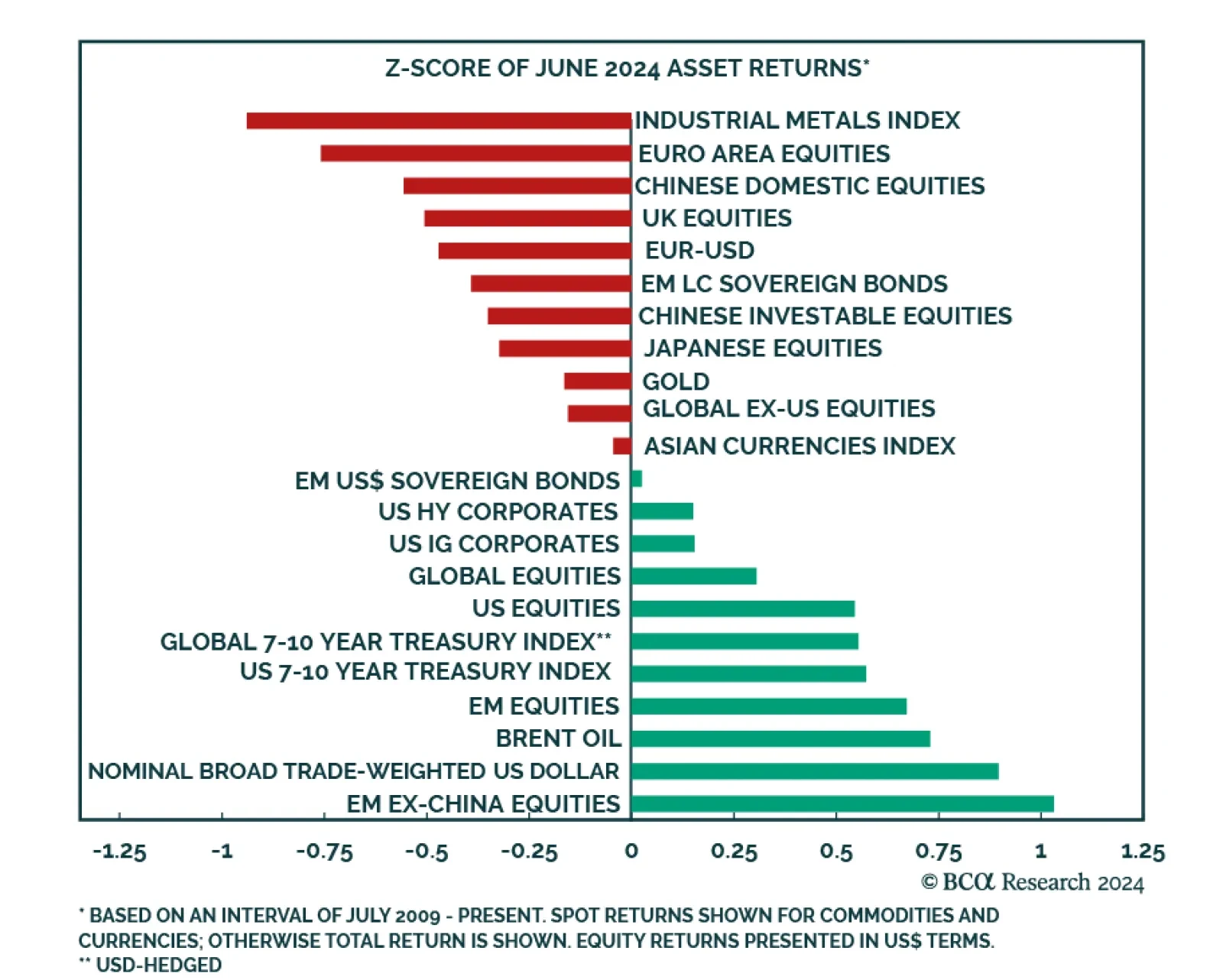

The risk-on soft-landing narrative dominated US markets in June. US equities continued their tech-led gains while lower yields sent Treasuries higher. US spread product also ended the month in the green. Outside the US,…

Concerns about the global economy have shifted from sticky inflation to faltering growth. Tight monetary policy is finally starting to bite. We suggest increasing portfolio defensiveness.

