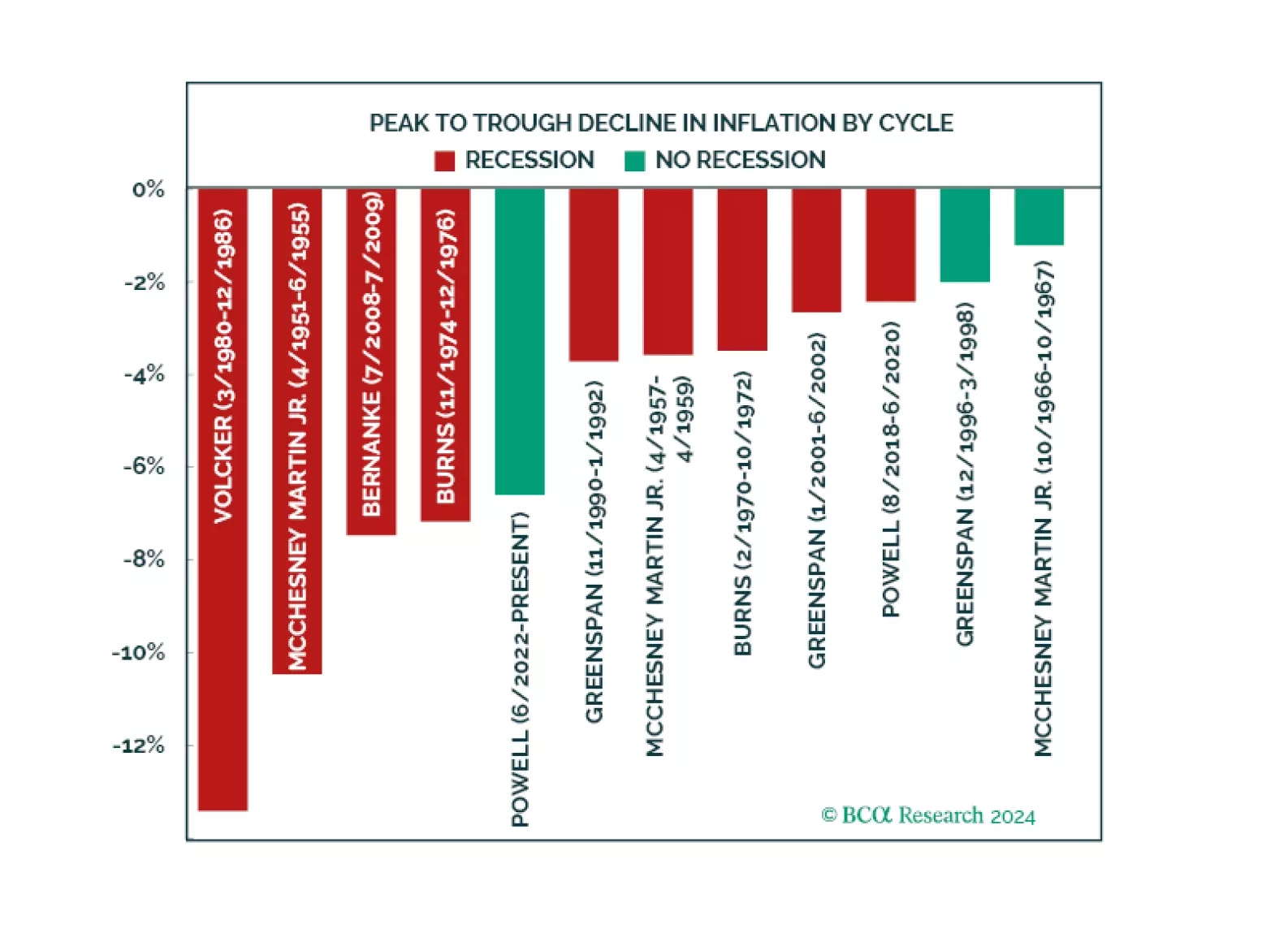

Can Powell achieve a soft landing? There are some indications he is doing it. We examine why our negative stance was wrong and analyze the four growth engines that kept recession at bay. Half of these forces remain while the other…

