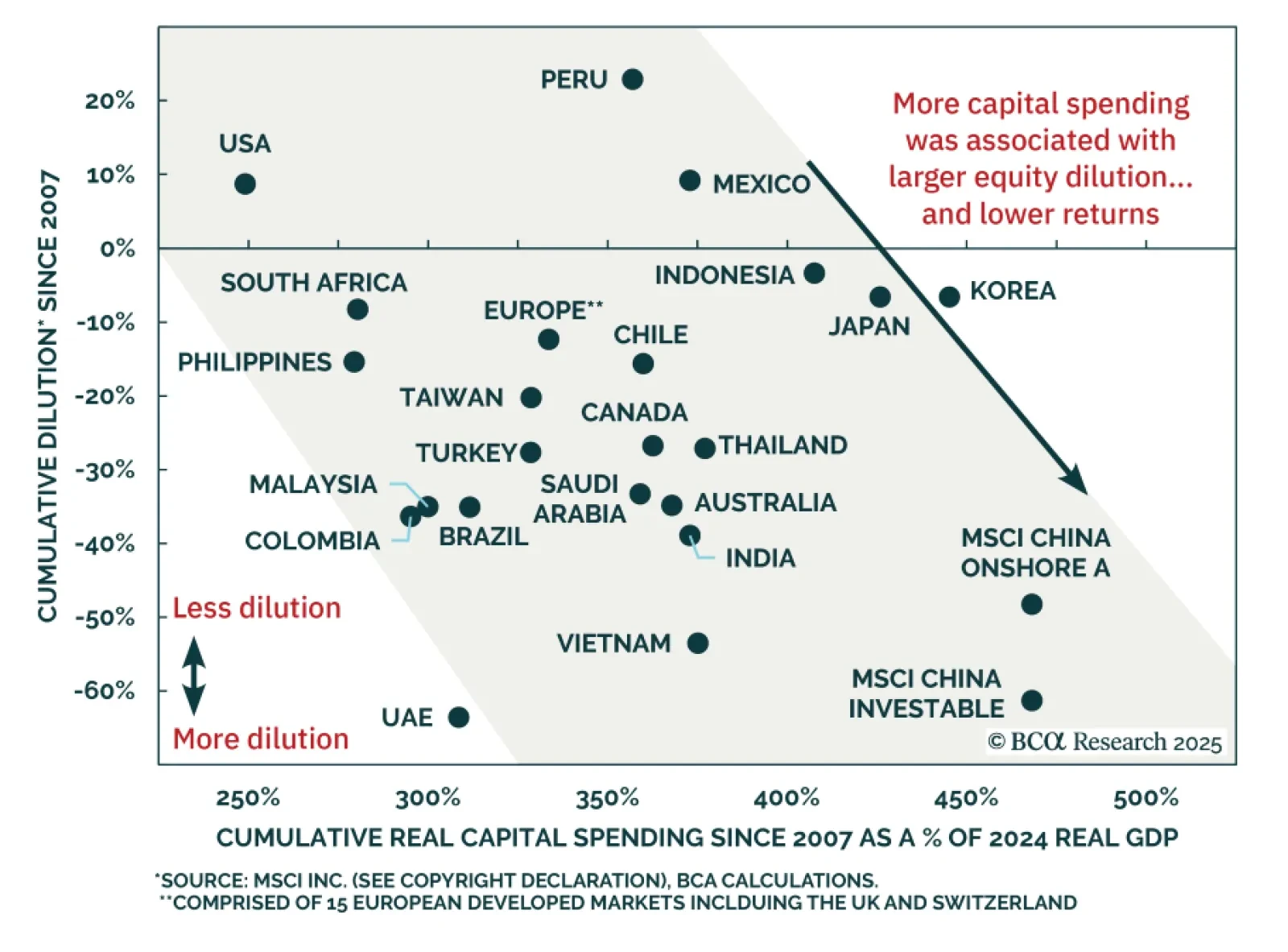

BCA’s Emerging Markets strategists remain negative on EM stocks in absolute terms but recommend a neutral weighting within global equity portfolios. Economic growth does not reliably translate into earnings per share or shareholder…

