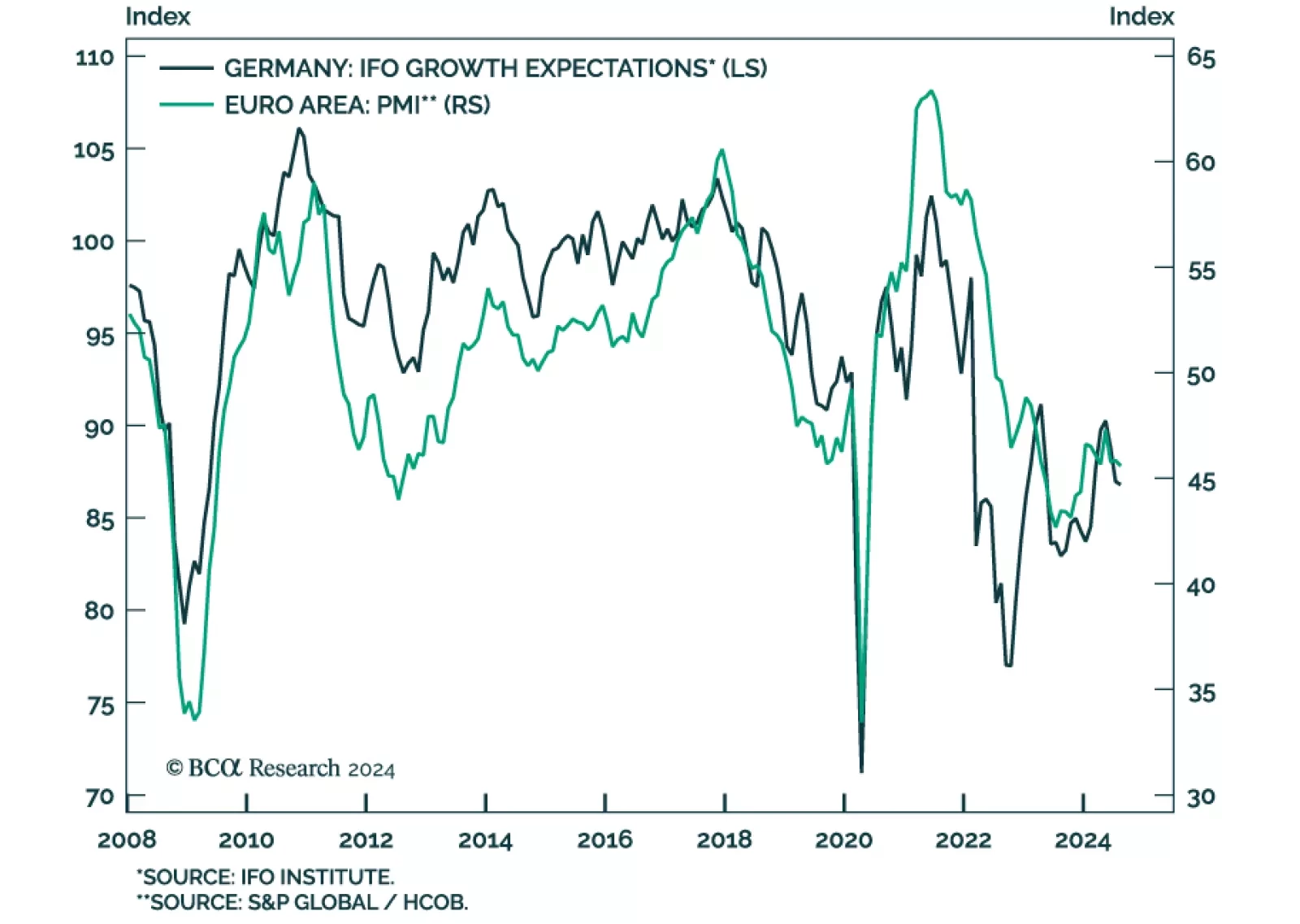

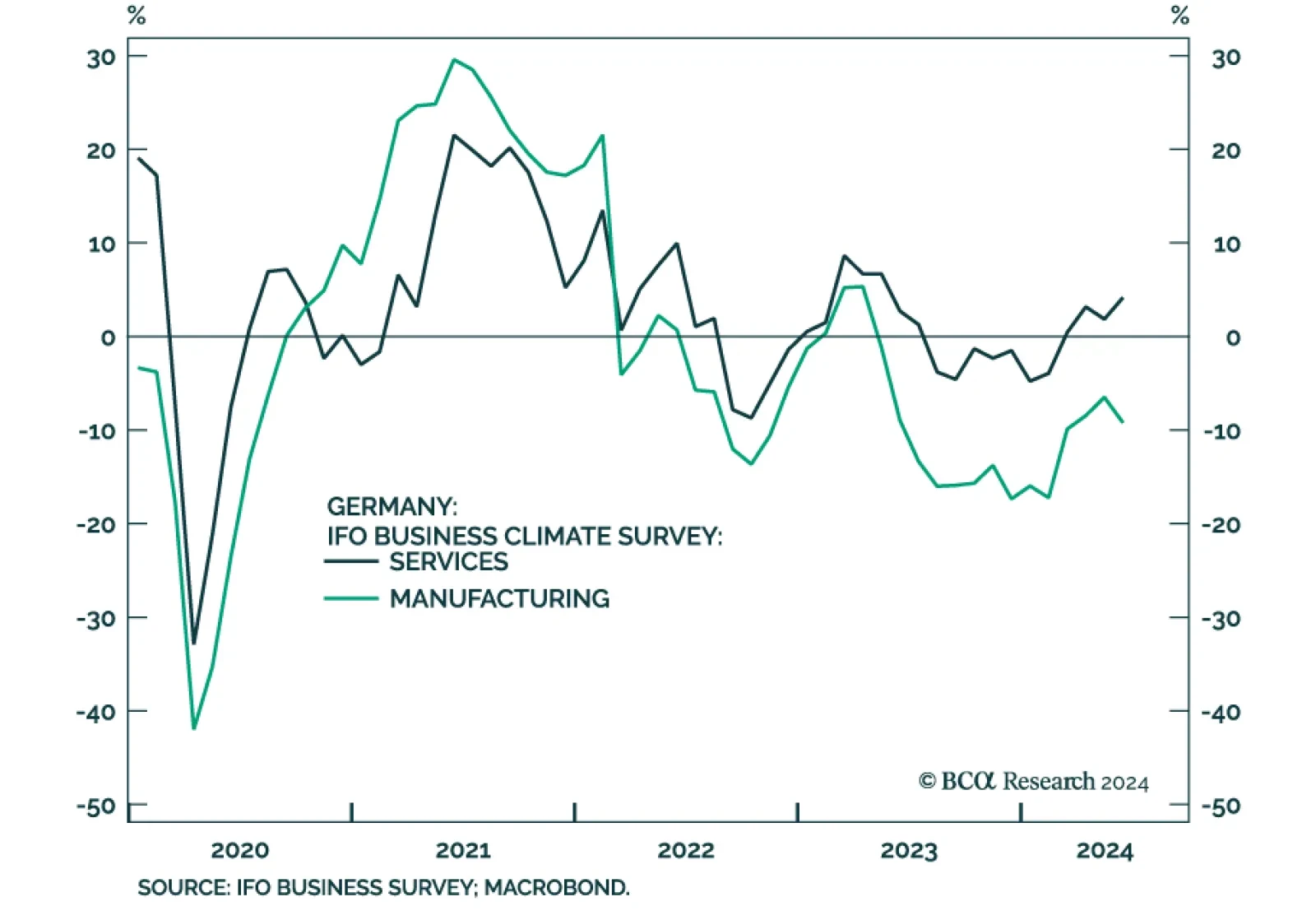

Sentiment among German companies declined in August from 87.0 to 86.6. Current conditions shed 0.6 points to 86.5 while the expectations component ticked 0.2 points lower. It nevertheless exceeded consensus expectations for a…

