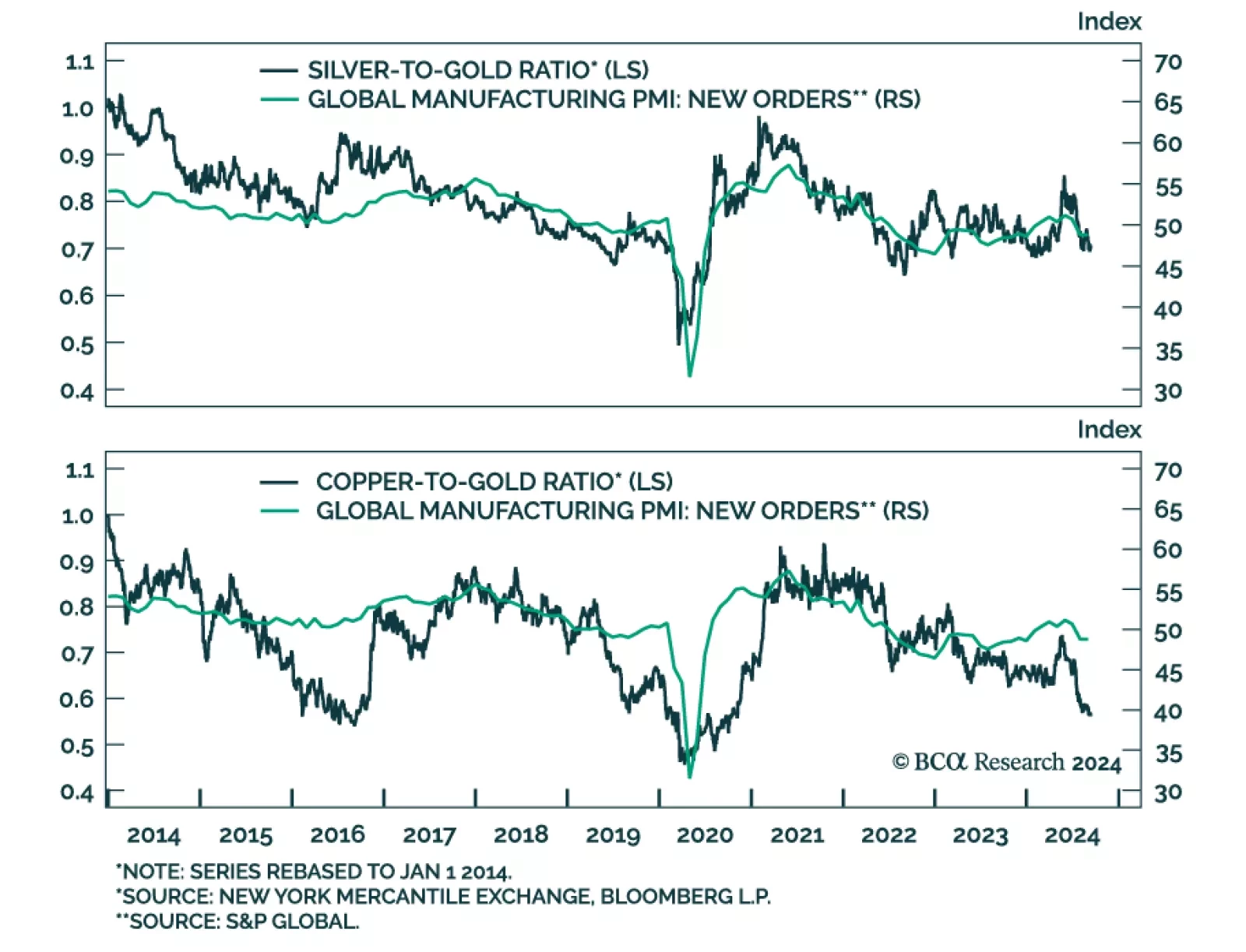

As an industrial metal, copper acts as a barometer of economic activity. Silver and gold are safe-haven assets with inflation-hedging properties, though silver is relatively more sensitive to global growth developments given that…

