According to BCA Research’s Geopolitical Strategy service, US policy will have an impact on China’s willingness to adopt a preemptively hawkish foreign policy. But the US is in the middle of a chaotic election that…

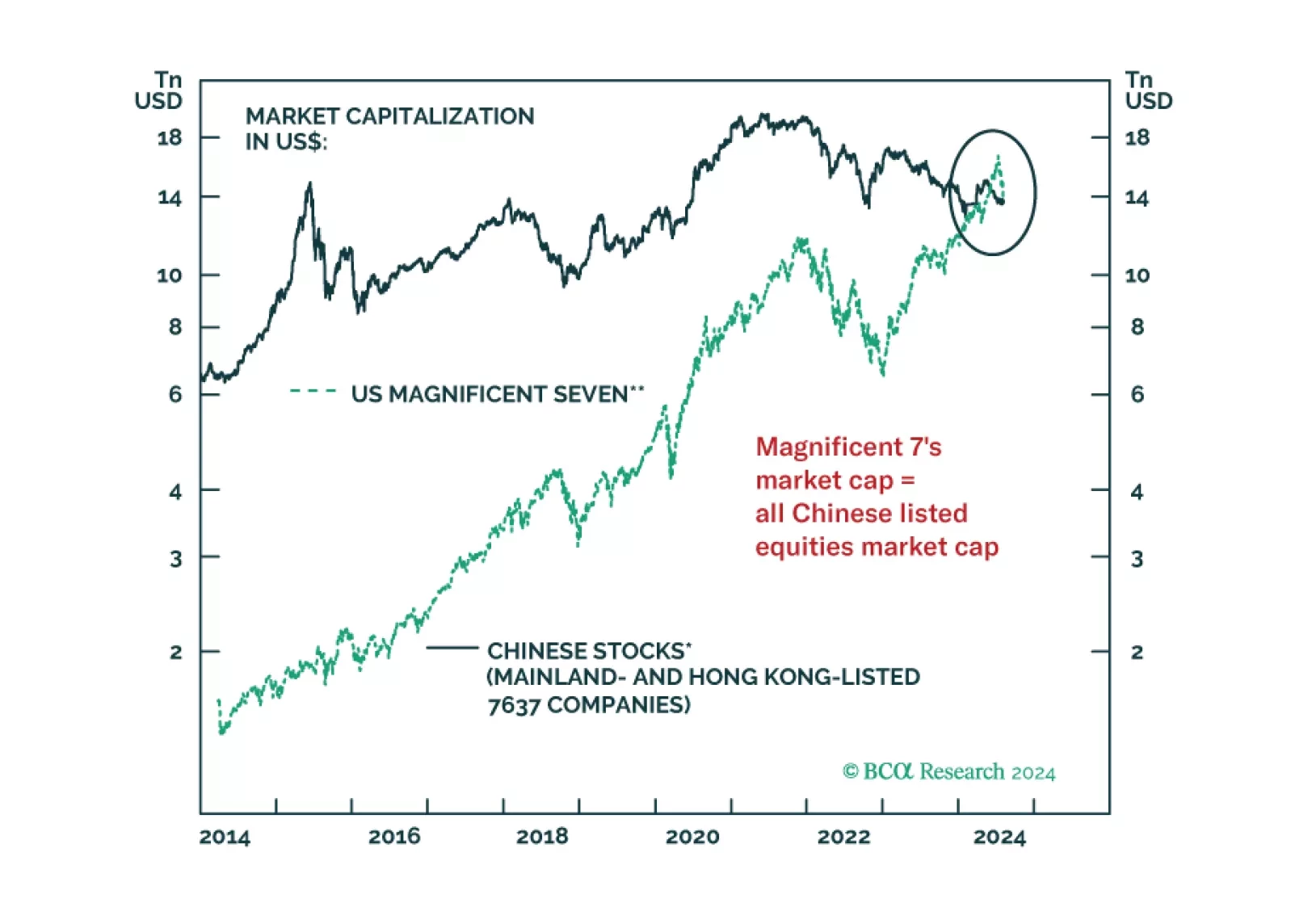

