Japanese core machinery orders decreased by 1.9% in August and dropped 3.4% year-over-year, missing expectations for modest growth. This decline reversed July’s improvement, when machinery orders grew at an 8.7% annual pace…

While recent cross-asset developments have sent a risk-on signal, with equities and bond yields both higher, the commodity complex has recently been sending a more somber message. “Dr. Copper” is a bellwether for…

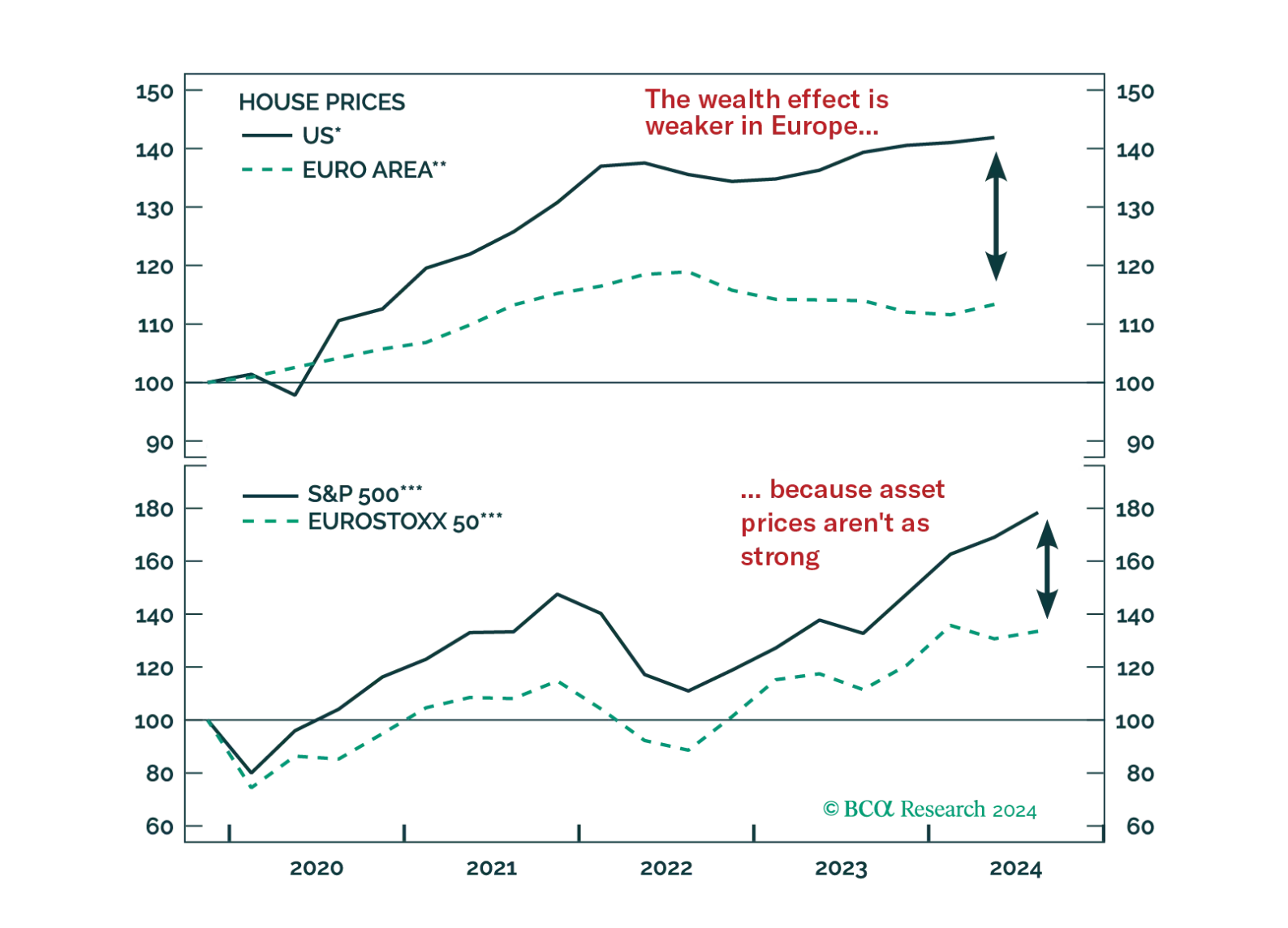

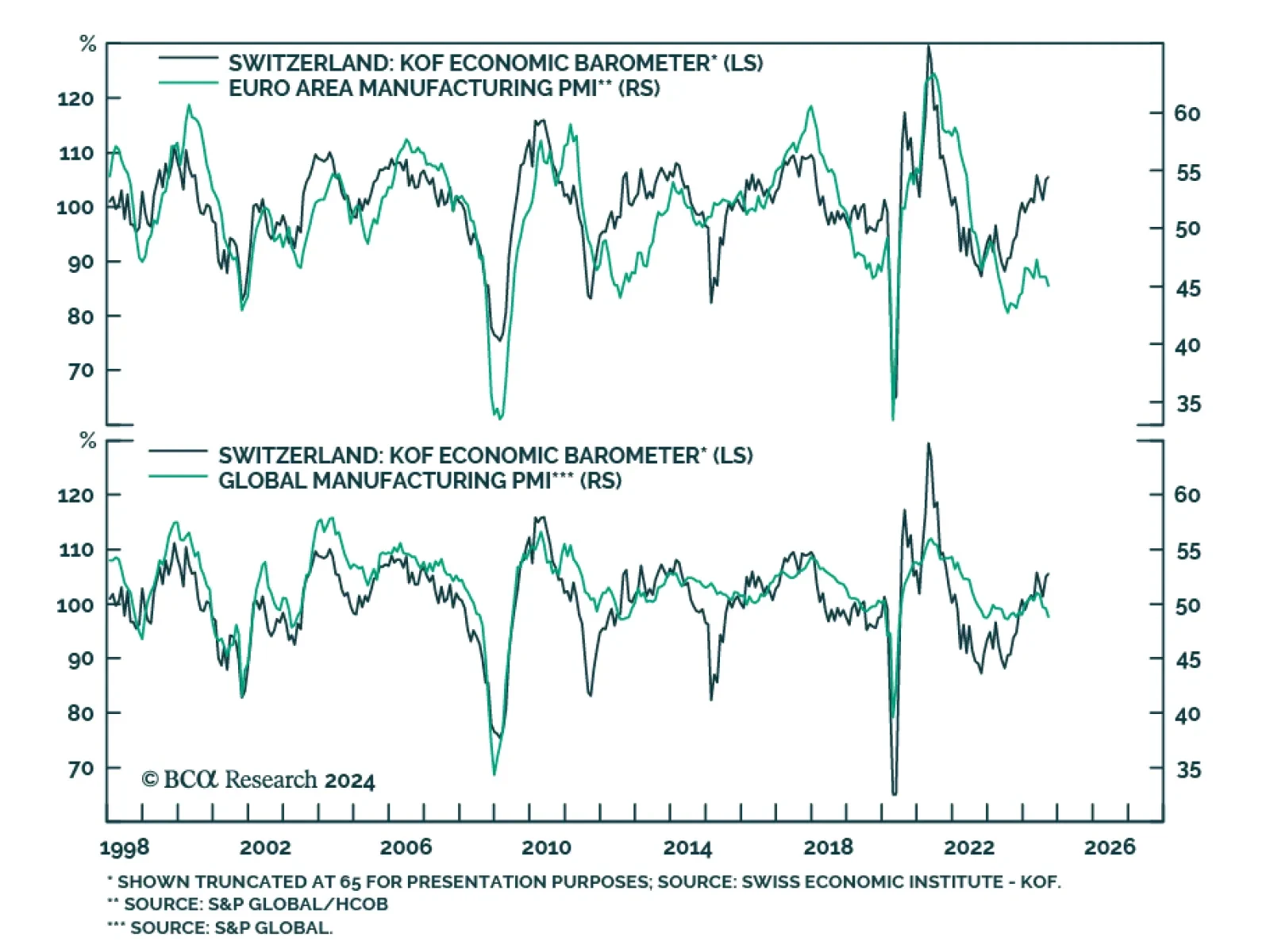

This week, we cover the main questions we fielded during our latest client trip in Europe. Among the many topics broached are Europe’s recession odds, the impact of China’s stimulus, and the outlook for European markets.

