Highlights GameStop & Bond Yields: The reflationary conditions that helped create a backdrop highly conducive to the wild stock market speculation on display last week – namely, aggressive monetary and fiscal policy stimulus…

Highlights In the wake of COVID-19, the low-probability, high-impact “Black Swan” event is as relevant as ever. Investors should already expect US terrorist incidents, a fourth Taiwan Strait crisis, and crises involving…

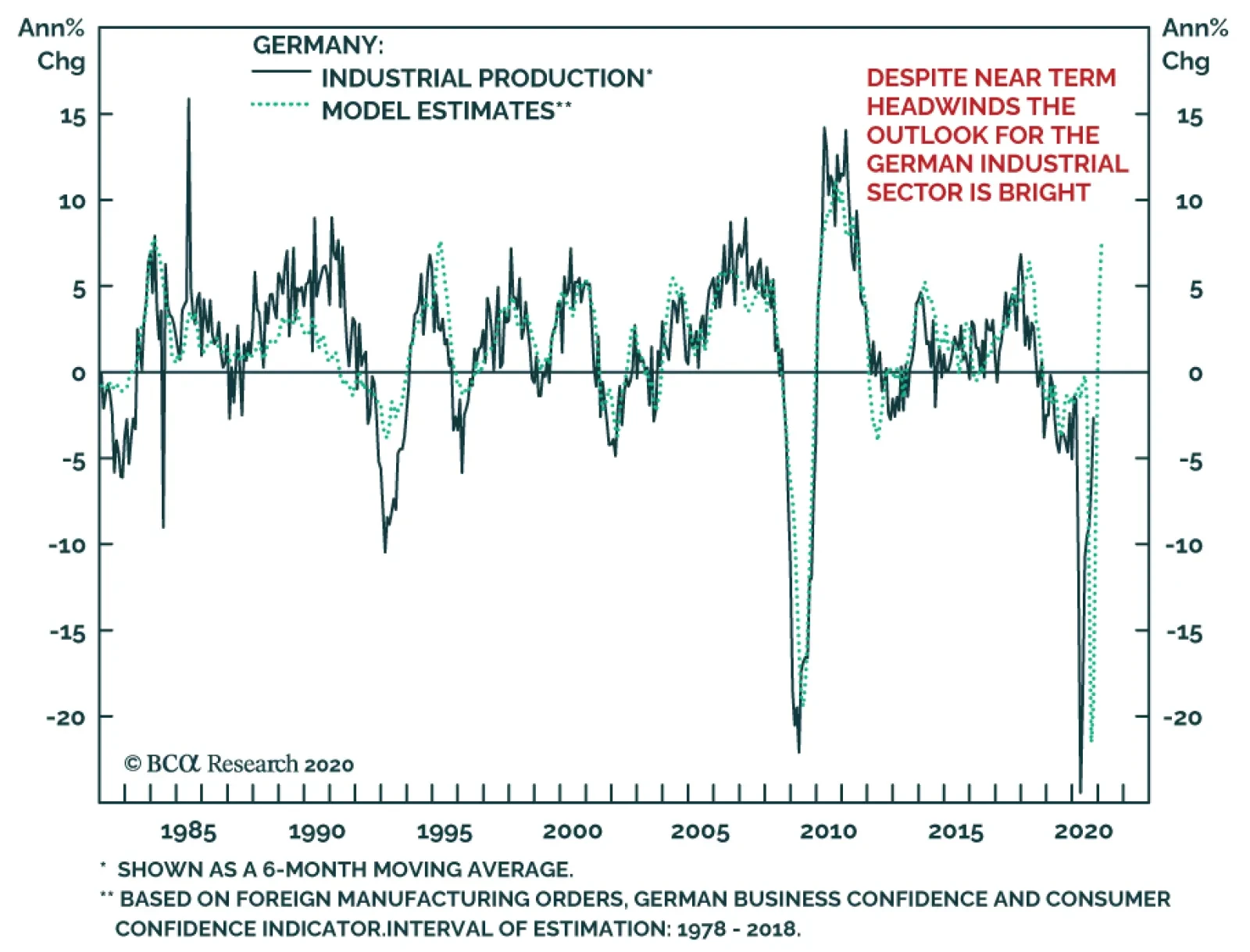

