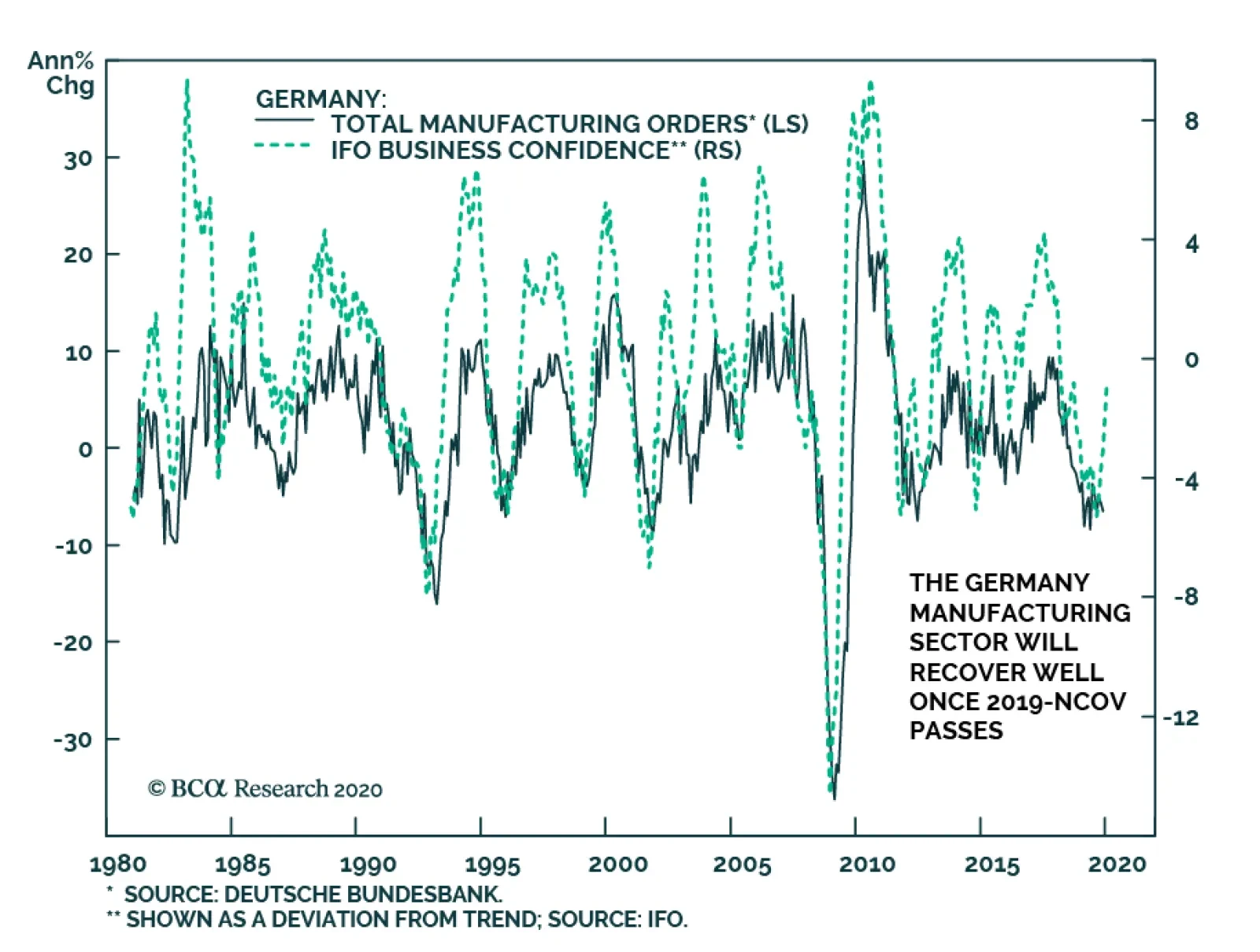

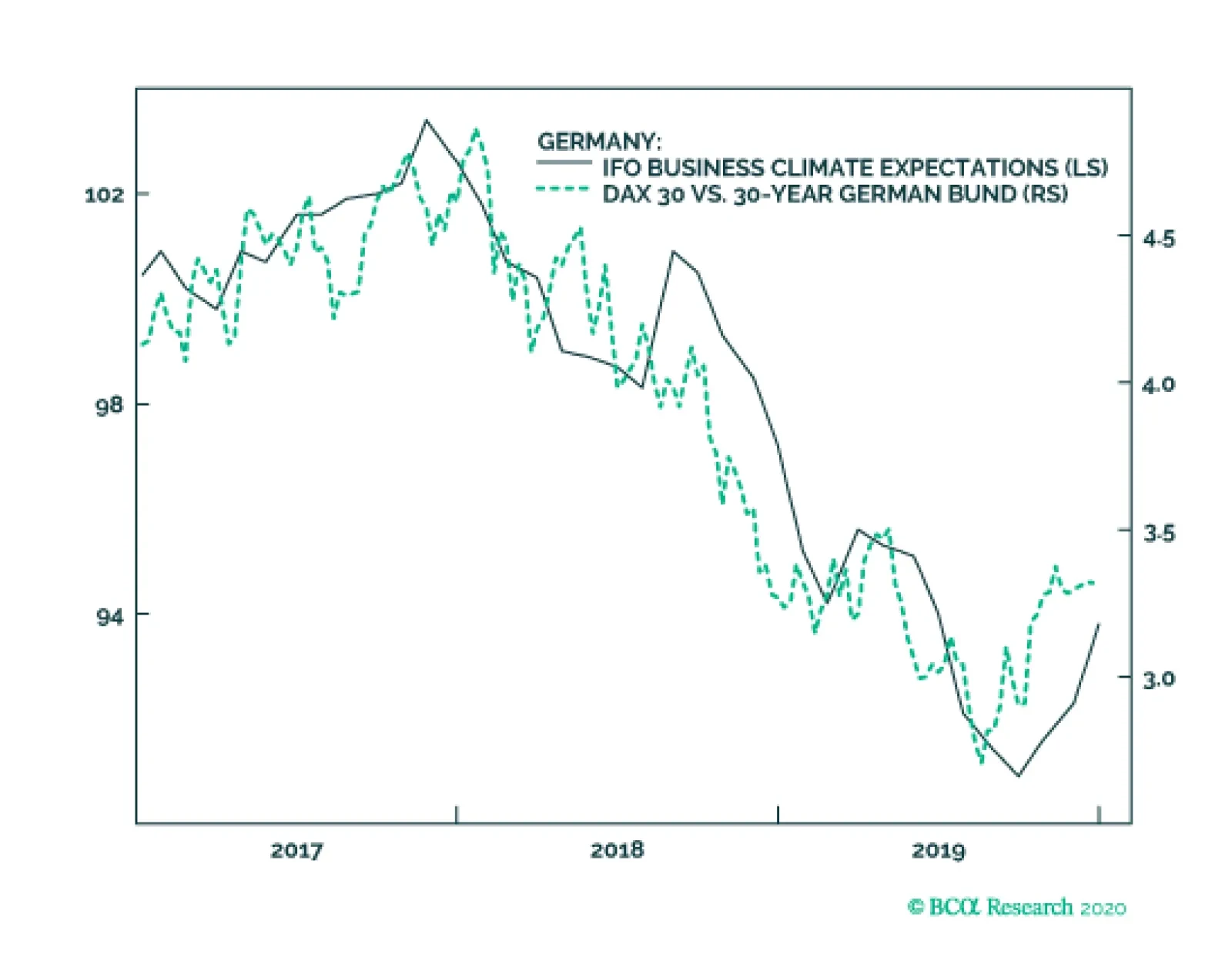

The German economy has been the main European victim of the global manufacturing slowdown. However, there are early signs that Germany should soon mend. In particular, the momentum in the IFO Survey points to an upcoming rebound…

Highlights China’s economic rebound in Q1 will be delayed due to the coronavirus, which will have a larger negative hit than SARS. New stimulus measures will assist a rebound in demand later this year. Europe remains a…

Highlights Stock markets begin 2020 with fragile short-term fractal structures, which means there is a two in three chance of a tactical reversal. The bond yield impulse is now a strong headwind, which reliably predicts that bond…

The December German Ifo not only rebounded, but also beat expectations. Business climate increased from 95.1 to 96.3 and the expectations component climbed to 93.8 from 92.3. The German Ifo tends to provide a lead on the PMI…

Dear Client, In lieu of our regular report next week, I will be hosting a webcast on Wednesday, December 18th at 10:00 AM EST, where I will discuss the major investment themes and views I see playing out for 2020. This will be…

