Highlights The short-term trade is to overweight the DAX or Euro Stoxx 50… …versus German bunds or the S&P 500. These trades have outperformed since late last year and can continue to do so for a while longer. But…

Highlights So what? Quantifying geopolitical risk just got easier. Why? In this report we introduce 10 proprietary, market-based indicators of country-level political and geopolitical risk. Featured countries include…

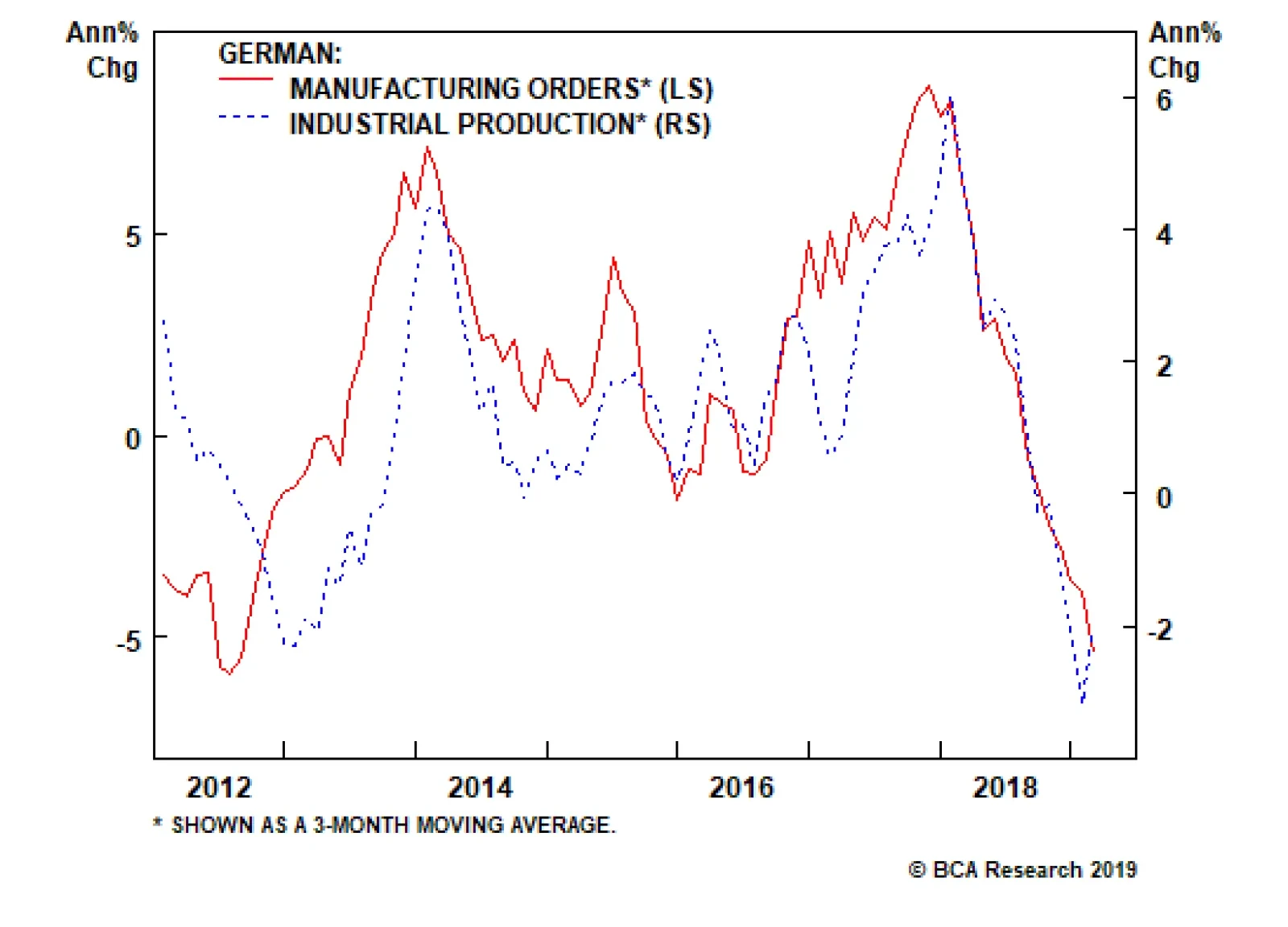

Yesterday, the German factory orders sent a chill down the spine of anyone with a positive disposition toward European growth, as they fell 8.4% on an annual basis in February. However, foreign orders drove this meltdown,…