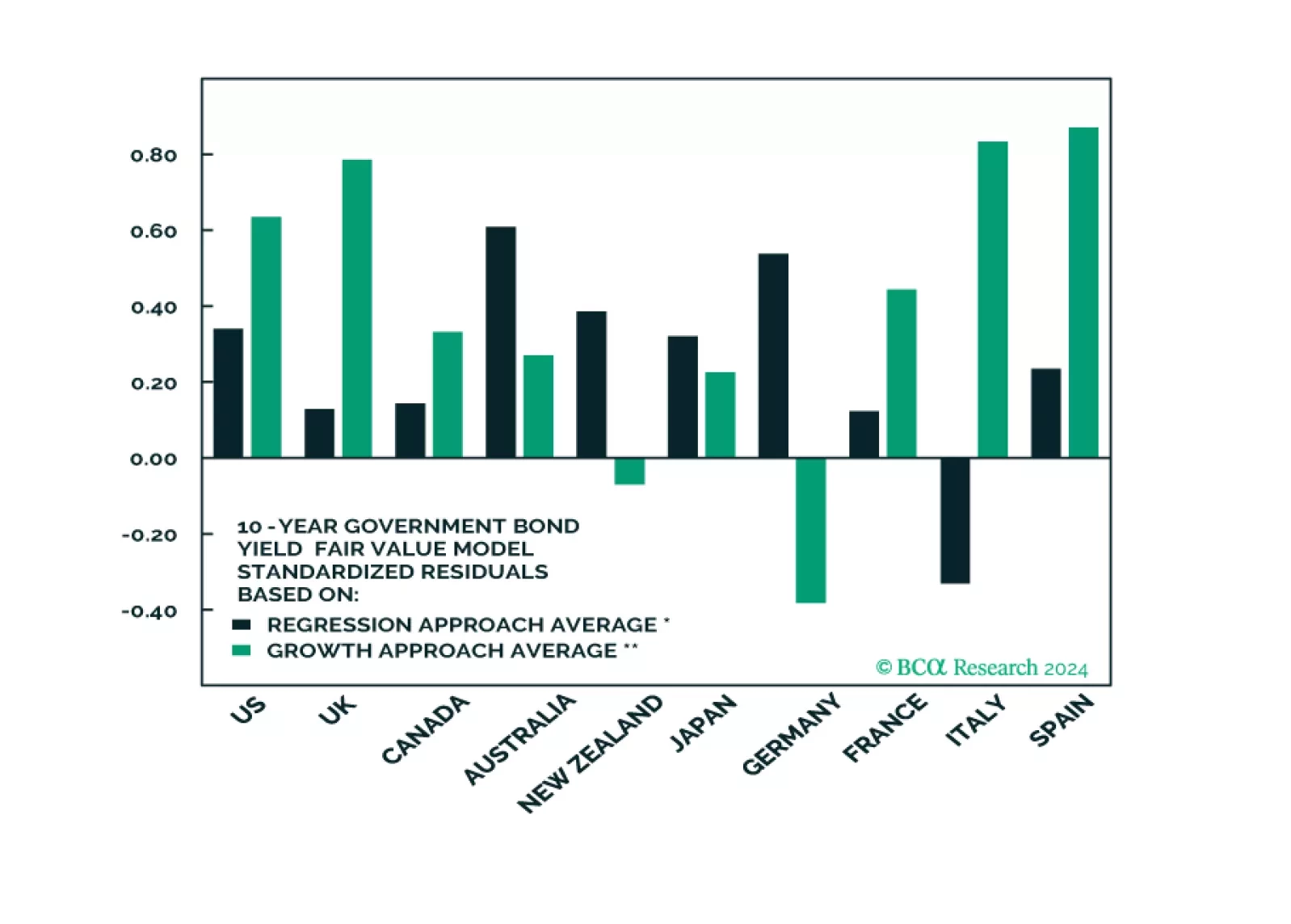

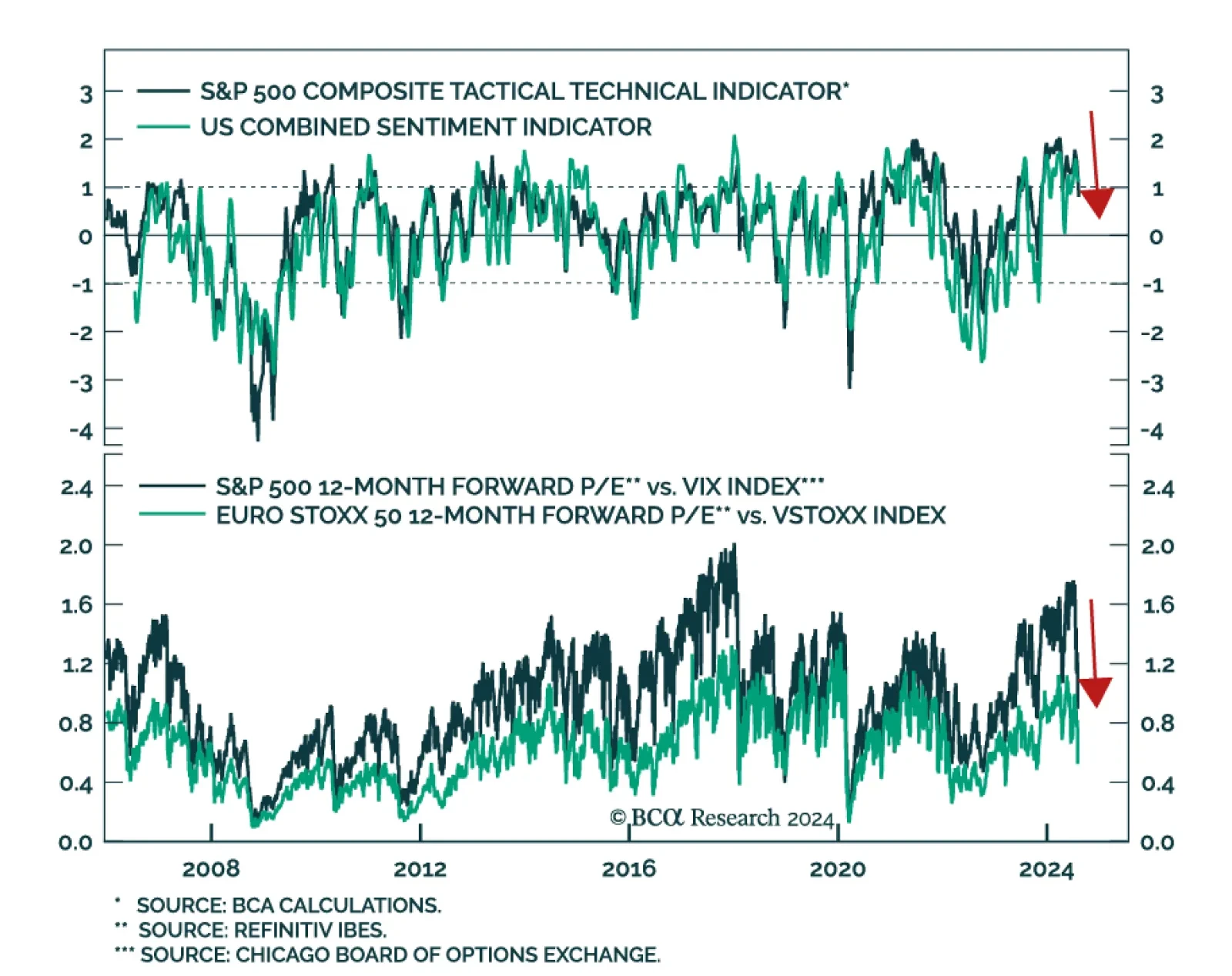

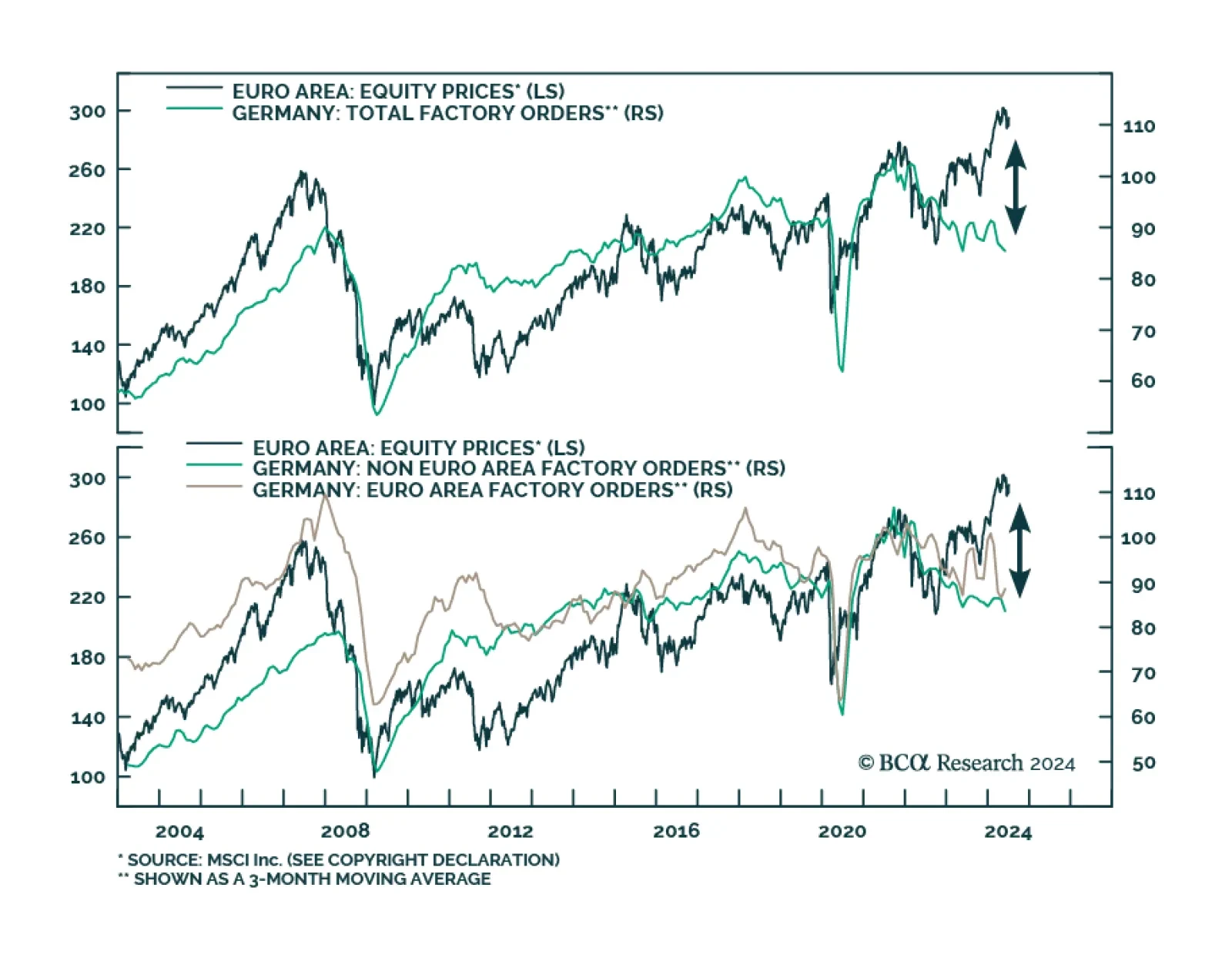

According to BCA Research’s European Investment Strategy service, investors should fade the rebound in European equities and bond yields as the euro is also at risk. Last week’s bounce in global equities is…

