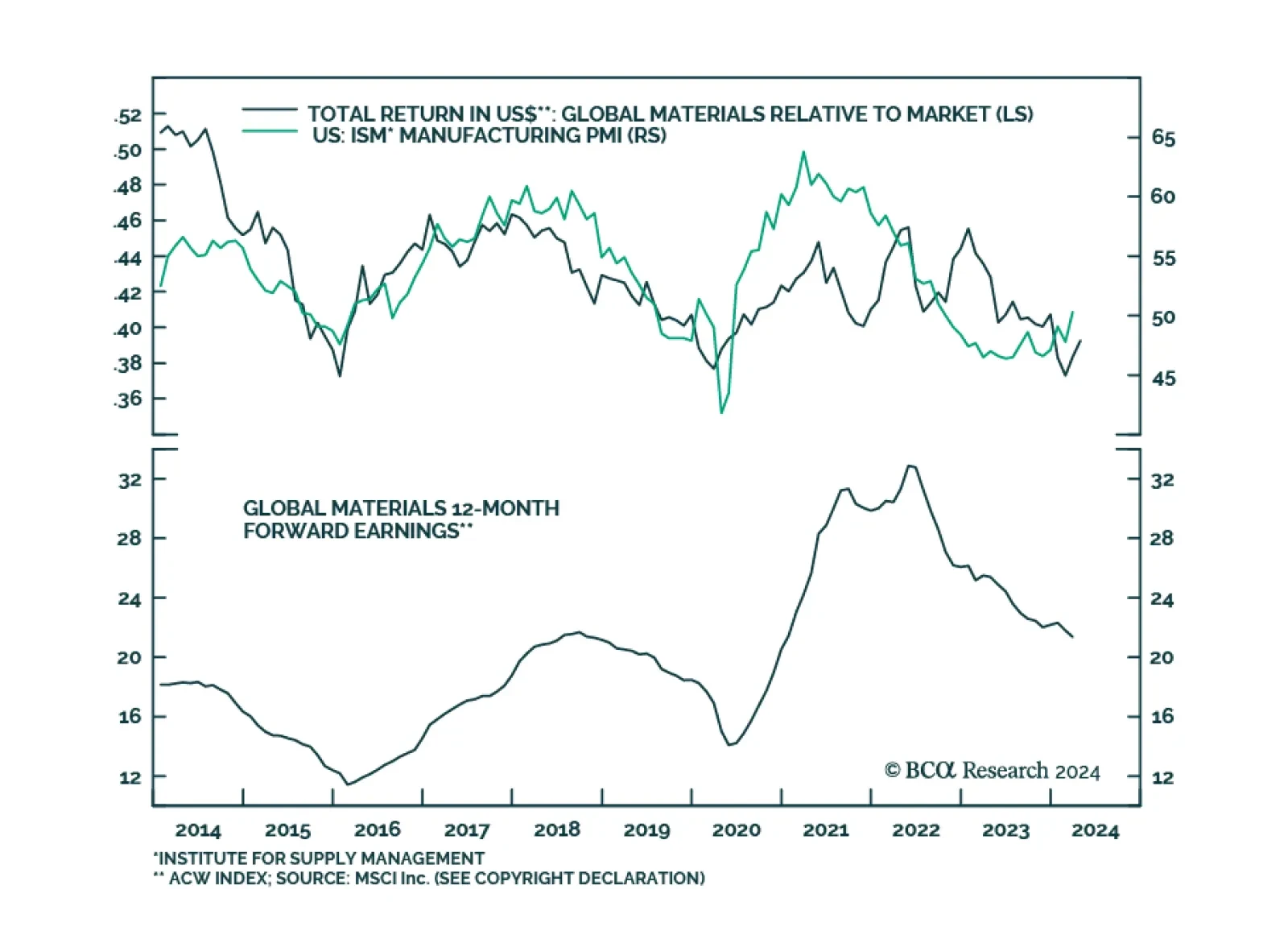

Global material stocks have underperformed over the past 12 months, returning only 11.3% vs 21.4% for the overall market. But could they be a buy now? There are several arguments to argue that they will: The ISM has…

