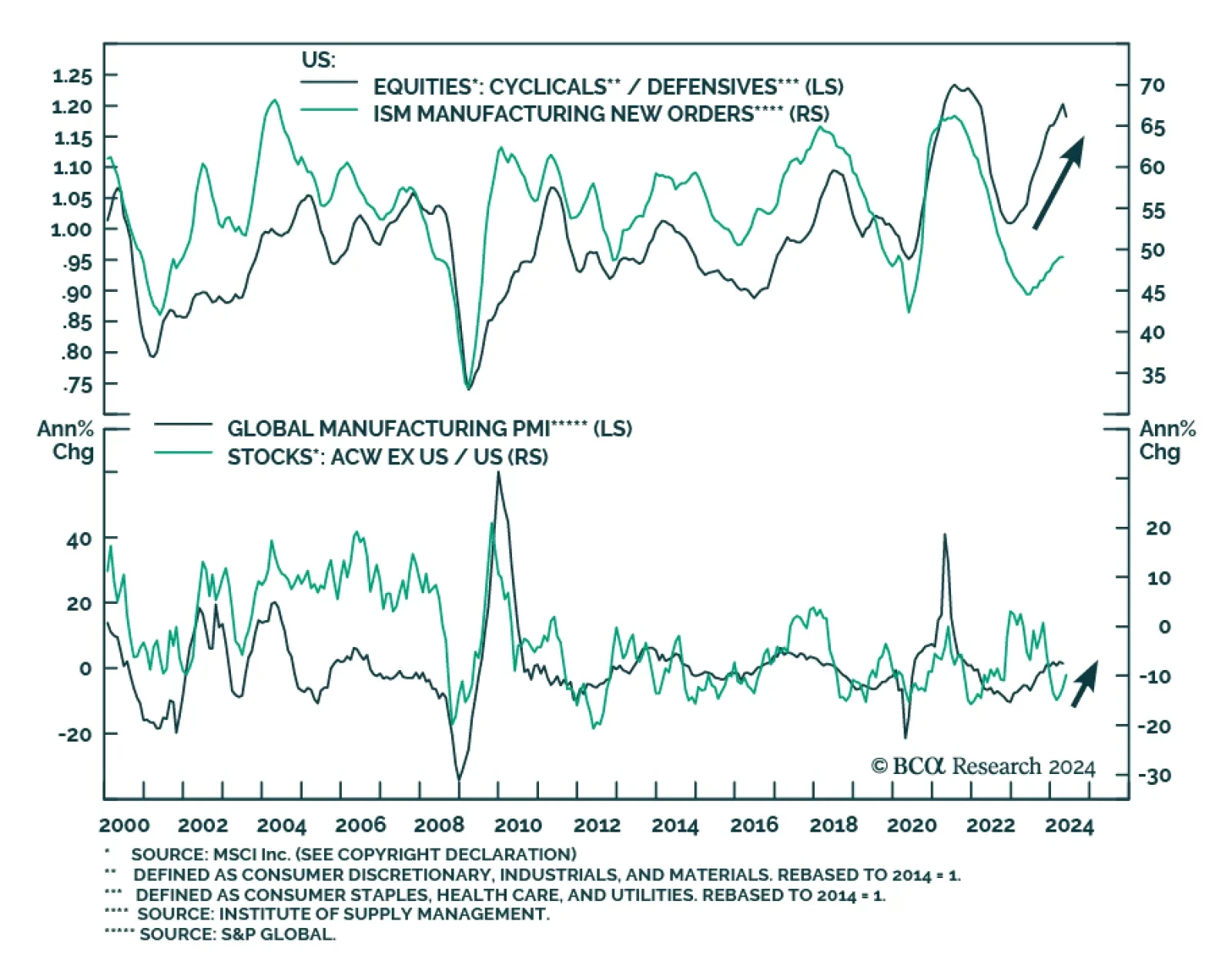

The US manufacturing cycle has followed a surprisingly stable pattern for over seven decades. History suggests that this cycle tends to last for about 36 months, with a down leg spanning 18 months, followed by an up leg…