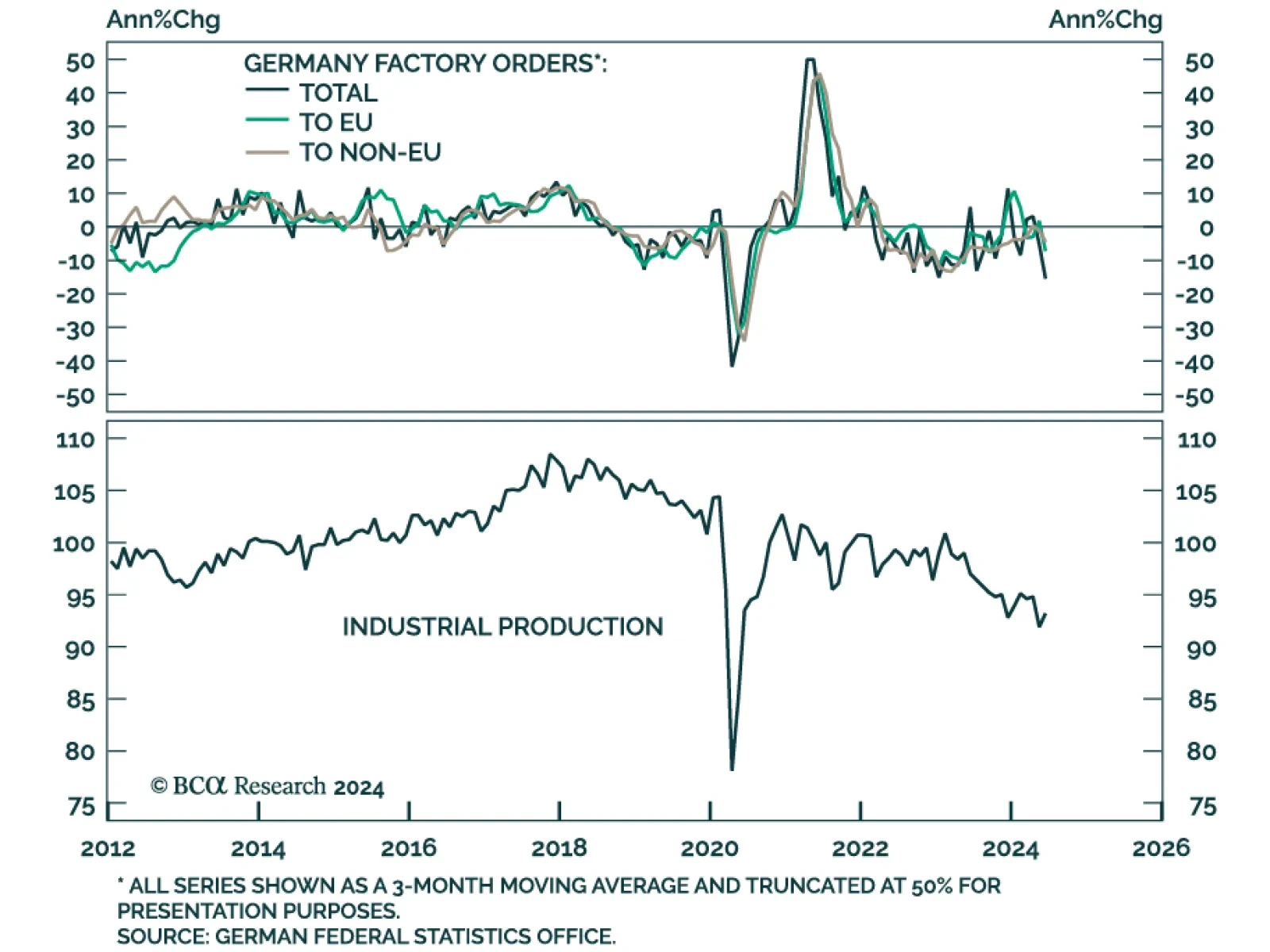

German Industrial production and factory orders continued their slump in June. The usual powerhouse of the Euro Area economy has been trailing its peers throughout 2024. While both industrial production and factory orders…

