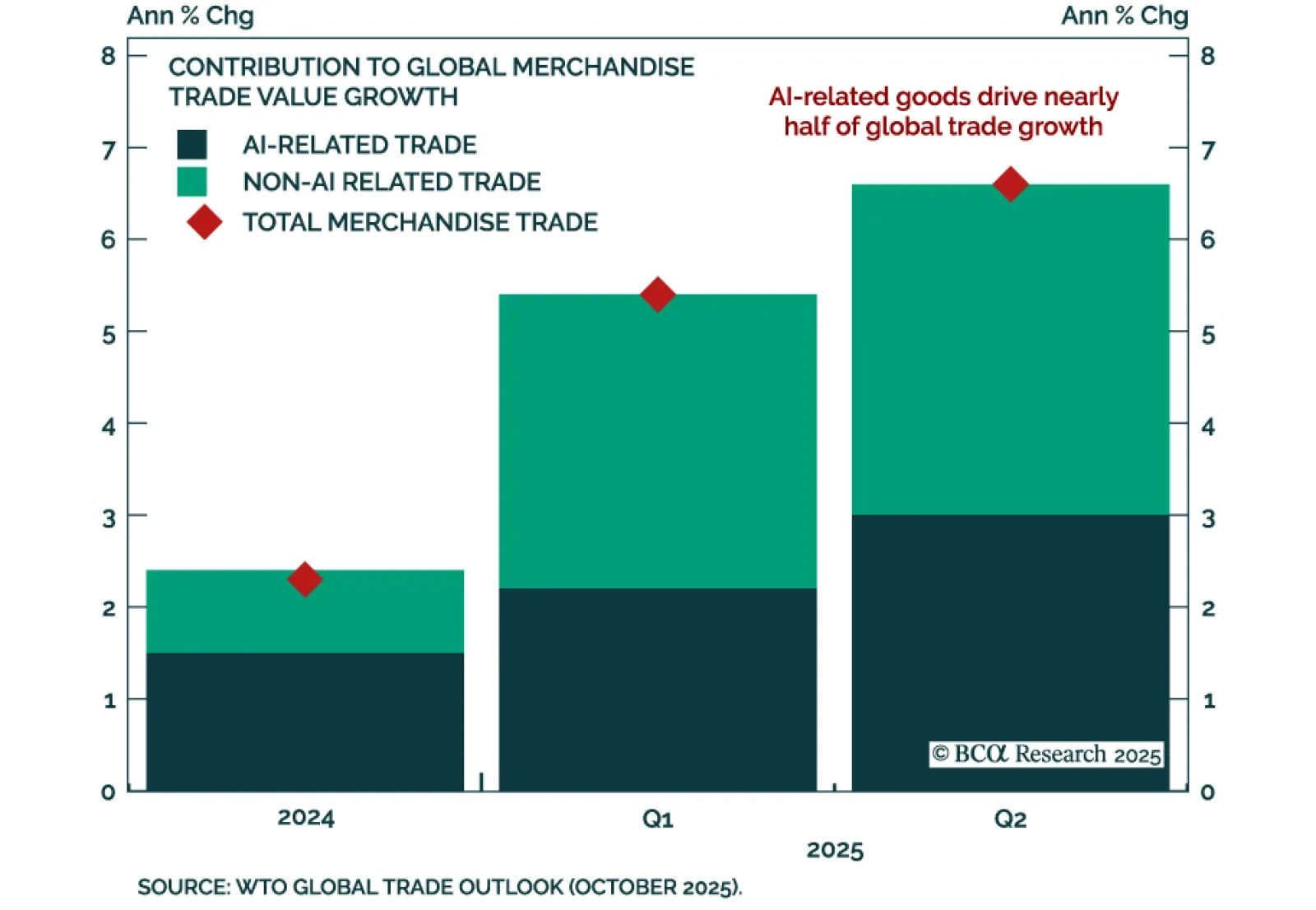

AI-related trade and frontloading lifted global trade growth in 2025 but also increased the risk of a slowdown next year, according to the WTO’s latest Global Trade Outlook. The organization sharply revised up its forecast for 2025…

