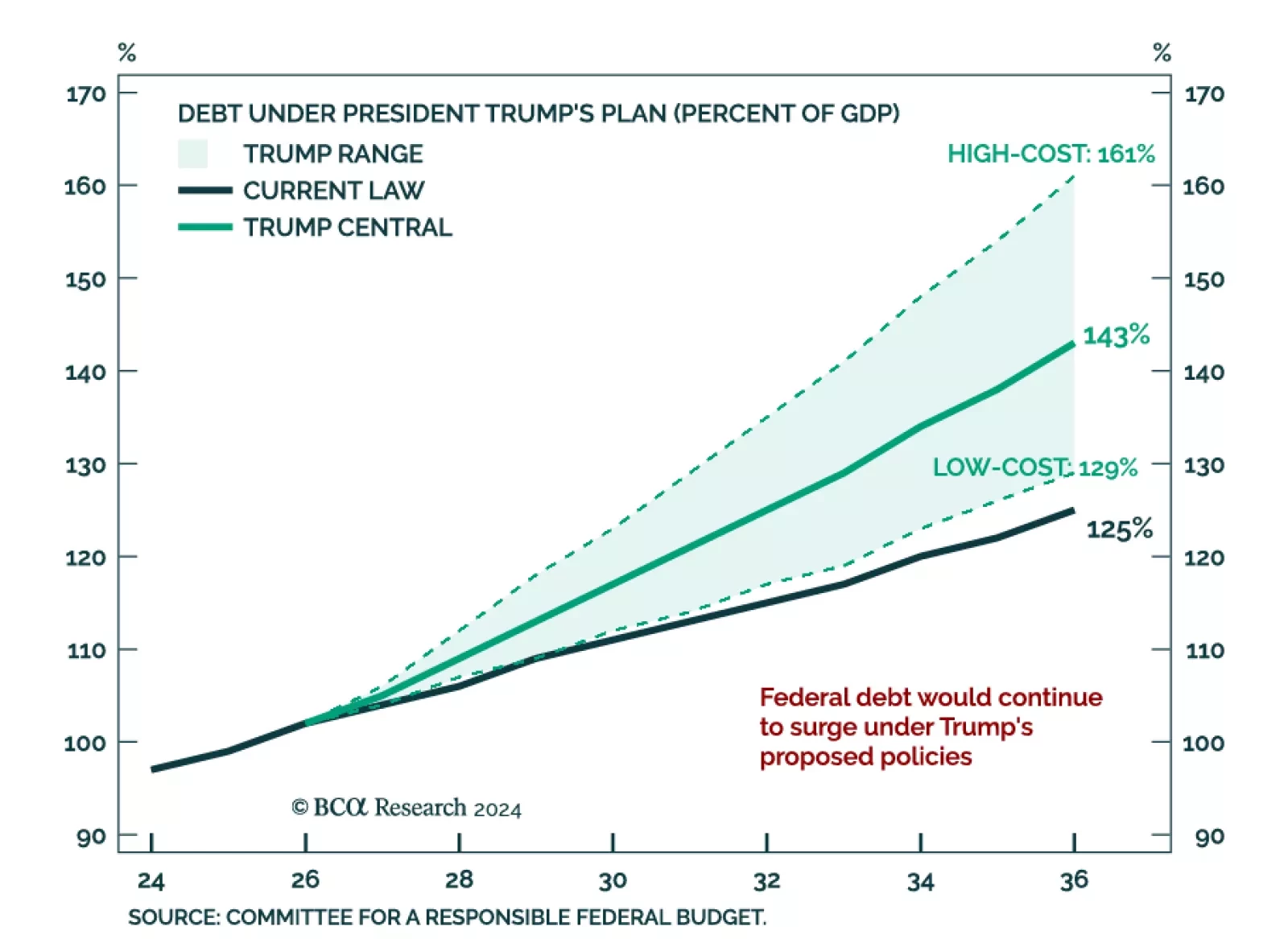

Our Global Investment Strategy team examined the risk of a fiscal crisis amid rising global debt levels. Stabilizing the US debt-to-GDP ratio would require a nearly 4% GDP improvement in the primary budget balance at…