If those expectations continue to rise, likely in the context of stickier realized U.S. inflation alongside solid U.S. growth, then the Fed will return to a hawkish bias. That ultimately means higher U.S. real yields and, most…

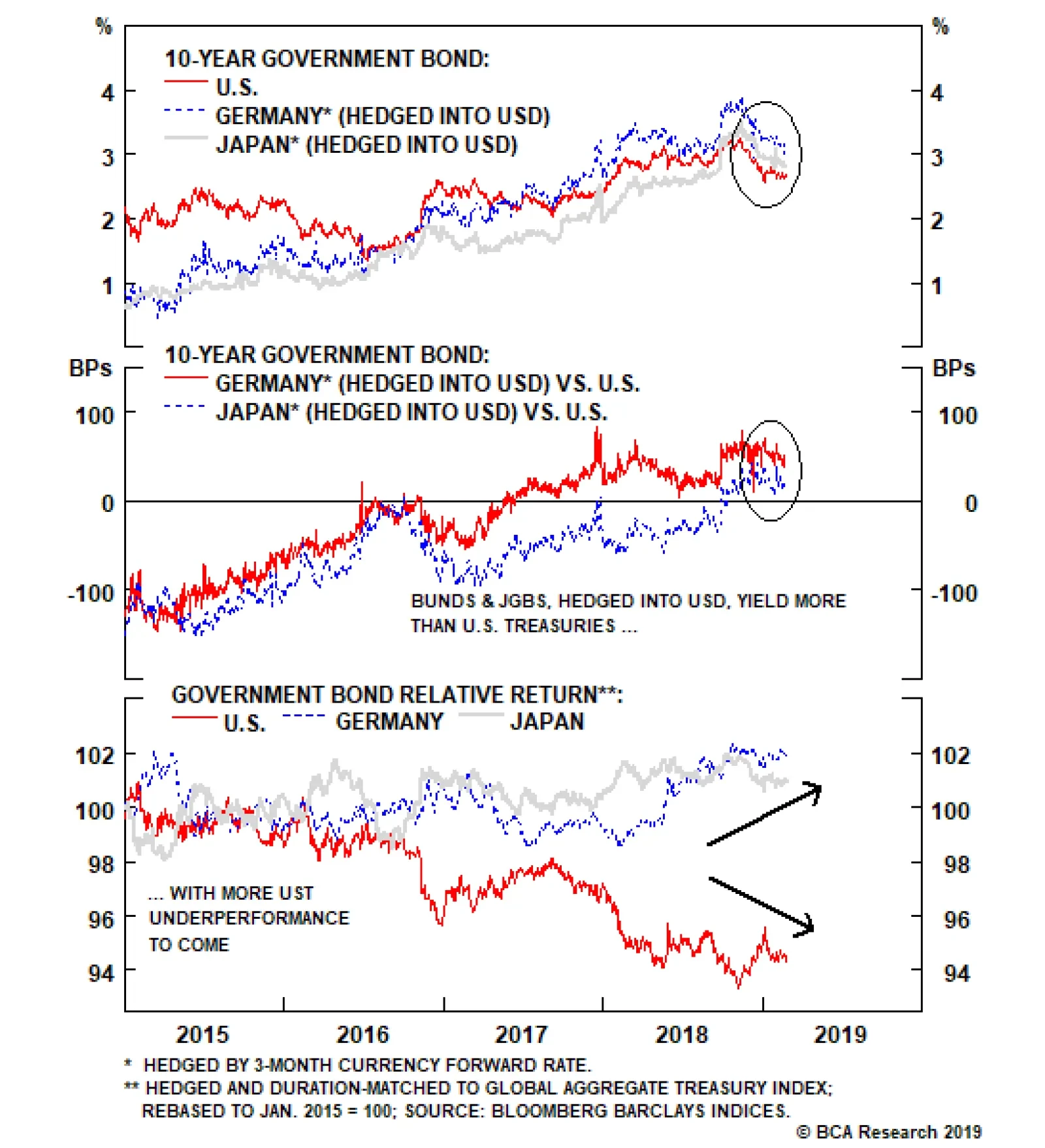

Highlights Low Bond Volatility: Weakening non-U.S. growth and a more dovish Fed have crushed global government bond volatility, especially in Europe and Japan where yields are struggling to stay above 0%. Treasury-Bund and Treasury-JGB…

