Our expectation that a looming US recession will morph into a global recession remains intact. US monetary easing will only take effect with a lag and current deteriorating economic conditions are the product of past…

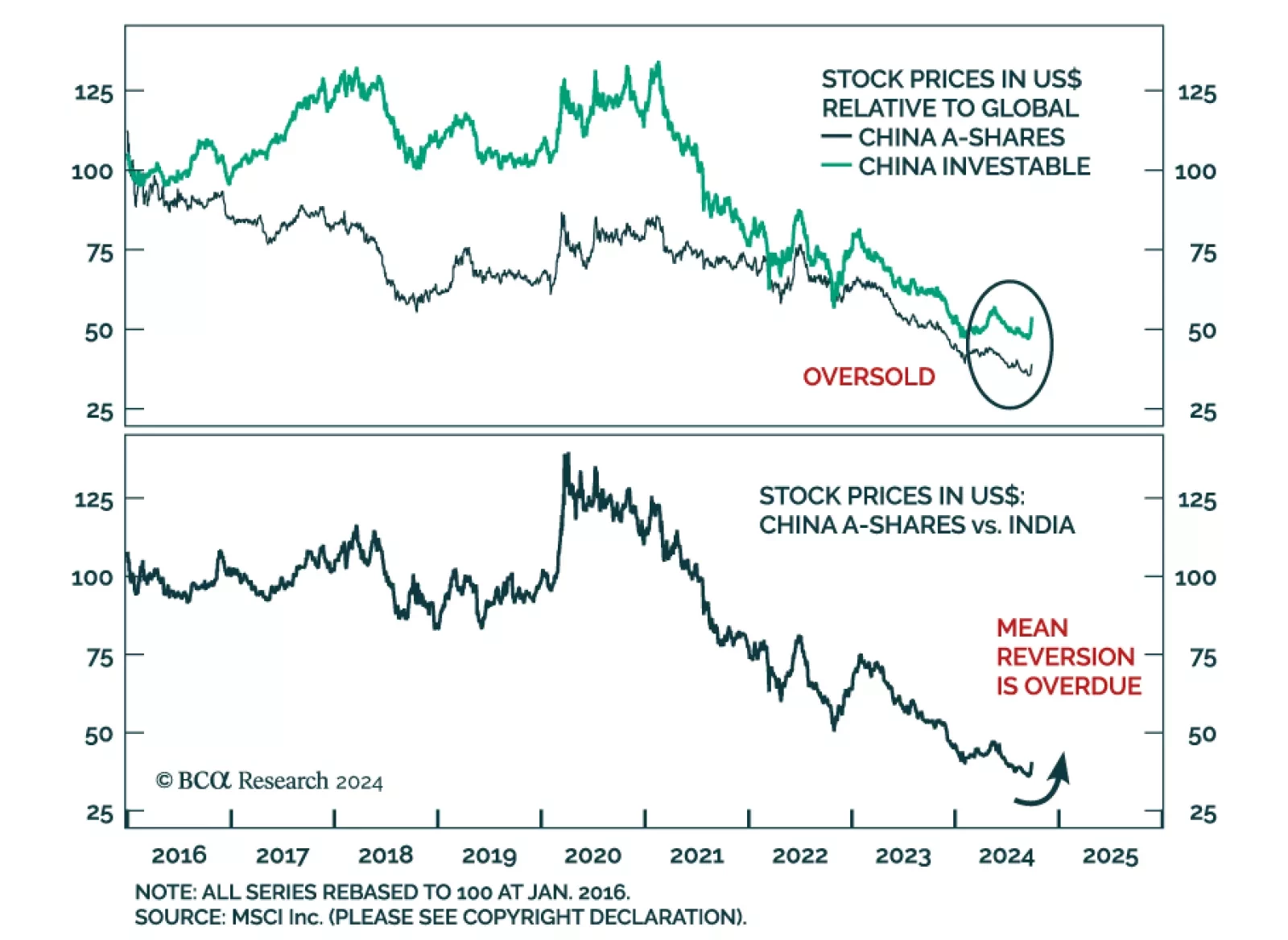

We highlighted last week that while the Politburo policy announcements are unlikely to produce a meaningful business cycle recovery in China, they nevertheless administered a shot of adrenaline to investor sentiment. Chinese…

