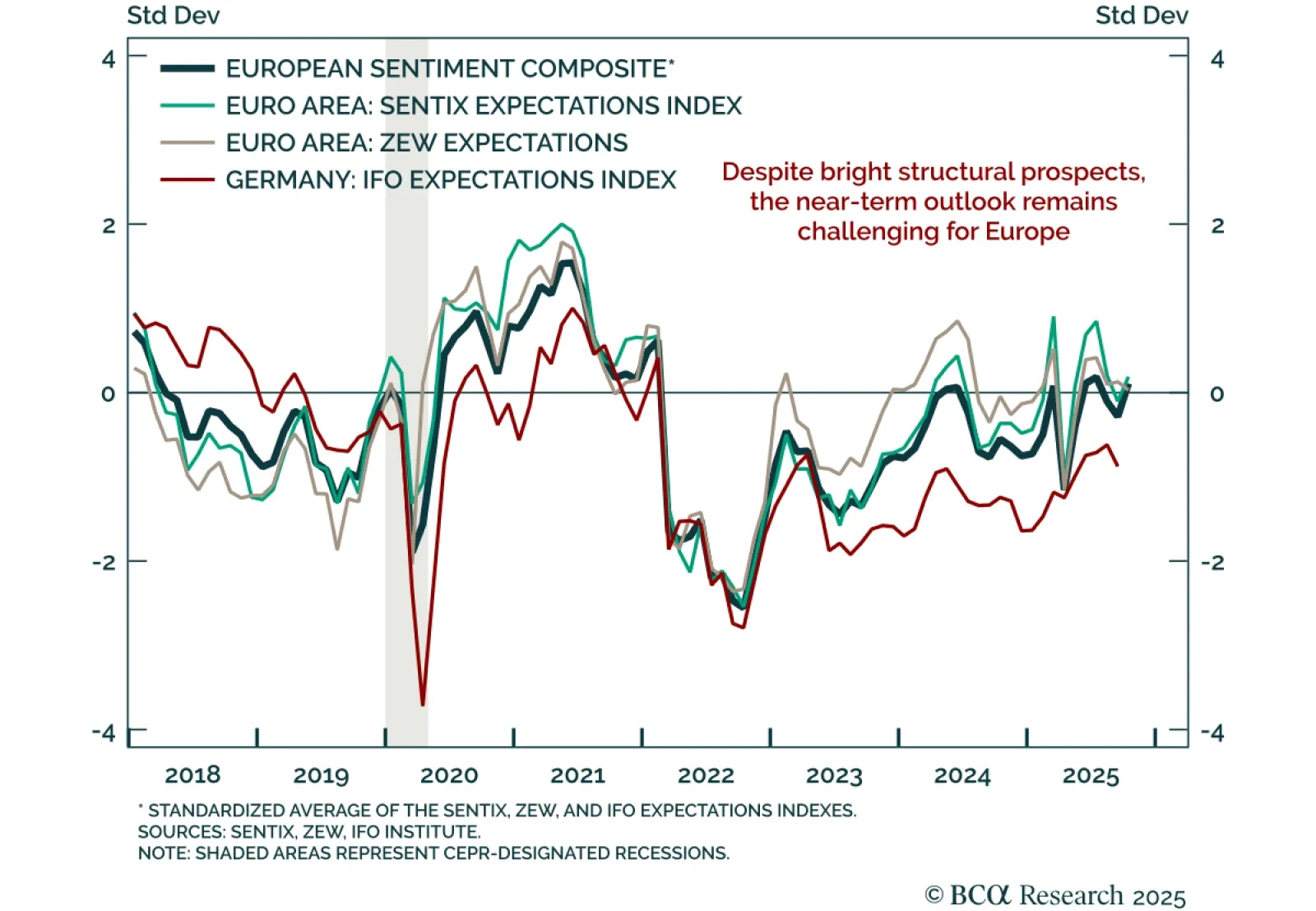

The October ZEW survey sent a mixed signal on near-term European growth, confirming limited growth momentum. Euro area growth expectations fell to 22.7 from 26.1, while German expectations missed estimates but rose slightly to 39.3…