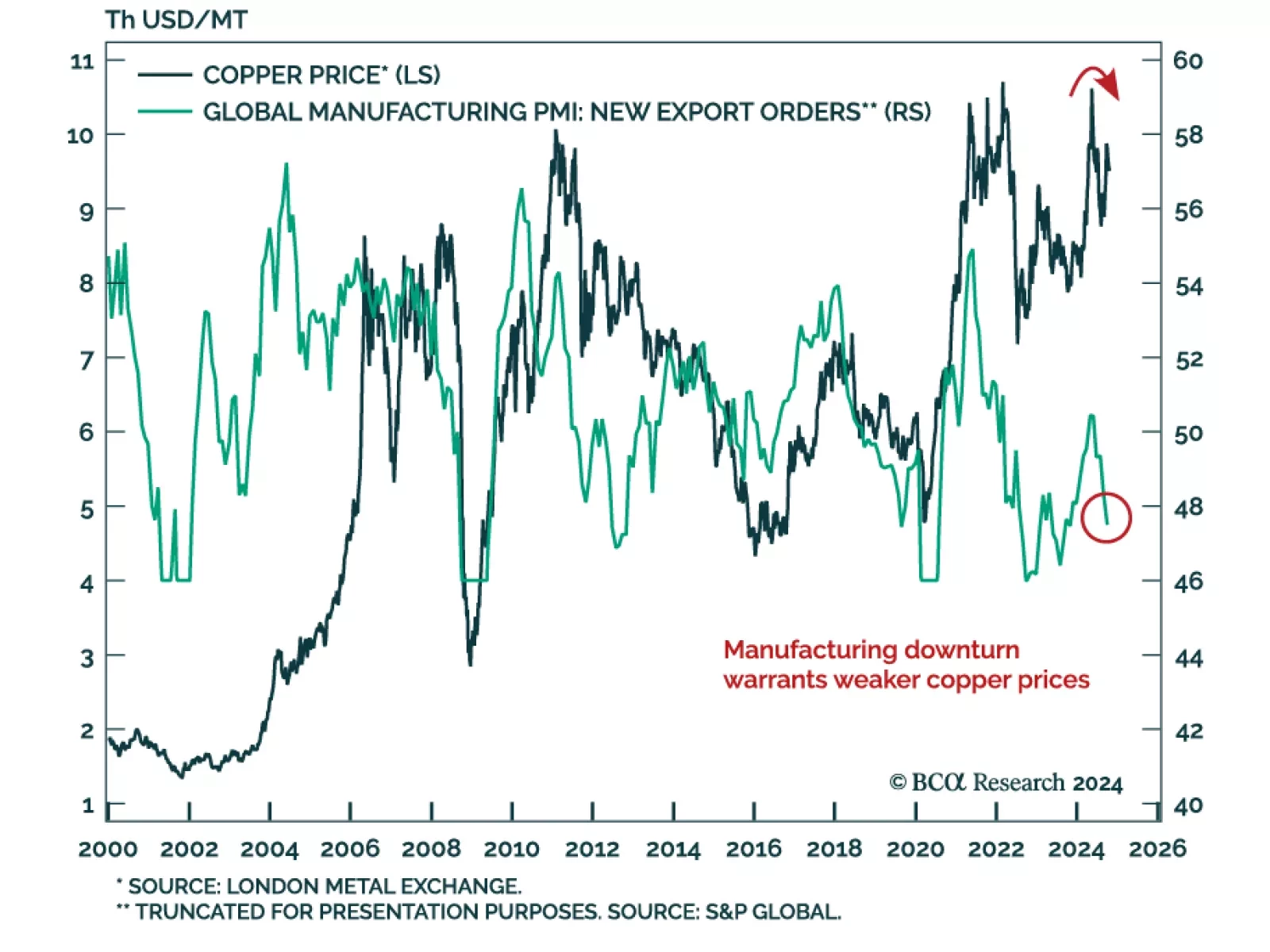

Speculators have supported copper prices as demand growth slowed below the pace of supply growth. Our Commodity and Energy Strategy colleagues believe this does not bode well for the metal. The copper market faces a situation…