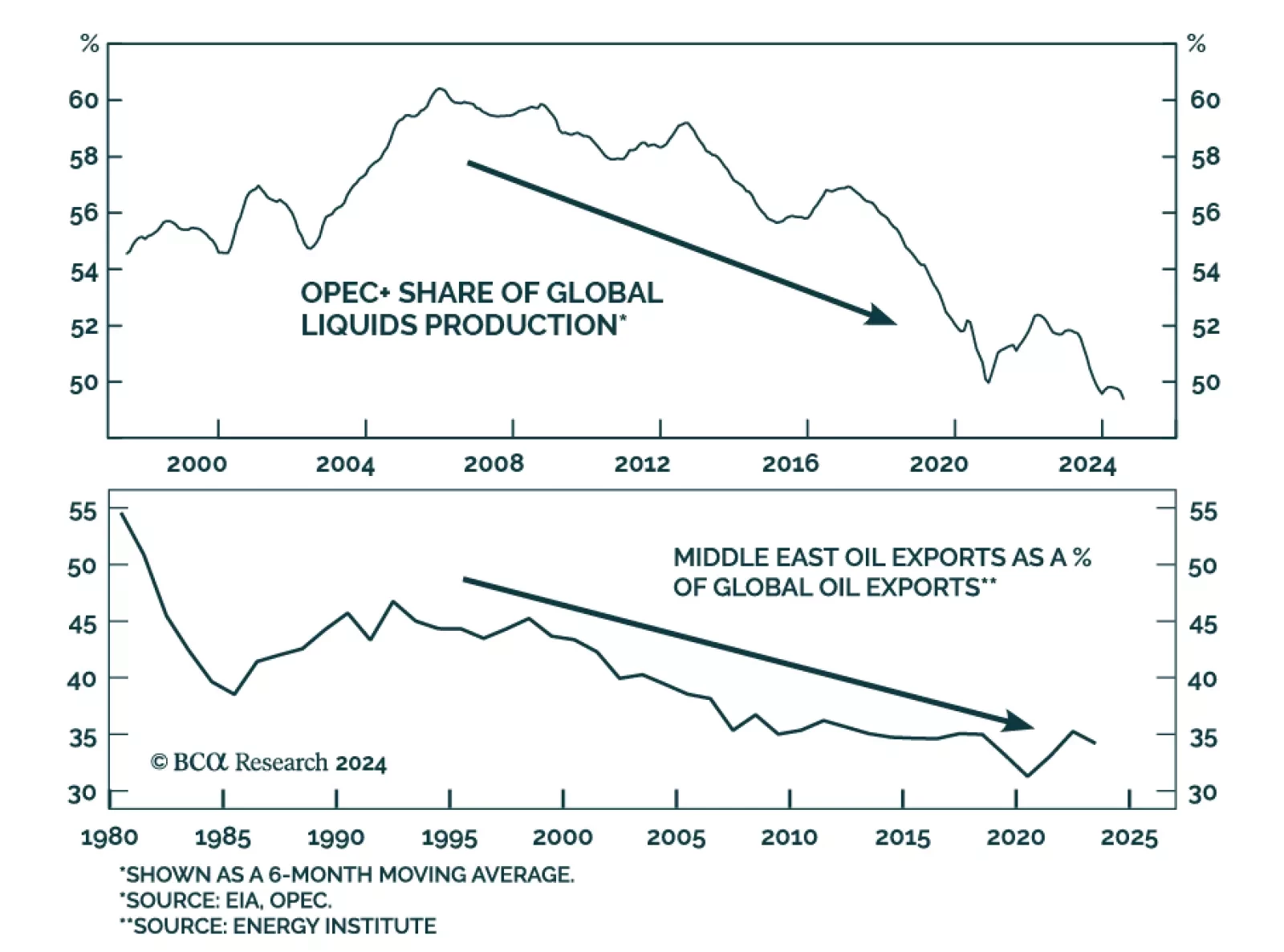

One commodity that has not reacted to the bullish demand-side news from the Politburo (see The Numbers) is crude oil. Brent shed over 2% on Thursday, in sharp contrast to Copper’s gains. Oil markets seem to be reacting…