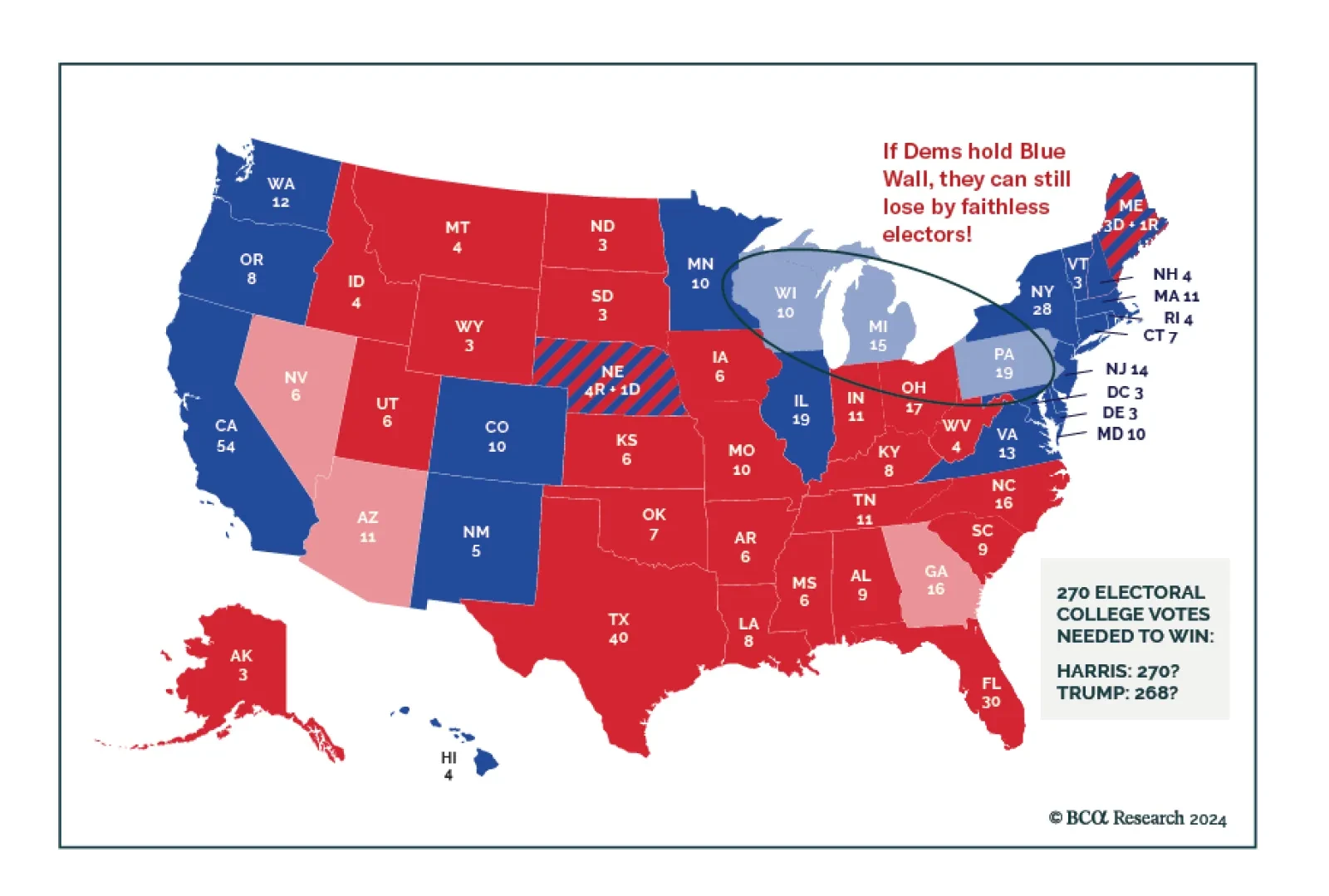

According to BCA Research’s US Political Strategy service, former President Trump still has a path to come back to power, despite his disastrous performance in the debate with Vice President Kamala Harris on September 10…