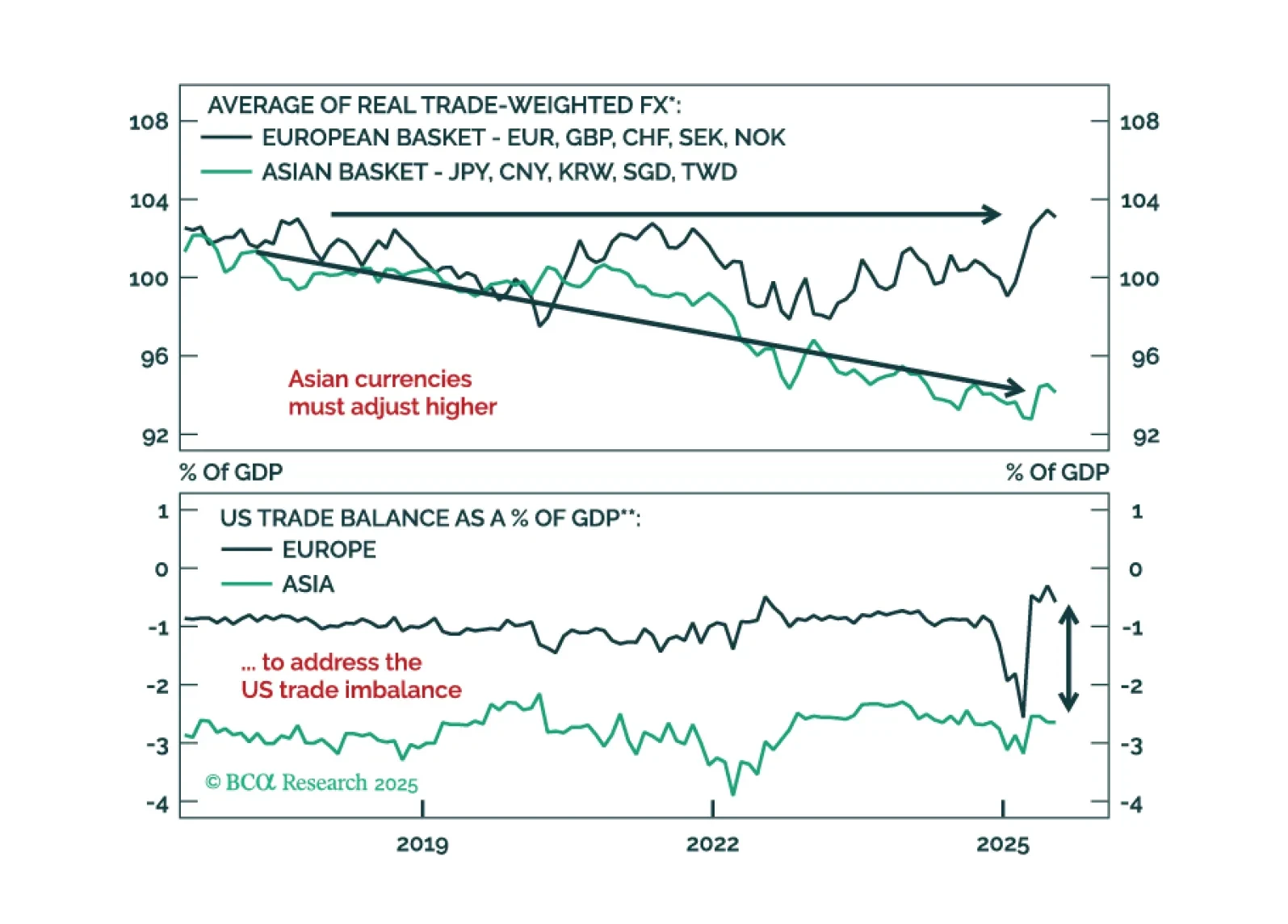

A fleeting greenback rally post Fed rate cut will offer a final chance to reset short dollar exposures. See why undervalued Asian FX are poised to lead the next leg lower in USD and how to position now.