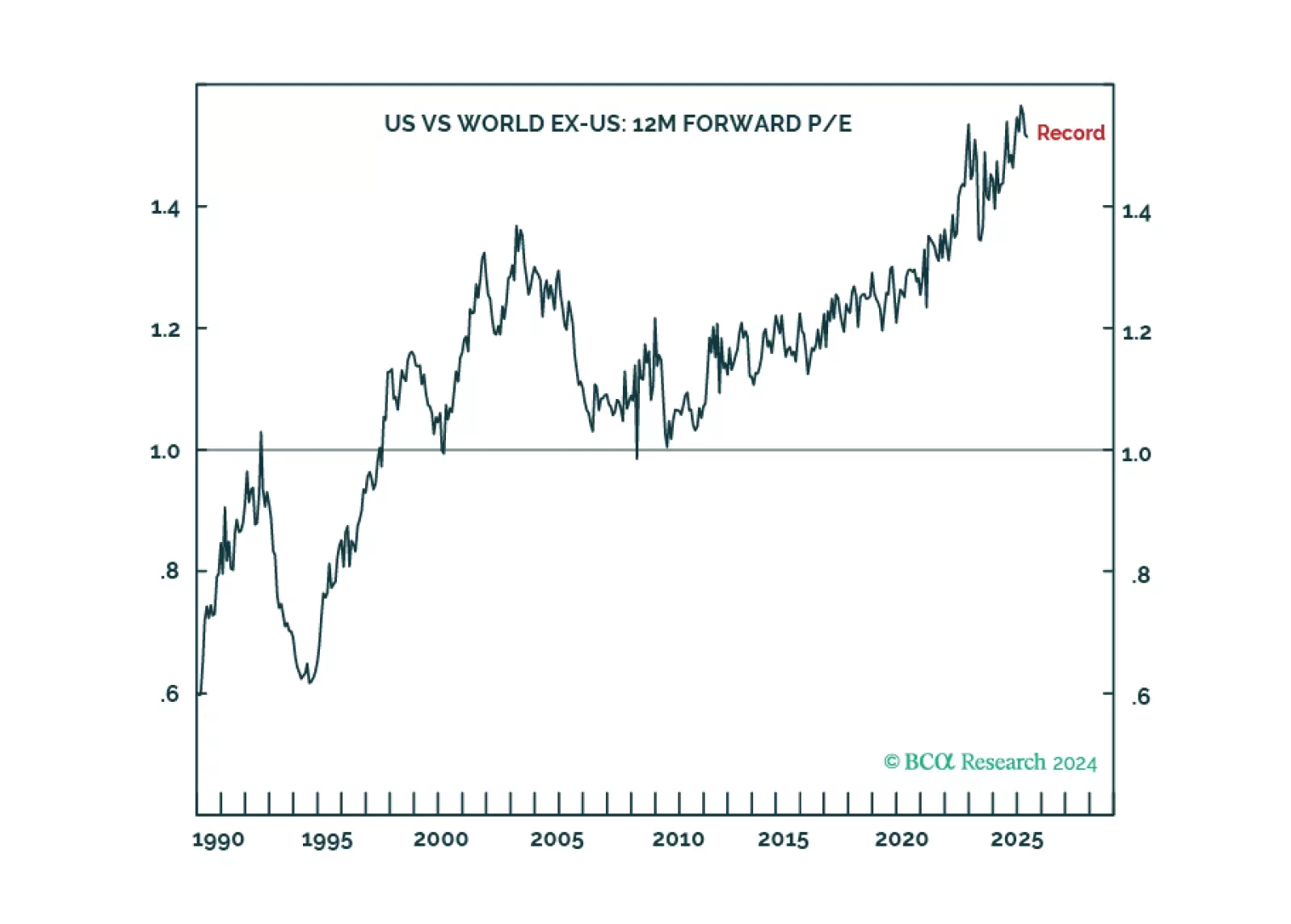

According to BCA Research’s Counterpoint service, the non-US developed economy is “demand-constrained” whereas the US economy is “supply-constrained”. This schism will continue but in reverse. The…