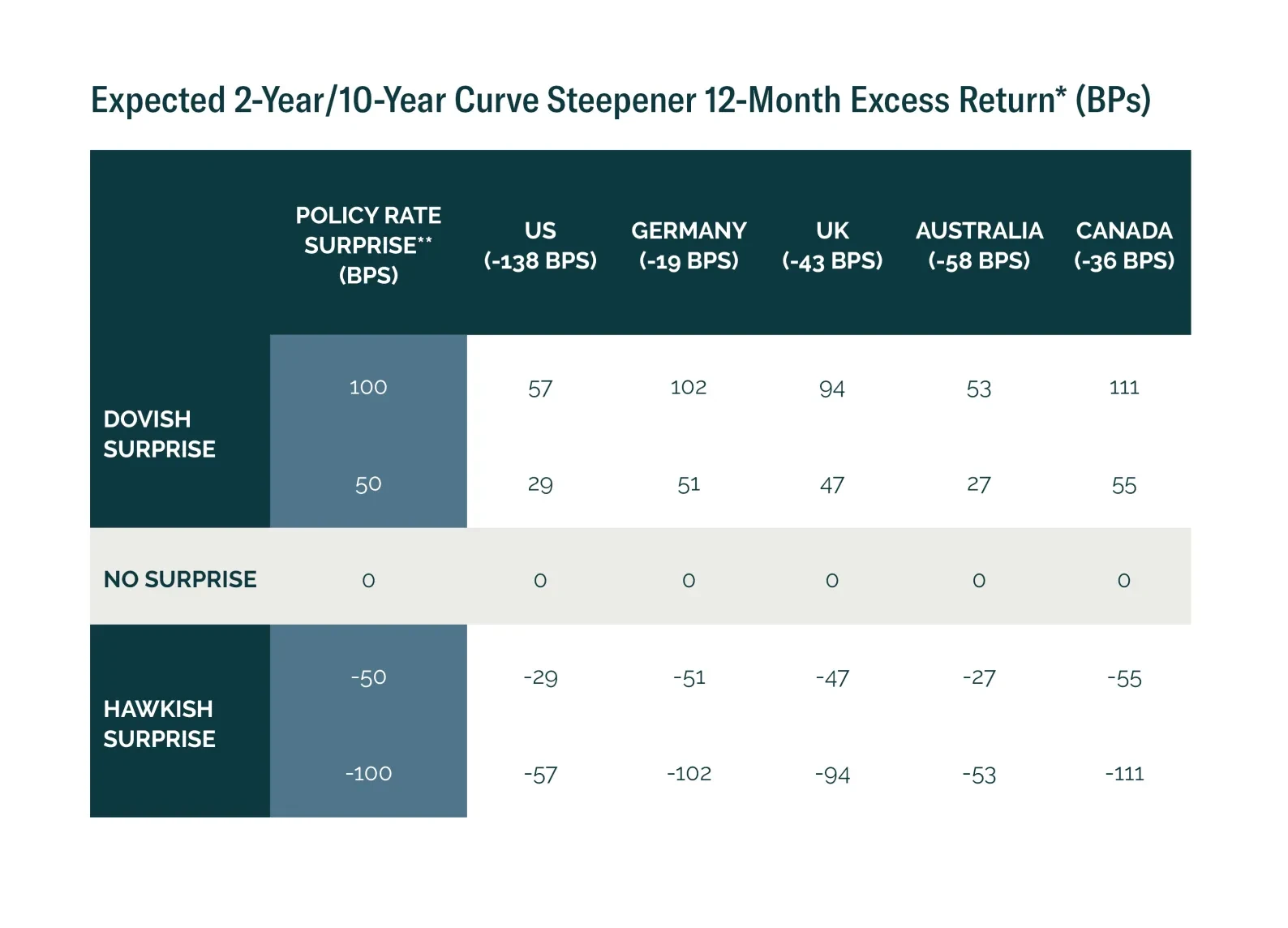

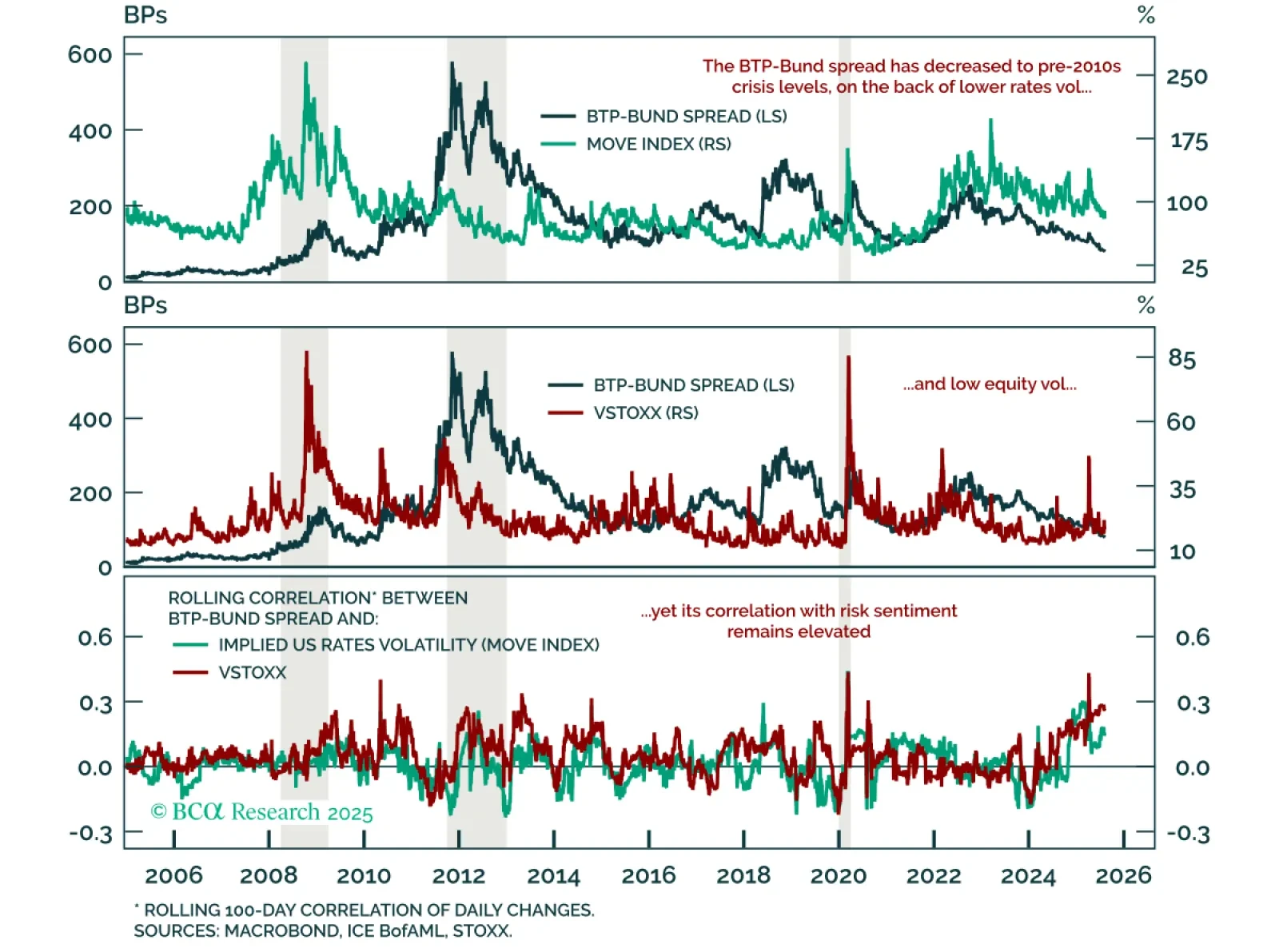

Despite concerns about fiscal sustainability, a rise in term premia, and attacks on central bank independence, monetary policy remains the primary driver of bond markets. In our Q3 Review & Outlook, we update our views and…