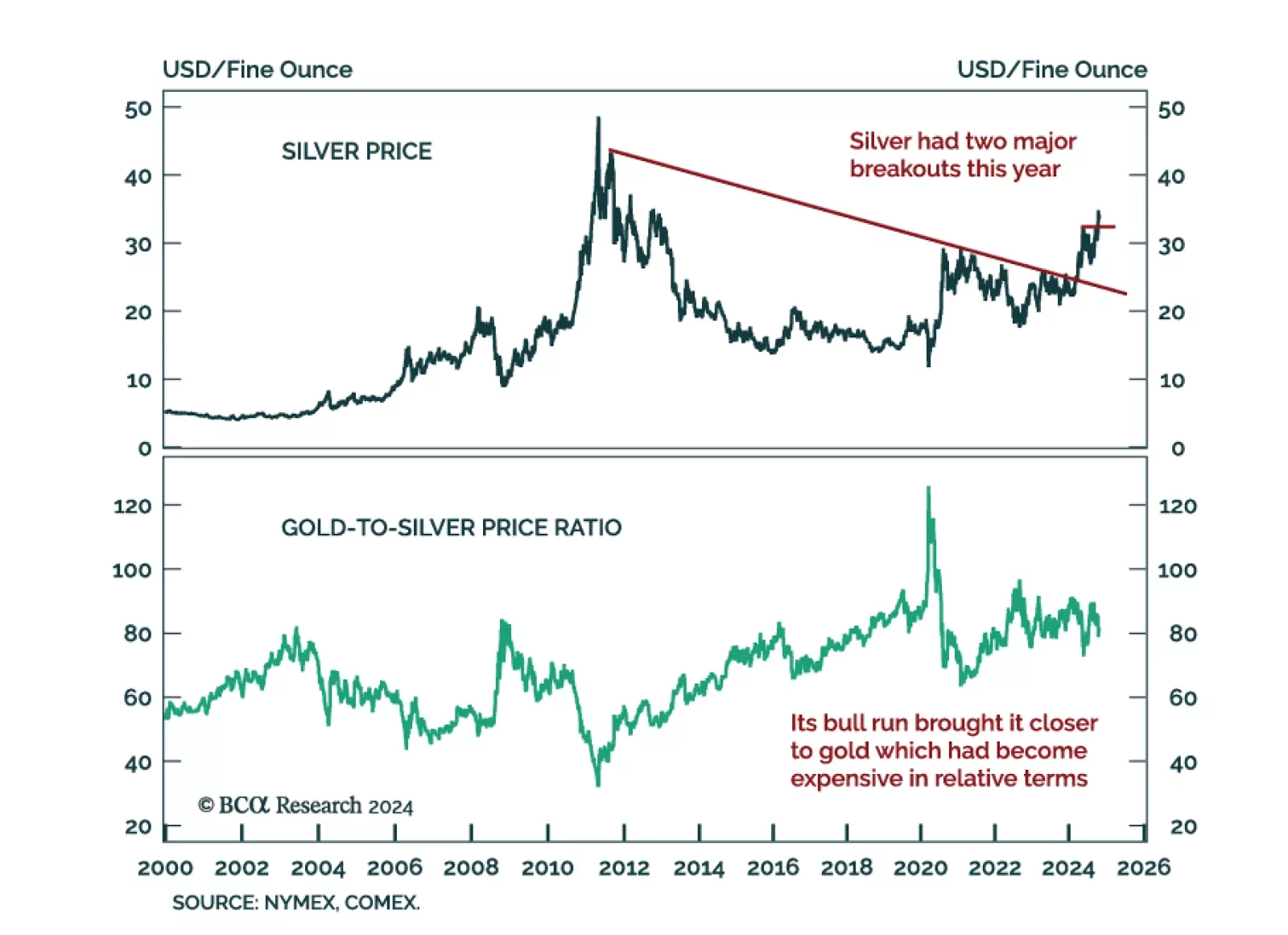

Silver has shone this year, especially after it breached a multi-decade downward slopping trendline. Silver is a precious metal, but its heavy usage in industrial processes makes us wonder whether it is sending a bullish message…