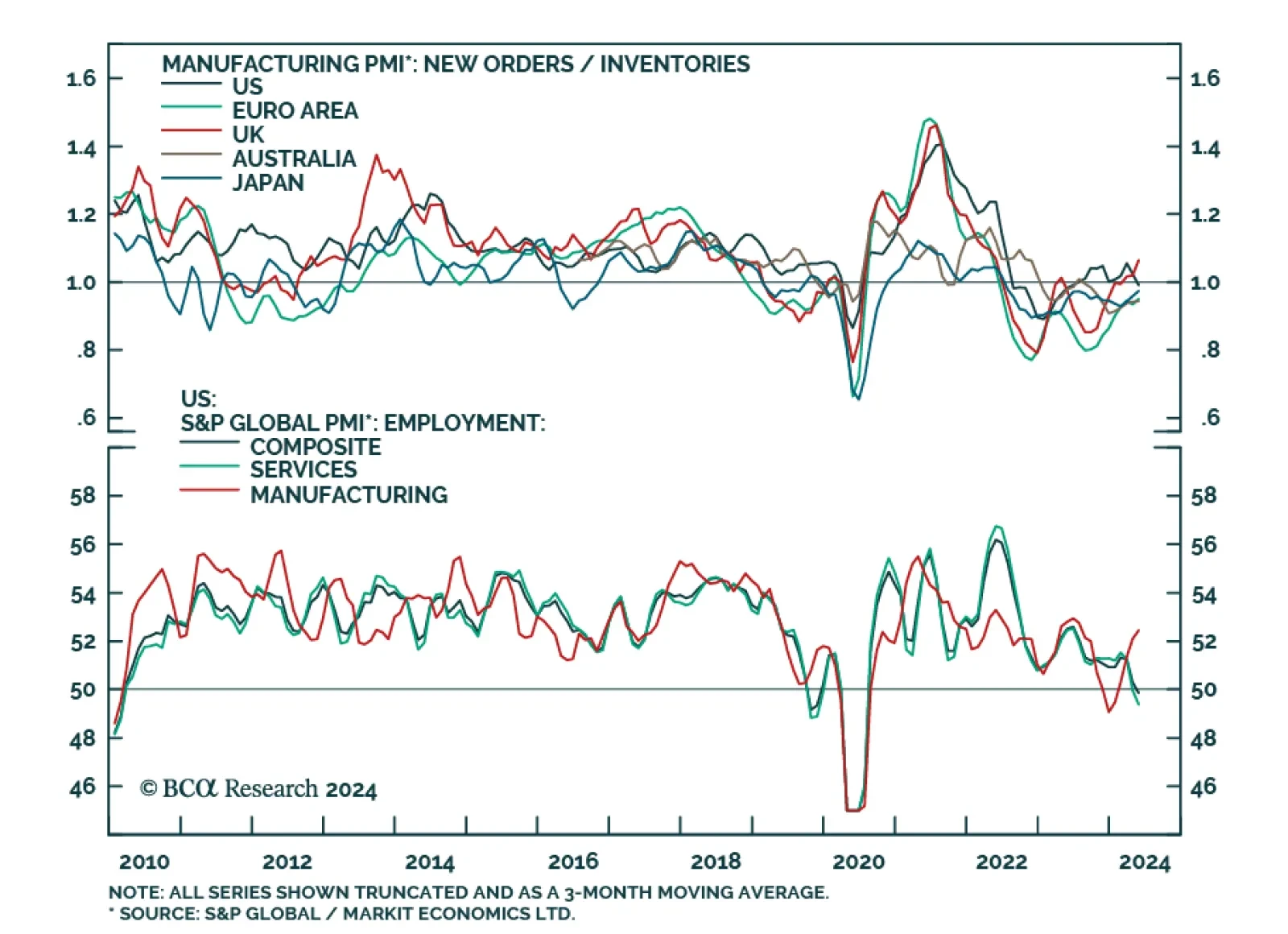

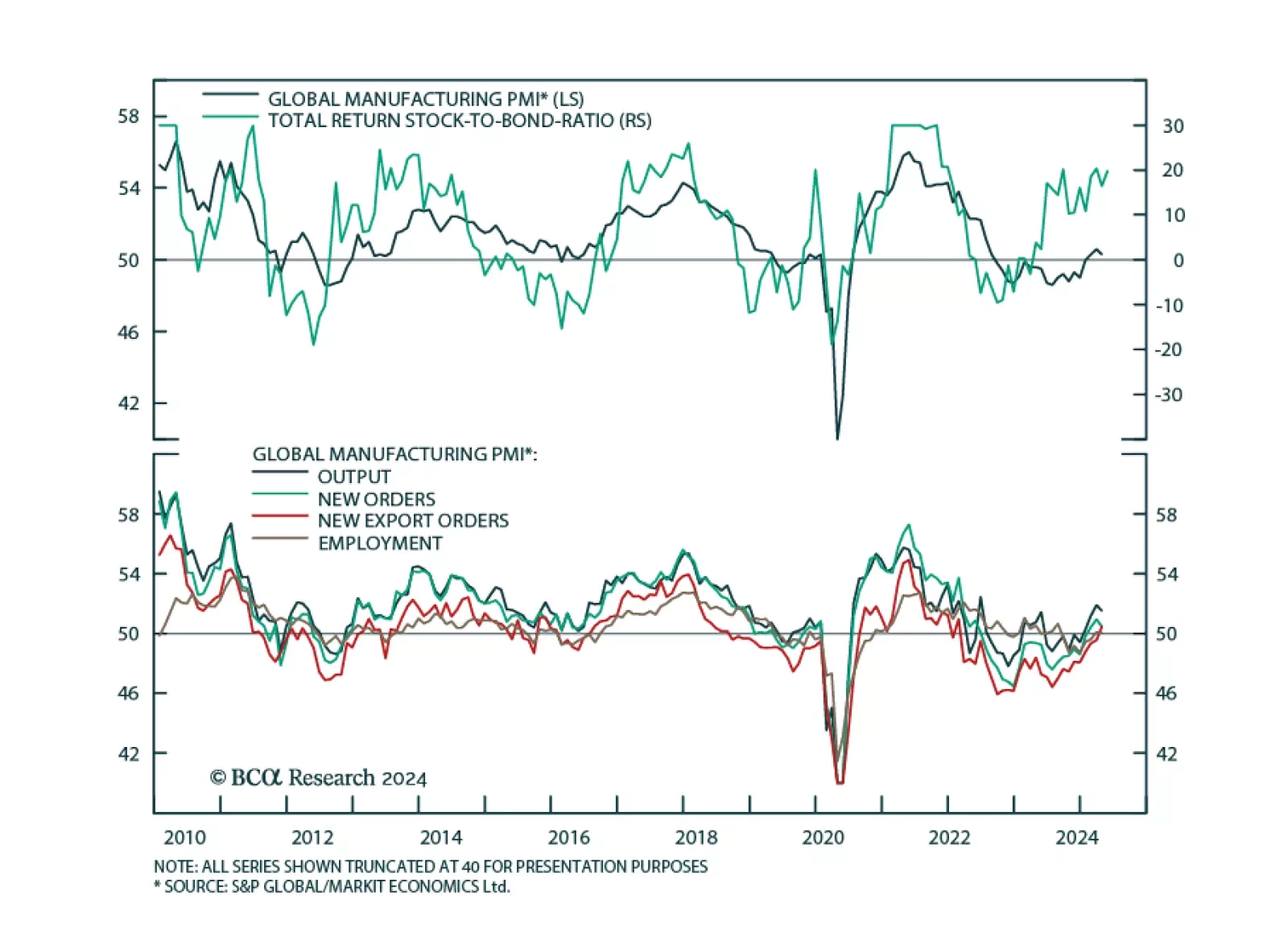

Preliminary estimates suggest that manufacturing activity generally improved across DM economies in May. Manufacturing PMIs for the US, the Eurozone, Japan and the UK all improved from their April levels. Notably,…