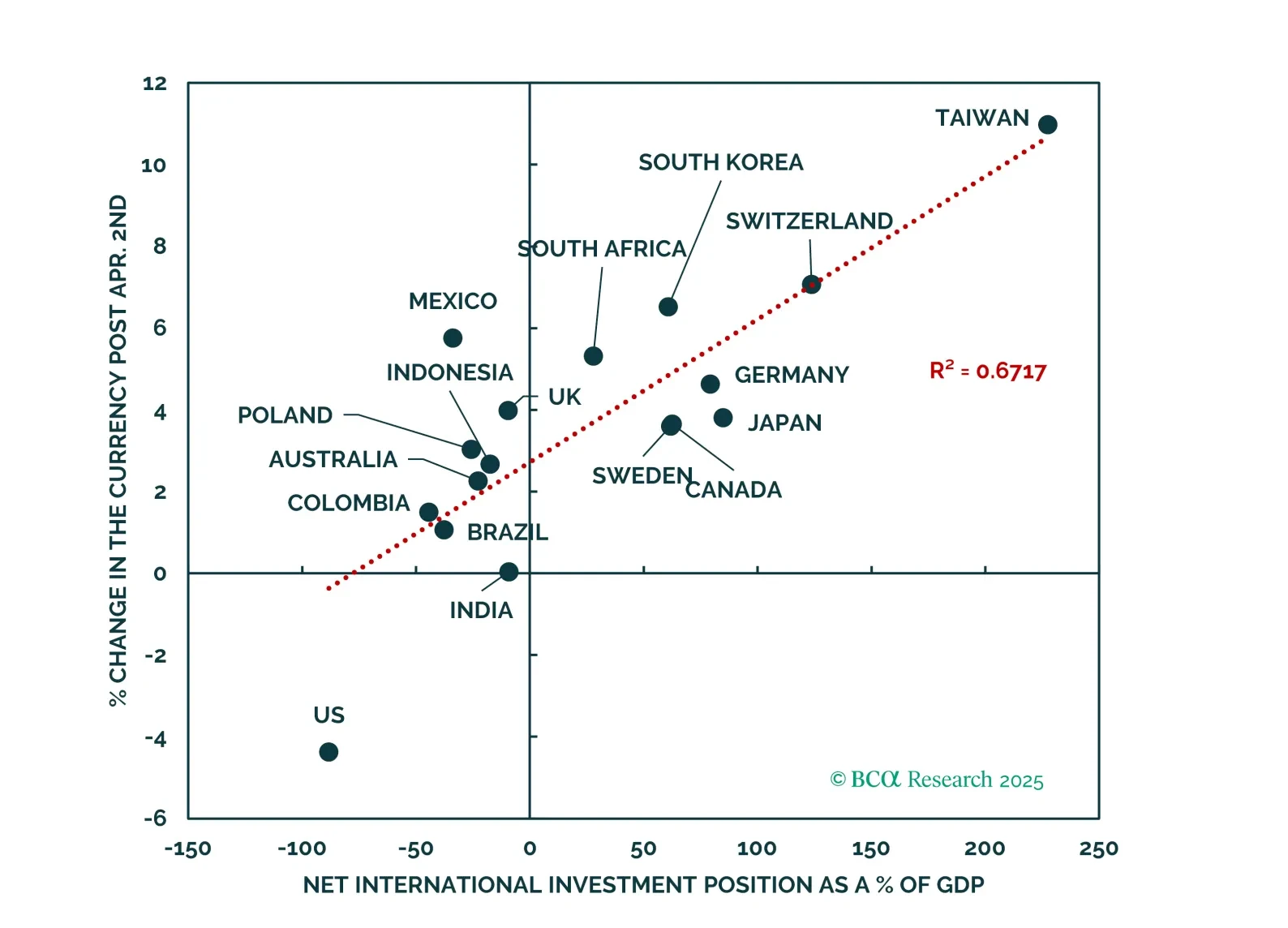

In this chartbook, we look at the balance of payments across DM and EM countries. The US does not fare well, but neither do a few other countries.

Our Foreign Exchange strategists recommend strategic investors sell the dollar on strength, while tactical investors position for a near-term bounce. The key risk for the dollar today is a potential balance-of-payments crisis.…

