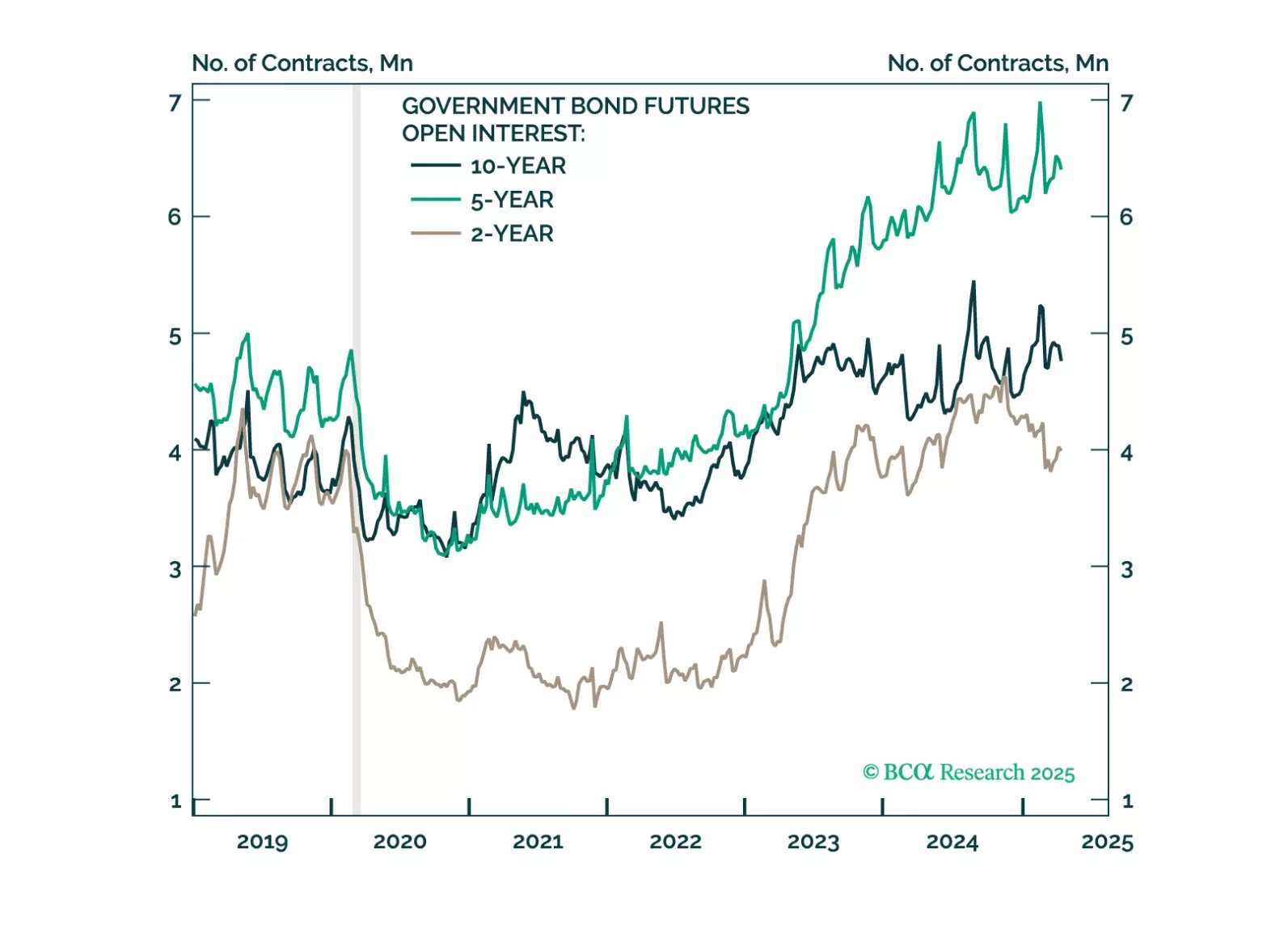

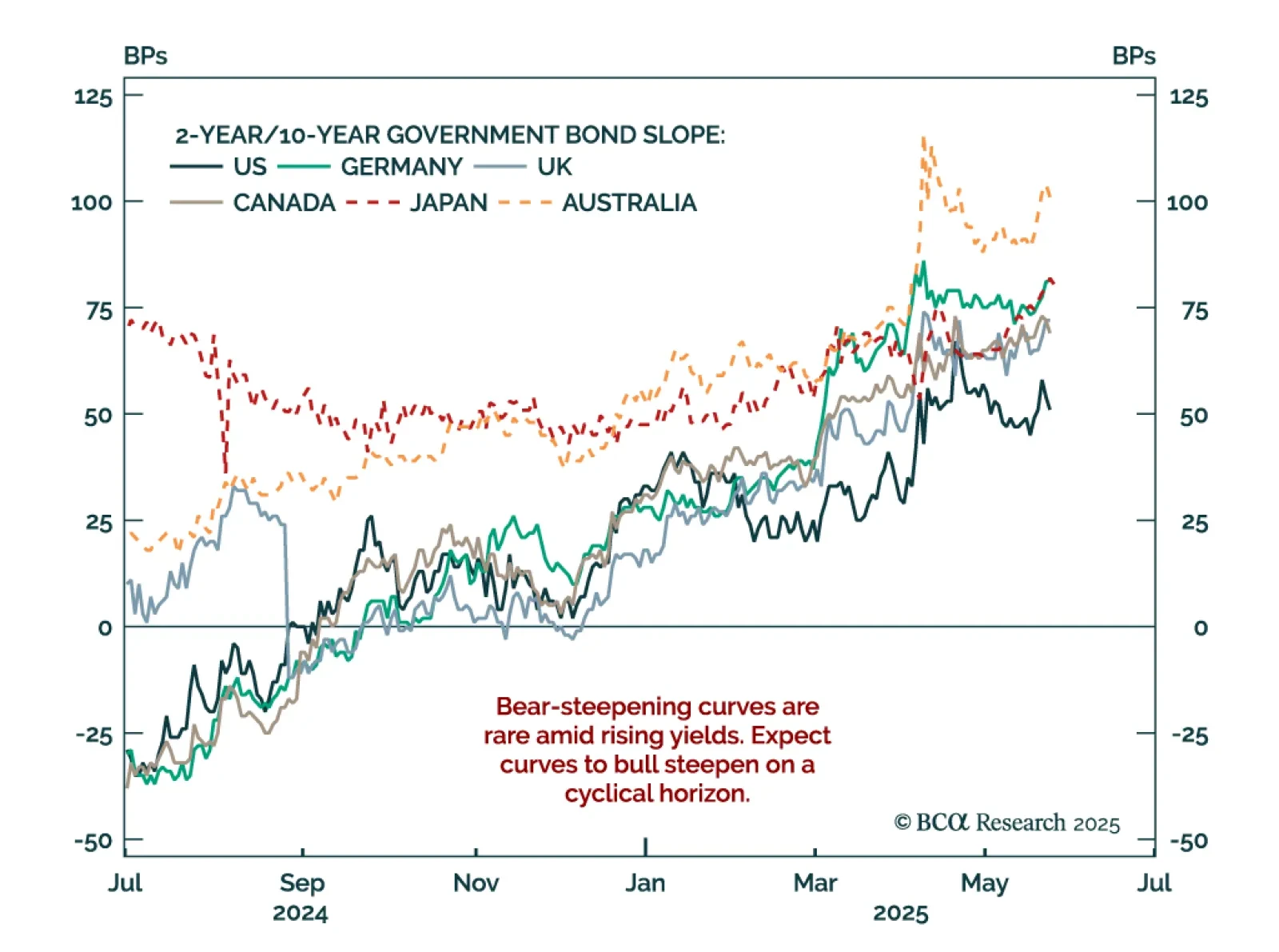

According to our fixed income strategists, the main drivers of rising global yields have been widening bond/OIS spreads and term premiums. Wider government bond/OIS spreads reflect increasing government bond supply (net of…

