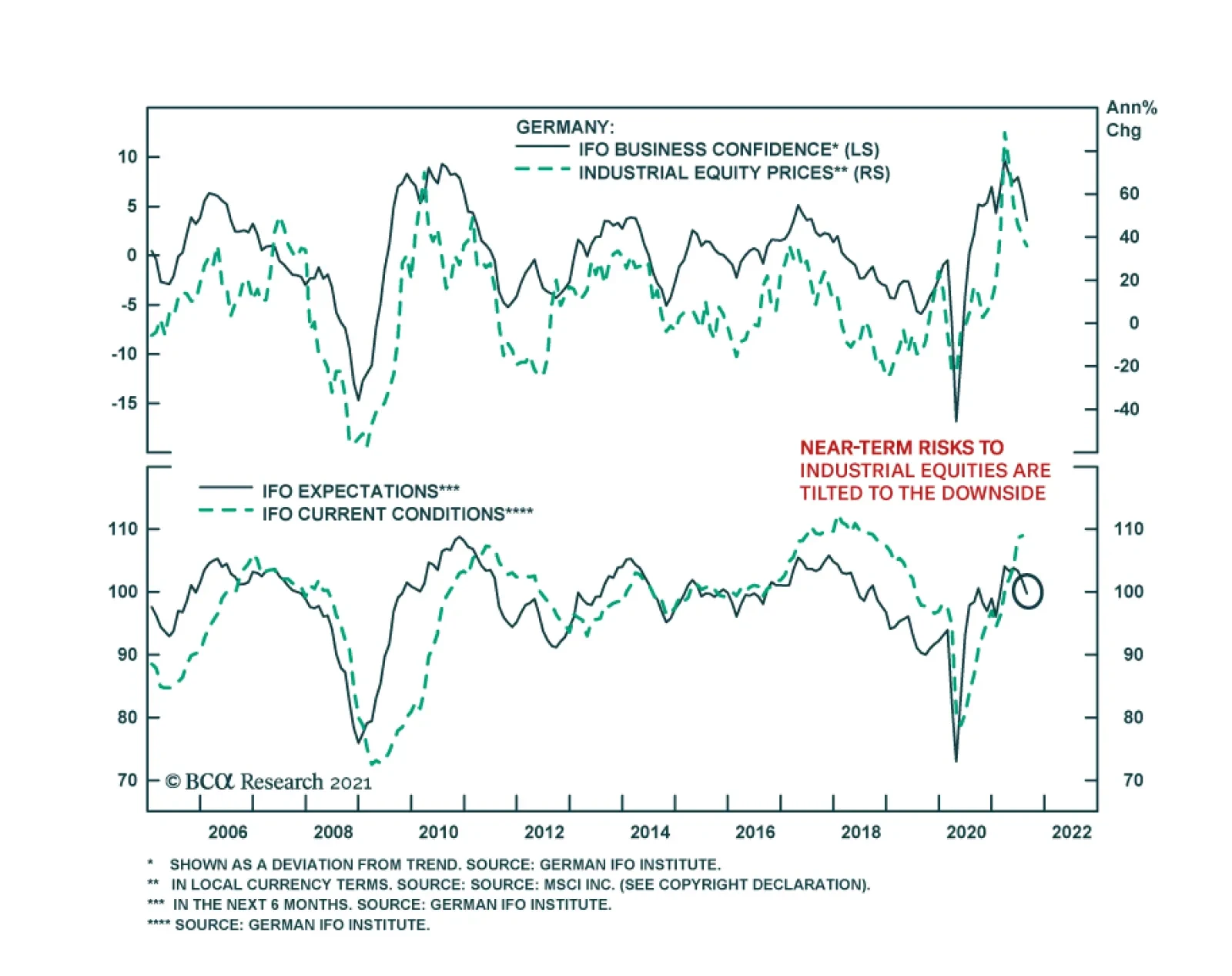

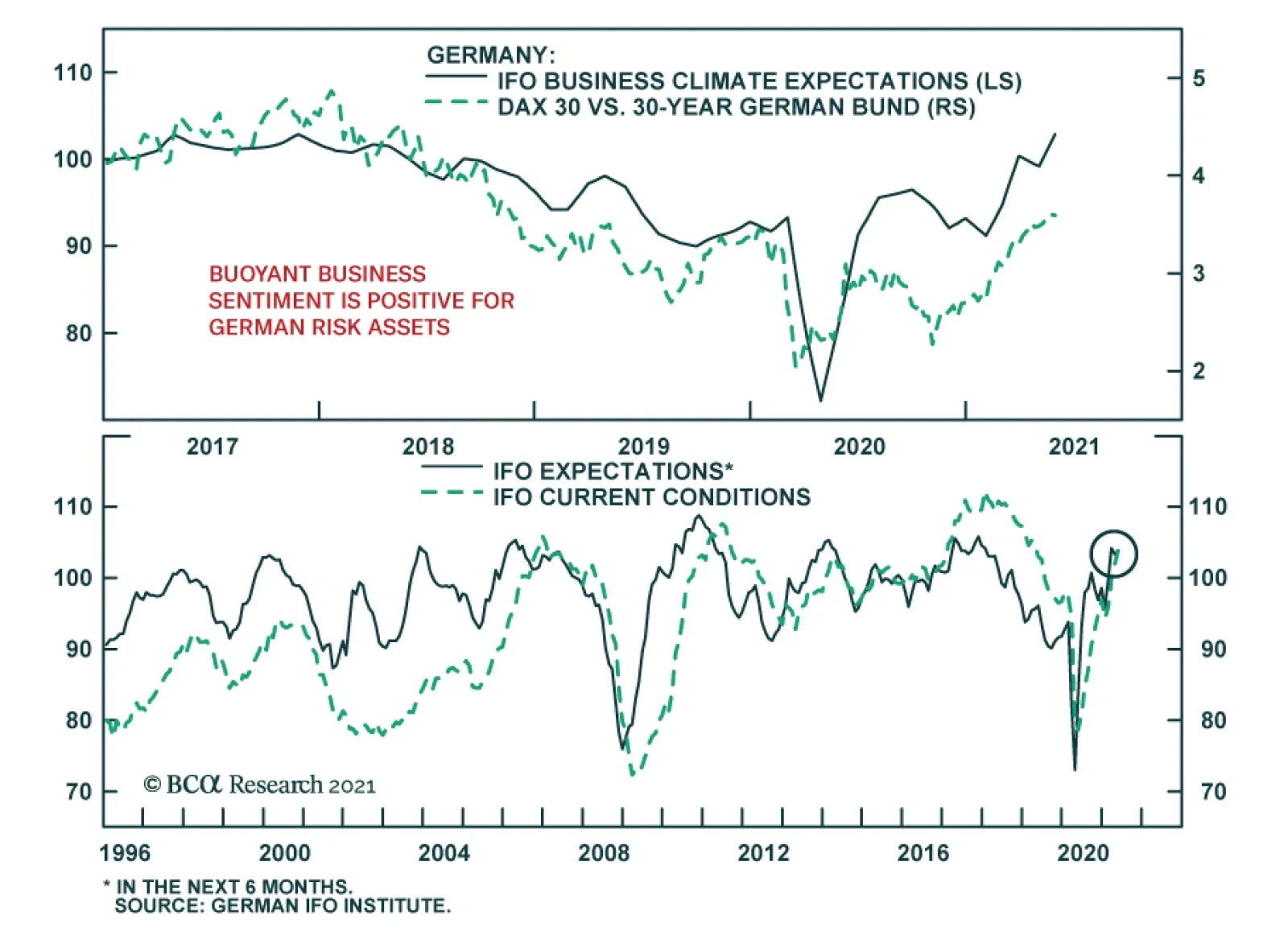

The German IFO reveals that businesses continue to pare back optimism. The headline index fell 1.3 points to 99.4 on the back of a greater than expected 3.5-point decline in expectations. Meanwhile, the current assessment…