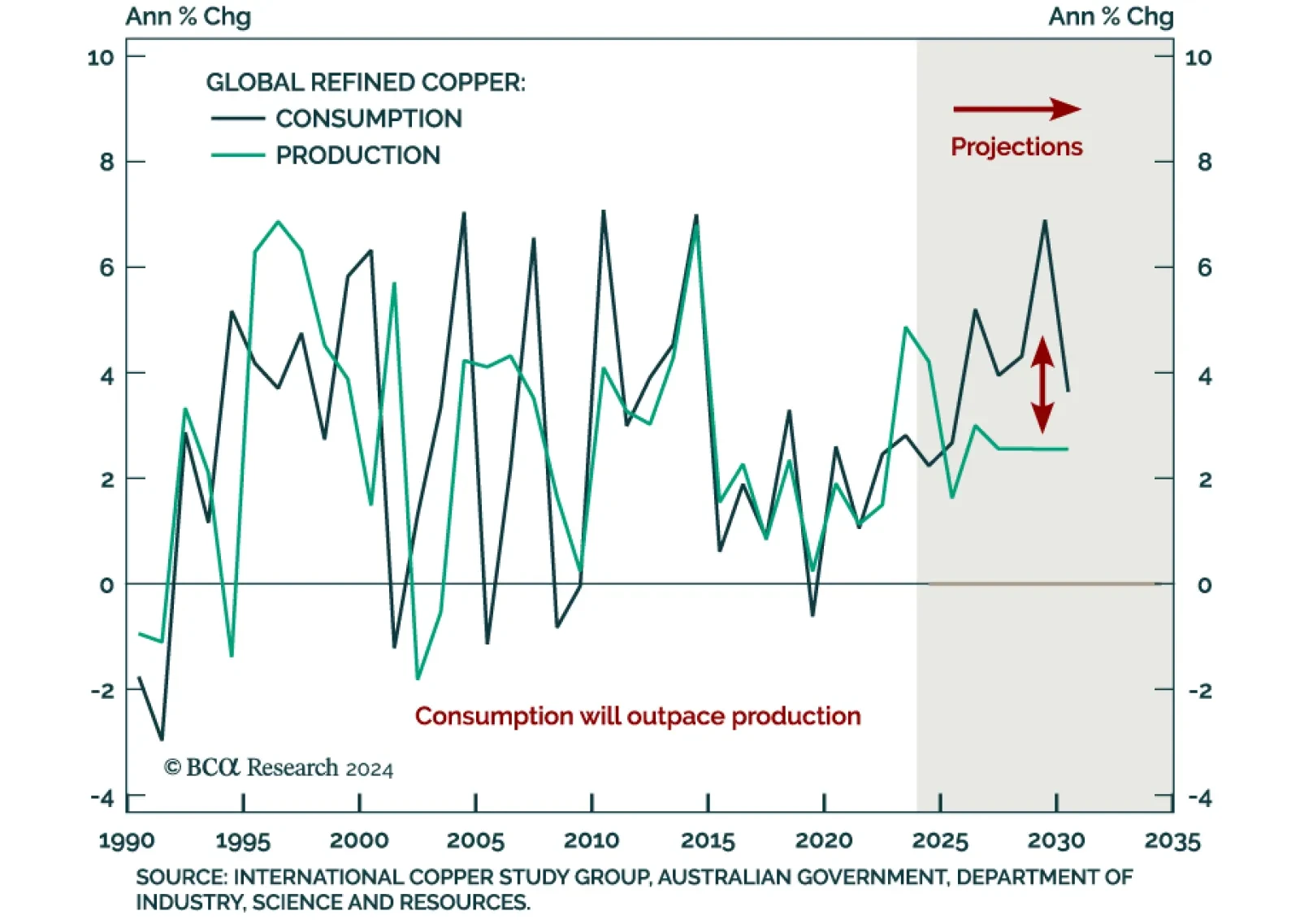

Our Commodity and Energy strategists believe a supply-demand deficit will emerge in 2026, and widen into the end of the decade. Copper demand is set to grow over 4% annually between 2025 and 2030, fueled by the green energy…

