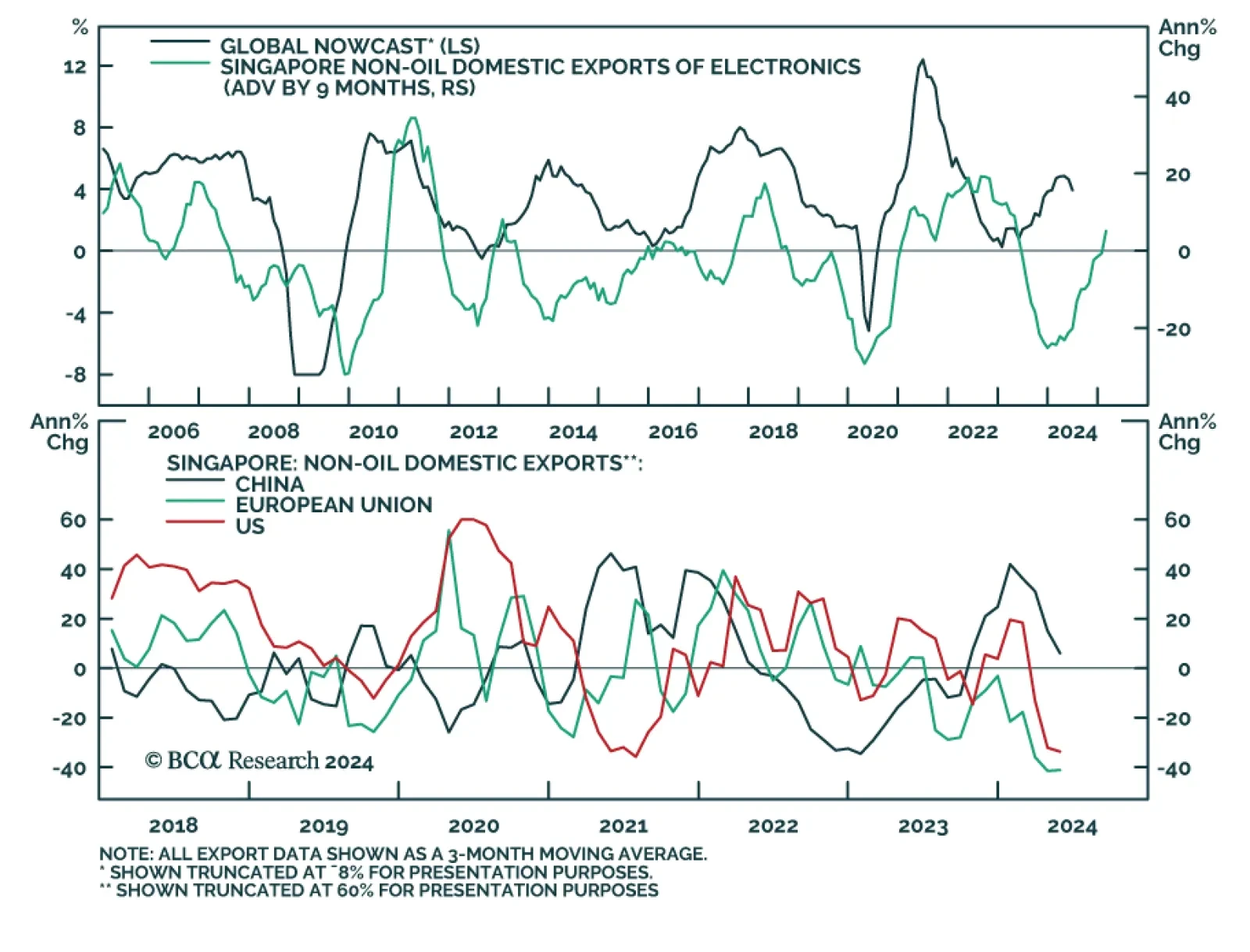

Singapore is a small open economy sensitive to global trade dynamics. Its non-oil exports (NODX) are thus a good bellwether for global growth conditions and they surprised to the upside in May. Notably, electronics exports, which…