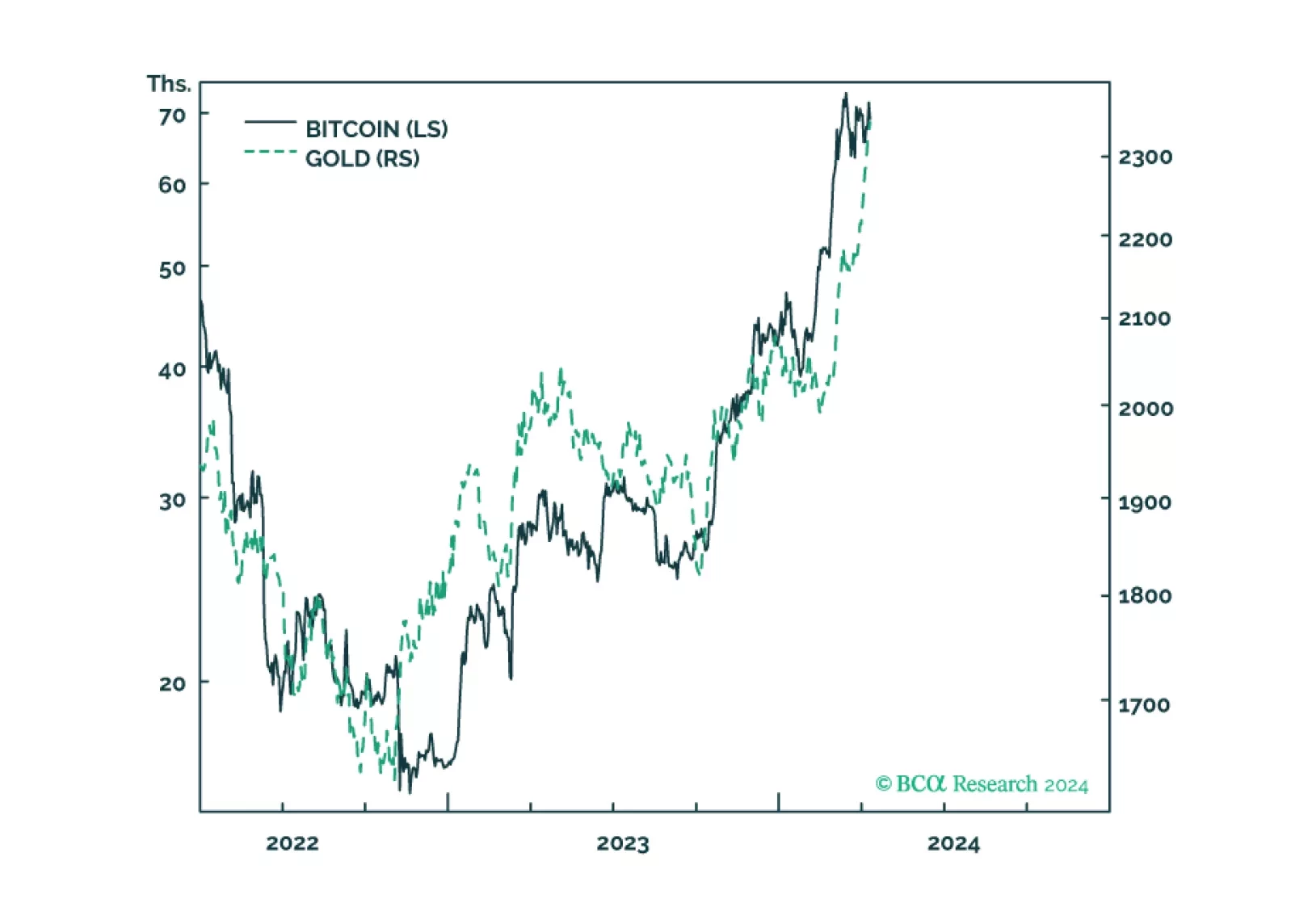

Gold and bitcoin are conceptually joined at the hip because the value of both comes from their ‘non-confiscatability’ by inflation, by bank failure, and in the case of bitcoin, by state expropriation. The sharp recent rallies in both…