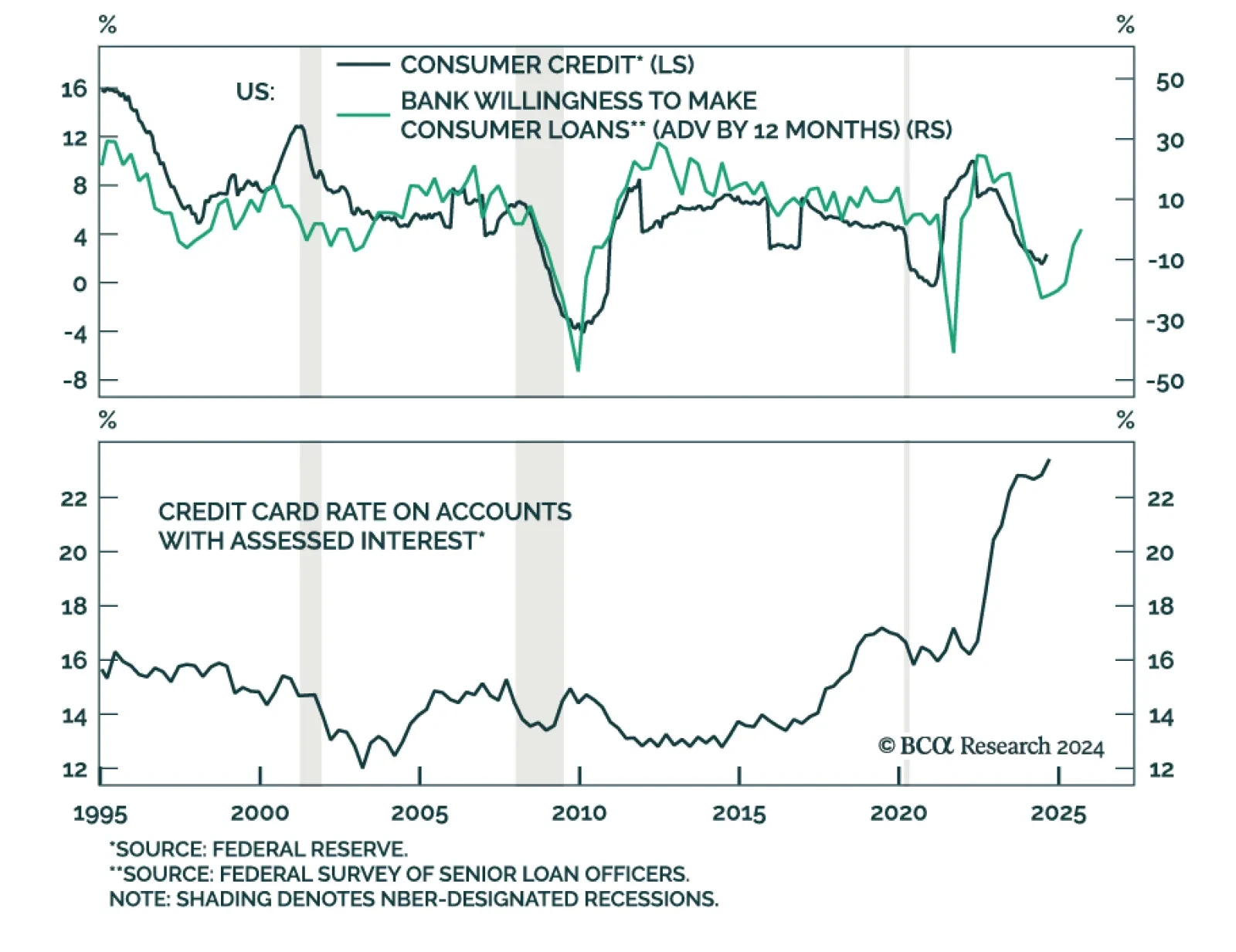

Consumer credit growth slowed in August, rising by USD 8.9 bn (to USD 5,097.6 bn outstanding) from USD 26.6 bn, disappointing expectations of a USD 12 bn monthly increase. Notably, revolving credit (which includes credit cards)…

