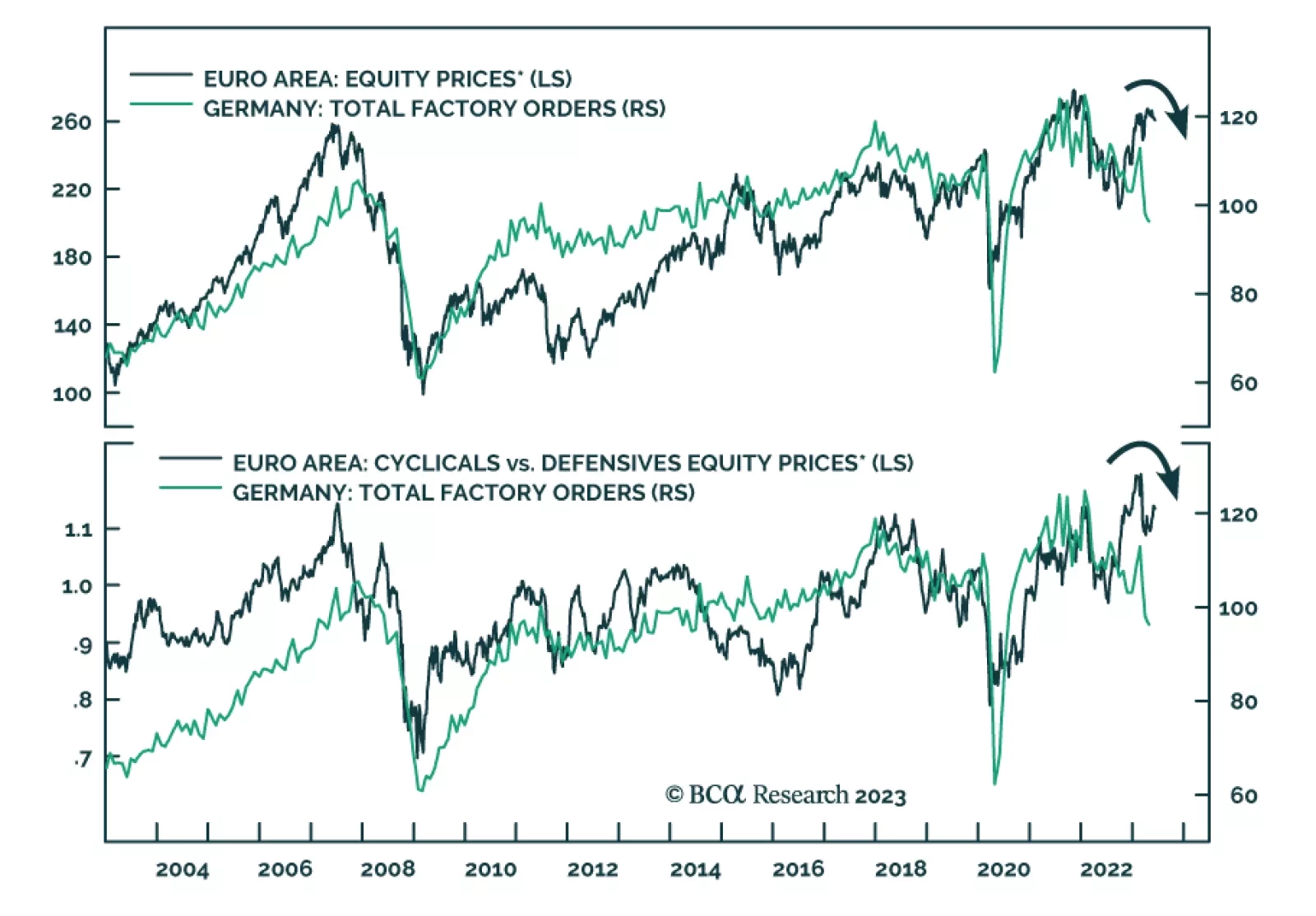

Tuesday’s German factory orders release sent a disappointing signal about industrial demand. Although the pace of decline eased from -10.9% m/m to -0.4% m/m in April, it fell below expectations of a 2.8% m/m increase. Both…