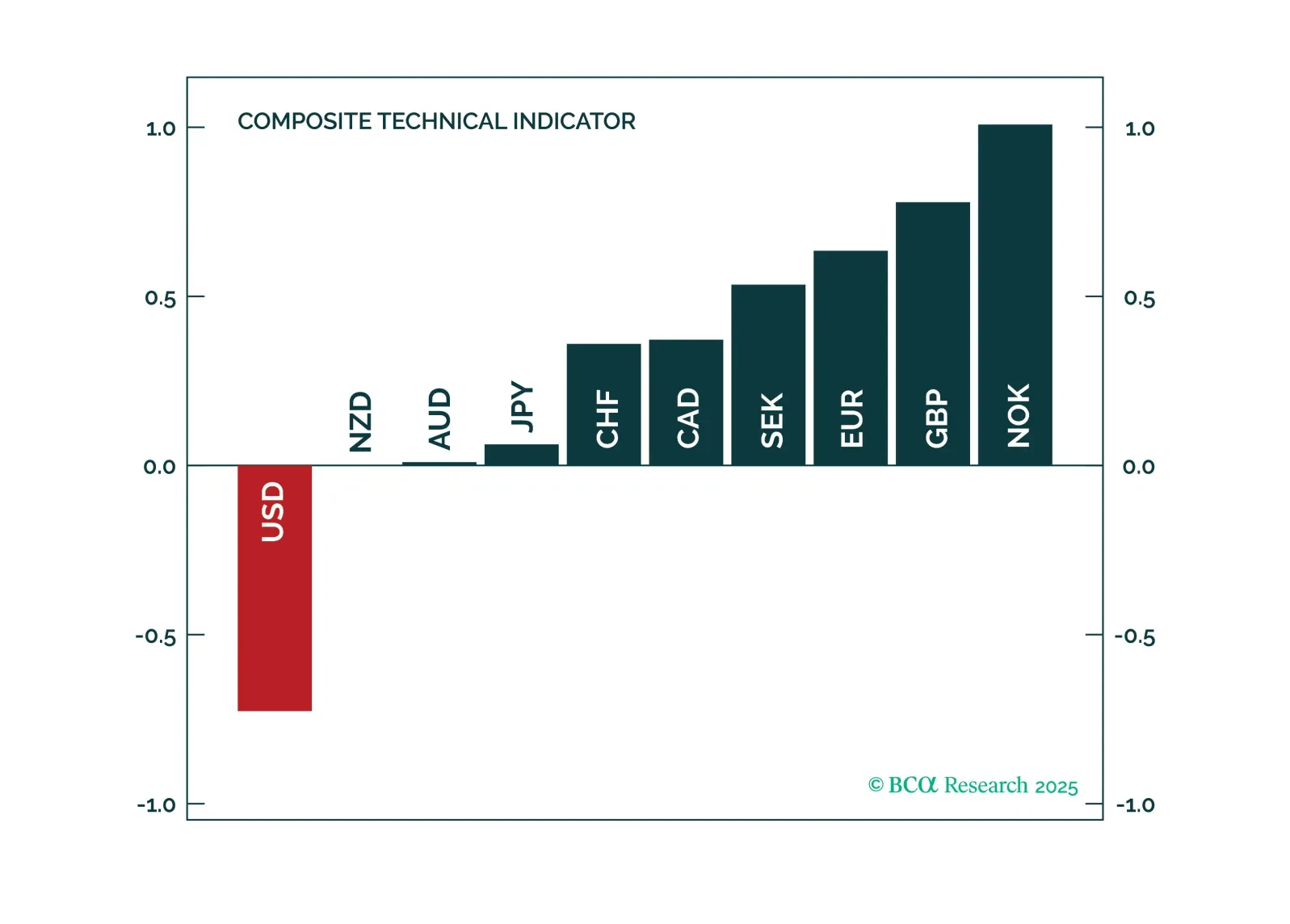

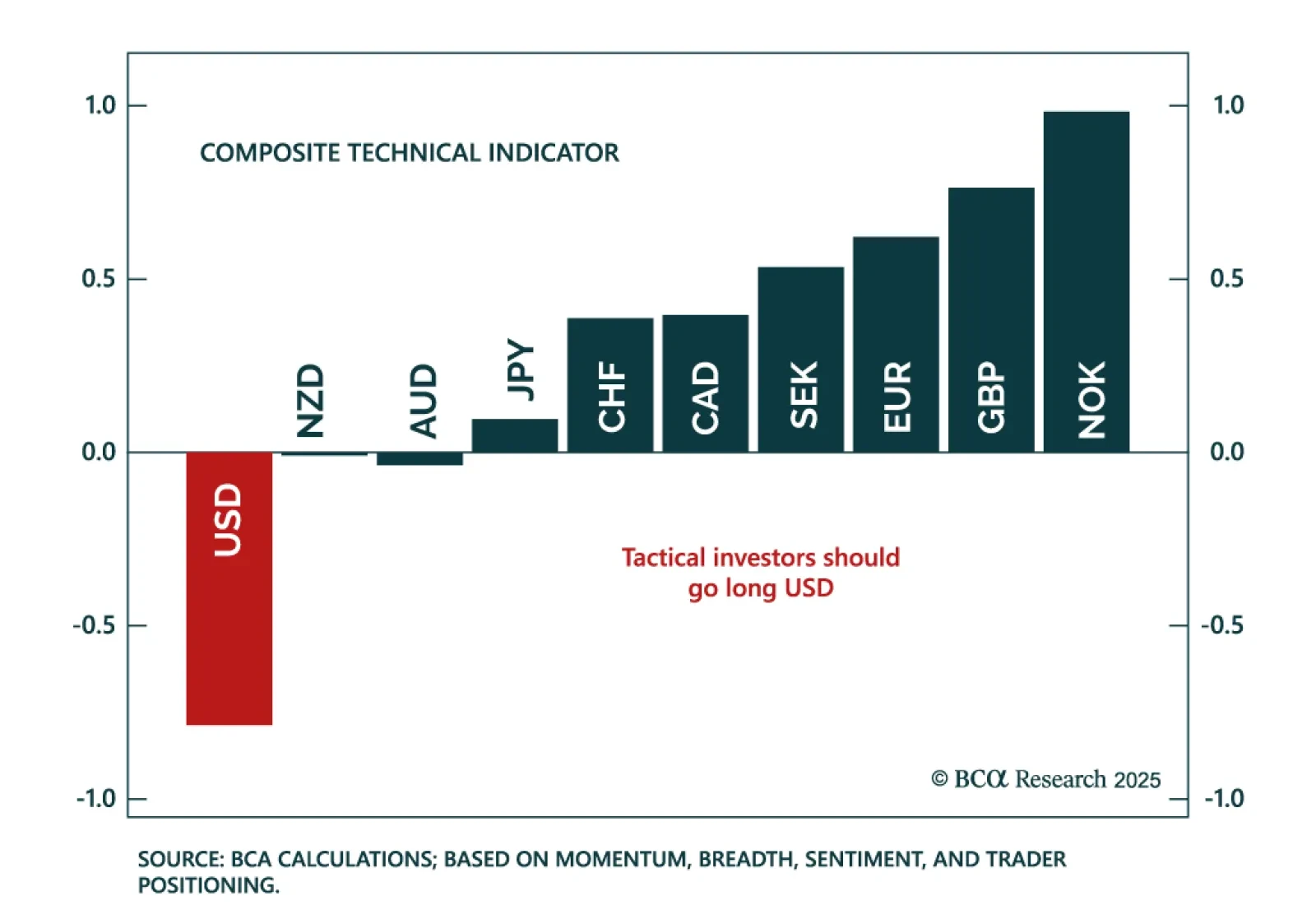

In this FX note, we provide a rationale for why it is important to pay attention to technical indicators, while still keeping your eyeball on the structural factors that drive currencies. This report answers the following questions:…