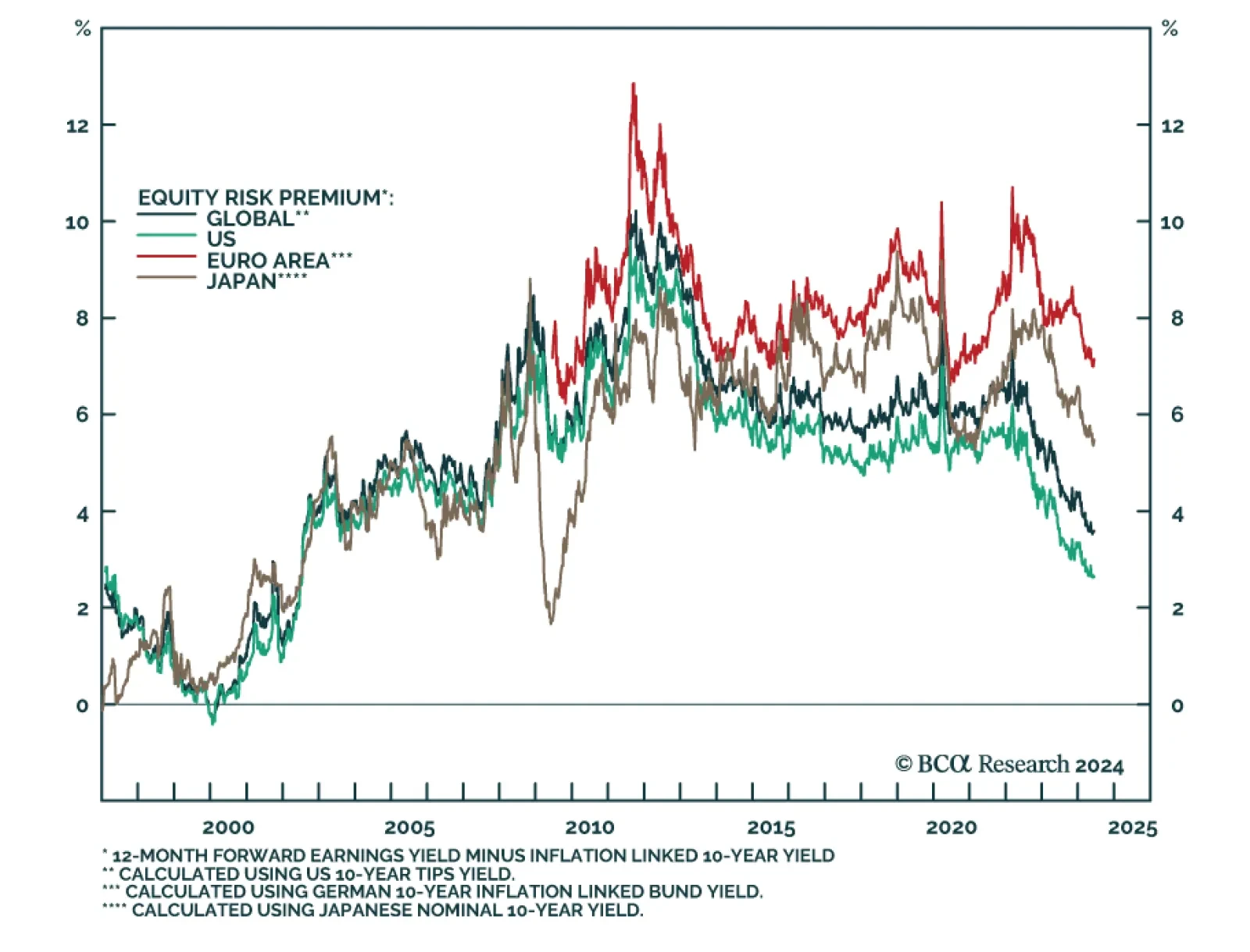

The equity risk premium (ERP) allows investors to assess the additional compensation they are offered as an enticement to assume equities’ incremental risk. The ERP measures equities’ excess return by deduct…