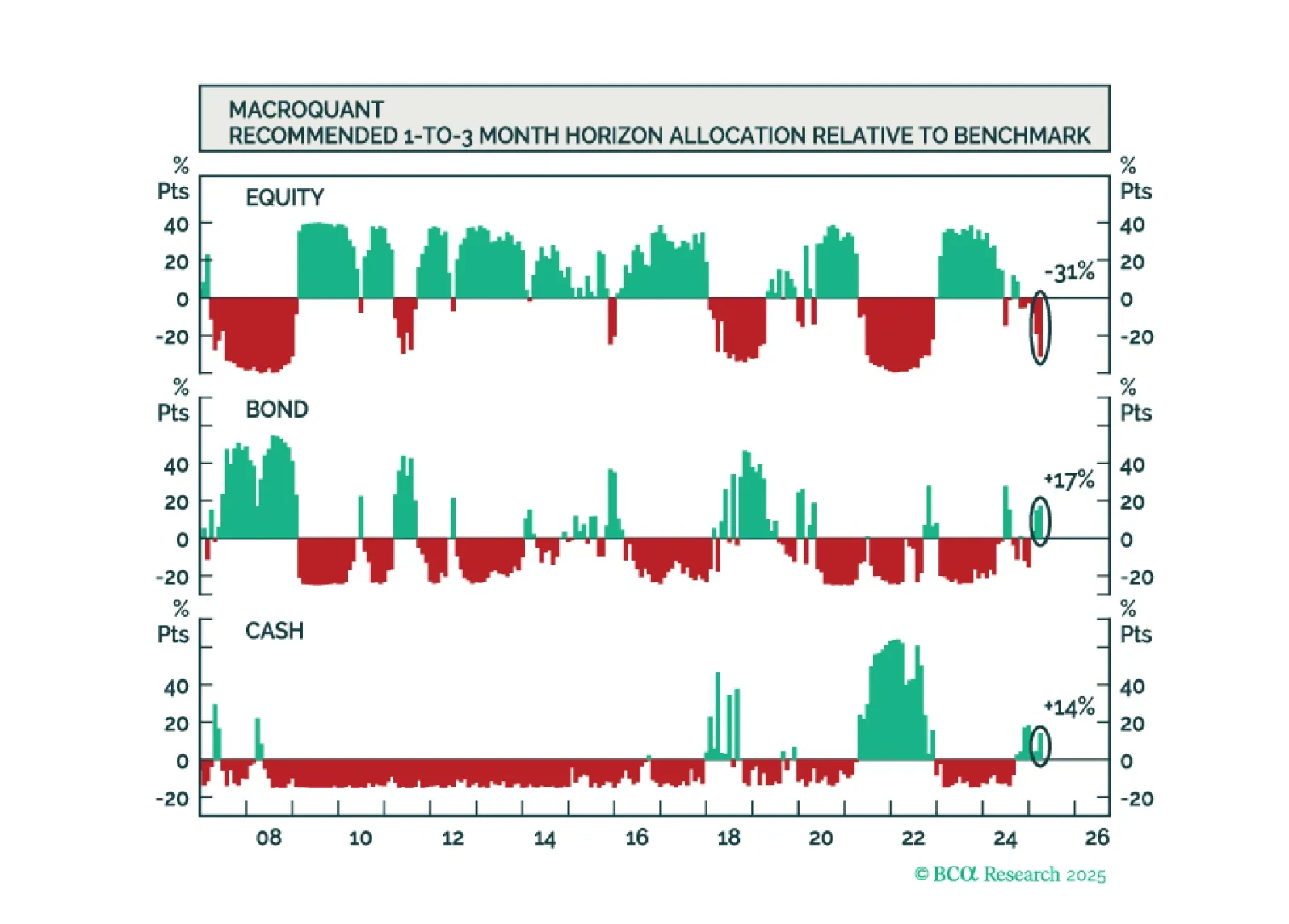

MacroQuant sees the risks to US growth as being to the downside and the risks to inflation as being to the upside. Such a stagflationary brew justifies an underweight on stocks.

MacroQuant sees the risks to US growth as being to the downside and the risks to inflation as being to the upside. Such a stagflationary brew justifies an underweight on stocks.