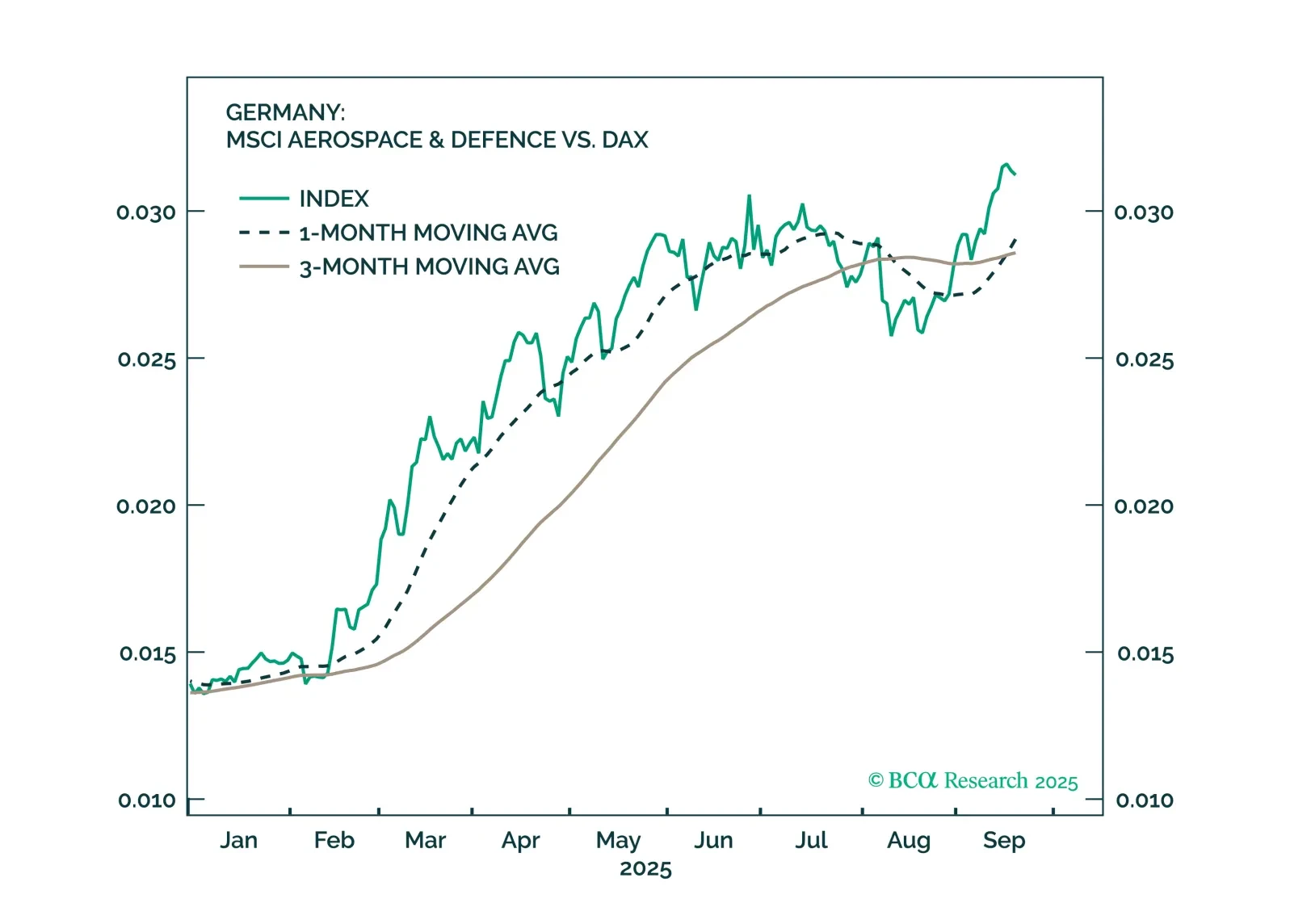

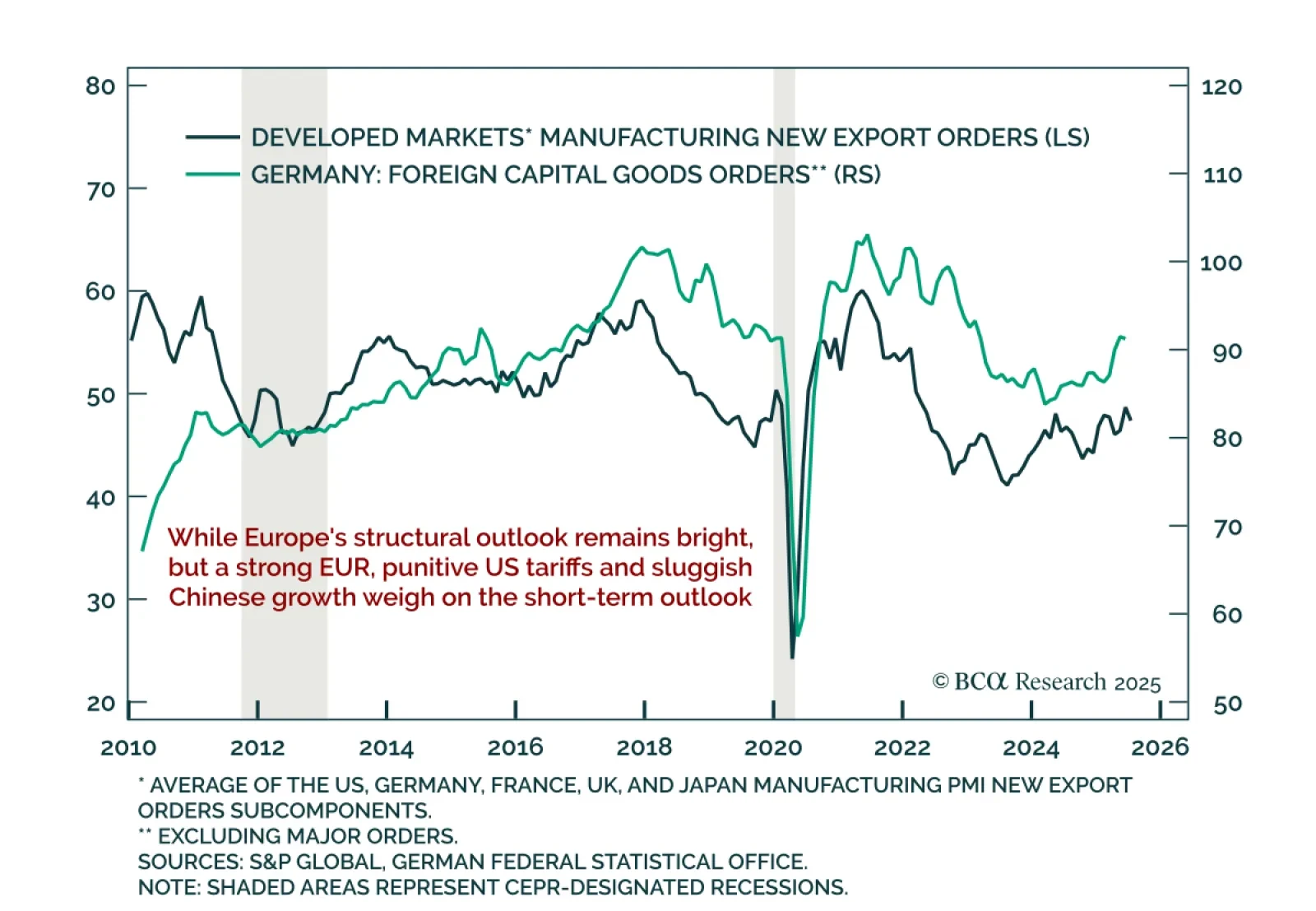

Germany is moving forward with implementing the large fiscal and defence spending announced earlier this year. Fiscal reforms are also positive, though they will fall short of expectations.