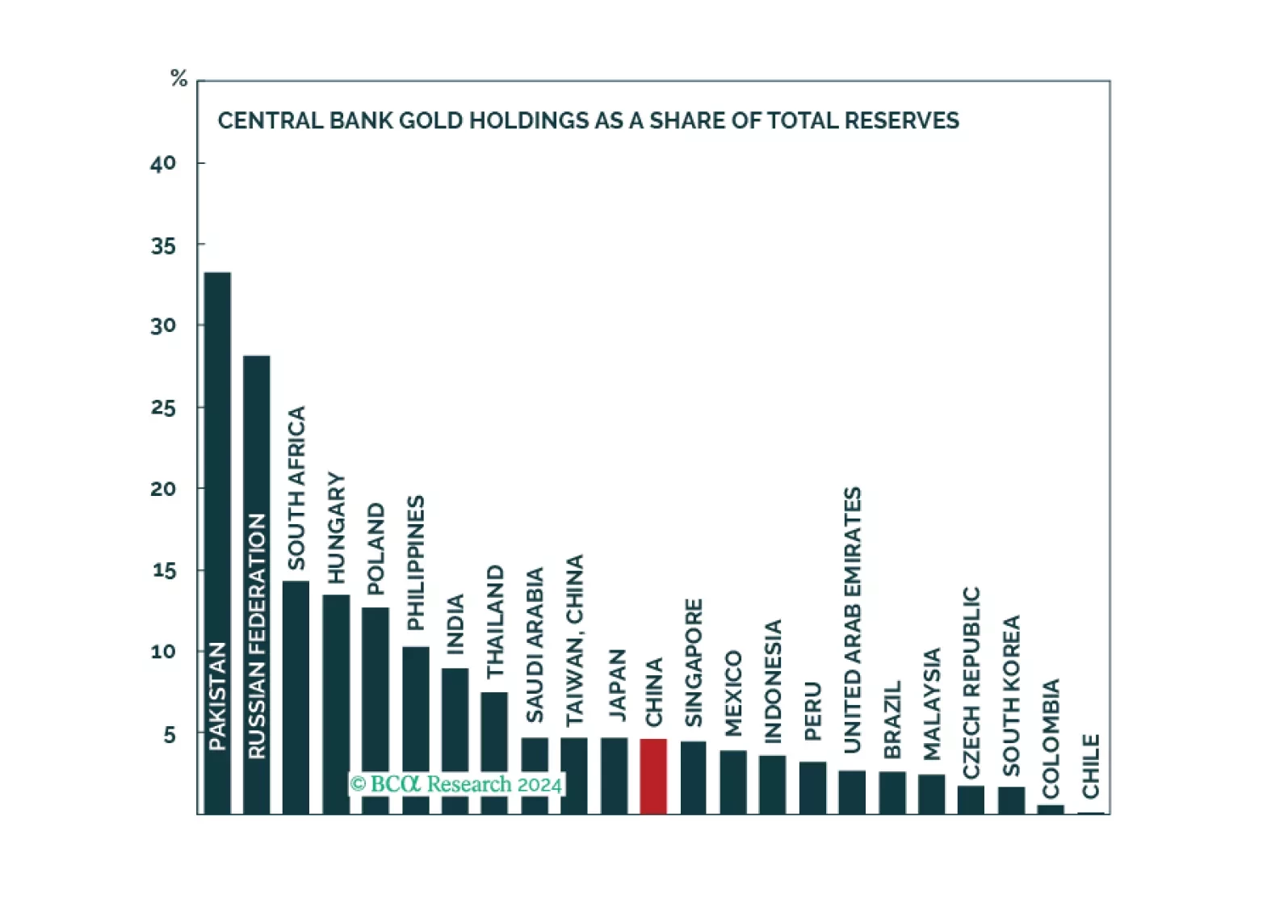

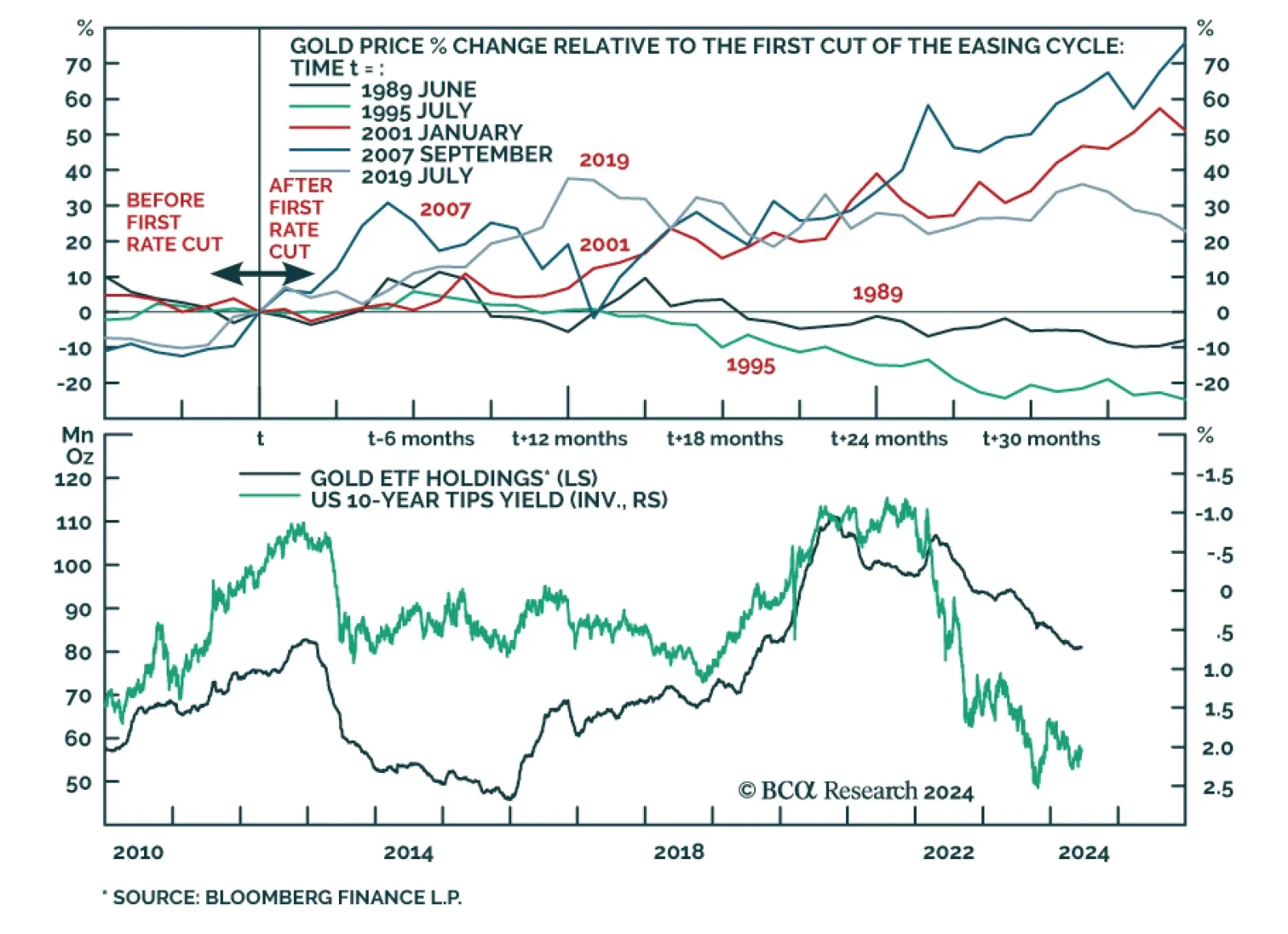

According to BCA Research’s Commodity & Energy Strategy service, a Fed pivot to rate cuts will provide gold prices with a tailwind. At first blush, the historical evidence is mixed. While gold rallied in the three…