In Section I, we examine some concerning signs of US economic weakness that emerged in June. We also discuss portfolio positioning in the face of falling interest rates and cross-check our recommended US equity overweight in the face…

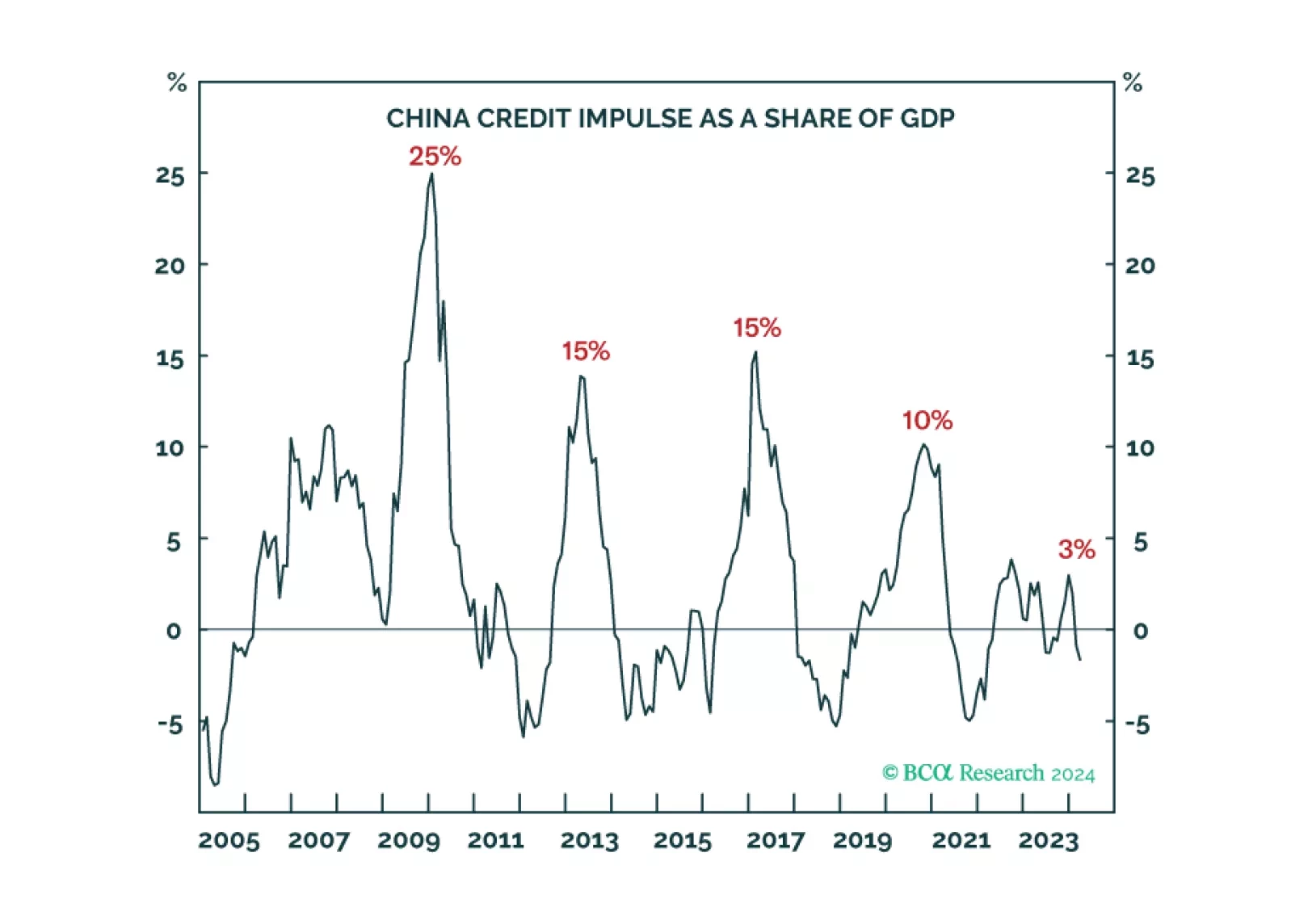