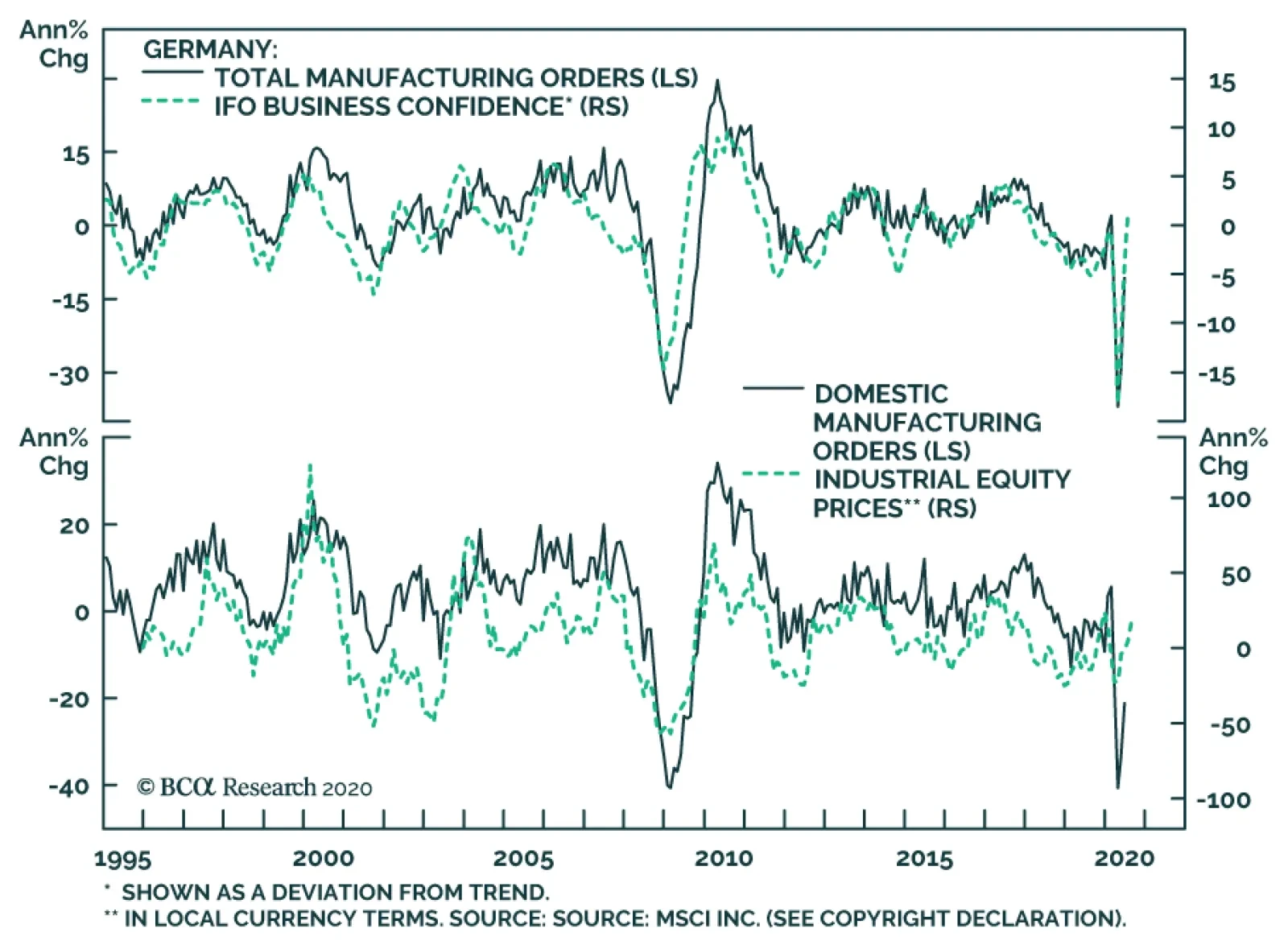

After bottoming in Q4, the German DAX is rallying and outperforming the Euro Stoxx 50 in the process. While the near-term is muddled by the pandemic’s resurgence, the global manufacturing recovery this year will ultimately…

Highlights The ongoing pandemic underscores the need for fiscal and monetary policymakers to continue to provide a reflationary “bridge” until vaccination ends the threat to the health care system. The pending deal being…