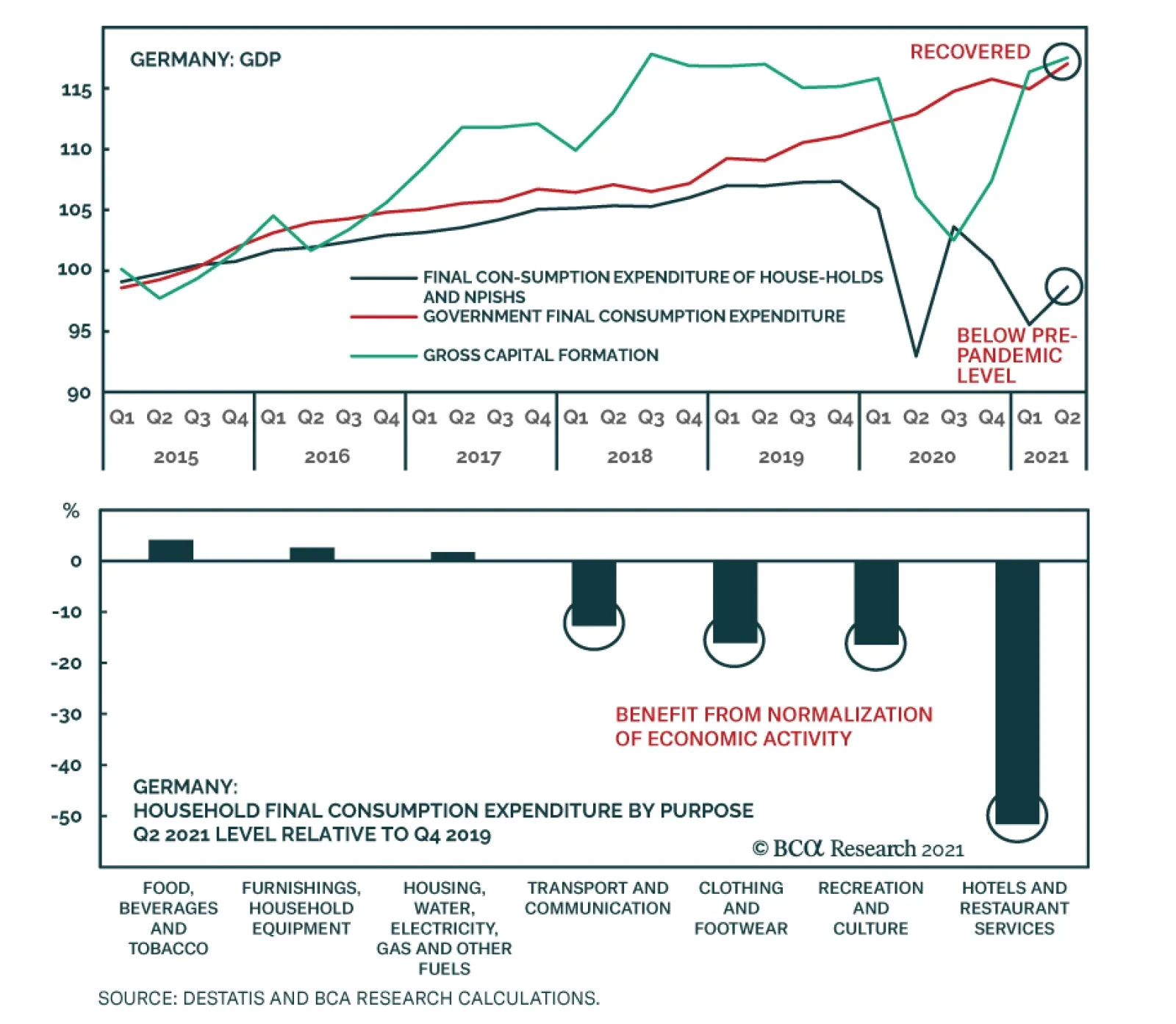

Germany's Q2 GDP was revised up to 1.6% q/q versus the initial estimate of 1.5% q/q. The latest figure reduces the GDP gap relative to Q4 2019 to 3.2%. The details of the release reveal that while government spending and…

Highlights China’s July Politburo meeting signaled that policy is unlikely to be overtightened. The Biden administration is likely to pass a bipartisan infrastructure deal – as well as a large spending bill by Christmas.…

Highlights Portfolio Duration: The decline in US bond yields is overdone. We anticipate that strong US employment data will catalyze a jump in bond yields this fall and that the 10-year US Treasury yield will reach a range of 2% - 2.25…