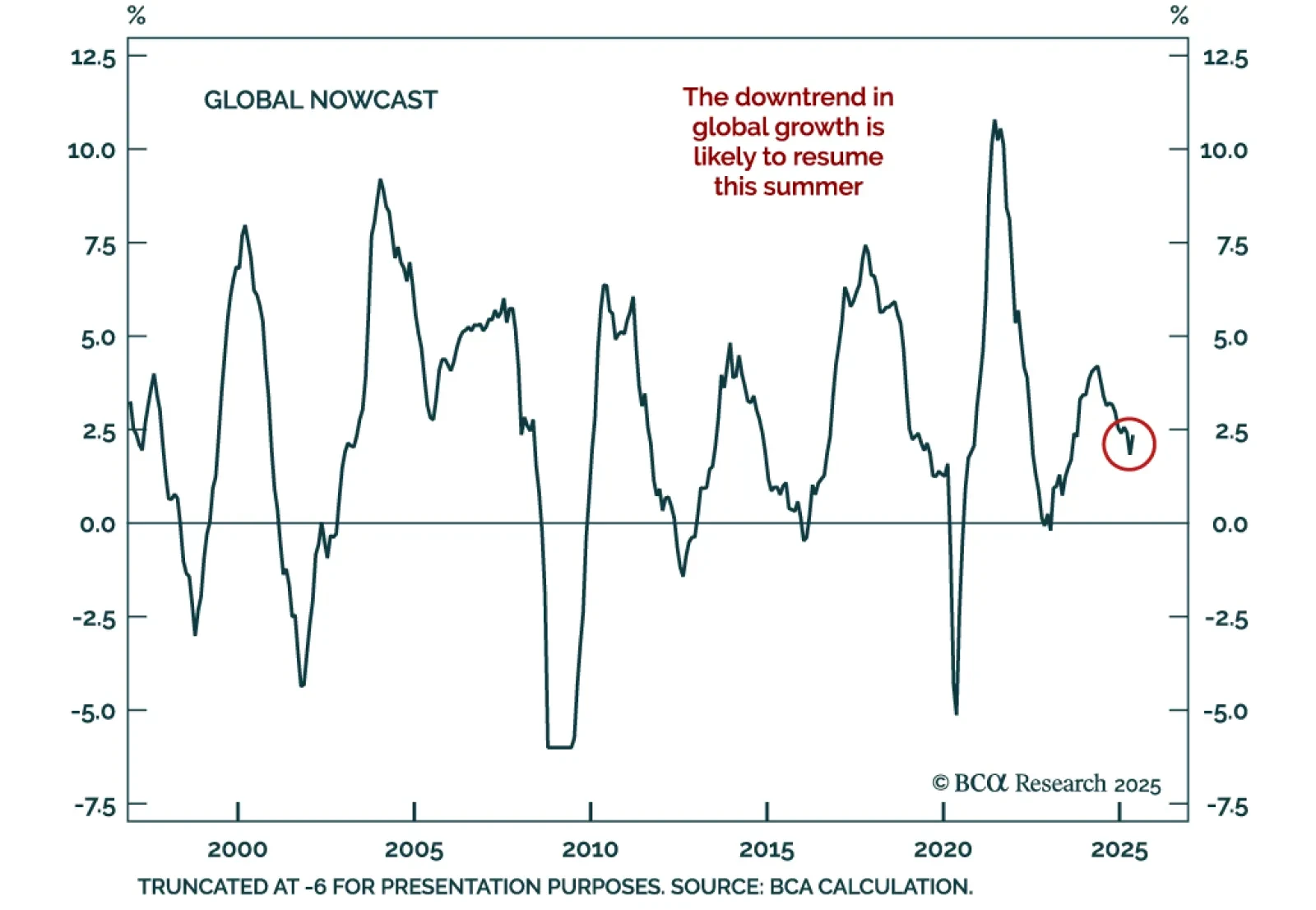

Global growth showed tentative signs of improvement in May, but it is too early to call it a turning point. Our Chart Of The Week comes from Mathieu Savary, Chief European Investment Strategist. BCA’s nowcast for global industrial…