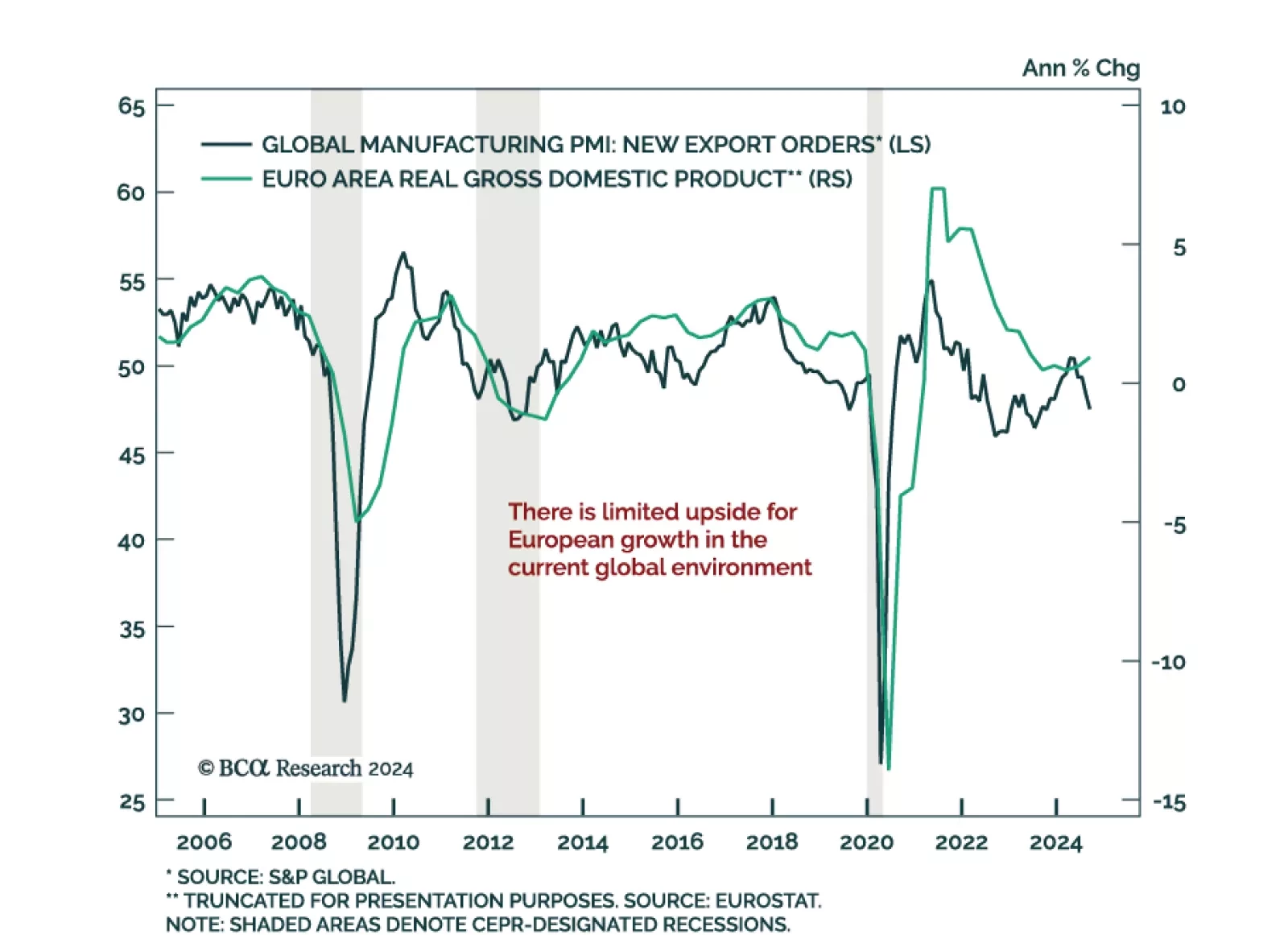

Flash Q3 GDP estimates for the Euro Area beat expectations, accelerating to 0.4% quarterly growth from 0.2% last quarter. The momentum was spread across major countries, except for Italy. Meanwhile, the European Commission’…