Along with the rest of Europe, the German economy is suffering from the impact of the second wave of COVID-19 infections. The recently announced containment measures will only exacerbate this headwind to growth over the remainder…

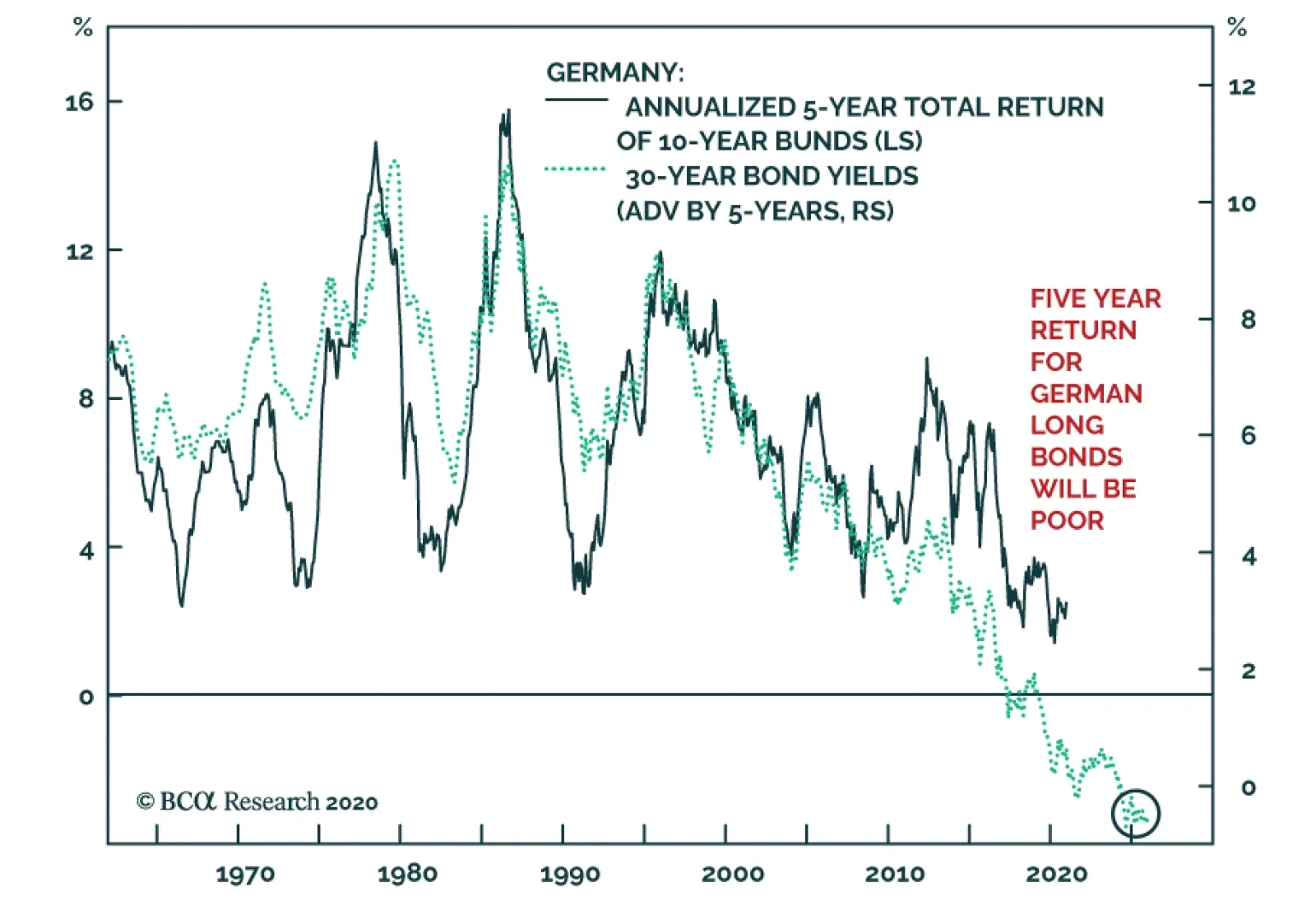

Empirically, the current yield to maturity gives a robust sense of the returns of 30-year German government bonds over the coming five years. At the present juncture, the yield of -0.2% suggests that over the next five years, the…