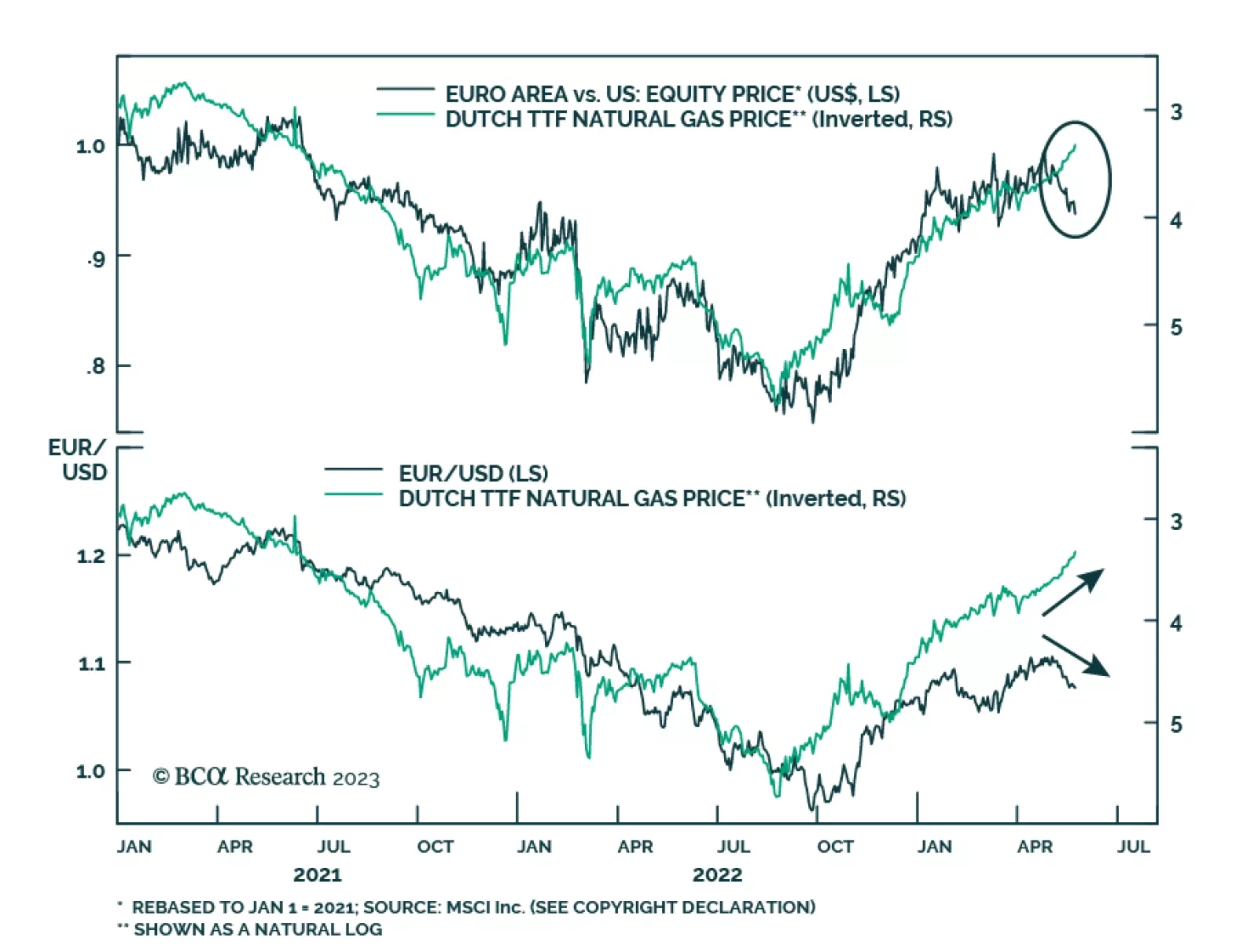

Over the past couple years, the price of natural gas has closely tracked the relative performance of European assets. Specifically, the underperformance of Euro Area stocks vis-à-vis US equities and the weakening EUR/USD…