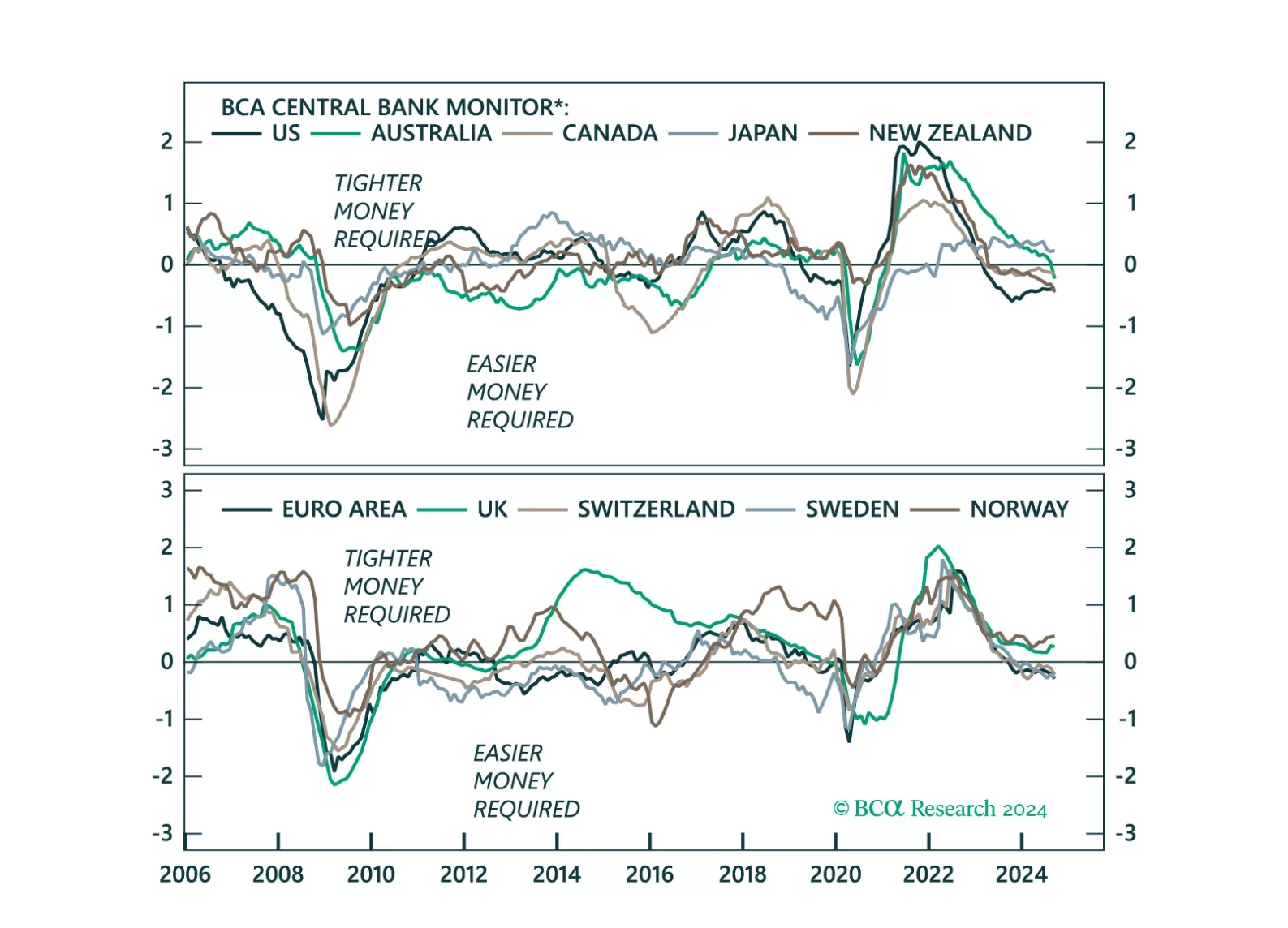

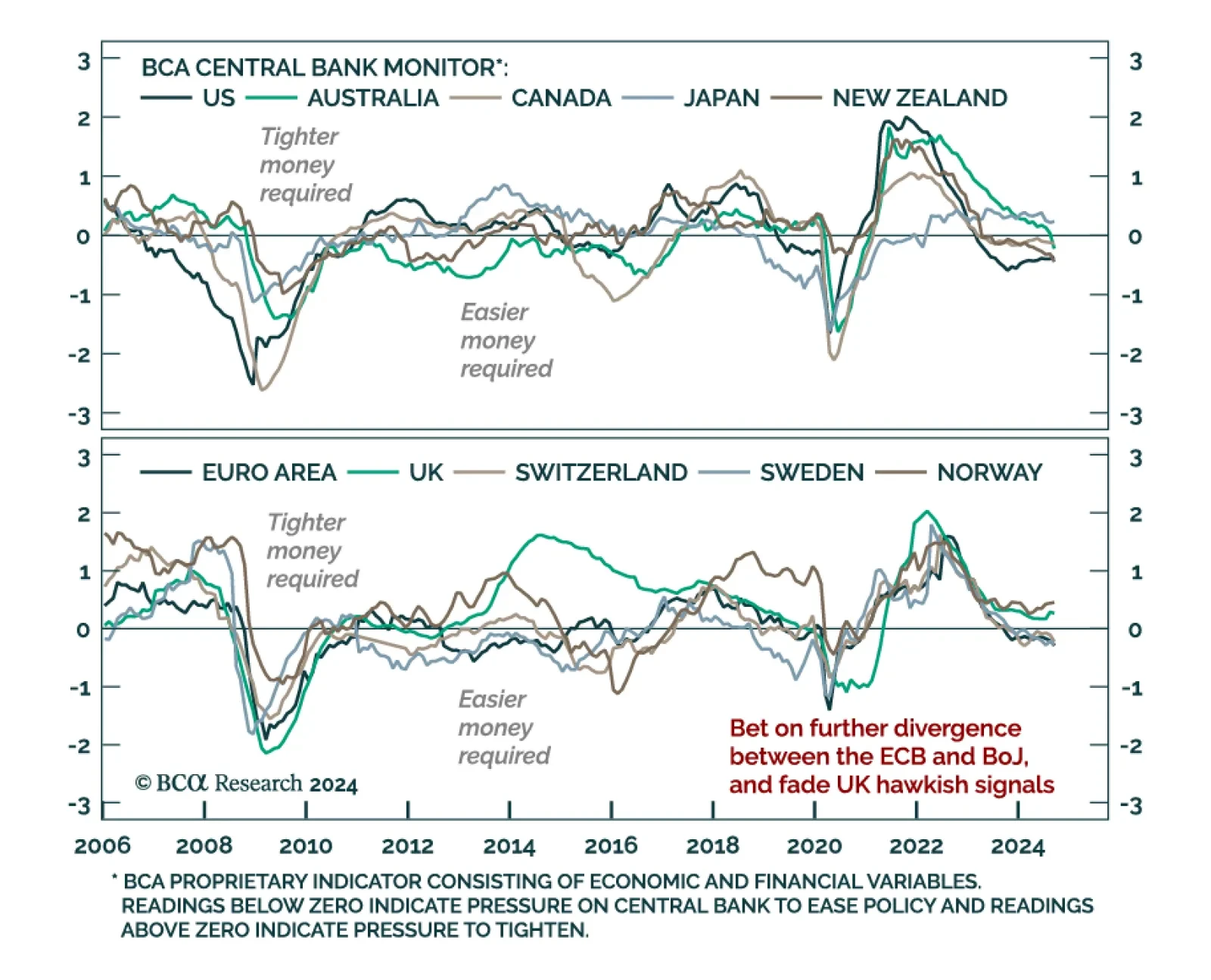

According to the latest update of the Central Bank Monitors from BCA’s Global Fixed Income strategists, economic weakness and diminishing inflation pressures warrant a shift towards easier global monetary conditions. The…