Gold prices might experience a correction or consolidation over the near term. However, cyclical and structural forces will ultimately cause the yellow metal to trend upwards.

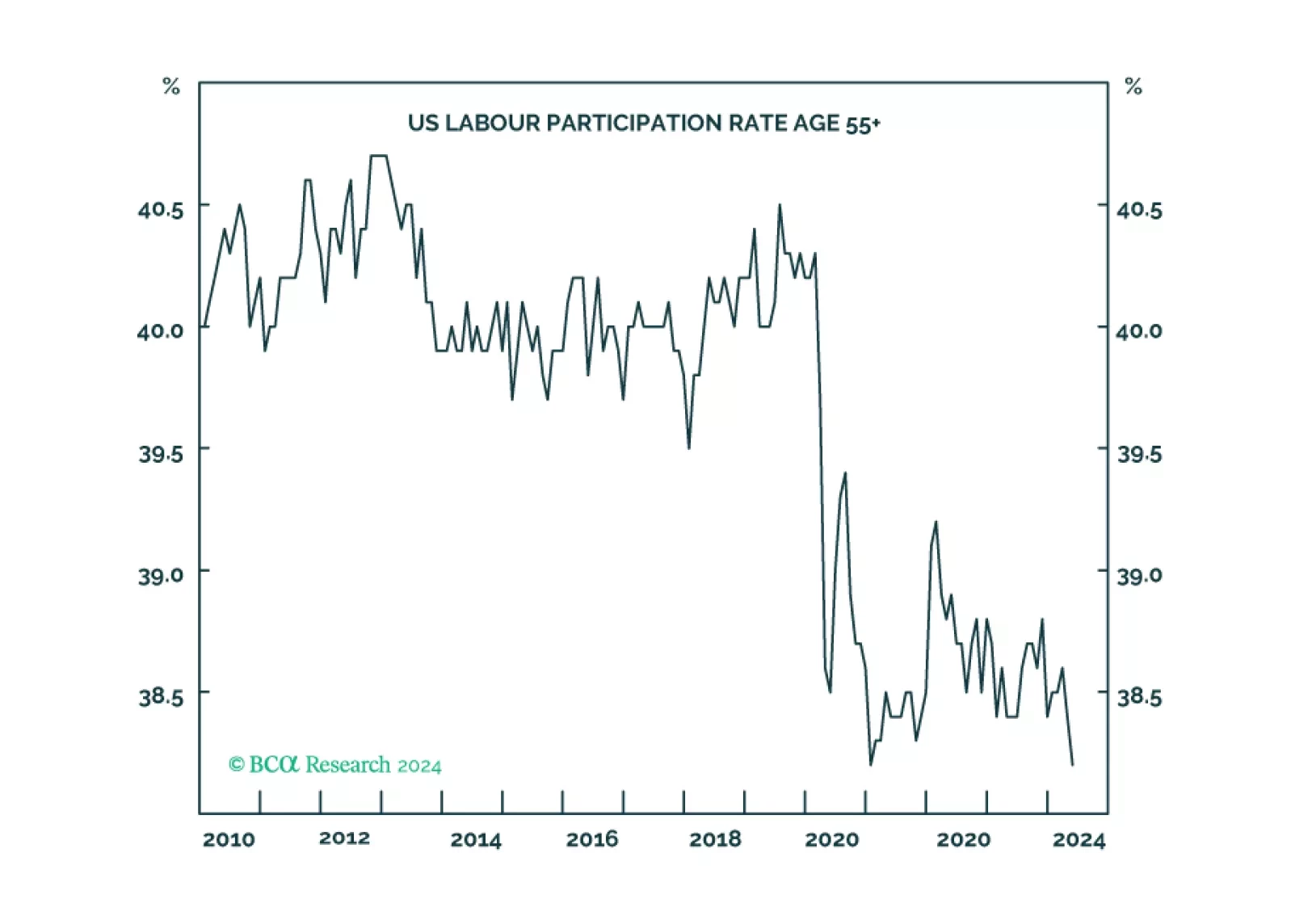

1 in 17 older Americans workers have gone missing either through ‘excess retirements’ or ‘excess mortality’. The consequent dislocation of the labour market means that the Fed’s work is not yet done. We go through some investment…

