Highlights The coronavirus scare is the catalyst for the recent correction, not the cause. The true cause is that the stock market had reached a point of groupthink-triggered instability and therefore needed the slightest catalyst to…

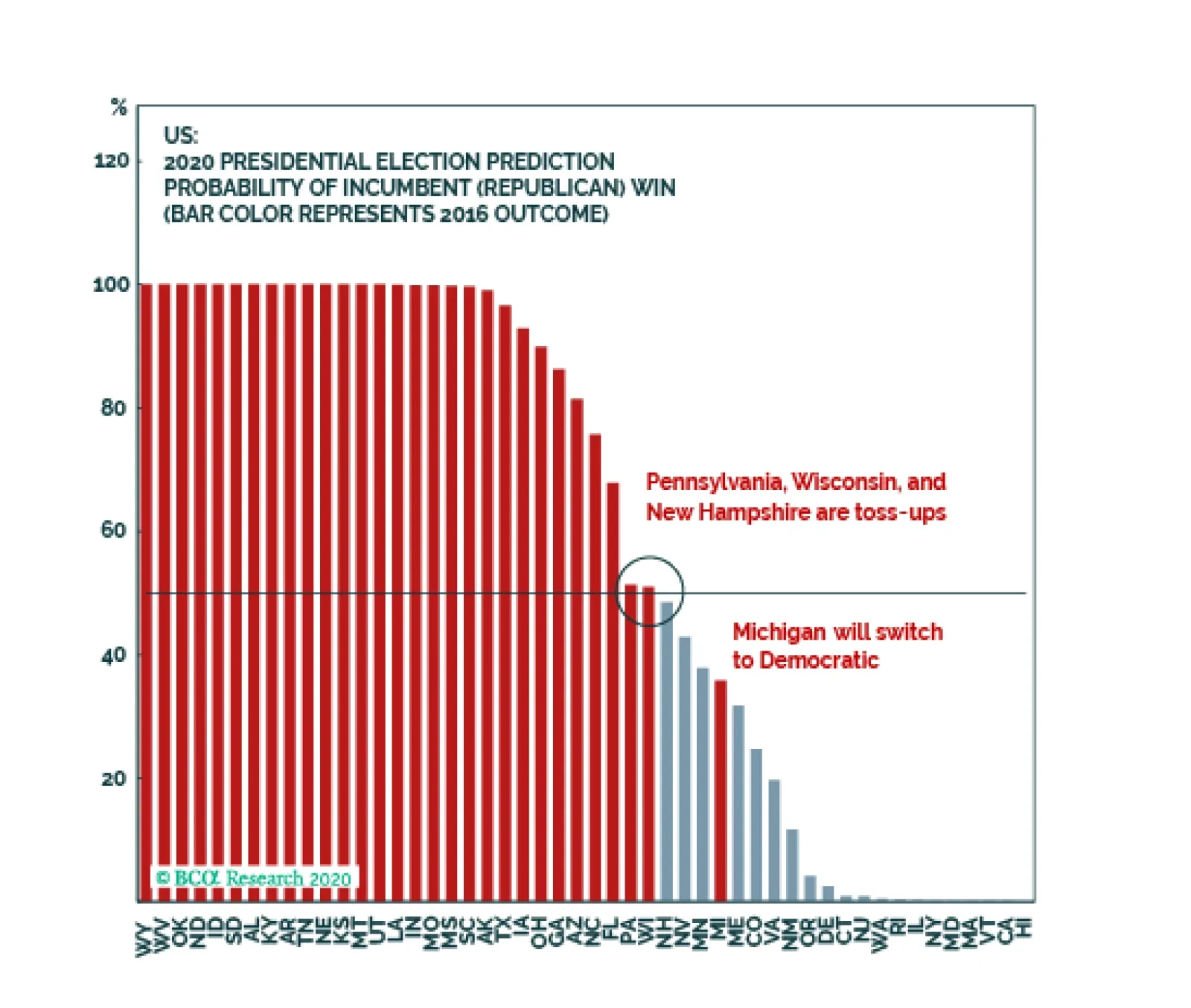

Trump is slightly favored to win re-election. Bets on the related question of which party will hold the White House have flipped from Democratic to Republican. Yet, investors may be becoming complacent about Trump’s…