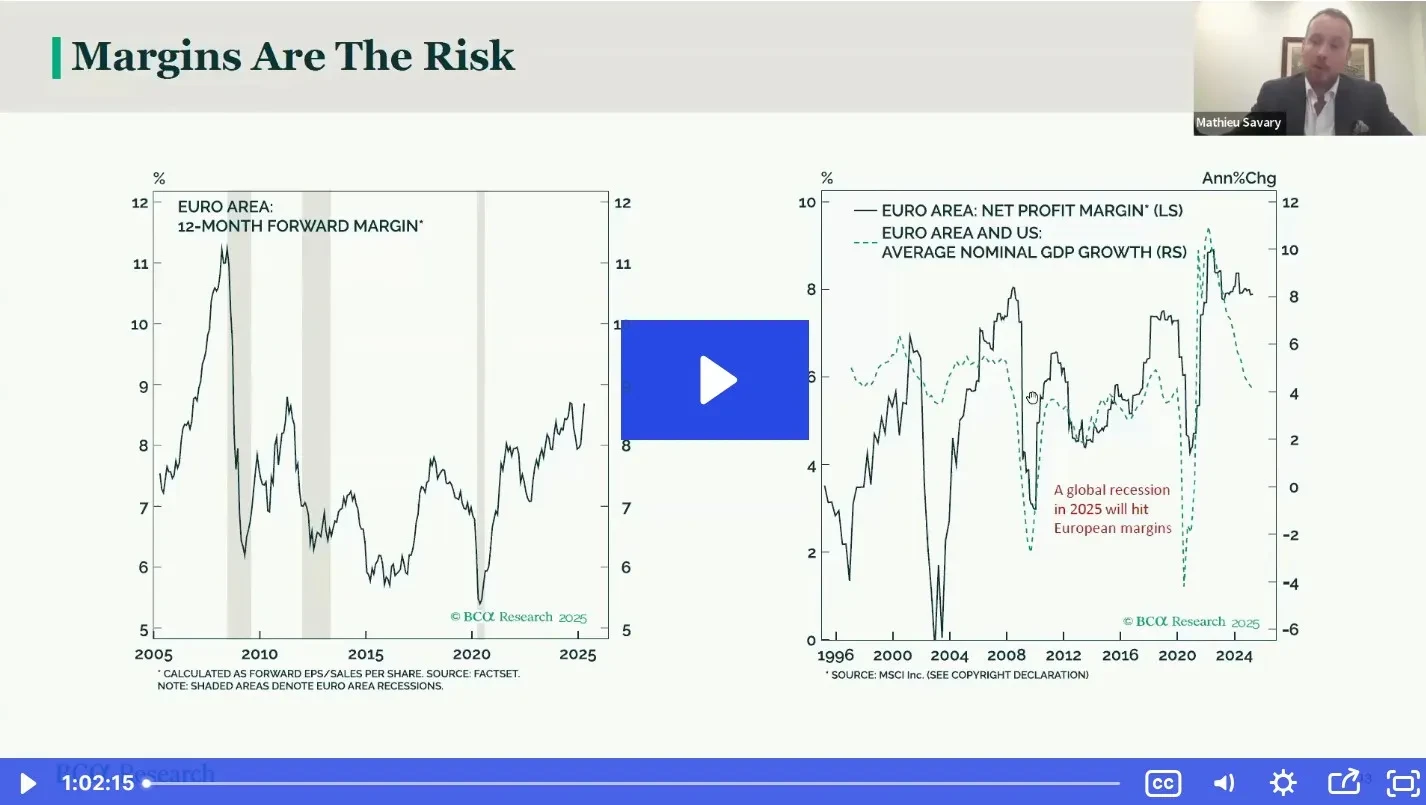

The BTP-Bund spread has tightened to pre-2010s levels, but with global growth risks we favor Gilts over Bunds and prefer BTPs over credit. While the EURO STOXX 50 remains rangebound since the Liberation Day recovery, European…

Germany’s June factory orders missed expectations, highlighting persistent headwinds reinforcing the case for a cautious tactical outlook on European assets. Orders fell 1.0% m/m, slowing to 0.8% y/y on a calendar-adjusted basis…

In this chartbook, we look at the balance of payments across DM and EM countries. The US does not fare well, but neither do a few other countries.