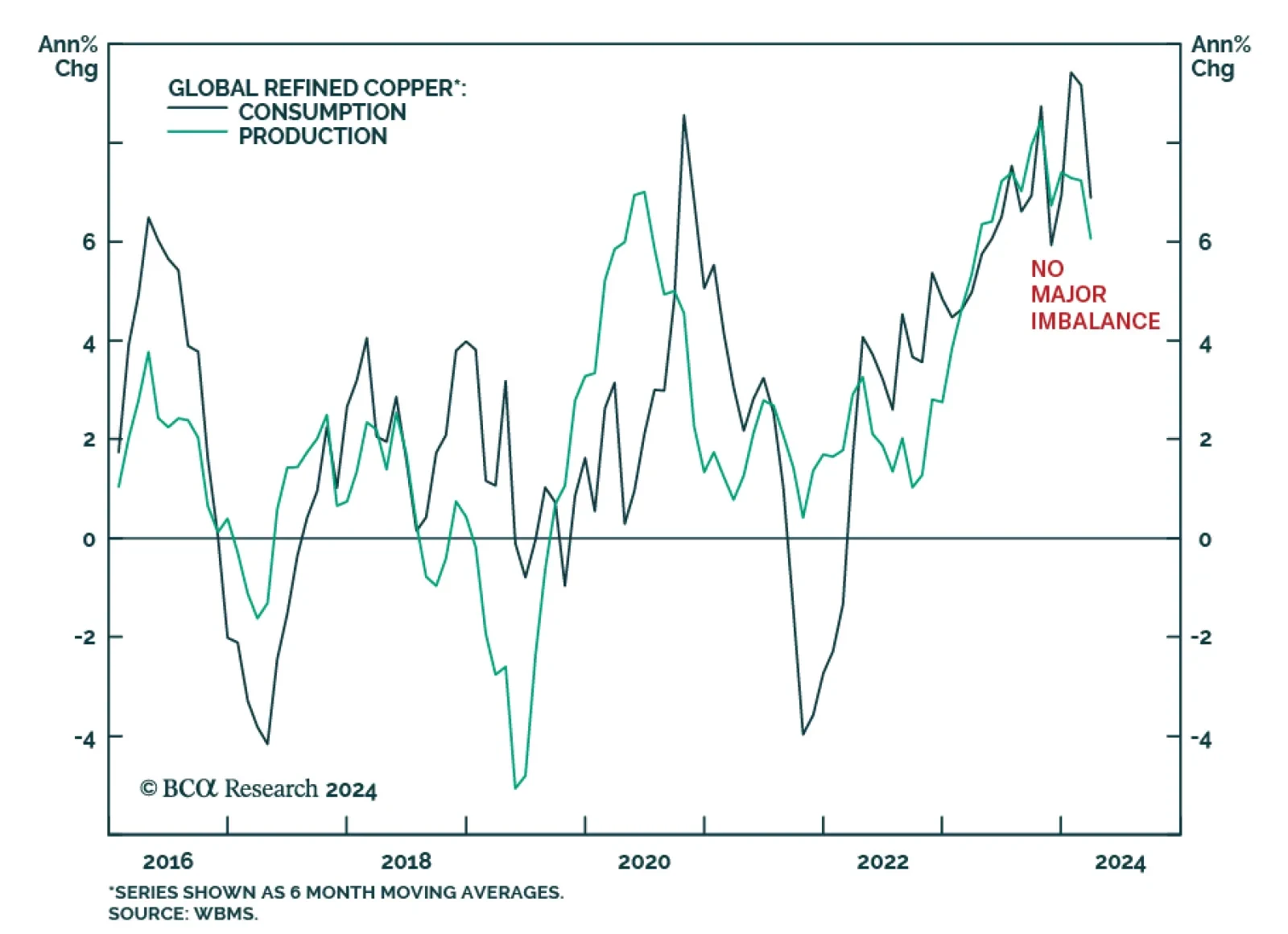

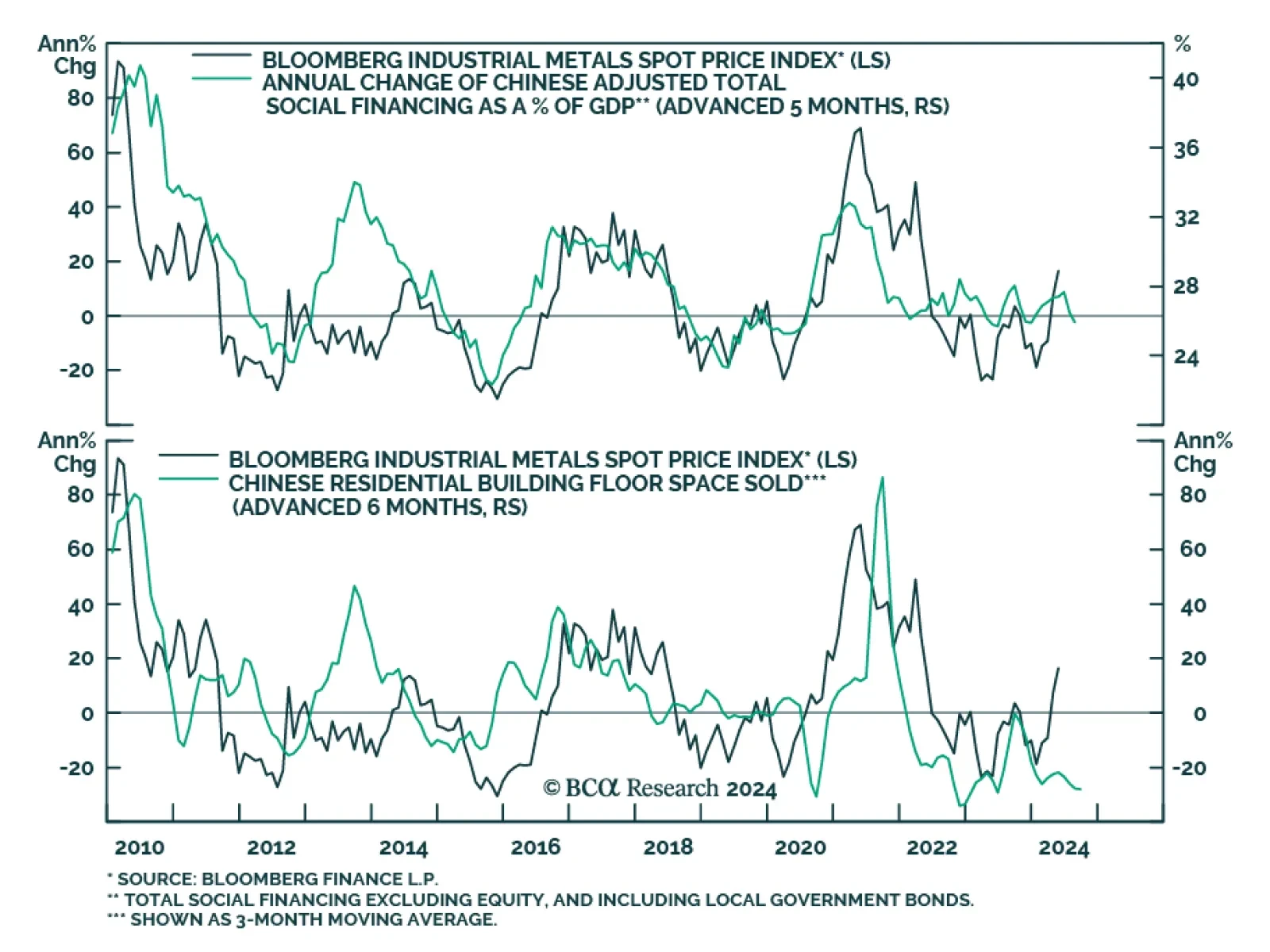

According to BCA Research’s Commodity & Energy Strategy service, the sudden increase in investor optimism about copper and lopsided long positioning has led to a short squeeze. Short squeezes are typically short-lived…