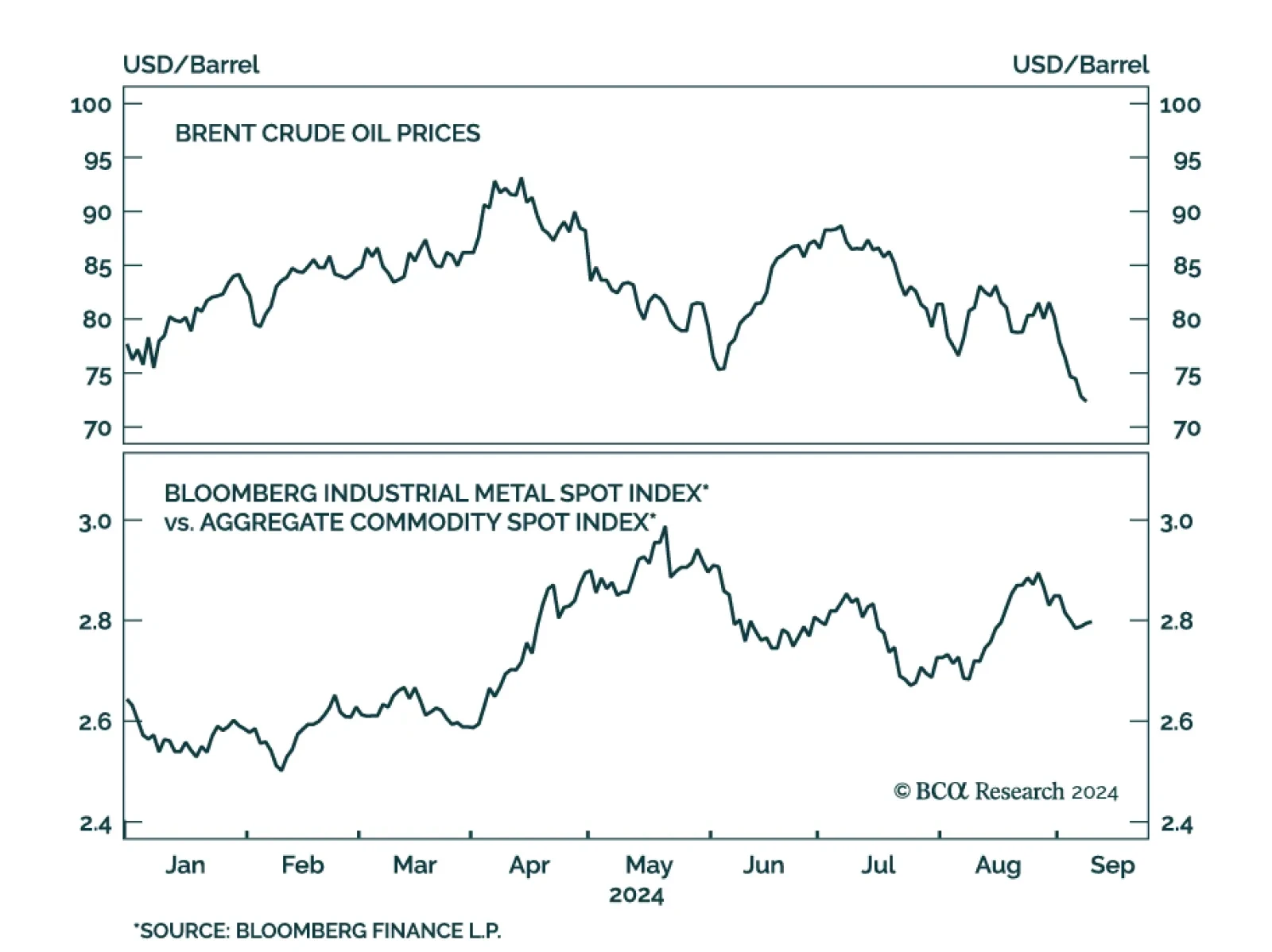

The decline in oil prices accelerated this month. Although Wednesday’s moves reversed Tuesday’s sharp daily declines, Brent and WTI have fallen 11% and 10% so far in September, and 30% and 33% from their April peaks…

