Highlights China and India periodically fight each other on their fuzzy Himalayan border with zero market consequences. A major conflict is possible in the current environment – but it would present a buying opportunity.…

Dear client, It was my pleasure to join Dhaval Joshi, BCA’s Chief European Investment Strategist, this past Friday June 12, 2020 on a webcast he hosted titled: “Sectors To Own, And Sectors To Avoid In The Post-Covid World…

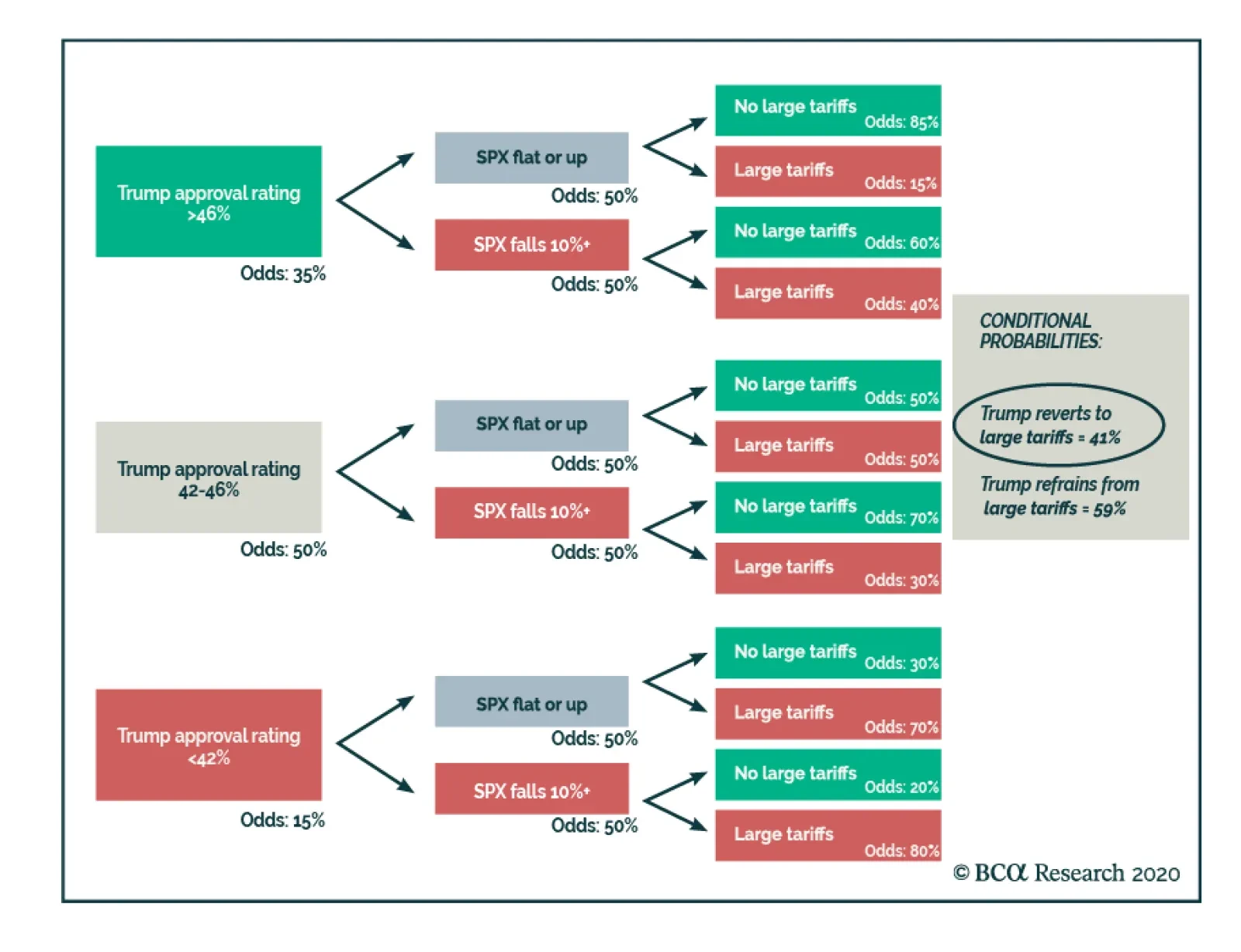

According to BCA Research's China Investment Strategy service, odds are rising that President Trump will become significantly more hawkish on China, which adds a significant geopolitical hurdle to the recent market rally. President…