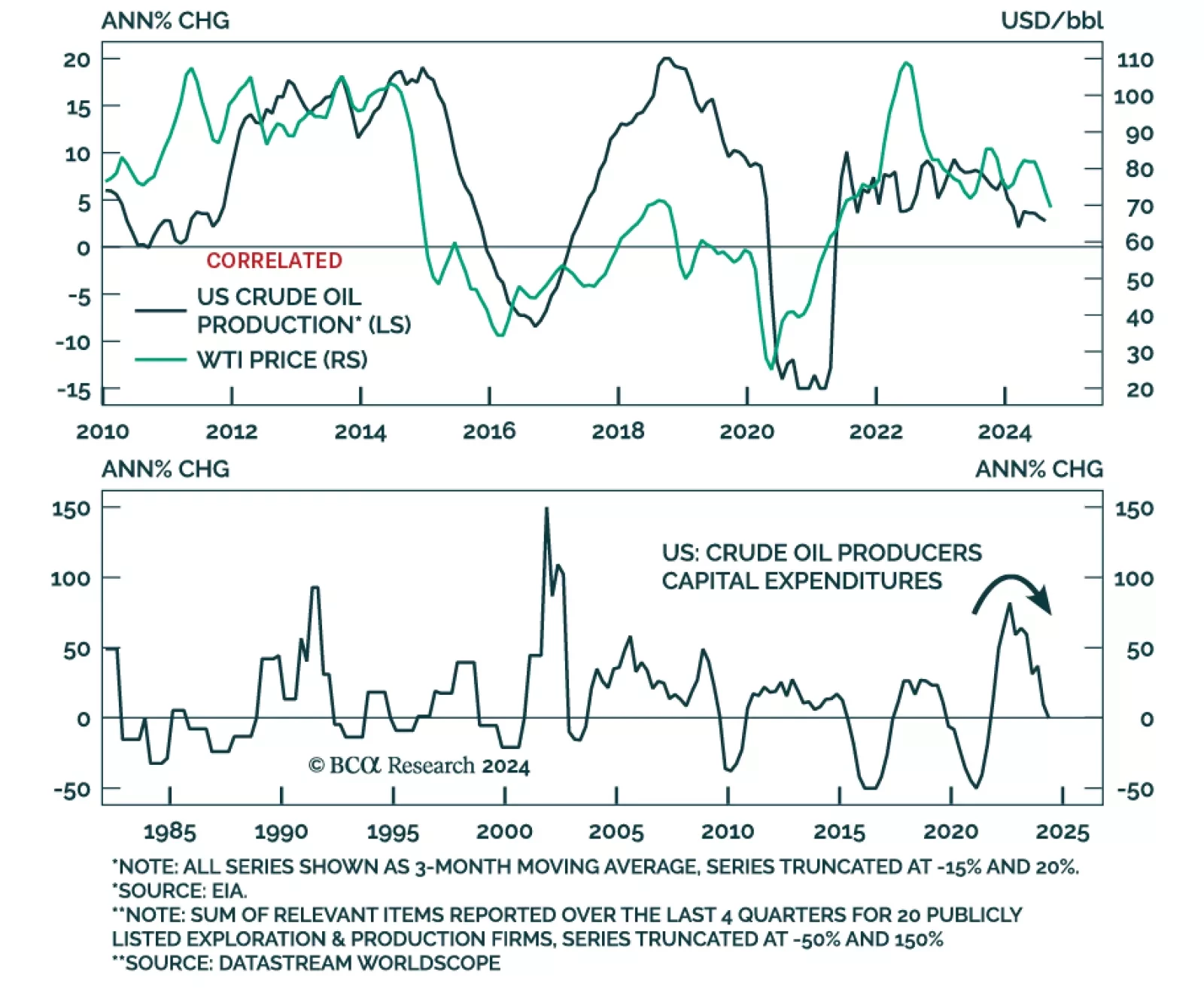

According to BCA Research’s Commodity and Energy strategy service, even though US crude output will continue rising, a meaningful growth acceleration is unlikely. US producers adjust their output in response to market…