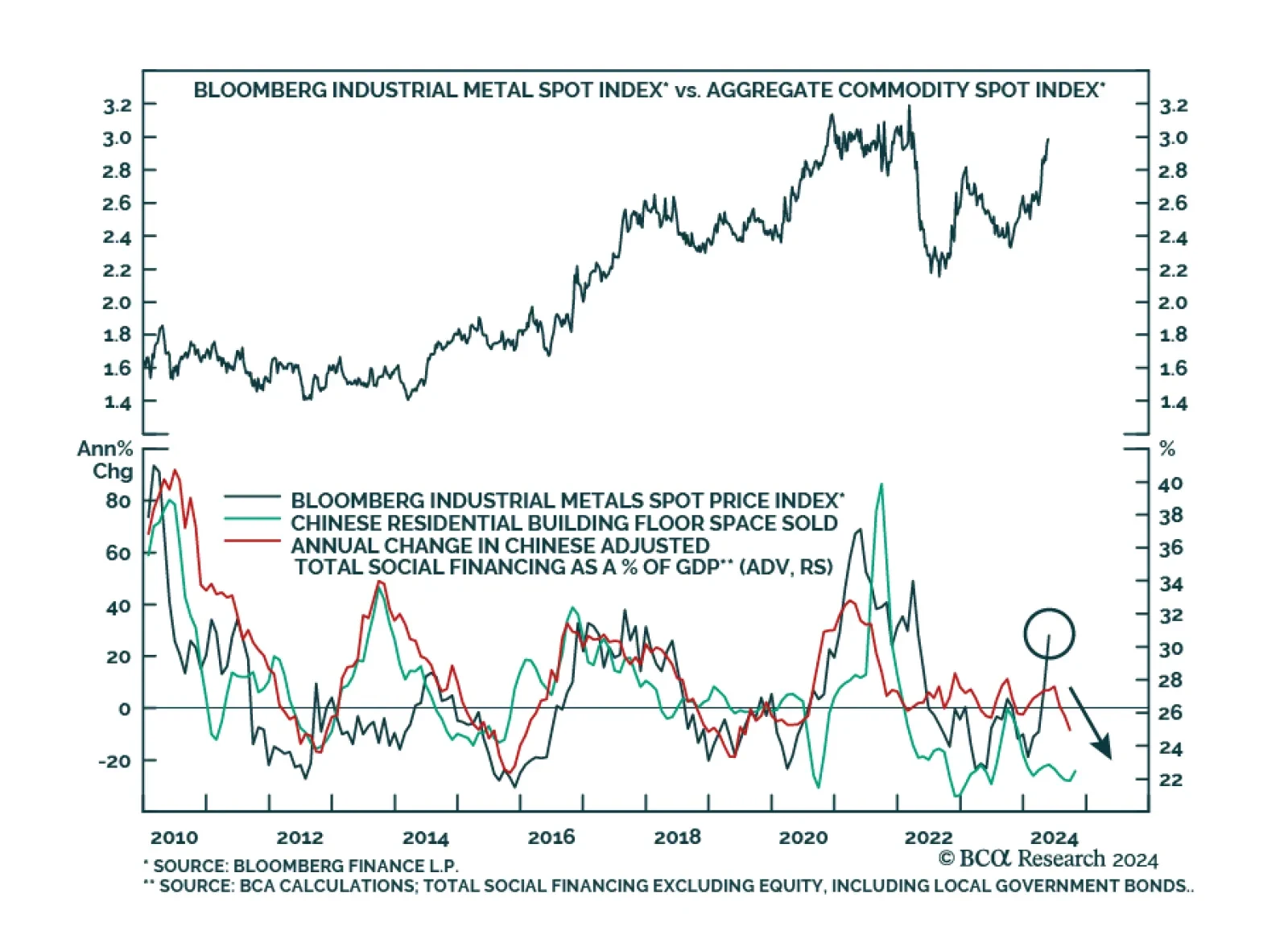

Industrial metals have outperformed the broad commodity complex this year and raced above the broad commodity complex even more meaningfully since the beginning of April. Our Commodity and Energy strategists have highlighted…