Investors typically associate high-flying tech stocks with high sensitivity to interest rates. The rationale is simple: Given that most of their cashflows are further into the future, their value will be more sensitive to changes…

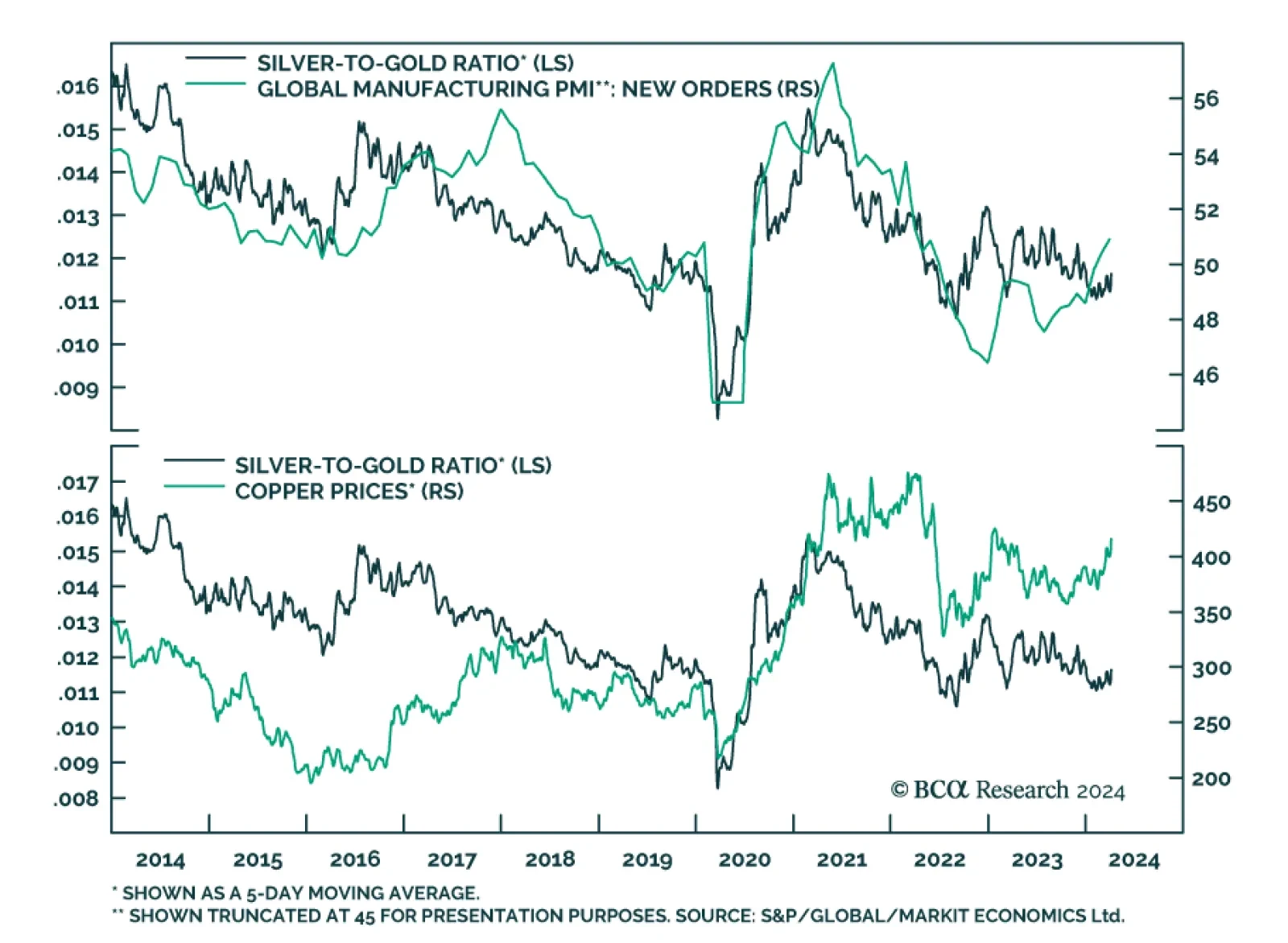

Commodities are making headlines with the prices of crude oil, copper, and gold all making sizeable gains since mid-February. Multiple forces have been cited as drivers of the rally across these commodities. Increased…