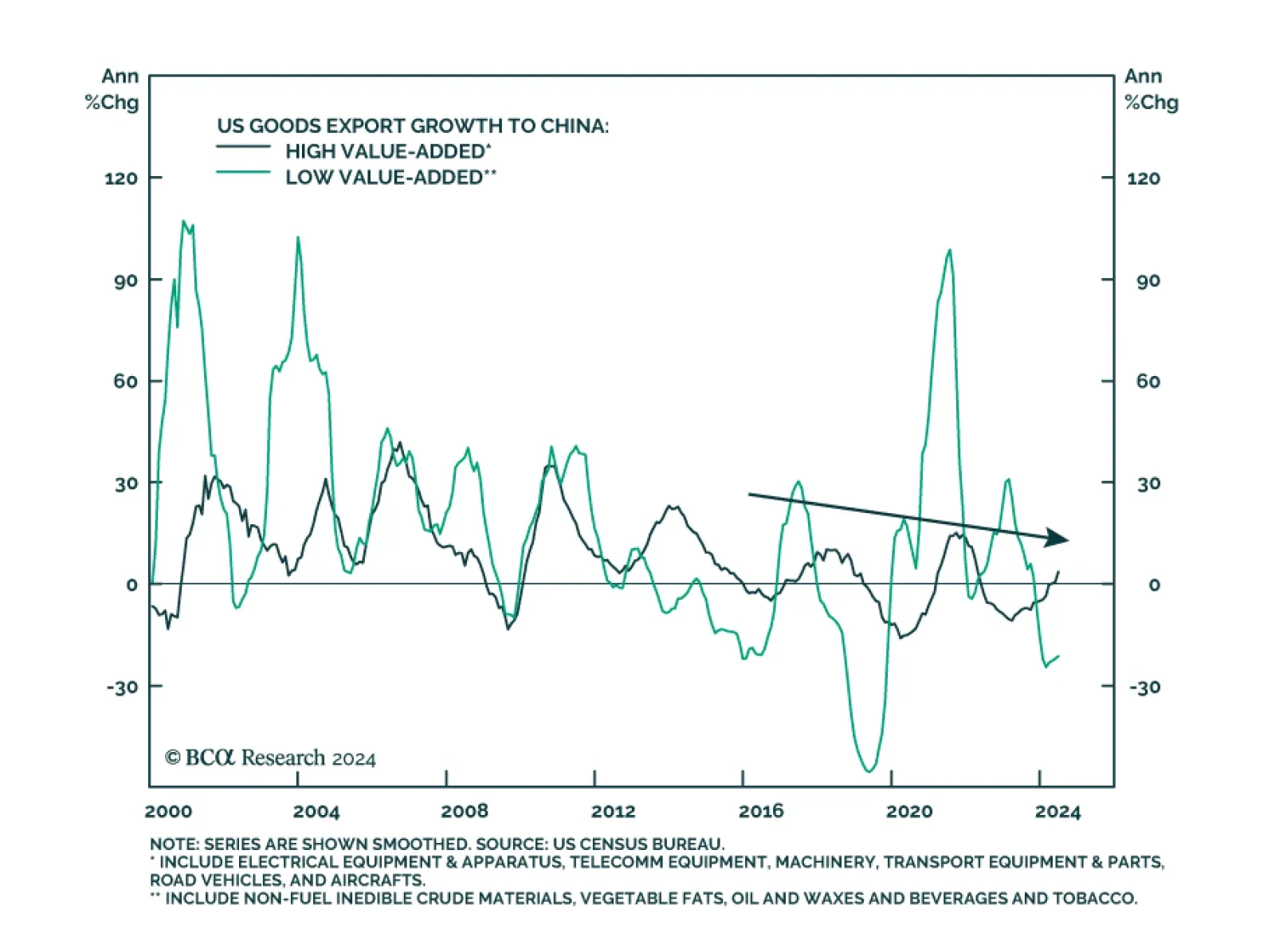

According to BCA Research’s Geopolitical Strategy service, Trump’s brand, legacy, and populist movement are based on the popular demand for a more hawkish US policy on trade and immigration. China has been the chief…