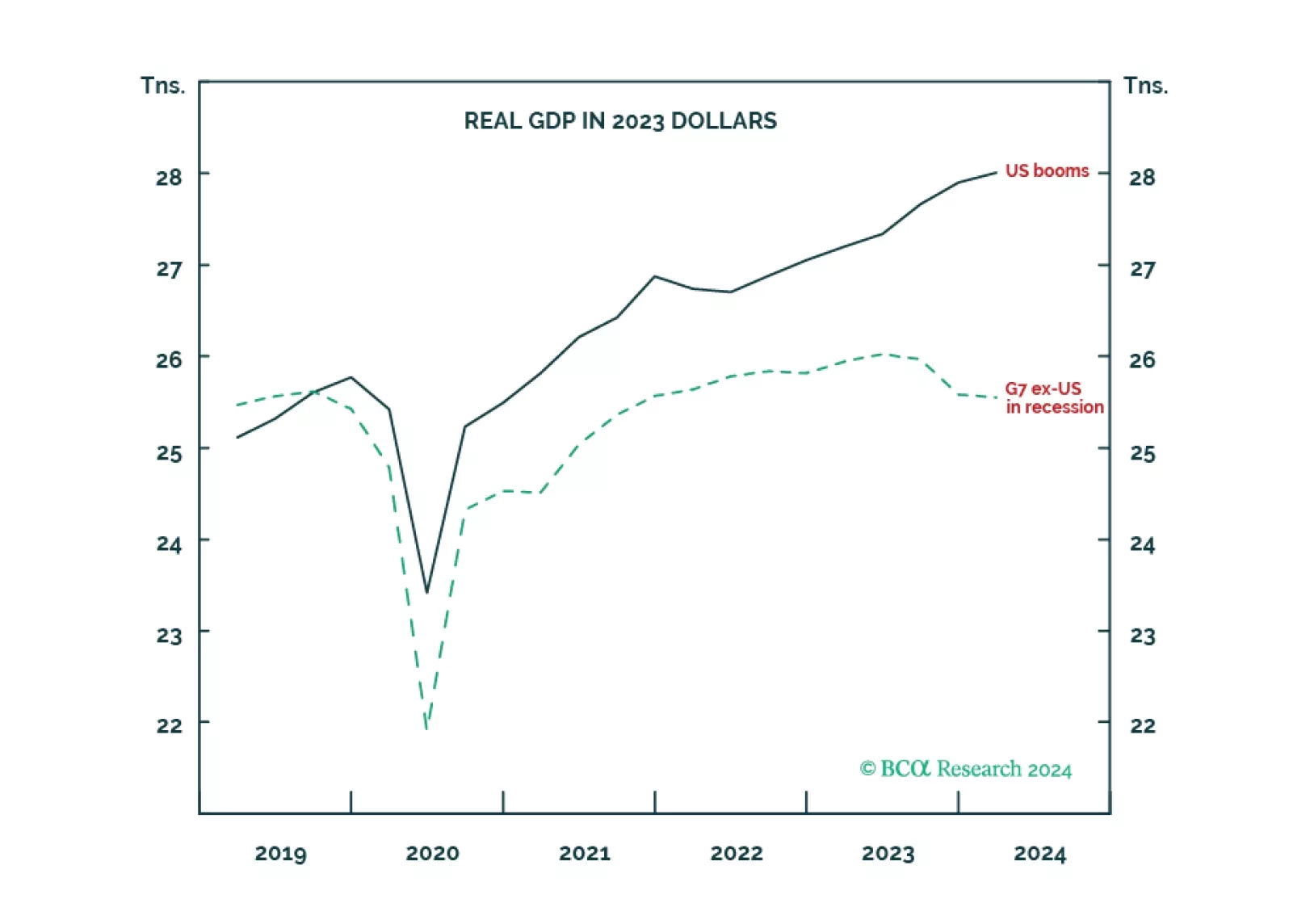

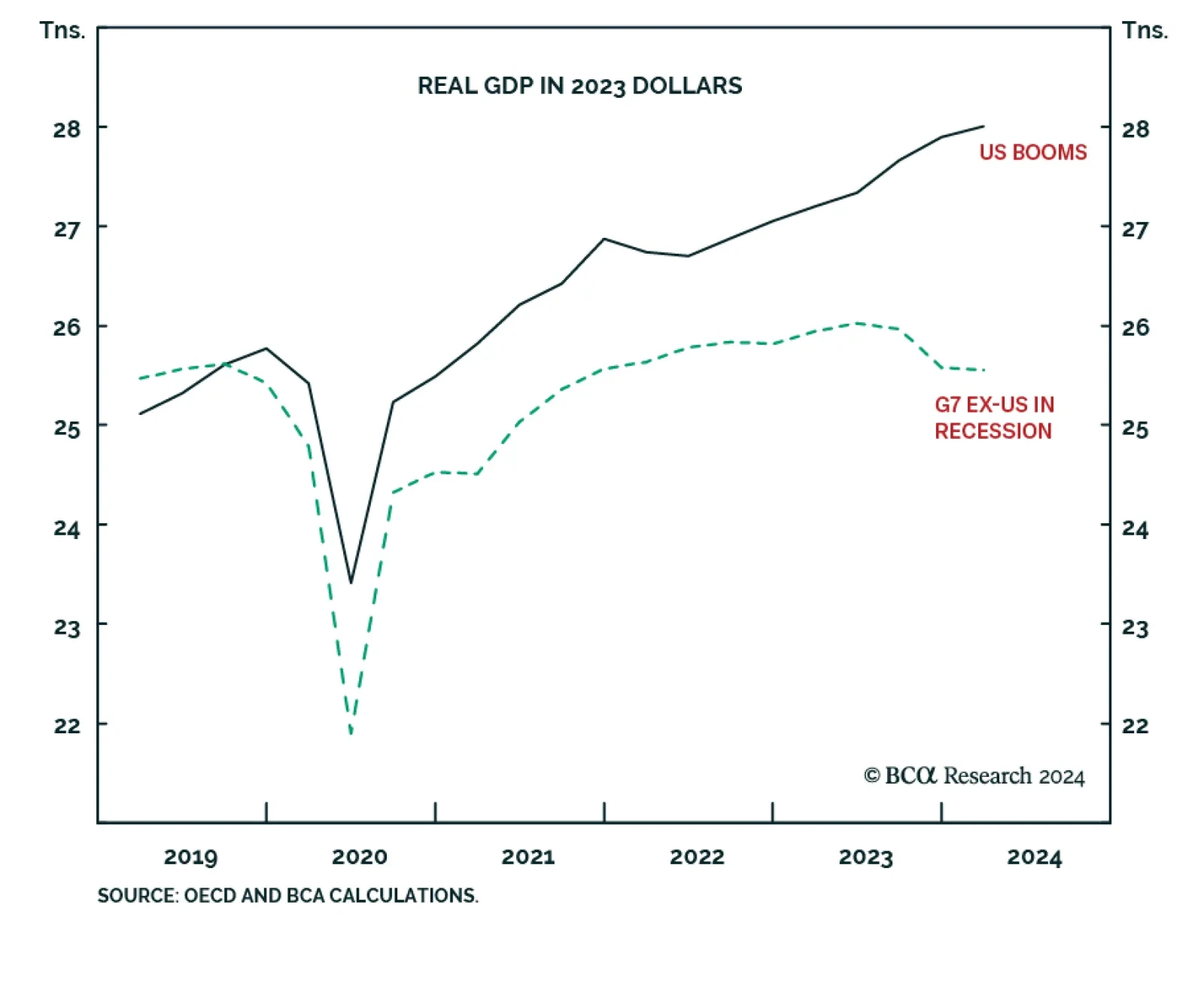

The economic schism in the world economy, between the non-US developed economy in recession and the US in strong growth, is unprecedented during our lifetimes. Now the schism will continue in reverse, as the non-US developed economy…