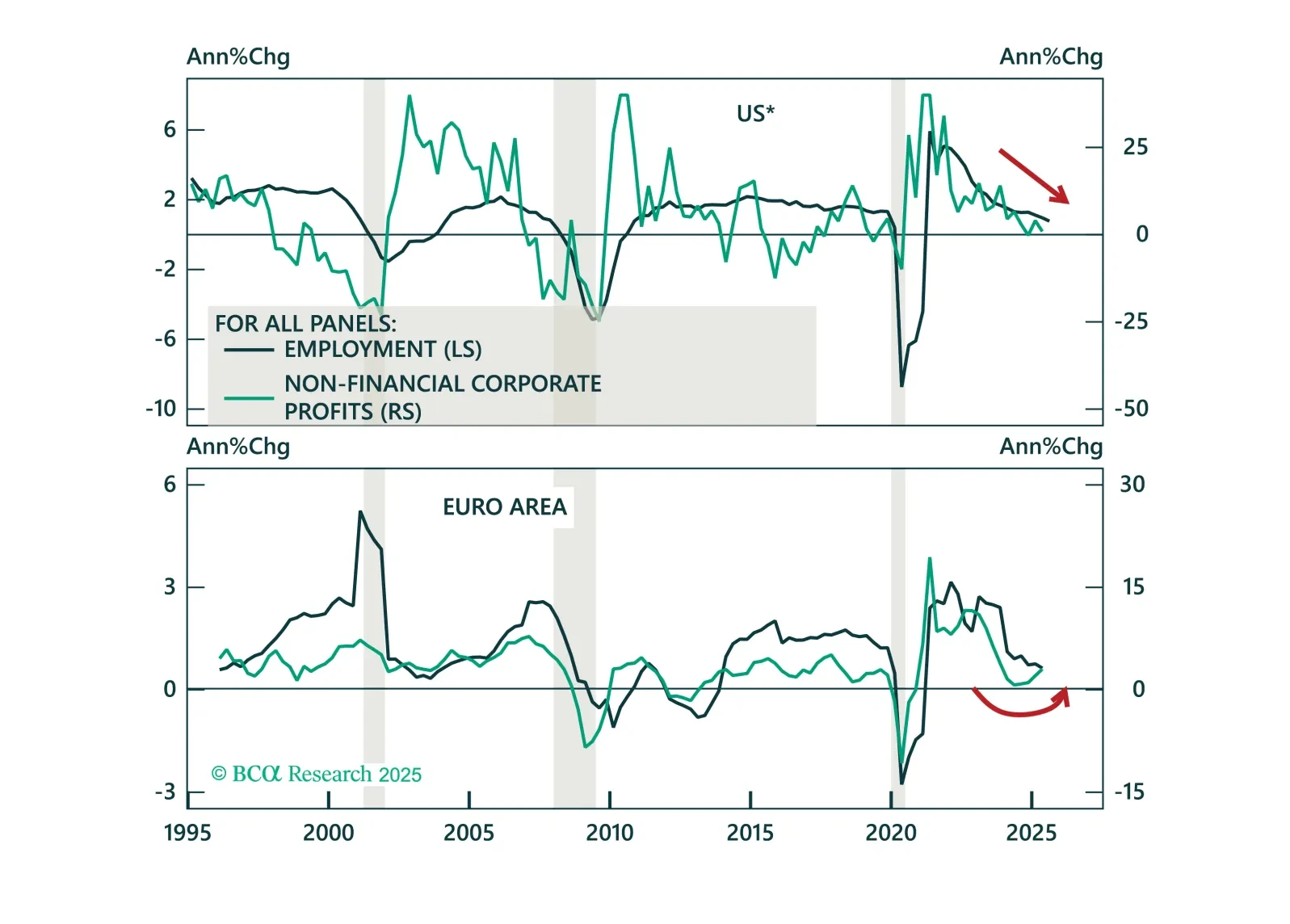

The European economy is losing altitude; and the second half of 2025 could get bumpier.

Join Mathieu Savary and Jérémie Peloso for our European Investment Strategy Webcast as we break down the key drivers shaping the outlook for…