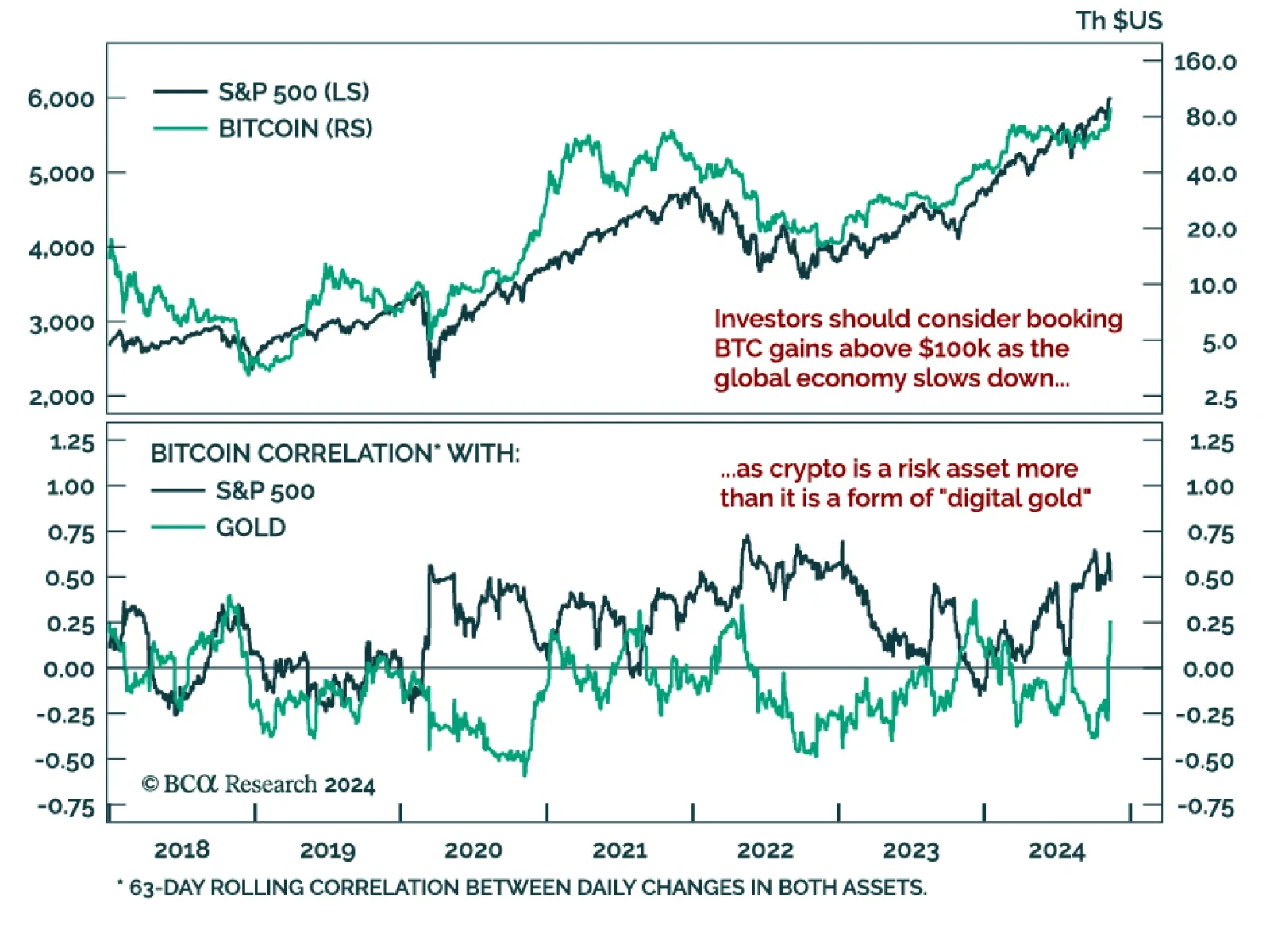

The crypto complex has rallied relentlessly since the election, with Bitcoin reaching an all-time high over $90,000. The rationale behind the recent rally is simple. President-elect Trump was friendly to crypto on the campaign…