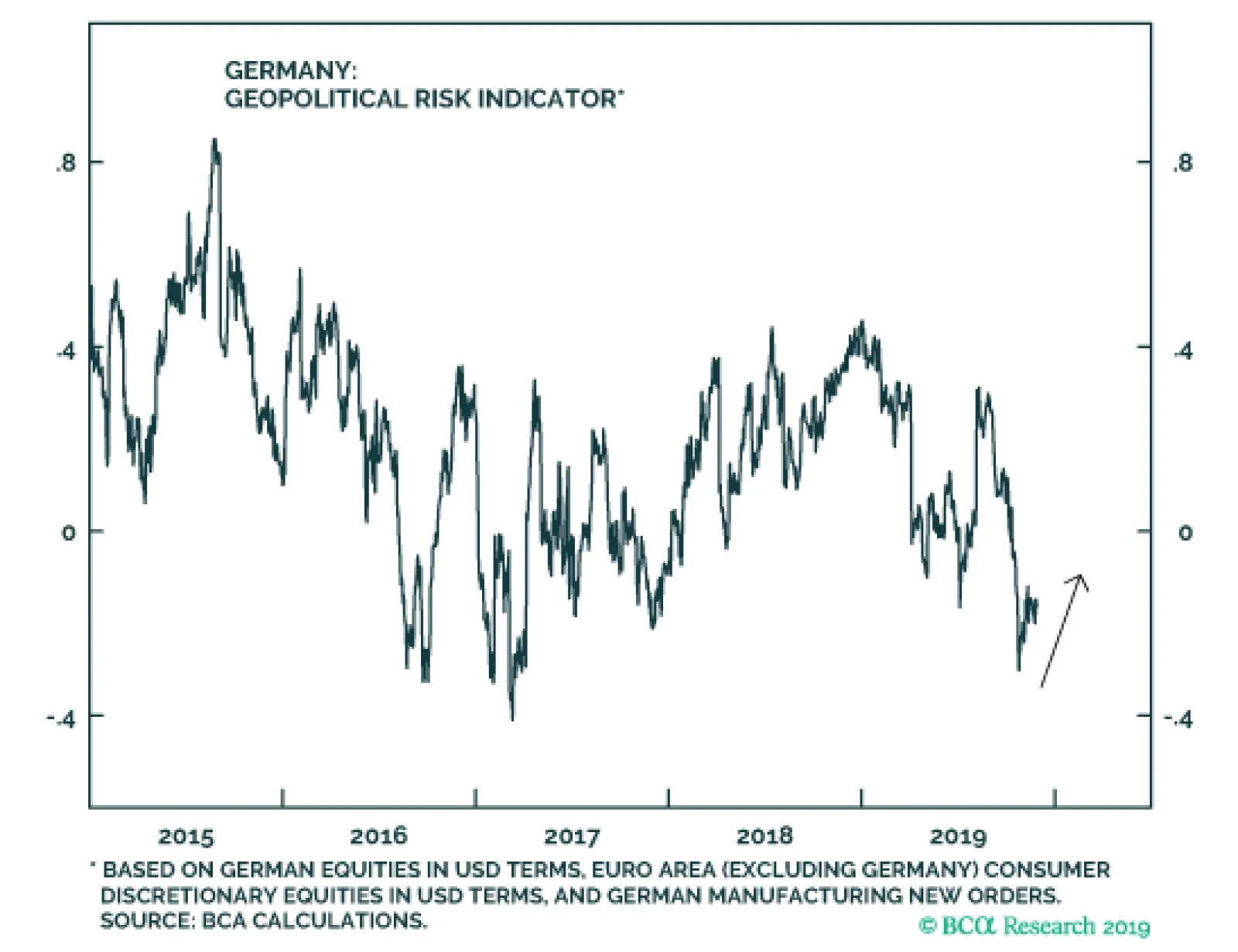

Germany is wading deeper into a period of political risk surrounding Chancellor Angela Merkel’s “lame duck” phase. The federal election of 2021 already looms large. Our indicator is only beginning to price this…

Highlights The US-China trade talks will continue despite Hong Kong. The UK election will not reintroduce no-deal Brexit risk – either in the short run or the long run. European political risk is set to rise from low levels,…

Highlights Equities & Bonds: The accelerating upward momentum of global equities – the ultimate “leading economic indicator” – suggests that the current rise in global bond yields can continue. Maintain…