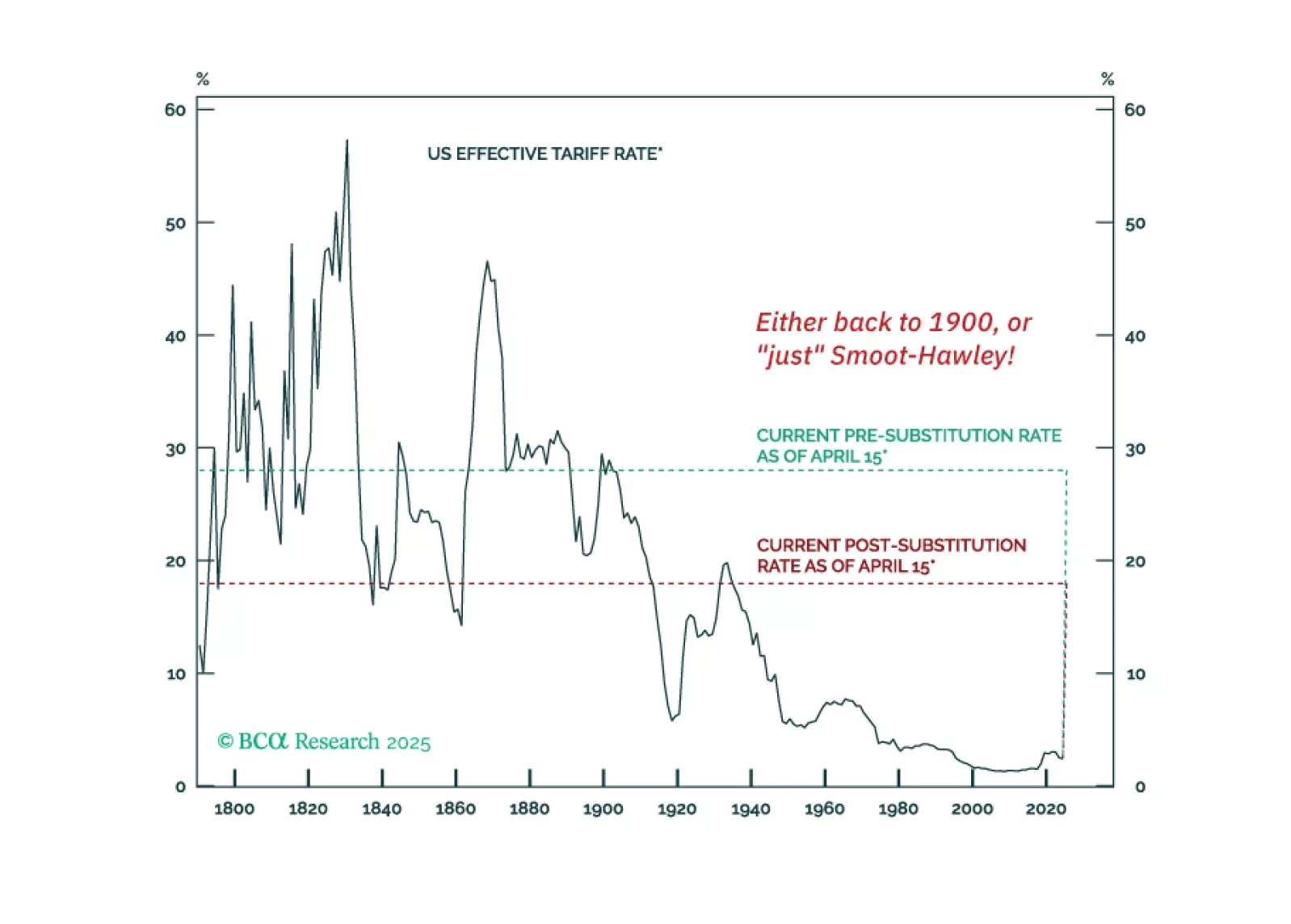

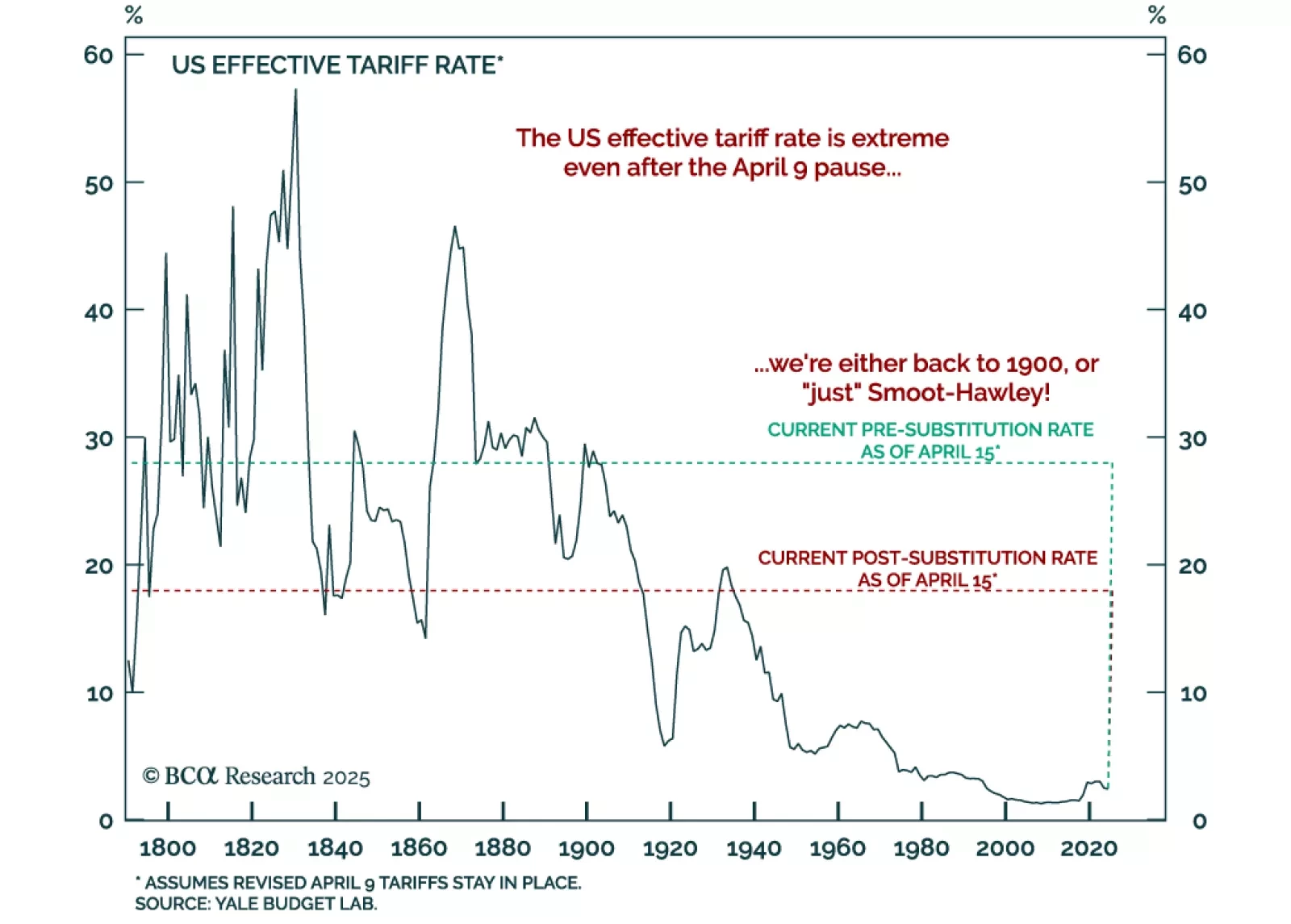

BCA’s House View recommends staying underweight stocks versus bonds, even in a stagflationary scenario. The US and global economies are likely to enter a recession this year unless tariffs are swiftly reversed or meaningful fiscal…

US Treasuries typically outperform both equities and global government bonds during downturns. Recent political shifts could lessen that outperformance this cycle, but we doubt it will disappear completely.