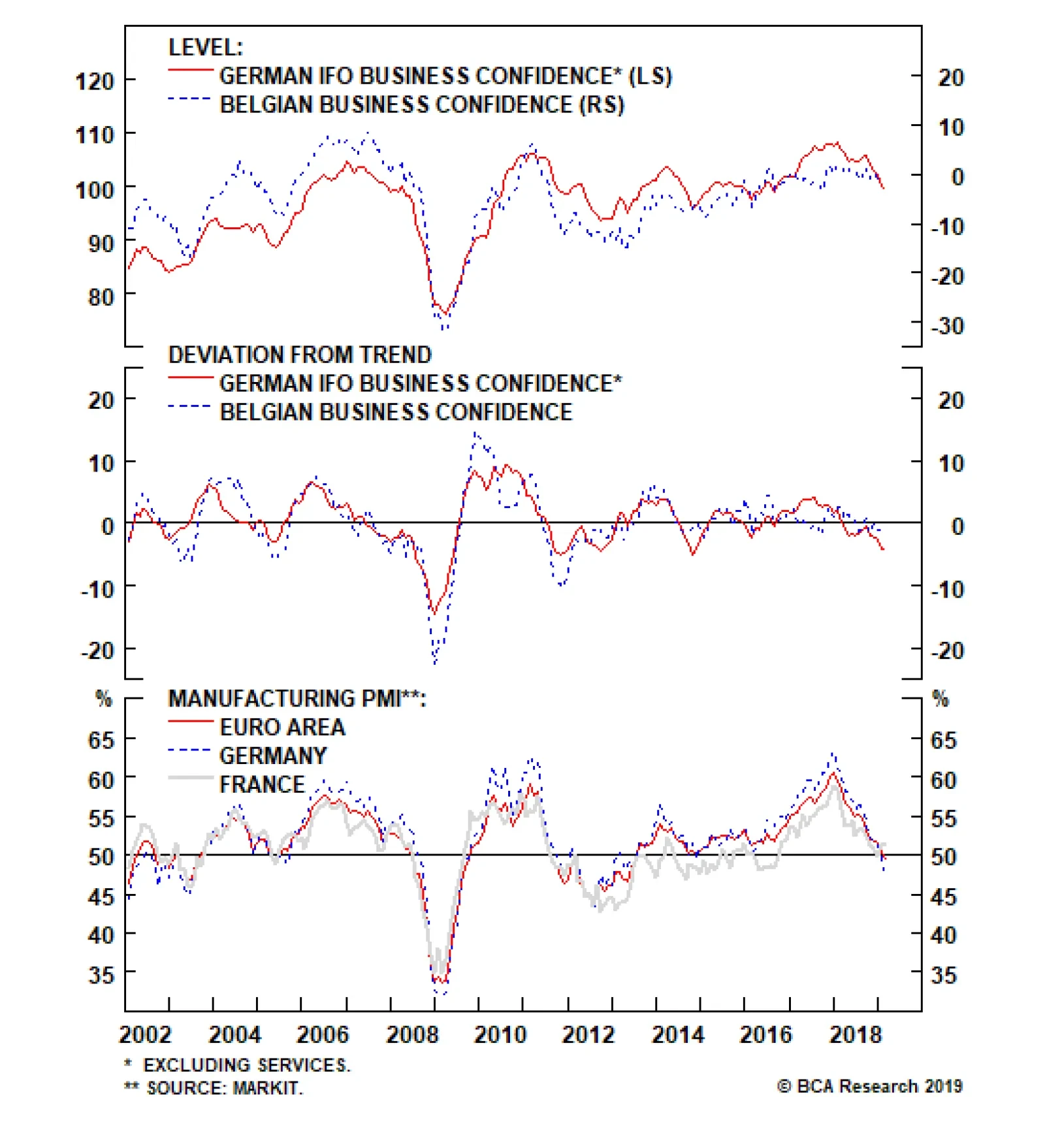

The European economic slowdown shows no sign of ending. This morning, both the German Ifo and the Belgian business confidence decelerated further, with the former falling to 98.5 from 99.3, and the latter weakening from -1.5 to -…

Highlights Fed Policy: The Fed’s move to a more dovish posture is positive for global risk assets in the near-term. This is setting up for a revival of volatility later in 2019, however, with U.S. growth unlikely to slow enough…