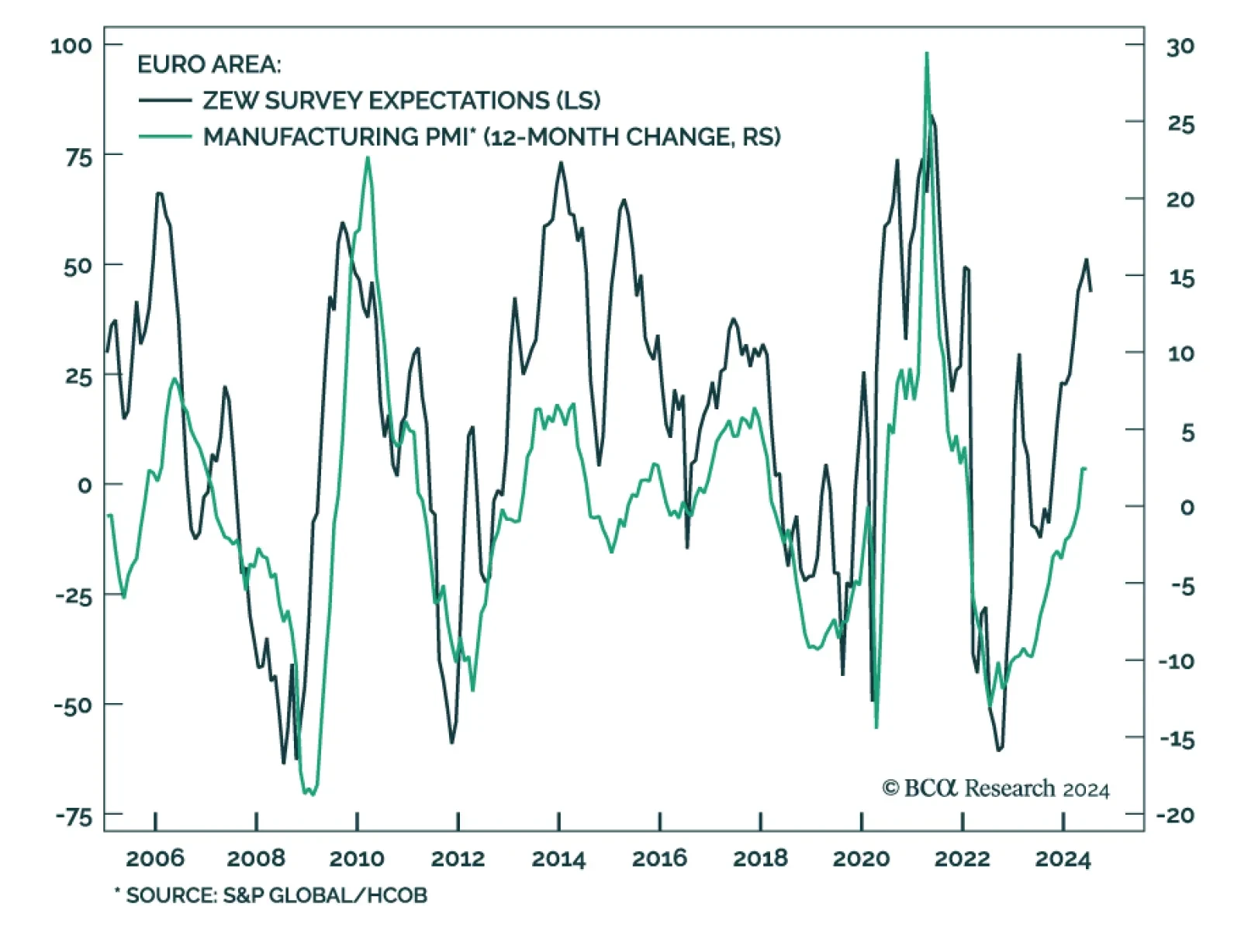

The Euro Area economy broadly surprised to the upside in the first half of 2024. Cooling inflation lifted real wages and the global late cycle amelioration benefitted the pro-cyclical Euro Area economy, but these tailwinds are…

The real threat to European equities is growth, not political risk. How low will Eurozone earnings fall during the coming recession and how much will equities decline in response?

German Factory orders disappointed on Thursday. The month-on-month contraction deepened to 1.6% in June from a contraction of 0.6% in May, revised down from the previously reported 0.2%, well below expectations of a modest 0.5%…

Does the incipient slowdown in European data herald a soft landing and a goldilocks period for equities? We have our doubts.