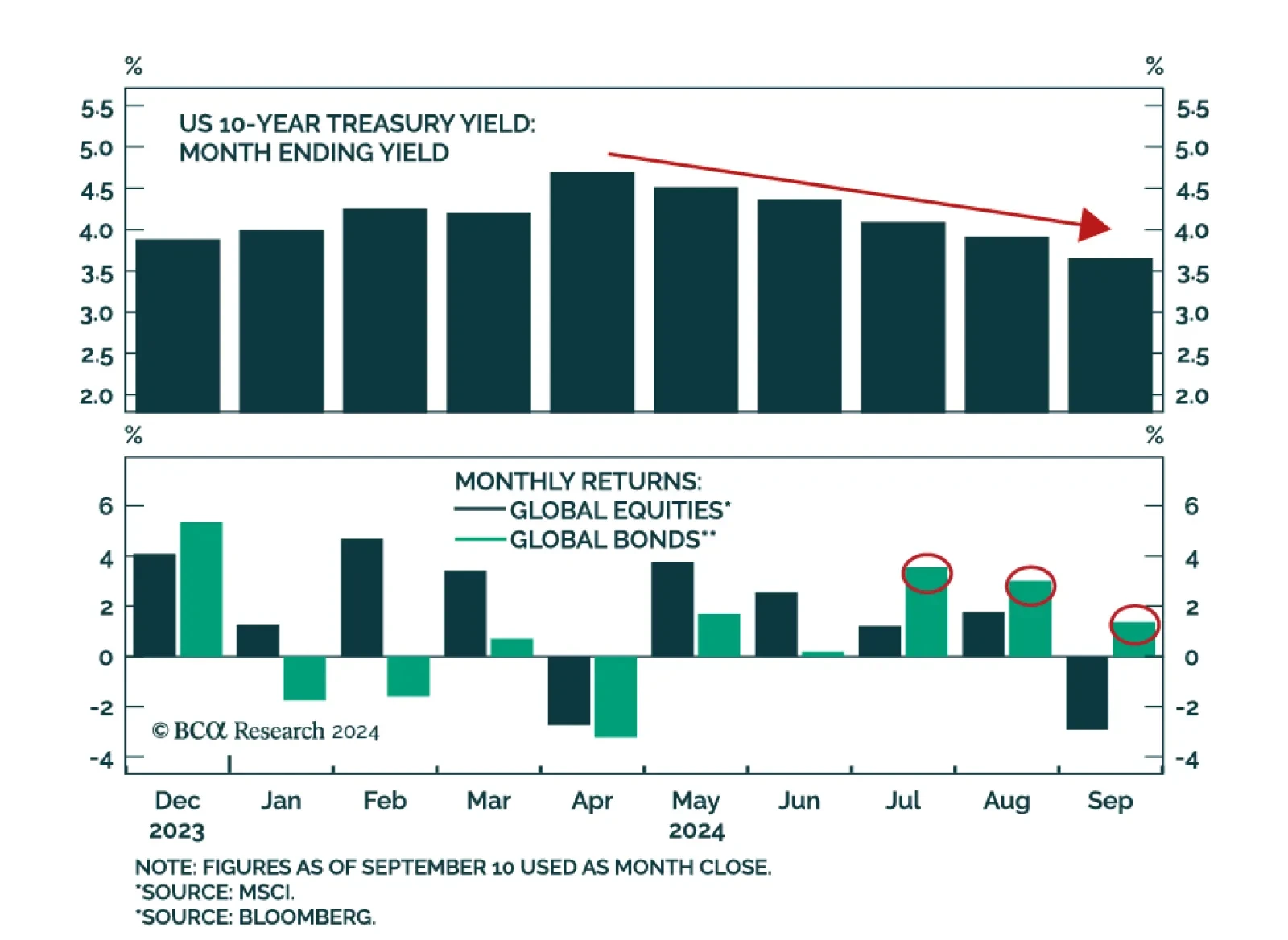

Despite global bond yields having trended lower since April, bonds have only started outperforming equities since July in US dollar terms. We expect this outperformance to persist going forward. Sentiment has largely driven…

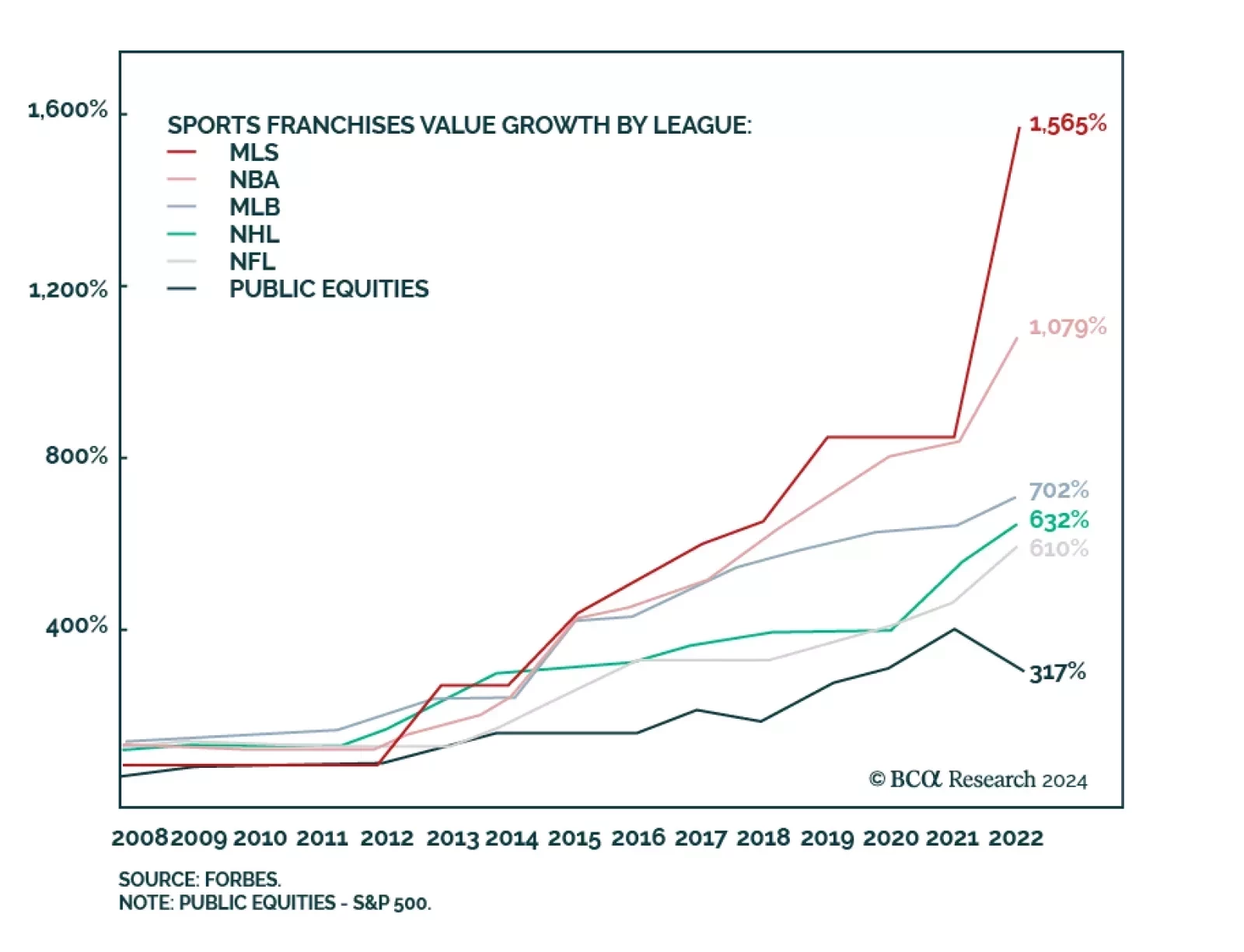

According to BCA Research’s Private Markets & Alternatives service, the Sports Franchise market presents a compelling opportunity for Private Equity due to its strong growth potential, evolving business models, and…