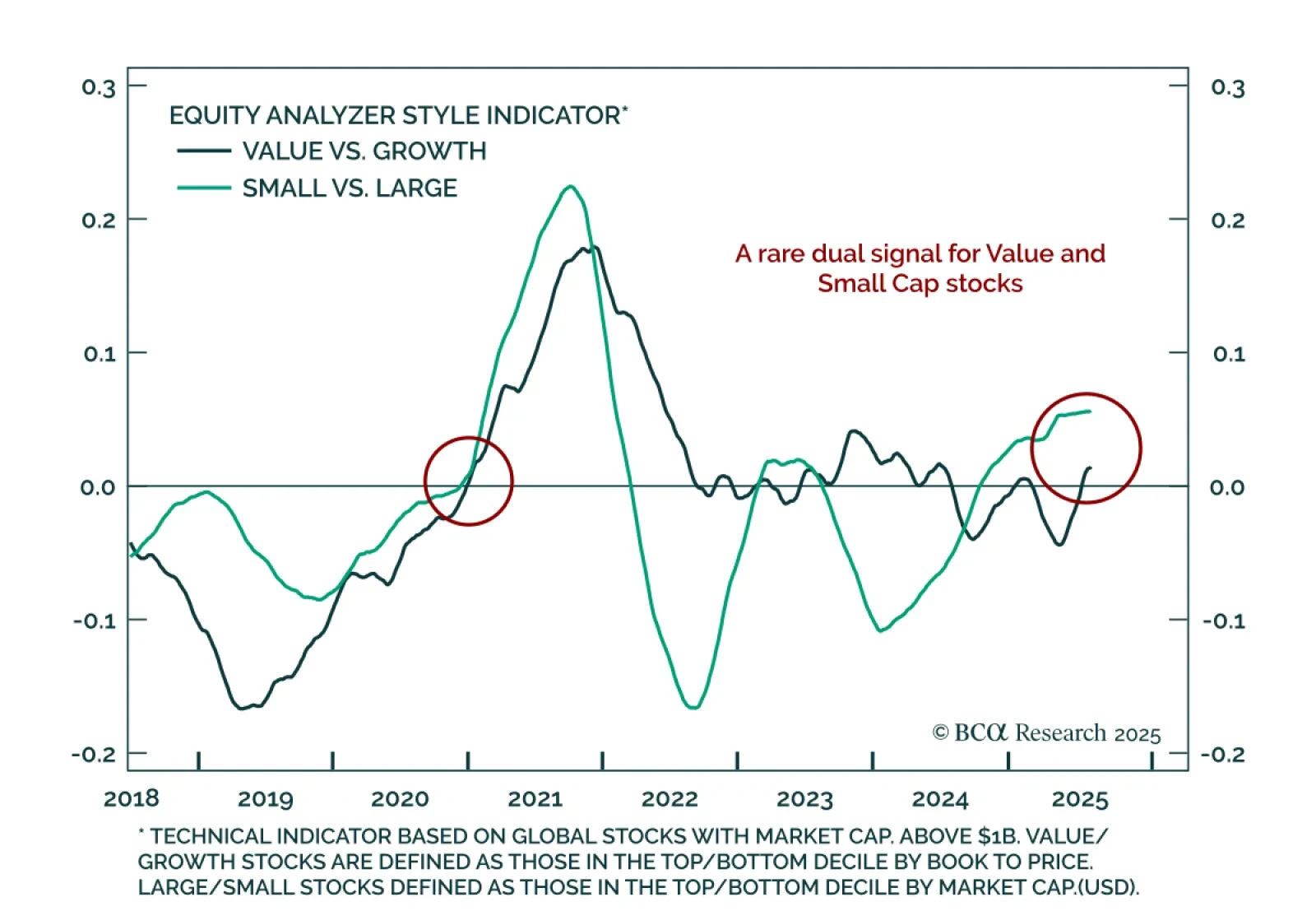

Momentum is building behind small-cap and value stocks, signaling a rare dual tailwind for cyclical styles. Our Chart Of The Week comes from Guy Russell, strategist for Equity Analyzer.While market attention remains focused on the…

