Highlights Europe’s dirty little secret: Euro area debt is already mutualised. Investment implication: Overweight Italian BTPs, underweight German bunds, and overweight the euro on a structural (2-year plus) horizon. ESM plus…

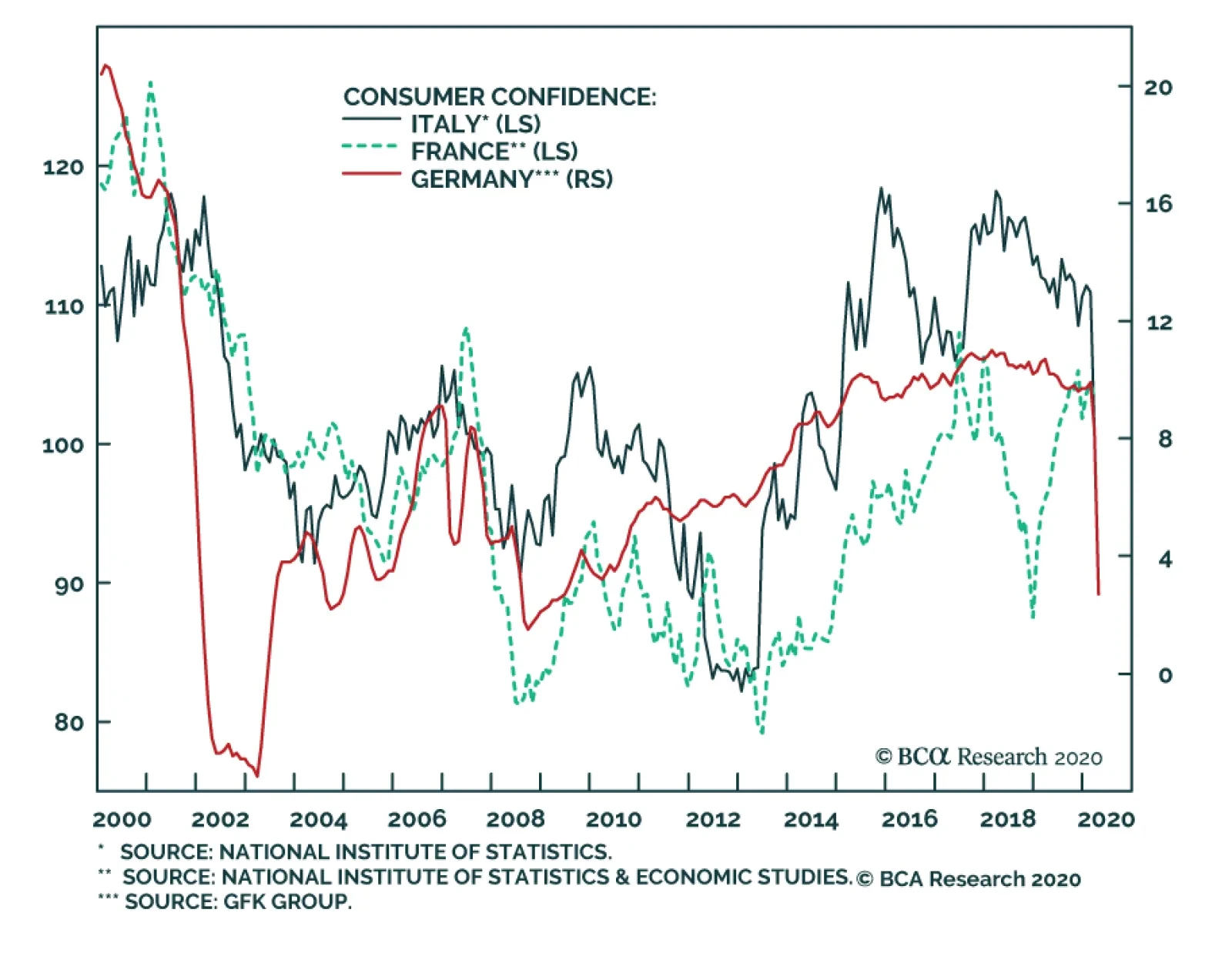

Unsurprisingly, European consumer confidence has declined sharply as a result of lockdown measures required to contain the spread of COVID-19. The GfK survey in Germany fell from 8.3 to 2.7, much worse than the consensus…