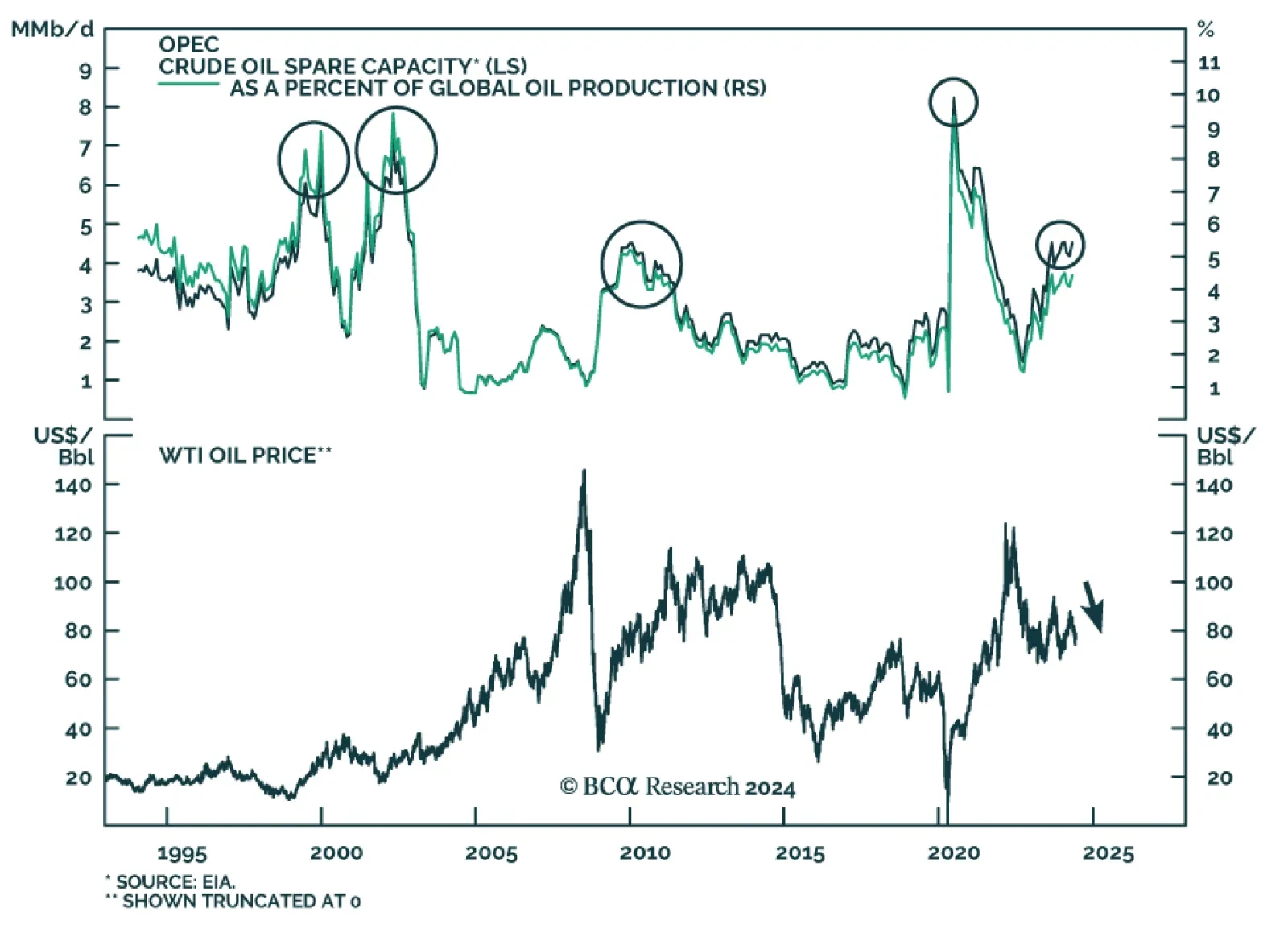

Earlier this year, WTI oil prices peaked on April 5th at $87.69 per barrel. They have since corrected by 12.7%. Should asset managers expect this decline to continue? Our Global Investment Strategy team believes oil prices…