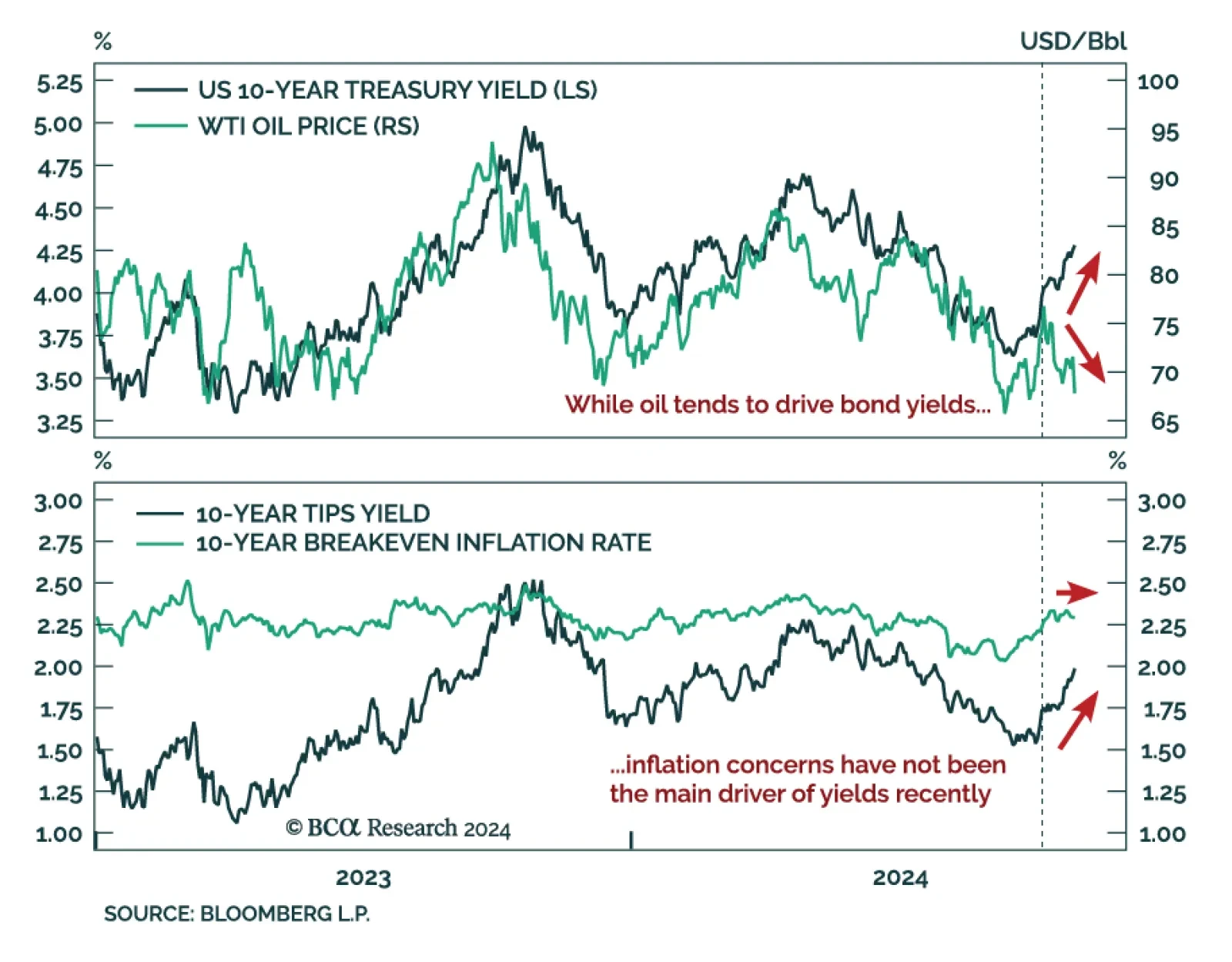

For the past two weeks, oil has sold off amid a global spike in yields. Oil prices and Treasury yields tend to be positively correlated, as oil prices are a fast-moving component of inflation, driving the inflation expectations…