Highlights Uncertainty & Yields: Global bond yields, driven to all-time lows as investors seek safety amid rioting markets, now discount a multi-year period of very weak global growth and inflation. Bond Portfolio Strategy:…

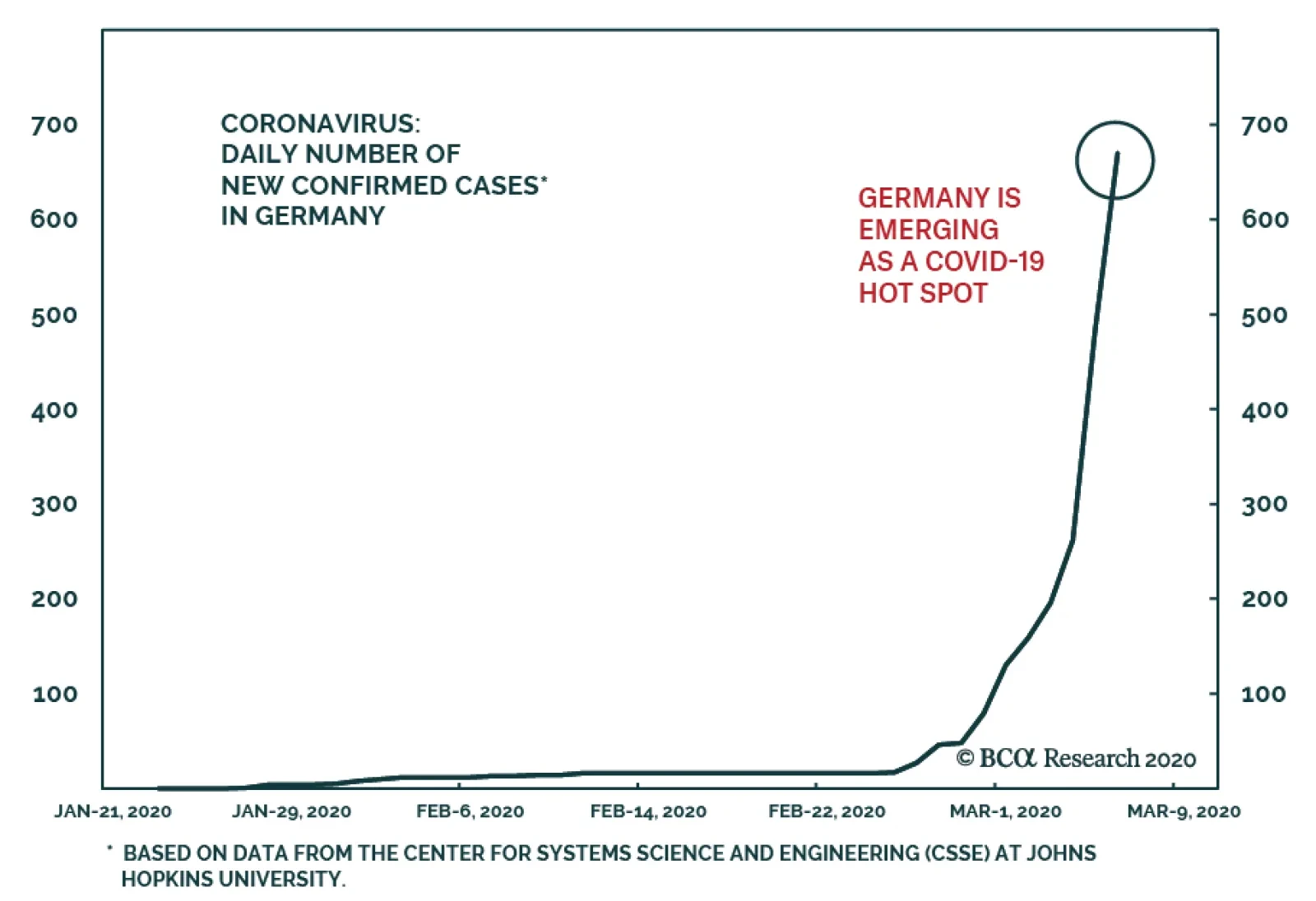

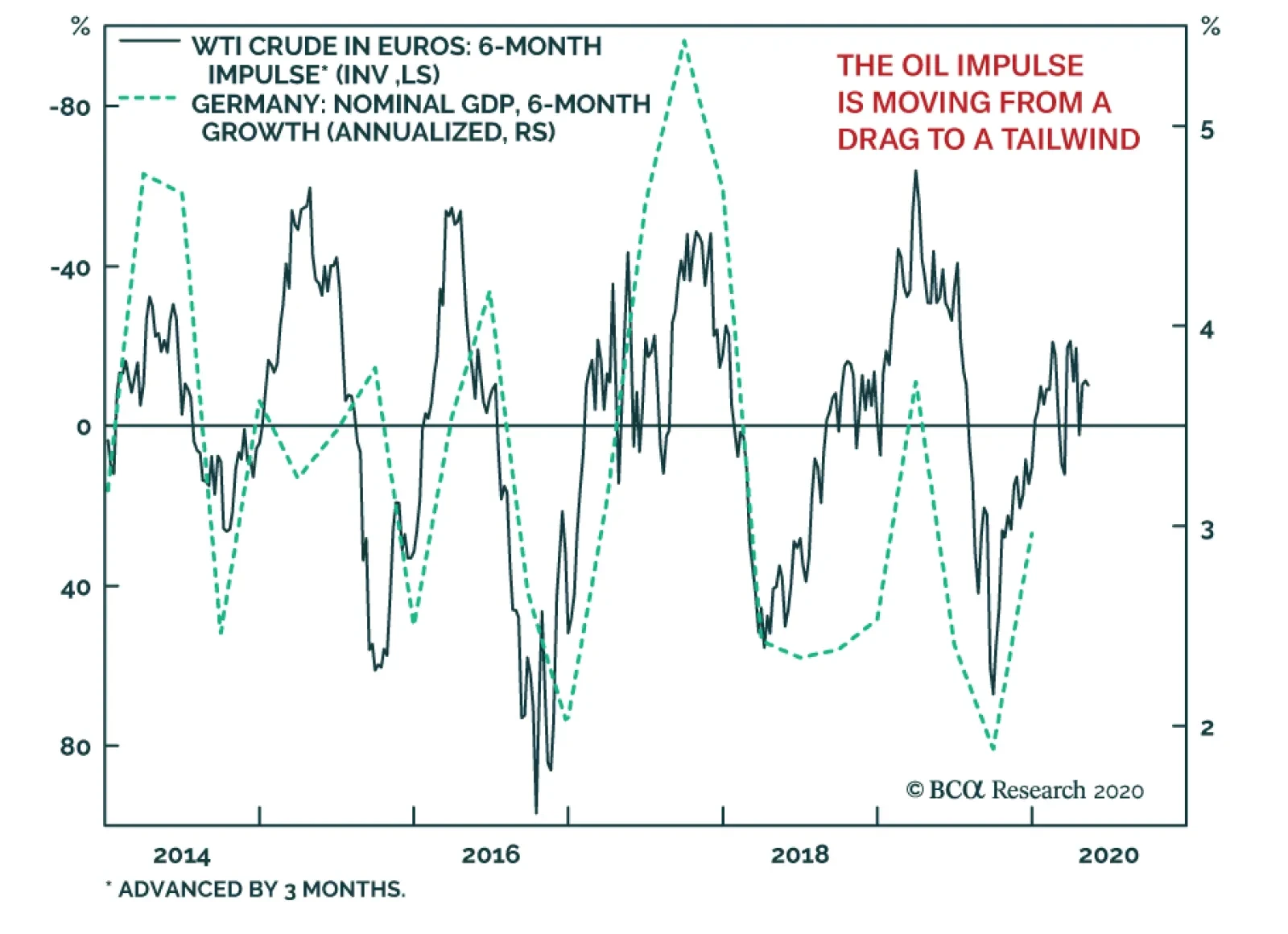

The German economy has suffered its set of woes in 2019, and 2020 is starting poorly. True, factory orders in January improved significantly, but Germany could suffer greatly from COVID-19. First, its industrial economy is very…

Highlights It is too soon to bottom feed with fears of a global pandemic and “socialist” boom in the United States. China’s government will do “whatever it takes” to stimulate the economy – but…