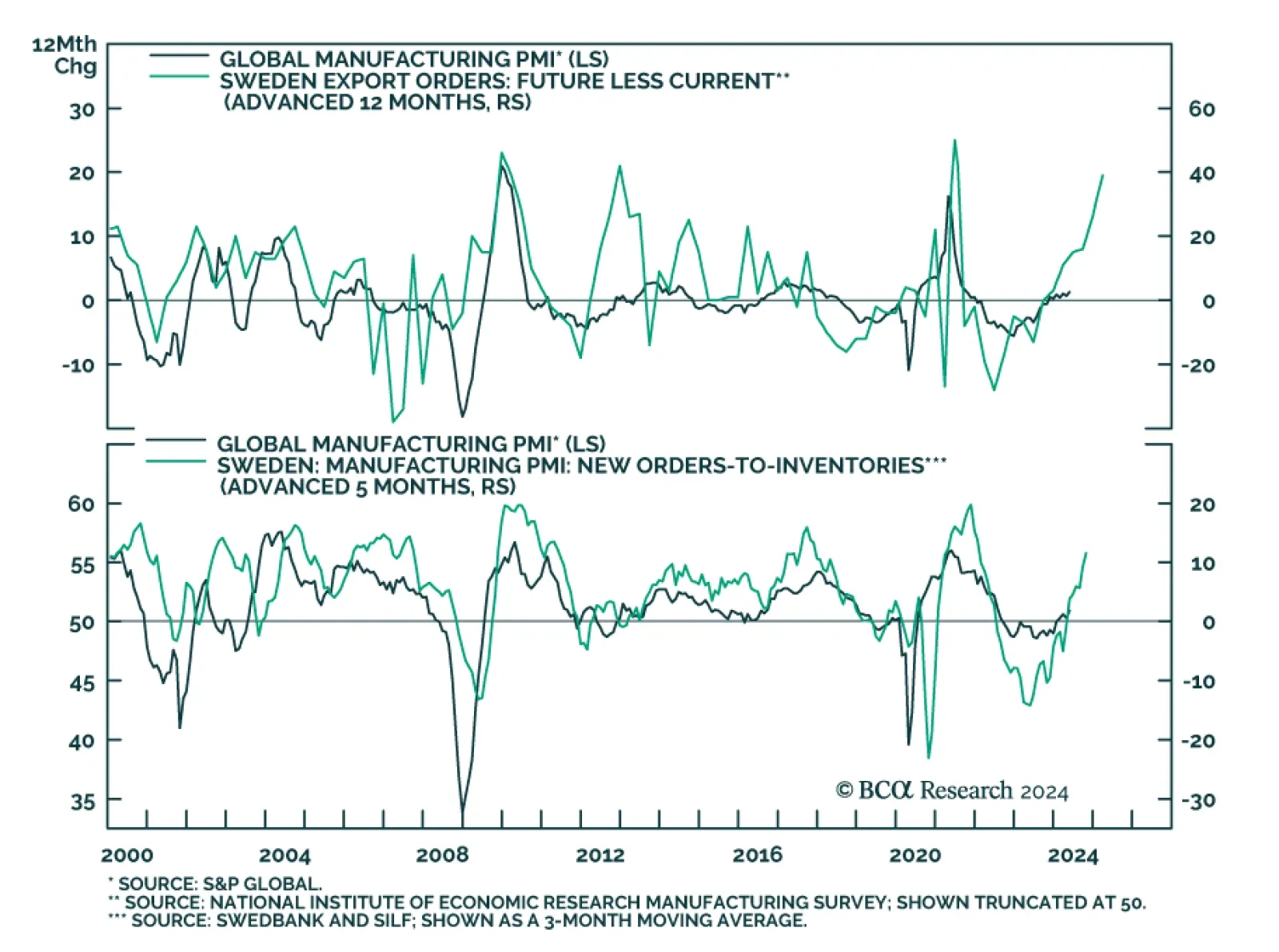

Sweden is a small export-oriented economy and its high sensitivity to global trade makes it a good bellwether of global growth developments. The headwinds from high borrowing costs are relatively more pronounced in Sweden…