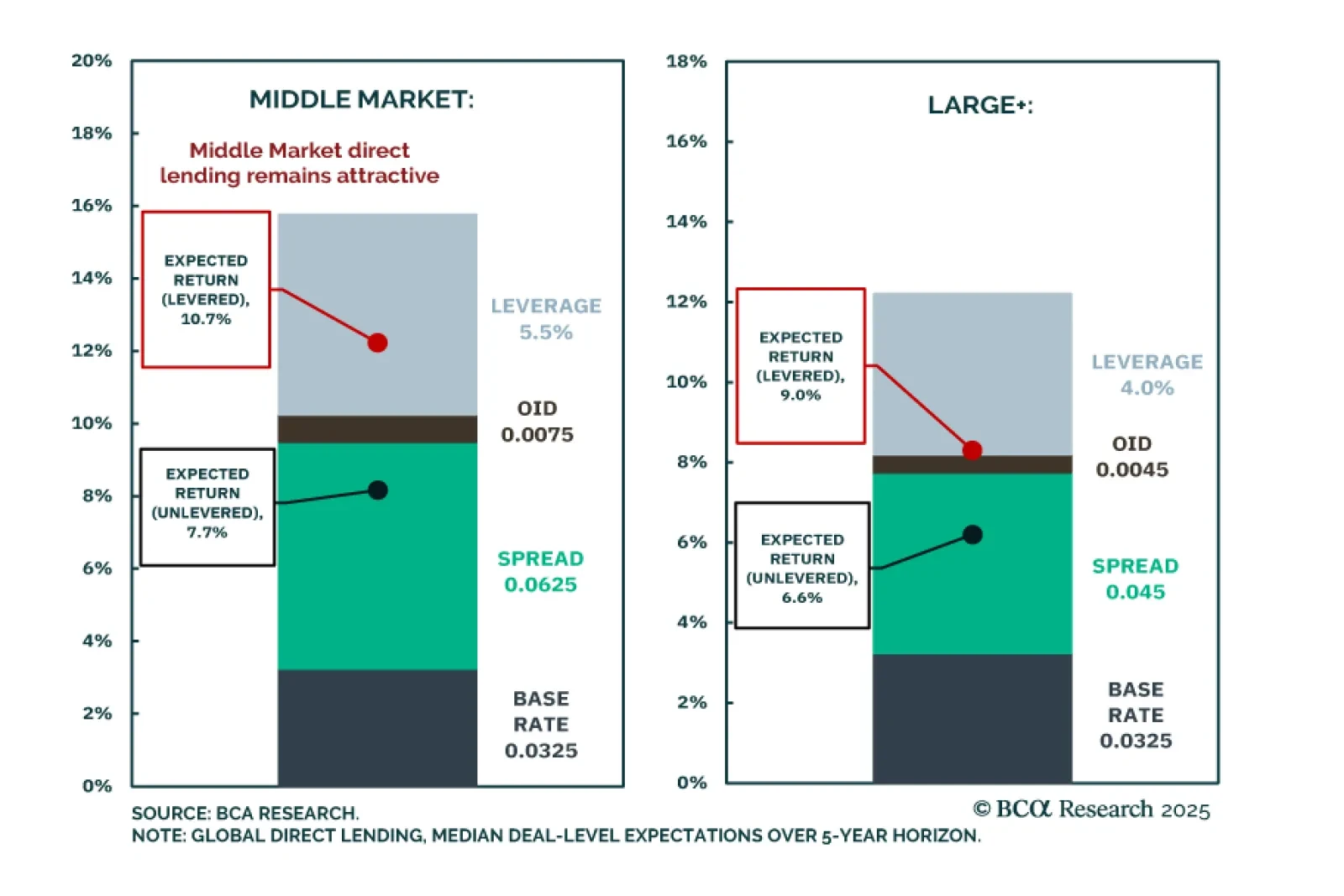

Our PMA strategists published Part 2 of their Capital Market Assumptions update, focusing on Direct Lending. They project gross annualized returns of 7.7% unlevered and 10.7% levered for Global Middle Market Direct Lending, and 6.5%…