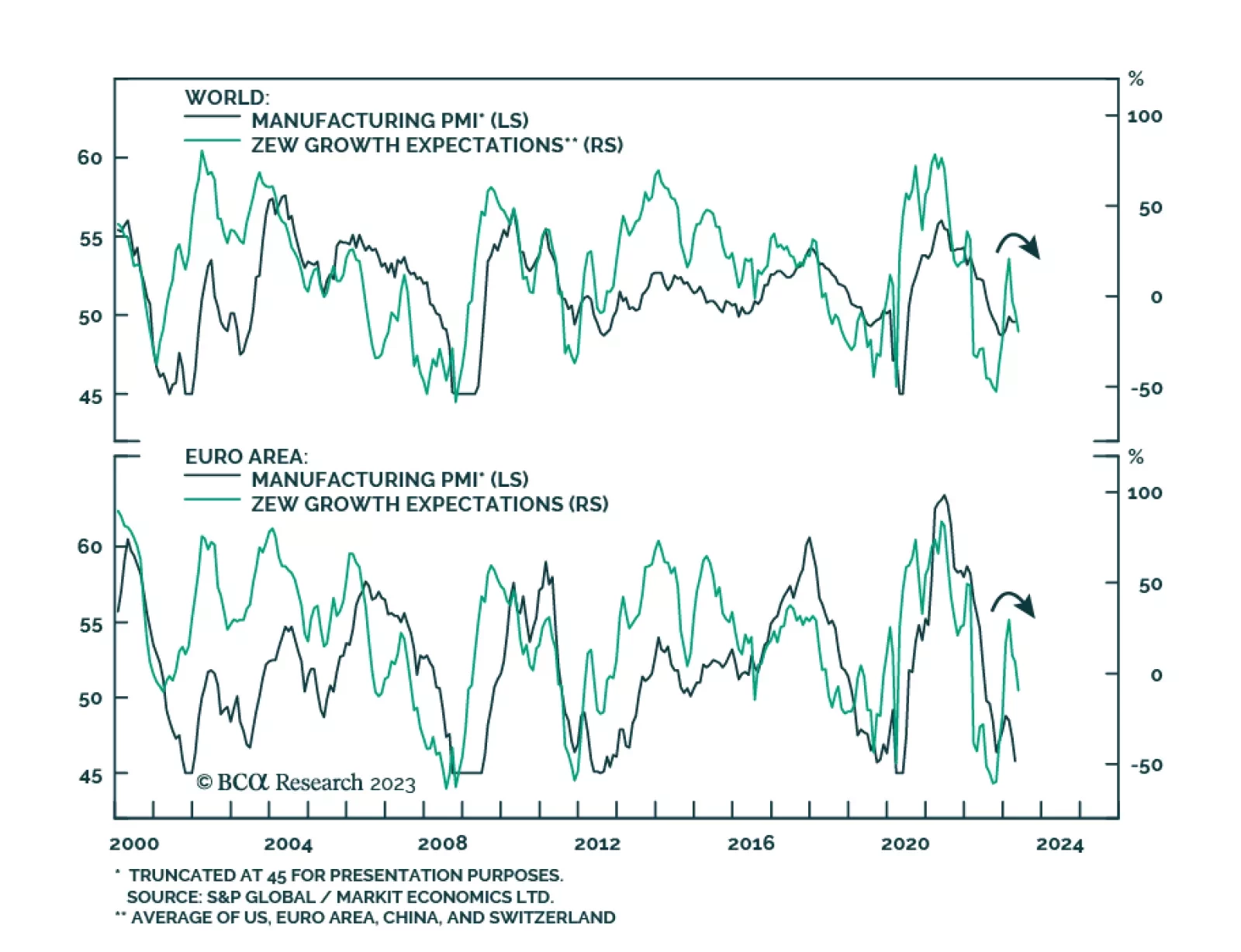

The lift to European investor sentiment from the ebbing energy crisis is now in the rear-view mirror. The German ZEW Indicator of Economic Sentiment fell back below 0 in May to -10.7 from 4.1. The negative reading indicates that…