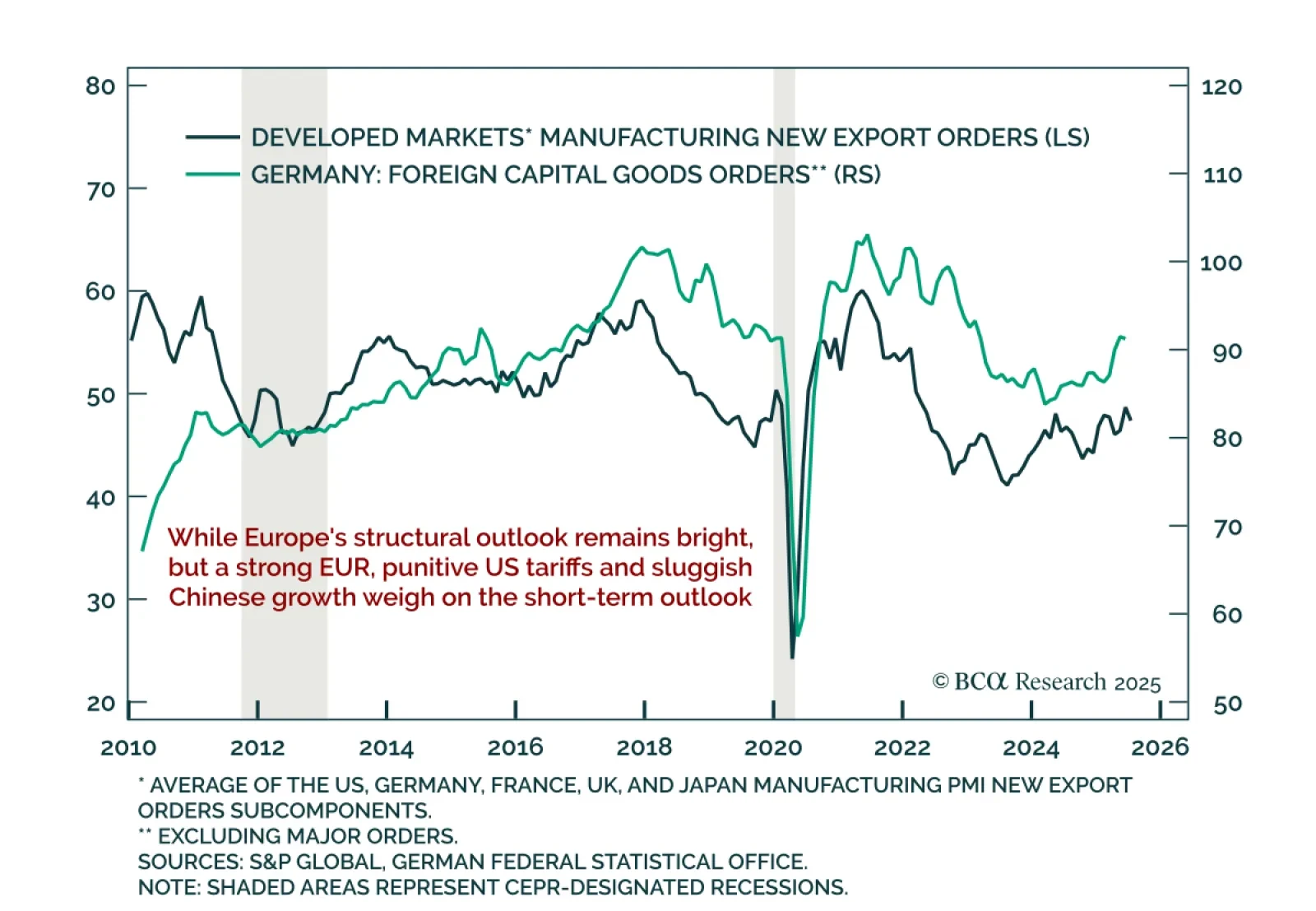

Germany’s June factory orders missed expectations, highlighting persistent headwinds reinforcing the case for a cautious tactical outlook on European assets. Orders fell 1.0% m/m, slowing to 0.8% y/y on a calendar-adjusted basis…