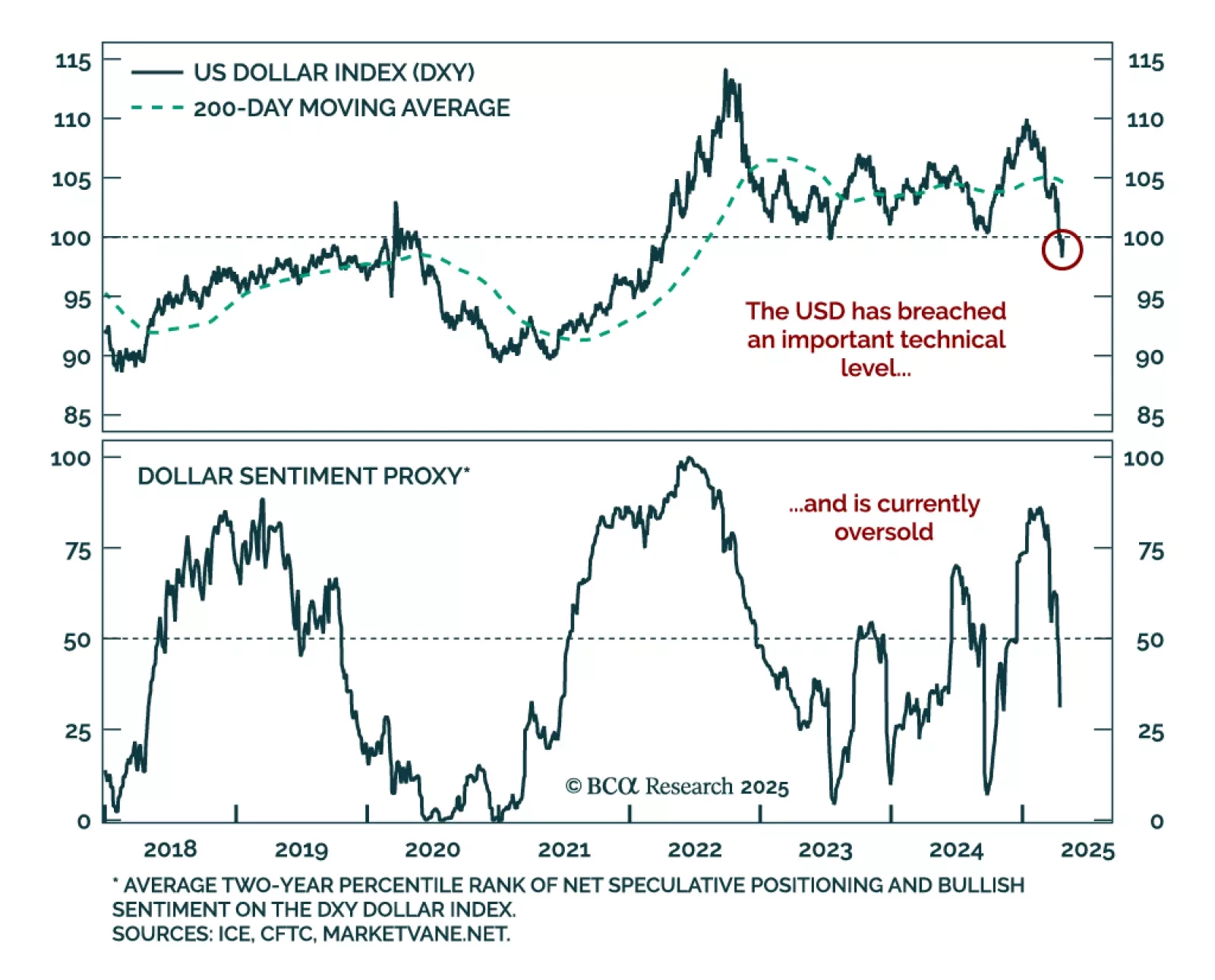

The US dollar’s underperformance since Liberation Day highlights shifting dynamics in global markets, but the recent “Sell America” move is overdone. During April’s market turmoil, the dollar failed to act as a safe haven, with US…