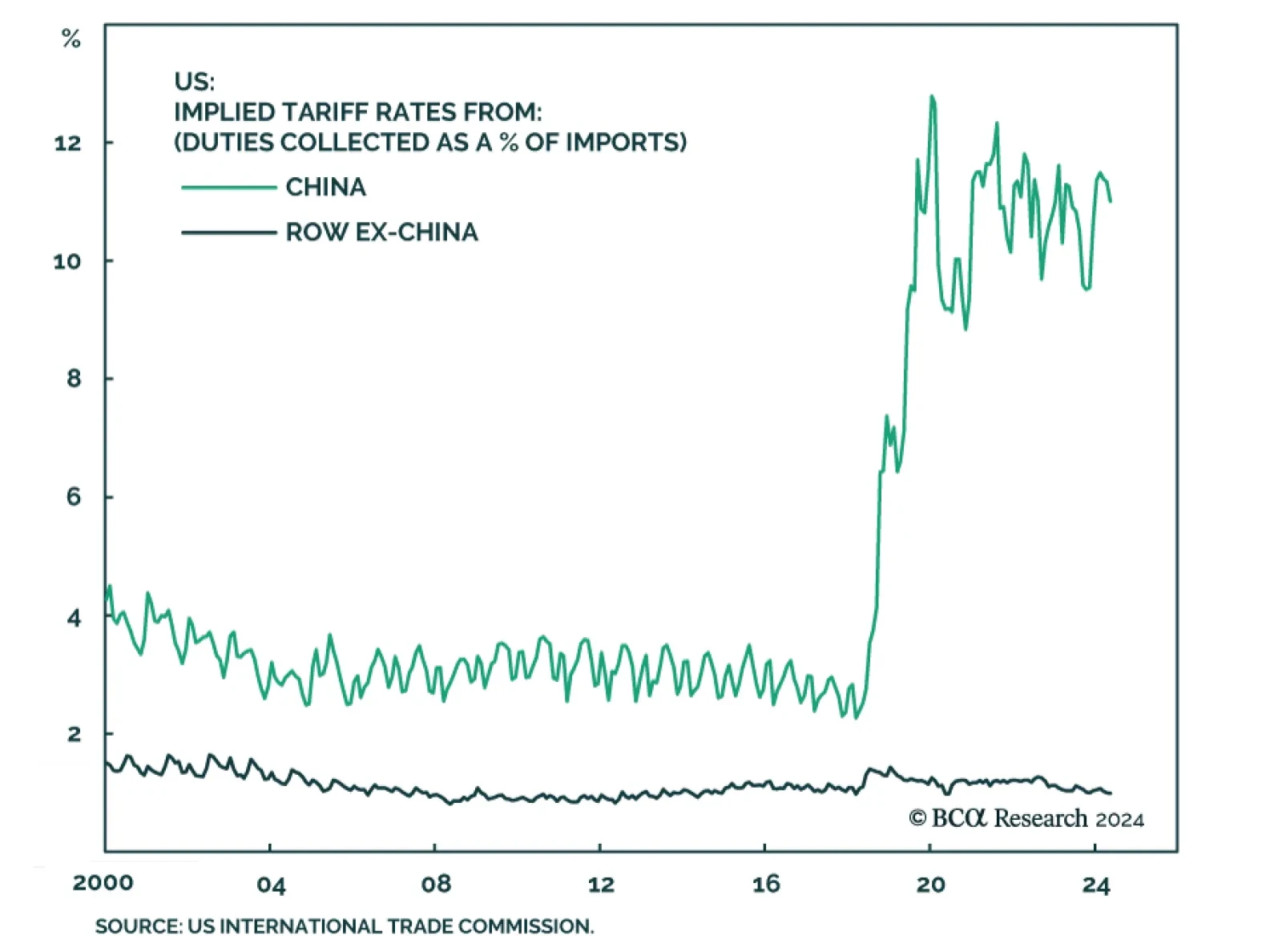

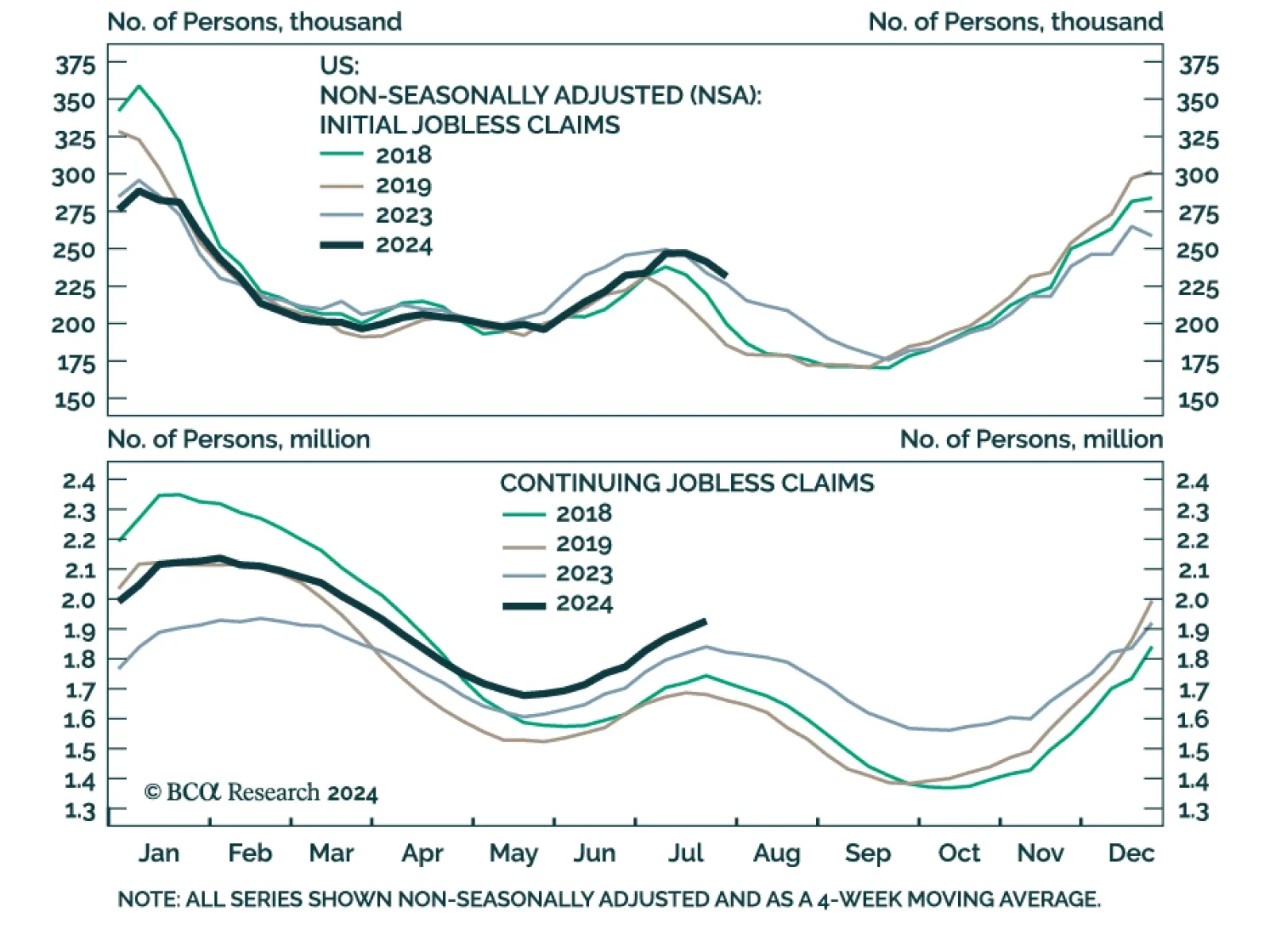

Regular readers are familiar with our expectation that the stabilization in global growth this year will be fleeting. The US has been the main source of demand in this cycle. We view the latest string of US employment data as…

There has been no shortage of twists since last Friday’s employment situation report. On Monday, the July ISM Services PMI release dissipated some of the risk-off mood that dominated markets. On Thursday, positive…