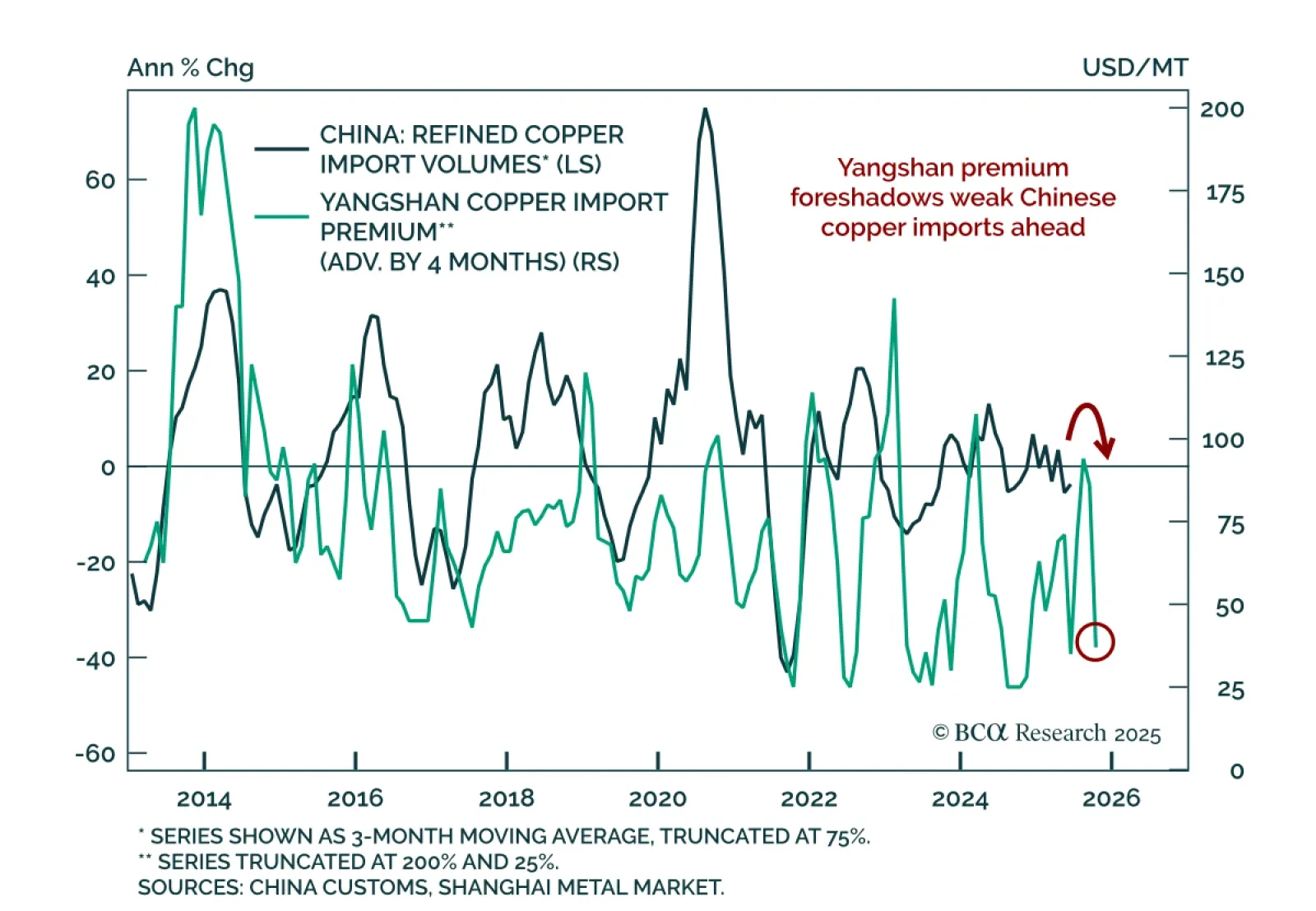

Our Commodity strategists recommend staying short LME copper outright and long gold/short LME copper on a cyclical basis. The unwind in copper, set off by the US tariff exemption on refined metal, is not yet complete. An inventory…