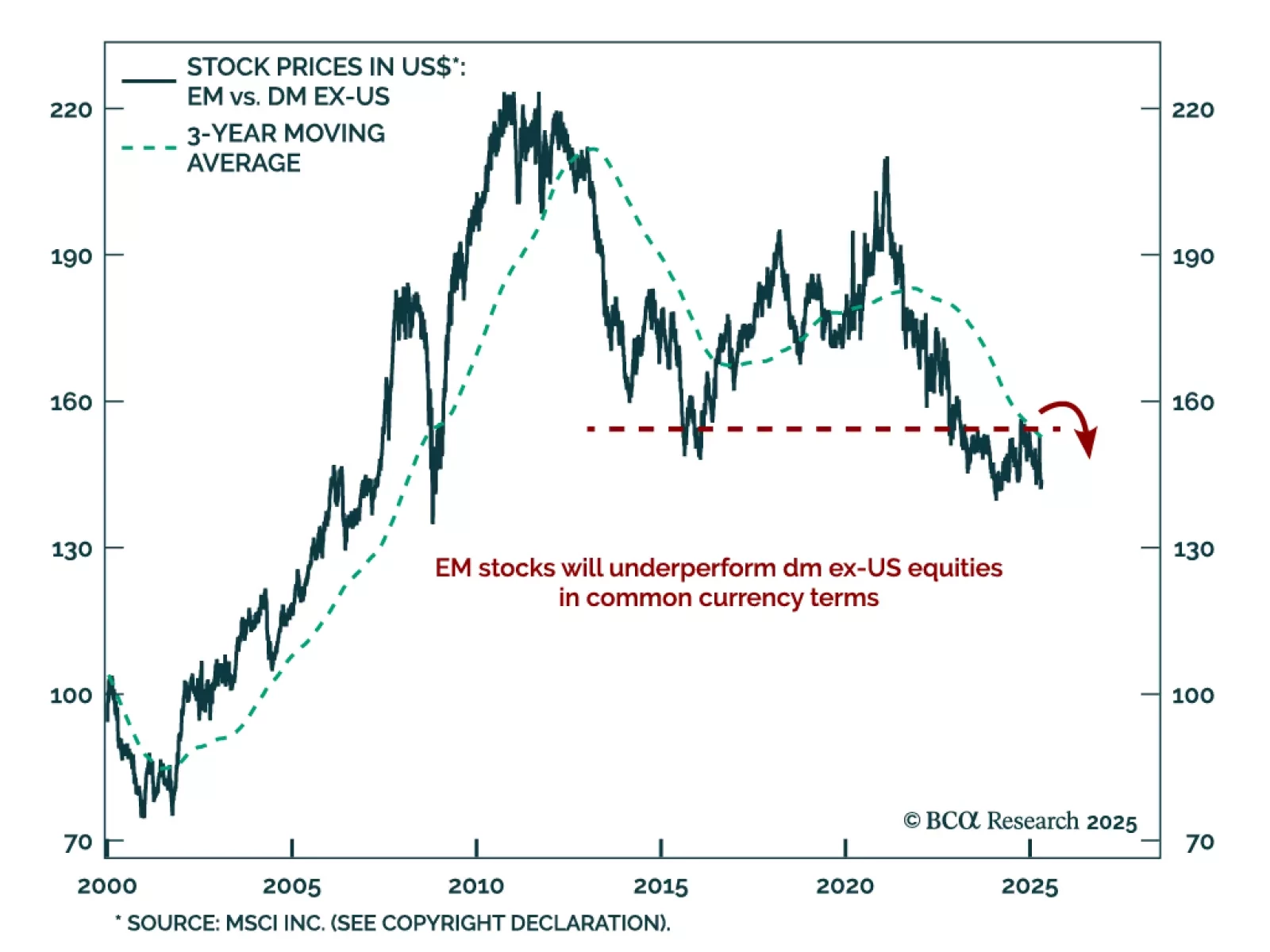

Our EM strategists advise selling into equities rebounds as Bessenomics has neither delivered lower rates nor stronger growth. The dollar’s weakness stems not from policy success but from broader market dynamics, and global equities…