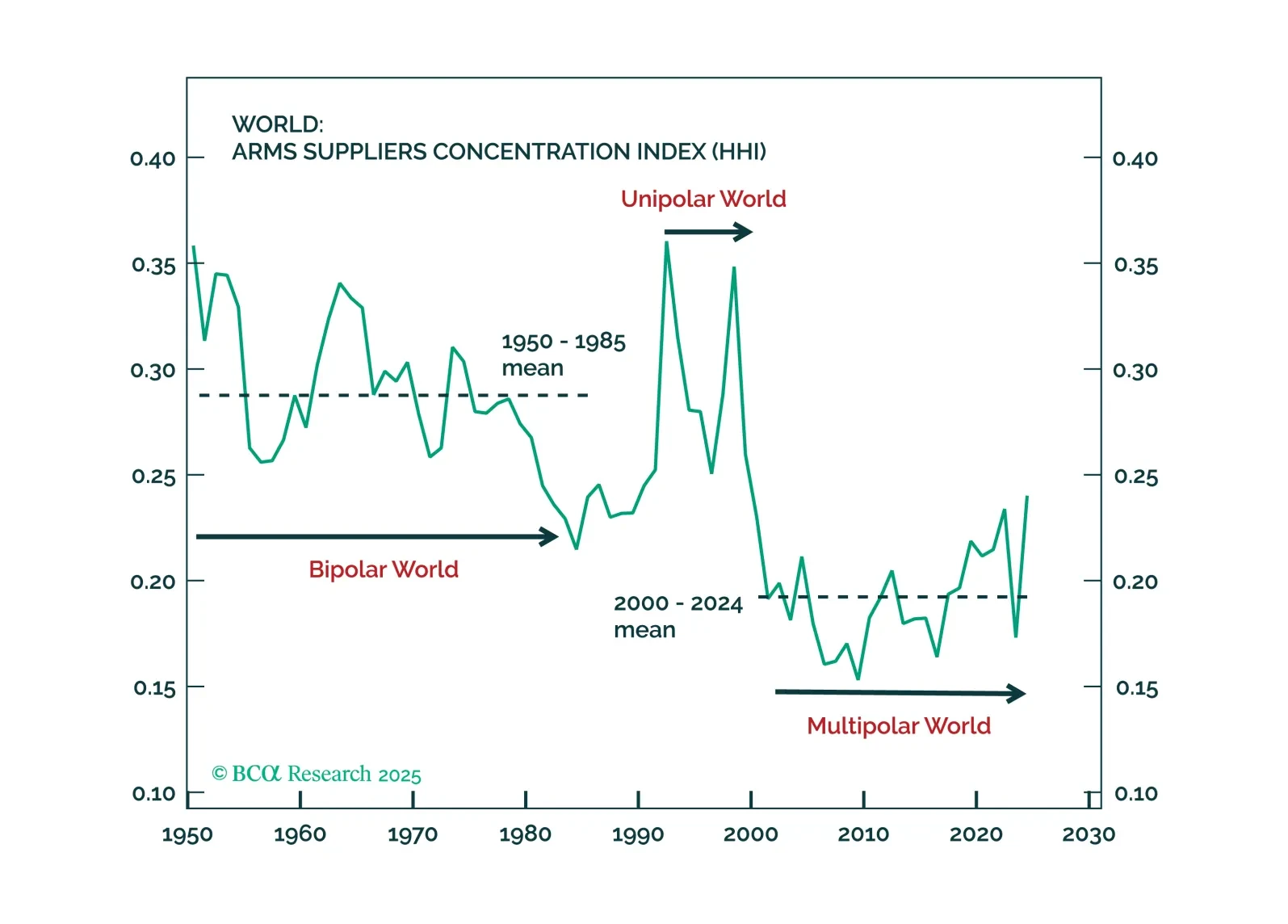

In our Beta report, we focus on our decade view. Many of our global allocator clients are scrambling to incorporate geopolitics into their strategic asset allocation. For most, this means thinking about war… or about future end-…

Fiscal policy, not tariffs, is now driving markets as Congress advances the One Big Beautiful Bill. The