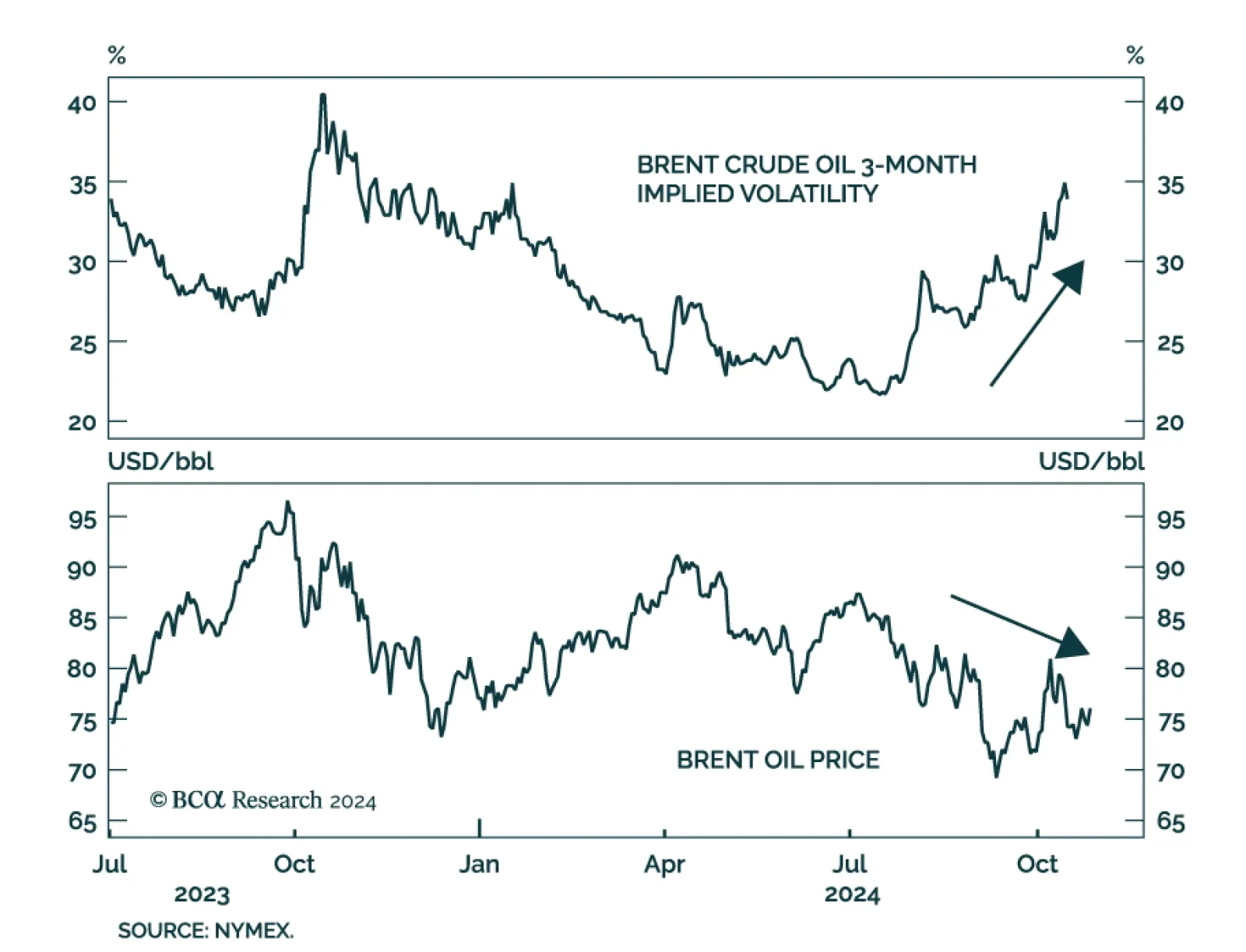

In a trendless yet volatile year for oil, Israel’s retaliatory attack on Iran this weekend is a reminder the outlook is fraught with geopolitical risks. Risks are usually expressed as a geopolitical price premium, but this…