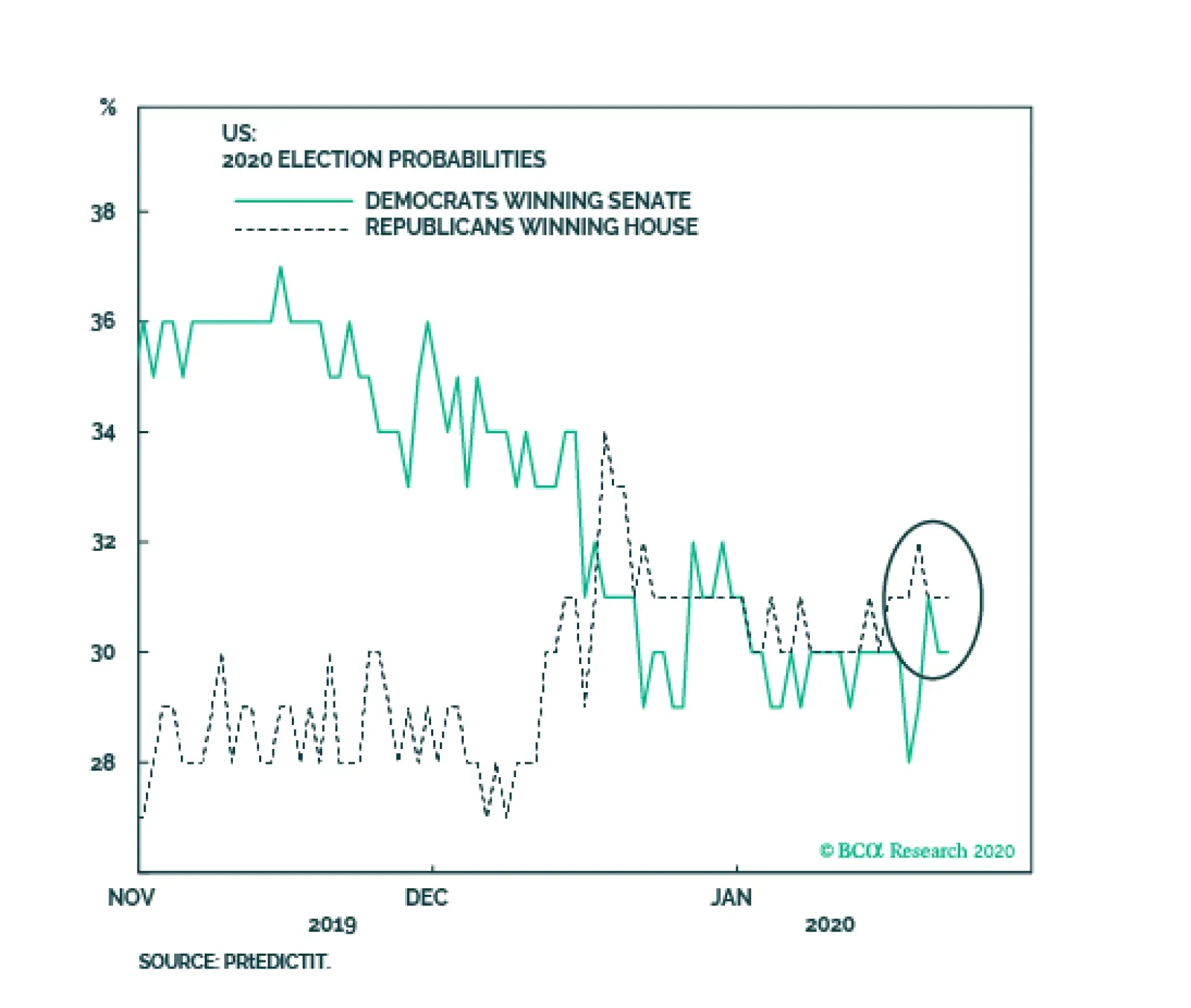

Assuming Biden clinches the nomination, he has a 45% chance of winning the election – and in that case, his chance of bringing the Senate over to the Democrats is higher than investors realize. For Democrats to unseat…