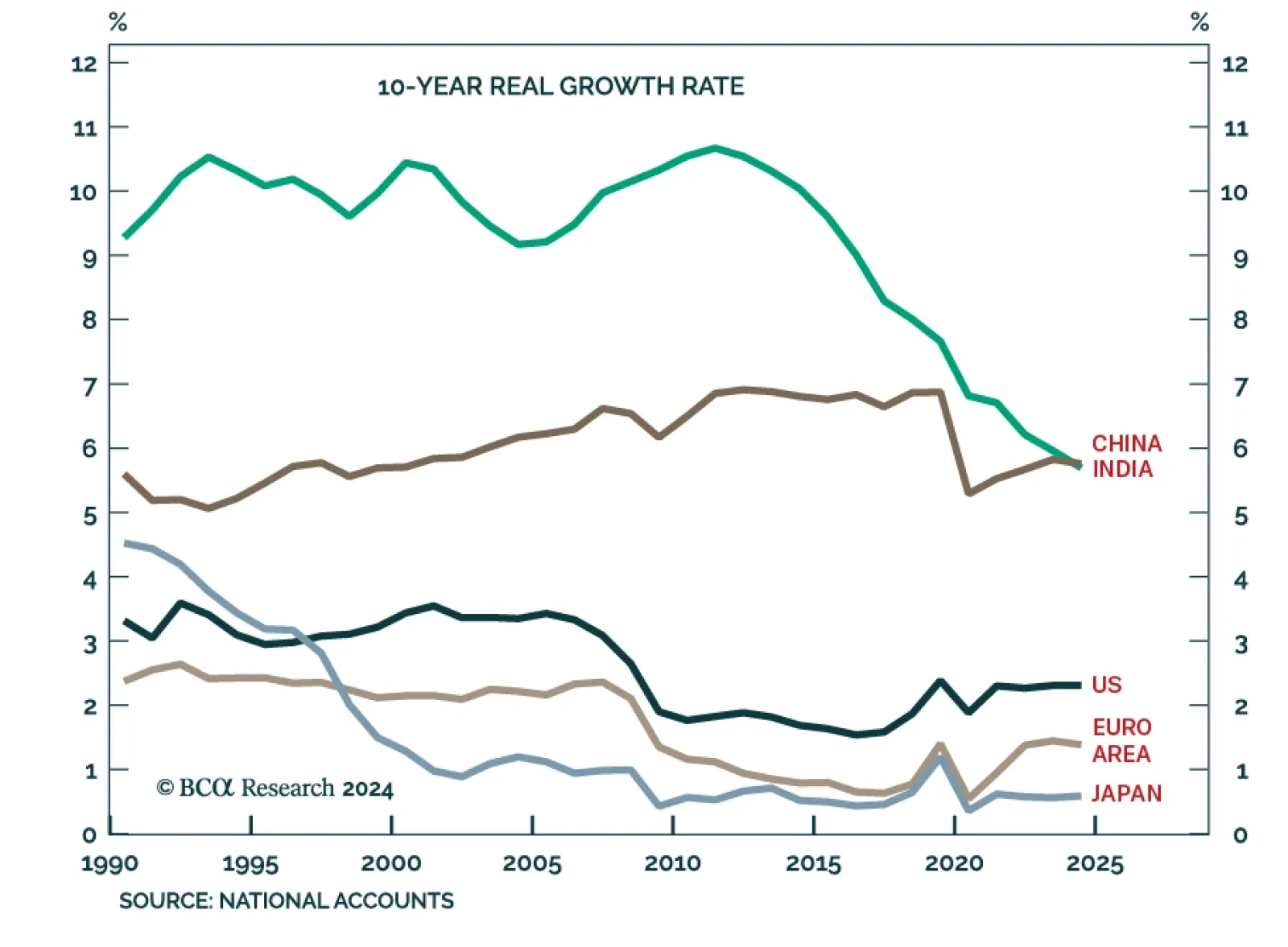

According to BCA Research’s Counterpoint service, absent China’s exponential credit growth, China’s trend growth rate will fall to 4 percent and the world’s trend growth rate will fall to sub-3 percent.…