This week, we update our Central Bank Monitors (CBMs), that help us calibrate how monetary policy should be adjusted in developed-market economies. Our conclusion is that while overall, easier monetary settings are required, there a…

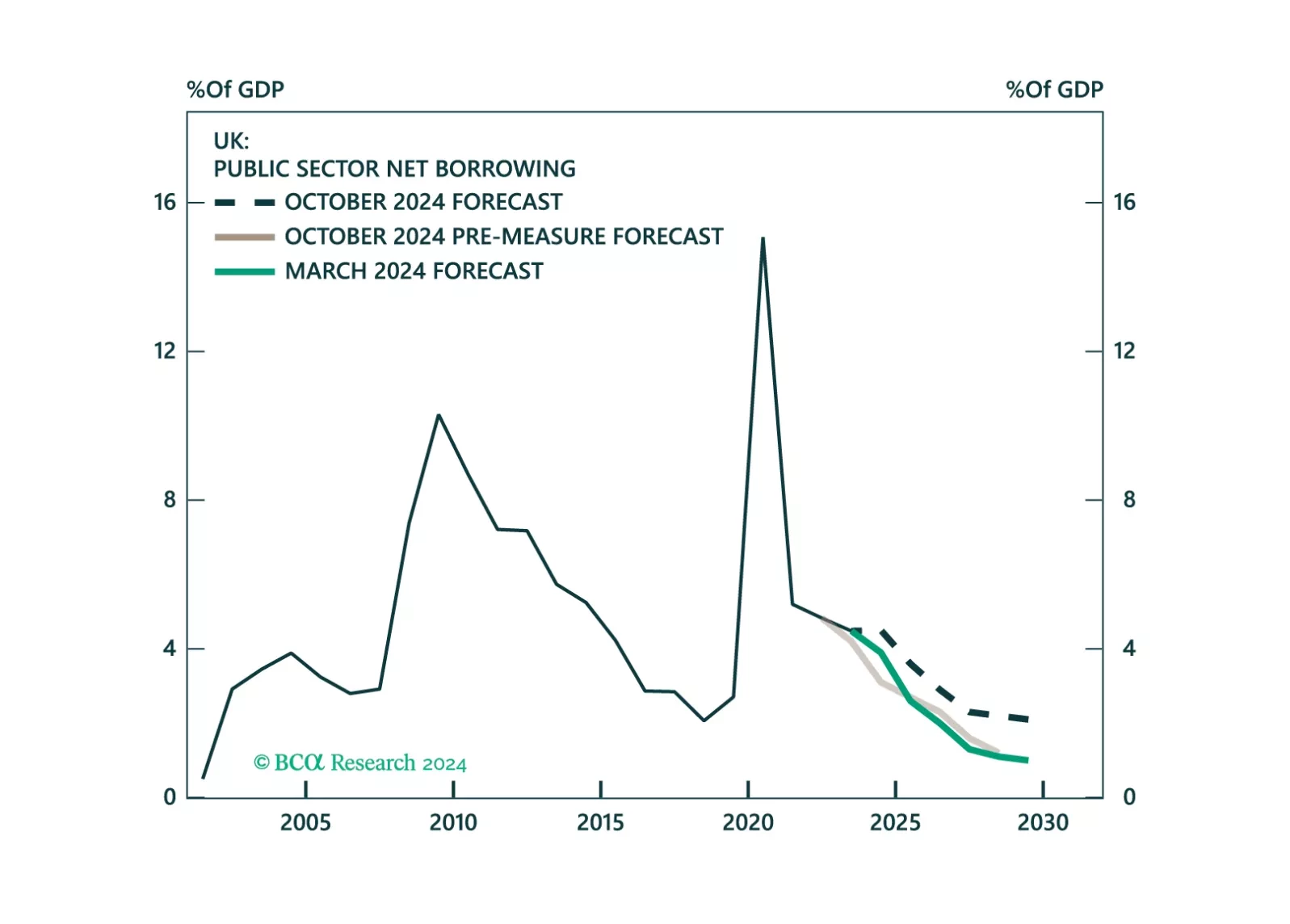

This Strategy Insight presents our view on today’s rate cut by the Bank of England as well as the budget announced by the UK government last week.