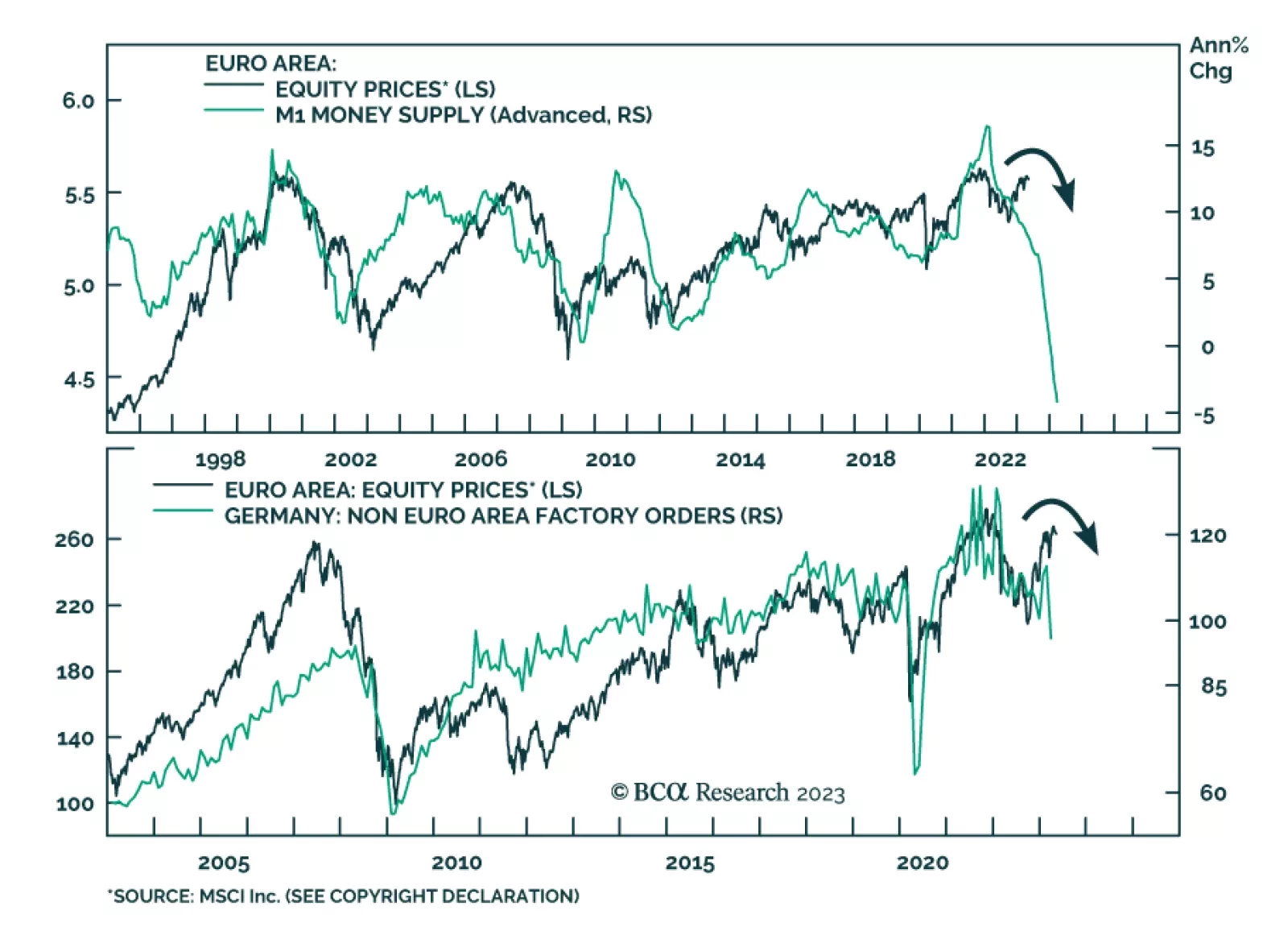

According to BCA Research’s European Investment Strategy service, a large set of variables points to some additional correction in European stocks over the coming months. The collapse in the Euro Area M1 is consistent…

Remain cautious and defensive overall. Stay long DM Europe over EM Europe. Look for EM opportunities in Southeast Asia and Latin America over Greater China.

Stay short Greater China assets. Stay long Japanese yen. Hold back on Brazil for now but look forward to opportunities in future.

Executive Summary Our negative view on the summer rally is coming to fruition, with equities falling back on the negative geopolitical, macro, and monetary environment. China is easing policy ahead of its full return to autocratic…

Listen to a short summary of this report. Executive Summary The odds of a recession in the US are lower than widely perceived. The probability of a recession is higher in Europe, although this week’s partial…