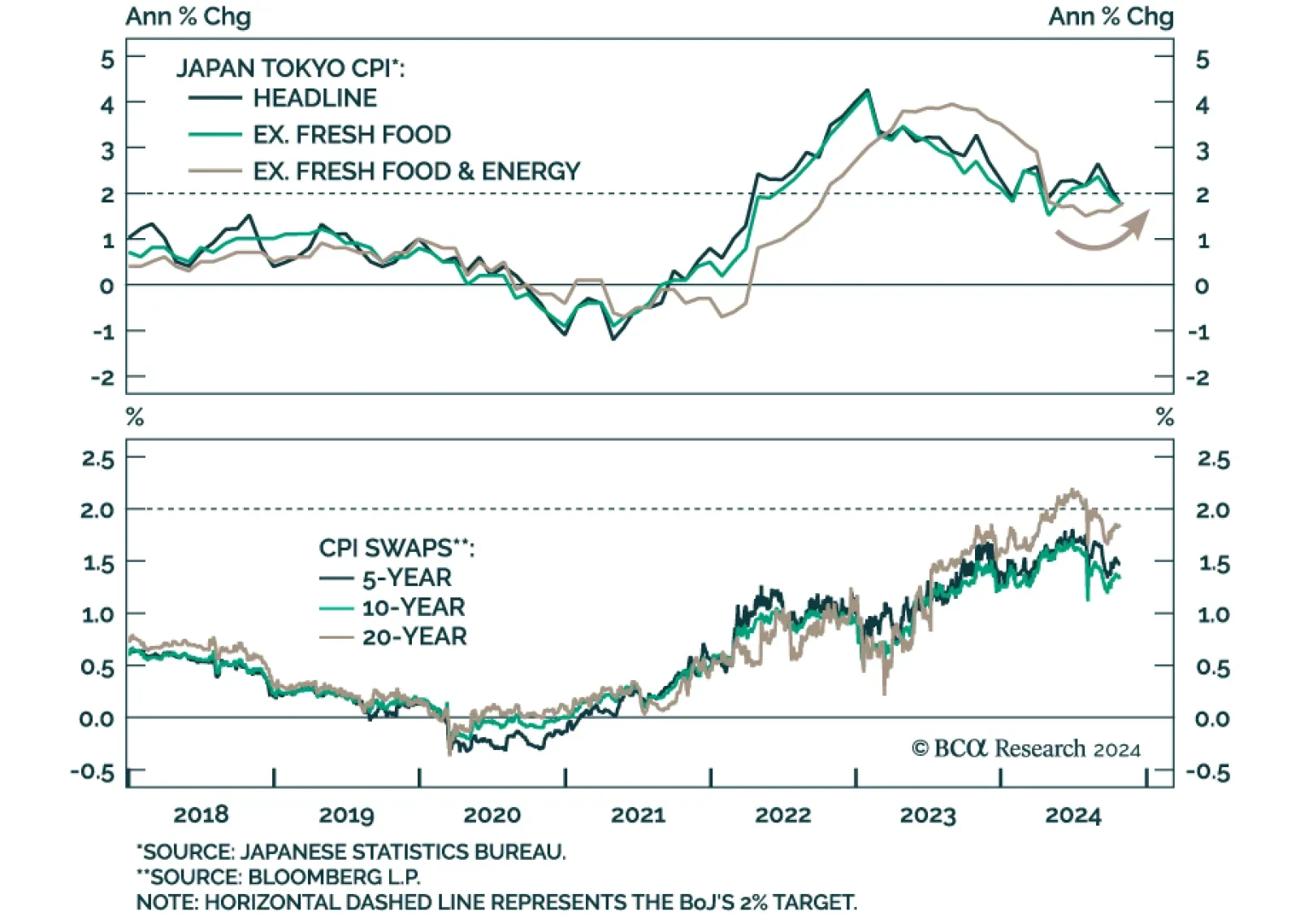

The “core core” (ex. fresh food & energy) segment of the Tokyo CPI basket beat expectations in October, printing at 1.8% year-over-year and accelerating from 1.6% in September after troughing at 1.5% in July. The…