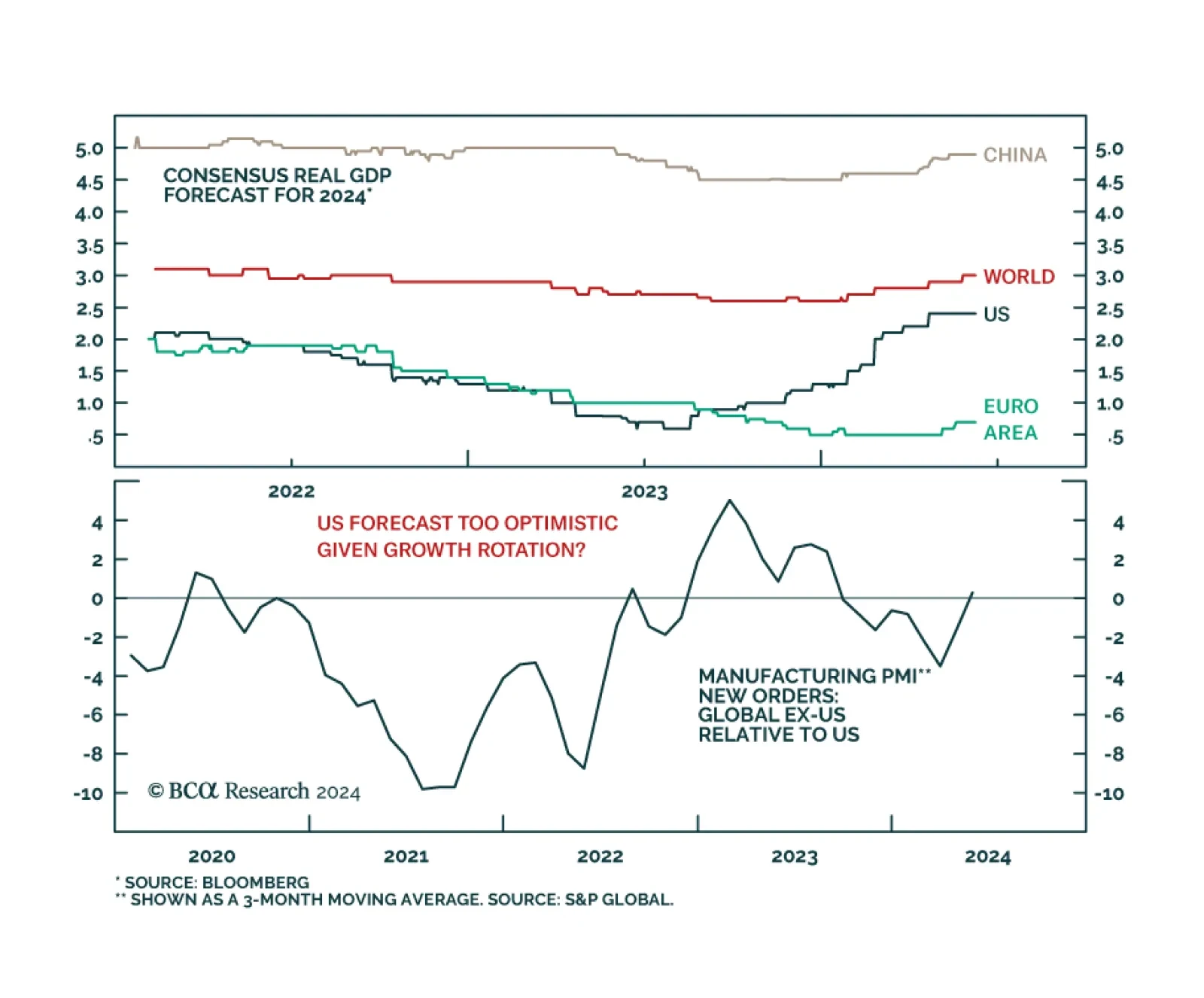

Global growth expectations for 2024 have been revised higher. Investors now forecasts 2024 GDP growth to clock in at 3%, up from 2.6% at the beginning of this year. A 1.1% upward revision in US growth expectations since January…