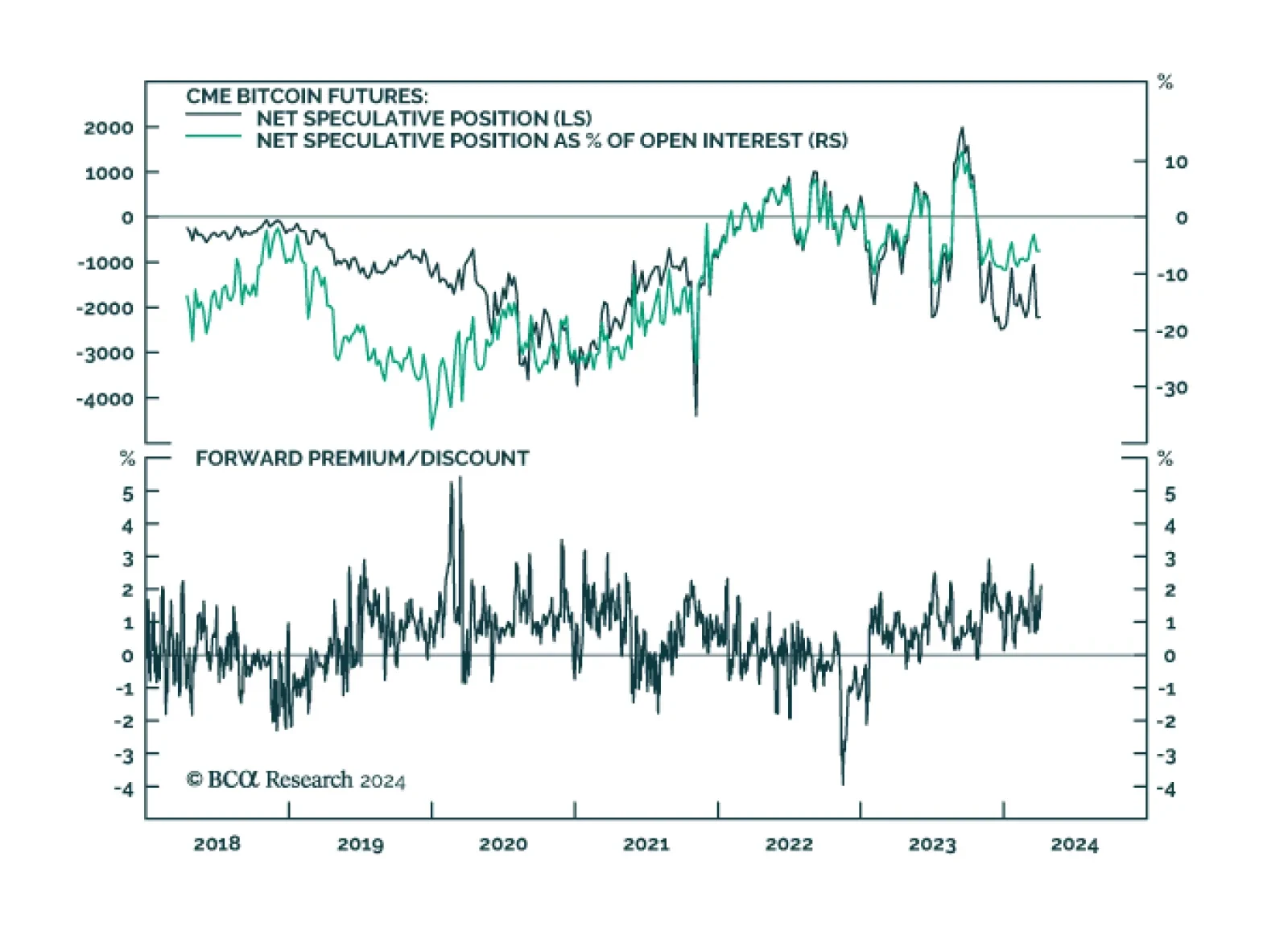

Short speculative positions on Bitcoin at the CME are near theie highest level on record. Some financial commentators have suggested that this bearish positioning in bitcoin could act as kindle and spark a short squeeze. But…