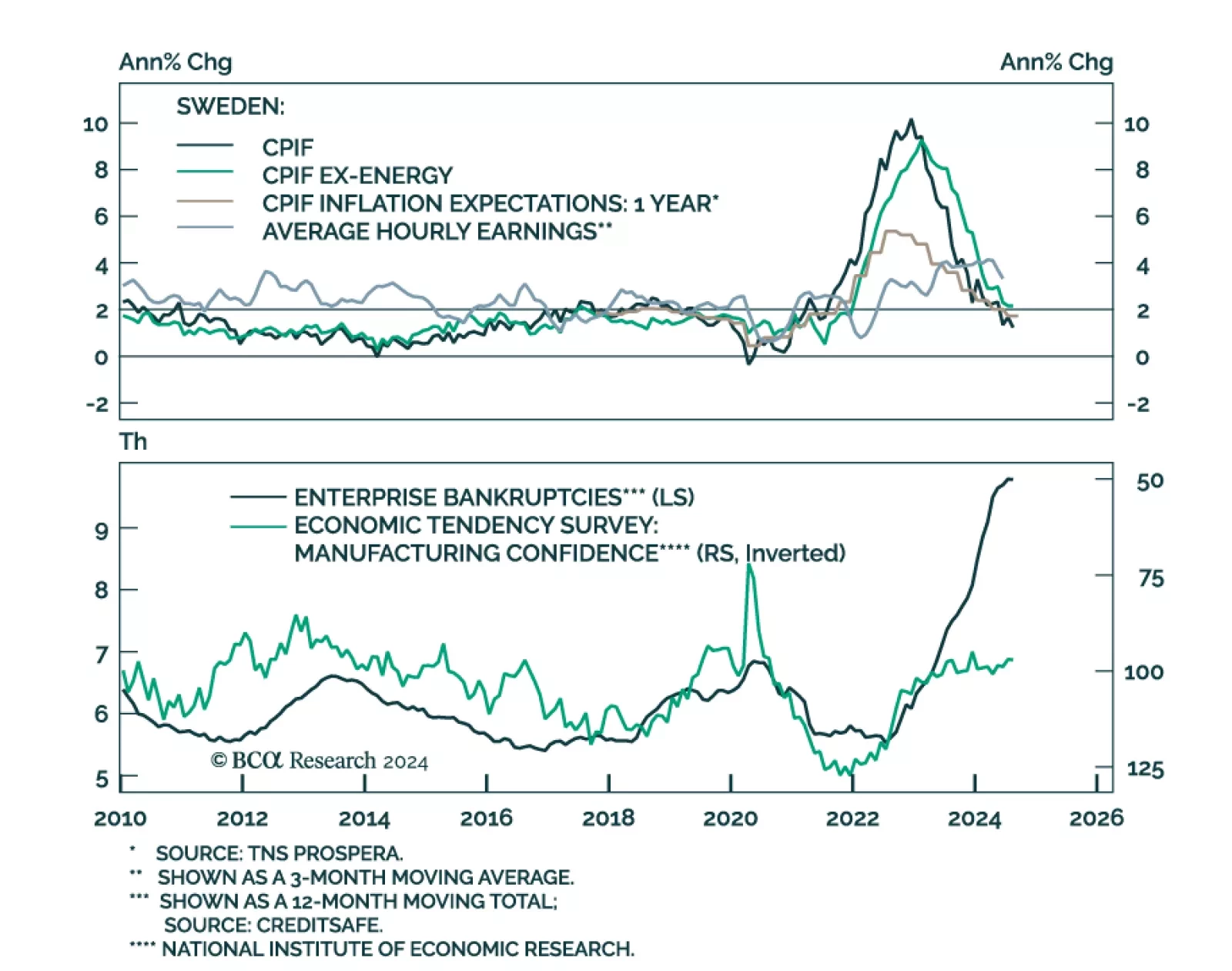

In a widely expected move, the Riksbank lowered its policy rate from 3.5% to 3.25% in September, marking its third cut this year. It embarked on its easing cycle in May, leading many other DM central banks, and has been…