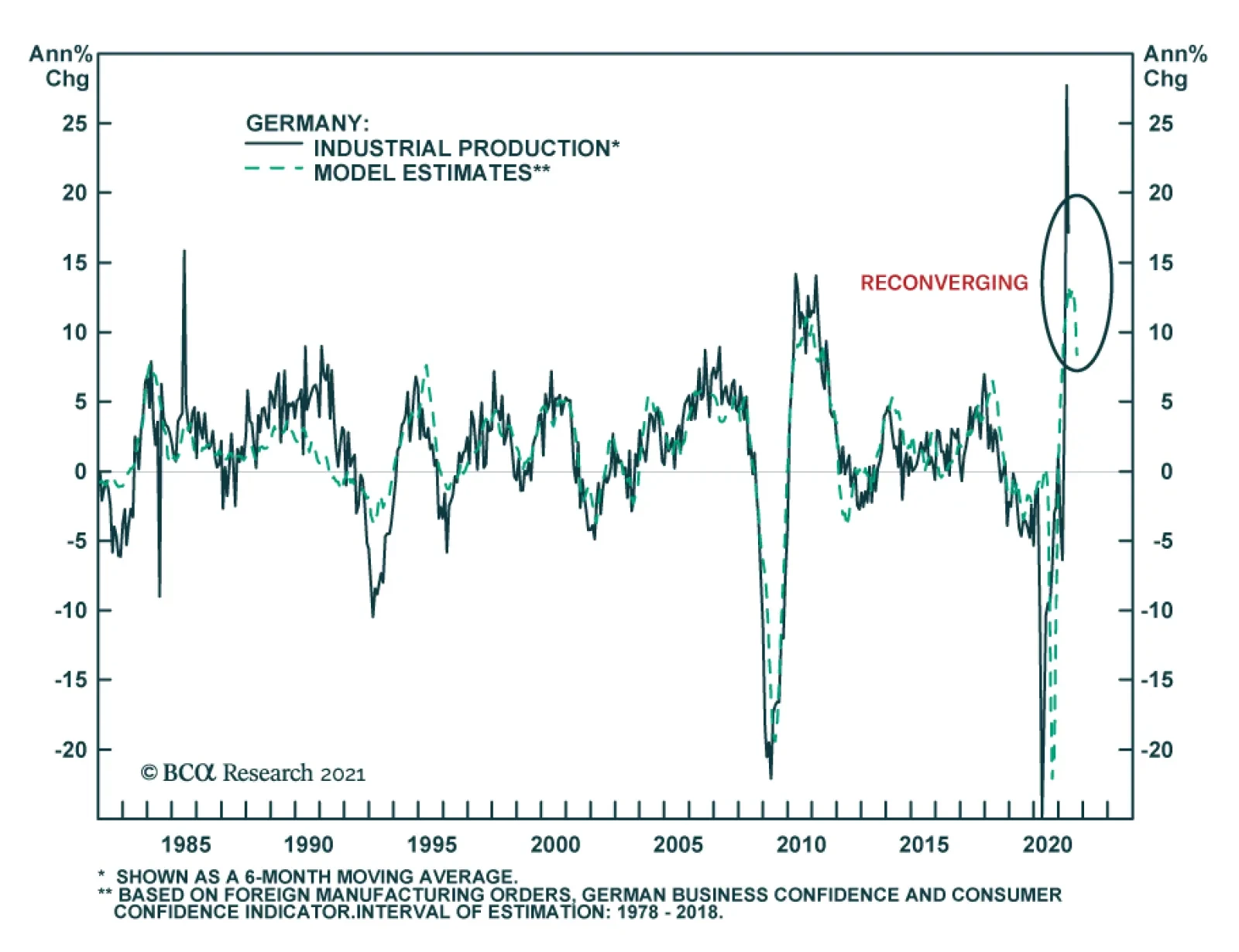

Germany’s May industrial production contracted for the second month in a row. Although it has underperformed market expectations of 0.5%, these results are rather unsurprising given the previous recovery pace of the past…

Highlights The US is withdrawing from the Middle East and South Asia and making a strategic pivot to Asia Pacific. The third quarter will see risks flare around Iran and the US rejoin the 2015 Iranian nuclear deal. The result is…

Highlights Geopolitical risk is trickling back into financial markets. China’s fiscal-and-credit impulse collapsed again. The Global Economic Policy Uncertainty Index is ticking back up after the sharp drop from 2020. All of our…