Germany’s IFO business survey for February came out slightly stronger than expected, rising from 96 to 96.1. Germany is highly sensitive to both global trade and China, which should make the German economy a prime casualty…

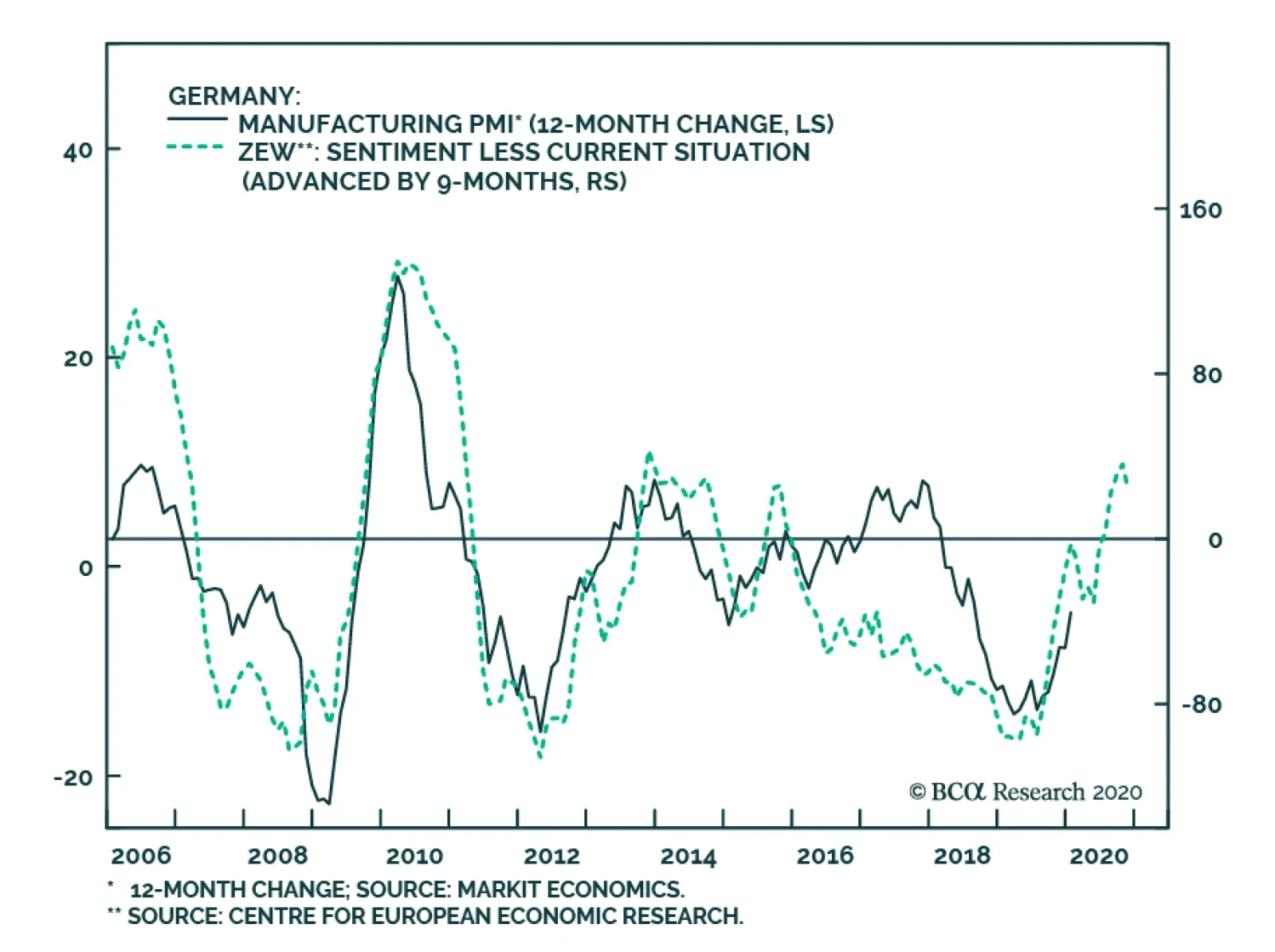

Tuesday’s release of the German ZEW survey showed that the nascent recovery in the economy is at risk from the COVID-19 shock. The current situation component of the index deteriorated from -9.5 to -15.7, while the…