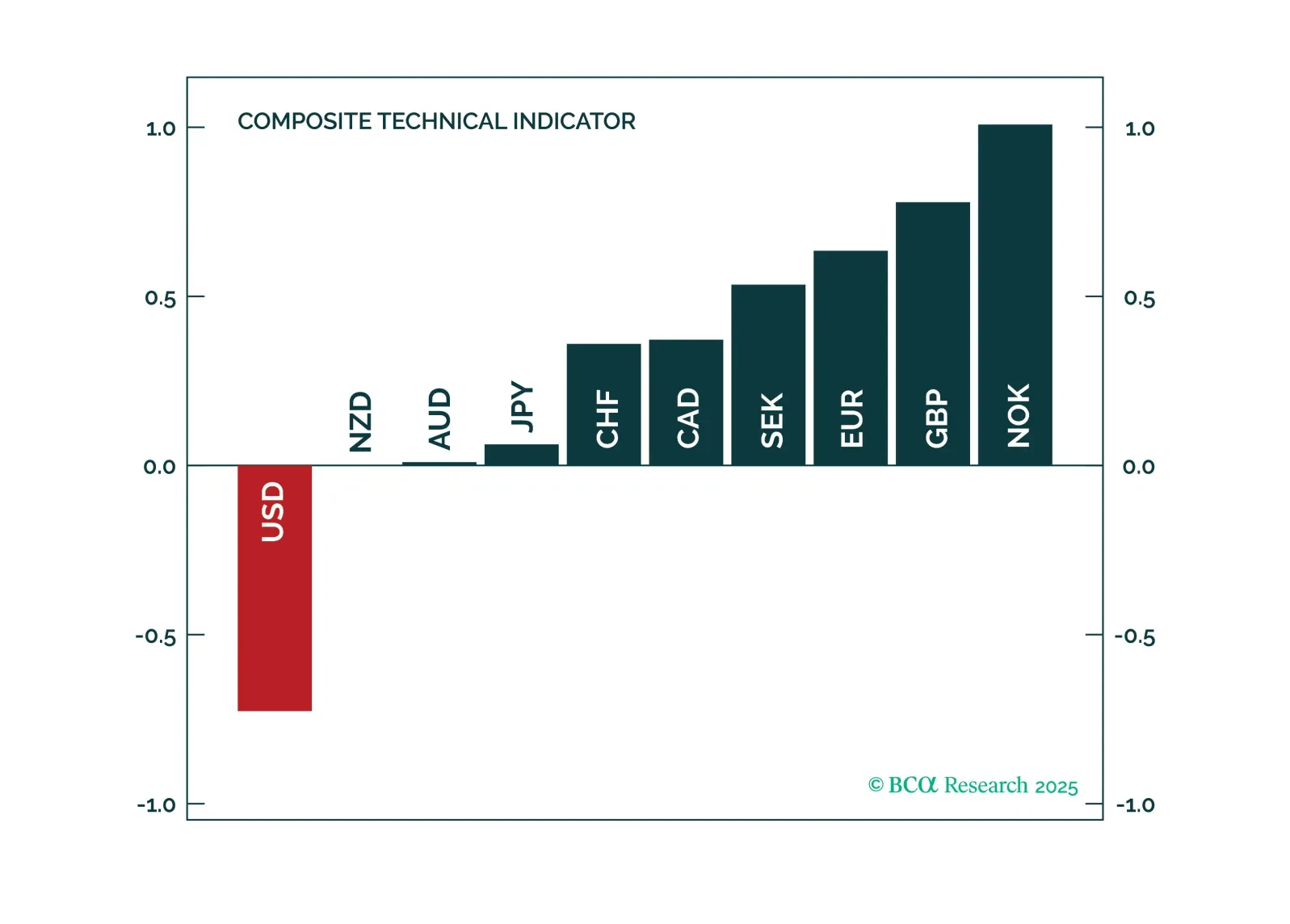

In this FX note, we provide a rationale for why it is important to pay attention to technical indicators, while still keeping your eyeball on the structural factors that drive currencies. This report answers the following questions:…