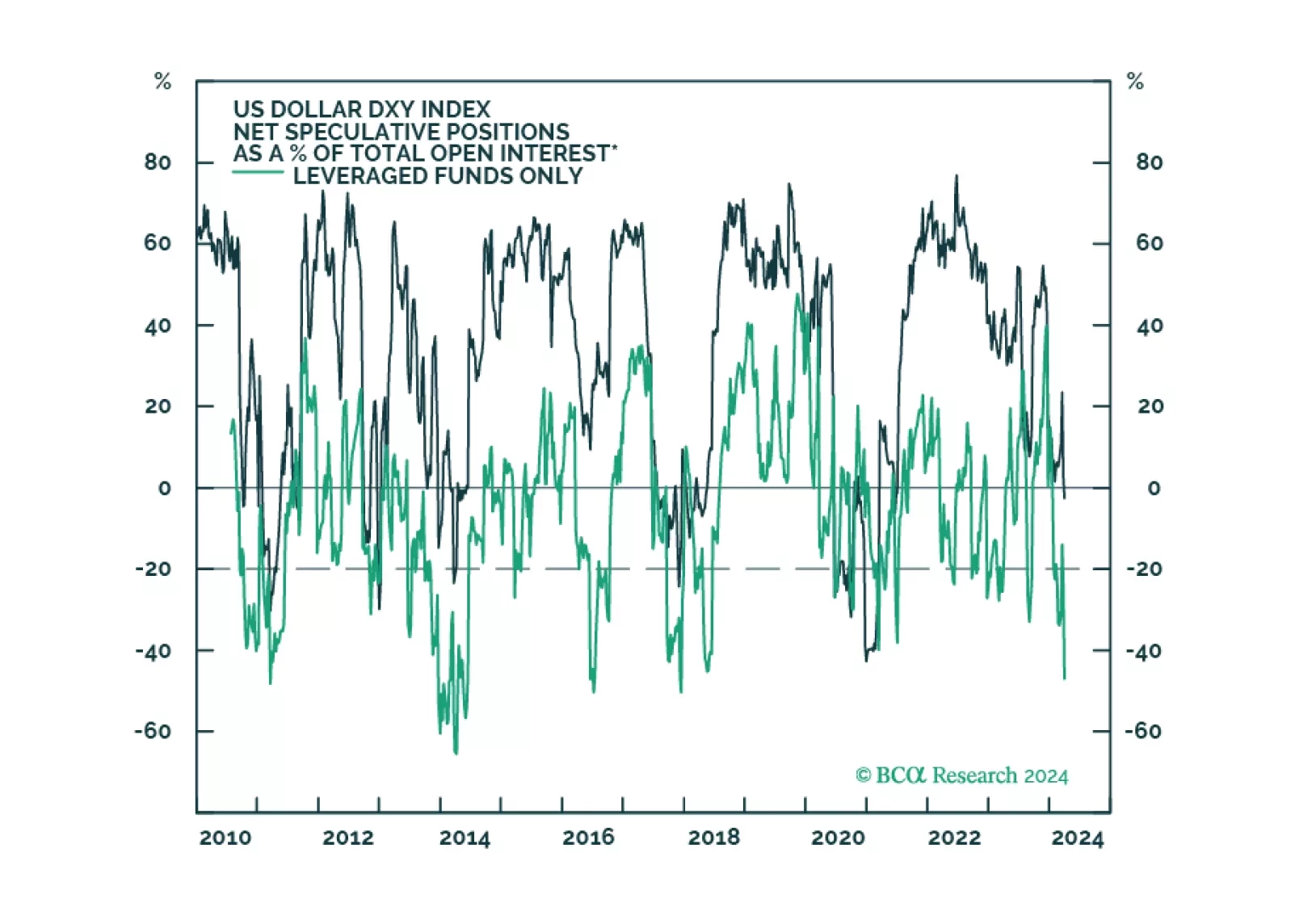

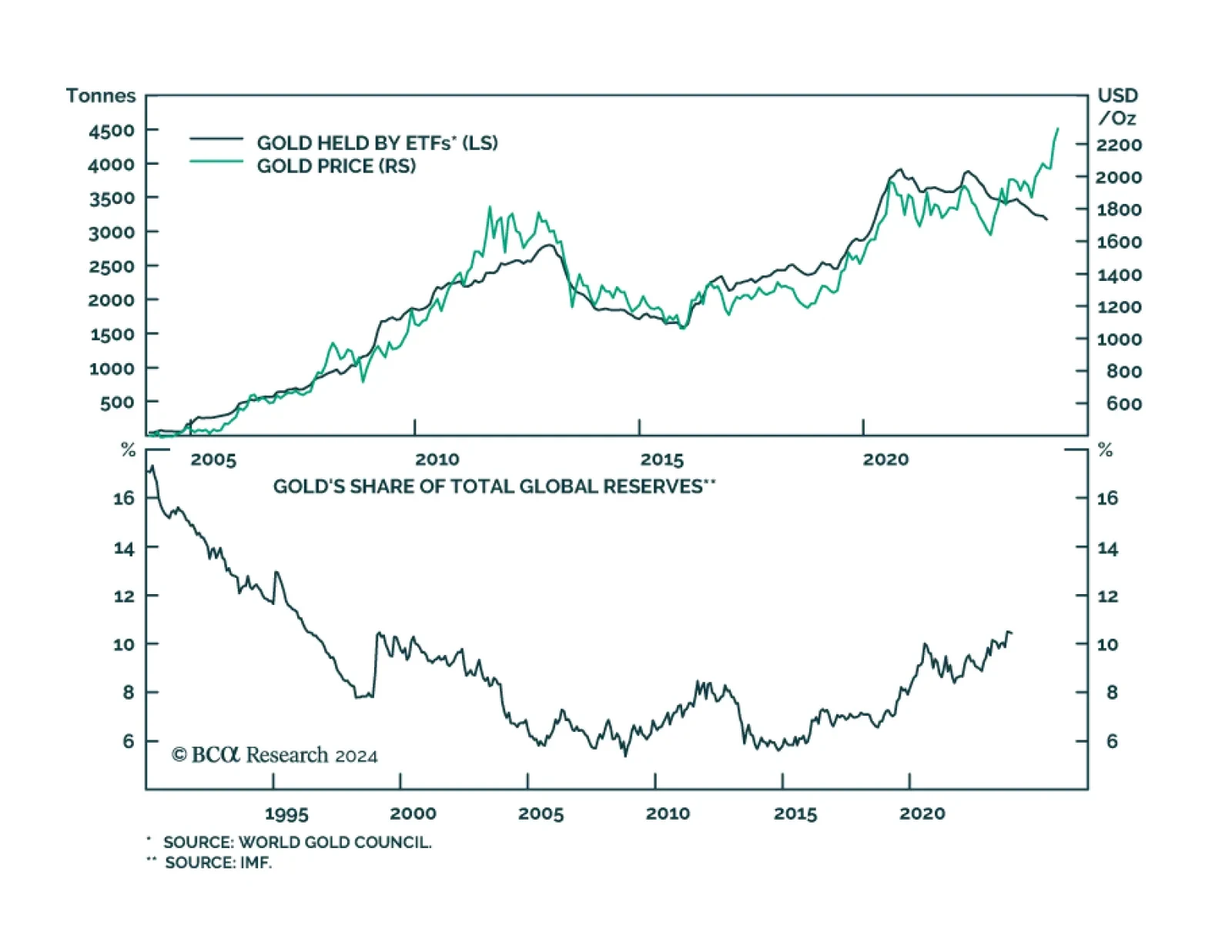

Gold prices reached $2300 per ounce for the first time on Wednesday. They have now rallied by more than 12% so far this year. To a degree the furious rally in gold has been puzzling. Who has been buying? It certainly has not…

In this report, we review our trade recommendations based on incoming data in the last month.