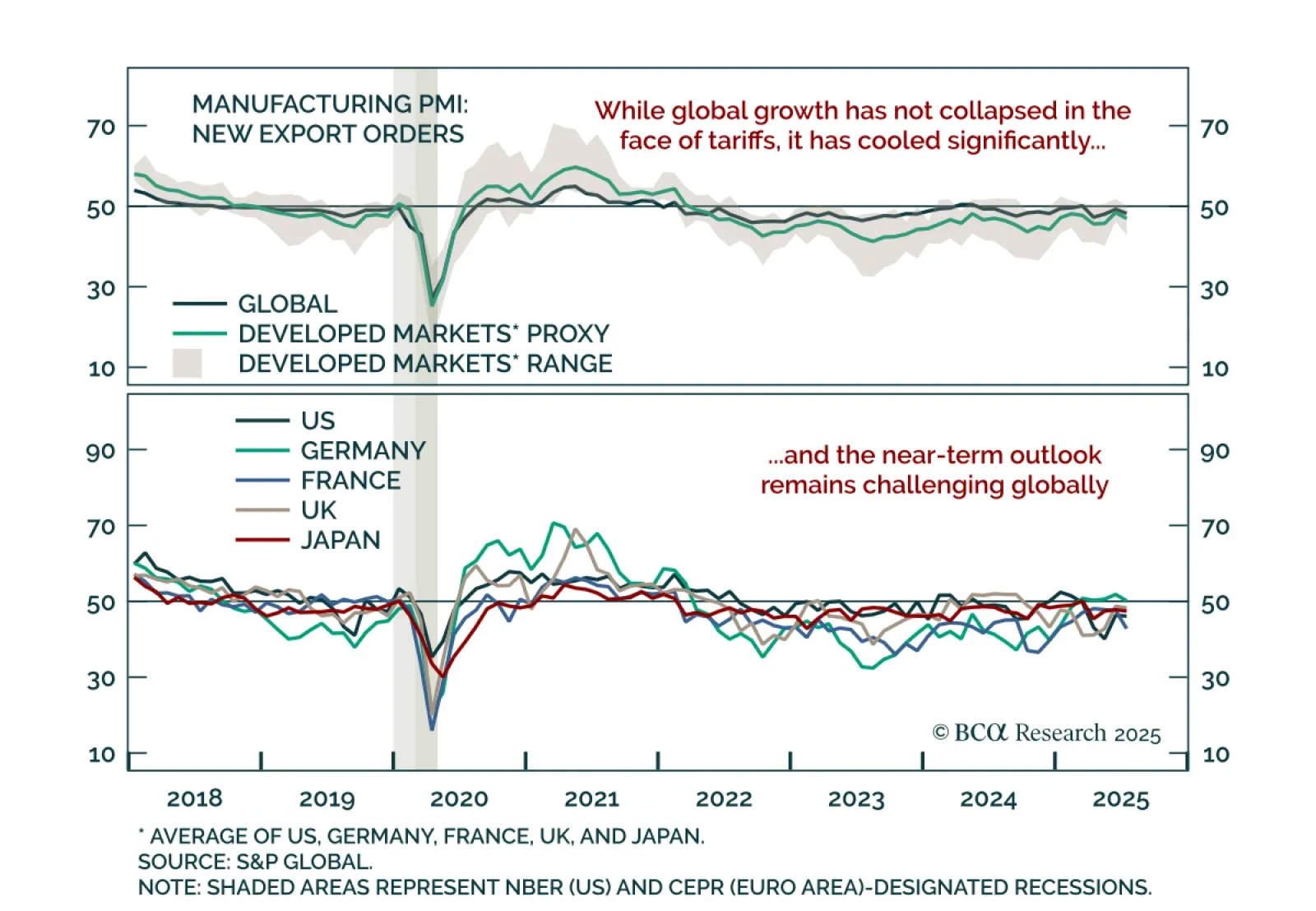

In response to trade uncertainty, global growth is cooling but not collapsing, supporting a cautious near-term view on risk assets. Trade disruption earlier this year raised fears of a global recession, but the data so far point…

BCA’s US Political strategists warn that Russia presents an immediate market risk, with near-term pullbacks offering potential buying opportunities. President Trump is pivoting toward ceasefires and trade deals, supported by approval…