According to the results of the latest German IFO survey, overall sentiment deteriorated slightly in June. The IFO Business Climate index declined from 89.3 in May to 88.6 in June, disappointing expectations of a modest…

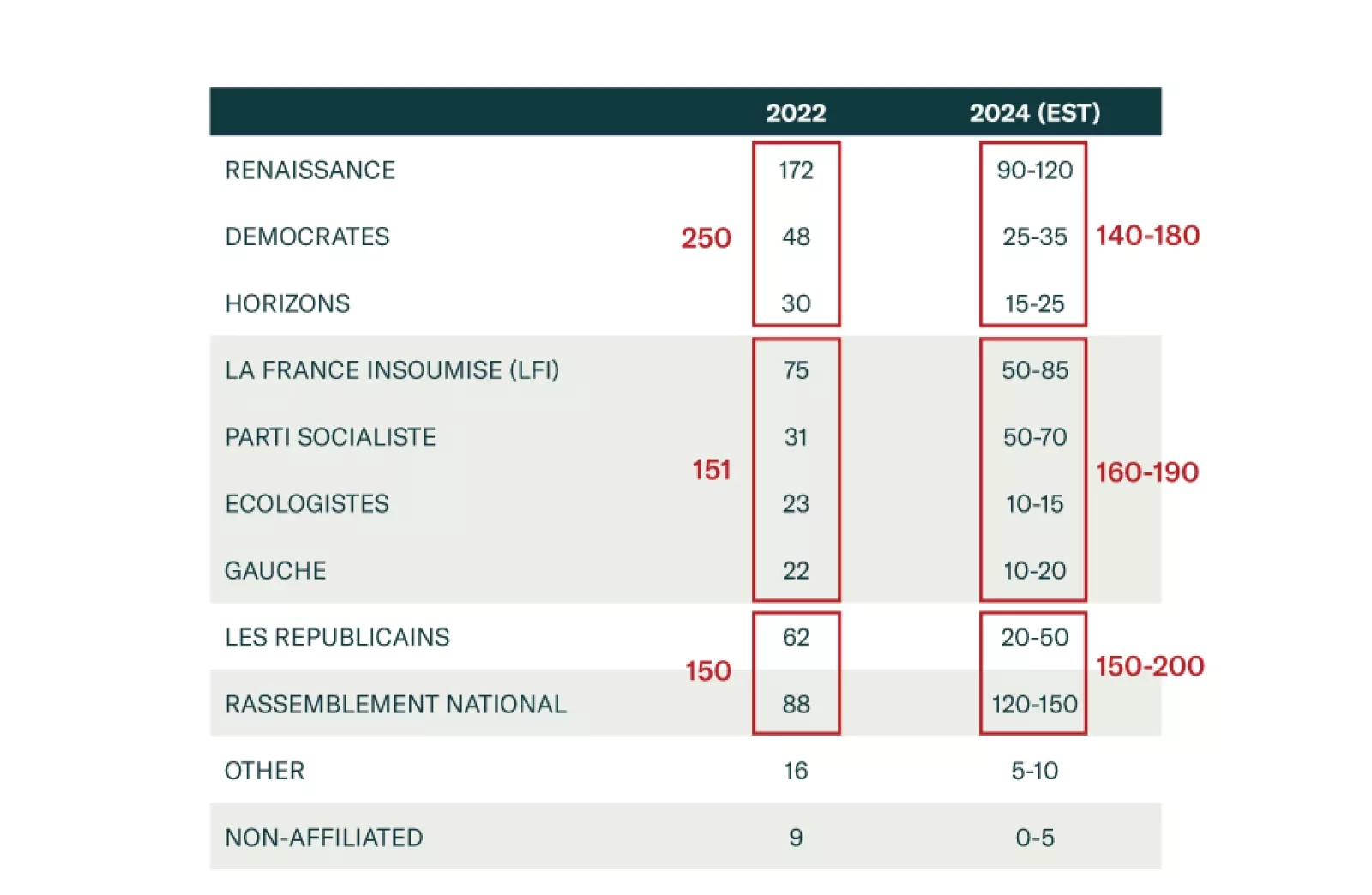

European assets are selling off as investors panic about the upcoming French election. Is this panic justified, and if so, for how long?