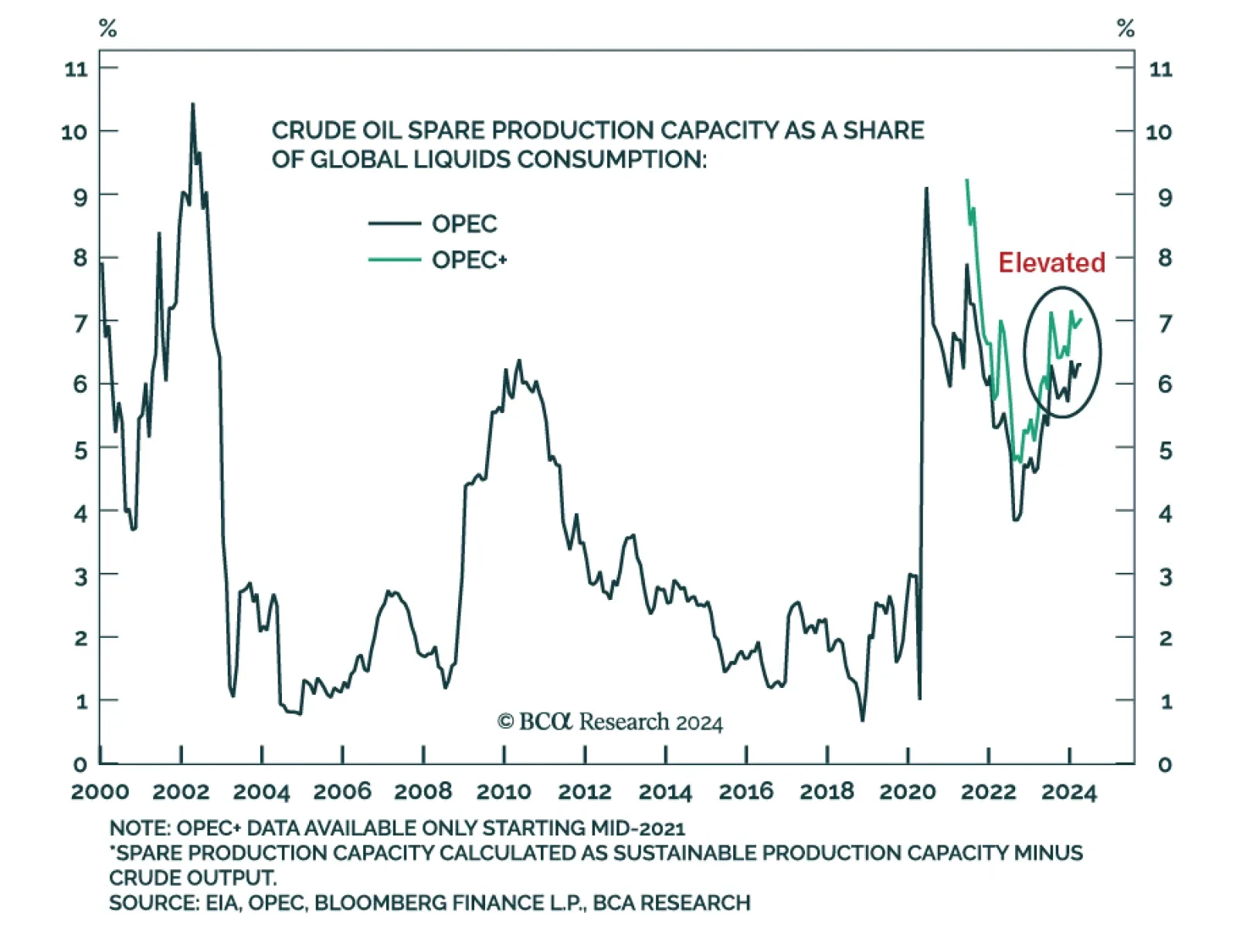

Regular readers are familiar with our expectations for a global recession over the cyclical investment timeframe. A global downturn is overwhelmingly bearish for oil demand. The supply side, on the other hand, is…