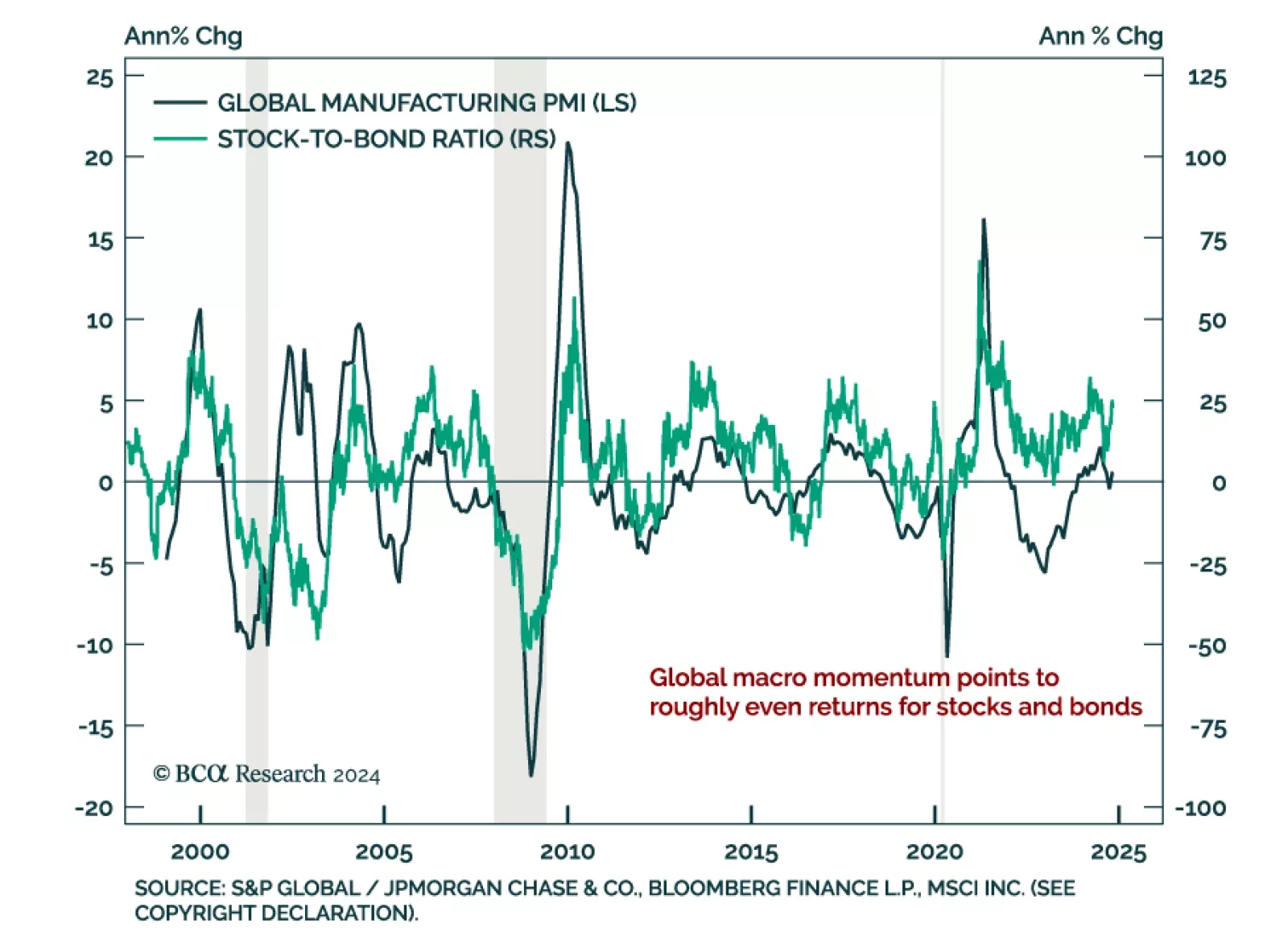

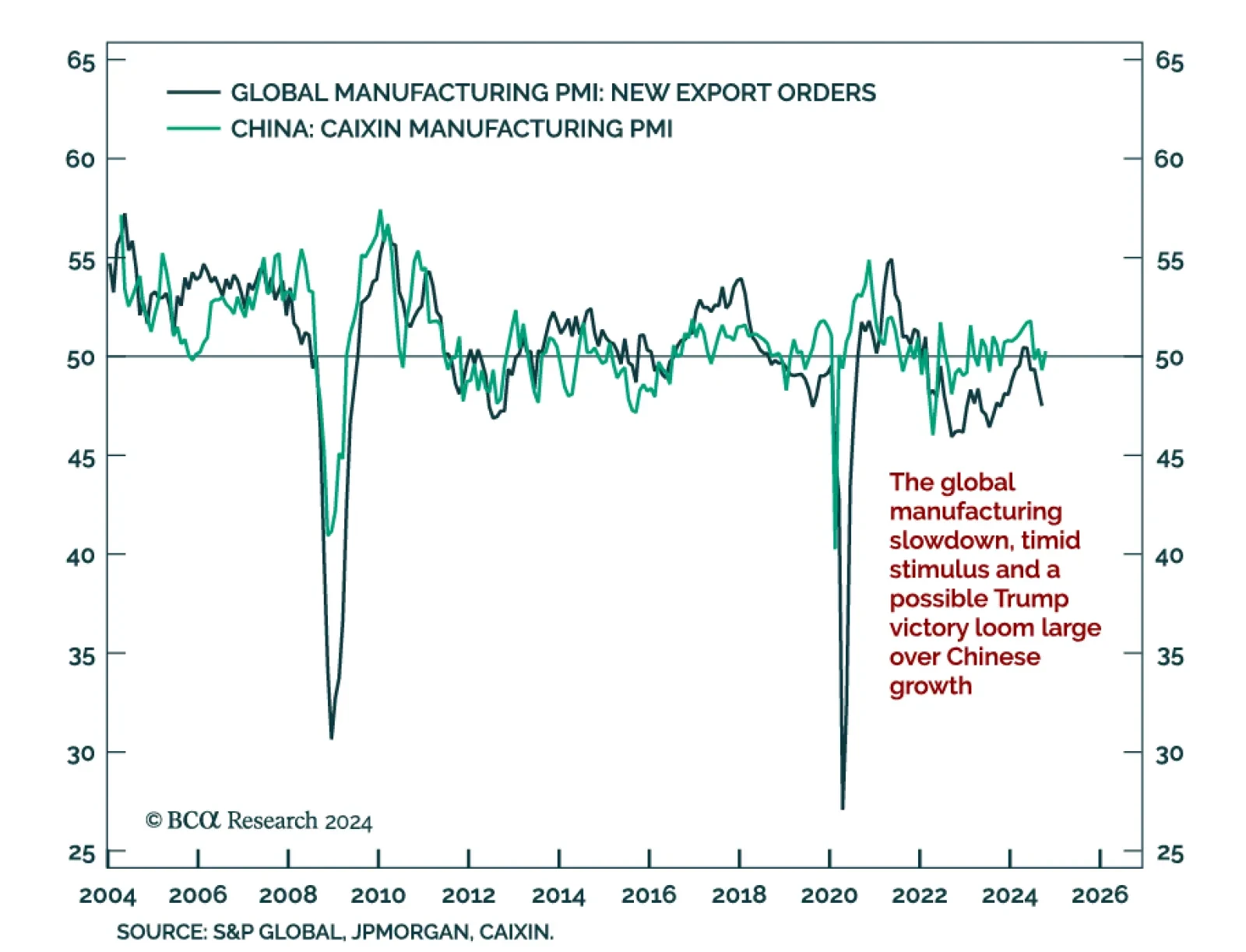

The October global manufacturing PMI printed at 49.4, up from 48.7 in September but still in contractionary territory. While output stabilized at 50.1, new orders (48.8) and new export orders (48.3) remain in contraction, as is…

Our Global Asset Allocation Strategy colleagues argue in their monthly report that while a soft landing is a possibility, it is already reflected in asset pricing. A Trump victory would be a threat to this scenario. Inflation…

China’s Caixin Manufacturing PMI rebounded one point in October to 50.3. This was in line with the NBS PMIs from earlier this week, which also showed a modest rebound. We are looking for a turning point in China as the…