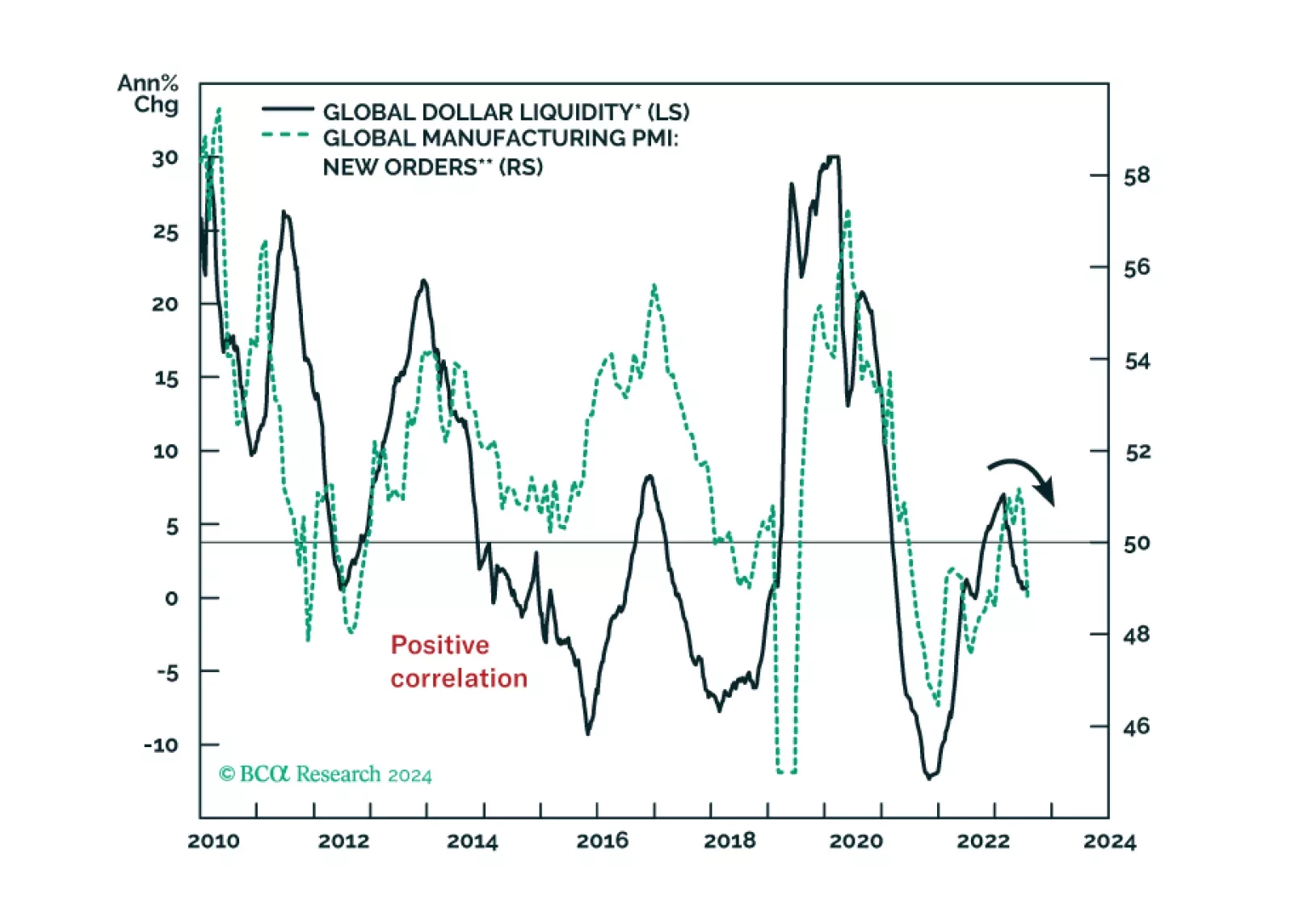

The undercurrents of global financial markets signal deteriorating global growth conditions. There is little cash on the sidelines in the US, the Euro Area, and Japan. If the budding bear market resembles the 2000-2003 one, EM stock…