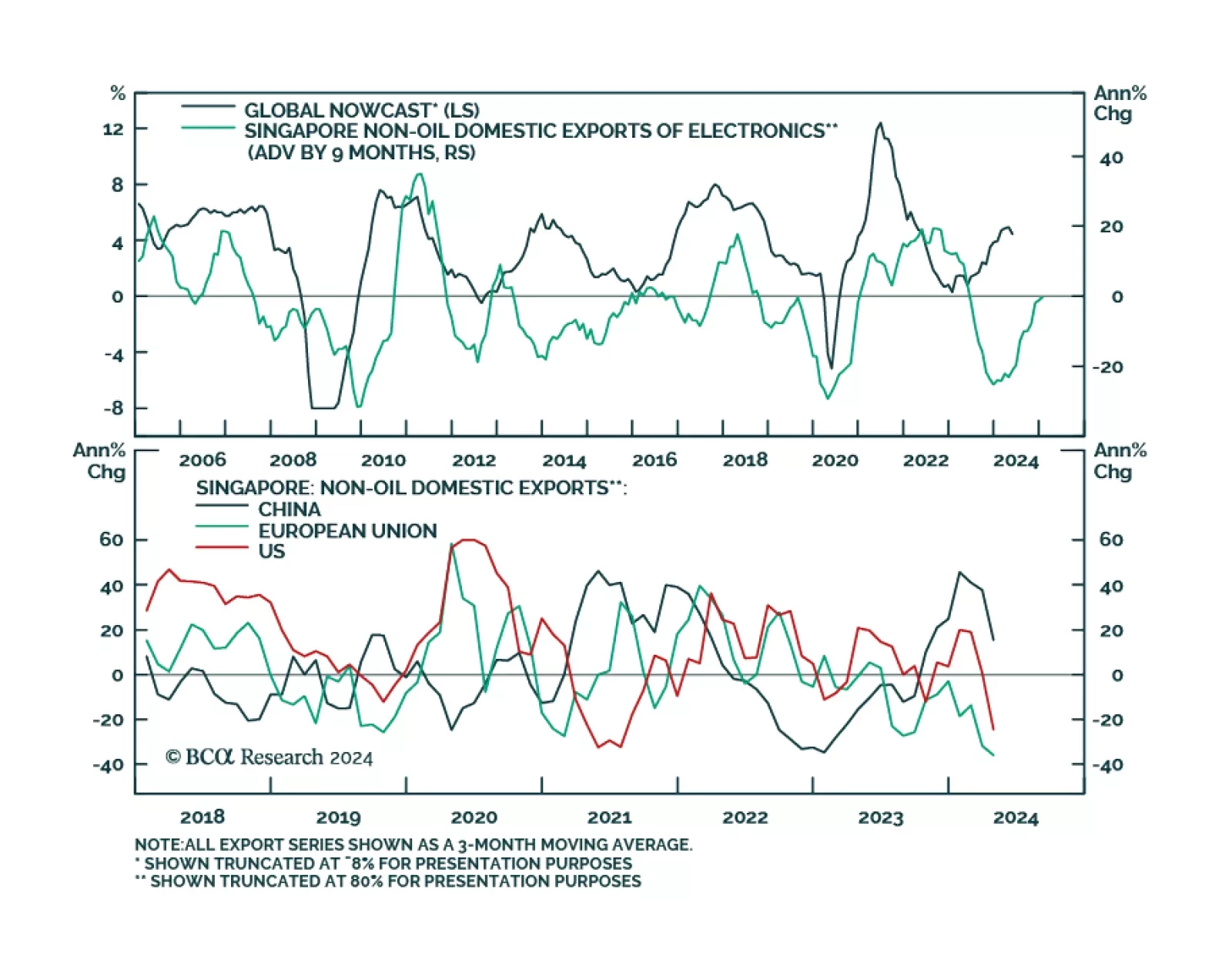

Export dynamics from small open economies are bellwethers for global trade and recent export data out of Taiwan and South Korea suggested robust global growth momentum in March. In April, Singapore’s electronics exports…

The S&P GSCI broad commodity index has returned 8% year-to-date. Improving investor sentiment has significantly broadened the rally since the beginning of the year. Over 65% of commodities in the index are now trading above…

The revival in global growth momentum continued in April. The JPM Global Manufacturing PMI came in at 50.3, marking its third consecutive month of expansion. Details underscored solid demand conditions. Output and new orders…