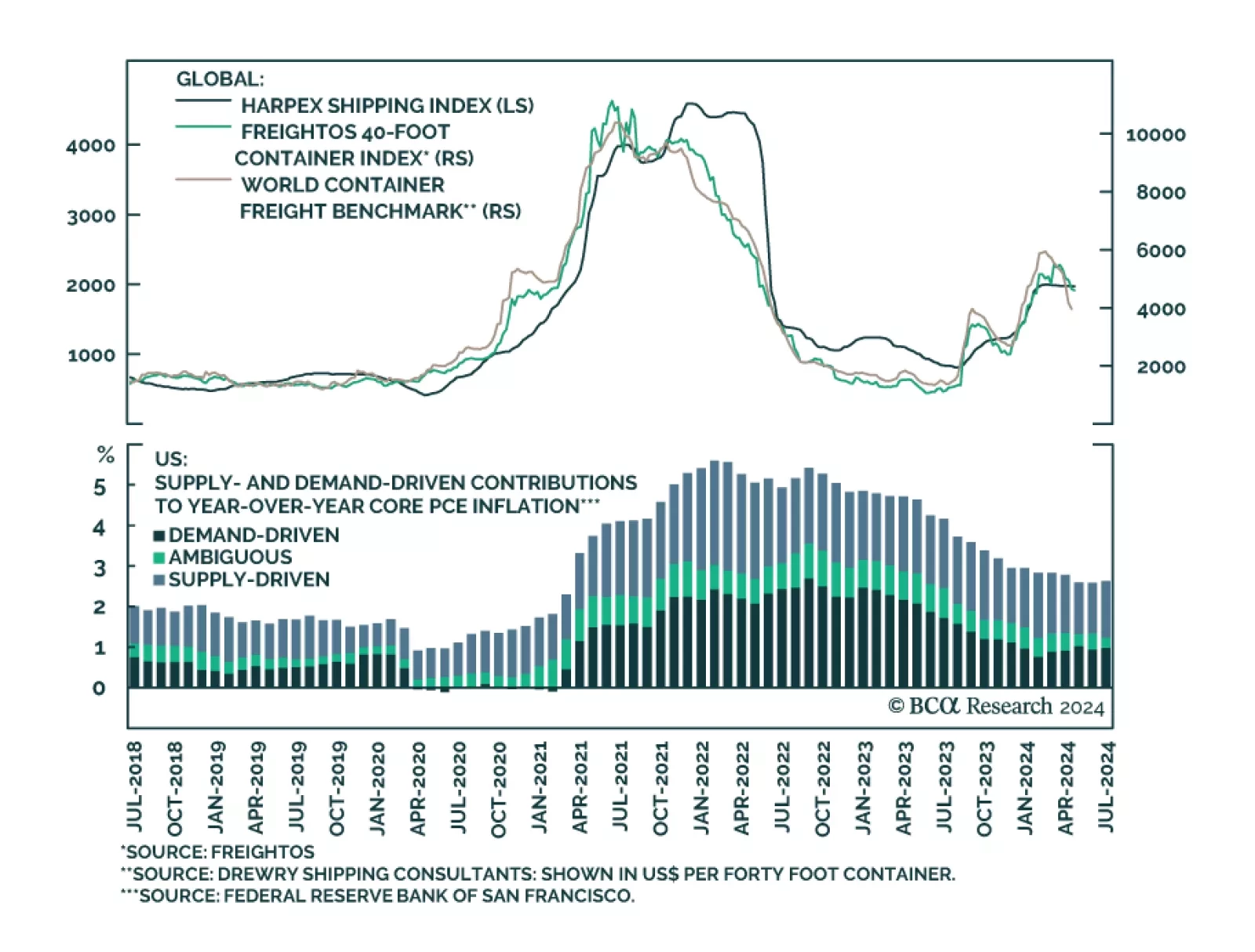

A US recession remains our base case over a cyclical investment horizon. We expect the ongoing labor market deterioration to eventually tip the economy into a recession. We therefore continue to expect the disinflationary forces…

BCA Research’s Geopolitical Strategy service introduced a Global Political Capital Index. Investors should favor countries with newly elected government, small government size, and ample room to cut policy rate. Ideally,…

