The drubbing in the US/EMU sovereign bond spread is cause for concern for the SPX’s slingshot recovery off the March 23 lows, especially given the tight positive correlation of these two series over the past three…

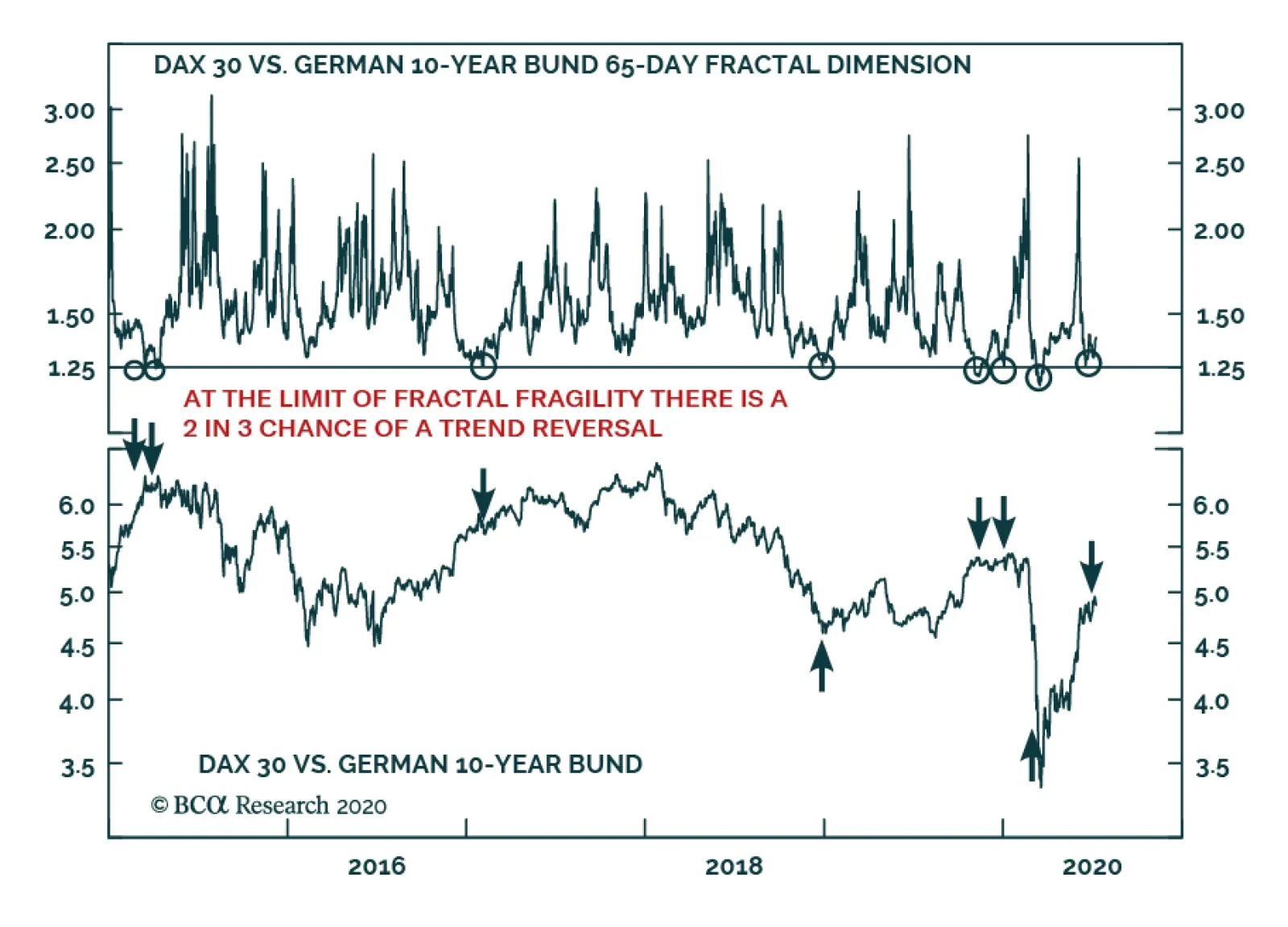

BCA Research's European Investment Strategy service's fractal trading model has given them a sell signal on the stock-to-bond ratio. Since 2015, a collapsed 65-day fractal structure of the German stock-to-bond ratio…

Highlights Butterflies & Yield Curve Models: With bond market volatility now back to the subdued levels seen prior to the COVID-19 market turbulence earlier in 2020, it is a good time to update our global yield curve valuation…