Senate cannot afford to remove the spending cuts in the bill, as they risk sparking a bond market riot. Even with this more…

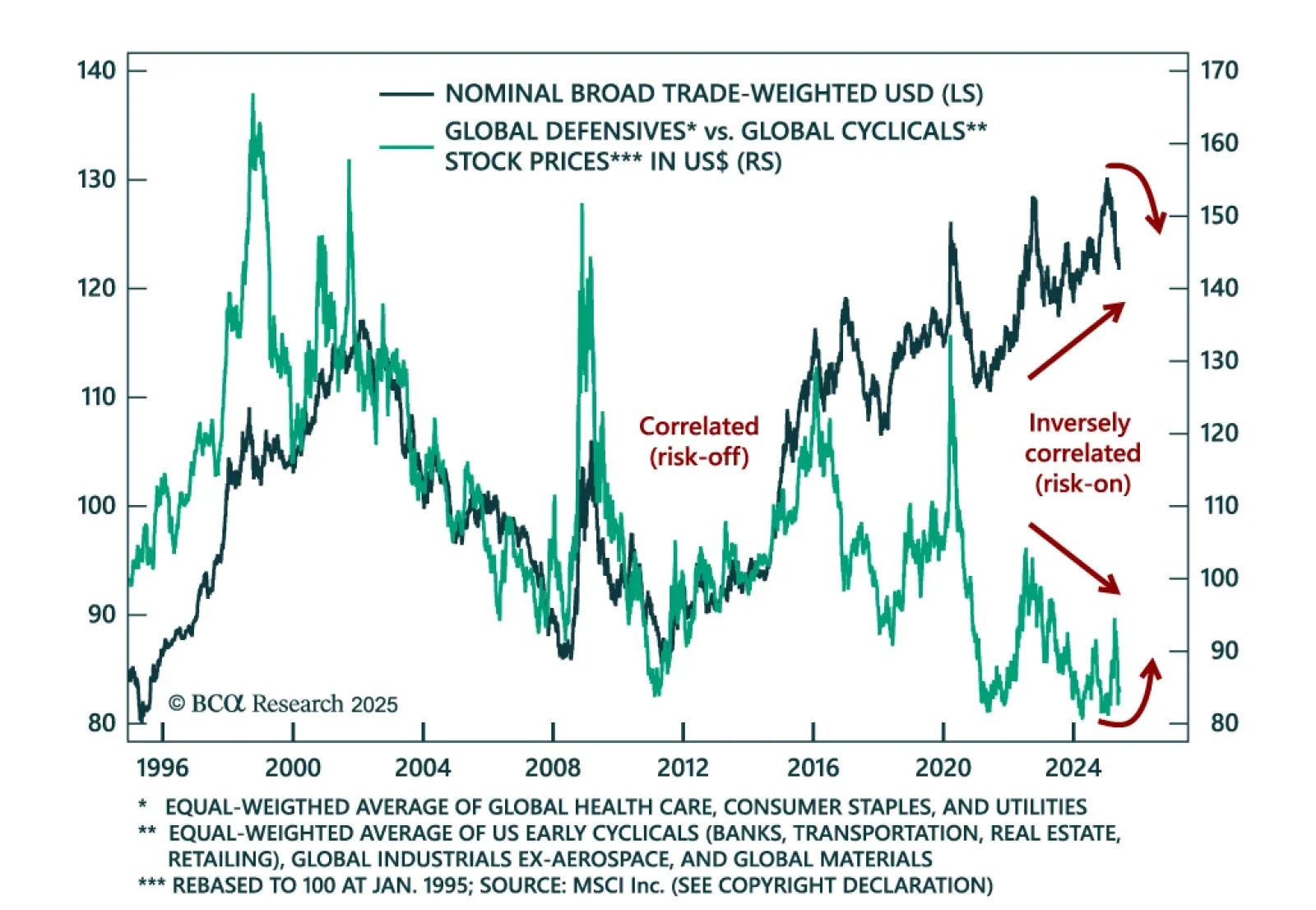

Global exchange rates are undergoing a regime shift, as the US dollar will likely become a risk-on currency, especially compared to DM exchange rates. Going forward, current-account dynamics will become the key…