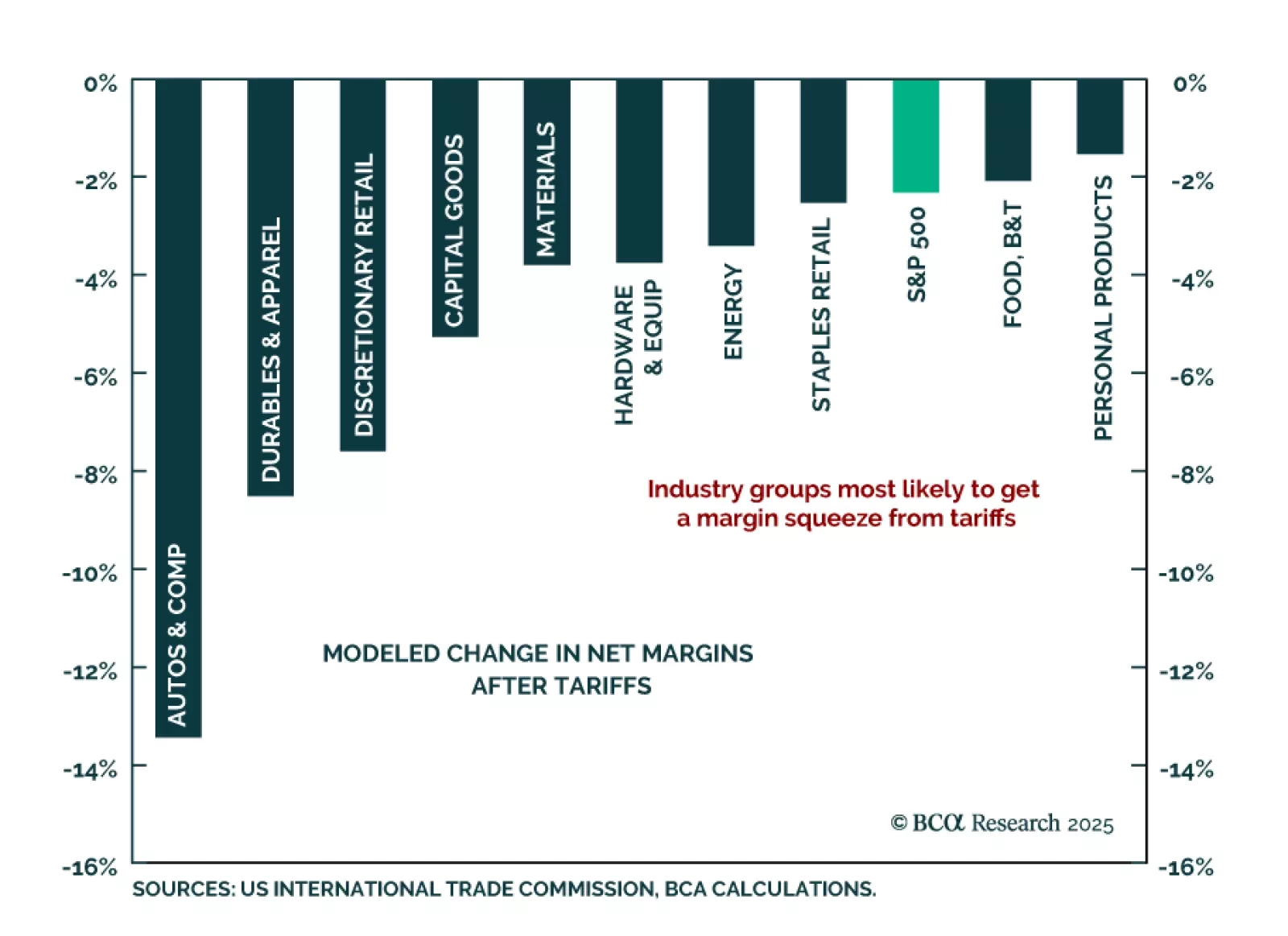

Our US Equity strategists warn that tariffs will meaningfully compress S&P 500 margins, with little pricing power to offset rising input costs. A two-point hit to net margins and falling multiples will drive earnings downgrades…