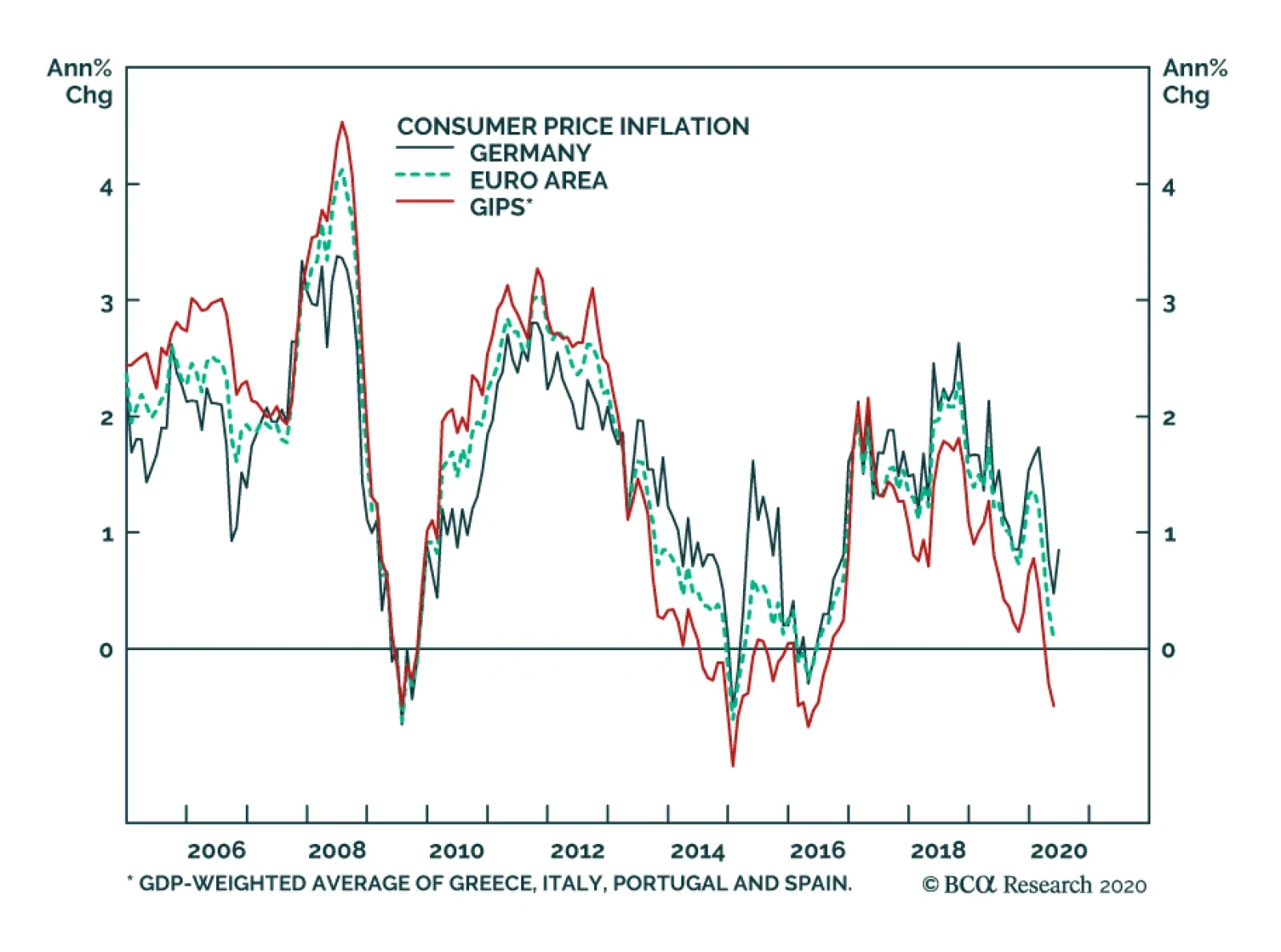

German inflation came in yesterday at +0.8%, versus a decline of -0.3% in Spain. In a general sense, inflation in Germany has been outperforming that in the periphery for a few months now. This is a sea change from the general…