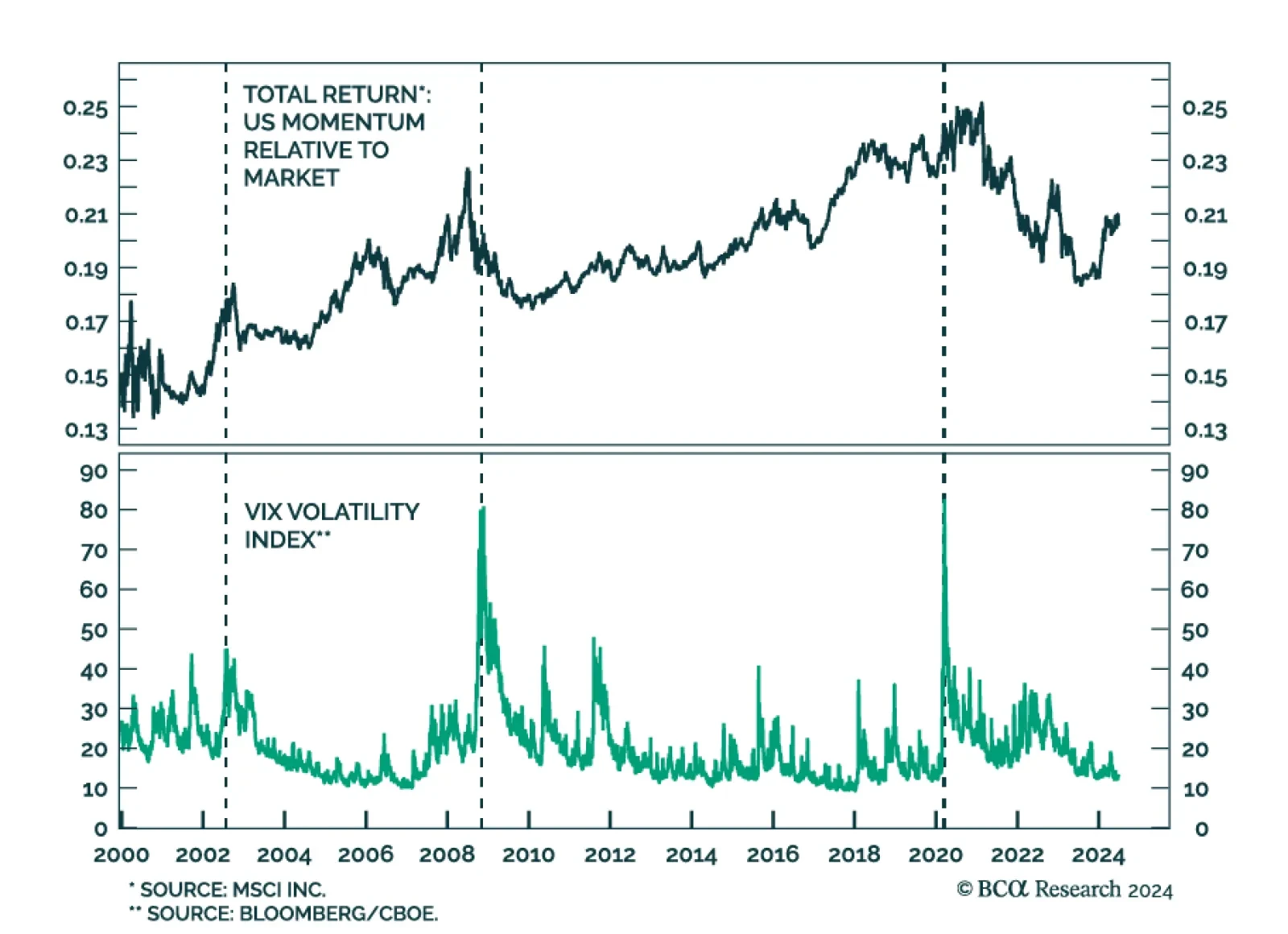

Volatility is usually a poor predictor of stock returns. It has no leading properties on the overall equity market. High volatility is contemporaneous with big drawdowns, while low volatility is contemporaneous with bull markets…