Highlights With a vaccine already rolling out in the UK and soon in the US, investors have reason to be optimistic about next year. Government bond yields are rising, cyclical equities are outperforming defensives, international stocks…

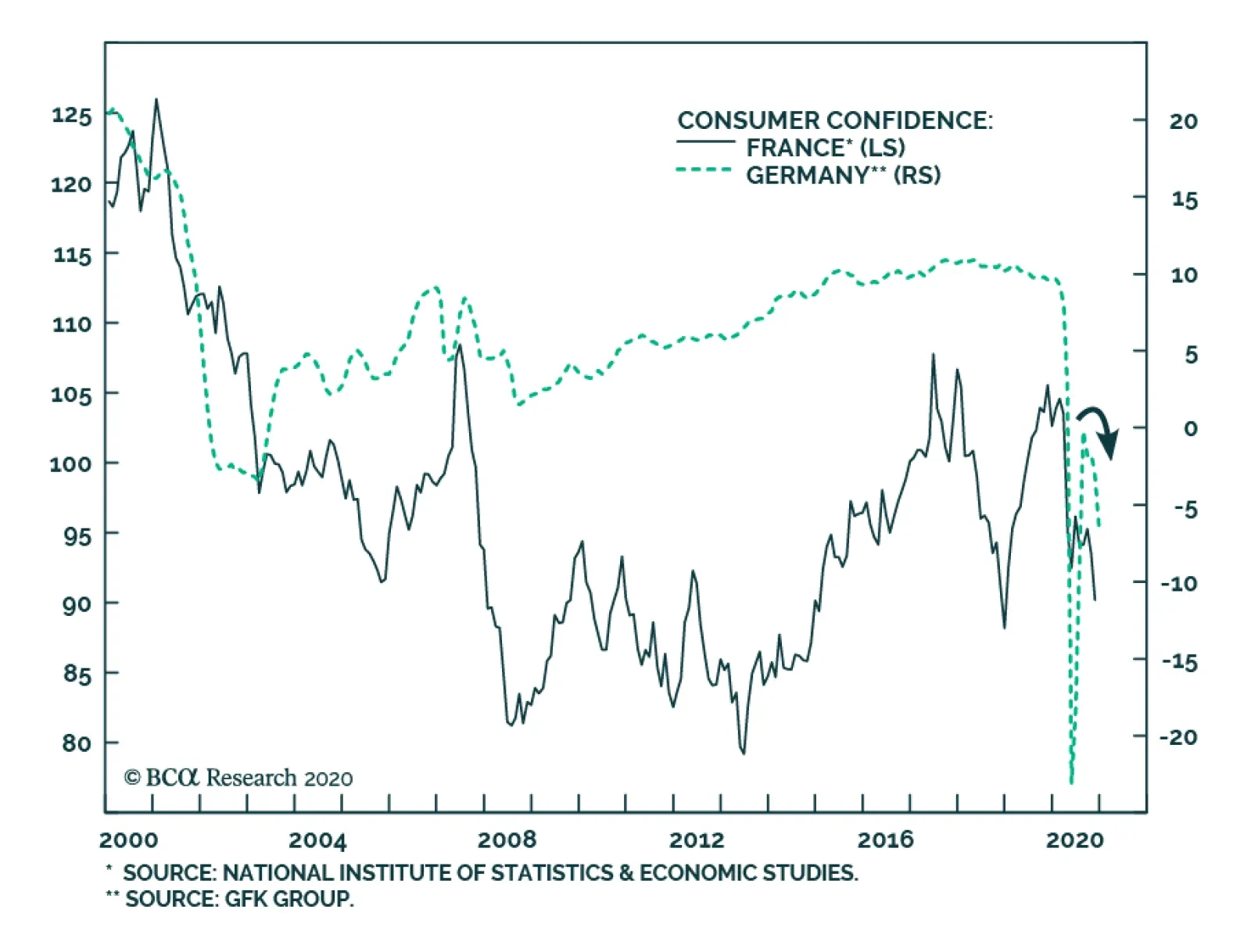

Consumer sentiment in the euro area’s two largest economies is souring amid the institution of renewed measures to control the pandemic. Germany’s GfK consumer confidence survey slipped to -6.7 from -3.2, missing…