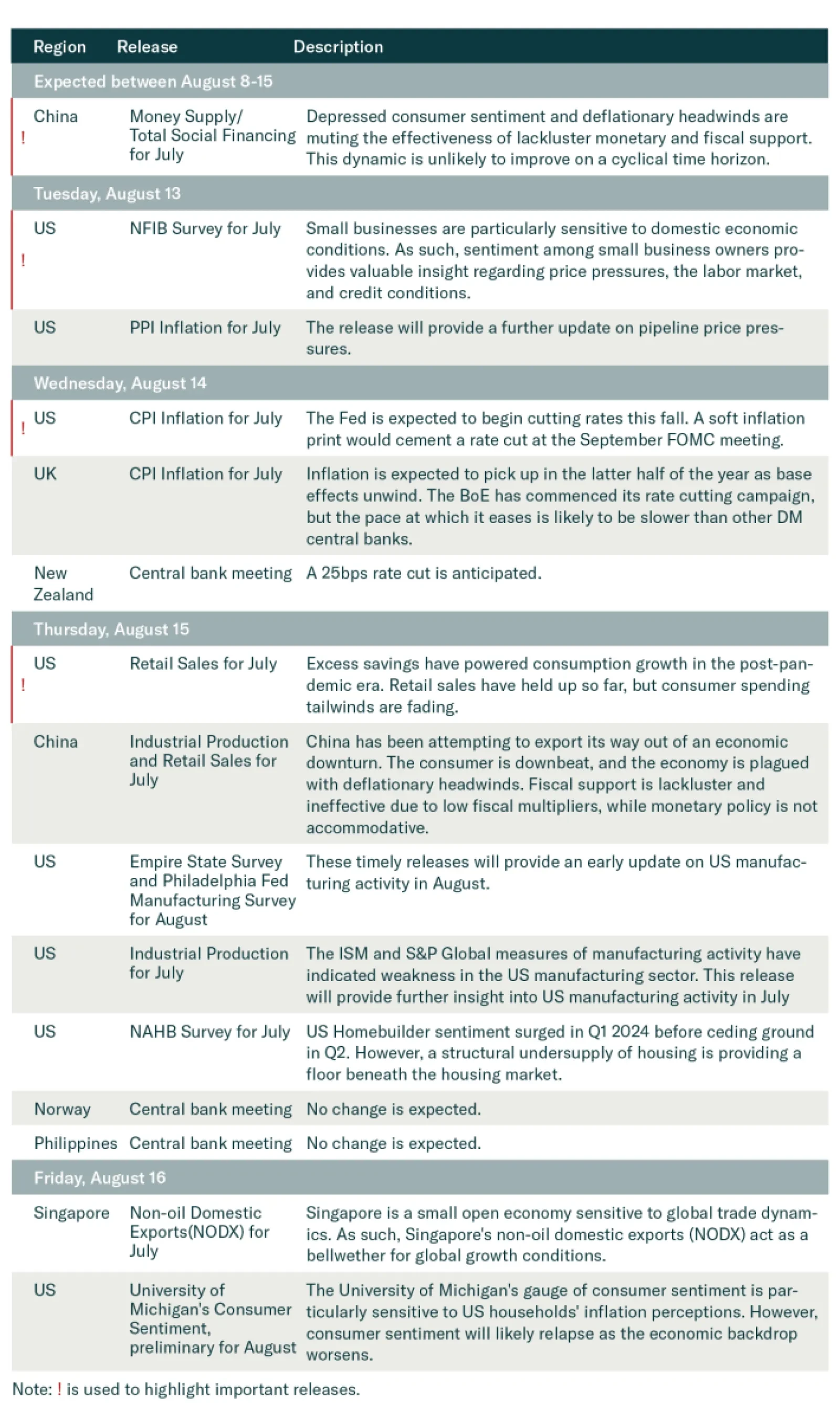

The prices of multiple financial assets have failed to break above their technical resistances. When this occurs, a breakdown ensues. In brief, global risk assets remain vulnerable. We are upgrading Chinese onshore stocks from…