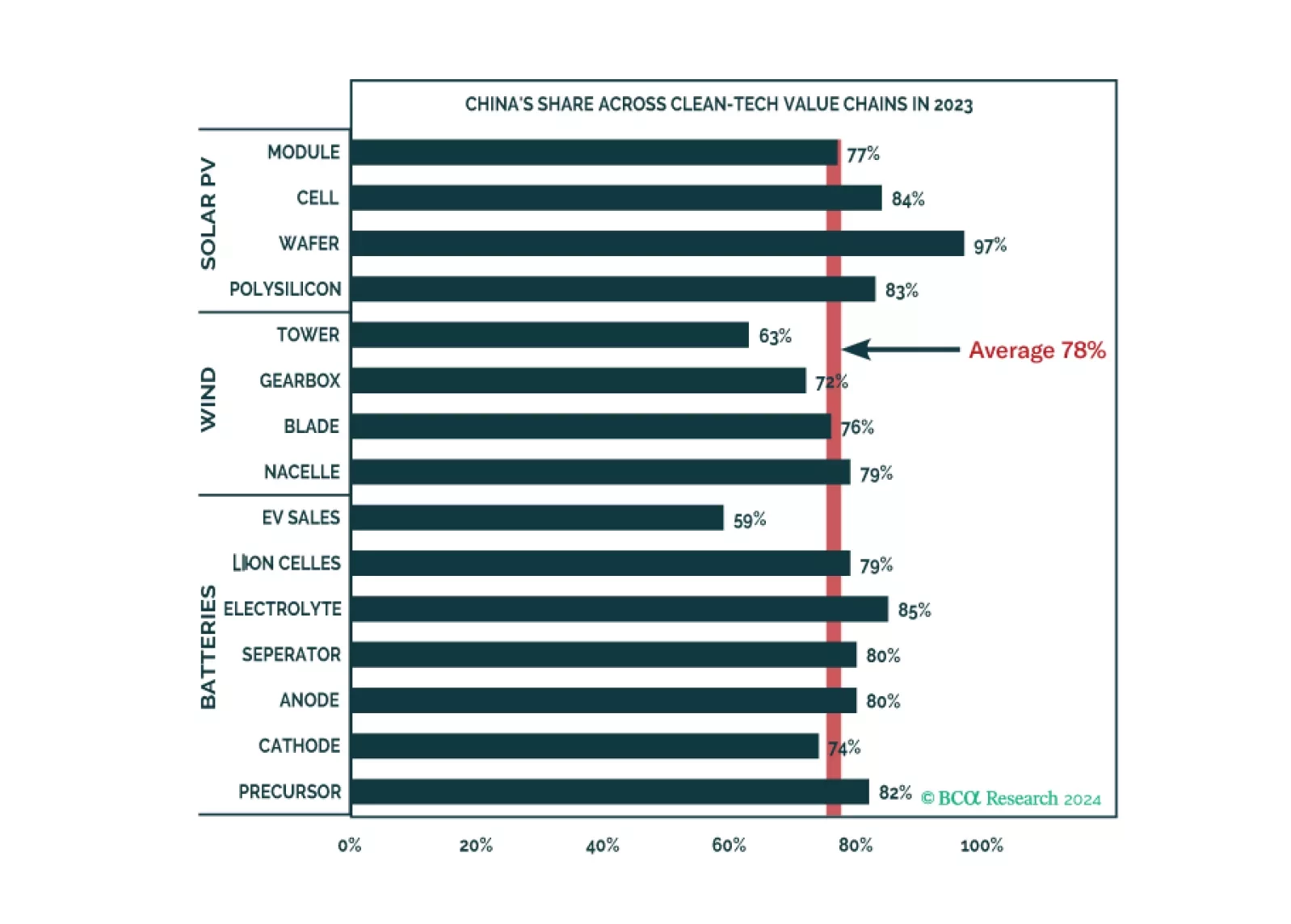

The end of China’s exponential credit growth will impede structural rallies in Chinese stocks and commodities, but US superstar stocks’ bubble-like valuations will impede them too. Leaving European stocks as the likely structural…