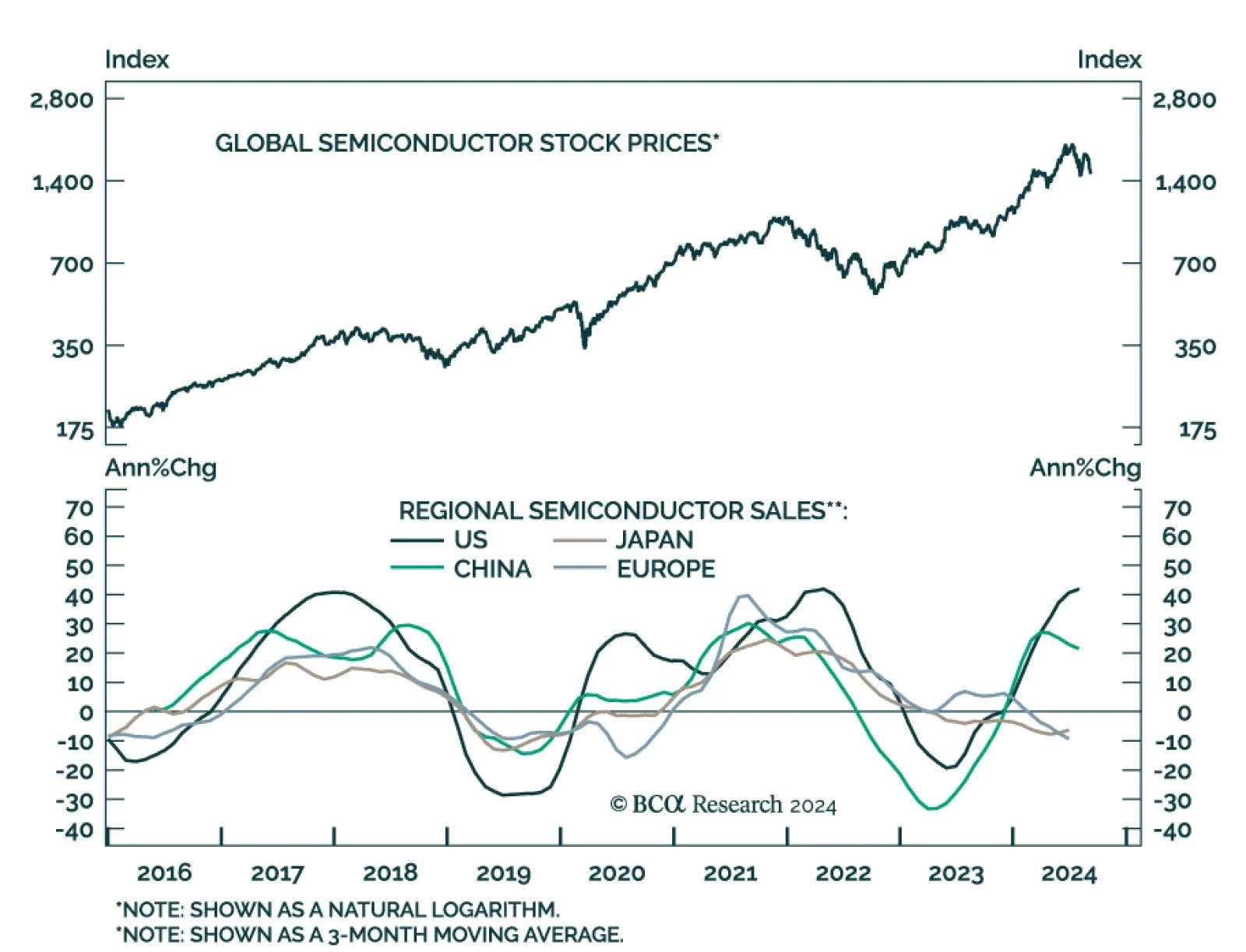

Global semiconductor stocks have returned 50% YTD in USD terms, and a whopping 200% since their September 2022 lows. However, they may have peaked back in July. Our Emerging Market strategists highlight a significant…