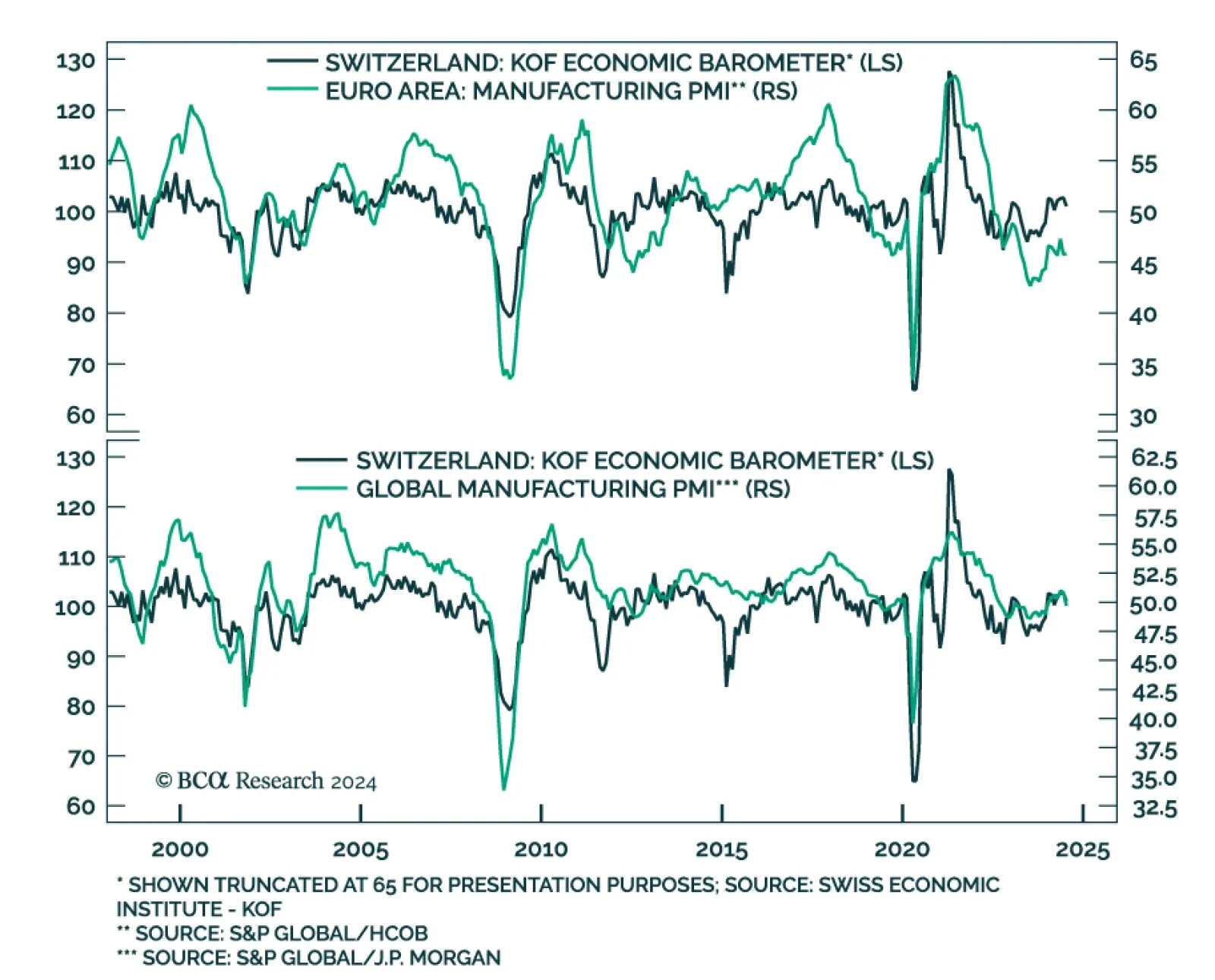

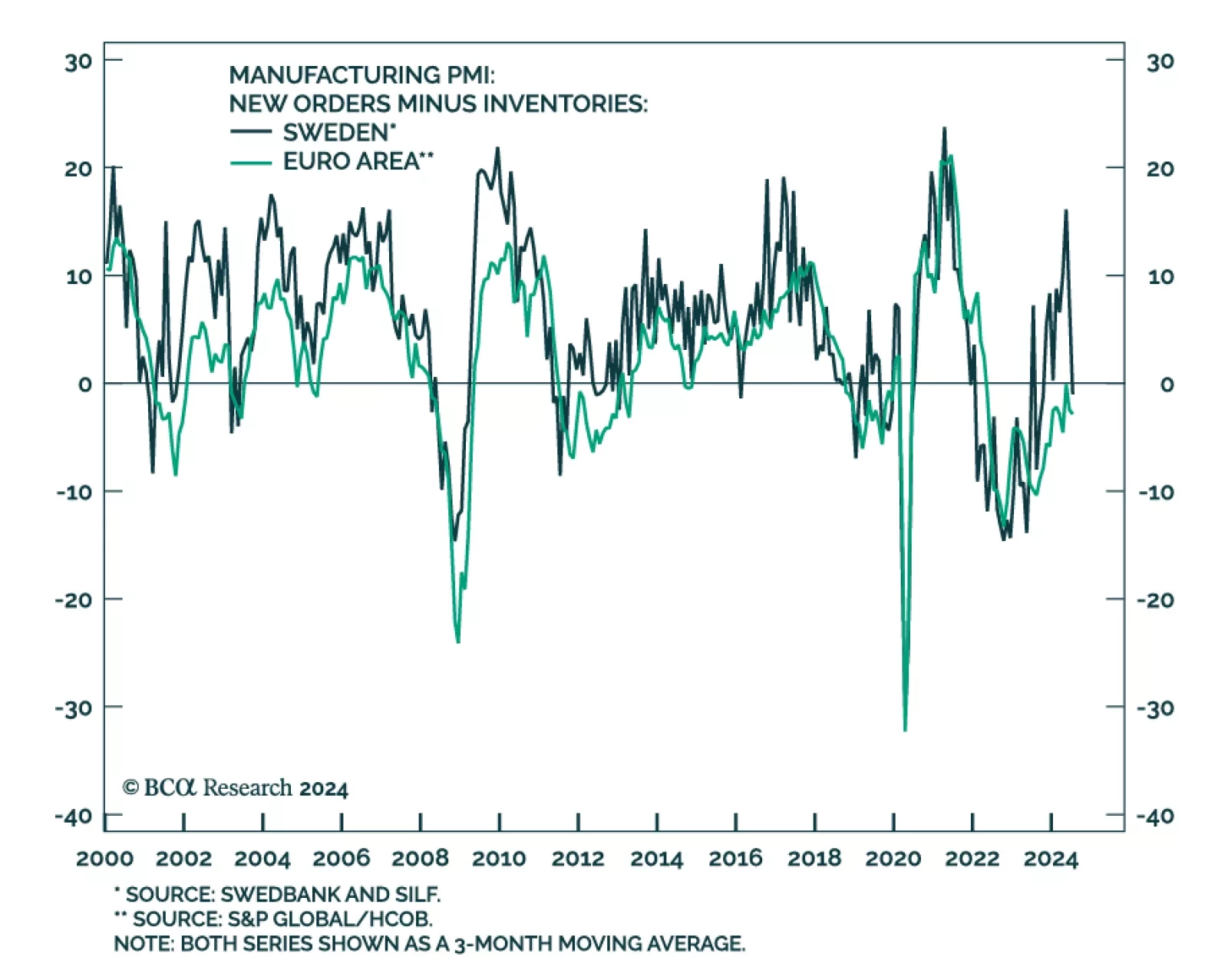

US economic news has stolen the spotlight in the past several days but economic developments in the rest of the world have also been uninspiring. The JPM Global Manufacturing PMI dipped into contraction territory in July,…

Sweden’s manufacturing PMI started contracting in July, plummeting from 53 to 49.2, falling far short of expectations that growth would broaden. Weakness was broad-based. Notably, new orders and new export orders plunged…