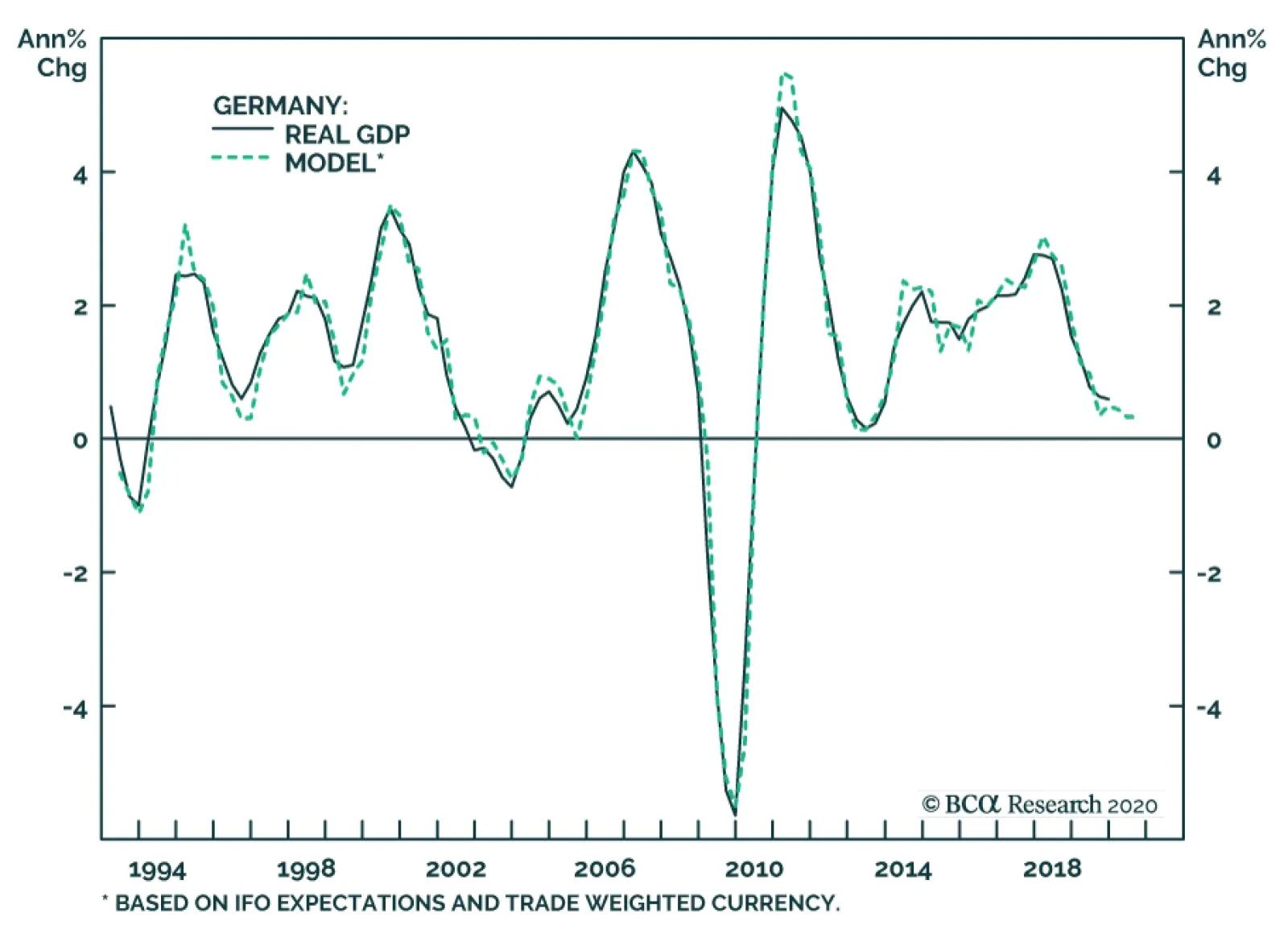

Following last week’s disastrous industrial production numbers, Germany’s Q4 GDP number was weak, coming in 0% on a quarter-over-quarter basis. As BCA Research’s European Investment Strategy service often…