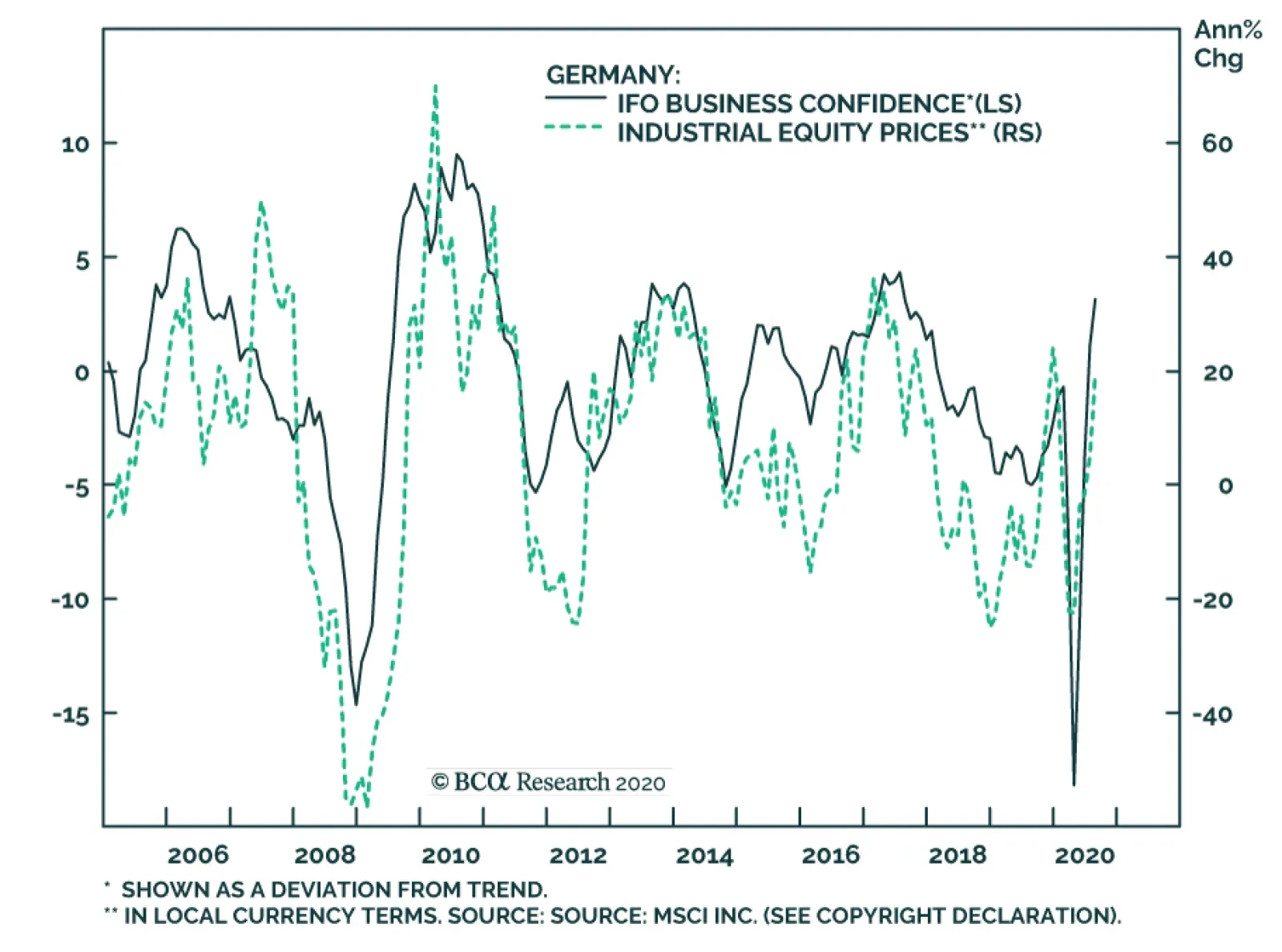

Yesterday’s Ifo survey of German Business Confidence was promising. The business climate index rose for the fourth consecutive month in August to 92.6, topping the 92.1 consensus forecast. The current assessment component…

German assets maintain the most appealing risk profile in the euro area. The DAX’s attraction reflects two forces. First, German equities are heavily overweight industrial stocks. The global manufacturing sector is…