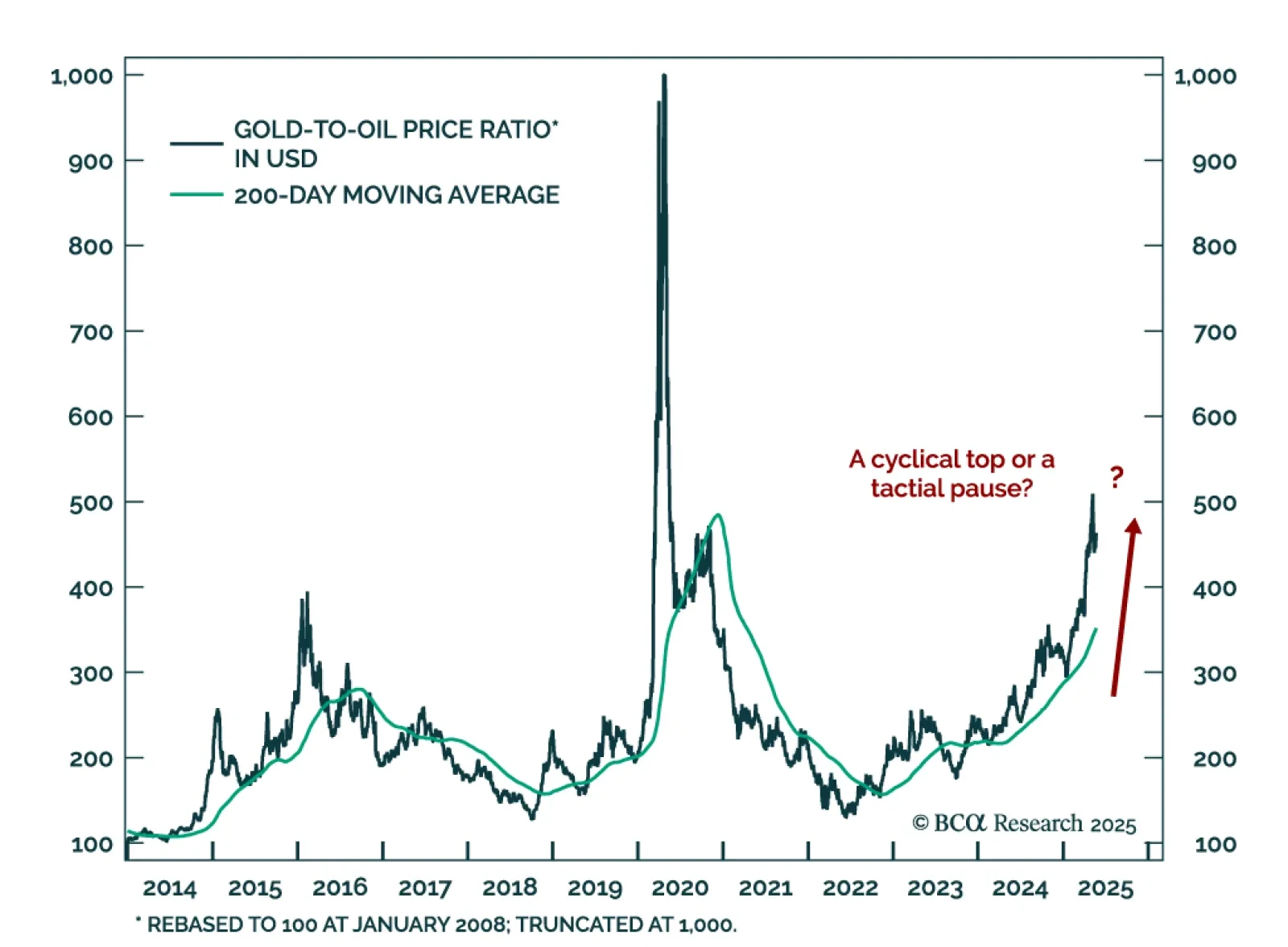

The gold-to-oil price ratio seems tactically overextended, but global macro drivers suggest it will rise further. The gold bull run is still relatively young and not yet stretched compared to rallies from the past 50…