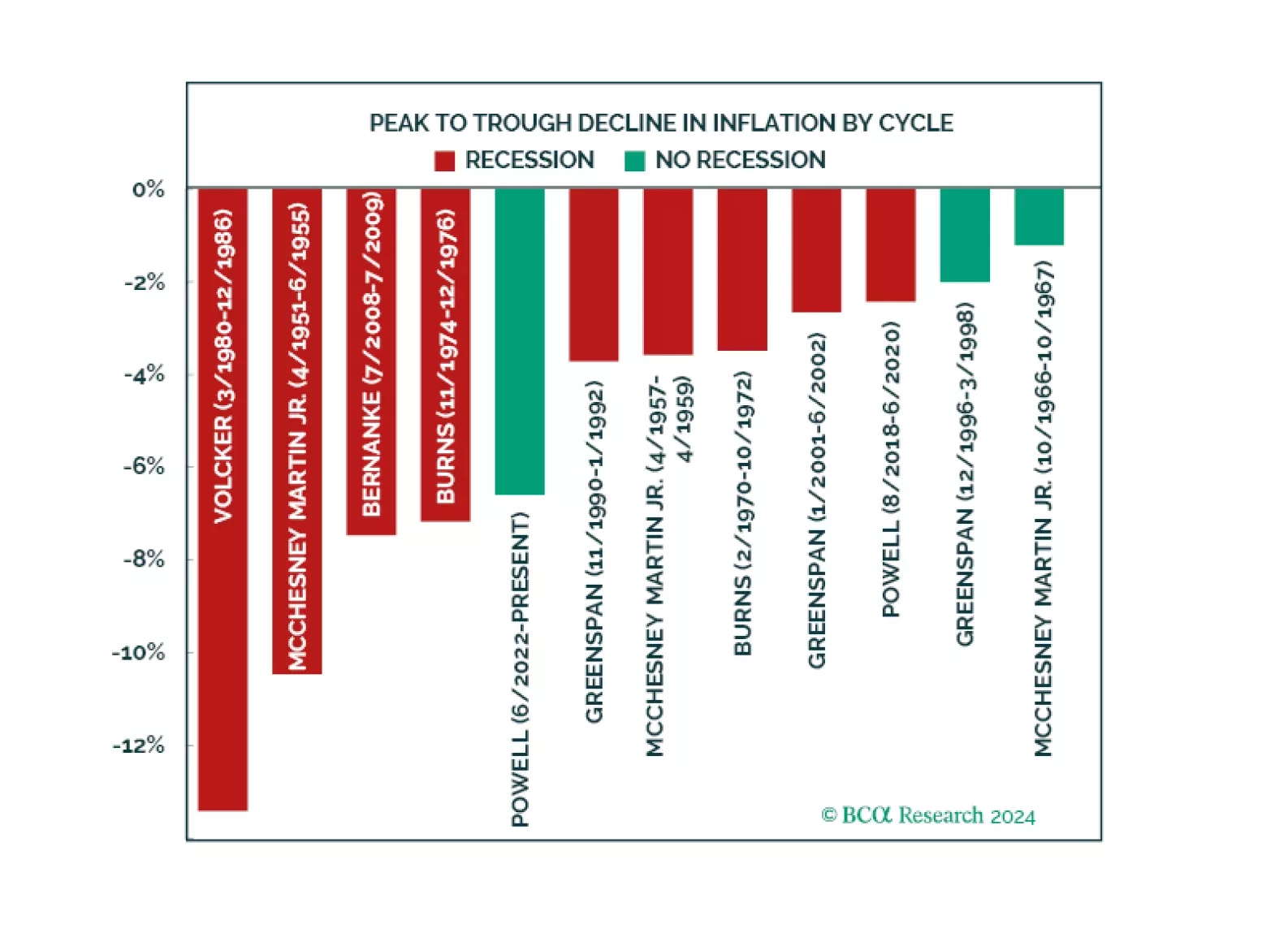

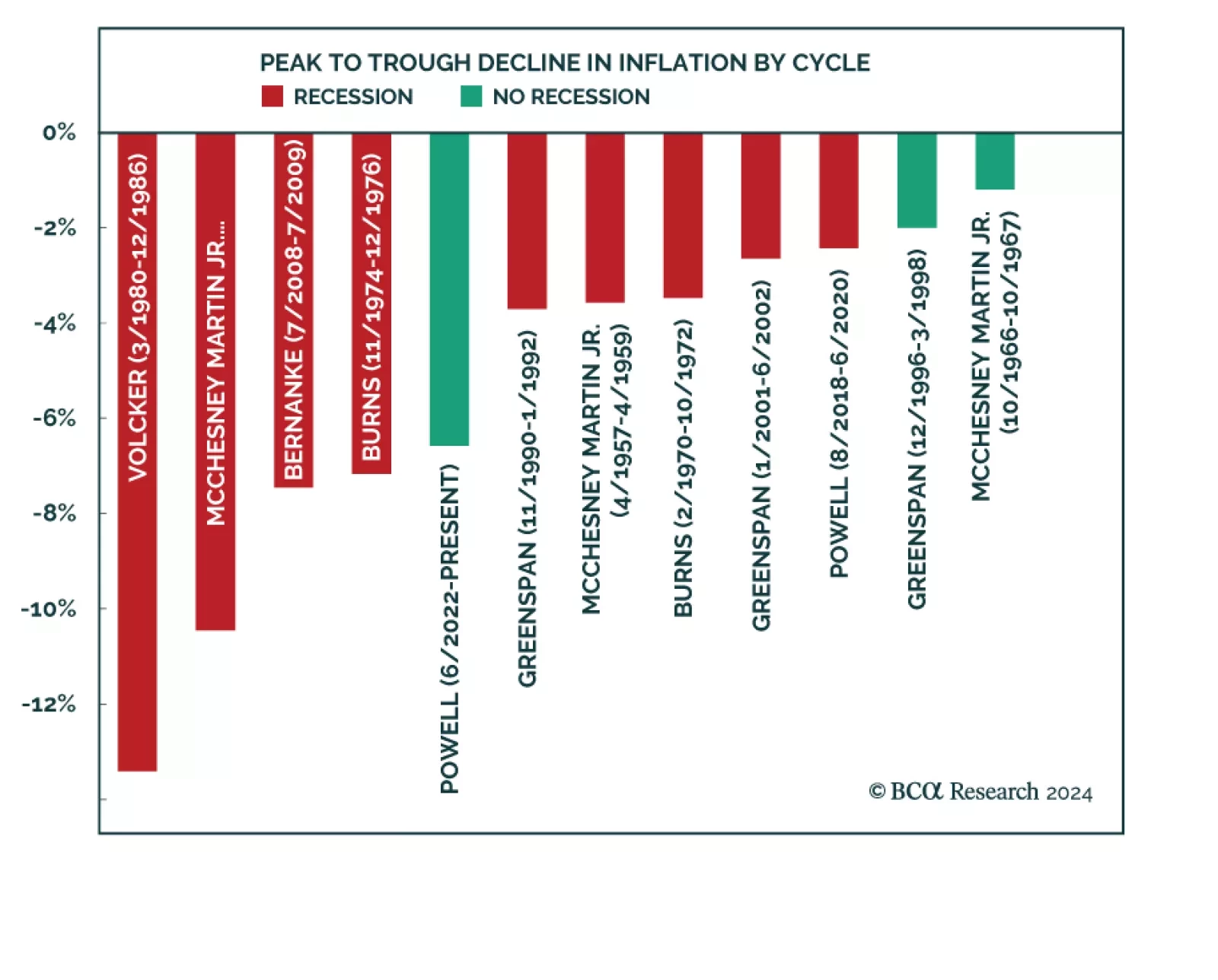

Can Powell achieve a soft landing? There are some indications he is doing it. We examine why our negative stance was wrong and analyze the four growth engines that kept recession at bay. Half of these forces remain while the other…