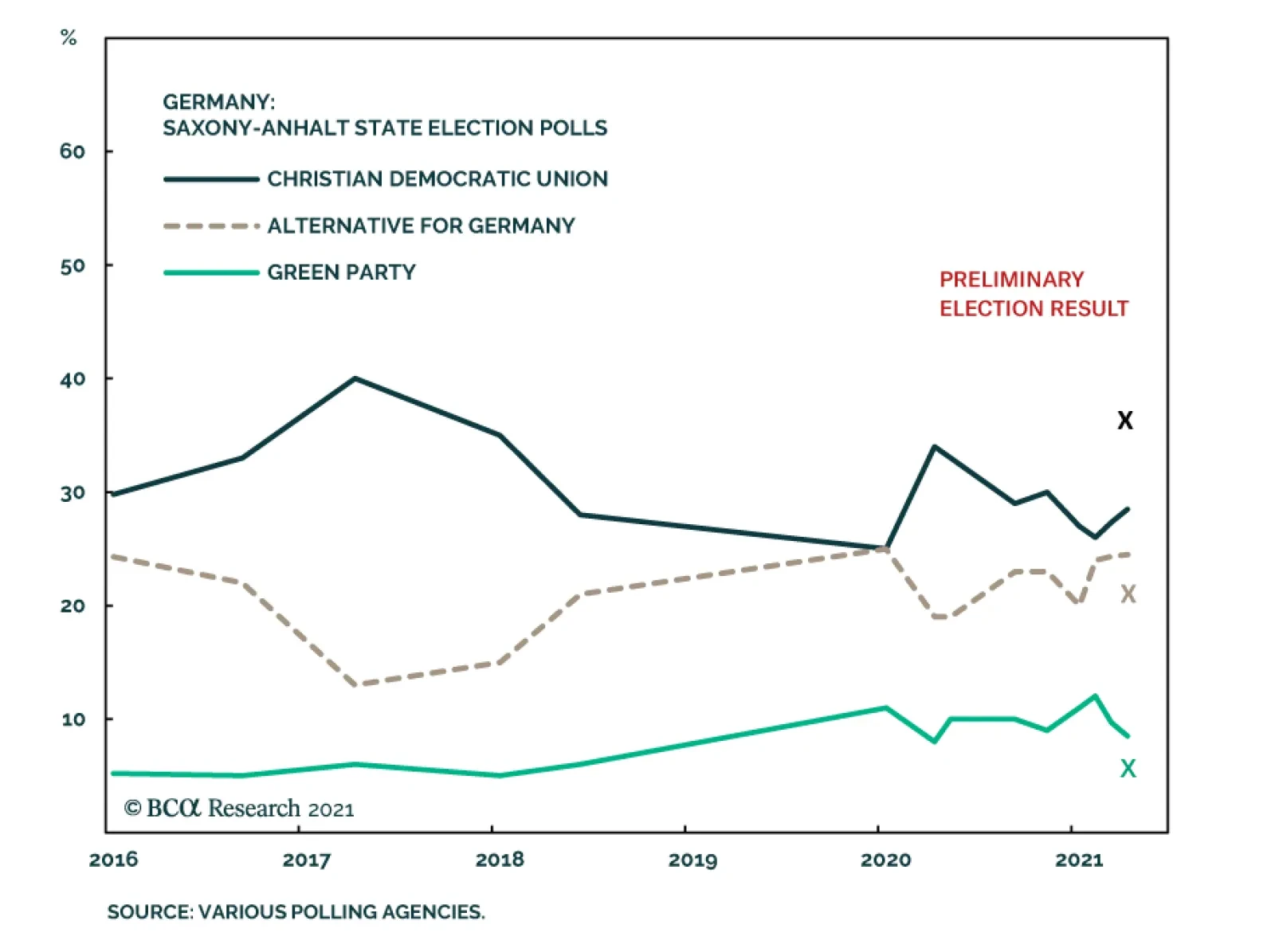

Germany’s latest state election confirms that German politics pose an upside risk to both the euro and European equity markets this year. The federal election on September 26 is important because it will determine who…

The German IFO rose sharply in May, indicating that business confidence is firming. After a disappointing release in April, the Business Climate index jumped 2.6 points to 99.2, beating expectations of a more muted increase to 98…