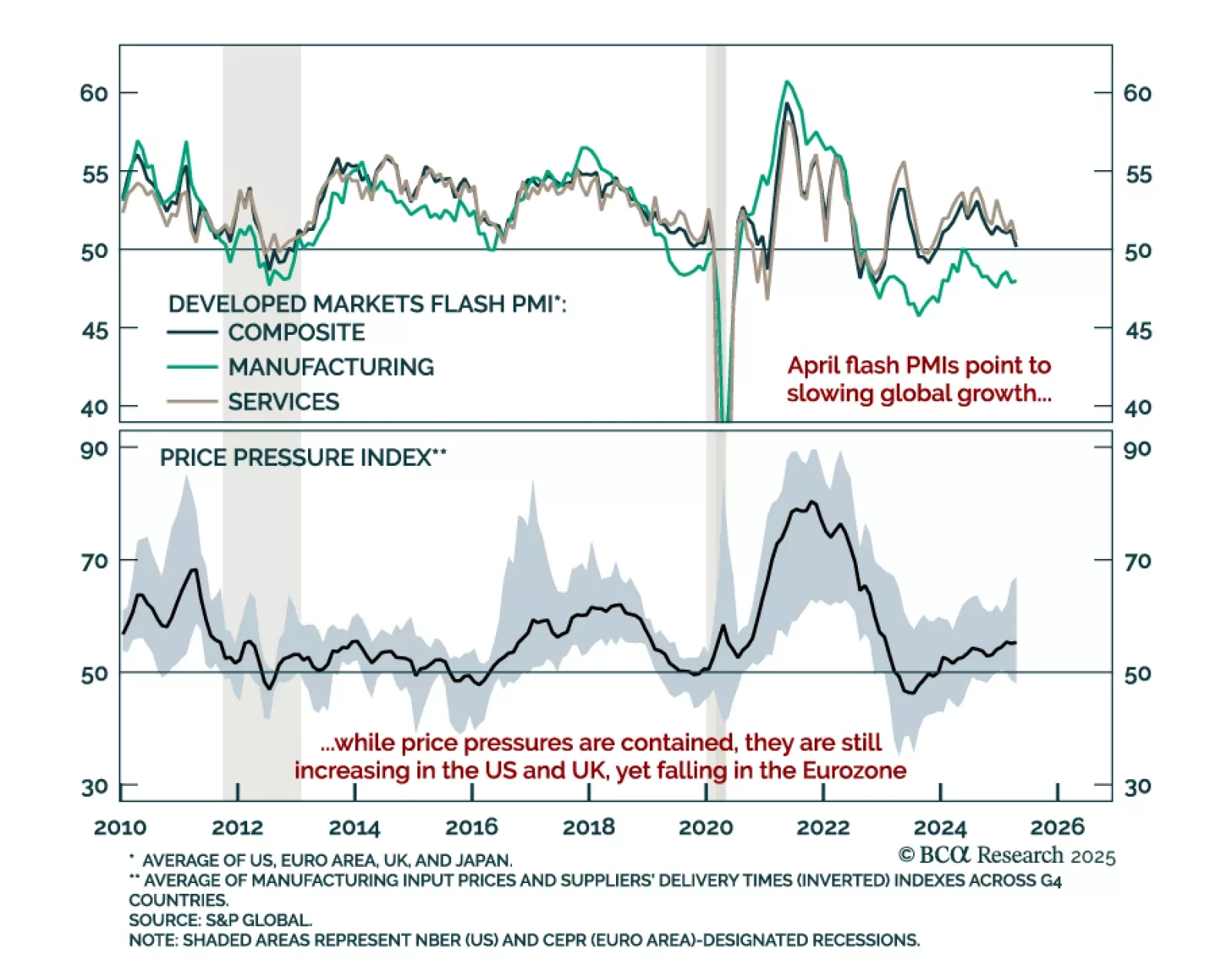

April PMIs confirm global growth is stalling, reinforcing our overweight in government bonds and underweight in risk assets. Services witnessed the worst deterioration, but manufacturing is still contracting even if broadly stable.…