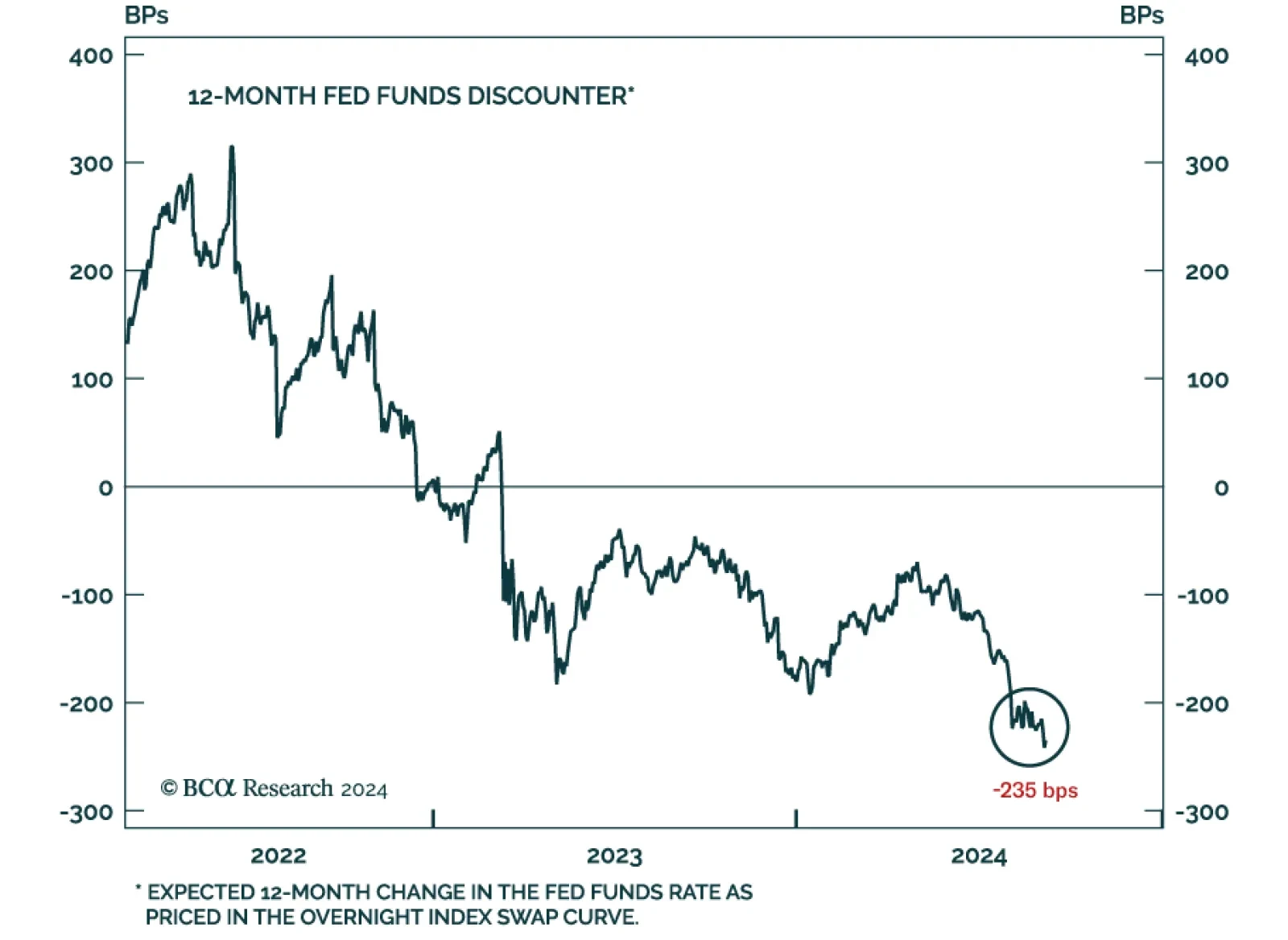

The July Employment Situation report had already cemented the case for a September rate cut and Chairman Powell’s Jackson Hole comments dispelled any remaining doubt about an imminent monetary easing cycle. All the labor…