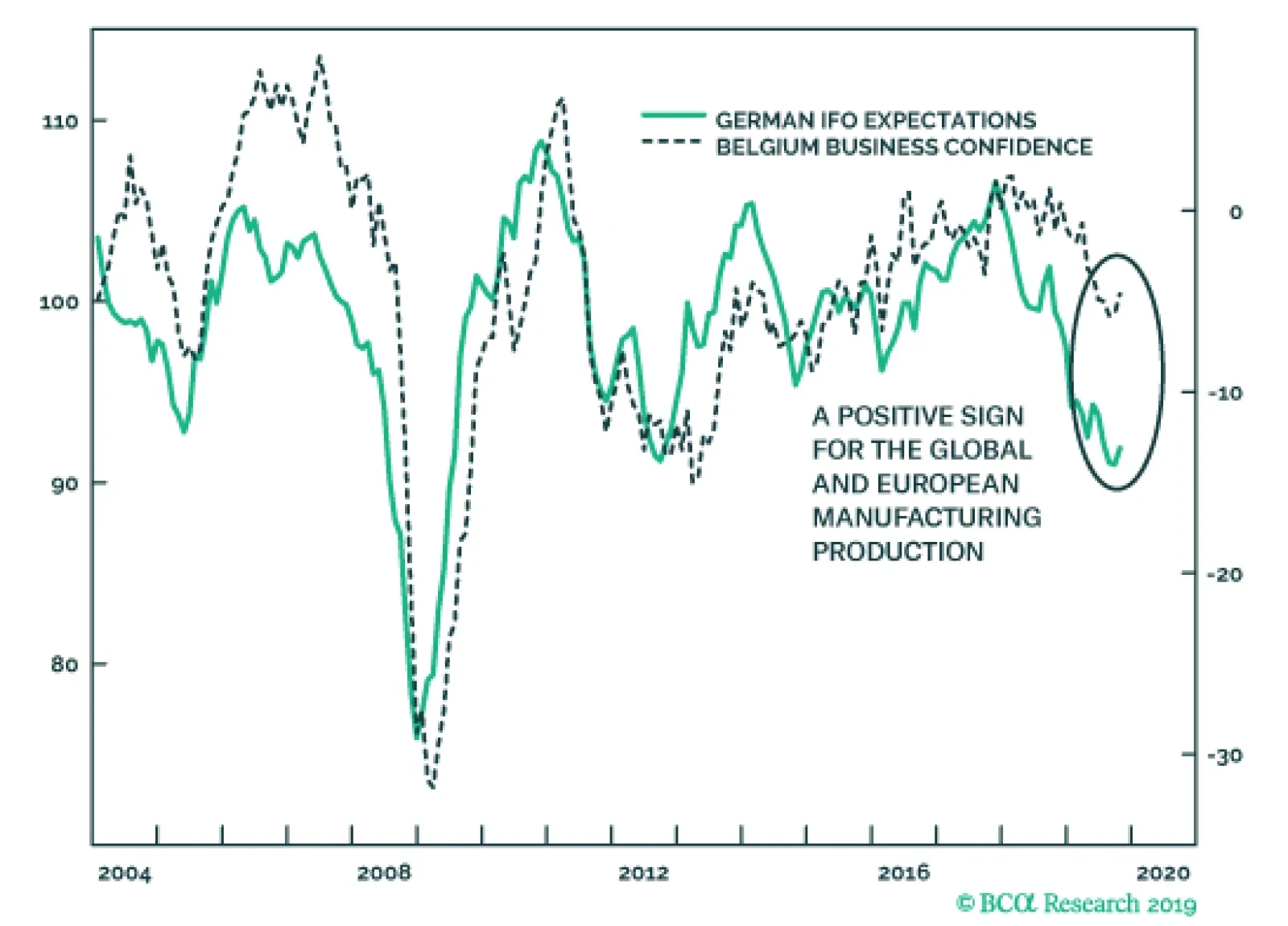

On the heels of yesterday’s disappointing German PMIs, the October Belgian Business Confidence and German IFO surveys will help alleviate fears towards the European economy. While the current assessment component of the IFO…

Highlights On a tactical horizon, underweight bonds versus cash, especially those bonds with deeply negative yields… …and underweight bonds versus equities. On a strategic horizon, remain overweight a 50:50 combination…