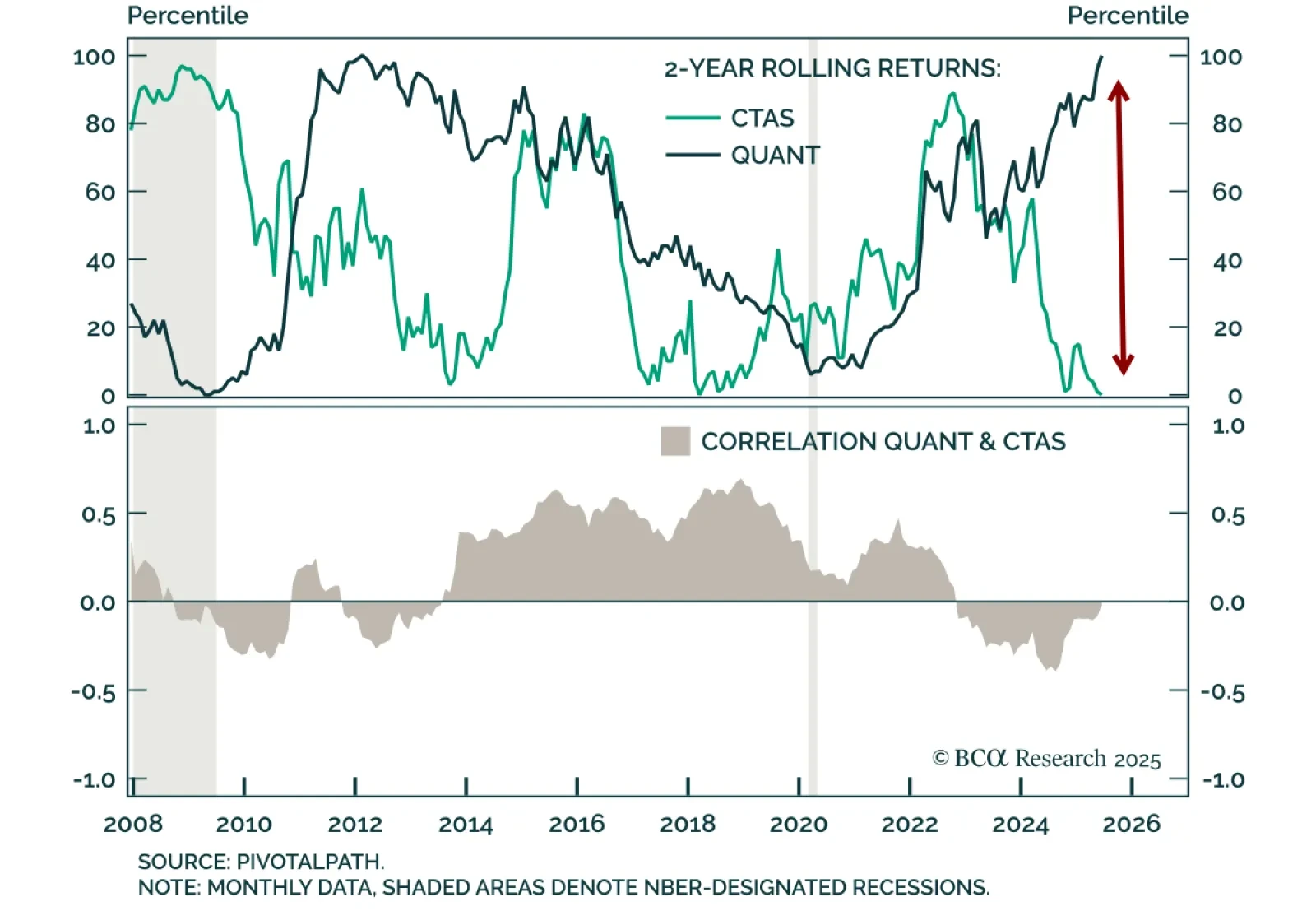

A historic divergence between systematic strategies is creating a compelling entry point into Managed Futures. Our Chart Of The Week comes from Brian Payne, Chief Strategist for our Private Markets & Alternatives team.…