Dear client, Along with an abbreviated report this week we are sending you this Geopolitical Strategy service report written by my colleague Matt Gertken, BCA’s Geopolitical Strategist. Matt argues that US social unrest is…

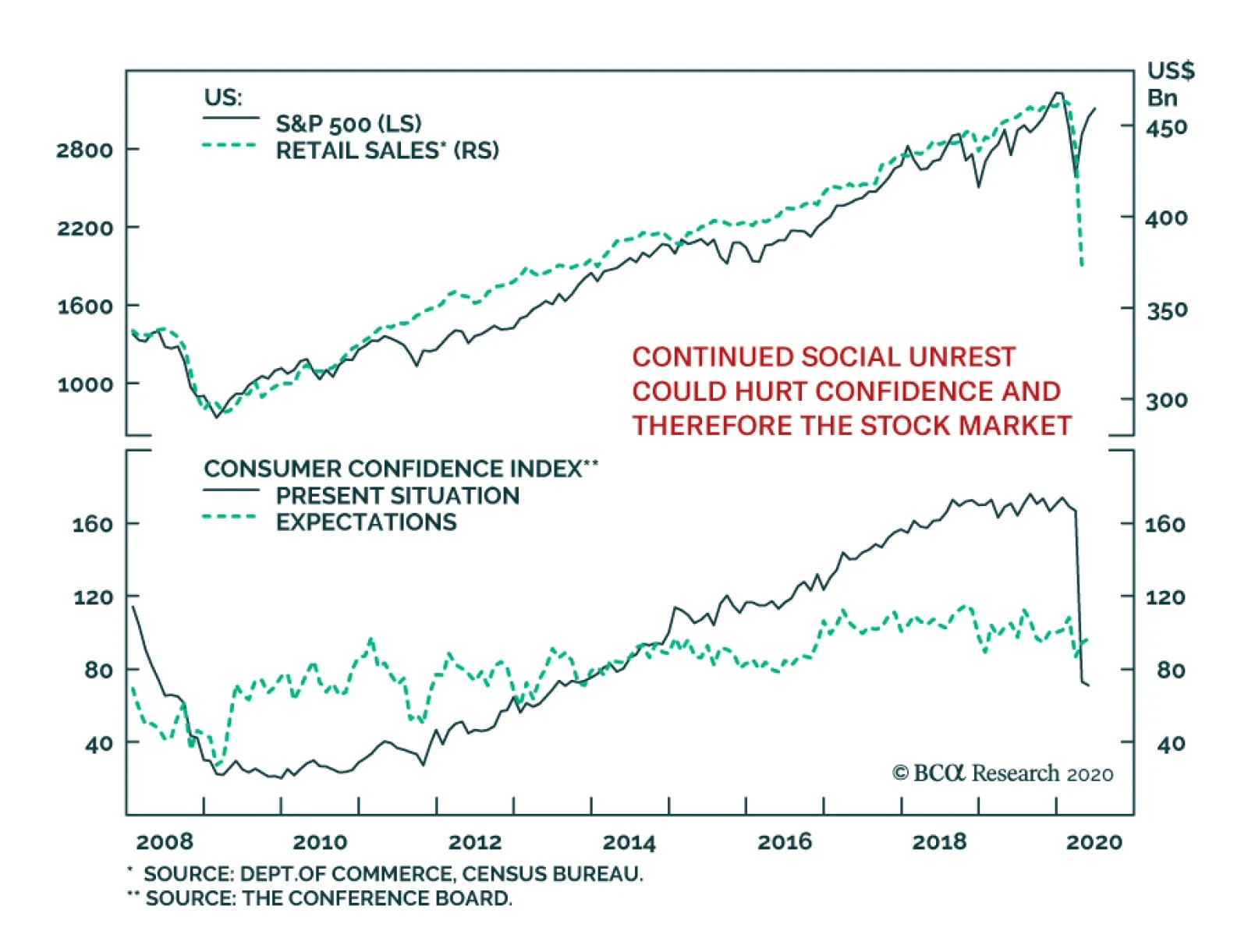

BCA Research's Geopolitical Strategy service believes markets are too complacent in the face of social unrest. The market is looking through the most widespread social unrest since 1968 in the United States. History…