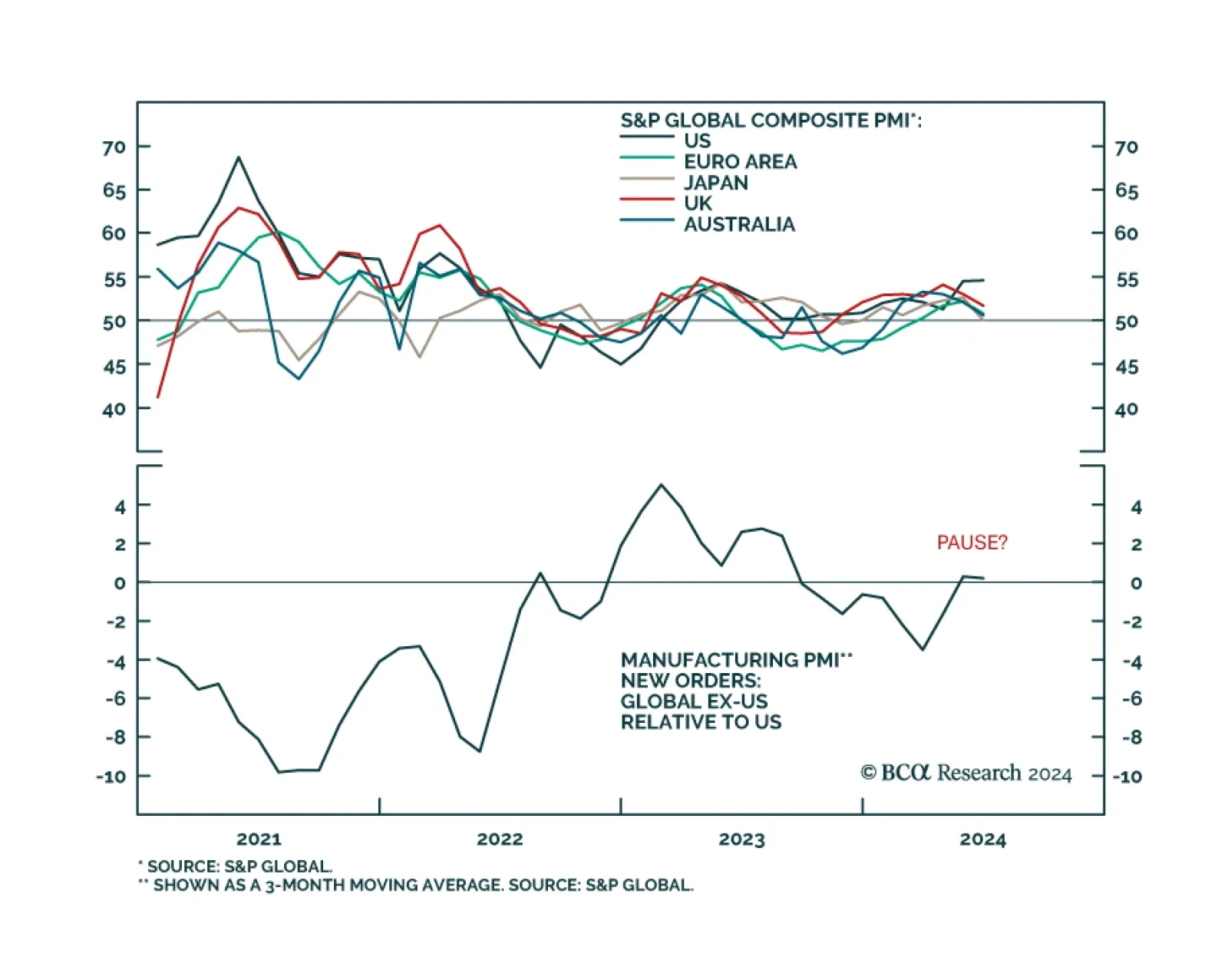

Preliminary PMI estimates suggest that US economic leadership remained intact in June, despite previous signs that it was passing the global growth baton to the rest of the world. US manufacturing, services and composite PMIs…