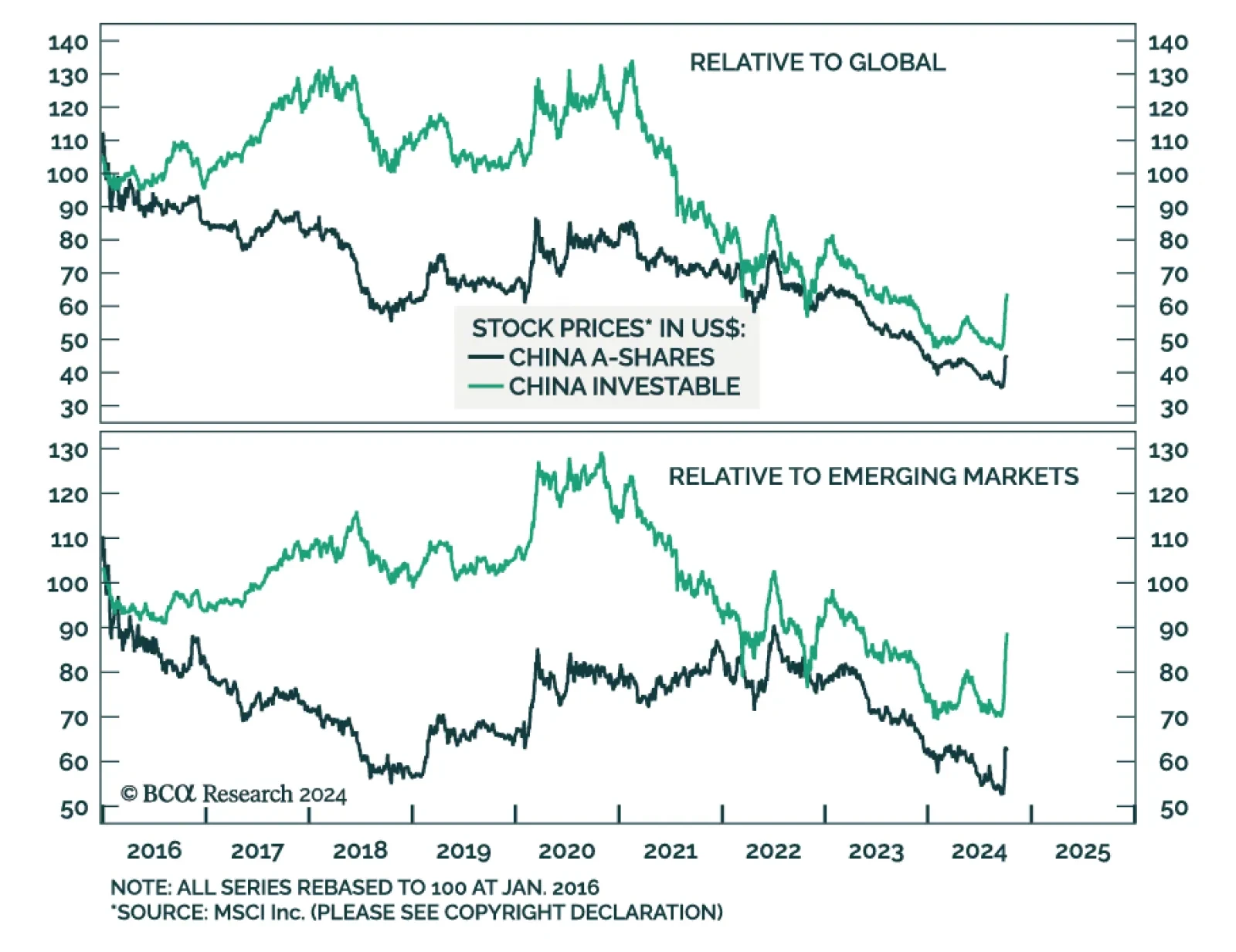

China’s National Development and Reform Commission (NDRC) provided no insights Tuesday on the size or nature of the fiscal stimulus Beijing promised in late September. The key takeaway of the authorities' first briefing…

The month of October ahead of a US general election tends to be a volatile month with negative outcome for equities. As such, it is prudent to remain on the sidelines until after the election.