Highlights The main headwinds to euro area growth in 2018 are easing in 2019, at least in part and for the time being. The two main tail-risks are a messy Brexit and financial market volatility, but these are not our central case.…

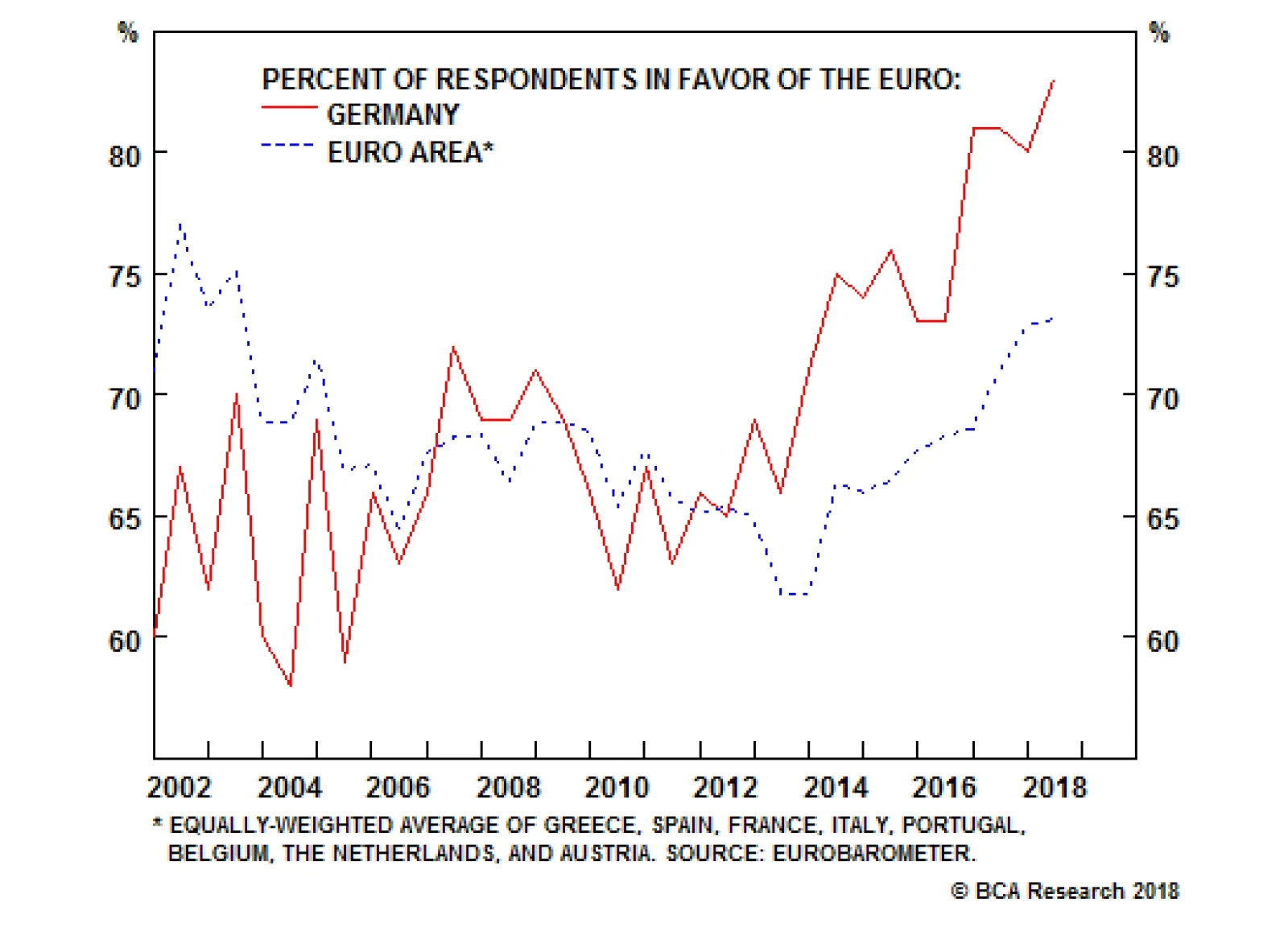

The most important question for global investors is whether Merkel's fall from grace is related to a growing trend of populism in Europe. The answer is ‘yes’ in part, but Merkel's problem runs deeper.…