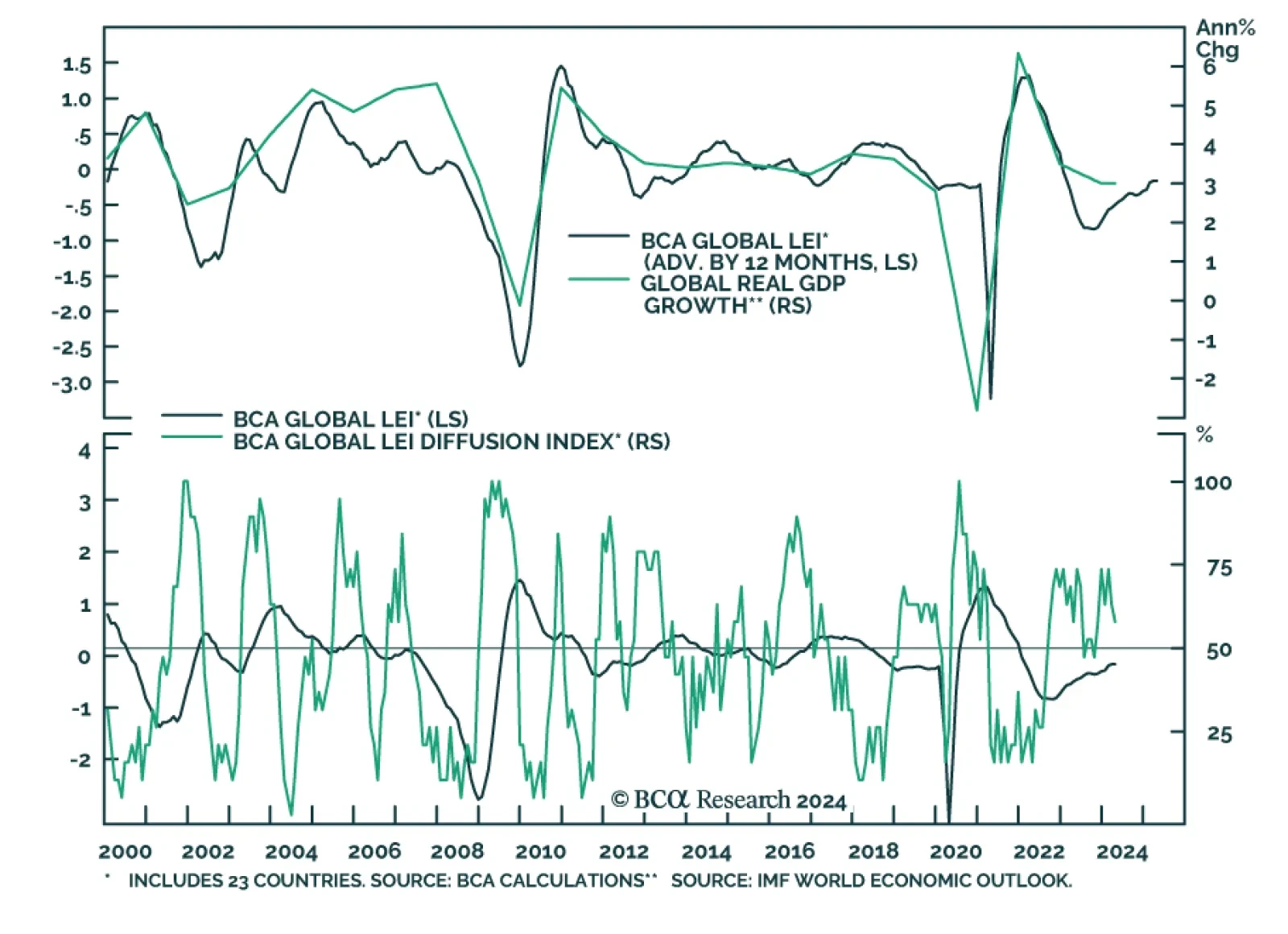

BCA’s Global Leading Economic Indicator has had a good track record of predicting year-on-year changes in the IMF global real GDP growth series. This GDP-weighted average of the standardized leading indicators of 23 DM and…

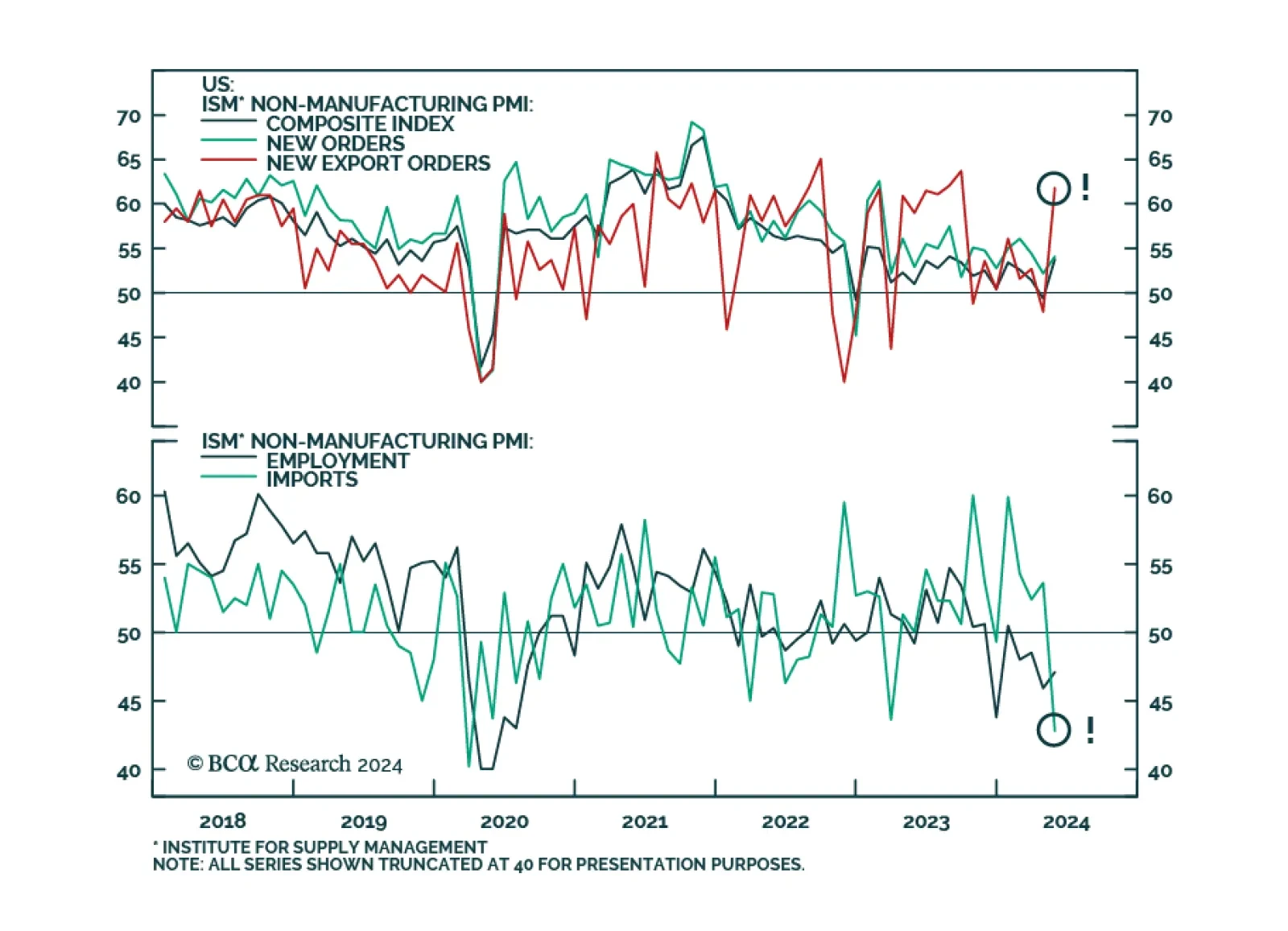

The ISM Services PMI largely surpassed expectations in May. The headline index grew by 4.4 ppt to 53.8, returning to expansion following April’s one-month contraction. Double-digit jumps in new export orders (13.9 ppt) and…