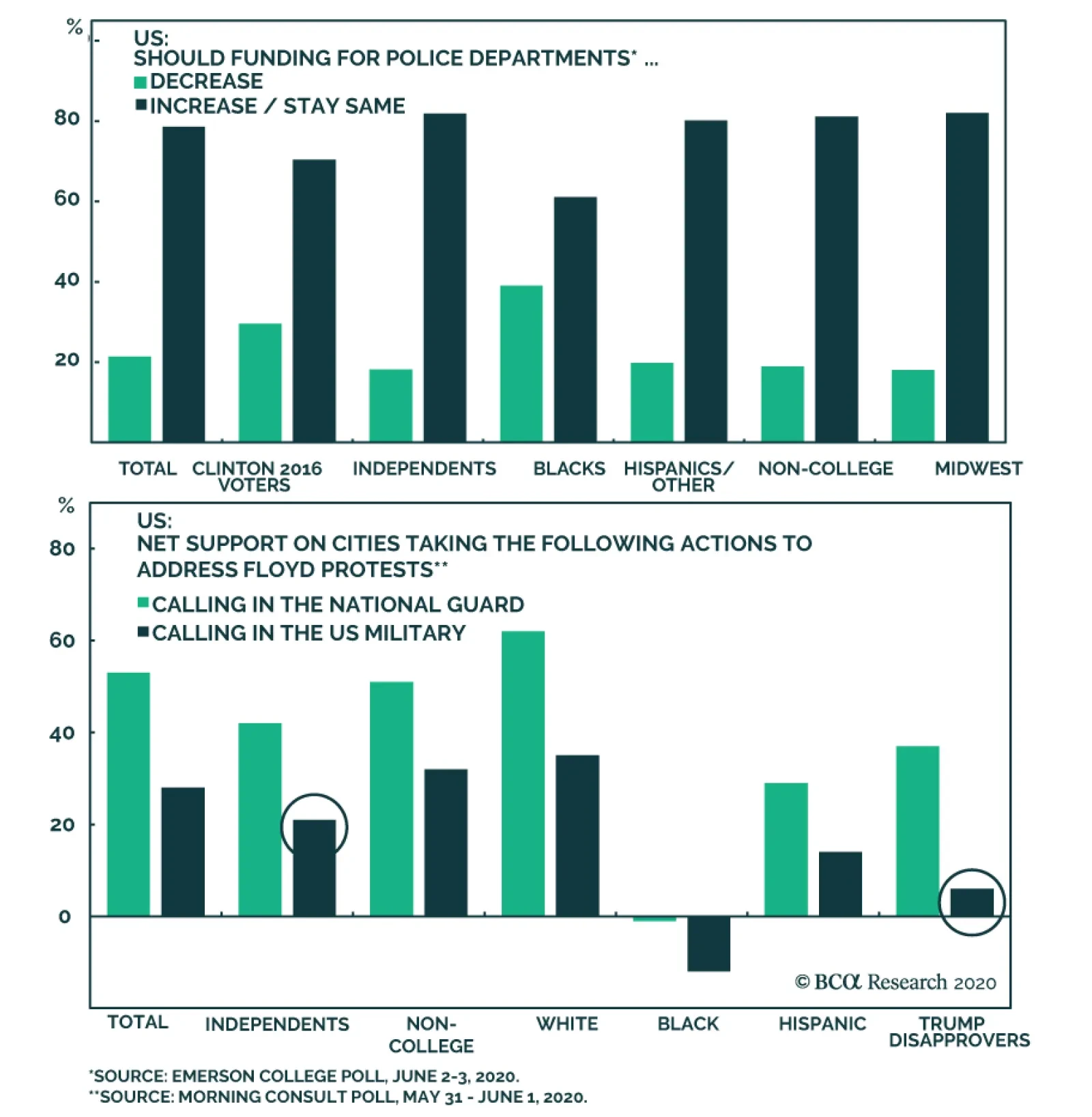

BCA Research's Geopolitical Strategy service believes that there is a possibility that Trump could benefit from his pitch as the candidate of law and order if unrest continues, violence worsens, and his actions are deemed to…

Highlights Social unrest in the US is driven by structural and cyclical factors as well as election-year opportunism. It can still cause volatility. Unrest will weigh on consumer and business confidence – adding to already ugly…

Highlights Our base case reflects our view that China’s strong fiscal and monetary stimulus, combined with a weaker US dollar, will provide a favorable backdrop for copper markets in 2H20. Supply factors are for the most part…