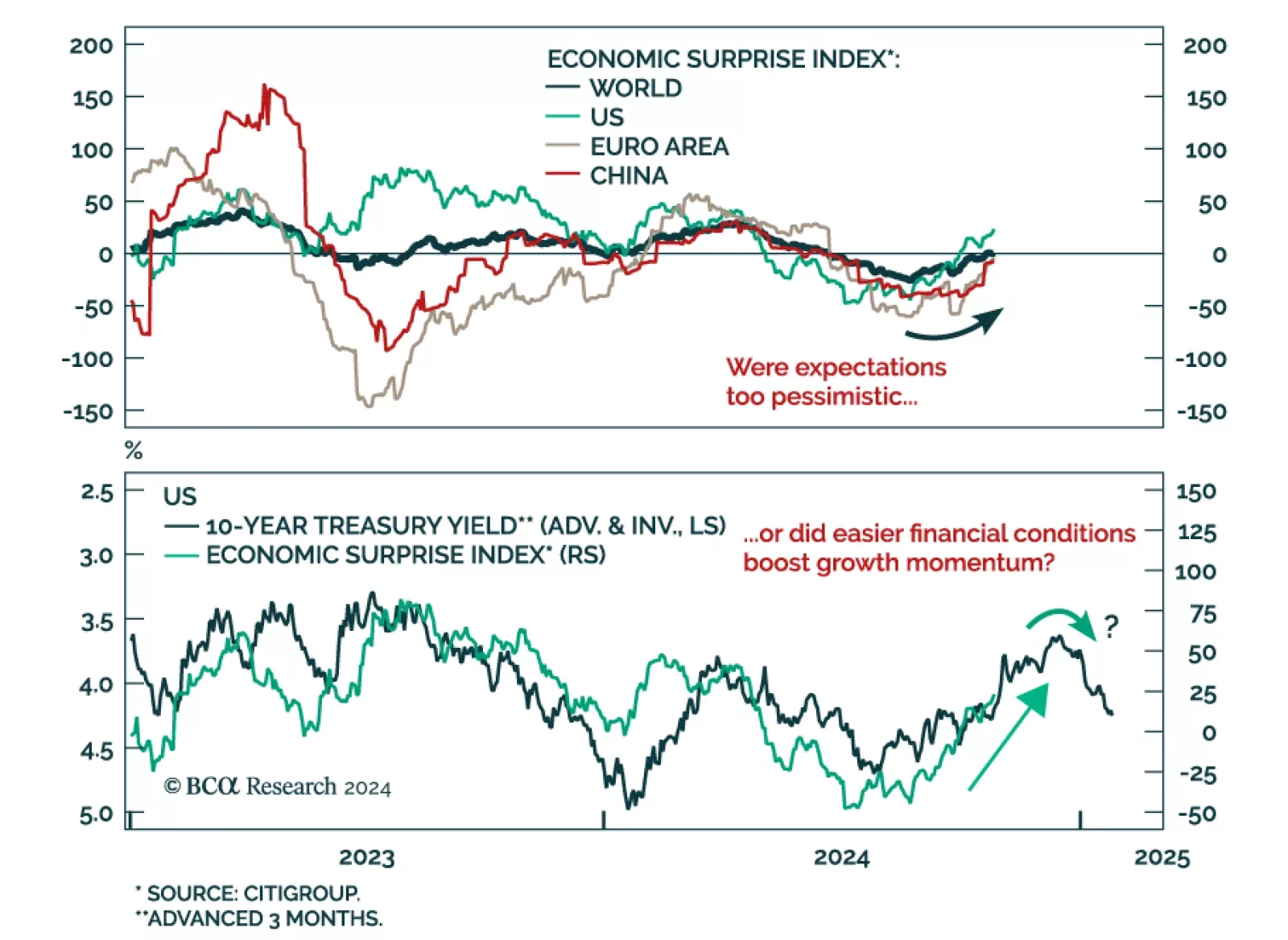

Global economic surprises have improved. Currently positive and improving in the US, they are rising from a low level in the Eurozone and China. Two explanations could explain this momentum. First, the recent easing in…