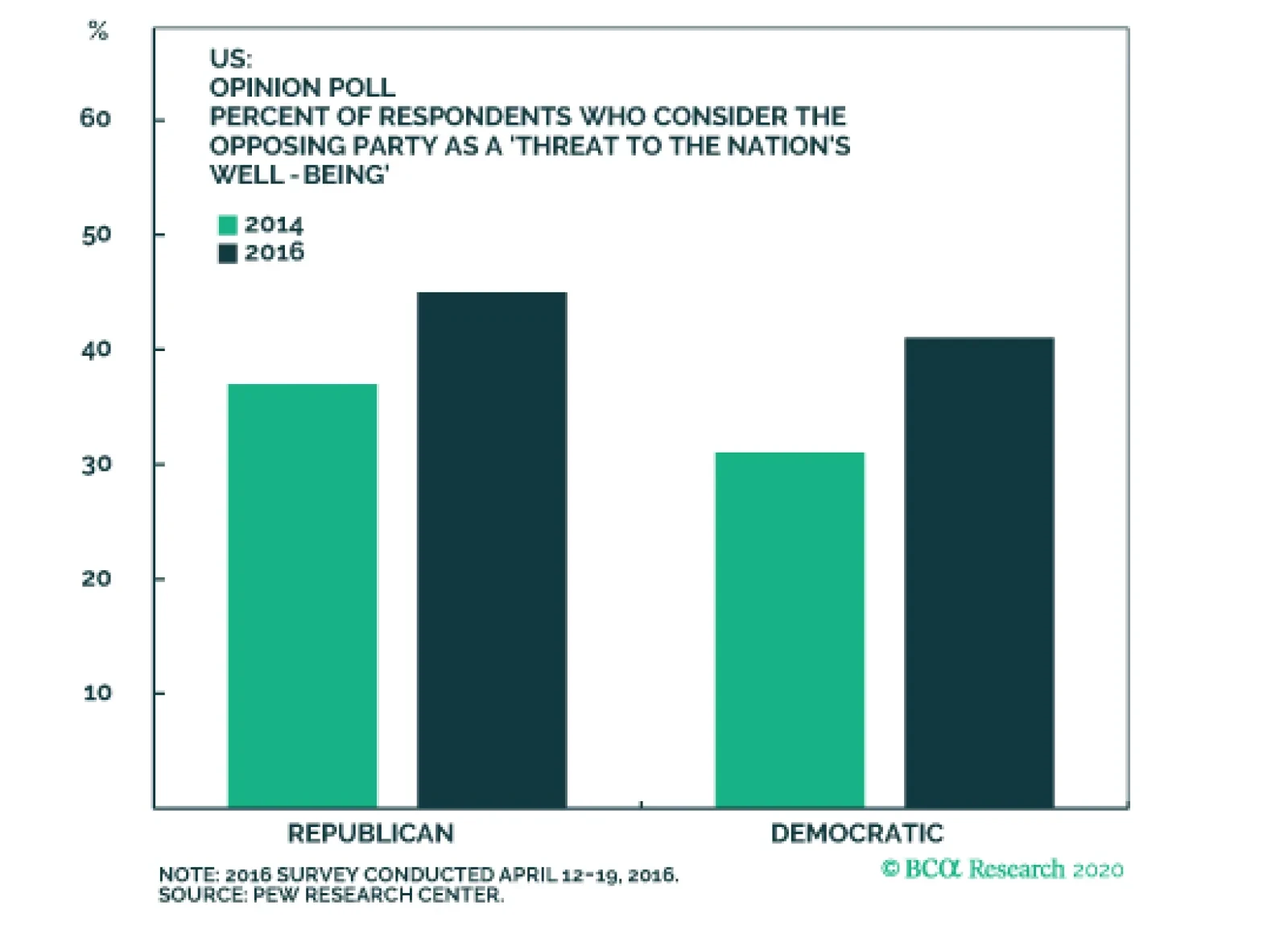

2020 may be a particularly violent year for the US. First, left wing activists may be shocked and angered to learn that Joe Biden is the nominee of the Democratic Party come July. With so much hype behind the progressive…

Highlights Our top five geopolitical “Black Swans” are risks that the market is seriously underpricing. With the “phase one” trade deal signed, Chinese policy could become less accommodative, resulting in a…

Highlights Duration: Despite recent setbacks, global growth looks set to improve and policy uncertainty set to ease during the next couple of months. Both will conspire to push bond yields higher. Investors should maintain below-…

Highlights Remain short the DXY index. The key risk to this view is a US-led rebound in global growth, or a pickup in US inflation that tilts the Federal Reserve to a relatively more hawkish bias. Stay long a petrocurrency basket. The…