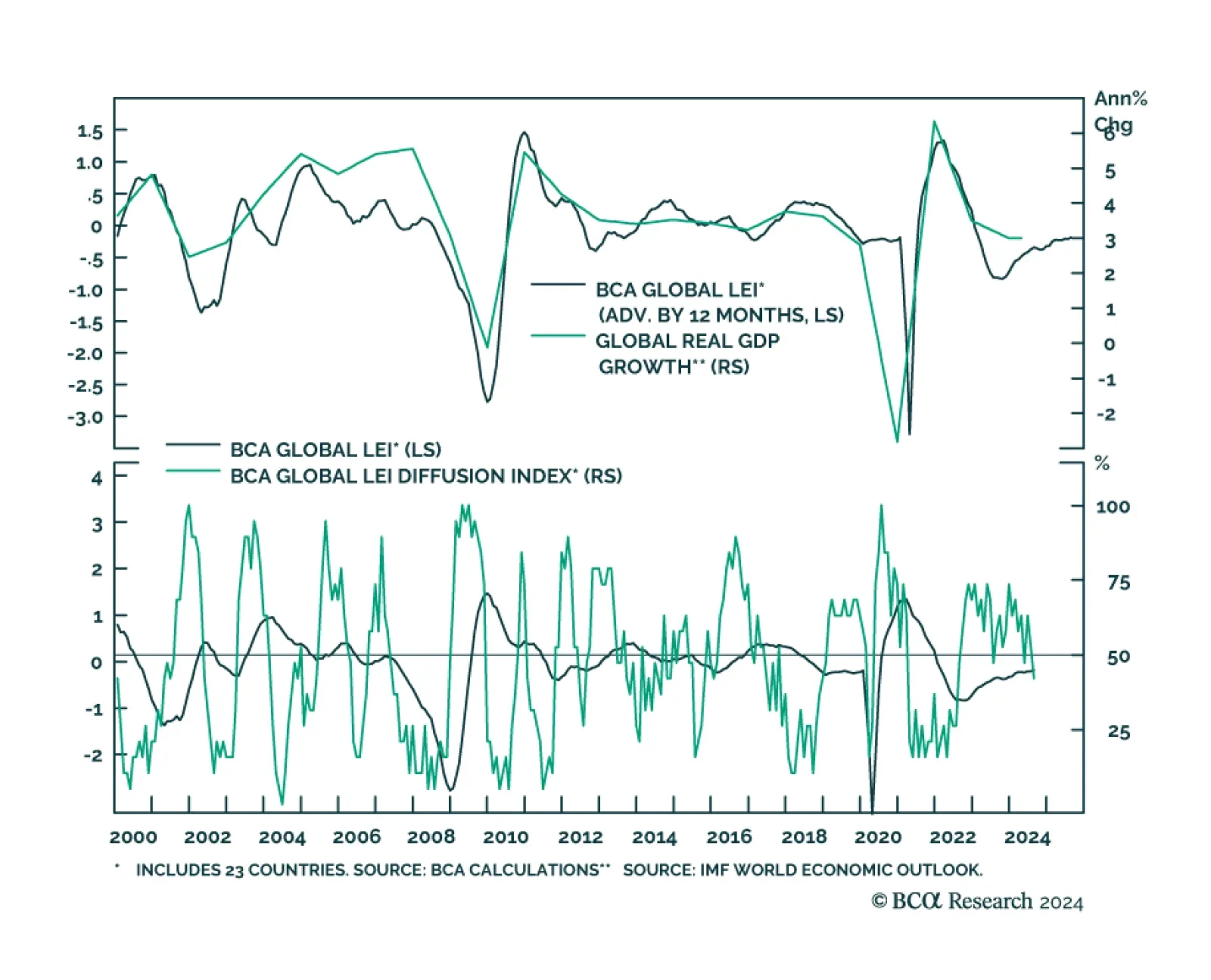

BCA’s Global Leading Economic Indicator, a GDP-weighted average of the standardized leading indicators of 23 DM and EM economies, has had a good track record of predicting year-on-year changes in the IMF global real GDP…

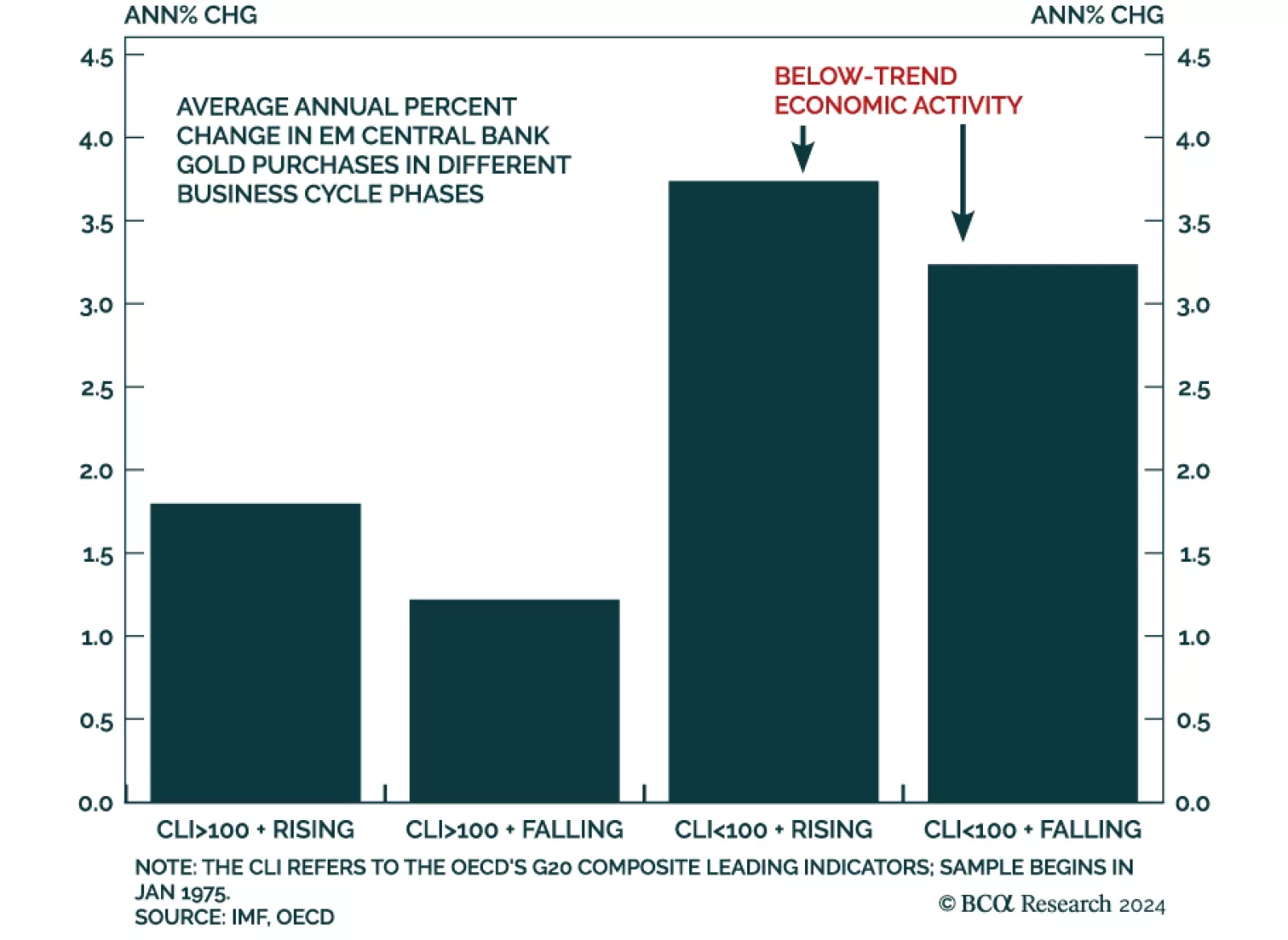

According to BCA Research’s Commodity & Energy Strategy service, central banks will continue to be a key source of gold demand. Central bank purchases in the first half of this year exceeded first-half purchases in…