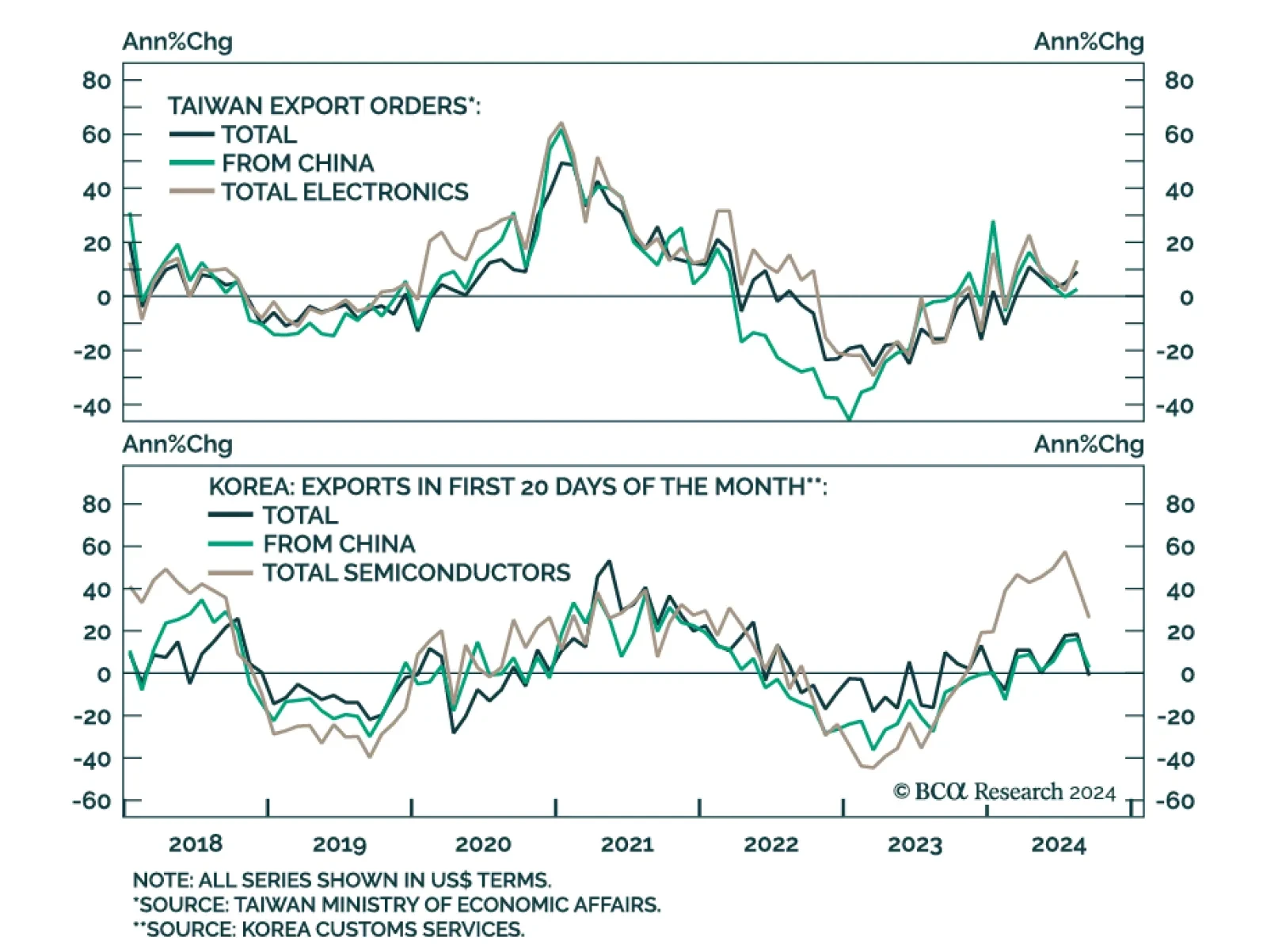

Export dynamics from small open economies are a good bellwether for global growth conditions. Taiwan export orders accelerated from 4.8% y/y to a faster-than-anticipated 9.1% in August. The faster pace of growth was also broad…