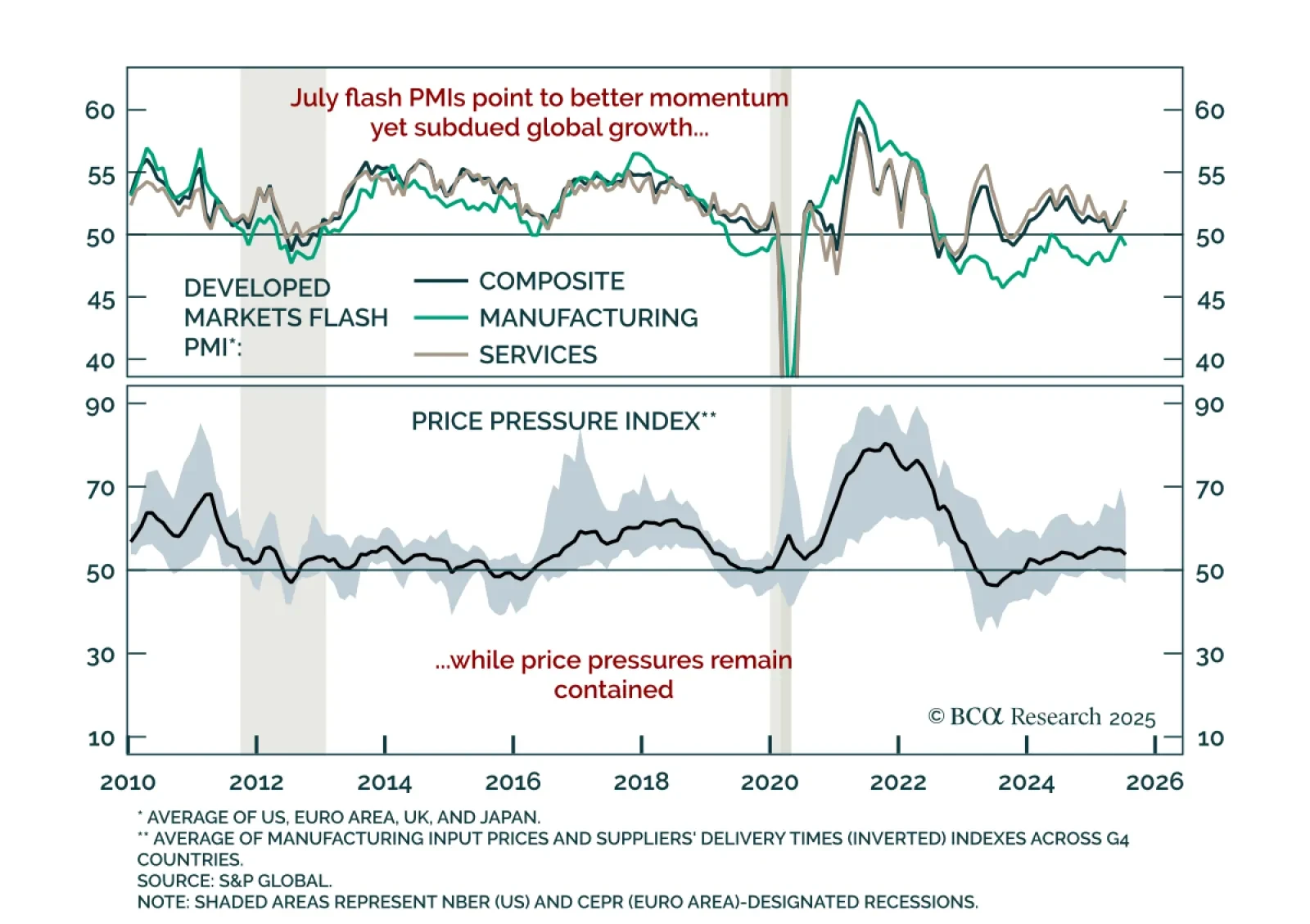

July DM flash PMIs point to improving global growth momentum led by services, but manufacturing remains weak and upside is limited, reinforcing our defensive stance. Services PMIs improved in the US, Europe, and Japan, but…

BCA’s Commodity strategists remain long gold/short LME copper and have initiated an outright short in LME copper as a cyclical trade. The US copper tariff will redirect supply away from the US, replenishing depleted inventories…