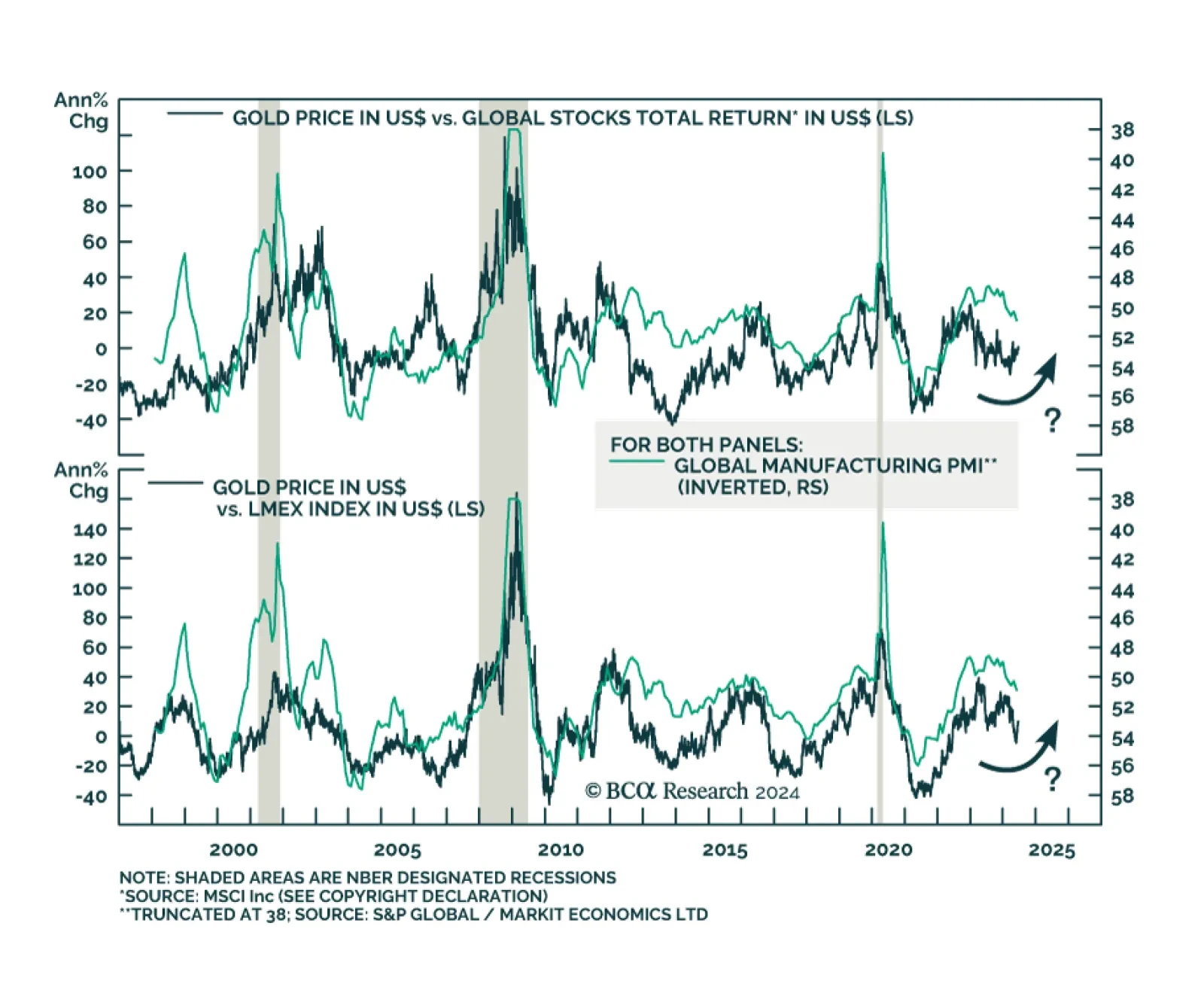

Gold spot prices have returned a whopping 25% YTD, with the bulk of this performance having occurred in the last three months. Interestingly, these gains have occurred despite the rise in real yields, with which they are…