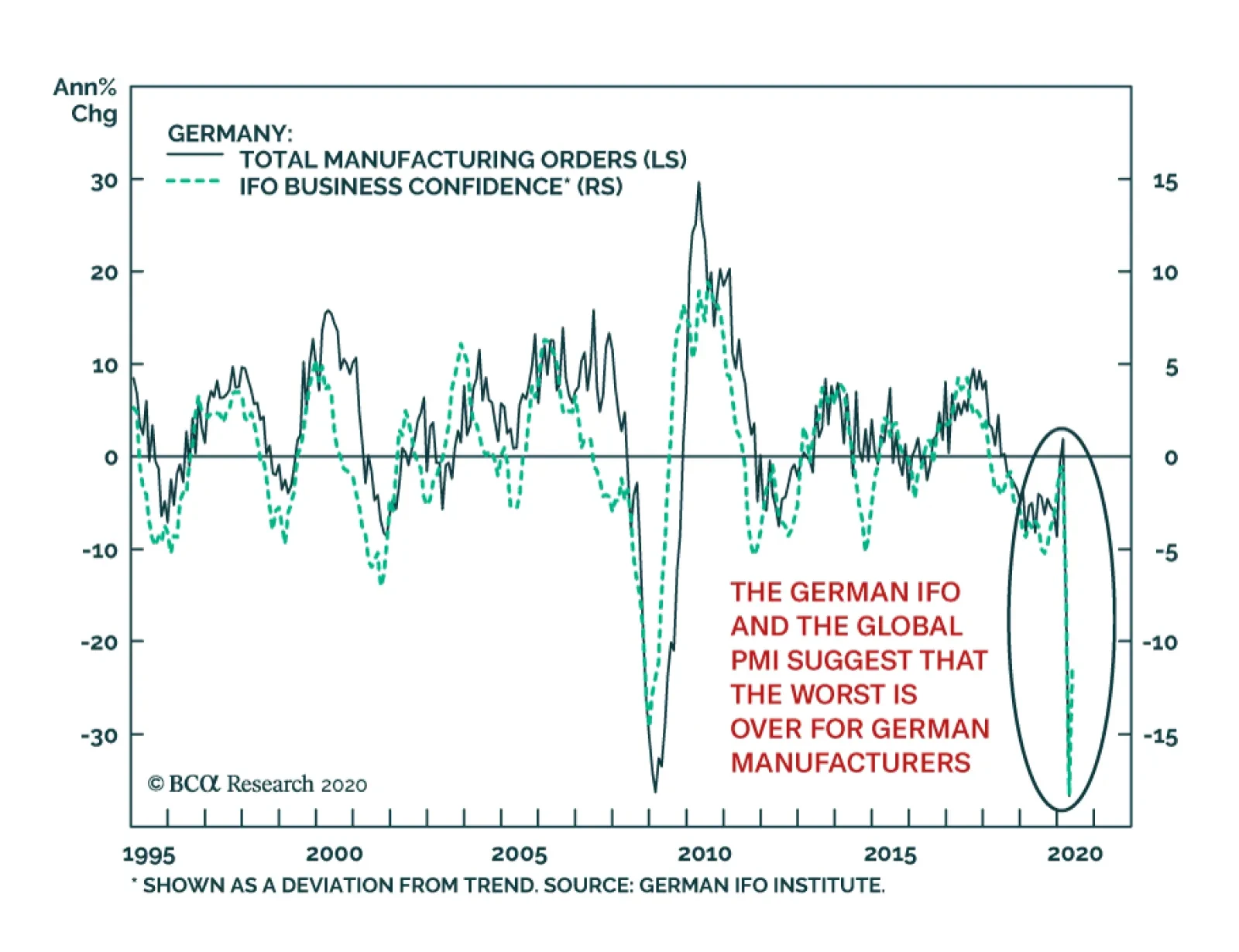

Germany’s April manufacturing orders were nothing short of atrocious. They bore the brunt of the pain created by the German shutdowns and the global recession. Overall orders contracted 36.7% on an annual basis, domestic…

Highlights German bunds and Swiss bonds are no longer haven assets. The haven assets are the Swiss franc, Japanese yen, and US T-bonds. Gold is less effective as a haven asset. During this year’s coronavirus crash, the gold…

Highlights Global stimulus efforts are sufficient thus far, but more will need to be done, especially by Europe and emerging markets. Hiccups will not be well-received by financial markets. The net public wealth of countries helps put…

Germany’s factory orders have begun a violent freefall in March, contracting 16% on an annual basis. Capital goods were particularly hard hit, contracting nearly 25% on an annual basis. Germany’s economy depends on…