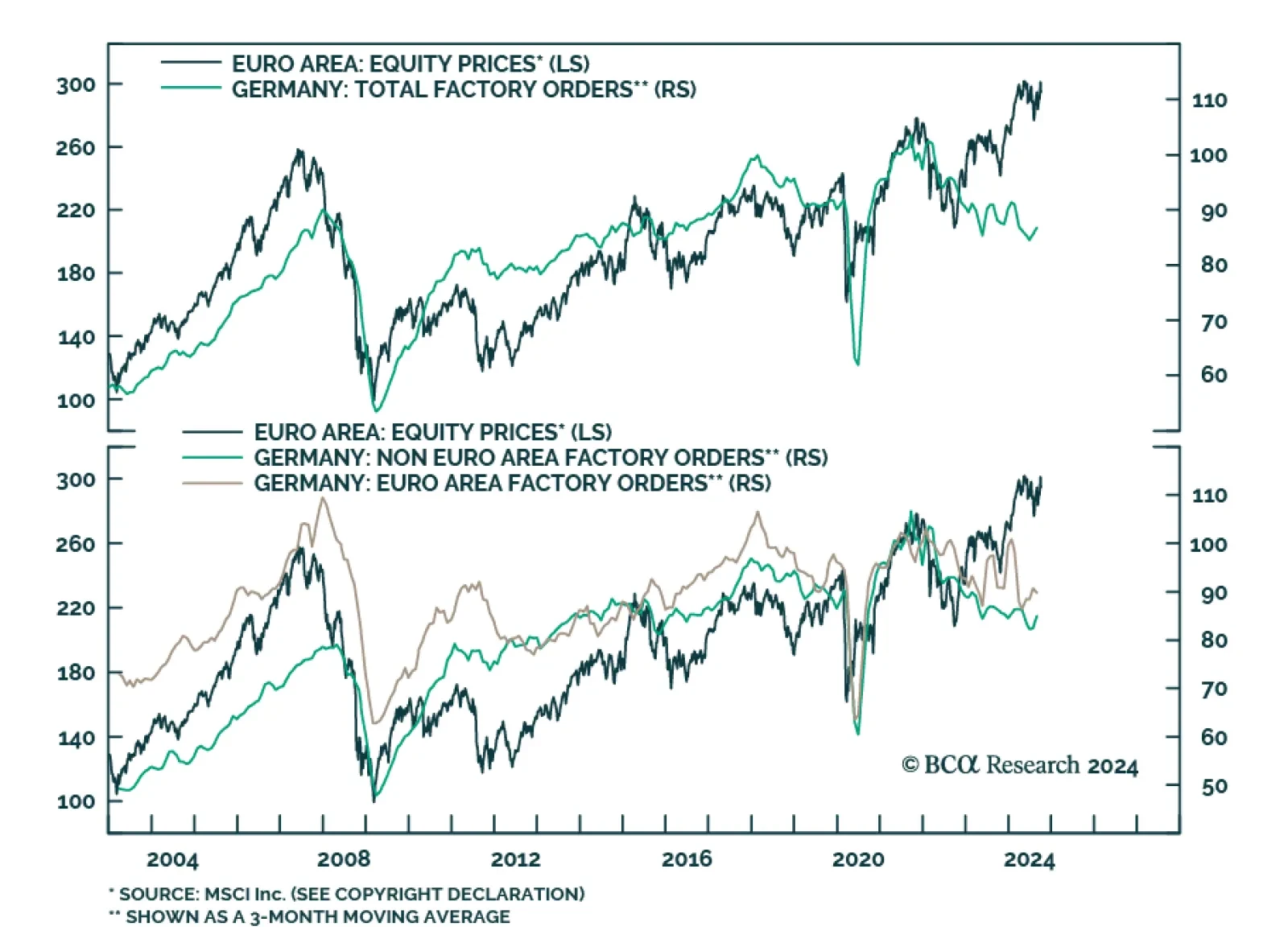

German factory orders contracted by a larger-than-anticipated 5.8% m/m (3.9% y/y) in August, from a 3.9% expansion (4.6% y/y). Domestically, Germany is constitutionally bound to maintain a balanced budget. The emergency…

The Swiss KOF Barometer is a composite leading indicator of the Swiss economy. It surprised to the upside in September coming in at 105.5 against expectations of 101.0. The August reading was also significantly revised higher,…