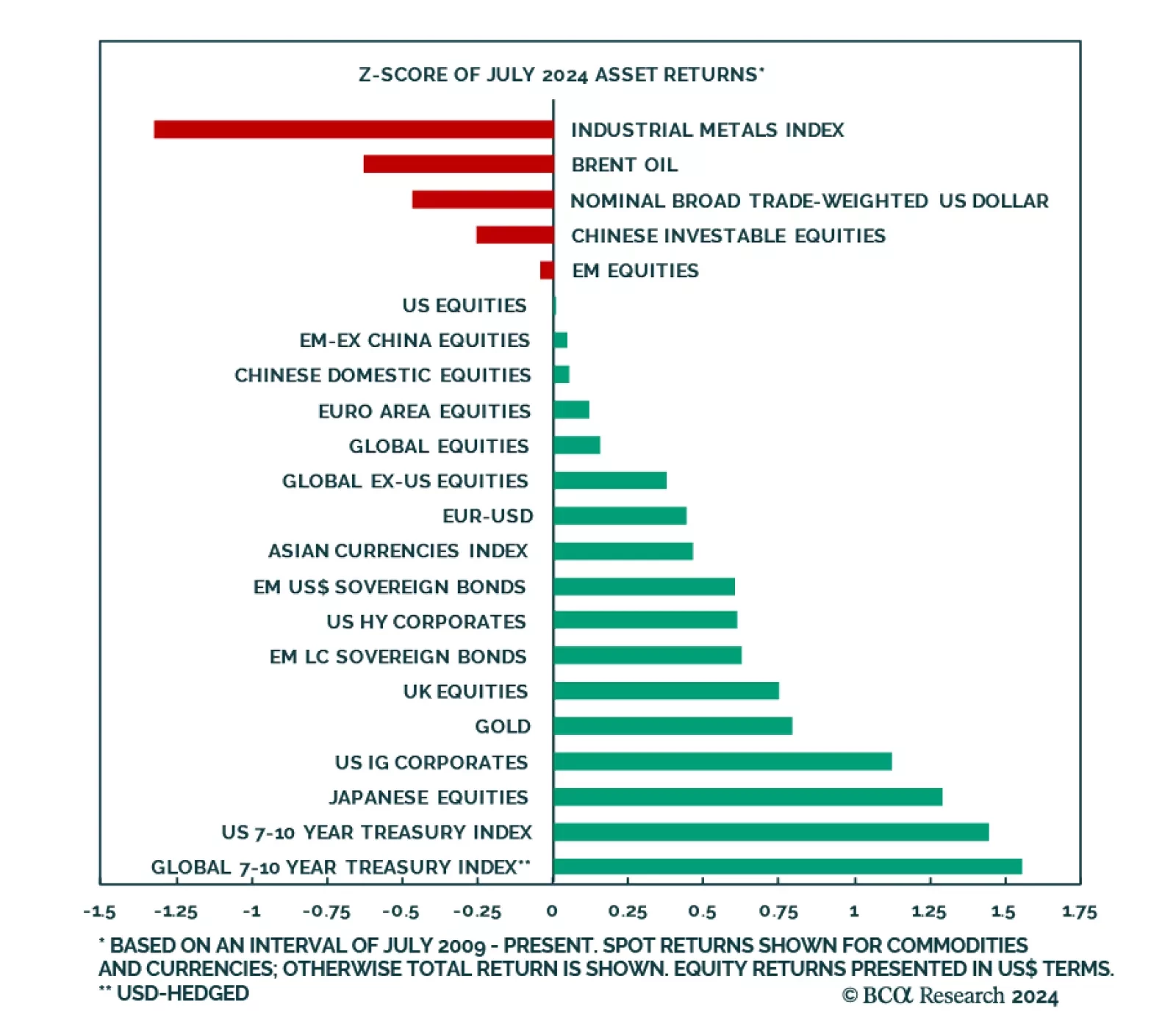

No clear risk-on/risk-off pattern emerged from July’s market performance data. On the one hand, consistent with a risk-off environment, US bonds ranked highest in the monthly return distribution, while pro-cyclical…

The market is pricing in a soft landing, but we see growing signs that the global economy is faltering. Investors should be defensively positioned.