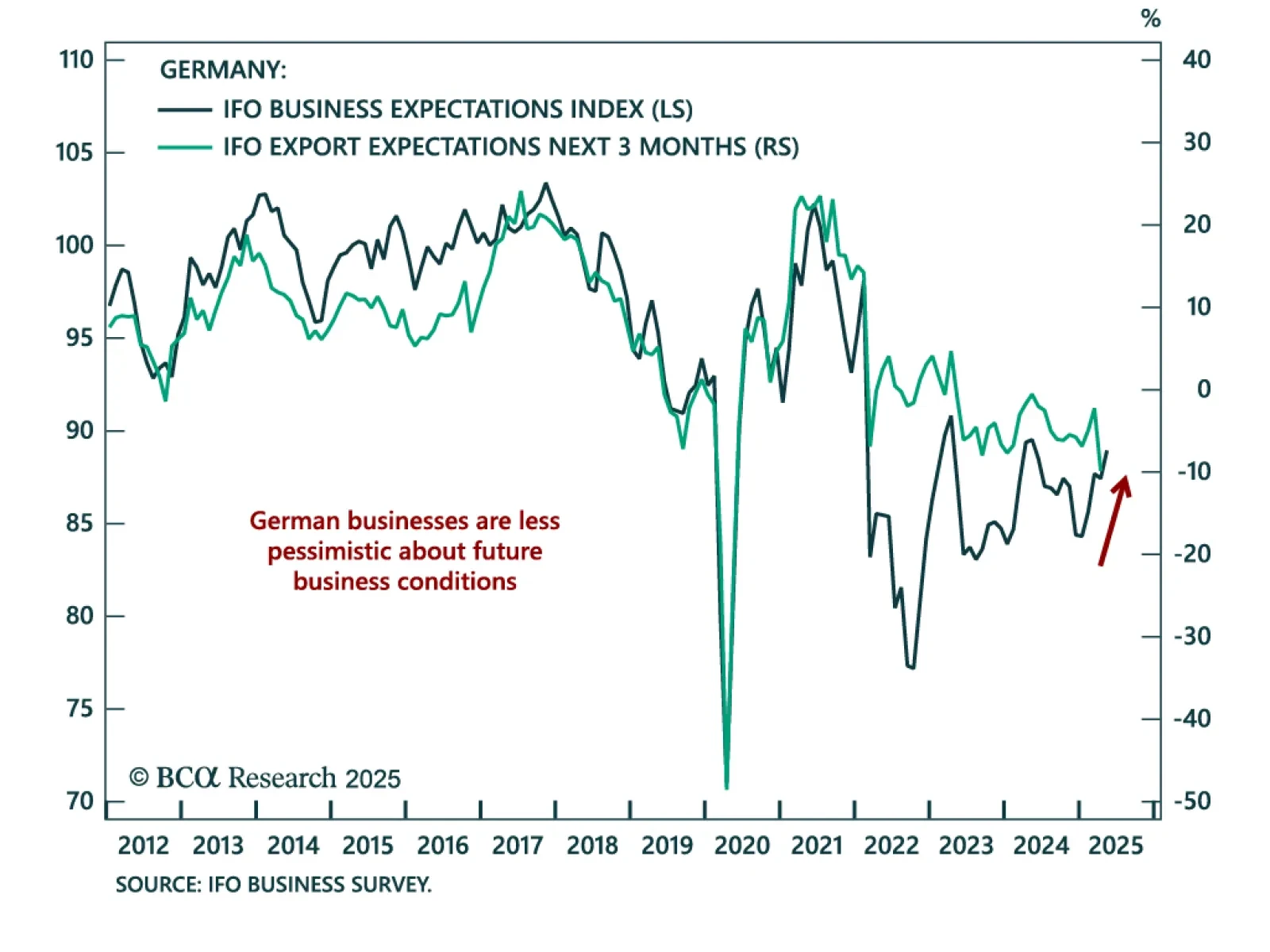

Business sentiment improved slightly in May, corroborating the message from other soft-data indicators of Eurozone business activity, which remain weak but are not plummeting. The increase in the future expectations index to 88.…