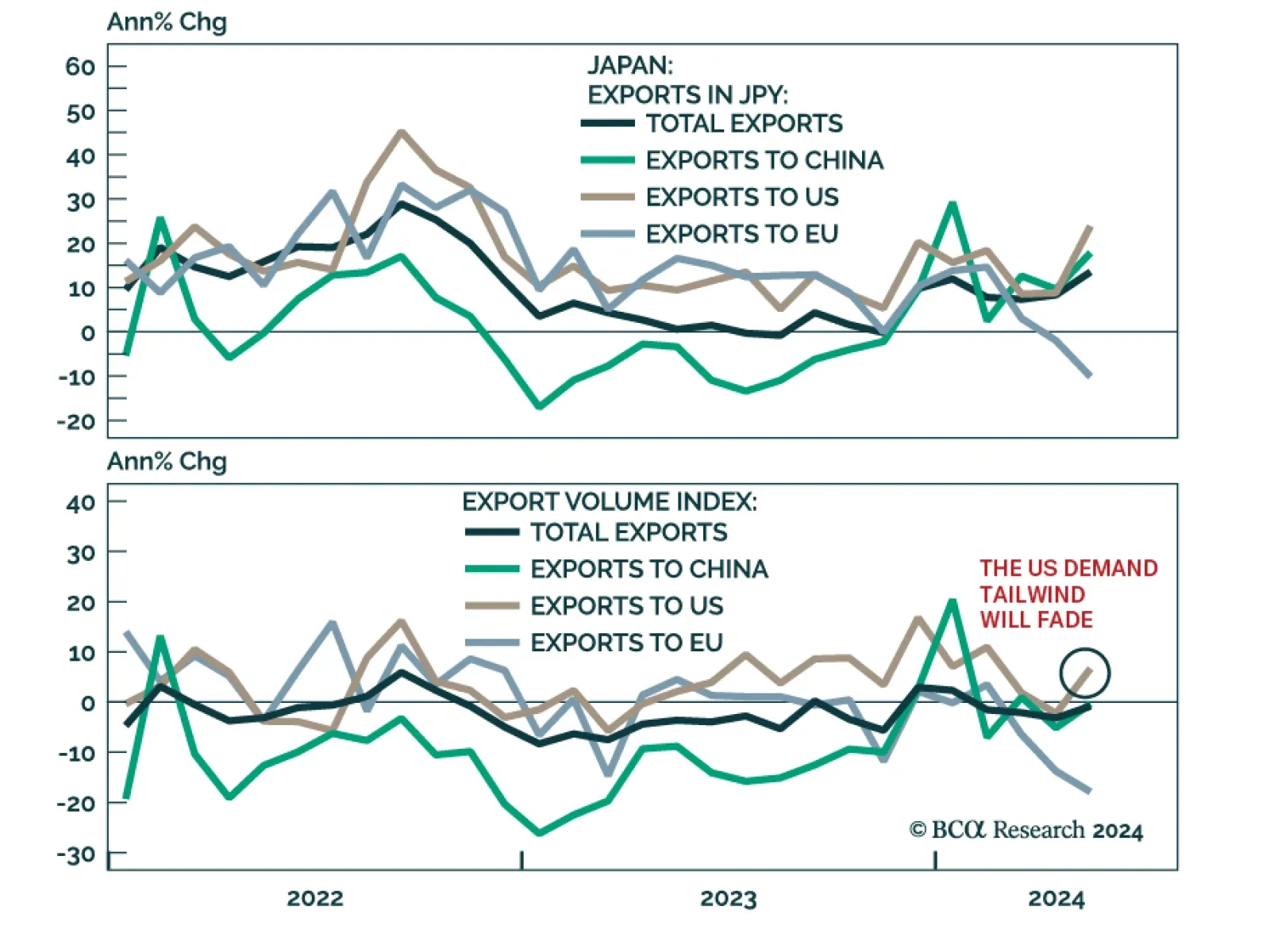

Japanese exports in JPY increased from 8.3% y/y to 13.5% in May, surpassing expectations of 12.7%. 23.9% and 17.8% y/y growth in exports to the US and China, respectively, led the overall surge. Trade data from Asian export-…